Global Digital Identity Market Size, Share, Industry Analysis Report By Offering (Solutions, Services), By Solution Type (Identity Verification, Authentication, Identity Lifecycle Management, Audit, Compliance, and Governance, Others), By Deployment (On-Premises, Cloud), By Organization Size (Small & Medium-Sized Enterprises (SMEs), Large Enterprises), By Vertical (BFSI, Government, Healthcare, Retail & Ecommerce, Telecommunications, IT & ITes, Energy & Utilities, Education, Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167502

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Digital Identity Statistics

- Global population and access statistics

- Role of Generative AI

- U.S. Digital Identity Market Size

- Regional and Country-Specific Statistics

- Offering Analysis

- Solution Type Analysis

- Deployment Analysis

- Organization Size Analysis

- By Vertical Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Future Outlook

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

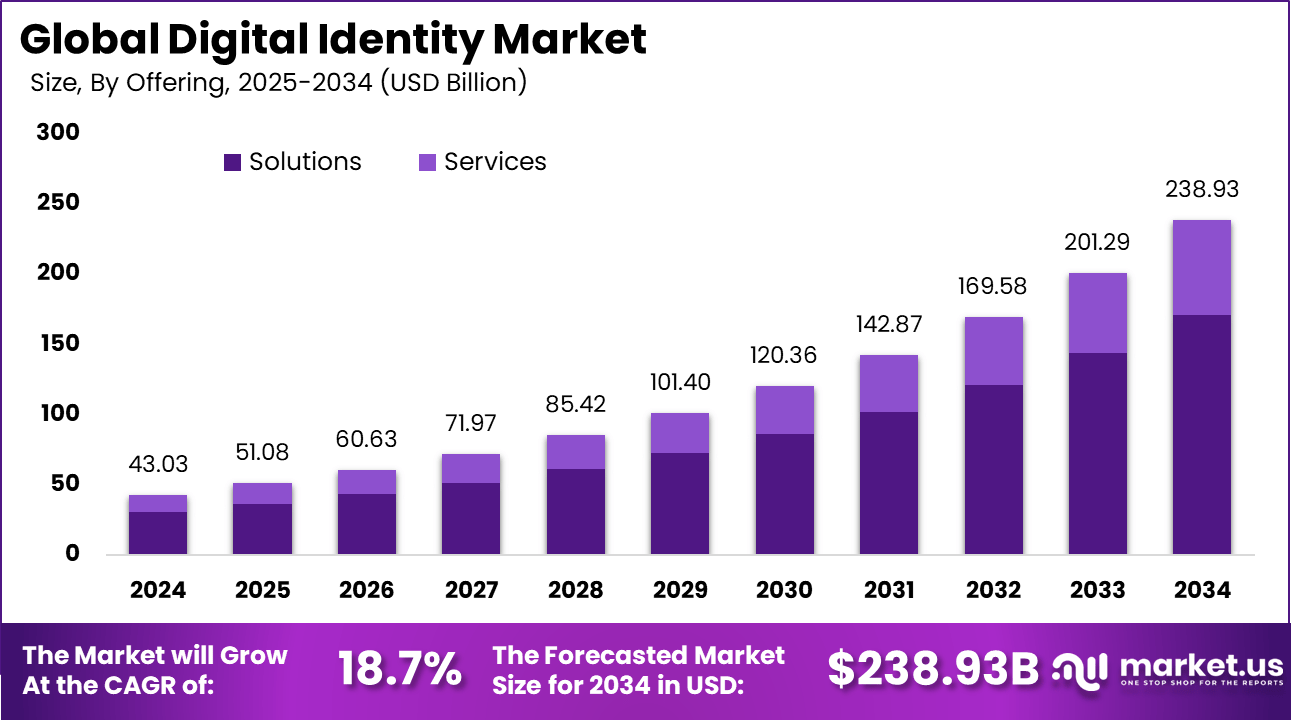

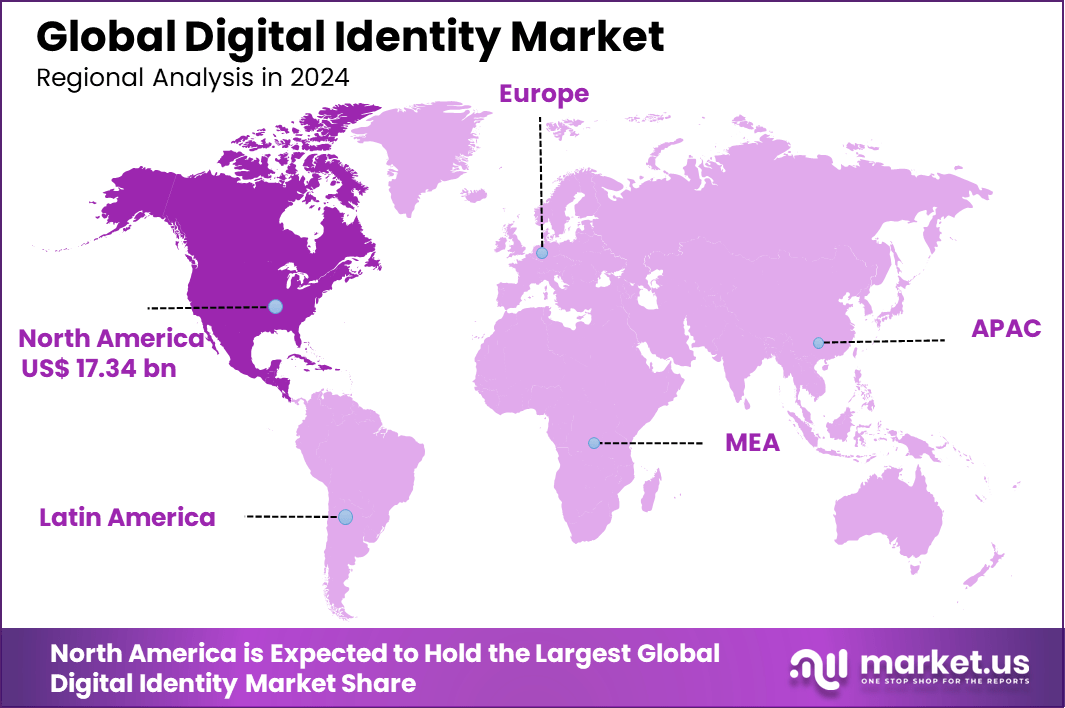

The Global Digital Identity Market size is expected to be worth around USD 238.93 billion by 2034, from USD 43.03 billion in 2024, growing at a CAGR of 18.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.3% share, holding USD 17.34 billion in revenue.

The digital identity market has expanded as governments, financial institutions and enterprises adopt secure digital identity frameworks to verify users and enable trusted online interactions. Growth reflects rising digital service usage, increasing cyber threats and wider reliance on remote authentication. The market now includes identity verification platforms, biometric authentication tools, digital credential systems and identity governance solutions used across public and private sectors.

Top driving factors for this market include the rapid growth of online services and escalating cyber threats targeting personal and business data. For instance, more than 50% increase in cyber attacks focusing on identity fraud underlines the critical need for reliable digital identity solutions. The shift to remote work and online transactions during the pandemic accelerated adoption, emphasizing the importance of secure, privacy-respecting identity verification techniques.

For instance, in October 2025, Okta Inc. rolled out new platform enhancements designed to support the secure adoption of AI agents and verified digital credentials. Their upcoming features include AI lifecycle security and verifiable digital credentials to combat AI-driven fraud and streamline onboarding. These innovations are targeted at helping enterprises adopt AI safely and manage digital identities at scale.

Demand is rising across banking, telecom, healthcare, retail, travel, government services and online marketplaces. Financial institutions require digital identity tools to meet regulatory requirements and reduce fraud. Telecom operators use identity verification for SIM registration and customer onboarding. Public agencies rely on digital credentials for welfare services, e governance programs and national identity schemes.

Key Takeaway

- In 2024, the Solutions segment dominated with a 71.5% share, reflecting strong demand for end-to-end identity management platforms across enterprises and public institutions.

