Global Digital Security Control Market Size, Share Analysis By Hardware (Smart Card, Sim Card, Biometric Technologies, Others), By Technology (Two-Factor Authentication, Three-Factor Authentication, Four-Factor Authentication), By Application (Anti-Phishing, User Authentication, Network Monitoring, Security Administration, Web Technologies), By End-use (Mobile Security and Telecommunication, Finance and Banking, Healthcare, Commercial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155701

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

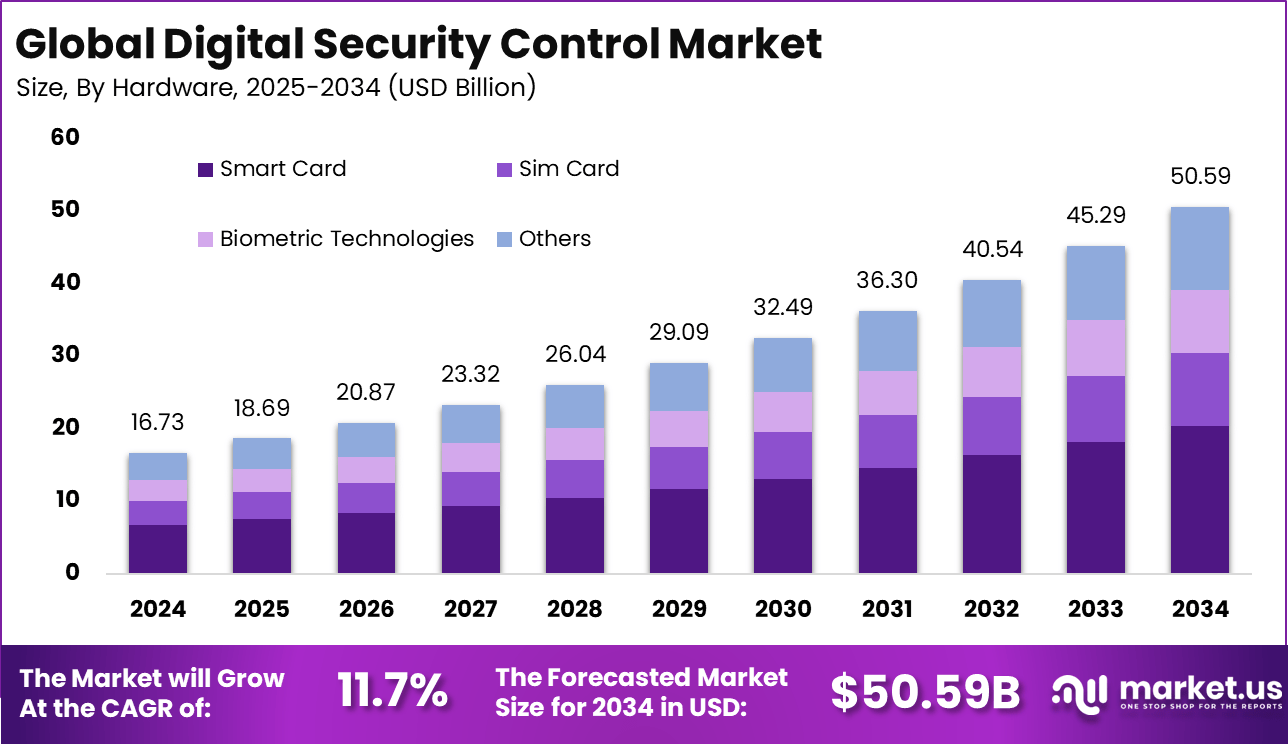

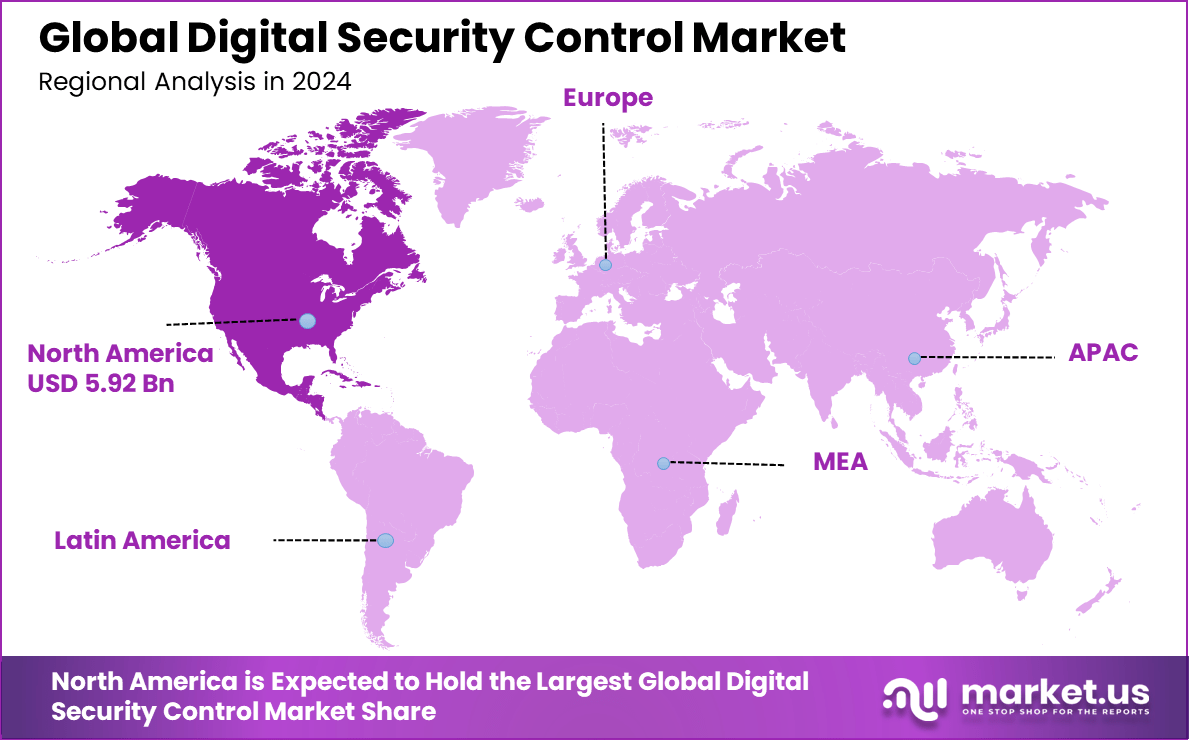

The Global Digital Security Control Market size is expected to be worth around USD 50.59 billion by 2034, from USD 16.73 billion in 2024, growing at a CAGR of 11.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.4% share, holding USD 5.92 billion in revenue.

The Digital Security Control market focuses on technologies and services that protect digital assets including data, networks, and identities. It covers solutions such as authentication systems, surveillance tools, encryption methods, and access controls. The market is expanding as organizations digitize their operations and seek stronger protection against cyber threats.

Key Takeaway

- The Smart Card segment dominated the hardware category, accounting for 40.3% of the Digital Security Control Market.

