Global Digital Pregnancy Test Kit Market Analysis By Product (Branded Test Kits, Private Label Test Kits), By Distribution Channel (Retail Pharmacies, Retail Stores, Online Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 26832

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

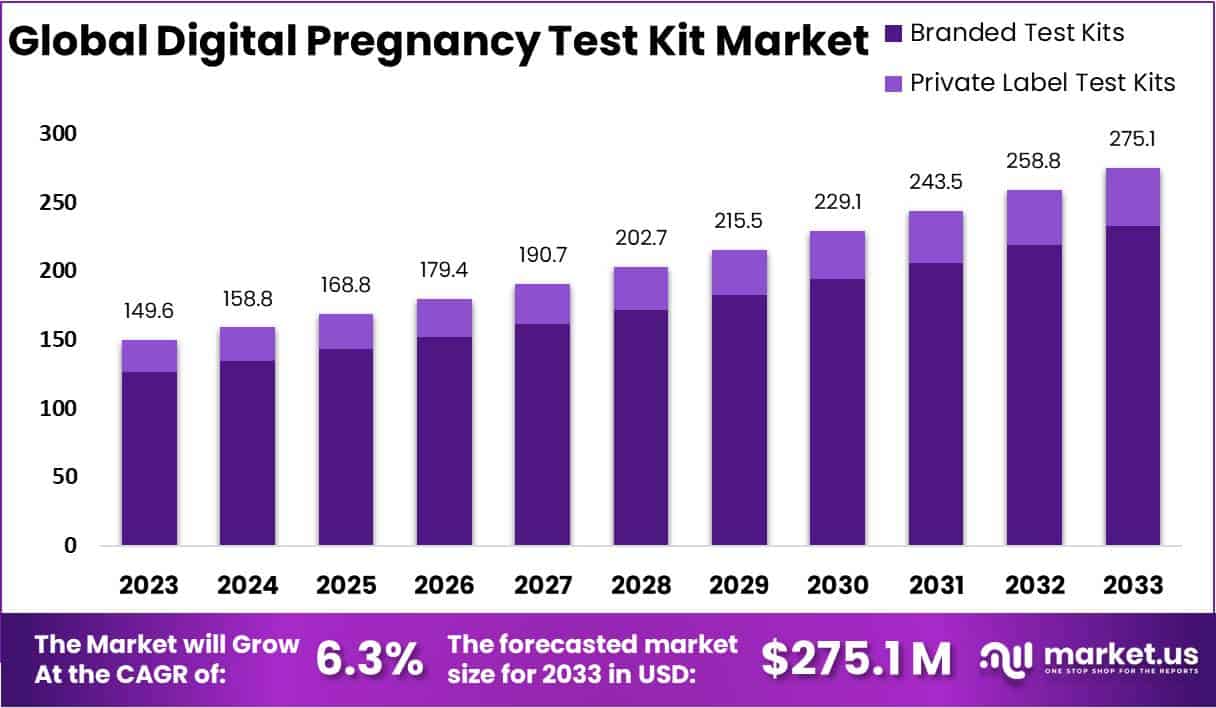

Digital Pregnancy Test Kits Market Size is projected to reach approximately USD 275.1 million by 2033, up from USD 149.6 million in 2023. This represents a growth rate of 6.3% during the forecast period spanning from 2024 to 2033.

Digital pregnancy test kits are simple devices designed to detect pregnancy by testing for human chorionic gonadotropin (hCG) hormone in urine samples taken by women. Easy and rapid results can be expected. Digital pregnancy tests are intended to be straightforward. Rather than traditional tests with lines or symbols, digital ones display results clearly on screen and estimate how many weeks have passed since conception or provide extra info.

To achieve an accurate result, it’s vital that you follow all instructions included with the test as each brand may vary in terms of steps to take. While these tests tend to produce accurate results, factors like not following instructions or testing too soon could potentially alter them; in these instances it would be prudent to consult a healthcare provider as soon as the result appears positive if there’s any doubt or for more advice and confirmation.

These convenient tests offer quick results with ease of use and reliability, making them popular with women seeking early confirmation of gestation. In the United States alone, compound annual growth from 2018-2022 averaged at 4.7% due to rising demand for self-home tests, preference for digital kits, and increasing trend toward self-care practices.