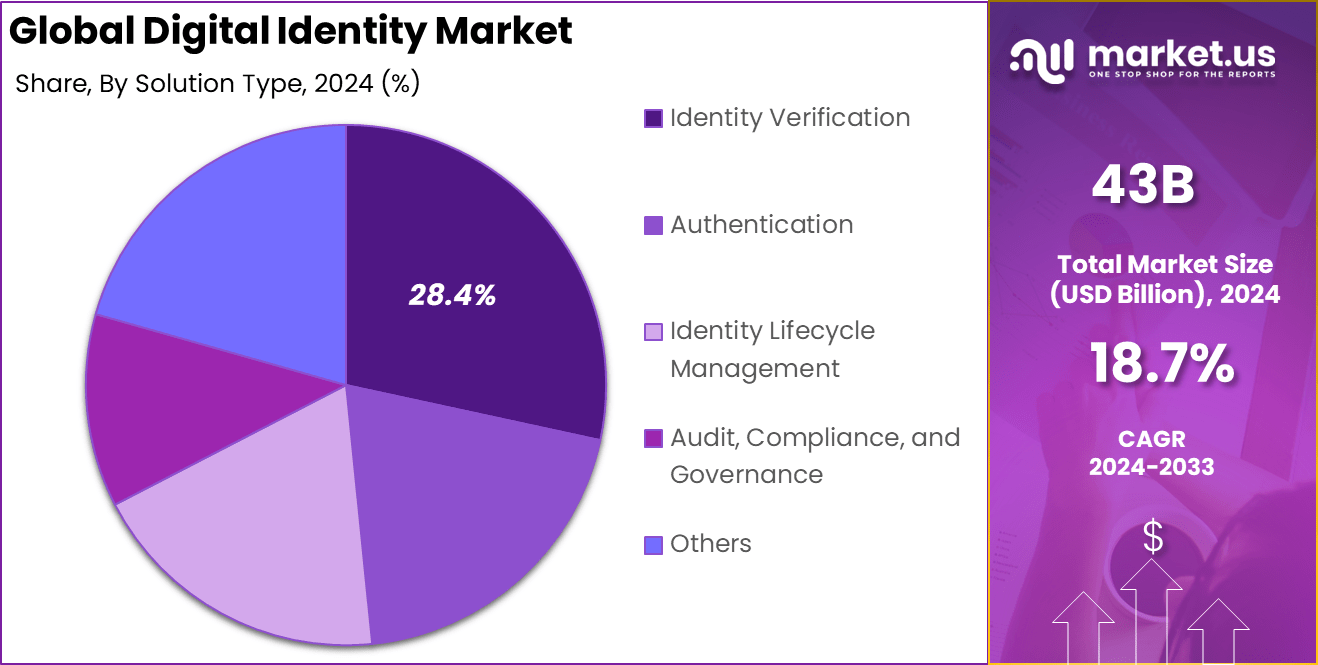

- The Identity Verification segment held a 28.4% share, driven by rising needs for secure onboarding, fraud prevention, and compliance with KYC and AML regulations.

- The Cloud segment led with 60.2%, highlighting the shift toward scalable, flexible, and cost-efficient digital identity architectures.

- The Large Enterprises segment accounted for 67.3%, as large organizations prioritize advanced identity frameworks to secure distributed workforces and digital ecosystems.

- The BFSI segment captured 24.5%, underscoring the sector’s reliance on robust identity systems to secure transactions and customer authentication workflows.

