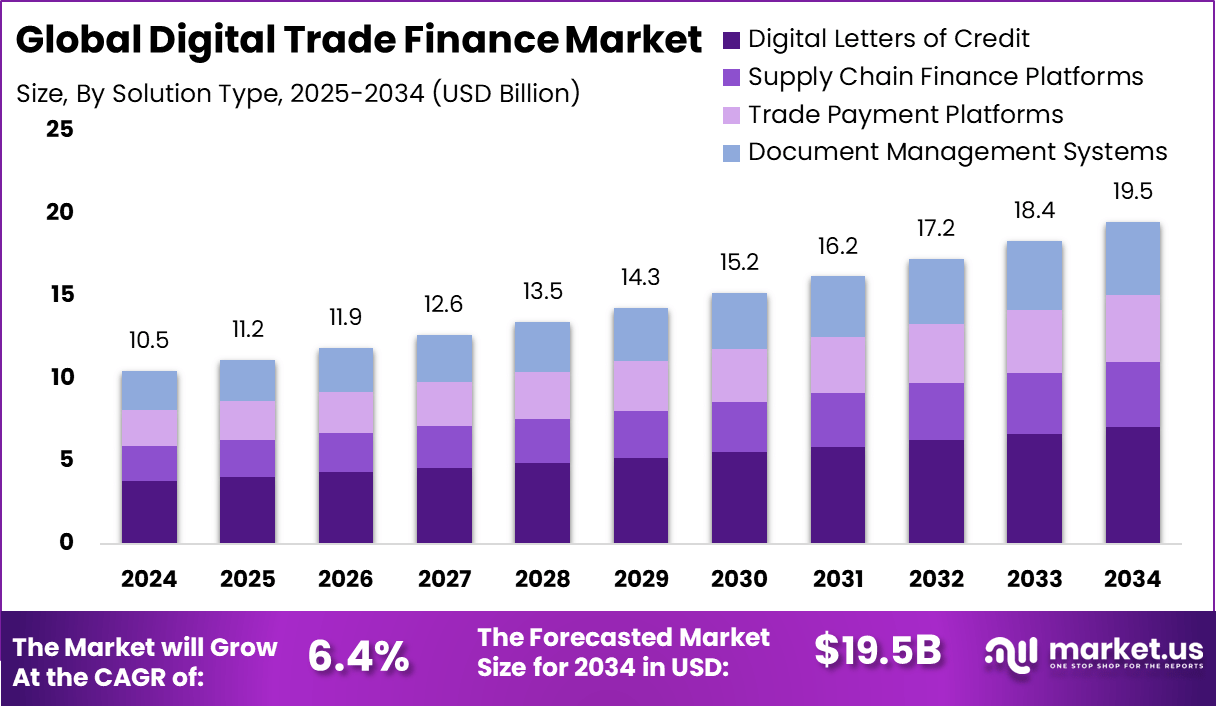

Global Digital Trade Finance Market Size, Share, Industry Analysis Report By Solution Type (Digital Letters of Credit, Supply Chain Finance Platforms, Trade Payment Platforms, Document Management Systems), By Application (Domestic Trade Finance, International Trade Finance), By End-User (Banks, Importers & Exporters, Trade Finance Institutions, Insurance Providers), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 168305

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Digital Trade Finance Market generated USD 101.22 billion in 2024 and is predicted to register growth from USD 107.23 billion in 2025 to about USD 180.24 billion by 2034, recording a CAGR of 5.94% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 38.7% share, holding USD 1.3 Billion revenue.

Digital trade finance refers to the use of digital technologies to simplify and speed up financial transactions in global trade. It replaces traditional paper-based processes with electronic systems that connect buyers, sellers, and financial institutions smoothly. Currently, more than 55% of banks are increasing investments in digital trade finance solutions to improve efficiency and reduce delays.

The digital trade finance market has expanded as global trade participants shift from paper based workflows to automated, technology driven processes that support faster verification, funding and settlement. Growth reflects rising demand for real time document handling, improved transparency and stronger risk control in cross border transactions. Digital platforms now support importers, exporters, banks and logistics providers through fully electronic trade finance operations.

