Global Digital Respiratory Devices Market By Product Type (Smart Inhalers & Nebulizers, Smart Spirometers and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies and Retail Pharmacies), By Application (Chronic Obstructive Pulmonary Disease (COPD), Asthma and Others), By End-User (Hospitals, Ambulatory Care Settings and Home Care Settings), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175201

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

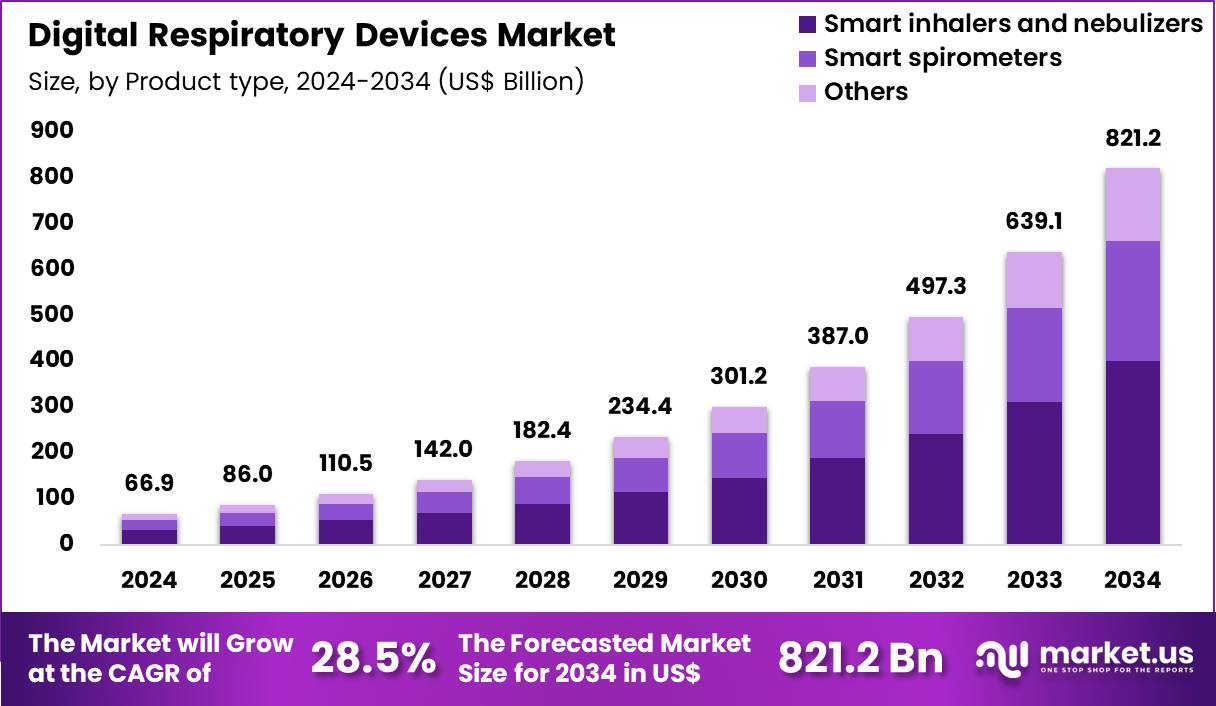

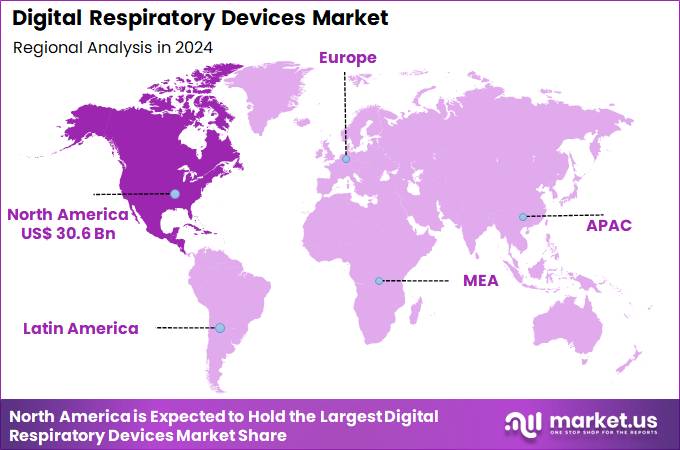

Global Digital Respiratory Devices Market size is expected to be worth around US$ 821.2 Billion by 2034 from US$ 66.9 Billion in 2024, growing at a CAGR of 28.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 45.8% share with a revenue of US$ 30.6 Billion.