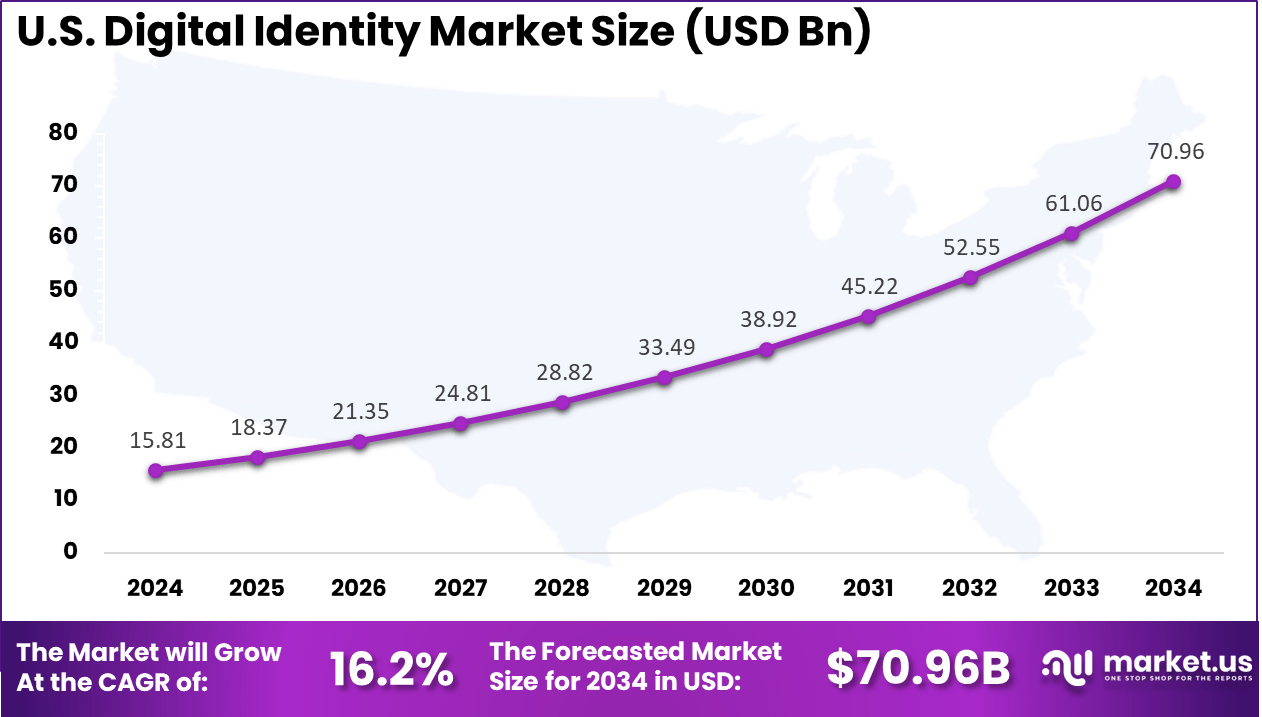

- The US market reached USD 15.81 billion in 2024 and is expanding at a strong CAGR of 16.2%, driven by digital transformation, regulatory compliance, and heightened fraud risks.

- North America led globally with over 40.3% share, supported by advanced cybersecurity adoption, strong enterprise investments, and a mature digital identity ecosystem.

Digital Identity Statistics

- Based on data from iproov, Global awareness remains limited, with only 58% of respondents stating they understand the term “digital identity”.

- 42% correctly identified digital identity as “any information that exists about me online”.

- 14% believed their digital identity was simply an e-signature, while five percent thought it referred to their email address.

- 90% of consumers already use or would consider using a single secure digital identity service, indicating strong adoption potential.

- Banks remain the most trusted, with 49% of consumers preferring them to deliver a single digital identity service.

- Google is trusted by 26% of respondents, reflecting confidence in major technology providers.

- Government services are trusted by 23%, indicating moderate but growing acceptance of public-sector digital identity systems.

Global population and access statistics

- As of mid-2022, 186 out of 198 countries have foundational ID systems with digitally stored identity records, indicating widespread global progress toward digital identity infrastructure.

- Approximately 375 million people still live in countries where identity records remain predominantly paper-based, reflecting significant modernization gaps.

- Nearly one billion people worldwide lack any form of legally recognized identification, limiting access to public services, financial systems, and social protections.

- An additional 3.4 billion people possess a legal ID but face restricted digital usability, underscoring challenges related to verification systems, connectivity, and digital inclusion.

- In India, more than 94% of the population now has a digital ID, with 1.42 billion Aadhaar numbers issued as of late 2025, marking one of the world’s largest digital identity ecosystems.

Role of Generative AI

Generative AI has begun to play a vital role in digital identity by enhancing how identity verification is handled. Around 50% of organizations are expected to adopt generative AI-powered video identity methods soon, as existing traditional methods are often viewed as inadequate. This technology helps simplify processes by reducing the need for repeated submission of sensitive identity data, thus lowering the risk of large-scale identity theft.

By leveraging generative AI, companies can better detect fraudulent activity through pattern recognition and automate the verification process, especially with biometric data like facial recognition and voice identification. This makes digital identity safer and more user-friendly, addressing many current challenges effectively. Usage of generative AI is growing rapidly, with about 73% of individuals in some regions already using it, especially younger generations who are the most active users.

These users find it valuable not only for personal tasks but increasingly for work applications, including identity management. However, adoption is cautious due to concerns like security risks and a lack of integration capabilities. Still, many organizations are increasing investments in generative AI, driven by its potential to improve accuracy, efficiency, and security. These improvements position generative AI as a powerful tool in advancing how digital identities are created, managed, and protected.

U.S. Digital Identity Market Size

The market for Digital Identity within the U.S. is growing tremendously and is currently valued at USD 15.81 billion, the market has a projected CAGR of 16.2%. The market is growing due to increasing demand for secure and efficient identity verification solutions across multiple sectors.

