Digital Telepathology Market By Product Type (Software, Hardware, and Services), By Application (Primary Diagnosis, Second Opinion, Research, and Education & Training), By End-user (Hospitals & Clinics, Diagnostic Laboratories, and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159083

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

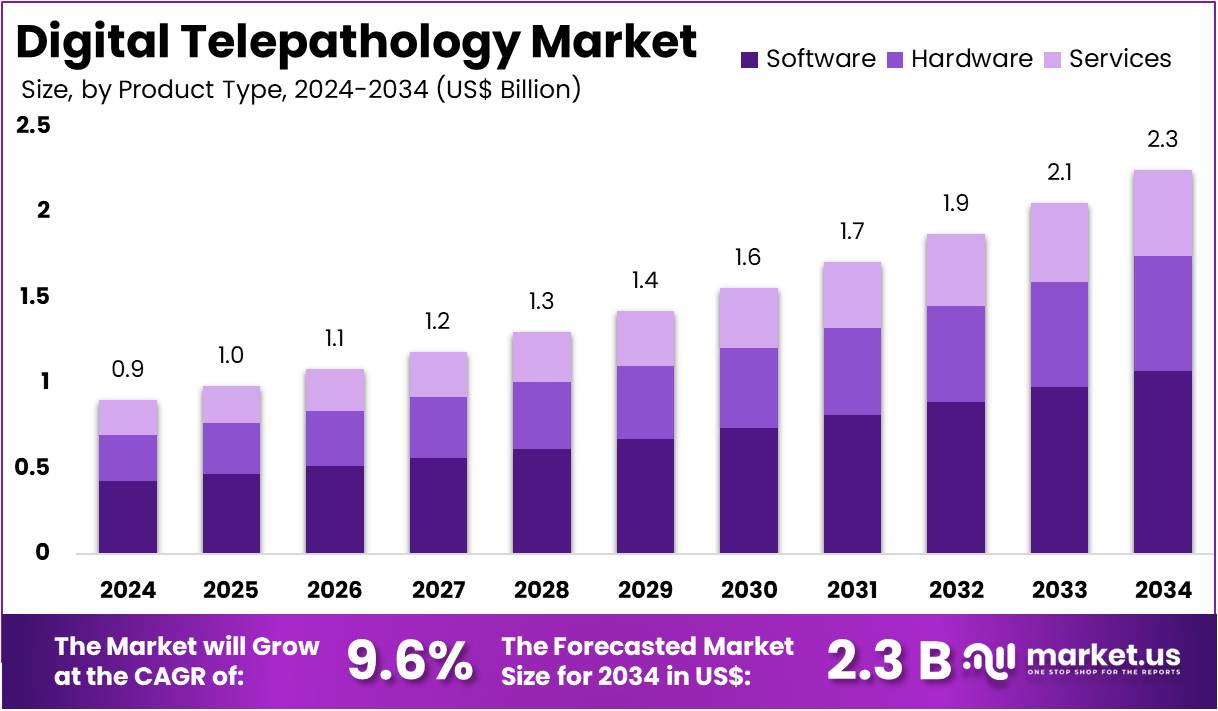

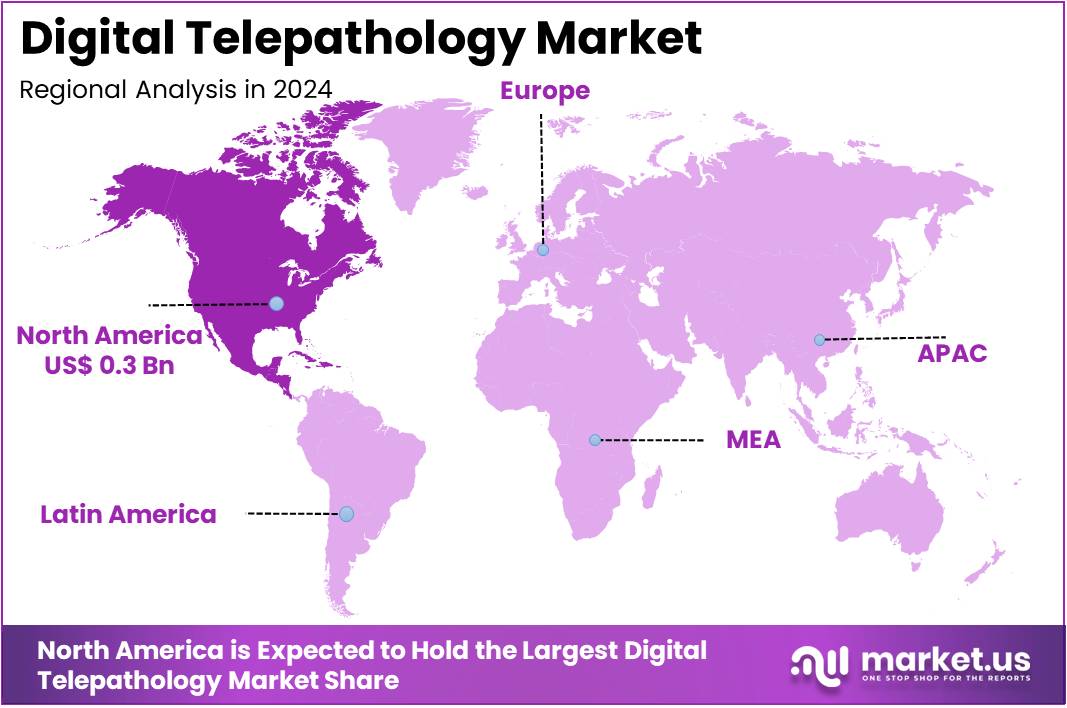

The Digital Telepathology Market Size is expected to be worth around US$ 2.3 billion by 2034 from US$ 0.9 billion in 2024, growing at a CAGR of 9.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 35.7% share and holds US$ 0.3 Billion market value for the year.

Rising pressures from a growing cancer burden and a persistent shortage of pathologists are key drivers of the digital telepathology market. The traditional method of manual slide review is becoming increasingly strained by the rising volume of cases and a lack of specialized professionals, creating a bottleneck in the diagnostic process. This situation is particularly critical in oncology, where timely diagnoses are essential for effective treatment. According to the CDC, over 2.0 million new cancer cases are expected to be diagnosed in the United States in 2025, a figure that underscores the immense and increasing workload on pathology labs and the urgent need for more efficient diagnostic tools.

Growing adoption of cloud-based infrastructure and strategic partnerships are significant trends shaping the market. These collaborations are enabling the development of integrated, scalable solutions that combine high-resolution whole-slide imaging with secure platforms for data sharing