One main factor driving digital trade finance is the advancement of secure technologies like blockchain, which cuts transaction times by nearly 50% in many cases. The rise of cross-border e-commerce also pushes demand, as businesses look for faster and safer payment solutions. In 2025, the adoption of AI in trade finance has increased from 32% to 45%, helping detect risks early and reducing fraud.

The growing need for speed and transparency in international trade is fueling demand for digital trade finance services. Cloud-based platforms supporting digital trade reporting have seen a 35% surge in usage since 2023. Small and medium-sized enterprises benefit greatly, with approval times cut by around 40% thanks to online verification. Meanwhile, more banks are upgrading legacy systems, with 18% doing so to handle the increasing digital trade volume.

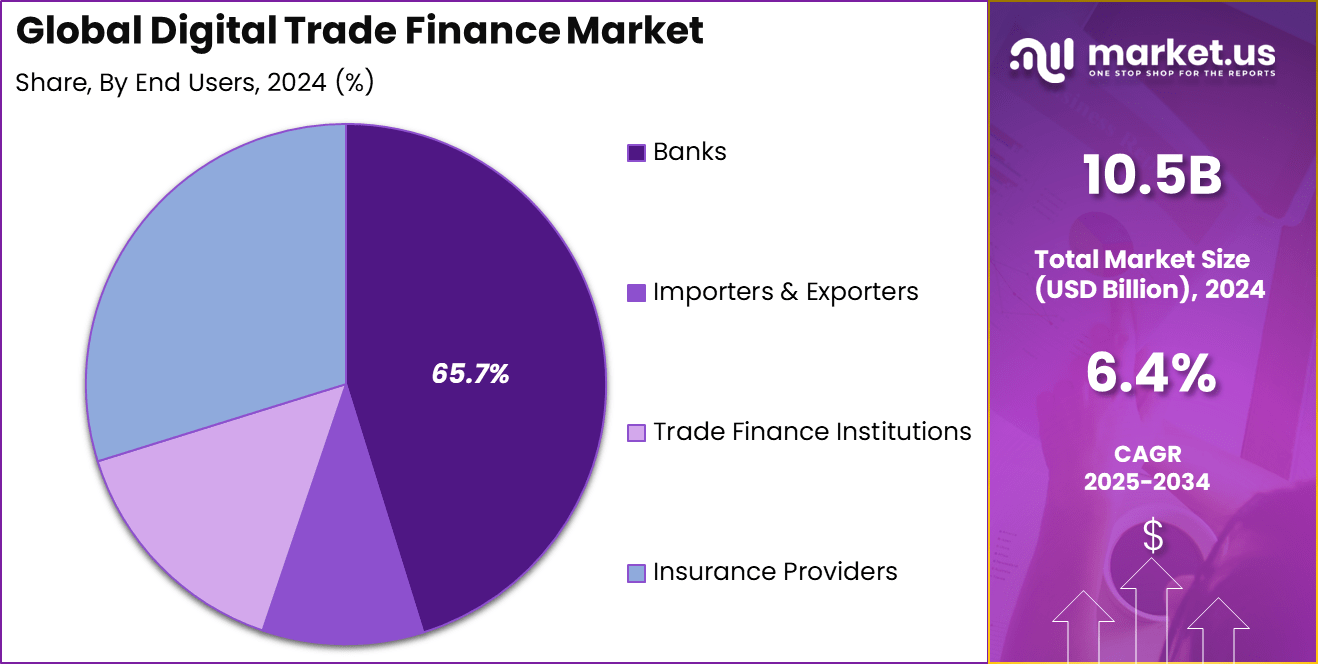

Quick Market Facts

- By solution type, digital letters of credit lead with 36.4%, supported by increased adoption of automated document verification and secure transaction workflows.

- By application, domestic trade finance dominates with 63.7%, reflecting strong use of digital platforms to streamline local trade processes and reduce paperwork.

- By end-user, banks hold 45.2%, driven by rapid digitalization of trade operations and compliance requirements.