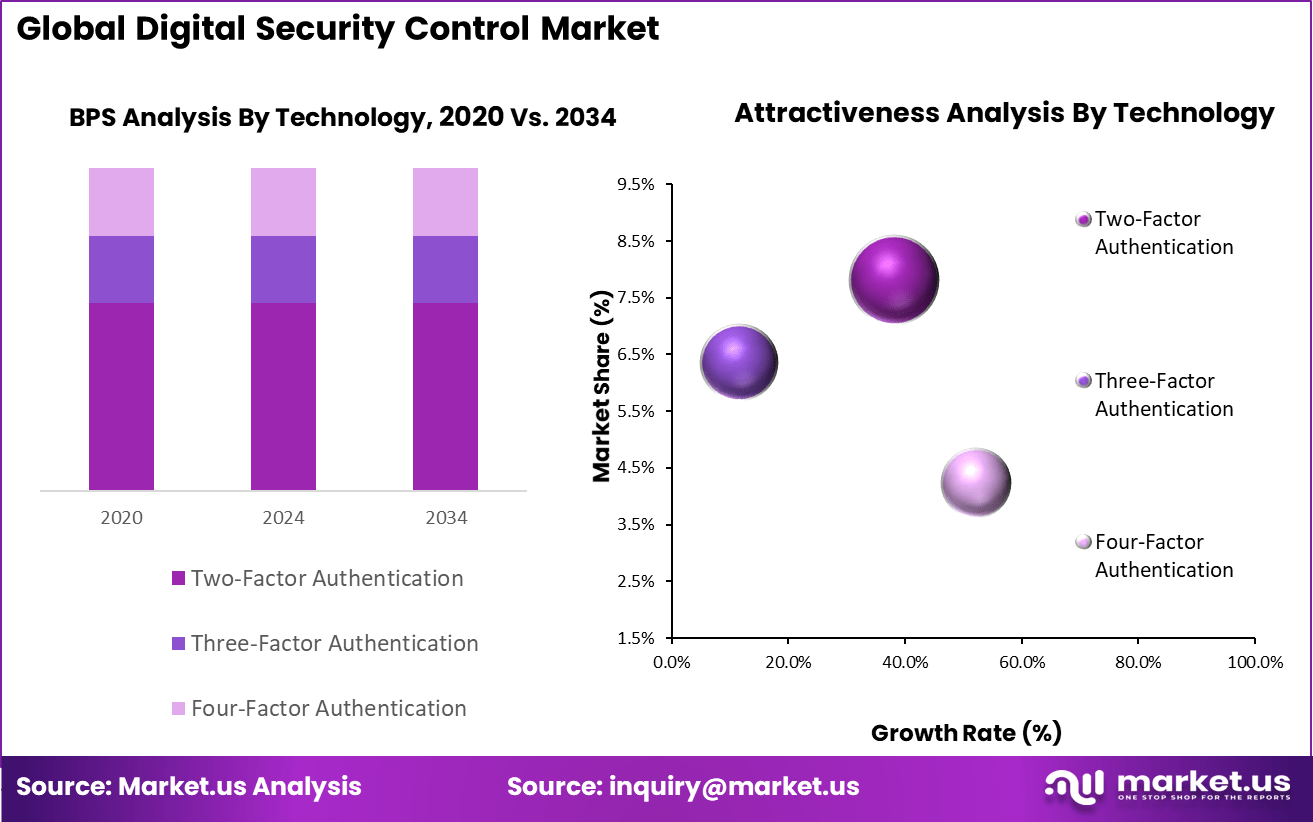

- The Two-Factor Authentication segment led the technology category, capturing 55.4% share, showing strong demand for layered protection.

