Global Digital Fashion Market Size, Share Analysis By Platform (Digital Fashion Platforms, E-commerce Platforms, Social Media Platforms), By Technology (Virtual Try-On, Augmented Reality, 3D Modeling), By Application (Online Fashion Design, Custom Clothing Creation, Virtual Fashion Shows), By End User (Consumers, Fashion Designers, Fashion Retailers), By Revenue Model (Subscription-Based, Transaction-Based, Advertising-Based) - Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146247

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- U.S. Market Size

- Platform Analysis

- Technology Analysis

- Application Segment Analysis

- End Users Segment Analysis

- Revenue Model Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

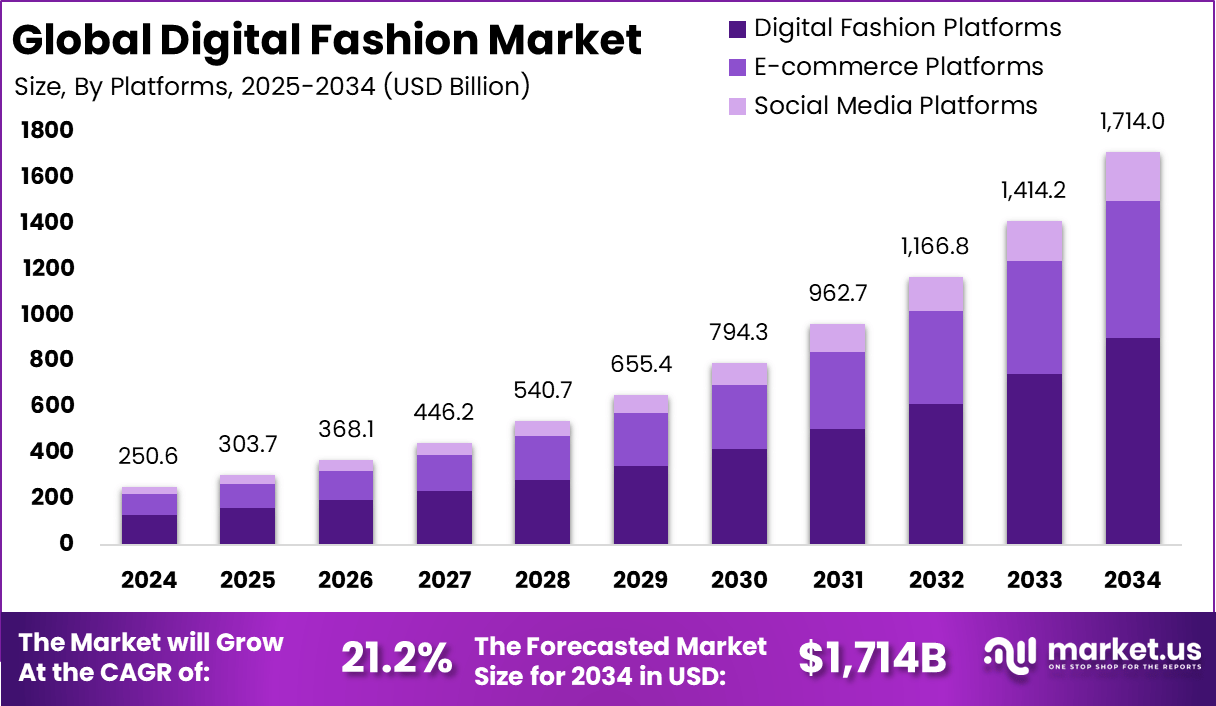

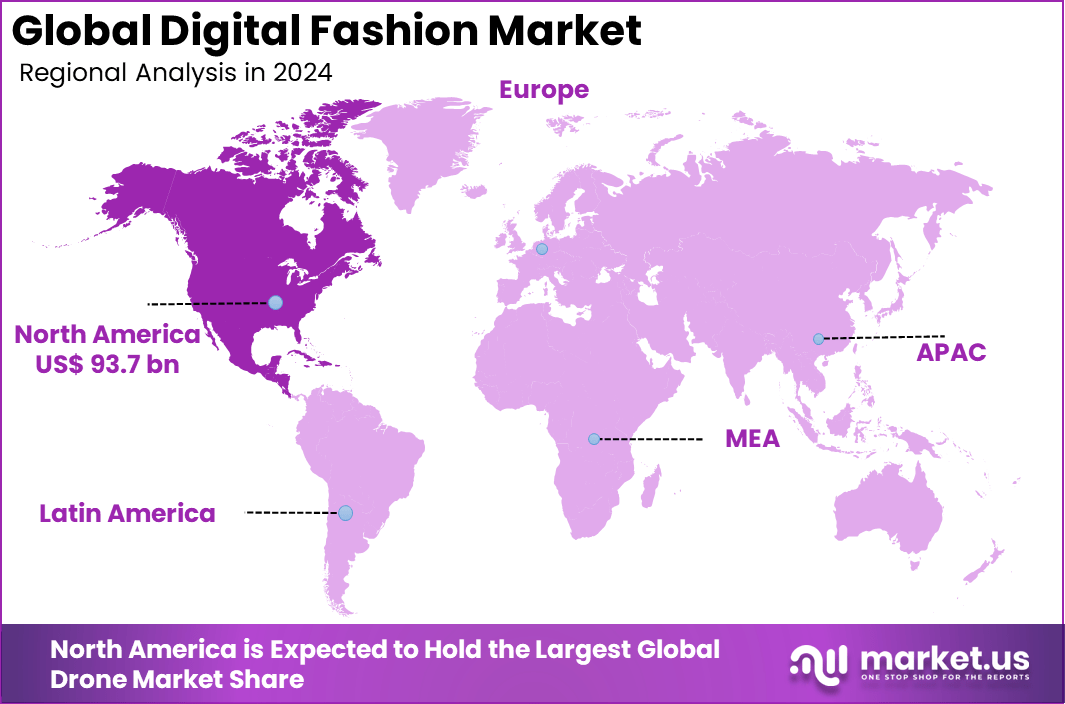

The Digital Fashion Market size is expected to be worth around USD 1,714 billion by 2034, from USD 250.6 billion in 2024, growing at a CAGR of 21.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.4% share, holding USD 93.7 Billion in revenue.