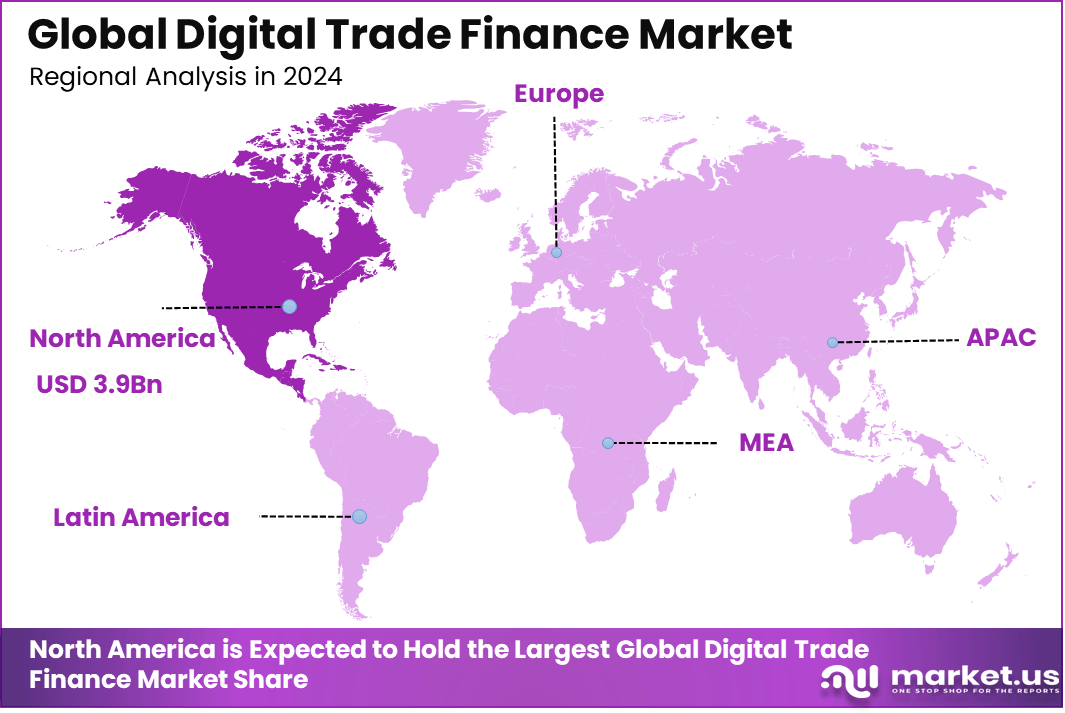

- North America accounts for 38%, benefiting from strong financial infrastructure and high adoption of digital transaction systems.

