Global Digital Remittance Market By Type (Outward Digital Remittance and Inward Digital Remittance), By Channel (Money Transfer Operators, Banks, Online Platforms, and Other Channels), By End-User(Business, Personal), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: March 2024

- Report ID: 12200

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

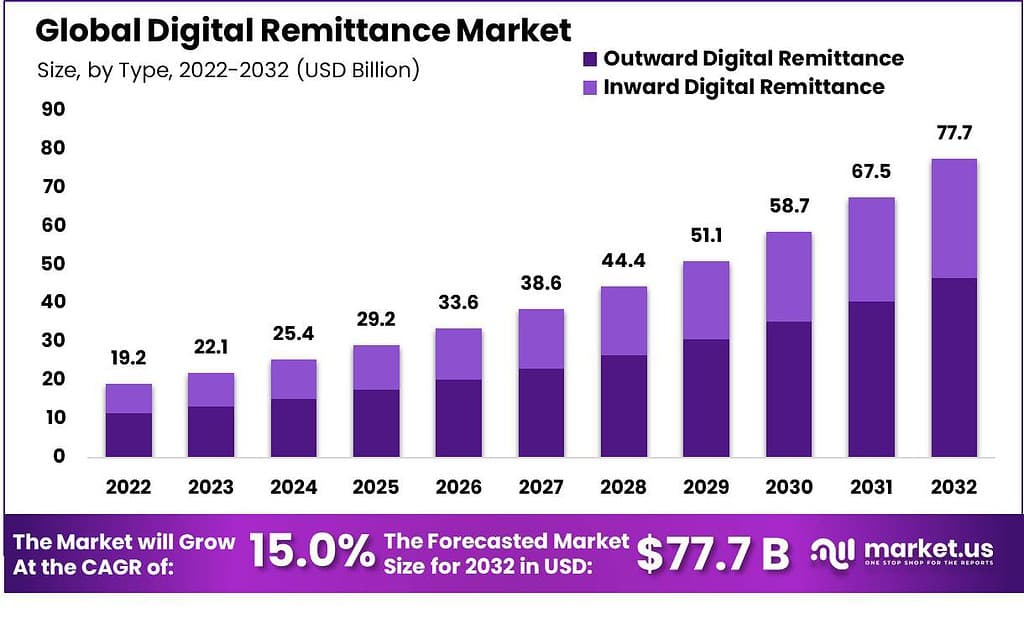

The Global Digital Remittance Market is anticipated to reach a valuation of USD 22.1 Billion in 2023, driven by mobile-based remittance solutions. This trend is expected to create new opportunities for the global market, leading to a projected CAGR of 15.0% between 2023 and 2032. It is estimated to gain a valuation of approximately USD 77.7 Billion by 2032.

The Digital Remittance Market, a dynamic and rapidly evolving sector within the financial industry, has witnessed significant transformation in recent years. This market revolves around the electronic transfer of funds across borders, offering a modern and convenient alternative to traditional money transfer methods. Leveraging advanced technology and digital platforms, it enables individuals and businesses to send money quickly, securely, and cost-effectively to international destinations.

The digital remittance landscape is characterized by fierce competition among established financial institutions, fintech startups, and tech giants. These players vie for market share by offering innovative solutions, competitive exchange rates, lower fees, and enhanced user experiences. Factors such as globalization, increased international migration, and the growing need for efficient cross-border transactions drive the market’s growth. In this fast-paced environment, staying informed about the latest trends, emerging players, and regulatory developments is crucial for businesses and consumers alike.

Key Takeaways

- Market Size and Growth Projection: The digital remittance market is expected to grow at a strong CAGR of 15.0%, reaching an estimated valuation of USD 77.7 billion by 2032, up from USD 22.1 billion in 2023.

- Dominance of Outward Digital Remittance Segment: In 2022, the outward digital remittance segment held over 60% of the market share, driven by globalization trends and the increasing need for convenient cross-border transactions.

- Factors Driving Outward Remittance Growth: The rise in adoption of banking technologies, coupled with smartphone proliferation, has fueled the outward digital remittance segment. Innovations such as blockchain and AI have enhanced transaction efficiency and security.