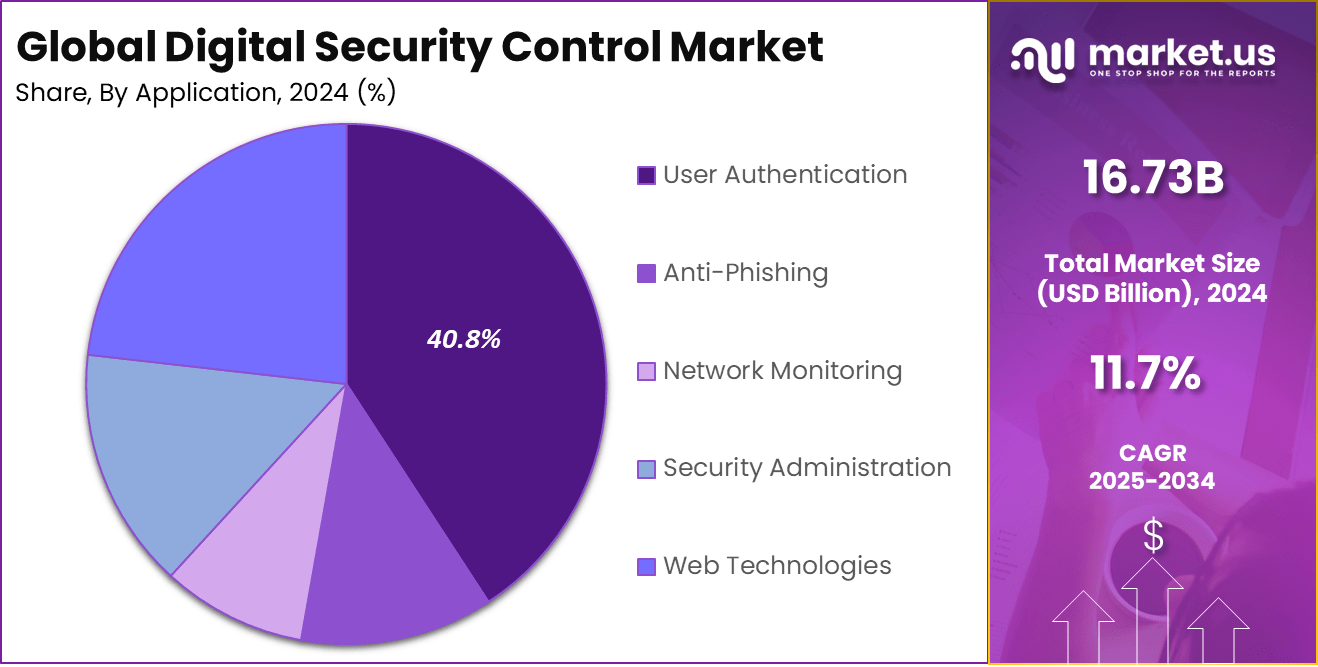

- The User Authentication segment held the largest share in applications, securing 40.8%, underlining its importance in identity verification.

- The Finance and Banking sector emerged as the leading end-use industry, with 30.1% share, reflecting high reliance on secure digital systems.

The growth of the market is supported by the adoption of advanced authentication systems such as biometric recognition and smart cards. Another factor is the expansion of connected devices and the Internet of Things, which increases vulnerabilities and creates a stronger need for security. Rising cyber incidents and stricter compliance requirements are also compelling industries to prioritize digital protection measures.

According to openprovider, In 2024, the financial and operational impact of cyber threats reached unprecedented levels. The average cost of a data breach rose to USD 4.88 mn, reflecting a 10% increase over the previous year and marking the highest recorded value to date. At the same time, the scale of attempted intrusions intensified sharply, with an estimated 750 mn cyber attack attempts per day, which equals nearly 8,680 attacks every second

The attack landscape also revealed critical vulnerabilities in organizational defenses. More than 75% of targeted cyberattacks originated from phishing emails, reinforcing email as the most exploited entry point for cybercriminals. Web applications represented another key risk area, with 17% of attacks focusing on application vulnerabilities.

Alarmingly, 98% of web applications were identified as being vulnerable to exploitation, with 72% of these weaknesses traced back to flaws in application coding. The frequency of attacks also continued to rise, with organizations facing an average of 1,636 cyberattacks per week in Q2 2024, a 30% increase year-over-year, underscoring the urgency of strengthening cybersecurity resilience.

Increasing adoption of technologies such as AI, biometrics, blockchain, and IoT security solutions are defining the technological frontier in digital security control. AI’s role is pivotal in delivering real-time threat detection and automation, while blockchain offers secure, transparent data management. IoT and edge computing present both challenges and opportunities by expanding connectivity but requiring enhanced security for distributed devices

For instance, in July 2025, Trend Micro launched a digital twin model for proactive cybersecurity defense, marking a significant advancement in digital security control. The innovative model replicates an organization’s digital environment, enabling real-time threat simulation and response. By predicting potential cyberattacks and automating defense strategies, Trend Micro’s solution enhances resilience, allowing businesses to stay ahead of evolving threats.