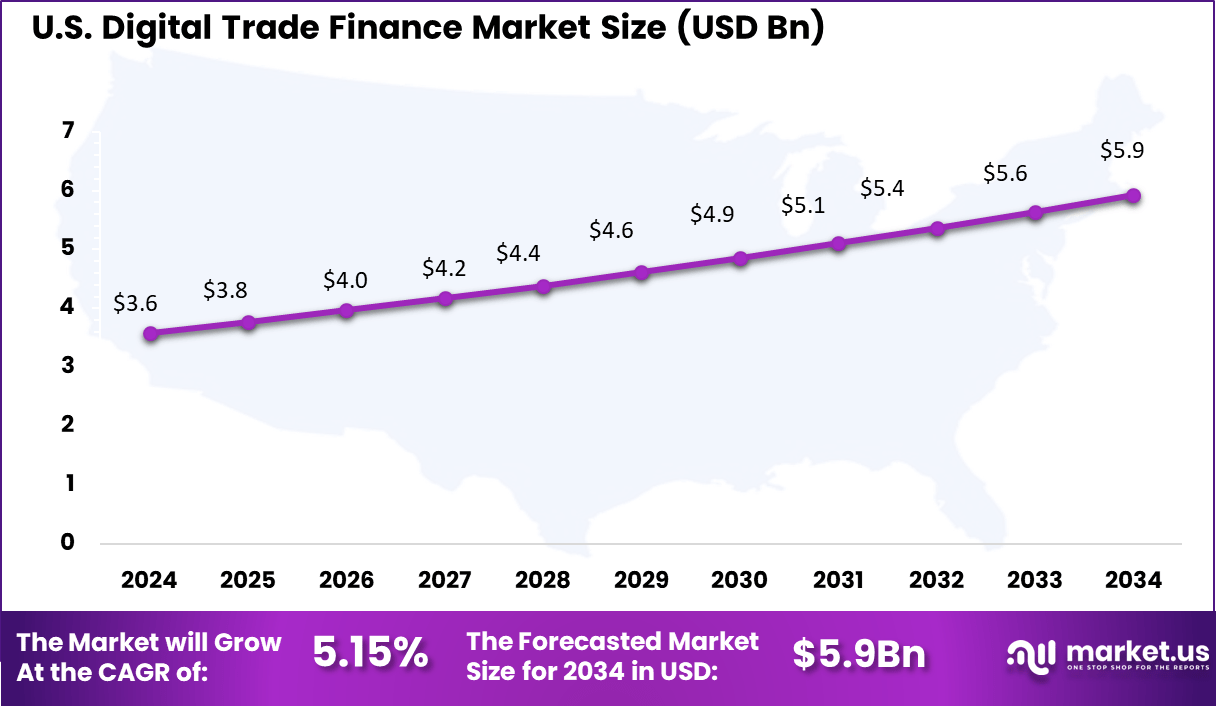

- The US market reached USD 3.59 billion and is expanding at a steady CAGR of 5.15%, indicating consistent modernization of trade finance across financial institutions.

Key Statistics

Impact on Businesses and Efficiency

- Digital platforms shorten credit approval times from several weeks to a few minutes and reduce approval times for SMEs by 40%.

- SMEs face the highest rejection rates in trade finance, accounting for nearly 60% of rejected applications. Digital platforms are helping to narrow this gap.

- AI-based document processing reduces error rates by 80% and cuts document handling time from 3 days to 40 minutes.

- Full automation increases straight-through processing rates by 70%, improving transaction speed and accuracy.

Challenges and Regulatory Impact

- Compliance costs for AML, KYC, and sanctions screening increased by 15% for banks in 2025, and nearly 40% report that high compliance expenses restrict their ability to serve SMEs.

- More than 50% of firms in emerging markets struggle with regulatory documentation requirements. Digital e-bills of lading are expected to reduce compliance time by 30%.

- Regulatory capital charges continue to limit trade finance supply, reducing bank appetite by nearly 20%.

Regional Insight

The United States contributes around USD 3.59 billion, with a 5.15% CAGR from fleet modernization and tech adoption. Focus on secure platforms aids domestic and export finance alike. Growth reflects robust commerce activity and policy support for digital upgrades.

In 2024, North America commands 38% of the digital trade finance market, thanks to advanced infrastructure and trade hubs. Strong e-commerce and cross-border links with neighbors drive demand for fast digital solutions. Innovation in automation and data sharing keeps the region ahead, supporting efficient flows for goods and services.

By Solution Type

Digital letters of credit capture 36.4% of the digital trade finance market. They remain a core tool for securing transactions, especially where trust between buyers and sellers needs formal backing. Banks and traders value their clear legal framework, which cuts risks in cross-border deals by ensuring payment only upon document verification. Digital versions speed up issuance and reduce paperwork errors compared to traditional methods.

Advancements like blockchain make these letters more secure and transferable. Real-time tracking and smart contracts automate approvals, appealing to firms handling high-volume imports and exports. This solution fits well with growing e-commerce, where quick, reliable assurances boost confidence in distant markets. Adoption grows as standards unify across borders, easing integration for global supply chains.

By Application

Domestic trade finance leads with 63.7% share, driven by steady local commerce needs. Businesses rely on it for smooth cash flow in everyday supplier payments and inventory buys, avoiding delays that hurt operations. Digital tools simplify local invoicing and guarantees, making finance quicker for small shipments within countries. This segment thrives on rising internal trade volumes fueled by online retail growth.

Efficiency gains from automation keep costs low for frequent, smaller deals. Platforms now handle real-time credit checks and fund releases, helping firms manage working capital better at home. As domestic markets expand with consumer demand, this application supports scalable growth without the complexities of international rules. Reliable local finance builds resilience against global disruptions.

