Digital Patient Monitoring Devices Market By Type (Wearable Devices, Wireless Sensor Technology, mHealth, Telehealth, Remote Patient Monitoring), By Product (Diagnostic Monitoring Devices, Therapeutic Monitoring Devices), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Apr 2024

- Report ID: 118815

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

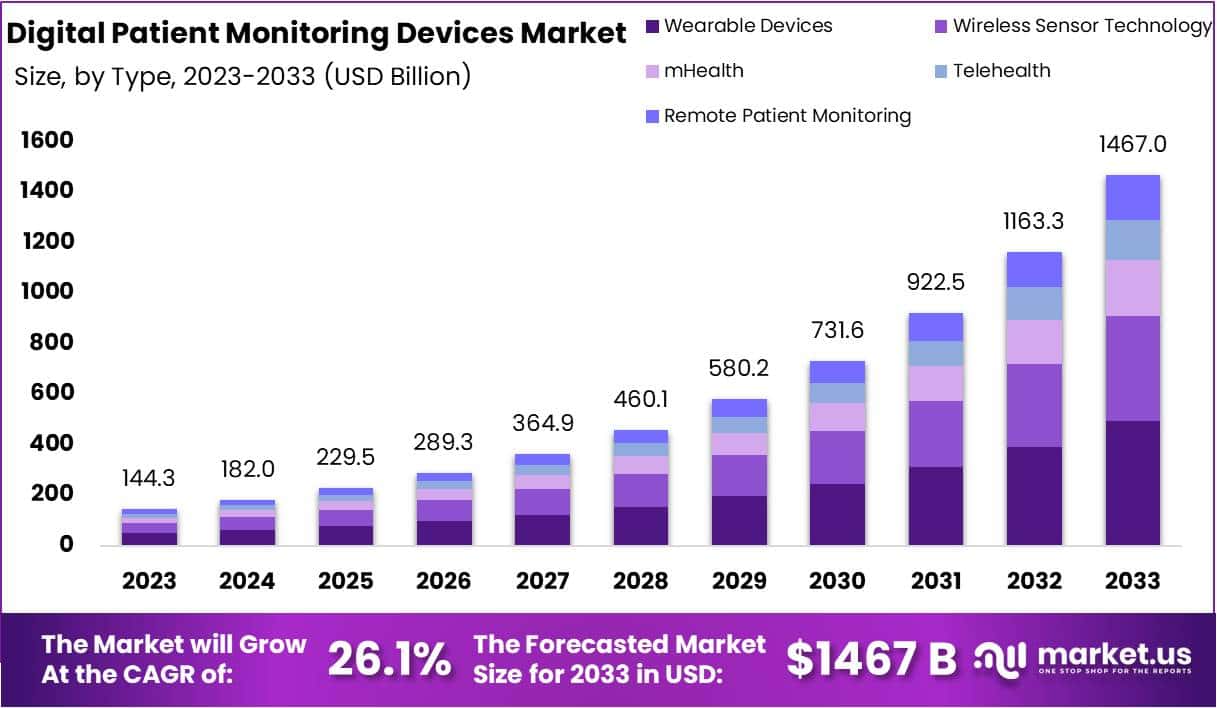

The Global Digital Patient Monitoring Devices Market size is expected to be worth around USD 1467 Billion by 2033, from USD 144.3 Billion in 2023, growing at a CAGR of 26.1% during the forecast period from 2024 to 2033.

The Digital Patient Monitoring Devices Market is experiencing significant growth driven by technological advancements, increasing chronic diseases, and the need for remote patient monitoring. These devices offer real-time data collection, analysis, and communication, enhancing patient care and management while reducing healthcare costs.

Key drivers of market growth include the rising prevalence of chronic diseases like diabetes, cardiovascular disorders, and respiratory ailments. Digital monitoring devices such as wearable sensors, remote monitoring systems, and mobile health apps enable continuous tracking of vital signs, medication adherence, and disease progression, facilitating early intervention and personalized treatment plans.