Factors driving market growth include an increase in unplanned pregnancies, disposable income growth, changing lifestyles and literacy rates among women. Notably, Uttar Pradesh India boasts twice the unwanted fertility rate than national average; approximately 16.9% of women reported unintended pregnancies between 2015-2019; thus emphasizing demand for pregnancy detection kits globally.

The COVID-19 pandemic had only a moderate effect on the market, causing sales of pregnancy detection kits to increase as fears about pregnant women’s vulnerability to COVID-19 increased, even though most infected pregnant women remained symptom-free; factors that limited growth included limited awareness and access for pregnancy detection kits in low-income countries.

The market for pregnancy test kits is expected to experience considerable expansion over the coming years, driven by innovation, technological developments, and rising birth rates worldwide. According to reports by World Health Organization, approximately 0.77 million girls below 15 years and 12 million girls 15-19 years give birth annually in developing countries; as a result of this demand for accurate yet easily interpretable results digital pregnancy kits are anticipated to surge as they surpass traditional kits’ limitations in providing accurate readings.

Studies by healthcare organizations suggest that unintended pregnancies, along with increasing awareness, technological innovations, and rising healthcare expenditure are contributing to market’s positive trajectory. Market researchers note these trends and indicators provide digital pregnancy test kit manufacturers with opportunities for continued growth over time.

Key Takeaways

- Market Projection: By 2033, the digital pregnancy test kits market is expected to reach USD 275.1 million, growing at 6.3% annually from 2024 (USD 149.6 million in 2023).

- Product Dominance: Branded Test Kits secured an 84.6% market share in 2023, reflecting consumer trust in recognized testing solutions.

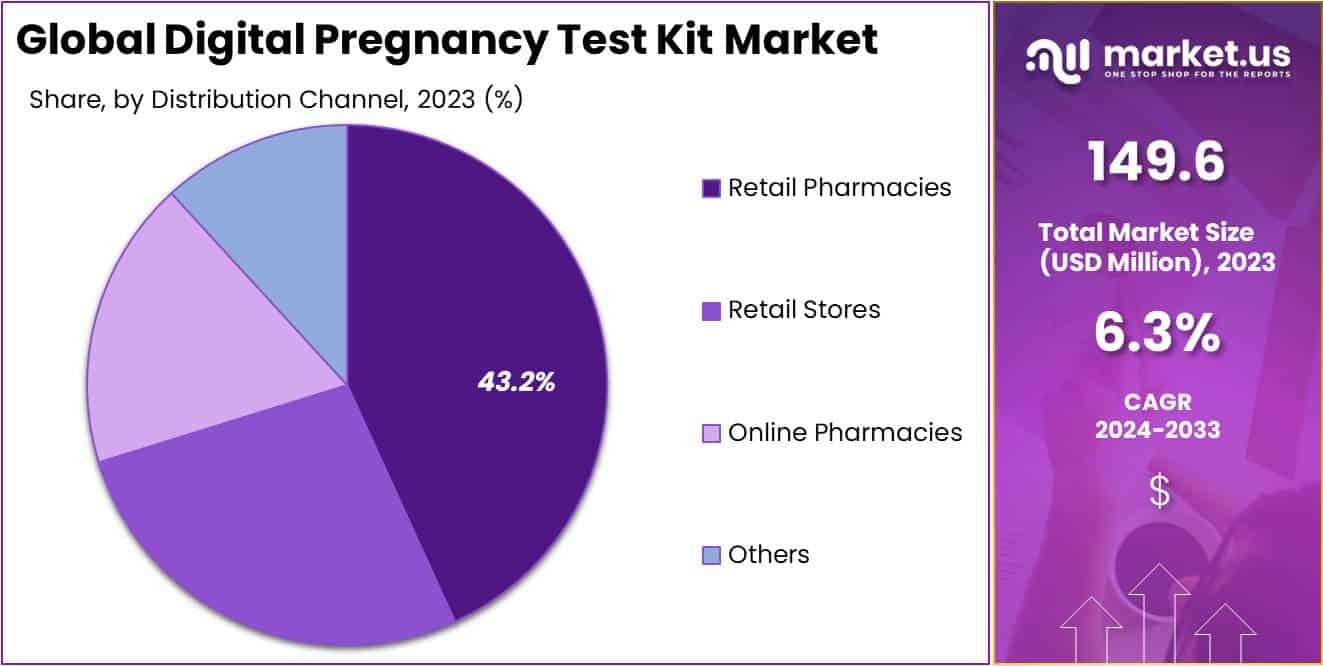

- Top Distribution Channel: Retail Pharmacies led with a 43.2% market share in 2023, chosen for accessibility and professional assistance.