By End-User

Banks hold 45.2% of the market, leveraging their scale in processing trade documents and risks. They offer trusted platforms for letters of credit and guarantees, backed by deep regulatory know-how. Digital shifts let banks automate compliance and cut manual reviews, serving clients from large exporters to midsize traders efficiently. Their networks provide broad access to liquidity and advice.

Partnerships with tech firms enhance banks’ reach to underserved areas. AI-driven checks and shared data pools speed up approvals while lowering fraud. This end-user group adapts quickly to new standards, ensuring secure flows for diverse clients. Their role strengthens as trade volumes rise, blending tradition with modern tools.

Emerging Trends

Emerging trends show that digitalization is accelerating rapidly in trade finance. About 87% of corporates report growth in trade transaction volumes, highlighting demand for faster, automated financing solutions. Digital processes can cut trade processing time by up to 60% while boosting trade revenues by 20%.

Adoption of AI platforms and blockchain is increasingly shaping trade finance regulations and operations, especially in growth markets such as Asia, where scalable digital solutions support surging cross-border trade.

Growth Factors

Growth factors for digital trade finance include technology innovations and the rising need for efficiency amid expanding trade volumes. Automation reduces operational costs and errors, with banks and corporates benefitting from streamlined workflows that accelerate approvals and reduce fraud risks by up to 50%.

The flexibility of AI-backed platforms helps integrate complex supply chains and enhances transparency, contributing to improved financial planning and risk control. These factors collectively support ongoing expansion and digitization in global trade finance environments.

Key Aspects

- Increased efficiency: Digital trade finance replaces slow paper-based processes with fast and secure data exchange. This improves document presentation, shipping coordination, and payment execution, resulting in shorter processing times across trade cycles.

- Reduced costs: Businesses benefit from lower operational expenses by eliminating the need to physically ship documents and avoiding delay-related charges such as port parking fees. Automation also reduces manual handling costs.

- Improved risk management: The use of AI, big data, and automated verification improves the ability of banks and companies to detect fraud, identify irregularities, and strengthen compliance. This leads to fewer losses and more secure transactions.

- Enhanced accessibility: Digital platforms make trade finance more accessible to SMEs. Easier onboarding, digital documentation, and reduced administrative barriers help smaller firms participate more effectively in international trade.

- Key drivers: The shift toward digital trade finance is supported by the need for agility in a volatile global environment. Disruptions during the pandemic and supply chain challenges highlighted the importance of faster and more resilient trade processes.

- Technological foundation: Growth is supported by innovations such as APIs for real-time communication, AI and big data for advanced risk analysis, and cloud systems that can securely manage high-volume trade documentation.

Key Market Segments

By Solution Type

- Digital Letters of Credit

- Supply Chain Finance Platforms

- Trade Payment Platforms

- Document Management Systems

By Application

- Domestic Trade Finance

- International Trade Finance

By End-User

- Banks

- Importers & Exporters

- Trade Finance Institutions

- Insurance Providers

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Push Toward Digital Transformation

The digital trade finance market gains momentum from the urgent need to replace paper-based processes with automated systems, cutting transaction times from weeks to hours. Banks and corporates adopt platforms using blockchain and AI to handle letters of credit and invoices securely, addressing the 4 billion paper documents still circulating globally. This shift boosts efficiency for SMEs facing traditional barriers.

Global trade growth, expected at steady rates through 2030, amplifies demand as digital tools enable real-time tracking and reduce errors. Non-bank fintechs capture share by embedding finance in supply chains, driving overall market expansion from $52 billion in 2025.

Restraint Analysis

Regulatory Compliance Hurdles

Complex cross-border regulations slow digital trade finance adoption, with varying rules on data standards and electronic documents creating uncertainty. Frameworks like MLETR help but national differences demand costly legal adaptations, limiting seamless global rollout.

Paper mandates persist in some regions, forcing hybrid systems that undermine full digitization benefits. These compliance burdens raise costs and deter smaller players, capping market penetration despite technology readiness.

Opportunity Analysis

Fintech and Blockchain Innovation

Fintech partnerships with banks open vast opportunities, offering API-driven financing and tokenized assets for instant settlements. Stablecoins and blockchain platforms like those from Standard Chartered cut intermediary costs, appealing to SMEs underserved by traditional finance.