Growth is fueled by regulatory compliance requirements, especially in financial services and healthcare, where protecting sensitive data is paramount. Advances in biometric authentication and AI-powered verification technologies also boost adoption, enabling seamless and fraud-resistant user experiences. The shift toward cloud-based identity solutions enhances scalability and flexibility for businesses.

For instance, in October 2025, OneSpan Inc. showcased its leading authentication portfolio at Authenticate 2025, reaffirming its commitment to FIDO technologies and advanced authentication solutions that help organizations reduce fraud and accelerate digital transformation in compliance-heavy environments.

In 2024, North America held a dominant market position in the Global Digital Identity Market, capturing more than a 40.3% share, holding USD 17.34 billion in revenue. This leadership comes from advanced technological infrastructure and the widespread adoption of secure digital identity solutions across key industries such as finance, healthcare, and government.

The region benefits from strong regulatory frameworks like CCPA, which push organizations to adopt stricter identity verification and data protection methods. The U.S., as the largest market within North America, drives much of this demand with its mature enterprise adoption of cloud-based and biometric identity technologies.

Investments by major players and early adoption of innovative identity verification systems fuel the strong growth, supported by growing cybersecurity concerns and regulatory compliance pressures that shape the market’s dynamics effectively.

For instance, in November 2025, Ping Identity Holding Corp. launched its “Identity for AI” solution, targeting enterprises to secure autonomous AI-driven workflows with visibility, governance, and access control tailored for AI agents. This innovative identity platform addresses risks from adversarial AI, positioning Ping as a key player in safeguarding the next generation of digital identities.

Regional and Country-Specific Statistics

- India’s Aadhaar System: India operates the world’s largest digital identity infrastructure, with nearly 1.3 billion citizens enrolled. Aadhaar supports large-scale authentication and is closely integrated with UPI, which processes about half of the world’s daily digital transactions by volume, illustrating India’s advanced digital public infrastructure.

- European Union: In 2024, about 70% of people aged 16–74 used e-government services within the previous 12 months. Adoption of national eID for accessing public services averaged 36% across EU member states, indicating continued progress but also variation in national adoption rates.

- Estonia: Estonia remains a global benchmark for digital identity. In 2023, approximately 78% of citizens used their eID to access private-sector services, demonstrating deep integration of digital identity into daily life and commercial activities.

- United States: The US follows a fragmented digital identity landscape, lacking a unified national ID system. A 2022 survey showed that only 45% of Americans felt confident that they understood the term “digital identity”, reflecting limited public awareness and uneven adoption.

- Africa and South Asia: The majority of the world’s population without official identification resides in Sub-Saharan Africa and South Asia, where structural gaps, limited infrastructure, and affordability challenges continue to impede widespread digital ID adoption.

Offering Analysis

In 2024, The Solutions segment held a dominant market position, capturing a 71.5% share of the Global Digital Identity Market. This strong inclination reflects the market’s focus on providing core identity management functions such as multi-factor authentication and identity verification platforms.

Organizations continue to invest heavily in these solutions to strengthen security frameworks, streamline compliance, and reduce identity-related fraud risks. The steady growth in solutions underlines their central role in enabling businesses to manage digital identities effectively and securely.

Alongside solutions, service offerings are growing but have not yet overtaken solution demand. The increasing complexity of digital identification and the need for customized implementation propel the ongoing preference for mature, ready-to-use solution platforms that cater to broad and specialized needs.

For Instance, in October 2025, Thales Group launched identity verification and account recovery solutions that use biometrics and advanced cryptography, supporting enterprises’ needs for robust identity solutions that reduce fraud and increase security. This aligns well with the strong market preference for ready-to-use digital identity solutions that handle complex identity management demands.

Solution Type Analysis

In 2024, the Identity Verification segment held a dominant market position, capturing a 28.4% share of the Global Digital Identity Market. This segment is crucial as it encompasses technologies and methods that confirm users’ identities through document checks, biometrics, and liveness detection.

Advances in biometric authentication, such as facial recognition and fingerprint scanning, make identity verification a cornerstone of trustworthy digital interactions. It addresses a wide array of use cases across different industries that require rigorous authentication to prevent fraud. Consumers and enterprises alike demand secure and seamless verification to ensure genuine access to services.