The market landscape is characterized by a mix of established players and innovative startups, driving competition and innovation. Established companies offer a wide range of products with advanced features, while startups focus on niche solutions and disruptive technologies like AI-driven analytics and IoT integration.

- According to American Medical Association, between 2016 and 2022, there was a significant increase in the adoption of tele-visits or virtual visits among physicians, rising from 14% to 80%. Similarly, the utilization of remote monitoring devices by physicians also saw a notable growth, climbing from 12% in 2016 to 30% in 2022.

- According to a report by the Bipartisan Policy Center, while the percentage of patients using Remote Patient Monitoring (RPM) remains comparatively low, there has been a substantial increase in RPM usage among Medicare beneficiaries, growing more than sixfold from 2018 to 2021.

Key Takeaways

- The global digital patient monitoring devices market garnered a revenue of USD 144.3 billion in 2023, with predictions to exceed USD 1467 billion by the end of the forecast period, accompanied by a CAGR of 26.1%.

- Based on type, the wearable devices segment commanded the market in 2023 with its market share of 33.6%.

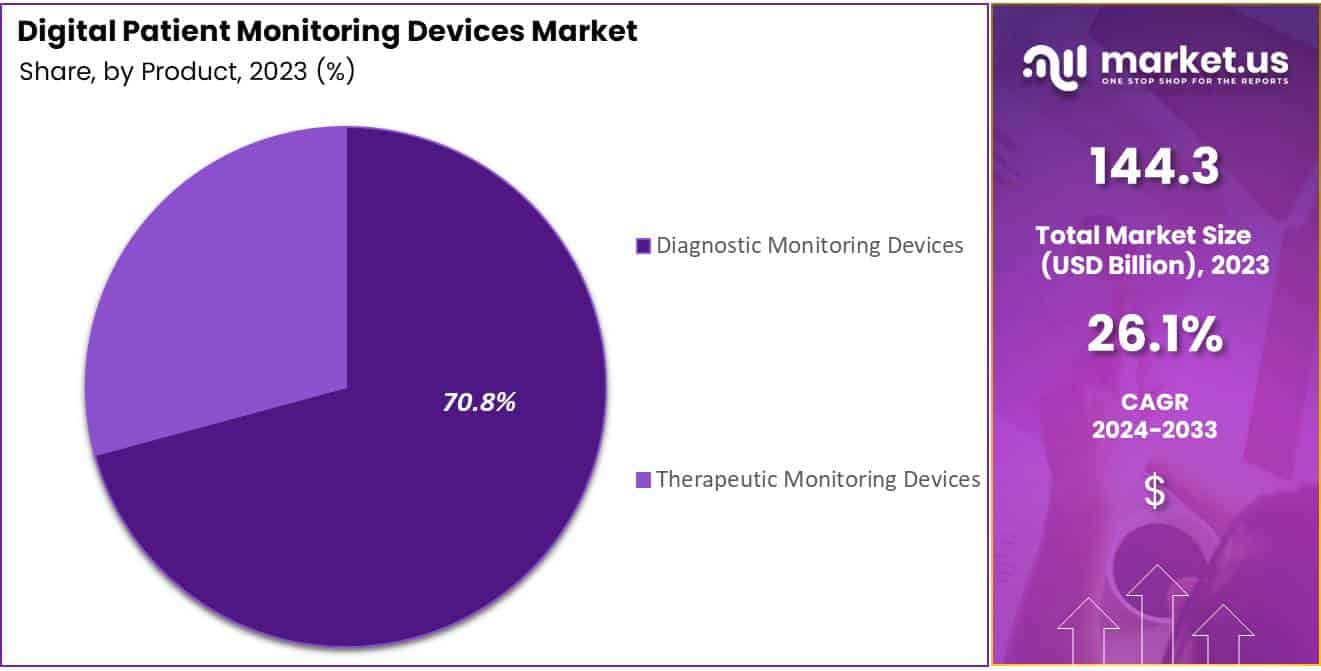

- By product, the diagnostic patient monitoring devices led the market, capturing a noticeably larger market share of 70.8%.