Increasing prevalence of chronic respiratory conditions such as asthma and chronic obstructive pulmonary disease accelerates demand for digital respiratory devices that enable real-time monitoring and personalized management strategies. Patients with asthma increasingly utilize smart inhalers equipped with sensors to track medication adherence and inhalation technique, alerting users to improper use and preventing exacerbations through app-based reminders.

These devices support COPD management by integrating with digital spirometers that measure lung function remotely, allowing clinicians to adjust therapies based on trend data and reduce hospital visits. Sleep apnea sufferers employ connected CPAP machines that record breathing patterns and compliance, facilitating adjustments to pressure settings for optimal nocturnal therapy.

Pulmonary rehabilitation programs apply wearable oximeters and activity trackers to monitor oxygen saturation and exercise tolerance, guiding customized recovery plans for post-surgical or chronic patients. Manufacturers seize opportunities to embed artificial intelligence algorithms into digital respiratory devices, predicting flare-ups and optimizing treatment regimens for individualized care.

Developers advance interoperable platforms that sync with telehealth systems, expanding applications in remote consultations where physicians review inhalation data and spirometry results in real time. These innovations facilitate integration with electronic health records, streamlining data flow for multidisciplinary teams managing complex cases like cystic fibrosis.

Opportunities emerge in gamified apps linked to devices that enhance patient engagement, particularly in pediatric asthma control through interactive adherence challenges. Companies invest in battery-efficient sensors for prolonged wear, supporting continuous monitoring in occupational health for workers exposed to respiratory hazards. Recent trends emphasize cybersecurity enhancements and data privacy features, ensuring secure transmission of sensitive health metrics while fostering trust in digital ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 66.9 Billion, with a CAGR of 28.5%, and is expected to reach US$ 821.2 Billion by the year 2034.

- The product type segment is divided into smart inhalers & nebulizers, smart spirometers and others, with smart inhalers & nebulizers taking the lead with a market share of 48.7%.

- Considering distribution channel, the market is divided into hospital pharmacies, online pharmacies and retail pharmacies. Among these, hospital pharmacies held a significant share of 43.8%.