Identity verification’s growing importance is fueled by the rise in remote onboarding activities and the increasing need for compliance with regulatory frameworks such as KYC and AML. As an evolving area, it benefits from AI-powered enhancements that improve accuracy and user experience during the identity proofing process.

For instance, in November 2025, Experian plc was recognized as a leader in identity verification within financial services, highlighting its broad capabilities in fraud prevention and compliance technologies. This reinforces identity verification’s critical role in securing financial and other sensitive transactions.

Deployment Analysis

In 2024, The Cloud segment held a dominant market position, capturing a 60.2% share of the Global Digital Identity Market. It offers flexibility, ease of deployment, and cost advantages, which allow companies to quickly implement identity services without heavy upfront investment. The cloud’s scalability makes it suitable for varied enterprise sizes and regulatory demands.

Although on-premises deployment remains important for firms needing strict data control and compliance, cloud adoption continues to grow rapidly. Cloud solutions support dynamic security updates and multiple access points, making them ideal for today’s evolving identity management needs.

For Instance, in April 2025, Thales Group deepened cloud security partnerships, enhancing its encryption and key management offerings for cloud environments, further establishing the cloud as a preferred deployment method for identity management solutions due to flexibility and security.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 67.3% share of the Global Digital Identity Market. This segment is driven by their complex IT environments and critical need for robust identity governance.

These organizations handle vast amounts of sensitive data and face stringent regulatory expectations, making sophisticated digital identity solutions a priority for securing access and maintaining compliance. The scale and complexity of enterprise operations prompt substantial investment in advanced authentication frameworks and continuous identity monitoring.

Meanwhile, small and medium enterprises are growing rapidly in adoption, attracted by cloud-native and subscription-based models that lower barriers to entry. However, large enterprises remain the primary market segment due to their financial capacity, risk exposure, and regulatory requirements, positioning them as the main drivers of innovation and demand in the digital identity space.

For Instance, in July 2025, Microsoft Corporation launched advanced identity threat detection and response solutions designed for large-scale enterprise environments, emphasizing automation and integration to combat growing identity-based cyber threats. These moves highlight how large enterprises remain focal customers in this market.

By Vertical Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 24.5% share of the Global Digital Identity Market. This dominance stems from the critical need to secure transactions, comply with stringent KYC and AML regulations, and prevent increasingly sophisticated financial fraud.

BFSI organizations are driving substantial investment in identity technologies that provide reliable, real-time authentication and fraud detection capabilities. This sector’s emphasis on digital transformation, coupled with regulatory pressure, accelerates the adoption of identity verification and management solutions.

For Instance, in June 2025, Daon Inc. emphasized its partnership with financial technology players to provide identity continuity, supporting security and regulatory compliance needs unique to BFSI entities. This sector’s focus on fraud prevention and compliance drives significant digital identity adoption.

Emerging Trends

Emerging trends in digital identity are focused on improving accuracy, security, and user control. Biometric systems combining facial, fingerprint, and iris recognition are becoming more widespread because they offer higher security than passwords alone. These multi-modal biometric approaches provide more reliable verification by using several identity factors simultaneously.

At the same time, there is a clear shift toward decentralized identity models. These models give individuals control over their digital identities without depending on a single authority, often supported by blockchain technology. This enhances privacy and reduces risks associated with centralized data breaches.

Another key trend is the rise of AI-driven identity verification, which uses machine learning to detect fraud and verify identities with greater speed and accuracy. Real-time behavioral analytics are also gaining traction as a way to continuously confirm user identity. This shift toward more dynamic and user-centric identity systems reflects a broader demand for convenience without compromising security.

Growth Factors

Growth in digital identity adoption is driven primarily by the rising threat of identity fraud online, which pushes businesses to strengthen authentication methods. The increase in online services and digital transactions makes seamless and secure identity verification essential to protect both users and organizations.

Advances in AI, biometrics, and blockchain technology are making digital identity solutions more effective and easier to use. These technologies reduce operational friction while increasing confidence in user identities, encouraging broader adoption across sectors such as finance, healthcare, and retail. Additionally, the need to comply with tightening data security and privacy regulations also fuels growth.

Governments and regulators are demanding stronger identity protections, which motivates both public and private sectors to invest in modern identity systems. Despite some challenges like cost and privacy concerns, the outlook remains positive as technological improvements continue to lower barriers and improve trust.