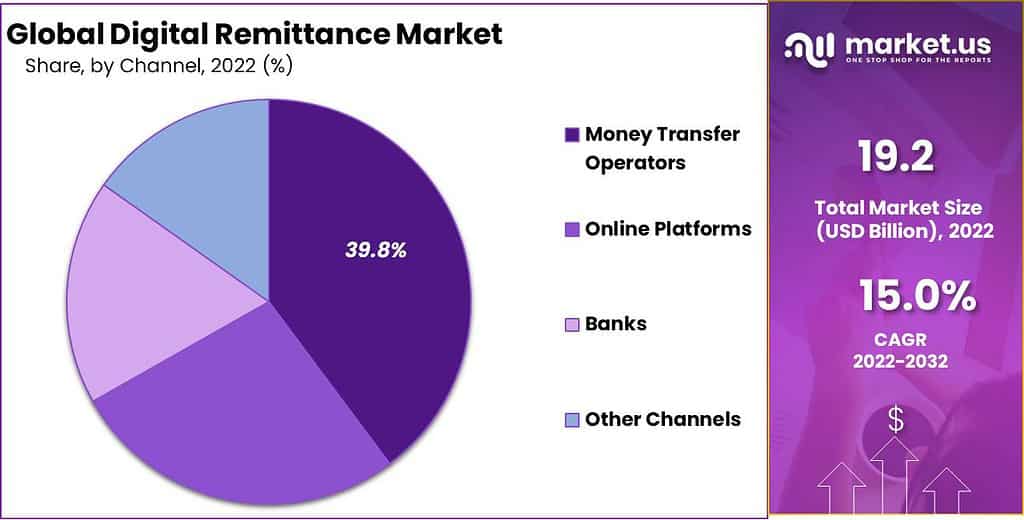

- Role of Money Transfer Operators (MTOs): MTOs dominated the market in 2022, capturing over 39.8% of the market share. Their established reputation for reliability, coupled with digital advancements, has made them preferred choices for remittance services.

- Personal Segment Leading Market: In 2023, the personal segment held a substantial share of 58.4%, driven by globalization, international employment, and tourism. The ease of use and speed of digital platforms have further propelled personal remittances.

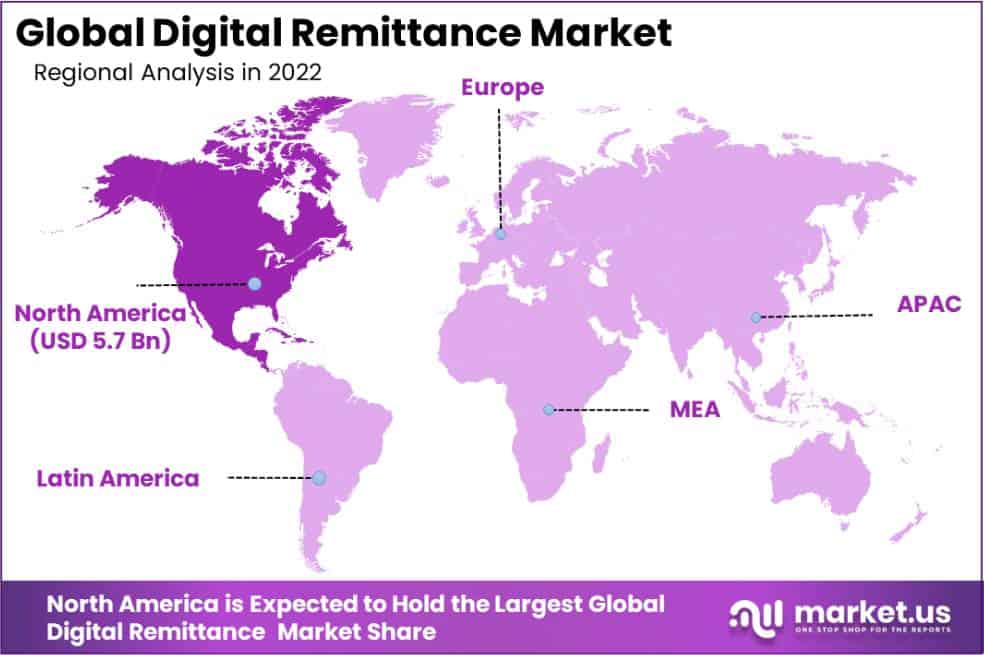

- Regional Analysis: North America leads the market, with a significant revenue share of 30.2%, followed by the Asia Pacific region, which is expected to grow substantially during the forecast period.

