Global Digital Signage for Smart Cities Market Size, Share, Industry Analysis Report By Screen Size (22 inches - 32 inches, 32 inches - 55 inches, 55 inches - 75 inches, 75 inches - 98 inches, Others), By Display Type (LED, LCD, OLED, Others), By Application (Public Information, Advertising, Wayfinding, Traffic Management, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157955

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business Benefits

- Role of Generative AI

- China Market Revenue

- Emerging Trends

- By Screen Size Analysis

- By Display Type Analysis

- By Application Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

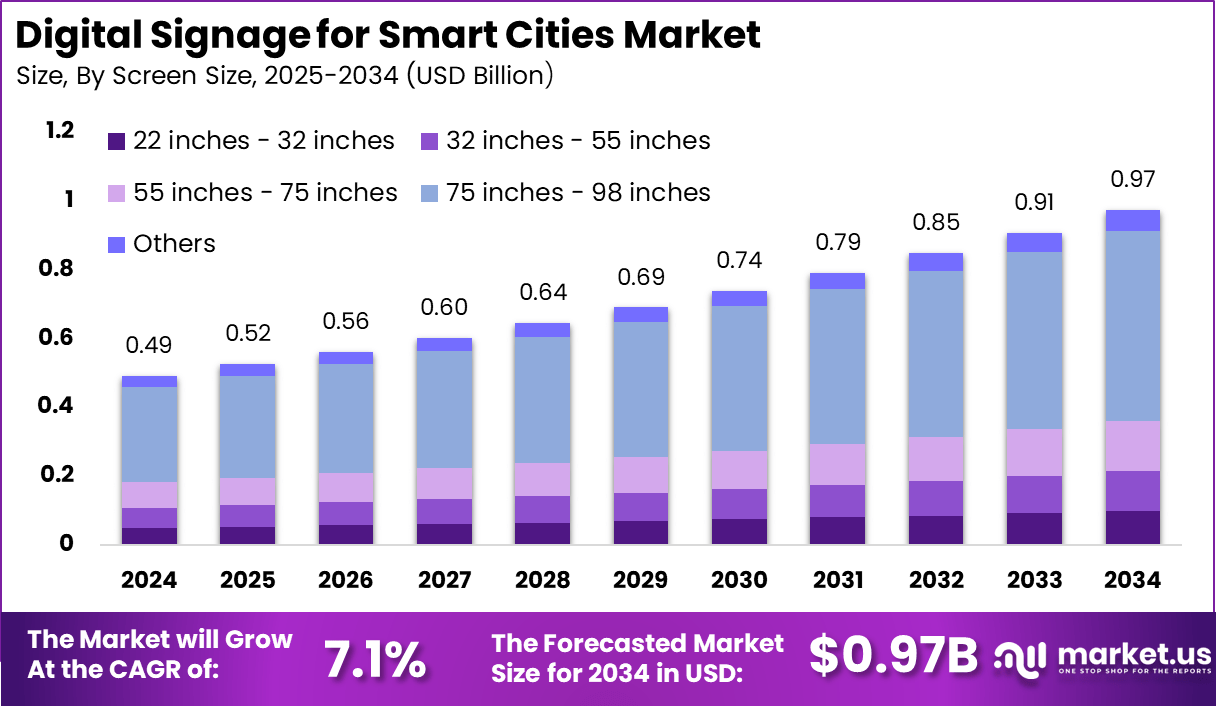

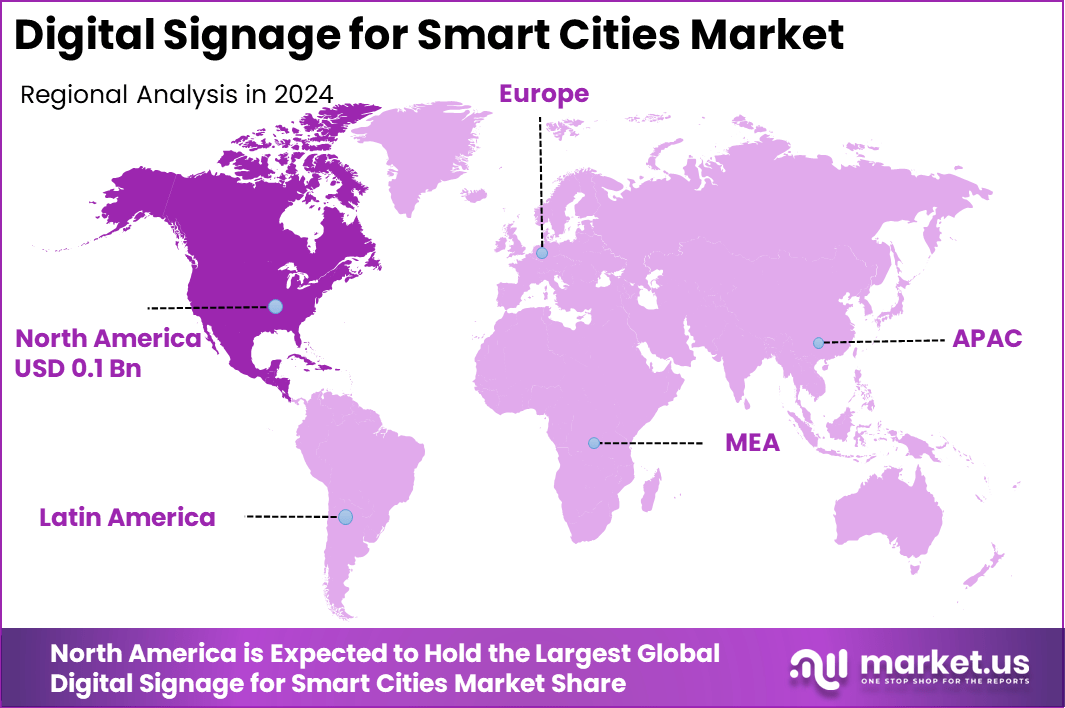

The Global Digital Signage for Smart Cities Market size is expected to be worth around USD 0.97 Billion By 2034, from USD 0.49 billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominan market position, capturing more than a 40.6% share, holding USD 0.1 Billion revenue.

The Digital Signage for Smart Cities Market covers digital display systems deployed across urban environments for public communication, information dissemination, wayfinding, public safety notifications, transit updates, advertisement, and civic engagement. These systems combine hardware (screens, video walls, kiosks), software (content management, scheduling, analytics), network infrastructure, and services (installation, maintenance, content creation).

Top driving factors include the growing need for real-time communication and efficient management of urban resources. Cities are looking to digital signage to improve public safety with emergency alerts, streamline public transport information, and engage citizens through interactive services. The rise of smart city initiatives worldwide is pushing governments to adopt these technologies as part of their urban development plans.

According to Market.us, In 2024, the global digital signage market was valued at USD 28.9 billion and is projected to reach USD 52.7 billion by 2032, growing at a CAGR of 7.7%. The global digital signage hardware market is forecasted to expand from USD 15.7 billion in 2024 to around USD 30 billion by 2034, at a CAGR of 6.8%. In 2024, North America led the hardware segment with more than 36% share, generating approximately USD 5.6 billion in revenue.

Key Insight Summary

- By screen size, the 75–98 inches category dominated, holding 56.8% share.

- By display type, LED screens led the market with 52.1% share.