Key Market Segments

By Offering

- Solutions

- Hardware

- RFID Readers & Encoders

- Hardware-based Tokens

- Processor ID Cards

- Others

- Software

- Hardware

- Services

- Professional Services

- Integration & Deployment

- Support & Maintenance

- Training & Development

- Managed Services

- Professional Services

By Solution Type

- Identity Verification

- Authentication

- Identity Lifecycle Management

- Audit, Compliance, and Governance

- Others

By Deployment

- On-Premises

- Cloud

By Organization Size

- Small & Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- BFSI

- Government

- Healthcare

- Retail & Ecommerce

- Telecommunications

- IT & ITes

- Energy & Utilities

- Education

- Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Government Initiatives and Regulatory Push

Governments worldwide are actively promoting national digital identity programs to simplify and secure citizen identification processes. These initiatives increase the demand for digital identity solutions by enabling residents to have a single, verifiable digital ID for services ranging from banking to healthcare.

This public sector push is a strong market driver because it encourages adoption across industries and regions, particularly in Asia-Pacific and North America, supporting steady market growth. These government-led programs often include biometric data collection and trusted authentication frameworks, reinforcing the need for advanced digital identity technologies.

For instance, in July 2025, Thales Group demonstrated its strong government-oriented push by supporting large national digital ID programs such as those in Queensland, Australia, and Mauritius. Their Mobile Driver’s License and legal identity program simplify government-citizen interactions, driving adoption and financial inclusion. This public sector backing showcases how government initiatives propel market growth and trust in digital identities globally.

Restraint

Privacy Concerns and Data Breach Risks

Despite growth opportunities, privacy and data security worries restrain market adoption. Digital identity systems handle highly sensitive personal data, including biometrics and government IDs, making them prime targets for cyber attacks. Regulatory frameworks like GDPR in Europe and other data laws globally impose strict controls on how this information is stored and shared, adding complexity for providers.

Many users and organizations remain cautious due to past incidents of data breaches and misuse, slowing broader acceptance. The risk of financial penalties and reputation damage from privacy violations means companies must invest heavily in compliance and security measures, which can hinder fast market expansion.

For instance, in November 2025, Experian plc highlighted its focus on enhancing fraud prevention and privacy protections through AI-driven identity verification on its Experian Ascend Platform. Despite technological advances, Experian acknowledges ongoing privacy concerns and the complexity of managing sensitive data while adhering to evolving regulations, which continue to restrain broad market adoption.

Opportunities

Integration of AI, Blockchain, and Biometrics

The digital identity market has a significant opportunity through the adoption of cutting-edge technologies like artificial intelligence, blockchain, and biometric authentication. AI enhances identity verification accuracy and speeds up processing, while blockchain offers a decentralized and tamper-proof way to store and verify identity data, improving trust and user control.

Further incorporation of biometric methods such as facial recognition and fingerprint scanning across industries creates new use cases, especially in finance, healthcare, and retail sectors. This technology blend can boost the user experience by making identity checks more secure and seamless, spurring wider adoption among enterprises and consumers alike.

For instance, in September 2025, Okta Inc. announced new identity fabric capabilities integrating AI agents and verifiable credentials that enable safer digital interactions. This move addresses the opportunity for advanced technologies to enhance identity security and streamline onboarding workflows, paving the way for broader enterprise adoption and novel use cases involving AI-driven identity verification.

Challenges

Interoperability and Regulatory Fragmentation

A key challenge lies in the lack of unified standards and regulatory frameworks across regions, which creates interoperability problems for digital identity solutions. Different countries and sectors adopt varying protocols, causing identity data to become siloed and harder to manage across borders. This fragmentation also complicates compliance for providers operating in multiple markets.

As regulators struggle to keep pace with the rapid technology evolution, this uncertainty can delay investments and innovation. Market players must navigate diverse laws and technical standards while striving to create scalable, cross-border digital identity systems, a complex task that slows down global market progress.

For instance, in October 2025, Ping Identity entered an agreement to acquire a biometric authentication startup to enhance frictionless fraud prevention. This acquisition reflects the ongoing challenge of integrating diverse technologies under unified platforms amid fragmented standards and regulatory environments that complicate scaling digital identity solutions across borders and industries.

Future Outlook

Future outlook in the digital identity market shows promising new opportunities driven by emerging technologies and evolving user needs. One significant area is the development of decentralized digital identity frameworks, which offer users greater control over their data and reduce reliance on central authorities. This shift has the potential to transform identity verification by enhancing privacy and security while enabling seamless cross-border identity usage.