By Type Analysis

In 2022, the Outward Digital Remittance segment held a dominant position in the digital remittance market, capturing more than a 60% share. This significant market share can be attributed to the increasing globalization of businesses and the growing diaspora communities worldwide. Individuals and companies are leveraging digital channels to send money across borders with greater ease, speed, and reduced costs compared to traditional methods.

The rise in the adoption of banking and financial services technologies, alongside the proliferation of smartphone usage and internet penetration, has further bolstered the growth of outward digital remittances. This trend reflects a broader shift towards digital financial solutions, emphasizing convenience and accessibility.

The leading role of the Outward Digital Remittance segment is underscored by several key factors. Firstly, technological advancements and the integration of blockchain and artificial intelligence in remittance services have significantly improved the efficiency and security of transactions. These innovations have made it possible for users to conduct cross-border payments without the need for physical banking infrastructure, appealing to a wider audience, including unbanked populations. Secondly, regulatory support and initiatives aimed at promoting financial inclusion have also played a crucial role in facilitating the growth of this segment.

Governments and financial institutions are increasingly recognizing the importance of digital remittances as a tool for economic development and are, therefore, implementing policies to encourage their use. Lastly, the impact of the COVID-19 pandemic has accelerated the digital transformation of remittances, as consumers shifted towards online platforms for financial transactions to comply with social distancing measures.

By Channel Analysis

In 2022, the Money Transfer Operators (MTOs) segment held a dominant market position in the digital remittance market, capturing more than a 39.8% share. This prominence is largely due to MTOs’ established reputation and trust among consumers for providing reliable and efficient remittance services. MTOs have been pivotal in facilitating cross-border financial transactions, especially in regions with limited access to traditional banking institutions.

Their widespread network and the ability to offer lower transaction fees compared to conventional banks have made them particularly attractive to migrant workers and expatriates sending money home. Furthermore, MTOs have been quick to adopt digital technologies, enhancing their service offerings with features like mobile apps and online transaction capabilities, which have significantly improved the convenience and accessibility of sending remittances.

The leading position of the Money Transfer Operators segment is reinforced by their strategic partnerships with local financial institutions and telecom companies. These collaborations have expanded their reach, allowing them to serve a broader base of customers, including those in remote or underserved areas.

Moreover, MTOs have capitalized on the growing consumer preference for digital and mobile-based financial services, driven by the increasing penetration of smartphones and internet connectivity globally. By integrating advanced security measures, such as biometric verification and encryption, MTOs have also addressed concerns over digital transaction safety, further boosting consumer confidence in their services.

By End-User Analysis

In 2023, the Personal segment held a dominant position in the Digital Remittance Market, capturing more than a 58.4% share. This substantial market share can be attributed to the increasing globalization and the growing need for migrants to send money back to their home countries. As people seek more efficient, secure, and cost-effective ways to transfer funds, digital remittance platforms have become increasingly popular.

Additionally, the rise in international employment, higher education abroad, and global tourism has significantly contributed to the growth of this segment. The ease of use, improved transaction speeds, and the ability to send remittances through mobile devices have further facilitated the expansion of the personal segment in the digital remittance market.

The Money Transfer Operators (MTOs) segment leads within the digital remittance industry due to several key factors. First, MTOs have established a vast network of physical and digital touchpoints, making it convenient for users to initiate and receive transfers. Their brand trust and recognition, built over years of reliable service, play a crucial role in attracting users who prioritize security and reliability in their transactions.