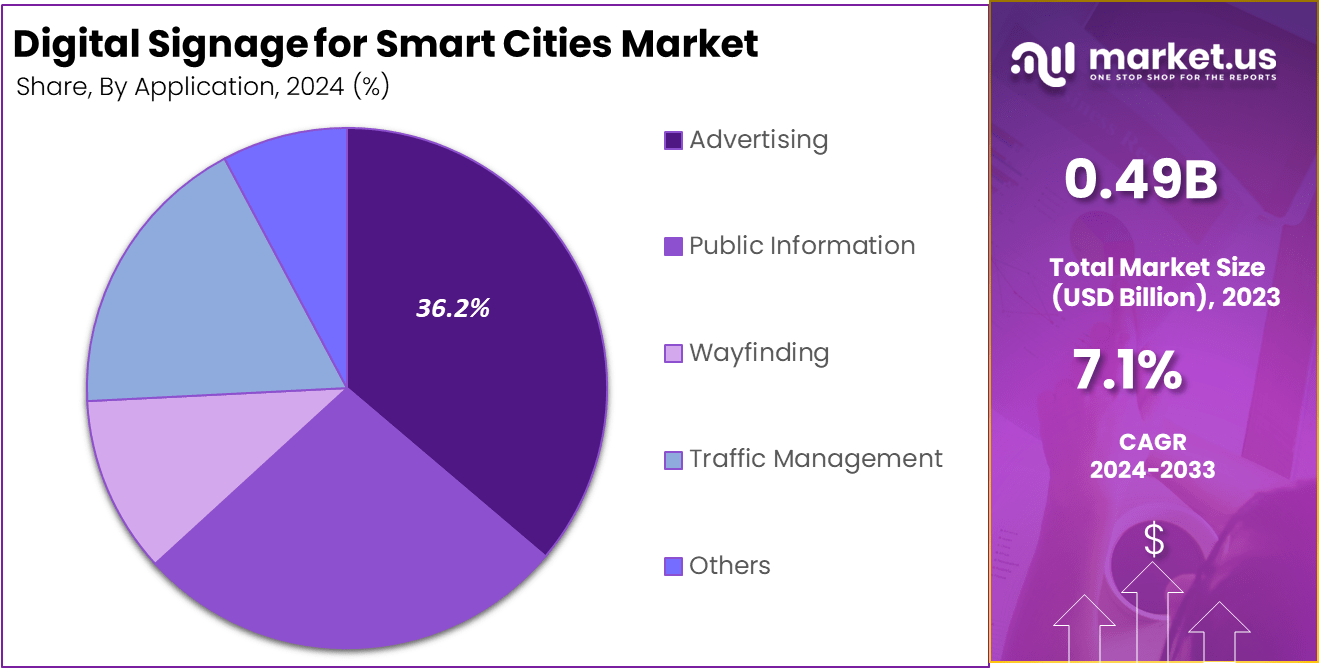

- By application, Advertising was the largest segment, capturing 36.2% share.

- Regionally, Asia Pacific dominated with 40.6% share of the global market.