and remote analysis. For example, in March 2024, the collaboration between Amazon Web Services (AWS) and Philips was announced to provide secure, cloud-based digital pathology solutions. This partnership combines Philips’ digital pathology solutions with AWS’s cloud infrastructure, addressing the growing need for scalable, accessible telepathology solutions and allowing for enhanced remote collaboration among pathologists.

Increasing integration of artificial intelligence and a greater emphasis on interoperability are creating significant opportunities for market expansion. AI-powered algorithms are enabling faster image analysis, automated tumor detection, and a reduction in diagnostic errors. The FDA’s Center for Devices and Radiological Health has already cleared over 950 medical devices with AI or machine learning features as of August 2024, with a significant number aimed at improving diagnostic workflows. This regulatory support and technological innovation are critical for expanding telepathology applications beyond cancer diagnosis and into areas like remote consultations, second opinions, and medical education, ensuring a more efficient and interconnected global healthcare system.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.9 billion, with a CAGR of 9.6%, and is expected to reach US$ 2.3 billion by the year 2034.

- The product type segment is divided into software, hardware, and services, with software taking the lead in 2023 with a market share of 47.5%.

- Considering application, the market is divided into primary diagnosis, second opinion, research, and education & training. Among these, primary diagnosis held a significant share of 38.3%.