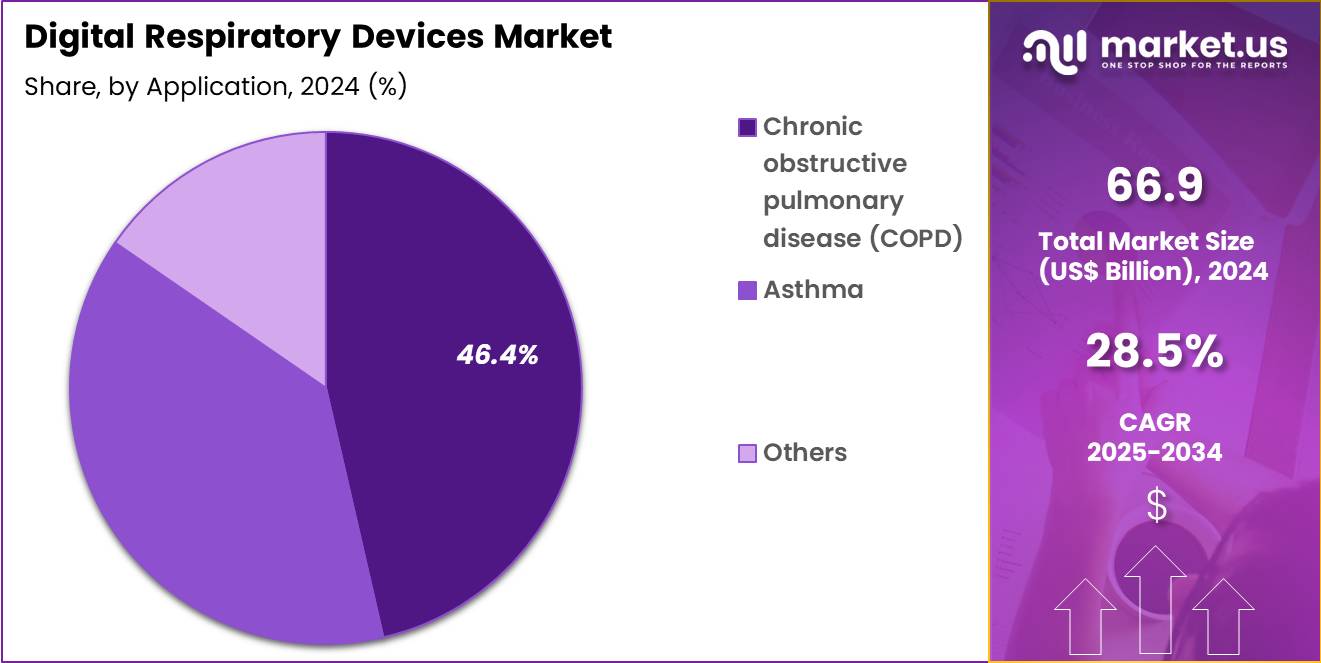

- Furthermore, concerning the application segment, the market is segregated into chronic obstructive pulmonary disease (COPD), asthma and others. The chronic obstructive pulmonary disease (COPD) sector stands out as the dominant player, holding the largest revenue share of 46.4% in the market.

- The end-user segment is segregated into hospitals, ambulatory care settings and home care settings, with the hospitals segment leading the market, holding a revenue share of 44.6%.

- North America led the market by securing a market share of 45.8%.

Product Type Analysis

Smart inhalers and nebulizers contributed 48.7% of growth within product type and lead the digital respiratory devices market because they directly influence medication delivery and adherence. Clinicians prioritize these devices since they track dose timing, inhalation technique, and usage frequency, which helps reduce missed therapy and poor control.

COPD and asthma patients often struggle with correct inhaler use, so feedback features improve real-world outcomes. Hospitals and pulmonary clinics also adopt smart nebulizers for severe cases where monitored treatment sessions matter. Device manufacturers continue to add Bluetooth connectivity and app-based reminders, which strengthens patient engagement and daily compliance.

Smart inhalers also support data-driven treatment adjustments by giving clinicians objective adherence records instead of self-reported usage. Remote monitoring programs increasingly use inhaler data to detect early deterioration and intervene before exacerbations worsen. Health systems value these devices because fewer flare-ups reduce emergency visits and inpatient burden.

Better sensor miniaturization improves comfort and portability, which raises acceptance among older adults. The segment is projected to remain dominant due to direct therapy linkage, measurable adherence benefits, and expanding connected care models in respiratory disease management.

Distribution Channel Analysis

Hospital pharmacies accounted for 43.8% of growth within distribution channels and remain the primary route for digital respiratory devices due to controlled procurement and clinical oversight. Hospitals prefer in-house distribution because respiratory devices often form part of discharge kits and inpatient care protocols.

Pharmacy-led supply also supports consistent model selection that matches hospital treatment guidelines. Bulk purchasing reduces unit cost, which improves access to smart inhalers and monitored nebulizer systems. Hospital pharmacies also provide fast replacement access for wards where devices undergo frequent usage and cleaning cycles.

Hospital pharmacy teams support correct device selection by coordinating with pulmonology and respiratory therapy departments. This channel improves trust because hospitals avoid counterfeit risk and ensure validated device quality. Training support often starts inside the hospital, and pharmacy distribution helps align device rollout with patient education.