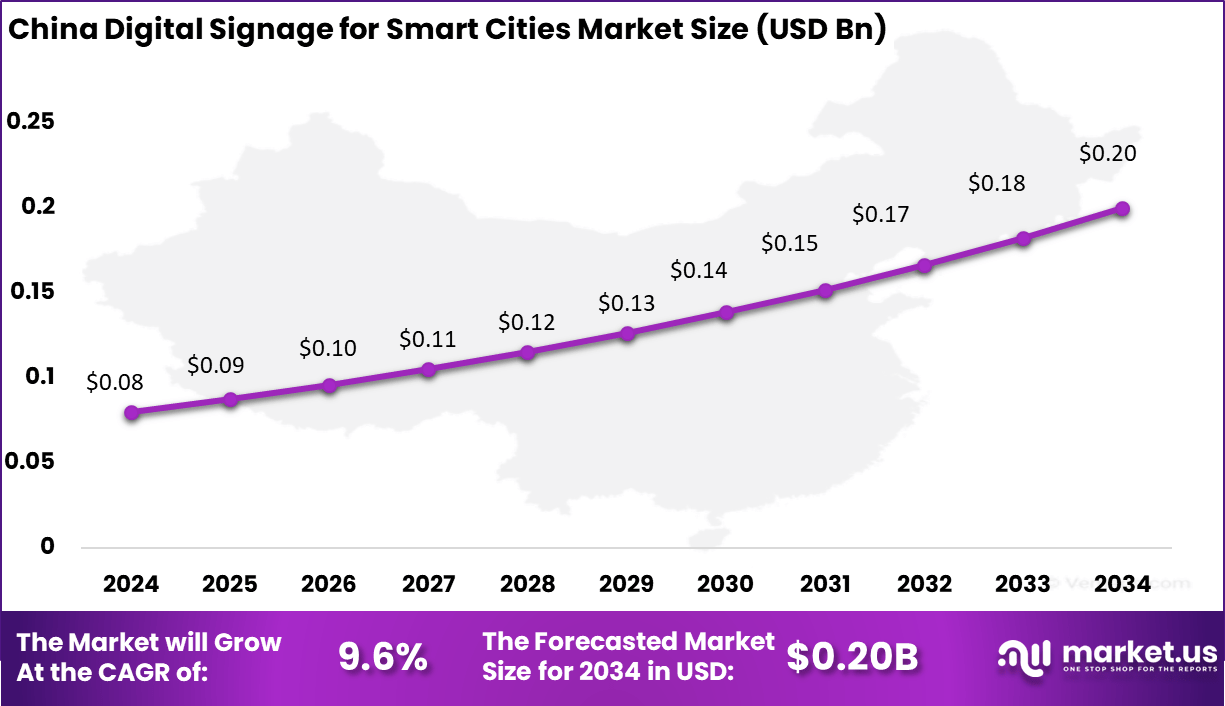

- Within Asia Pacific, China accounted for USD 0.08 Billion, expanding at a steady 9.6% CAGR.

Analysts’ Viewpoint

Demand for digital signage in smart cities is increasing due to its ability to deliver personalized and context-aware content. Citizens and visitors expect timely updates about traffic, weather, events, and local services. Additionally, businesses see value in digital signage as a tool for targeted advertising in high-footfall public areas, which drives adoption further.

The technologies boosting digital signage adoption include AI, IoT, 5G connectivity, and advanced display solutions like LED, OLED, and transparent screens. AI enables targeted content delivery by analyzing audience data, while IoT sensors allow real-time updates. 5G offers fast data transmission, ensuring smooth content updates without delays. These technologies enhance the user experience and operational efficiency.

Cities adopt digital signage to improve communication, generate additional revenue through advertising, and promote local businesses. The interactive nature of these displays also fosters citizen engagement by facilitating feedback, surveys, and access to government services. Furthermore, they support urban planning by displaying development updates and community initiatives.

Investment and Business Benefits

Investment opportunities arise from the increasing demand for integrated signage networks that combine hardware, software, and data analytics. There is strong potential for vendors providing AI-powered content management systems, real-time monitoring solutions, and cloud-based platforms. Public-private partnerships in smart city projects create room for funding and expanding digital signage infrastructure.

Business benefits include enhanced brand visibility, improved customer engagement, and operational cost savings. Digital signage offers dynamic advertising capabilities, which can increase recall and drive sales. For city administrations, it reduces reliance on static signage costs, allows centralized content control, and supports sustainability goals through energy-efficient displays.

The regulatory environment requires compliance with data privacy and security standards, as digital signage often collects user data and interacts with networks. Policies are evolving to ensure that digital signage content respects user consent and that systems are protected from cyber threats. Cities also promote the use of sustainable materials and energy-saving technologies in signage deployments.

Role of Generative AI

Key Points Description Personalized Content Creation Generative AI creates tailored video and visual content dynamically based on viewer demographics, preferences, and real-time environmental data, enhancing engagement. Intelligent Urban Planning Support AI helps optimize urban layouts, traffic routing, and zoning by analyzing complex data to improve city design and functionality. Real-Time Content Adaptation AI adjusts signage content instantly according to current conditions like weather, crowd size, or events to maintain relevance. Data-Driven Decision Making Generative AI analyzes extensive urban data to provide predictive insights and support strategic decisions in city management. Enhanced Interactive Messaging AI enables more immersive, context-aware interactions through intelligent chatbots, facial recognition, and voice commands on digital signs. China Market Revenue

The China Digital Signage for Smart Cities Market was valued at USD 0.08 Billion in 2024 and is anticipated to reach approximately USD 0.20 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 9.6% during the forecast period from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than 40.6% share and generating USD 0.1 billion in revenue in the digital signage for smart cities market. The region’s leadership is driven by rapid urbanization and strong government initiatives to build smart city infrastructure across countries such as China, India, Japan, and South Korea.

With cities investing heavily in intelligent transportation systems, public information networks, and advanced advertising platforms, digital signage has become a critical tool for communication, traffic management, and citizen engagement. APAC’s dominance is also supported by the region’s massive population base and growing demand for real-time digital solutions.

Governments and private enterprises are adopting digital signage to enhance urban living by providing dynamic updates in transportation hubs, public spaces, and commercial areas. The availability of cost-effective LED and LCD display solutions, combined with rising adoption of 5G and IoT technologies, has further accelerated the deployment of smart signage systems across major metropolitan cities.