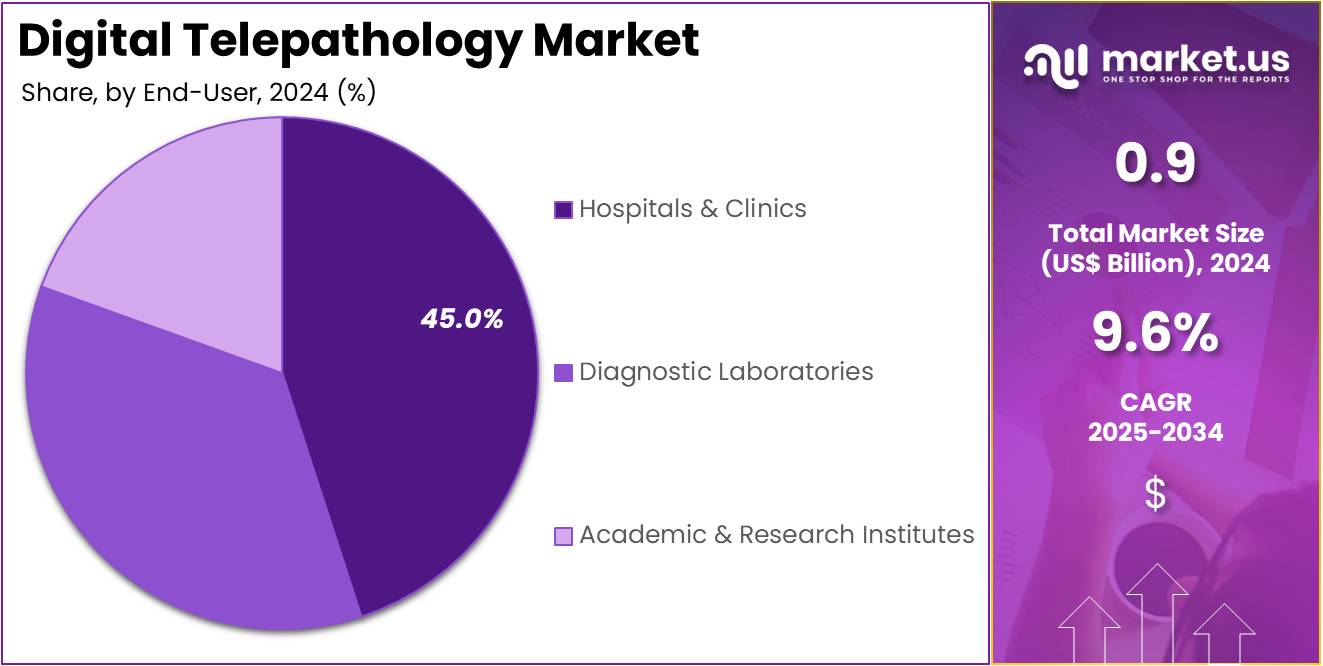

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, diagnostic laboratories, and academic & research institutes. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 45.0% in the market.

- North America led the market by securing a market share of 35.7% in 2023.

Product Type Analysis

Software holds the largest share at 47.5%. This growth is primarily attributed to the increasing adoption of telemedicine and digital healthcare solutions across hospitals, clinics, and diagnostic laboratories. As the healthcare industry continues to embrace digital transformation, the demand for software solutions to enable remote consultation, diagnosis, and pathology image analysis is growing.

Telepathology software solutions facilitate quicker, more accurate diagnoses by allowing pathologists to analyze high-resolution images remotely. Additionally, the increasing availability of cloud-based platforms is expected to enhance software demand, as these platforms offer cost-effective, scalable, and secure solutions for managing large volumes of medical images and patient data. The software segment’s growth is anticipated to continue as digital pathology becomes more integrated into daily medical practices, improving workflow efficiency and expanding diagnostic capabilities.

Application Analysis

Primary diagnosis leads the application segment with 38.3%. This segment is expected to grow due to the growing demand for remote healthcare solutions, particularly in regions with limited access to specialized medical professionals. Digital telepathology is playing a crucial role in enabling pathologists to conduct primary diagnoses from remote locations, thus improving access to timely and accurate care.

The growth of telemedicine, especially in rural and underserved areas, is anticipated to further drive this segment. Additionally, the COVID-19 pandemic has highlighted the importance of remote diagnosis solutions, and the trend is likely to continue as healthcare systems shift towards more accessible, flexible, and efficient care models. The primary diagnosis application of digital telepathology offers pathologists the ability to review tissue samples and images from any location, which is expected to drive further growth in the market.