Electronic prescribing and inventory integration further strengthen hospital pharmacy dominance. The segment is anticipated to stay strong due to institutional purchasing concentration, discharge-driven demand, and the need for standardized respiratory device supply inside clinical settings.

Application Analysis

Chronic obstructive pulmonary disease accounted for 46.4% of growth within application and drive demand for digital respiratory devices due to high exacerbation risk and long-term therapy dependence. COPD management requires consistent inhaler adherence, symptom tracking, and early response to breathing deterioration.

Digital devices help patients recognize missed doses and irregular patterns that increase flare-up probability. Clinicians also value objective usage data for optimizing maintenance therapy and reducing rescue medication overuse. Many COPD patients require nebulized therapy during acute phases, which increases demand for connected nebulizers that support monitored delivery.

COPD prevalence rises in aging populations and in regions with high smoking and air pollution exposure, expanding the treated patient base. Frequent readmissions after exacerbations push hospitals to adopt connected devices as part of prevention-focused care pathways.

Remote care programs use inhaler and nebulizer data to flag early warning signs and support timely intervention. Better patient confidence improves when digital reminders reduce anxiety around missed doses. The segment is projected to remain dominant due to disease burden, chronic therapy intensity, and strong clinical value of adherence and monitoring tools.

End-User Analysis

Hospitals represented 44.6% of growth within end-users and lead adoption because they manage severe respiratory cases and coordinate treatment initiation. Inpatient COPD exacerbations and acute asthma episodes often require structured medication delivery supported by smart devices.

Hospitals also deploy digital respiratory tools in respiratory wards, emergency departments, and discharge planning programs to lower repeat admissions. Clinicians prefer hospital-led enrollment because it ensures correct technique training and device onboarding. Procurement teams purchase at scale, enabling broad deployment across departments and faster replacement when devices wear out.

Hospitals integrate digital respiratory data into follow-up care through pulmonary clinics and transitional care programs. Respiratory therapists use device feedback to correct technique errors and improve treatment response. Hospitals also benefit from outcome tracking, since digital adherence data supports population health metrics and care quality reporting.

Expansion of hospital-at-home and remote monitoring strategies strengthens hospital demand for connected respiratory platforms. The segment is expected to retain dominance due to patient concentration, clinical oversight needs, and strong incentives to reduce exacerbations and readmissions.

Key Market Segments

By Product Type

- Smart Inhalers & Nebulizers

- Smart Spirometers

- Others

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Application

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Others

By End-User

- Hospitals

- Ambulatory Care Settings

- Home Care Settings

Drivers

Rising prevalence of chronic respiratory diseases is driving the market.

The growing incidence of conditions such as asthma and chronic obstructive pulmonary disease has intensified the demand for digital respiratory devices that enable precise monitoring and management. These devices support real-time data collection, which aids clinicians in adjusting treatments promptly. Environmental factors and lifestyle changes contribute to the sustained increase in respiratory conditions across populations.

According to the Centers for Disease Control and Prevention, the age-adjusted prevalence of diagnosed COPD among adults aged 18 and older was 3.8% in 2023. This statistic reflects a substantial patient base requiring ongoing respiratory support. Asthma affects a broader demographic, with 8.6% of adults aged 18 and older reporting current asthma in 2024.

Digital tools facilitate adherence tracking and early intervention to mitigate exacerbations. Healthcare systems are prioritizing preventive strategies to address the economic burden of unmanaged respiratory diseases. Key manufacturers are aligning product development with these epidemiological patterns. This driver underpins continuous investment and innovation in the sector.

Restraints

High costs and reimbursement limitations are restraining the market.

The elevated pricing of digital respiratory devices, incorporating sensors and connectivity features, poses a barrier to widespread adoption in many healthcare settings. Budget constraints in public and private institutions often favor conventional equipment over advanced digital alternatives. Reimbursement policies in various regions provide limited coverage for these technologies, reducing their accessibility.