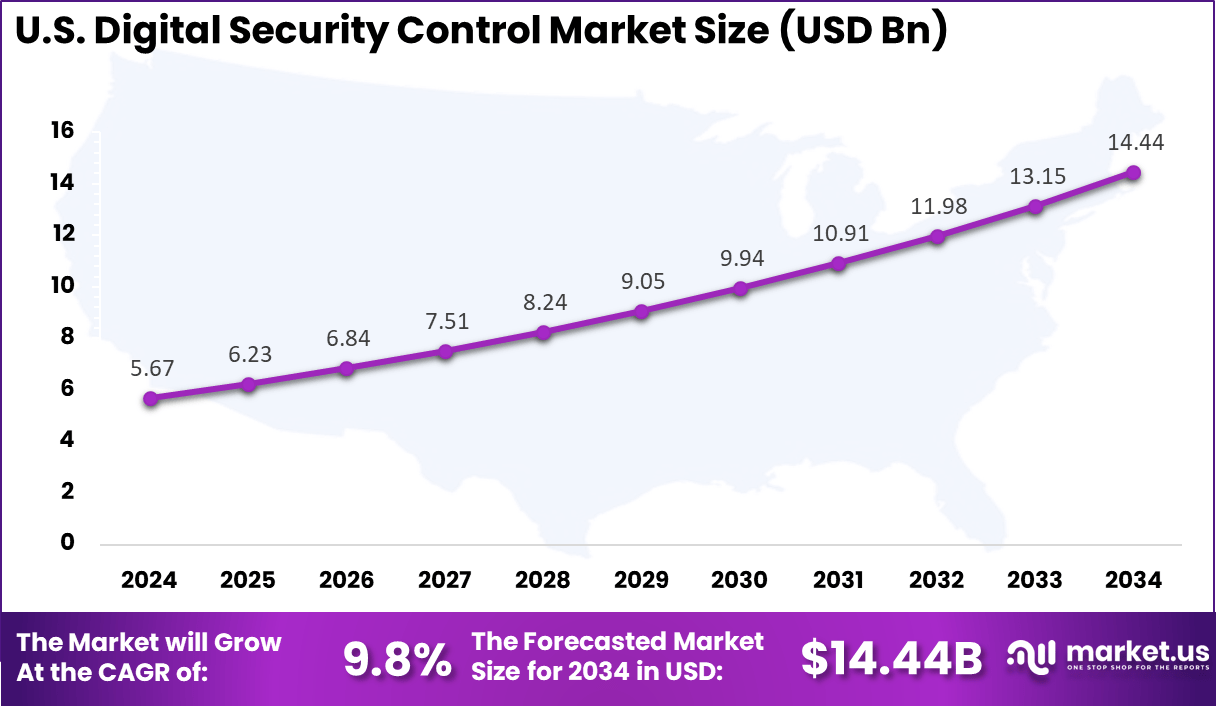

U.S. Market Size

The market for Digital Security Control within the U.S. is growing tremendously and is currently valued at USD 5.67 billion, the market has a projected CAGR of 9.8%. The market is growing tremendously due to the rising frequency of cyberattacks targeting both private and public sectors. With increasing regulatory requirements like CCPA and evolving federal mandates, organizations are prioritizing stronger security frameworks.

The rapid adoption of cloud computing, IoT devices, and remote work has expanded vulnerability points, further driving demand for advanced security solutions. Additionally, U.S. businesses are heavily investing in AI-driven tools and identity management systems to stay ahead of sophisticated threats.

For instance, in January 2025, the U.S. Cyber Trust Mark was launched, marking a significant step in reinforcing digital security control within the U.S. The initiative aims to set a standard for consumer-facing digital products, ensuring they meet stringent cybersecurity requirements. This move enhances the U.S.’s dominance in the global digital security market, emphasizing trust and transparency in cybersecurity practices.