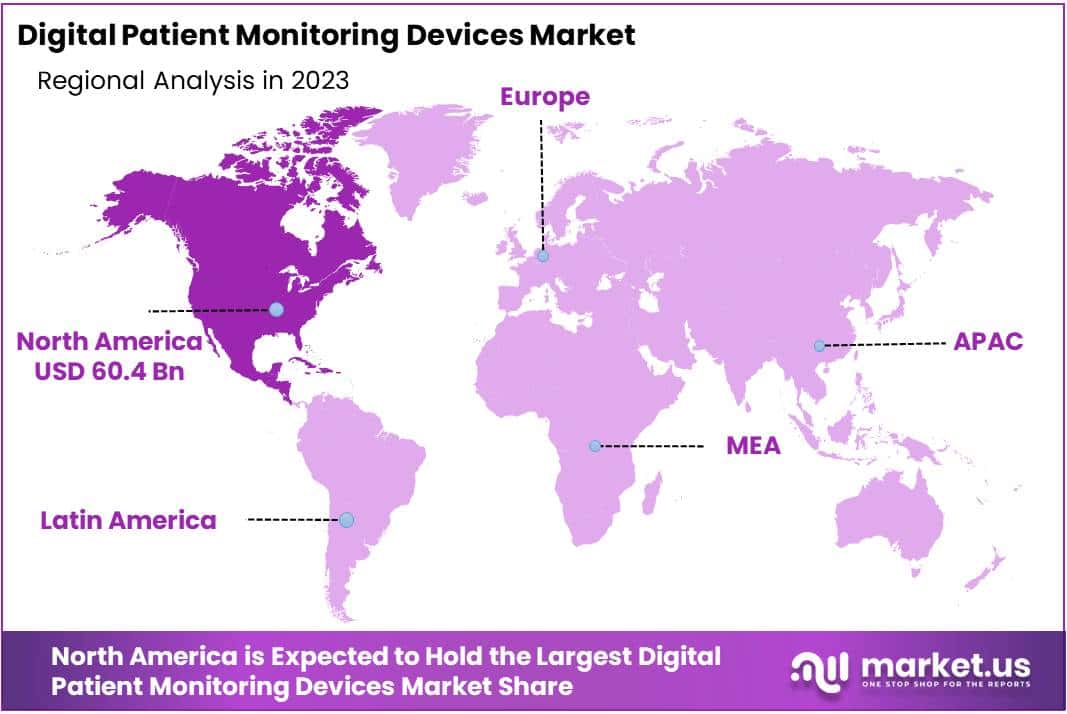

- North America maintained its stronghold on the market with a market share of 41.9%.

Type Analysis

When classified on the basis of type, the segments observed in the market are Wearable Devices, Wireless Sensor Technology, mHealth, Telehealth, and Remote Patient Monitoring. Among these, the wearable devices segment generated the most revenue for the Digital Patient Monitoring Devices Market in 2023, claiming a revenue share of 33.6%. conversely, the mHealth segment is expected to grow at an unmatched pace during the forecast period primarily due to increasing number of internet and smartphone users.

Product Analysis

Based on product, the market is bifurcated into diagnostic and therapeutic, of which diagnostic patient monitoring devices stood out as leader. The segment secured a market share of 70.8% in 2023. The growth of this segment is primarily driven by the increasing incidence of chronic illnesses on a global scale. the increasing demand for respiratory and blood glucose monitors further contributes to the dominance of the segment.

Key Market Segments

By Type

- Wearable Devices

- Wireless Sensor Technology

- mHealth

- Telehealth

- Remote Patient Monitoring

By Product

- Diagnostic Monitoring Devices

- Therapeutic Monitoring Devices

Drivers

Technological Advancements

One of the main drivers of the global digital patient monitoring devices market is rapid Technological advancements. Innovations in wearable sensors, remote monitoring systems, mobile health apps, and data analytics have revolutionized patient care. Such devices now real-time data collection, analysis, and processing capabilities, with subsequent provision of inferential insights.