Providers hesitate to invest when return on investment remains uncertain due to inconsistent payer support. Patients in lower-income brackets encounter affordability challenges, leading to suboptimal utilization. Regulatory requirements for validation and cybersecurity add to manufacturing expenses. This restraint slows penetration in community-based care environments.

Efforts to standardize reimbursement codes are progressing slowly. Industry stakeholders advocate for policy adjustments to enhance economic viability. These factors collectively limit market expansion despite clinical advantages.

Opportunities

Integration of telehealth platforms is creating growth opportunities.

The expansion of virtual care services provides a platform for digital respiratory devices to support remote patient monitoring and consultations. Telehealth adoption has accelerated access to specialized respiratory care in underserved areas. Connected devices enable seamless data sharing between patients and providers during virtual visits. This synergy improves treatment adherence and reduces the need for in-person appointments.

Healthcare systems are investing in digital infrastructure to facilitate such integrations. Opportunities arise for partnerships between device manufacturers and telehealth providers to develop tailored solutions. The approach addresses chronic disease management in aging populations effectively.

Regulatory frameworks are adapting to support reimbursement for remote monitoring. Emerging markets present untapped potential due to increasing internet penetration. This opportunity enhances patient engagement and outcomes through convenient care delivery.

Impact of Macroeconomic / Geopolitical Factors

Steady global economic conditions foster greater healthcare allocations, enhancing the digital respiratory devices market through rising adoption of connected inhalers and monitors in response to chronic respiratory ailments. Executives align product launches with expanding insurance coverage in affluent nations, which sustains momentum for remote monitoring solutions amid demographic shifts.

However, escalating worldwide inflation boosts expenses for sensors and software development, requiring firms to recalibrate strategies in economically challenged areas. Geopolitical disputes in electronics manufacturing zones hinder access to vital microchips, prompting suppliers to grapple with production halts in interdependent global operations.

Business heads resolve these issues by investing in multi-regional assembly partnerships, which improves workflow stability and identifies new scalability options. Current US tariffs, applying rates from 10% to 25% on imported medical devices from dominant producers like China, heighten fiscal demands for entities sourcing advanced components abroad.

Local manufacturers utilize this setting to upgrade U.S.-driven facilities, which cultivates expertise in integrated tech and supports economic multipliers at home. Evolving connectivity features and data analytics tools invariably drive the market’s adaptability, securing improved patient engagement and long-term profitability across the board.

Latest Trends

Advancements in AI-enabled smart inhalers is a recent trend in the market.

In 2024, developments in smart inhalers incorporated artificial intelligence to analyze usage patterns and predict exacerbations. These devices utilize Bluetooth connectivity for real-time data transmission to mobile applications. AI algorithms process inhalation technique data to provide feedback for improved delivery.

Manufacturers focused on enhancing user interfaces for better patient engagement. Clinical studies emphasized the role of AI in boosting adherence among asthma and COPD patients. The trend supports personalized respiratory management through data-driven insights. Regulatory approvals facilitated the introduction of updated models in key markets.

Industry efforts prioritized interoperability with electronic health records. These innovations aim to reduce hospital admissions by enabling proactive interventions. The integration of AI positions digital devices as essential tools in modern respiratory care.

Regional Analysis

North America is leading the Digital Respiratory Devices Market

North America holds a 45.8% share of the global digital respiratory devices market, evidencing marked progression in 2024 through widespread implementation of connected inhalers and monitoring tools for managing chronic conditions like asthma and COPD. Progress stems from heightened emphasis on telemedicine integration, allowing real-time data sharing between patients and providers to optimize treatment adherence and early intervention.

Prominent manufacturers have upgraded device interoperability with electronic health systems, facilitating seamless analytics for personalized care plans in ambulatory settings. Escalating awareness of air quality impacts on lung health has prompted broader utilization in home-based therapy for vulnerable groups. Policy incentives from health authorities have promoted reimbursement for remote monitoring, spurring uptake among Medicare beneficiaries.