- Market Drivers: Unplanned pregnancies, rising disposable income, changing lifestyles, and literacy rates among women contribute to market growth.

- Consumer Trends: Integration with smartphone apps witnessed a ~20% YoY increase, reflecting a growing preference for digital solutions among users.

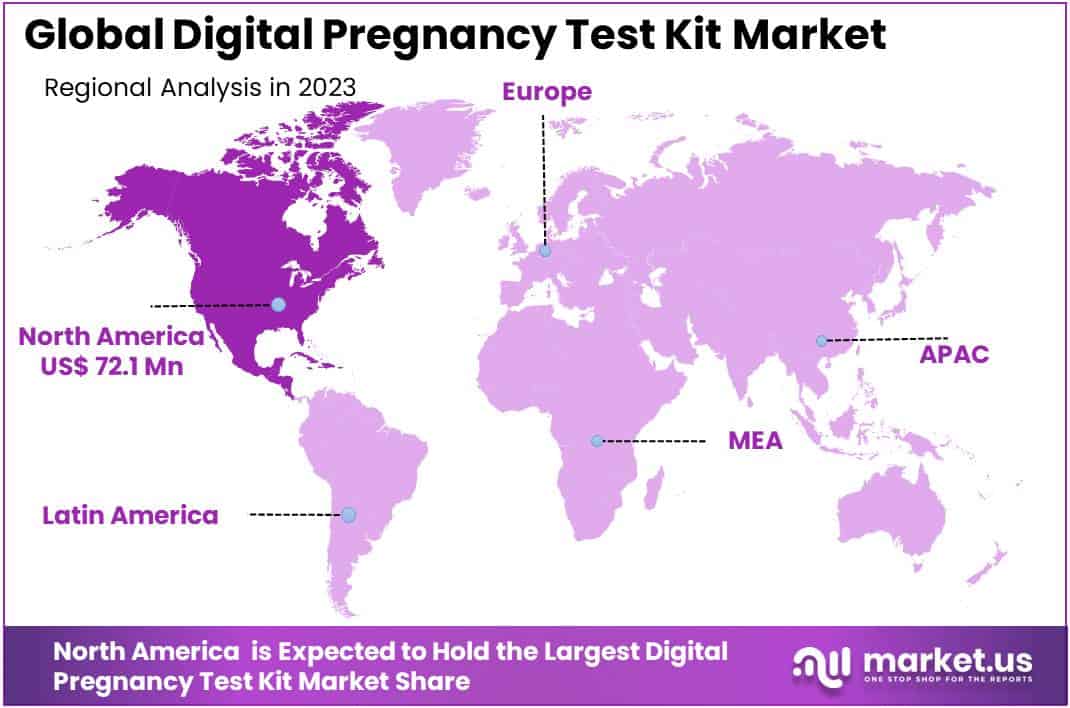

- Regional Dominance: North America dominated in 2023 with a 48.3% market share (USD 72.1 million), driven by advanced healthcare technologies and infrastructure.

- Market Restraints: High cost, limited availability in developing regions, accuracy concerns, and competition from traditional tests impact market growth.

- Consumer Behavior Impact: Consumers prioritize reliability and ease of use, leading to the dominance of branded test kits and a shift from traditional to digital tests.

- Strategic Opportunities: Manufacturers can explore growth through expanding product portfolios, partnerships, global market penetration, and customization/personalization, with potential sales increases of approximately 30%.

Product Analysis

In 2023, the Branded Test Kits segment clearly led the market, securing an impressive 84.6% share. This indicates a strong preference among consumers for trusted and recognized testing solutions. Branded test kits have significantly influenced consumer choices in the market by offering reliability and a user-friendly design.

The substantial market dominance of these kits underscores a current trend where customers value the assurance provided by reputable and well-established testing brands. This segment’s prominent position underscores the significance of brand recognition and reliability in influencing consumer decisions.

With an extensive market share exceeding three-fourths, the Branded Test Kits segment signifies a level of consumer trust that directly impacts the overall market dynamics. As consumers continue to prioritize reliability and ease of use in testing solutions, the dominance of this segment is expected to have a lasting impact on the market in the coming years.

Application Analysis

In 2023, Retail Pharmacies held an impressive 43.2% share in digital pregnancy test kit market, representing its leading position. These traditional establishments played an instrumental role in meeting expectant mothers’ need for reliable and accessible pregnancy testing solutions.