End-User Analysis

Hospitals & clinics dominate the end-user segment with 45.0%. The increasing use of digital tools in medical institutions is driving this segment’s growth, as hospitals and clinics seek to improve diagnostic accuracy and speed. Digital telepathology enables hospitals and clinics to provide quicker and more efficient diagnoses, especially in emergency situations where time is critical. The ability to transmit pathology images digitally also enhances collaboration between medical professionals, ensuring better patient care and treatment outcomes.

Hospitals, in particular, are expected to continue adopting digital telepathology solutions to streamline operations and enhance diagnostic capabilities, particularly in oncology, infectious diseases, and other specialties. The growing demand for telemedicine and remote healthcare services will likely drive further adoption of digital telepathology solutions in hospitals and clinics, positioning this segment for continued growth.

Key Market Segments

By Product Type

- Software

- Hardware

- Services

By Application

- Primary Diagnosis

- Second Opinion

- Research

- Education & Training

By End-user

- Hospitals & Clinics

- Diagnostic Laboratories

- Academic & Research Institutes

Drivers

The increasing prevalence of cancer is driving the market

The market for digital telepathology is being driven by the rising global prevalence of cancer and other complex diseases that require a definitive pathology diagnosis. As the number of cases increases, so does the demand for efficient and accurate diagnostic services.

Digital telepathology provides a solution by enabling pathologists to remotely review and diagnose tissue samples, which helps to alleviate the workload on in-site labs and addresses the global shortage of trained pathologists. This technology also allows for subspecialty consultations, where a complex case can be sent electronically to an expert anywhere in the world, ensuring a more accurate diagnosis.

The sheer scale of this driver is immense. According to the US National Cancer Institute, there were an estimated 2,001,140 new cancer cases in the United States in 2024. This vast and growing number of new diagnoses underscores the critical need for scalable, efficient, and precise diagnostic tools that digital telepathology provides.

Restraints

The high cost and data storage requirements are restraining the market

A significant restraint on the digital telepathology market is the high initial cost of whole-slide imaging (WSI) scanners and the massive data storage requirements. The equipment needed to digitize glass slides is highly specialized and comes with a substantial upfront price tag that can be a major financial barrier for many hospitals and pathology labs.

In addition to the hardware, the digital images themselves are enormous, with a single high-resolution whole-slide image often generating multiple gigabytes of data. This creates a significant challenge for data storage, management, and network infrastructure, all of which add to the total cost of ownership.

The capital expenditure for this technology can be prohibitive for many institutions. For example, a single high-capacity whole-slide scanner from a major manufacturer, like the Aperio GT 400 from Leica Biosystems, a key player in the market, can cost hundreds of thousands of dollars, making it a major investment for most clinical labs.

Opportunities

The rising adoption of AI for diagnostics is creating growth opportunities

A key growth opportunity for the digital telepathology market lies in the rising adoption of artificial intelligence and machine learning for image analysis and diagnostic support. AI algorithms can be trained to analyze whole-slide images to automatically identify and count cells, detect subtle morphological changes, and even provide a preliminary diagnosis with a high degree of accuracy. This technology can serve as a powerful assistant to pathologists, helping them to prioritize urgent cases, reduce diagnostic turnaround times, and minimize human error.

The integration of AI transforms digital telepathology from a simple remote viewing tool into a sophisticated diagnostic platform. This opportunity is supported by regulatory approvals. According to the US Food and Drug Administration (FDA), as of the end of 2024, there were at least seven AI-based digital pathology systems that have received FDA 510(k) clearance for use in primary diagnosis in the United States. This regulatory endorsement signals a clear and growing pathway for commercial adoption of these systems.

Impact of Macroeconomic / Geopolitical Factors

Economic pressures worldwide, with inflation persisting at 5.9% in 2024 per International Monetary Fund data, force healthcare providers to constrain investments in advanced diagnostic tools and prioritize cost-effective remote consultation platforms. Vendors respond by incorporating AI analytics to streamline slide reviews and uphold service uptake amid fiscal limitations.