In 2024, North America held a dominant market position in the Global Digital Security Control Market, capturing more than a 35.4% share, holding USD 5.92 billion in revenue. The dominance is due to its advanced technological infrastructure, widespread digital adoption, and stringent regulatory frameworks.

The region’s high concentration of cybersecurity investments, driven by major industries like finance, healthcare, and government, fuels the demand for robust security solutions. Additionally, the increasing frequency of cyberattacks and the adoption of cloud services and IoT devices have prompted organizations to prioritize cybersecurity, ensuring North America’s leading role in the market.

For instance, in July 2024, Gerardo de la Torre from Nissan discussed the growing importance of cybersecurity and digital security controls within the automotive supply chain during an interview with Automotive Logistics. He highlighted North America’s dominance in advancing digital security measures, as manufacturers increasingly prioritize cybersecurity to protect connected vehicle technologies and data.

Hardware Analysis

In 2024, The Smart Card segment held a dominant market position, capturing a 40.3% share of the Global Digital Security Control Market. This dominance is due to the increasing use of smart cards for secure authentication across sectors like finance, healthcare, and government. Their features, such as robust encryption, multi-factor authentication, and portability, make them perfect for access control and payment systems.

The rising trend of cashless transactions and their seamless integration with digital platforms are also contributing to their widespread adoption, further accelerating the growth of the smart card segment in the Digital Security Control Market.

For Instance, in June 2025, Toppan Security of Singapore acquired DZCard, a leading provider of smart card solutions in Thailand. This strategic acquisition underscores the growing demand for secure, efficient smart card technologies across Southeast Asia. The move enables Toppan to expand its market presence, offering enhanced solutions in payment security, access control, and digital authentication.

Technology Analysis

In 2024, the Two-Factor Authentication segment held a dominant market position, capturing a 55.4% share of the Global Digital Security Control Market. The demand for Two-Factor Authentication (2FA) has surged due to the rise in cyberattacks, such as phishing and credential theft.

As businesses across sectors focus on securing user access and protecting sensitive data, 2FA provides an effective and straightforward solution. Adding an extra layer of protection beyond traditional passwords enhances security. Additionally, 2FA integrates factors like biometrics or hardware tokens, further minimizing the risk of breaches and making it an essential tool in modern cybersecurity strategies.

For instance, in April 2025, the National Informatics Centre (NIC) mandated OTP-based Two-Factor Authentication (2FA) for all e-tax systems in India to enhance security. This move aims to better protect sensitive financial data by requiring both a password and a OTP, strengthening access control, and reducing the risk of unauthorized access. It aligns with ongoing efforts to prioritize digital security across government platforms.

Application Analysis

In 2024, the User Authentication segment held a dominant market position, capturing a 40.8% share of the Global Digital Security Control Market. This dominance is due to the rising demand for secure access across digital platforms, especially in sectors like finance, healthcare, and e-commerce.

Technologies such as passwords, biometrics, smart cards, and two-factor authentication help ensure that only authorized users can access sensitive information. As businesses increasingly depend on online services, protecting data has become a top priority. The widespread adoption of multi-factor authentication (MFA), biometrics, and single sign-on (SSO) further accelerates the growth of the user authentication segment.

For Instance, in March 2025, Clio launched a real-time logging tool with locking capabilities, enhancing user authentication and digital security control. This tool helps track and log user activities in real-time, ensuring that only authorized individuals access sensitive information. By integrating advanced locking mechanisms, Clio’s solution prevents unauthorized users from gaining access, providing an added layer of protection.

End-Use Analysis

In 2024, The Finance and Banking segment held a dominant market position, capturing a 30.1% share of the Global Digital Security Control Market. This dominance is due to the high volume of sensitive financial transactions and the increasing threat of cyberattacks targeting financial institutions.

With the rise of digital banking, mobile payments, and online trading, the need for robust security measures such as encryption, multi-factor authentication, and fraud detection systems has become critical in safeguarding customer data and maintaining trust.