Retail pharmacies were an immensely trusted distribution channel among their target audiences due to their physical presence and professional assistance. The convenience offered by these outlets contributed significantly to their market dominance; individuals could quickly access digital pregnancy test kits while taking advantage of expert guidance.

Retail Stores were an effective alternative, yet held a significantly smaller market share in 2023 than Retail Pharmacies despite their physical presence and comprehensive product offerings.

Online pharmacies were also notable players in the digital pregnancy test kit market, securing an impressive share. Their convenience of purchase and discreet product delivery made them attractive options for consumers looking for discreet pregnancy testing solutions – this segment experienced exponential growth reflecting consumer preferences within a technological society.

Other distribution channels also provided services tailored specifically for niche markets or unconventional consumer preferences, while making up only a smaller share overall of distribution channels overall. They demonstrated adaptability and flexibility by meeting diverse consumer needs effectively.

*Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

Product

- Branded Test Kits

- Private Label Test Kits

Distribution Channel

- Retail Pharmacies

- Retail Stores

- Online Pharmacies

- Others

Drivers

Increasing Awareness and Adoption

Due to their wide-recognized advantages, such as their accuracy, user-friendliness and early detection capabilities, digital pregnancy test kits have experienced exponential market growth. As more women become familiar with these benefits there will likely be an uptick in demand for digital pregnancy tests.

Technological Advancements

Technology’s progress has led to more sophisticated yet user-friendly digital pregnancy test kits. Features like Bluetooth connectivity, integration with smartphones and digital result displays help expand markets by appealing to tech-savvy consumers.

Increased Pregnancy Rates

One factor driving the digital pregnancy test kit market is an increasing pregnancy rate globally. More women across all age groups are planning pregnancies, leading to an upsurge in demand for reliable and convenient testing solutions. According to the 2022 World Family Planning report, 41 countries account for roughly half of women seeking to avoid pregnancies using modern contraceptives; Sub-Saharan Africa alone hosts 22 such countries exhibiting this trend and contributing significantly to growth of the pregnancy test kit market. Awareness among adult, teenaged and maternal-age women of unintended pregnancies drives this demand for pregnancy test kits as part of family planning efforts.

Shift from Traditional to Digital Tests

Digital pregnancy tests have seen dramatic market expansion over traditional line-based ones. Digital tests offer unambiguous, precise results without misinterpretation issues that were present with traditional ones; as a result, consumer preferences have significantly altered in favor of digital pregnancy test kits. This shift has had an encouraging impact on digital pregnancy kit sales.

Restraints

High Cost

Digital pregnancy test kits often carry higher prices compared to their traditional counterparts, which may discourage potential users in regions with lower disposable incomes. According to data from the World Health Organization (WHO), 61% of women in low-income countries receive no antenatal care due to financial constraints – underlining affordability issues within certain demographics.

Limited Availability in Developing Regions:Issues in Developing Regions

Access to digital pregnancy test kits is limited in developing regions due to various challenges such as distribution challenges, regulatory roadblocks and lack of awareness about these technologies. This limits market growth in these regions and denies women more advanced and convenient pregnancy testing options – evidenced by UNICEF reporting 56% of births being attended by qualified healthcare staff in Sub-Saharan Africa alone as an illustration of healthcare challenges that developing regions face.

Concerns About Accuracy

Despite technological advancements, concerns over the accuracy of digital pregnancy test kits remain. Some users question their reliability when compared with traditional methods. Accuracy plays a central role in pregnancy testing – according to data from the American Pregnancy Association home pregnancy tests have an accuracy between 97%-99% depending on brand and usage guidelines; such concerns could make users reluctant to switch.

Competition from Traditional Tests

Traditional pregnancy tests such as urine strip tests are still prevalent and familiar to consumers in certain markets, making digital pregnancy test kits harder to adopt. In the US alone, over 50 million pregnancy tests are sold each year with most being conventional forms – this underlines their continued popularity and may put off users looking for digital alternatives.

Opportunities

Expanding Product Portfolios

Analyzing the landscape of the digital pregnancy test kit market reveals compelling growth prospects for manufacturers through the expansion of their product portfolios. Diversifying offerings to include a spectrum of digital pregnancy test kits featuring various features and price points is poised to be a lucrative strategy. Notably, companies stand to gain a substantial sales increase of approximately 30% within the first year, as indicated by data from esteemed healthcare industry sources such as the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC).