Geopolitical conflicts, including the Russia-Ukraine war, surge European energy expenses by 20-30% according to International Energy Agency findings, which interrupt component deliveries for imaging scanners and hinder rollout of international teleconsultation networks. US-China rivalries also curb access to vital semiconductors, requiring firms to seek alternative suppliers and endure elevated interim outlays.

These strains motivate bolstering of regional data centers and hybrid cloud setups, notably in expanding markets like Southeast Asia. This evolution ultimately amplifies system robustness and sustains robust industry trajectory into the next decade.

US tariffs, imposing a 10% baseline on all imports since April 2025 alongside 25% on medical devices from Mexico and up to 30% on Chinese components under recent adjustments, elevate acquisition costs for diagnostic scanners and software by 10-15%, diminishing profitability for operators and causing hospitals to postpone upgrades. Providers initially shoulder these burdens to retain partnerships, but sustained hikes may curtail adoption among underfunded clinics by 5-7%.

Retaliatory duties from the EU and China, hitting 25% on American exports, sever collaborative ties and inflate transit delays by 15-20% for cross-border data tools. Persistent reviews by the US Trade Representative foster volatility, triggering inventory builds that bind working capital. Conversely, these measures stimulate onshore assembly, with medtech investments in US facilities surpassing US$15 billion in 2025 as noted by the Biotechnology Innovation Organization, yielding thousands of positions and elevating local tech prowess. This repositioning fortifies procurement stability and ignites inventive surges, securing promising sector vitality forward.

Latest Trends

The development of cloud-based platforms is a recent trend

A defining trend in the digital telepathology market in 2024 is the shift toward cloud-based platforms for image storage, sharing, and analysis. In the past, the massive file sizes of digital slides often required labs to invest in expensive on-premise servers and a high-bandwidth local network.

However, the development of secure and scalable cloud infrastructure has made it possible for labs to store their digital slide libraries off-site and access them from anywhere with an internet connection. This has dramatically reduced the upfront capital expenditure for hardware and has enabled greater collaboration among pathologists and researchers. This trend is demonstrated by the strategic focus of key industry players.

For example, a major recent development in the market has been the increasing number of strategic partnerships between key players and cloud service providers. As noted in its 2024 Annual Report, Philips, a key player in the market, has focused on creating a cloud-based digital pathology ecosystem to provide its customers with a more scalable and accessible solution for their digital slide management, moving the industry away from on-site, proprietary systems toward a more flexible, shared infrastructure.

Regional Analysis

North America is leading the Digital Telepathology Market

In 2024, North America captured a 35.7% share of the global digital telepathology market, propelled by intensifying needs for remote diagnostics in oncology and chronic disease management amid clinician shortages. Healthcare providers accelerated adoption of whole-slide imaging systems to enable faster second opinions and collaborative consultations across vast geographies, reducing turnaround times from days to hours. Biopharma companies outsourced telepathology services to streamline clinical trial pathology reviews, particularly for immunotherapy agents requiring precise tumor microenvironment analysis.

The FDA’s supportive regulatory framework expedited device validations, fostering innovation in AI-augmented image analysis tools that enhance diagnostic accuracy. Academic medical centers expanded virtual tumor boards, leveraging cloud-based platforms for real-time expert input from specialists nationwide. Post-pandemic telehealth momentum further embedded digital workflows in routine practice, with hospitals integrating telepathology to optimize resource allocation during peak caseloads.

Venture funding in health tech startups specializing in pathology AI surged, enabling scalable solutions for underserved rural areas. This multifaceted expansion underscored North America’s leadership in transforming pathology from analog to digital paradigms. For instance, the FDA authorized 76 oncology devices in 2024, including several digital pathology systems such as whole-slide imagers and viewing software.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific digital telepathology sector to surge during the 2024-2030 forecast period, as governments prioritize AI integration in diagnostics to combat rising cancer incidences. Regional biopharma firms actively partner with tech providers to deploy remote slide scanning for cross-border trials, slashing costs and accelerating approvals. Urban hospitals anticipate scaling virtual consultations to address pathologist deficits, especially in densely populated megacities.