This ultimately assists healthcare professionals in informed decision making and intervening when necessary. The advancements in capabilities of such devices have allowed efficient tracking of various vitals like heart rate, blood pressure, and oxygen saturation levels. Furthermore, novel sensor technologies offer improved accuracy and reliability, thus making wearable sensors a valuable tool for continuous patient monitoring.

Increasing Incidence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, cardiovascular disorders, respiratory ailments, and hypertension has proven to be a significant driver of the global digital patient monitoring devices market. Patients suffering from chronic conditions often require continuous monitoring and management. Digital monitoring devices aim to improve patient outcomes by offering a proactive approach to healthcare.

For instance, digital blood glucose monitoring devices play a crucial role in managing diabetes by monitoring blood glucose levels, insulin administration, diet, and physical activity, the examples of which include Continuous glucose monitors (CGMs) and insulin pumps.

Another example would be devices like wearable ECG monitors and blood pressure monitors that help in monitoring heart health, detecting arrhythmias, and managing hypertension. These devices provide valuable data for cardiovascular risk assessment and personalized treatment strategies.

Restraints

Data Privacy and Security Concerns

One of the significant restraints in the digital patient monitoring devices market is the concern over data security and patient privacy. As these devices collect sensitive health information, including vital signs, medical history, and treatment data, ensuring robust data security measures is paramount. Breaches in data security can lead to unauthorized access, data leaks, identity theft, and compromise patient confidentiality.

Furthermore, concerns about data privacy and security may impact patient trust in digital monitoring devices and telehealth services. Addressing these concerns by implementing measures like transparent privacy policies and secure data transmission protocols is essential to foster patient acceptance and engagement.

Opportunities

Growing Adoption Of Remote Patient Monitoring

One of the main opportunities for the digital patient monitoring devices market is the growing adoption of remote patient monitoring (abbreviated as RPM). RPM enables collection of real-time data, remote observation of patients and opportunities for proactive intervention. This ultimately assists in improving patient outcomes while reducing healthcare costs.

Integration Of AI-Driven Algorithms And Data Analytics

Another opportunity for the market lies in the integration of AI-driven algorithms and data analytics, which offer immense opportunities for enhancing the capabilities of digital patient monitoring devices. Machine learning algorithms have extensive capabilities, with which analysis of large datasets, pattern identification, health trends prediction is achieved with ease.

Emerging markets, particularly in Asia Pacific, Latin America, and Africa, present significant growth opportunities for the digital patient monitoring devices market. Factors such as increasing healthcare expenditure, growing adoption of digital health technologies, and rising awareness of preventive care accelerate market growth in the aforementioned regions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors such as GDP growth, inflation rates, and healthcare spending have a direct impact on the adoption of digital patient monitoring devices. Strong economic conditions with robust GDP growth and increased healthcare spending result in greater investments in healthcare. This leads to advancements in healthcare infrastructure and digital health solutions. Conversely, economic downturns or recessions may result in budget constraints, reduced funding for healthcare initiatives, and delayed adoption of advanced monitoring devices.

Government policies also play a significant role in shaping the regulatory environment for digital patient monitoring devices. Policies related to healthcare reform, reimbursement models, data privacy, and medical device regulations impact market access, product approvals, and compliance requirements for manufacturers. Changes in healthcare policies, such as the introduction of telehealth reimbursement policies or updates to medical device regulations, can create opportunities or challenges for digital patient monitoring device manufacturers.

Latest Trends

Integration of AI and machine learning algorithms assist in enhancing the quality of data analysis, predictive analysis and clinical decision making processes. Such technologies facilitate improved data interpretation, pattern identification, trend prediction, and curation of personalized treatment plans.

The COVID-19 pandemic assisted in increasing the adoption of remote patient monitoring solutions, which resulted in heightened demand for digital monitoring devices. Remote patient monitoring facilitates real-time monitoring of vital signs, medication adherence, and disease progression of patients on a remote basis. This reduces the need for in-person medical care and ultimately enhances patient convenience. Advanced RPM platforms allow integration with telehealth services, thus enabling virtual consultations and real-time data sharing between patients and medical professionals.