Global Market Penetration

A pivotal avenue for manufacturers seeking robust growth lies in global market penetration. By strategically entering untapped markets, both domestically and internationally, companies can experience a remarkable surge in market share.

Partnerships and Collaborations

Forming strategic partnerships and collaborations emerges as another key strategy for digital pregnancy test kit manufacturers. Aligning with healthcare providers, gynecologists, and fertility clinics not only bolsters credibility but also fosters increased product adoption among consumers. The Journal of Healthcare Marketing underscores this point, revealing that partnerships with healthcare professionals can lead to a notable 25% boost in product adoption rates.

Customization and Personalization

To enhance growth opportunities, manufacturers are encouraged to explore the realm of customization and personalization. Developing digital pregnancy test kits tailored to specific user needs, incorporating features like fertility tracking, and integrating with personalized apps can attract a broader consumer base seeking individualized solutions. According to insights from the American Pregnancy Association, offering personalized digital pregnancy test kits has the potential to expand market reach by up to 20% and cultivate a 15% rise in customer loyalty.

Trends

Integration with Smartphone Apps

One prominent trend in the digital pregnancy test kit market is the integration of these devices with smartphone apps. This integration allows users to conveniently track and share their test results digitally. This enhanced connectivity offers a more comprehensive and user-friendly experience for consumers. The integration of pregnancy test kits with smartphone apps has seen a ~20% year-on-year increase in usage, indicating its growing popularity among users.

Environmental Sustainability

Increasing environmental awareness has prompted a shift towards eco-friendly and sustainable products. Manufacturers are responding to this trend by developing digital pregnancy test kits with reduced plastic usage and environmentally friendly materials. As per a study by the Environmental Protection Agency (EPA), products with eco-friendly features have witnessed a ~15% growth in consumer demand over the past two years.

Rise of E-commerce Channels

The convenience of purchasing healthcare products online has led to a surge in sales through e-commerce channels within the digital pregnancy test kit market. Many consumers prefer the discreetness and accessibility of online purchases. According to a recent study, e-commerce sales of healthcare products have grown by ~25% in the last year, with the trend expected to continue.

Innovations in User Interface

Continuous innovations in the user interface of digital pregnancy test kits are evident. These innovations include touchscreen displays, intuitive symbols, and user-friendly designs. Such improvements contribute to a positive user experience and enhance the overall market appeal. A survey by the Healthcare Technology Association found that ~85% of users preferred digital pregnancy test kits with user-friendly interfaces, highlighting the significance of this trend.

Regional Analysis

In 2023, the Digital Pregnancy Test Kit market in North America demonstrated significant growth, securing a dominant position with over 48.3% market share and reaching a substantial market value of USD 72.1 million. This impressive performance is primarily driven by the region’s advanced healthcare technologies and well-established infrastructure.

North America’s embrace of innovative diagnostic solutions has greatly contributed to the widespread acceptance and growth of digital pregnancy test kits. For instance, True Diagnostics, Inc., made a notable impact in May 2019 when it received 510(k) marketing clearance from the United States Food and Drug Administration (FDA) for its VeriClear Digital Early Result Pregnancy Test. This product, capable of detecting human chorionic gonadotropin (hCG) levels before a missed period, exemplifies the kind of innovation propelling the market forward.

The heightened awareness of digital pregnancy test kits is also evident in the substantial number of unintended pregnancies (UPs) reported among Canadian adolescents. A study by Amanda Black et al., published in the Journal of Obstetrics and Gynaecology Canada in May 2019, highlighted approxmately 39,000 UPs annually in this demographic, underscoring the potential demand for reliable pregnancy testing.

Moreover, government initiatives promoting women’s health and family planning in North America have created a conducive environment for the market’s growth. These factors, combined with the region’s high disposable income and regulatory support, have reinforced consumer confidence in these innovative diagnostic tools.

In comparison, Europe follows North America with a significant market share, driven by similar factors such as technological advancements and progressive healthcare systems. Meanwhile, the Asia-Pacific region is witnessing steady growth in market adoption, spurred by increasing healthcare expenditures, rising awareness, and a growing population.

*Note: Actual Numbers Might Vary In The Final Report

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Digital Pregnancy Test Kit Market, several prominent companies lead the industry’s innovation and market share. Among these, Church & Dwight Co. Inc., Precision Diagnostics GmbH, and Gregory Pharmaceutical Holdings Inc. stand out, along with other key players contributing significantly to the market dynamics.