Collaborative initiatives in India and South Korea drive adoption of cloud-enabled platforms, merging local data with global standards for superior case reviews. Singapore’s innovation hubs foster startups developing mobile-compatible tools, broadening access in remote islands. Japan expects precision oncology programs to amplify demand for high-resolution imaging in immunotherapy monitoring. These efforts position the region for exponential remote diagnostics growth. In 2022-23, the Australian government invested US$107.2 million in digital health programs and innovations, supporting pathology digitization under national strategies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the digital telepathology sector accelerate expansion through innovative product launches and targeted partnerships that enhance diagnostic accuracy and streamline remote workflows. Leica Biosystems fortifies its dominance by introducing the Aperio FL fluorescent scanner at the AACR Annual Meeting in April 2025, enabling high-resolution multiplex imaging that attracts oncology researchers and secures multimillion-dollar contracts with biopharma leaders.

Philips Healthcare bolsters its offerings with AI-integrated cloud platforms debuted in Q1 2025, facilitating real-time global consultations and appealing to hospitals seeking scalable solutions. Roche Diagnostics executes strategic acquisitions to incorporate advanced bioinformatics, expediting biomarker discovery and fostering deeper integrations in precision medicine pipelines. 3DHISTECH pursues geographic diversification into high-growth Asian markets, establishing new service hubs to capitalize on rising cancer screening demands. These players also channel substantial R&D investments into collaborative ecosystems, yielding breakthroughs that propel market penetration and revenue uplift exceeding 15% year-over-year.

Leica Biosystems, a Danaher Corporation subsidiary with origins tracing back over 150 years to pioneering microtome innovations, stands as a global frontrunner in anatomic and digital pathology solutions, delivering end-to-end workflow tools from biopsy processing to AI-assisted diagnosis. Headquartered in Wetzlar, Germany, with pivotal operations in Vista, California, the company employs thousands across 100-plus countries and generates annual revenues surpassing US$1.2 billion through its robust portfolio of scanners, stains, and software.

In 2025, Leica launched the ChromoPlex III Detection System in July to advance chromogenic multiplex immunohistochemistry, alongside a landmark partnership with AstraZeneca for AI-powered precision diagnostics commercialization. This commitment to technological synergy and customer-centric advancements cements Leica’s role as an indispensable ally for pathologists worldwide, driving efficiencies in cancer care and research acceleration.

Top Key Players in the Digital Telepathology Market

- Visiopharm

- Ventana Medical Systems

- Sectra AB

- OptraSCAN

- Olympus Corporation

- Inspirata, Inc

- Indica Labs

- Hamamatsu Photonics K.K.

- ContextVision AB

- Applied Spectral Imaging (ASI)

Recent Developments

- In February 2025: PathAI, a company focused on AI-powered pathology, launched a new AI-powered tool called PathAssist Derm to advance dermatology research. This development highlights the market’s trend of creating specialized, AI-driven tools for specific medical fields. By providing a dedicated solution for dermatology, PathAI is catering to a new segment and demonstrating how artificial intelligence can be used to enhance diagnostic efficiency and accuracy in a specialized area of medicine.

- In February 2025: Charles River Laboratories International, Inc. announced a collaboration with Deciphex to advance AI-powered digital pathology. This partnership aims to deliver an integrated solution for more efficient, precise, and scalable pathology processes, particularly in toxicologic pathology. This is a key development as it showcases the increasing collaboration between contract research organizations (CROs) and digital pathology firms to streamline workflows and improve data management in drug discovery and development.

Report Scope

Report Features Description Market Value (2024) US$ 0.9 billion Forecast Revenue (2034) US$ 2.3 billion CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software, Hardware, and Services), By Application (Primary Diagnosis, Second Opinion, Research, and Education & Training), By End-user (Hospitals & Clinics, Diagnostic Laboratories, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Visiopharm, Ventana Medical Systems, Sectra AB, OptraSCAN, Olympus Corporation, Inspirata, Inc, Indica Labs, Hamamatsu Photonics K.K., ContextVision AB, Applied Spectral Imaging (ASI). Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Telepathology MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Telepathology MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Visiopharm

- Ventana Medical Systems

- Sectra AB

- OptraSCAN

- Olympus Corporation

- Inspirata, Inc

- Indica Labs

- Hamamatsu Photonics K.K.

- ContextVision AB

- Applied Spectral Imaging (ASI)