For Instance, in February 2025, the Reserve Bank of India (RBI) launched an exclusive banking domain aimed at tackling financial frauds and enhancing digital security measures. This initiative highlights the growing importance of robust digital security in the finance and banking sector, where the rise in online transactions and digital services has increased the risk of cyber fraud.

Key Market Segments

By Hardware

- Smart Card

- Sim Card

- Biometric Technologies

- Others

By Technology

- Two-Factor Authentication

- Three-Factor Authentication

- Four-Factor Authentication

By Application

- Anti-Phishing

- User Authentication

- Network Monitoring

- Security Administration

- Web Technologies

By End-use

- Mobile Security and Telecommunication

- Finance and Banking

- Healthcare

- Commercial

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Cybersecurity Threats

The surge in cyberattacks, including ransomware, phishing, and data breaches, is intensifying pressure on organizations to adopt robust digital security controls. High-profile breaches have exposed vulnerabilities across sectors, prompting a shift toward proactive threat management.

Enterprises are investing in advanced authentication, encryption, and behavioral analytics to safeguard critical infrastructure and sensitive data. The growing sophistication of attackers underscores the urgency for dynamic, scalable digital security strategies that can preempt evolving threat vectors and protect organizational resilience.

For instance, in November 2024, Microsoft’s Digital Defense Report revealed a staggering increase in global cyberattacks, with an average of 600 million cyberattacks per day targeting individuals, organizations, and governments worldwide. This surge underscores the growing sophistication and frequency of cyber threats, showing the critical need for robust cybersecurity measures.

Restraint

High Cost of Implementation

Implementing advanced digital security solutions often requires significant capital investment, posing barriers for small and mid-sized enterprises. Technologies such as AI-driven analytics, biometric authentication, and encrypted communication systems involve high upfront costs, integration expenses, and ongoing maintenance.

For many organizations, budget constraints hinder the adoption of these critical systems, leaving them exposed to escalating threats. Cost-related concerns also impact return-on-investment calculations, especially in regions where cybersecurity awareness and regulatory enforcement remain uneven.

For instance, in July 2025, a report from Bitlyft highlighted the growing challenge of the high cost of cybersecurity for organizations. As cyber threats become increasingly sophisticated, implementing advanced digital security controls, such as AI-driven threat detection, encryption technologies, and biometric authentication, requires significant investment.

Opportunities

Expansion in Asia-Pacific

The Asia-Pacific region presents a substantial growth opportunity for the digital security control market, driven by rapid digitization, expanding IT infrastructure, and heightened cybersecurity awareness. Governments and enterprises in markets such as India, China, and Japan are investing heavily in cybersecurity infrastructure and regulations.

As these economies digitize financial systems, healthcare, and public services, demand for robust and scalable digital security solutions is accelerating. Vendors that localize offerings and address regional compliance needs are well-positioned to capture market share.

For instance, in August 2025, Accenture announced its acquisition of CyberCX, a move that significantly strengthens its cybersecurity capabilities in the Asia-Pacific region. This expansion highlights the growing demand for advanced digital security solutions as businesses in countries like India, China, and Japan ramp up their digital transformation efforts.

Challenges

Privacy Concerns

A significant challenge is balancing user privacy with optimal digital safety. When companies adopt tools, behavior analysis, or systems that scrutinize physical characteristics, they become more concerned about data misuse, overmonitoring, and the proper handling of personal information.

Observing international and local privacy laws, including GDPR, necessitated strict guidelines for data collection and storage practices. This complexity can slow adoption, increase legal risk, and erode public trust, showing the need for transparent, privacy-by-design approaches in security architecture.

For instance, in January 2025, the introduction of the UK’s new Digital IDs raised significant privacy concerns around digital security controls. While the initiative aims to streamline online verification and access, critics worry about the potential for misuse of personal data, surveillance, and unauthorized tracking. The lack of clear regulatory frameworks on how this sensitive information will be stored and protected has fueled anxiety over data breaches and identity theft.