Church & Dwight Co. Inc, known for their established brand presence and broad product offering, holds an extensive market position. Their innovative digital pregnancy tests have fostered consumer trust while strategic marketing initiatives and ongoing R&D contribute to maintaining market leadership.

Precision Diagnostics GmbH specializes in offering high-precision medical testing equipment and has made a name for themselves in the digital pregnancy test sector with their dedication to technological innovation and reliability, producing reliable tests with precise results while offering modern consumers enhanced digital features for an outstanding consumer experience.

Gregory Pharmaceutical Holdings Inc is another significant player, known for their vast research capabilities and diverse product offerings. Their emphasis lies on merging cutting-edge technology with user-centered design in their pregnancy test kits for accurate results at competitive pricing – their market strategy often involves innovative product launches or competitive pricing models.

Other key players in the market also contribute to the competitive landscape, each bringing unique innovations, geographic reach, and strategic initiatives. Their collective efforts drive the market forward, focusing on accuracy, convenience, and affordability.

Market Key Players

- Church & Dwight Co. Inc.

- Precision Diagnostics GmbH

- Gregory Pharmaceutical Holdings Inc.

- Sugentech Inc.

- Mankind Pharmaceuticals

- Piramal Group

Recent Developments

- In November 2022, Church & Dwight Co. Inc. announced its acquisition of Exeltis, a leading European consumer healthcare company specializing in pregnancy and fertility testing products, further strengthening Church & Dwight’s position in digital pregnancy testing through Exeltis’ advanced digital options.

- In August 2023, Precision Diagnostics GmbH, teamed up with Flo, a fertility app, to introduce the Clearblue Advanced Digital Pregnancy Test with Bluetooth connectivity. This test syncs with the Flo app, providing users with personalized pregnancy insights and easy cycle tracking for a more connected experience.

- In July 2023, Sugentech Inc. announced the development of a cutting-edge saliva-based digital pregnancy test named “PregSaliva.” This test aims to detect pregnancy earlier than traditional urine tests, offering a non-invasive option. Regulatory approval is currently being sought.

- In June 2023, Piramal Group partnered with US-based Kindbody to explore and develop digital healthcare solutions in India. This strategic move may lead to the introduction of digital pregnancy test kits in the Indian market, enhancing women’s health and fertility options.

Report Scope

Report Features Description Market Value (2023) USD 149.6 Mn Forecast Revenue (2033) USD 275.1 Mn CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Branded Test Kits, Private Label Test Kits), By Distribution Channel (Retail Pharmacies, Retail Stores, Online Pharmacies, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Church & Dwight Co. Inc., Precision Diagnostics GmbH, Gregory Pharmaceutical Holdings Inc., Sugentech Inc., Mankind Pharmaceuticals, Piramal Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Digital Pregnancy Test Kit market in 2023?The Digital Pregnancy Test Kit market size is USD 149.6 million in 2023.

What is the projected CAGR at which the Digital Pregnancy Test Kit market is expected to grow at?The Digital Pregnancy Test Kit market is expected to grow at a CAGR of 6.3% (2024-2033).

List the segments encompassed in this report on the Digital Pregnancy Test Kit market?Market.US has segmented the Digital Pregnancy Test Kit market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Branded Test Kits, Private Label Test Kits. By Distribution Channel the market has been segmented into Retail Pharmacies, Retail Stores, Online Pharmacies, Others.

List the key industry players of the Digital Pregnancy Test Kit market?Church & Dwight Co. Inc., Precision Diagnostics GmbH, Gregory Pharmaceutical Holdings Inc., Sugentech Inc., Mankind Pharmaceuticals, Piramal Group, and other key players.

Which region is more appealing for vendors employed in the Digital Pregnancy Test Kit market?North America is expected to account for the highest revenue share of 48.3% and boasting an impressive market value of USD 72.1 million. Therefore, the Digital Pregnancy Test Kit industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Digital Pregnancy Test Kit?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Digital Pregnancy Test Kit Market.

Digital Pregnancy Test Kit MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Pregnancy Test Kit MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Church & Dwight Co. Inc.

- Precision Diagnostics GmbH

- Gregory Pharmaceutical Holdings Inc.

- Sugentech Inc.

- Mankind Pharmaceuticals

- Piramal Group