Furthermore, MTOs have been quick to adopt new technologies, enhancing their services with features like real-time tracking, multi-currency support, and lower transaction fees compared to traditional banks. This adaptability has enabled MTOs to meet the evolving needs of consumers, especially in underserved markets where traditional banking services are limited.

Key Market Segments

Type

- Outward Digital Remittance

- Inward Digital Remittance

Channel

- Money Transfer Operators

- Banks

- Online Platforms

- Other Channels

End-User

- Business

- Personal

Driving Factor

Continuously Increasing Digitization is Driving the Growth of the Market.

One of the most prominent drivers for market growth is the growing global diaspora, with millions of individuals working abroad and sending money back home to support their families and communities. This steady stream of remittances has become a lifeline for many developing economies. Moreover, the rise of digital technology has revolutionized how money is transferred across borders. Mobile apps, online platforms, and blockchain technology have made remittance processes faster, more convenient, and cost-effective. Consumers now seek streamlined and user-friendly solutions, prompting financial institutions and fintech companies to innovate continuously. Additionally, favorable government policies and regulatory frameworks have facilitated the growth of the digital remittance market, ensuring the security and transparency of cross-border transactions.

Restraining Factor

Unavailability of Advance Technological Infrastructure in Many Parts of the World Can Restrict the Growth of the Market.

A notable restraint in the market is the ongoing challenge of financial inclusion. While digital remittance services have the potential to provide financial services to underserved populations, many individuals in remote or economically disadvantaged regions still lack access to the necessary technology and infrastructure. Limited internet connectivity, smartphone penetration, and awareness of digital financial services hinder adoption in these areas. Bridging this digital divide remains a substantial challenge, requiring investment in infrastructure, digital literacy programs, and innovative solutions tailored to the specific needs of these underserved populations. Overcoming these barriers is essential for the market’s sustainable and inclusive growth.

Growth Opportunity

Integration of Blockchain Technology is Expected to Create Many Opportunities in the Market over the Forecast Period.

Blockchain technology represents an exciting prospect in the market, promising to revolutionize remittance services with improved security, transparency, and efficiency. Remittance transactions using blockchain solutions are faster, with lower fees, increased transparency, and traceability. Furthermore, blockchain provides a decentralized platform for cross-border transactions, reducing reliance on traditional financial intermediaries. As blockchain matures and gains wider acceptance, it provides innovative remittance providers an opportunity to provide more cost-effective and accessible services – thus revolutionizing the industry landscape and meeting evolving consumer needs in a digitally connected global population.

Latest Trends

Mobile-Based Remittance Solutions are Currently Trending in the Market.

A prominent trend in the market is the growing adoption of mobile-based remittance solutions. As smartphones become increasingly ubiquitous worldwide, people are leveraging mobile apps and digital wallets to send and receive money across borders swiftly and conveniently. This trend is driven by the ease of use, accessibility, and cost-effectiveness of mobile platforms for remittance transactions. Providers are continually innovating their mobile applications to offer user-friendly interfaces, real-time exchange rate information, and secure payment options, further fueling the shift towards mobile-based remittances.

Geopolitical and Recession Impact Analysis

Volatility in Exchange Rates and Economic Downturns can Significantly Affect the Market Growth.

Geopolitical uncertainties, such as trade disputes or regulatory changes, can lead to increased volatility in currency exchange rates and stricter cross-border financial regulations. These factors can deter people from using digital remittance services due to concerns about currency devaluation or regulatory hurdles. During economic recessions, individuals may become more cautious with their finances, reducing remittance volumes as they prioritize essential expenses over sending money abroad. Additionally, job losses or reduced incomes can impact both the senders and receivers of remittances, affecting the overall demand for digital remittance services.

Regional Analysis

North America Dominates the Market with a Major Revenue Share of 30.2%.

North America Leads the Market with a Major Revenue Share of 30.2%. North America’s dominance in the digital remittance market can be attributed to its sizeable immigrant population and advanced financial infrastructure. The region is home to many immigrants who regularly send money to their home countries. This demographic creates a consistent demand for remittance services, driving market growth. Furthermore, North America’s well-established financial system and stringent regulatory environment have facilitated the development and adoption digital remittance platforms. This robust infrastructure ensures the security and efficiency of cross-border money transfers.