Emerging Trend Analysis

Integration of AI and Zero Trust Architecture in Digital Security Controls

The digital security control market in 2025 is being shaped by the integration of artificial intelligence and zero trust security models. AI-driven threat detection and response capabilities are becoming essential as cyber threats grow more sophisticated, leveraging machine learning to identify and react to unusual patterns in real time.

These intelligent systems reduce reliance on manual oversight and enable faster, more accurate identification of potential breaches. Zero trust architecture, which assumes no implicit trust inside or outside the network, is gaining traction among organizations aiming to strengthen access controls.

By continuously verifying users and devices, this approach minimizes the risk of unauthorized access across cloud services, IoT endpoints, and mobile environments. Together, AI and zero trust frameworks are driving a shift toward more adaptive, resilient security postures across industries

Key Players Analysis

The Digital Security Control Market is shaped by the presence of leading global players such as Cisco Systems, Inc., Microsoft, IBM Corporation, and Palo Alto Networks. These companies dominate through advanced security infrastructure, large-scale enterprise adoption, and strong investment in next-generation technologies. Their solutions address a broad range of cybersecurity needs, from threat detection to cloud-based security controls.

Specialized firms such as Fortinet, Inc., Check Point Software Technologies Ltd., Trend Micro, Inc., and FireEye, Inc. contribute significantly to the competitive landscape. These companies are recognized for their expertise in network security, malware defense, and intrusion prevention systems. Their strong focus on product innovation, advanced firewalls, and integrated security services makes them critical players.

Regional and niche-focused companies such as Digital Security Concepts, Hadrian Security, Linked Security NY, and Orbit Security Systems also hold an essential position. While smaller in scale compared to global leaders, these firms address specialized markets and localized security challenges.

Top Key Players in the Market

- Cisco Systems, Inc.

- Digital Security Concepts

- Fortinet, Inc.

- Hadrian Security

- Linked Security NY

- McAfee, LLC

- Microsoft

- Orbit Security Systems

- Palo Alto Networks

- Symantec Corporation (now part of Broadcom Inc.)

- Check Point Software Technologies Ltd.

- IBM Corporation

- Trend Micro, Inc.

- FireEye, Inc.

- RSA Security LLC (a subsidiary of Dell Technologies)

- Others

Recent Developments

- In July 2025, Palo Alto Networks announced its acquisition of CyberArk, a leader in identity security, for $25 billion. This strategic move aims to enhance Palo Alto’s platform-first strategy by integrating CyberArk’s identity security solutions, addressing the growing need for securing digital identities in an AI-driven landscape.

- In June 2024, Trend Micro launched the first security solutions designed specifically for consumer AI PCs, addressing the rising cybersecurity risks linked to AI-driven devices. These solutions protect users from emerging threats targeting AI applications, ensuring data privacy and device security.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Hardware (Smart Card, Sim Card, Biometric Technologies, Others), By Technology (Two-Factor Authentication, Three-Factor Authentication, Four-Factor Authentication), By Application (Anti-Phishing, User Authentication, Network Monitoring, Security Administration, Web Technologies), By End-use (Mobile Security and Telecommunication, Finance and Banking, Healthcare, Commercial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Digital Security Concepts, Fortinet, Inc., Hadrian Security, Linked Security NY, McAfee, LLC, Microsoft, Orbit Security Systems, Palo Alto Networks, Symantec Corporation (now part of Broadcom Inc.), Check Point Software Technologies Ltd., IBM Corporation, Trend Micro, Inc., FireEye, Inc., RSA Security LLC (a subsidiary of Dell Technologies), Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Security Control MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Security Control MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Digital Security Concepts

- Fortinet, Inc.

- Hadrian Security

- Linked Security NY

- McAfee, LLC

- Microsoft

- Orbit Security Systems

- Palo Alto Networks

- Symantec Corporation (now part of Broadcom Inc.)

- Check Point Software Technologies Ltd.

- IBM Corporation

- Trend Micro, Inc.

- FireEye, Inc.

- RSA Security LLC (a subsidiary of Dell Technologies)

- Others