The capturing and tracking capabilities of wearable devices such as smartwatches, fitness trackers, and continuous monitoring sensors are becoming increasingly advanced. These devices monitor vital signs, physical activity, sleep patterns, and even environmental factors that impact health. Wearable health technology is then integrated with digital patient monitoring platforms, thus facilitating provision of actionable insights that assist in proactive health management.

Regional Analysis

North America is leading the Digital Patient Monitoring Devices Market

North America remained the lead contributor to the global digital patient monitoring devices market, and the trend is expected to continue in the forecast period. The region claimed a revenue share of 41.9% in 2023. According to an article by the Harvard Health Publishing, approximately 50 million individuals in the United States are utilizing remote patient monitoring devices.

These gadgets are essential in healthcare because they let patients keep track of their health at home while giving healthcare providers up-to-date information for better care decisions. The market in this area is growing because more people have chronic illnesses. Also, new technology is improving fast, and there are more older people, which is helping the market grow.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Conversely, Asia Pacific is expected to undergo a period of exponential growth, accompanied by an unmatched CAGR throughout the forecast period. This is chiefly owed to the increasing burden of cardiovascular and respiratory diseases. Moreover, changing lifestyle habits and a presence of substantial customer base assist in the process of market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The market for Digital Patient Monitoring Devices market is moderately fragmented, with multiple companies vying for larger market shares. Companies effectively utilise advanced technologies to develop novel products aimed at achieving command of the market. Established players employ a variety of strategies to cement their market positions. Examples of such strategies include mergers, acquisitions, collaborations and joint ventures. Conversely, small businesses and start-ups often focus on niche products in order to meet the needs of specific consumer bases.

Top Key Players in Digital Patient Monitoring Devices Market

- Omron Corporation

- Airstrip Technologies

- AT&T Inc.

- Athenahealth, Inc.

- Jude Medica

- Phillips Healthcare

- Welch Allyn

- GE Healthcare

- Zephyr Technology Corporation

- Other Key Players

Recent Developments

- In March 2023, Zephyr AI, Inc. and KangarooHealth, Inc. announced a multi-year strategic partnership aimed at leveraging their respective technologies to enhance patient care for individuals diagnosed with chronic conditions. Zephyr AI specializes in developing transparent AI solutions for precision medicine, focusing on improving outcomes across prevention, treatment, and patient well-being. On the other hand, KangarooHealth offers an AI-assisted remote patient monitoring platform and care management services.

- In August 2023, OMRON Corporation shared their intention to introduce three new series of operating microswitches worldwide. These series, named D2FC, D2LS, and D2FP, aim to offer a refined operational experience in controllers, thereby improving user precision and satisfaction across different applications.

- In December 2023, GE HealthCare unveiled a collaboration with AirStrip to jointly distribute cutting-edge patient monitoring technology. As per the agreement, GE HealthCare has taken on the role of exclusive distributor for AirStrip’s cardiology and patient monitoring solutions within the United States.

Report Scope

Report Features Description Market Value (2023) USD 144.3 billion Forecast Revenue (2033) USD 1467 billion CAGR (2024-2033) 26.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Wearable Devices, Wireless Sensor Technology, mHealth, Telehealth, Remote Patient Monitoring; By Product – Diagnostic Monitoring Devices, Therapeutic Monitoring Devices Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Omron Corporation, Airstrip Technologies, AT&T Inc., Athenahealth, Inc., St. Jude Medica, Phillips Healthcare, Welch Allyn, GE Healthcare, Zephyr Technology Corporation, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Patient Monitoring Devices MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Patient Monitoring Devices MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Omron Corporation

- Airstrip Technologies

- AT&T Inc.

- Athenahealth, Inc.

- Jude Medica

- Phillips Healthcare

- Welch Allyn

- GE Healthcare

- Zephyr Technology Corporation

- Other Key Players