Another growing opportunity lies in integrating artificial intelligence and machine learning into identity verification processes. These technologies boost accuracy and speed in detecting fraudulent activities and enable adaptive authentication methods based on user behavior. Consequently, industries such as finance, healthcare, and e-commerce can significantly reduce identity theft risks and compliance costs.

Additionally, there is expanding potential for digital identity in untapped sectors like IoT ecosystems, where ensuring trusted device identity is critical. The growing demand for secure smart environments and connected devices creates new use cases for digital identity solutions. Governments worldwide are also increasingly adopting digital identity initiatives for public services, driving large-scale implementation opportunities.

Key Players Analysis

Thales Group, IDEMIA, NEC, and Experian lead the digital identity market with strong capabilities in biometric authentication, identity verification, and secure credential management. Their platforms support national ID programs, border control systems, and enterprise security frameworks. These companies focus on improving accuracy, fraud detection, and real-time verification.

Microsoft, Okta, Ping Identity, Daon, Jumio, iProov, Tessi, and Signicat strengthen the competitive landscape with advanced cloud identity platforms and AI-driven verification tools. Their solutions support seamless login experiences, multi-factor authentication, and automated KYC processes. These providers serve banks, fintech companies, and enterprises seeking secure and frictionless digital interactions.

Onfido, ForgeRock, OneSpan, AuthID, Shufti Pro, Veriff, TransUnion, GB Group, and other participants expand the market with flexible identity-proofing engines and fraud-prevention capabilities. Their systems include document verification, biometric matching, and real-time risk scoring designed for high-volume digital applications. These companies focus on speed, scalability, and global coverage.

Top Key Players in the Market

- Thales Group

- IDEMIA Group

- NEC Corporation

- Experian plc

- Microsoft Corporation

- Okta Inc.

- Ping Identity Holding Corp.

- Daon Inc.

- Jumio Corporation

- iProov Ltd.

- Tessi SA

- Signicat AS

- Onfido Ltd.

- ForgeRock Inc.

- OneSpan Inc.

- AuthID Inc.

- Shufti Pro Ltd.

- Veriff OU

- TransUnion LLC

- GB Group plc

- Others

Recent Developments

- In July 2025, IDEMIA Group completed the sale of its IDEMIA Smart Identity division to IN Groupe. This marked a strategic refocus for IDEMIA on biometrics and secure transactions, while IN Groupe aims to become a global leader in secure identity by leveraging IDEMIA’s technologies and expertise.

- In March 2025, NEC Corporation showcased its face recognition technology at Expo 2025 Osaka, integrating biometric verification with decentralized identity and verifiable credentials to enable self-sovereign identity management. NEC is investing in solutions that empower individuals to control their digital identity with enhanced privacy and security.

Report Scope

Report Features Description Market Value (2024) USD 43.0 Bn Forecast Revenue (2034) USD 238.9 Bn CAGR(2025-2034) 18.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Solutions, Services), By Solution Type (Identity Verification, Authentication, Identity Lifecycle Management, Audit, Compliance, and Governance, Others), By Deployment (On-Premises, Cloud), By Organization Size (Small & Medium-Sized Enterprises (SMEs), Large Enterprises), By Vertical (BFSI, Government, Healthcare, Retail & Ecommerce, Telecommunications, IT & ITes, Energy & Utilities, Education, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thales Group, IDEMIA Group, NEC Corporation, Experian plc, Microsoft Corporation, Okta Inc., Ping Identity Holding Corp., Daon Inc., Jumio Corporation, iProov Ltd., Tessi SA, Signicat AS, Onfido Ltd., ForgeRock Inc., OneSpan Inc., AuthID Inc., Shufti Pro Ltd., Veriff OU, TransUnion LLC, GB Group plc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thales Group

- IDEMIA Group

- NEC Corporation

- Experian plc

- Microsoft Corporation

- Okta Inc.

- Ping Identity Holding Corp.

- Daon Inc.

- Jumio Corporation

- iProov Ltd.

- Tessi SA

- Signicat AS

- Onfido Ltd.

- ForgeRock Inc.

- OneSpan Inc.

- AuthID Inc.

- Shufti Pro Ltd.

- Veriff OU

- TransUnion LLC

- GB Group plc

- Others