After North America, the Asia Pacific region is expected to grow at a significant CAGR throughout the forecast period. The rapid adoption of smartphones and internet connectivity in Asia has made it easier for individuals to access and use digital remittance platforms. It is expected to drive the growth of the Asia Pacific region during the forecast period.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Western Union and MoneyGram have established extensive global networks, while newcomers like TransferWise/Wise have disrupted the market with innovative, cost-effective solutions. Market share often fluctuates as companies expand their services, form strategic partnerships, and invest in technology to enhance user experiences. The competition remains fierce as these players vie for a larger slice of the growing digital remittance pie. Some of the key players in the market are PayPal Holdings Inc., Digital Wallet Corporation, InstaReM Pvt. Ltd., MoneyGram, Azimo B.V., TransferGo Ltd, Western Union Holdings Inc., Ria Money Transfer., WorldRemit Ltd., OFX, and Other Key Players.

Top Key Players in the Digital Remittance Market

- PayPal Holdings Inc.

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- Azimo B.V.

- TransferGo Ltd.

- Western Union Holdings Inc.

- Ria Money Transfer.

- WorldRemit Ltd.

- OFX

- Other Key Players

Recent Developments

- In January 2023, Xoom established a strategic partnership with Visa Direct, enabling debit card users in 25 nations, such as Thailand, Philippines, Vietnam, Ukraine, and Sri Lanka, to access funds in minutes.

- In September 2022, Western Union acquired Te Enviei, a digital wallet located in Brazil. This acquisition facilitates Western Union’s introduction of their financial ecosystem services in the Brazil market more quickly. It provides customers with a means of storing funds, conducting international and domestic money transfers, and paying their bills through mobile phones – all through one convenient app.

Report Scope

Report Features Description Market Value (2023) US$ 22.2 Bn Forecast Revenue (2032) US$ 77.7 Bn CAGR (2023-2032) 15.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Outward Digital Remittance and Inward Digital Remittance), By Channel (Money Transfer Operators, Banks, Online Platforms, and Other Channels), By End-User(Business, Personal) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape PayPal Holdings Inc., Digital Wallet Corporation, InstaReM Pvt. Ltd., MoneyGram, Azimo B.V., TransferGo Ltd, Western Union Holdings Inc, Ria Money Transfer., WorldRemit Ltd., OFX, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is digital remittance?Digital remittance refers to the online transfer of funds across international borders or domestically via digital platforms and technology, eliminating the need for cash or traditional banking channels.

What is the size of the global remittance market?The Global Digital Remittance Market is anticipated to reach a valuation of USD 22.1 Billion in 2023, driven by mobile-based remittance solutions. This trend is expected to create new opportunities for the global market, leading to a projected CAGR of 15.0% between 2023 and 2032. It is estimated to gain a valuation of approximately USD 77.7 Billion by 2032.

What are the latest trends in the remittance industry?Remittance industry trends include blockchain technology, the growth of mobile money services and digital remittance services becoming more widely popular.

How are fintech remittance companies disrupting traditional remittance services?Fintech remittance companies are disrupting traditional remittance services by offering faster, simpler, and cheaper ways of sending money across borders. Leveraging technology to lower both costs and times associated with traditional services as well as additional offerings like mobile wallets and prepaid cards; fintech companies are revolutionizing global money transfers in ways traditional services never could.

What are the main players in the digital remittance market?The digital remittance market includes both traditional financial institutions and fintech companies. Some popular players include

- PayPal Holdings Inc.

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- Azimo B.V.

- TransferGo Ltd.

- Western Union Holdings Inc.

- Ria Money Transfer.

- WorldRemit Ltd.

- OFX

- Other Key Players

Digital Remittance MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Remittance MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- PayPal Holdings Inc.

- Digital Wallet Corporation

- InstaReM Pvt. Ltd.

- MoneyGram

- Azimo B.V.

- TransferGo Ltd.

- Western Union Holdings Inc.

- Ria Money Transfer.

- WorldRemit Ltd.

- OFX

- Other Key Players