Sustainability focus creates demand for ESG-linked digital trade tools, with AI analytics improving risk assessment. Market projections show fintech trade finance hitting $10 billion by 2030, fueled by embedded solutions in procurement systems.

Challenge Analysis

Cybersecurity and Interoperability Gaps

Cyber threats target sensitive trade data, with breaches risking fraud and eroding trust in digital platforms. Ransomware and attacks demand heavy investment in protection, straining resources amid rising incidents.

Lack of universal standards hinders system interoperability, as legacy bank tech clashes with new platforms. This fragmentation slows execution, requiring ongoing collaboration to bridge policy and practice gaps.

Future Outlook

Looking ahead, digital trade finance is set to transform global commerce further. AI is expected to improve risk evaluation by around 30%, while green finance tied to sustainable trade practices has grown by 22% this year. Cloud and blockchain technologies continue their rapid adoption, expanding at rates near 35% in key regions. Regulatory clarity on digital documents will boost trust and expand use.

Small businesses are poised to benefit the most, closing financing gaps in up to 35% of their transactions through digital access. Non-bank lenders are capturing around 25% of market share by offering quick funding options like invoice financing. The ability to track trades in real-time has increased compliance accuracy by 35%, opening new markets and supporting sustainable trade growth.

Competitive Analysis

HSBC, JPMorgan Chase, Citibank, Standard Chartered, and BNP Paribas lead the digital trade finance market with strong global banking networks and advanced digital platforms that support paperless processing, automated verification, and real-time transaction visibility. Their solutions focus on reducing processing time, improving credit availability, and enhancing cross-border transparency.

DBS Bank, ANZ, Banco Santander, Barclays, and Mitsubishi UFJ Financial Group strengthen the market with innovative digital tools for documentary trade, supply-chain financing, and automated risk assessment. Their platforms enable faster approvals, secure data exchange, and improved tracking for importers and exporters.

R3, Marco Polo Network, we.trade, Contour, Komgo, and other technology providers expand the landscape with blockchain-enabled trade networks and interoperable digital ecosystems. Their platforms streamline document exchange, reduce fraud risk, and improve transparency across trading parties. These companies support banks and corporates with standardized digital workflows, automated compliance, and scalable multi-party collaboration.

Top Key Players in the Market

- HSBC

- JPMorgan Chase

- Citibank

- Standard Chartered

- BNP Paribas

- DBS Bank

- ANZ

- Banco Santander

- Barclays

- Mitsubishi UFJ Financial Group

- R3

- Marco Polo Network

- we.trade

- Contour

- Komgo

- Others

Recent Developments

- October 2025, HSBC took embedded finance further by launching its joint venture with Tradeshift, called SemFi by HSBC. The company, three-quarters owned by the bank, focuses on invoice financing for e-commerce sellers using data from transaction histories. This move helps businesses get quicker credit limits without heavy paperwork.

- July 2025, JPMorgan Chase, rolled out a supply chain finance solution tied to Oracle Fusion Cloud, making working capital smoother for corporate clients. Around the same time, the bank pushed its Kinexys platform with partners like Qatar National Bank for 24/7 blockchain settlements in trade payments.

Report Scope

Report Features Description Market Value (2024) USD 10.5 Bn Forecast Revenue (2034) USD 19.5 Bn CAGR(2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution Type (Digital Letters of Credit, Supply Chain Finance Platforms, Trade Payment Platforms, Document Management Systems), By Application (Domestic Trade Finance, International Trade Finance), By End-User (Banks, Importers & Exporters, Trade Finance Institutions, Insurance Providers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape HSBC, JPMorgan Chase, Citibank, Standard Chartered, BNP Paribas, DBS Bank, ANZ, Banco Santander, Barclays, Mitsubishi UFJ Financial Group, R3, Marco Polo Network, we.trade, Contour, Komgo, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Trade Finance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Trade Finance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- HSBC

- JPMorgan Chase

- Citibank

- Standard Chartered

- BNP Paribas

- DBS Bank

- ANZ

- Banco Santander

- Barclays

- Mitsubishi UFJ Financial Group

- R3

- Marco Polo Network

- we.trade

- Contour

- Komgo

- Others