Emerging Trends

Key Trends Description AI and Machine Learning Integration Increasing integration of AI for personalized and context-aware content delivery to enhance user engagement. IoT-Enabled Smart Displays Digital signs connected with IoT sensors collect data and interact with other smart city systems for synchronized updates. Touchless Interaction Technologies Adoption of gesture recognition, voice commands, and mobile app integration for safer, contactless public interactions. Advanced Analytics for Optimization Use of analytic tools for tracking audience behavior and content performance to continually optimize displayed information. Sustainable and Energy-Efficient Displays Growing use of energy-saving OLED and LED screens with smart power management features to reduce environmental impact. By Screen Size Analysis

In 2024, the 75-inch to 98-inch screen size segment holds a dominant share of 56.8% in the digital signage market for smart cities. This size range is favored for its ability to deliver high-impact visual content that is easily visible from a distance in outdoor and indoor urban environments. These large screens are ideal for public spaces, transportation hubs, and commercial areas where visibility and clarity are key for effective communication, advertising, and information dissemination.

Large-format screens also enable flexible content presentation, supporting dynamic, real-time updates that engage city residents and businesses alike. The ease of integrating these displays with smart city IT infrastructure allows municipalities and advertisers to deploy scalable digital signage solutions that enhance urban experiences.

By Display Type Analysis

In 2024, LED displays account for 52.1% of the digital signage market in smart cities, valued for their superior brightness, energy efficiency, and longevity. LED technology is well-suited for both outdoor and indoor applications, offering vivid colors and high visibility even under direct sunlight. This reliability and versatility make LED the preferred technology for digital signage that must operate continuously and attractively in urban environments.

The advantages of LED include lower power consumption compared to older technologies, alongside improved contrast and viewing angles. These benefits contribute to reduced operational costs and enhanced user engagement, which are critical factors for city planners and advertisers investing in scalable, sustainable signage solutions.

By Application Analysis

In 2024, Advertising is the leading application segment for digital signage in smart cities, accounting for 36.2% of the market. Digital signage offers dynamic external advertising opportunities that outperform traditional static billboards by allowing real-time content updates, targeted messaging, and interactive elements.

Advertisers leverage these benefits to deliver engaging campaigns that adapt to audience demographics, weather conditions, and time of day, optimizing impact and reach. This application aligns with growing investments in digital out-of-home (DOOH) advertising, which is expanding rapidly due to better connectivity and data-driven content management.

Smart city infrastructures provide ideal platforms for deploying digital signage advertising across transit stations, public squares, and retail zones. This convergence of technology and urban planning helps advertisers maximize their influence while contributing to the city’s digital transformation.

Key Market Segments

By Screen Size

- 22 inches – 32 inches

- 32 inches – 55 inches

- 55 inches – 75 inches

- 75 inches – 98 inches

- Others

By Display Type

- LED

- LCD

- OLED

- Others

By Application

- Advertising

- Public Information

- Wayfinding

- Traffic Management

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Real-Time Information and Interactive Communication

Digital signage plays a crucial role in smart cities by providing real-time, dynamic information to citizens. This constant flow of up-to-date information improves urban living by offering timely public announcements, traffic updates, and emergency alerts.

The demand for such live communication tools is growing as cities evolve, pushing governments to invest in digital signage to enhance interaction between city management and residents. This driver leverages advances in IoT and 5G, enabling quick content updates that keep people informed and engaged in their environment.

Moreover, interactive digital signage enriches the user experience by allowing citizens to access localized and personalized information through touchscreens and voice commands. This interactive element helps in areas like transportation hubs, retail, and public spaces to better meet the needs of diverse audiences.

Restraint Analysis

High Initial Deployment and Maintenance Costs

One significant restraint for the adoption of digital signage in smart cities is the high initial investment and ongoing maintenance costs. Installing advanced digital signage, especially those equipped with AI, IoT integration, and touchless technologies, requires substantial capital expenditure.

In many cases, the need for specialized hardware, software, and network connectivity adds layers of cost that municipal budgets may find challenging to accommodate. Alongside installation, maintenance expenses such as power consumption, content management, and equipment repairs can strain resources.