Joint ventures with tech firms have introduced AI-driven predictive features to anticipate exacerbations, elevating clinical efficacy. Sophisticated cybersecurity measures have addressed data privacy concerns, building trust in cloud-connected platforms. In 2024, ResMed reported a 10% revenue increase in the U.S., Canada, and Latin America for its sleep and respiratory care segment, highlighting regional demand surge.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Medical equipment producers and scientific groups advance connected breathing technologies throughout the Asia Pacific region during the forecast period, harnessing urbanization trends and public health campaigns to tackle pollution-induced ailments. India bolsters indigenous fabrication via incentive-linked production schemes to supply affordable monitors for widespread screening programs.

Japan enhances precision engineering in portable oximeters to support aging populations with home-based chronic care. Pharmaceutical collaborators embed sensors into inhaler designs for compliance tracking in asthma management protocols. Healthcare providers adopt app-linked systems to enable virtual consultations, expanding access in remote areas.

Regional trade agreements facilitate component imports while nurturing local innovation hubs. Investment in workforce training ensures effective deployment of smart ventilators in intensive units. In 2022, China’s government allocated funds to public health rose by 33.4% compared to 2021, enabling expanded procurement of advanced respiratory aids.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Digital Respiratory Devices market drive growth by integrating sensors, connectivity, and data analytics into inhalers and respiratory support tools to improve adherence and clinical outcomes in asthma and COPD care. Companies expand adoption by partnering with healthcare providers and payers to embed digital monitoring into chronic disease management programs and value-based care models.

Commercial strategies emphasize platform ecosystems that combine hardware, patient apps, and clinician dashboards to deliver actionable insights rather than standalone devices. Innovation priorities focus on accurate dose tracking, user-friendly interfaces, and secure data interoperability with electronic health records.

Market expansion targets regions scaling telehealth services and home-based respiratory care for aging populations. ResMed operates as a leading participant with deep expertise in connected respiratory care, a strong cloud-based monitoring platform, and global distribution capabilities that support large-scale deployment of digital respiratory solutions.

Top Key Players

- ResMed

- Koninklijke Philips N.V.

- Medtronic

- GE HealthCare

- Masimo

- Omron Healthcare

- Hamilton Medical

- Fisher & Paykel Healthcare

- Drägerwerk AG & Co. KGaA

- Vyaire Medical

Recent Developments

- In April 2024, Bespak and H&T Presspart agreed to work together to speed up the move away from conventional pressurised metered dose inhalers toward greener inhaler options. Their joint effort supports the use of low global warming potential propellants, helping inhaled drug developers align future products with environmental goals while keeping aerosol performance and manufacturing readiness in focus.

- In February 2023, Teva shared updated evidence from the CONNECT2 research program on its Digihaler platform at the AAAAI 2023 meeting. The findings highlighted how digital inhalers can strengthen respiratory care by capturing real use data, supporting better inhaler technique, and enabling clinicians to monitor adherence more consistently in day to day asthma and COPD management.

Report Scope

Report Features Description Market Value (2024) US$ 66.9 Billion Forecast Revenue (2034) US$ 821.2 Billion CAGR (2025-2034) 28.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Smart Inhalers & Nebulizers, Smart Spirometers and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies and Retail Pharmacies), By Application (Chronic Obstructive Pulmonary Disease (COPD), Asthma and Others), By End-User (Hospitals, Ambulatory Care Settings and Home Care Settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ResMed, Koninklijke Philips N.V., Medtronic, GE HealthCare, Masimo, Omron Healthcare, Hamilton Medical, Fisher & Paykel Healthcare, Drägerwerk AG & Co. KGaA, Vyaire Medical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Respiratory Devices MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Digital Respiratory Devices MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ResMed

- Koninklijke Philips N.V.

- Medtronic

- GE HealthCare

- Masimo

- Omron Healthcare

- Hamilton Medical

- Fisher & Paykel Healthcare

- Drägerwerk AG & Co. KGaA

- Vyaire Medical