Smaller cities or those facing fiscal constraints might hesitate to adopt large-scale digital signage due to these financial challenges. Additionally, the cost of integrating these systems with existing urban infrastructure and training personnel contributes to slower implementation, affecting overall market penetration.

Opportunity Analysis

Expansion of AI-Driven Personalized Content

A major opportunity for digital signage in smart cities lies in the integration of artificial intelligence to deliver personalized, context-aware content. AI-powered digital displays can analyze audience behavior and environmental factors to tailor messaging in real time, enhancing engagement and relevance.

This capability is particularly useful in busy urban settings where diverse populations benefit from information customized to their needs, such as weather updates, transit alerts, and localized advertisements.

The growing adoption of AI also supports advanced analytics and automated content management, which streamline operations for city officials and businesses alike. As smart city initiatives expand globally, the potential to develop AI-enabled digital signage solutions that optimize communication and public services is immense, offering significant growth prospects for market players willing to innovate in this space.

Challenge Analysis

Data Privacy and Security Concerns

One of the key challenges for deploying digital signage in smart cities involves addressing data privacy and security risks. Since many digital signage systems collect and analyze user data to deliver personalized content, there is an increased risk of data breaches and misuse.

Ensuring compliance with privacy regulations and protecting sensitive information becomes complex when these systems operate across multiple public locations. Moreover, connected digital signage can be vulnerable to cyberattacks, potentially compromising city infrastructure or disrupting essential public communication.

The need for robust cybersecurity measures, secure networks, and transparent data policies requires coordinated efforts from technology providers and city authorities. Overcoming these concerns is crucial to building public trust and enabling wider adoption of digital signage technologies in smart city ecosystems.

Competitive Analysis

In the digital signage for smart cities market, Samsung, LG, Sony, and Panasonic lead with advanced display technologies and wide global networks. Their energy-efficient and durable solutions support city communication, transport systems, and advertising. Strong investments in smart and connected displays position them as key suppliers for urban projects.

NEC, Sharp, Leyard, and Daktronics strengthen the market with large-scale LED and LCD installations. Their focus on stadiums, transport hubs, and outdoor signage drives adoption. Expertise in fine-pitch and customized solutions ensures reliable performance in diverse city environments.

Regional players such as VGI Global Media, Eyevis, and Christie Digital Systems add value with tailored offerings. They provide localized solutions for public engagement, events, and advertising. Their role increases competition and supports wider adoption of digital signage across smart city initiatives.

Top Key Players in the Market

- Samsung Electronics

- LG Electronics

- NEC Corporation

- Sharp Corporation

- Leyard

- Daktronics

- VGI Global Media

- Panasonic Corporation

- Eyevis

- Sony Corporation

- Christie Digital Systems

- Others

Recent Developments

- In October 2024, Advantech launched the DS-086, an ultra-slim digital signage player designed for 4K/8K displays. It features Intel’s latest Core Ultra processing and advanced connectivity options. This product is crafted specifically to meet the demanding needs of smart cities, supporting real-time data analytics and AI-powered advertising.

- In July 2024, Wallboard, a US-based software company specializing in digital signage content management systems (CMS), completed the acquisition of Keywest Technology. This move expands Wallboard’s software capabilities and strengthens its position in smart city digital signage solutions.

Report Scope

Report Features Description Market Value (2024) USD 0.49 Bn Forecast Revenue (2034) USD 0.97 Bn CAGR(2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Screen Size (22 inches – 32 inches, 32 inches – 55 inches, 55 inches – 75 inches, 75 inches – 98 inches, Others), By Display Type (LED, LCD, OLED, Others), By Application (Public Information, Advertising, Wayfinding, Traffic Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics, LG Electronics, NEC Corporation, Sharp Corporation, Leyard, Daktronics, VGI Global Media, Panasonic Corporation, Eyevis, Sony Corporation, Christie Digital Systems, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Signage for Smart Cities MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Signage for Smart Cities MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics

- LG Electronics

- NEC Corporation

- Sharp Corporation

- Leyard

- Daktronics

- VGI Global Media

- Panasonic Corporation

- Eyevis

- Sony Corporation

- Christie Digital Systems

- Others