Digital fashion encompasses the virtual representation of clothing and accessories designed for use in digital environments. This segment includes virtual outfits, footwear, and accessories utilized in video games, social media platforms, and metaverse spaces, where users can buy and showcase these items on their avatars. The appeal of digital fashion lies in its capacity to offer unique, often fantastical designs that are unbounded by physical limitations, enabling a new form of expression within virtual worlds.

The digital fashion market is an evolving sector characterized by rapid technological advancements and a burgeoning interest in virtual goods. This market primarily caters to a tech-savvy consumer base and intersects significantly with gaming and entertainment industries. Prominent luxury and fashion brands are increasingly venturing into this space, collaborating with tech companies to offer exclusive virtual collections that mirror or complement their physical offerings.

Technological advancements, particularly in augmented reality (AR) and blockchain, are major catalysts propelling the digital fashion industry forward. These technologies enhance user experience through realistic virtual try-ons and secure ownership of digital assets via NFTs (Non-Fungible Tokens), respectively.

As per the latest industry insights, the global fashion industry revenue is projected to surpass $770 billion, with the U.S. contributing nearly $360 billion to this figure. This signals the continued dominance of the American market in driving global fashion consumption. Moreover, global spending on clothing and footwear is expected to reach $3 trillion in the near future, reflecting rising demand across both developed and emerging economies

The digital fashion market is witnessing a trend towards more sustainable practices and inclusivity. Brands are exploring digital fashion as a way to reduce waste associated with physical samples and collections, while also broadening the scope to include diverse avatars that represent various body types, ethnicities, and gender identities in the digital realm.

Key Takeaway

- In 2024, the Digital Fashion Platform segment held a dominant market position, capturing a 52.6% share of the Global Digital Fashion Market.

- In 2024, the Virtual Try-On segment held a dominant market position, capturing a 48.9% share of the Global Digital Fashion Market.

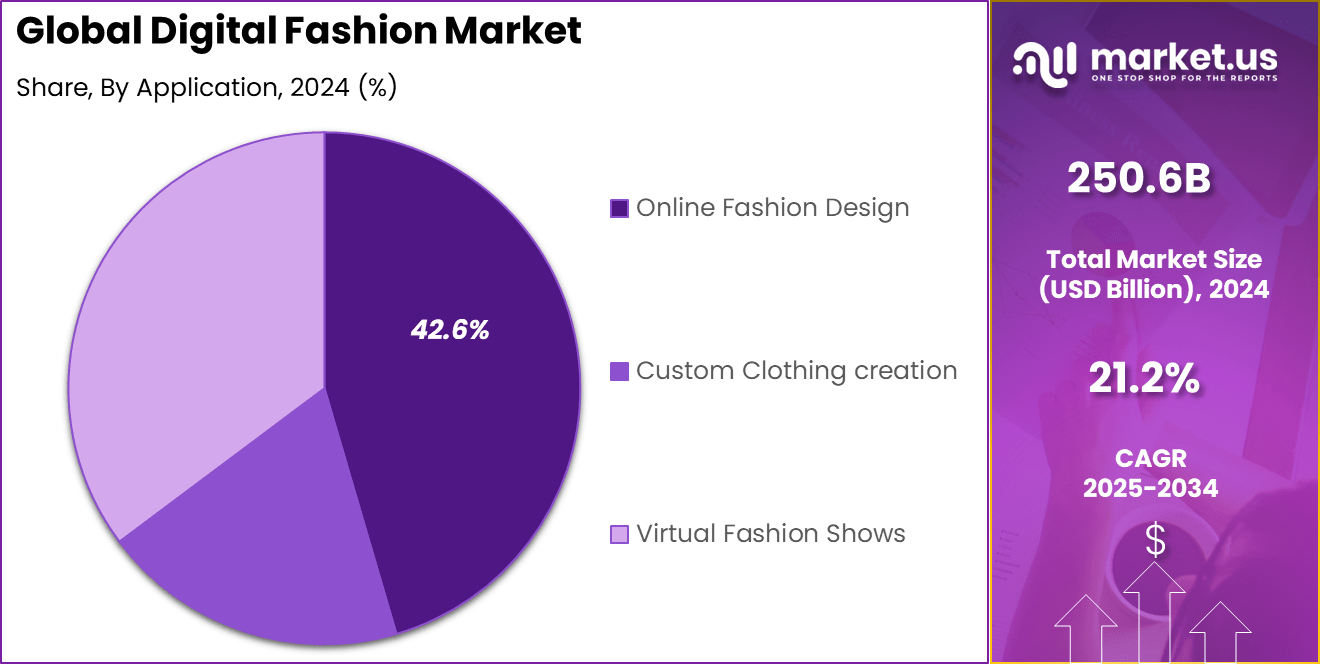

- In 2024, the Online Fashion Design segment held a dominant market position, capturing a 42.6% share of the Global Digital Fashion Market.

- In 2024, the Consumer segment held a dominant market position, capturing a 35.8% share of the Global Digital Fashion Market.

- In 2024, the Subscription-based segment held a dominant market position, capturing a 45.7% share of the Global Digital Fashion Market.

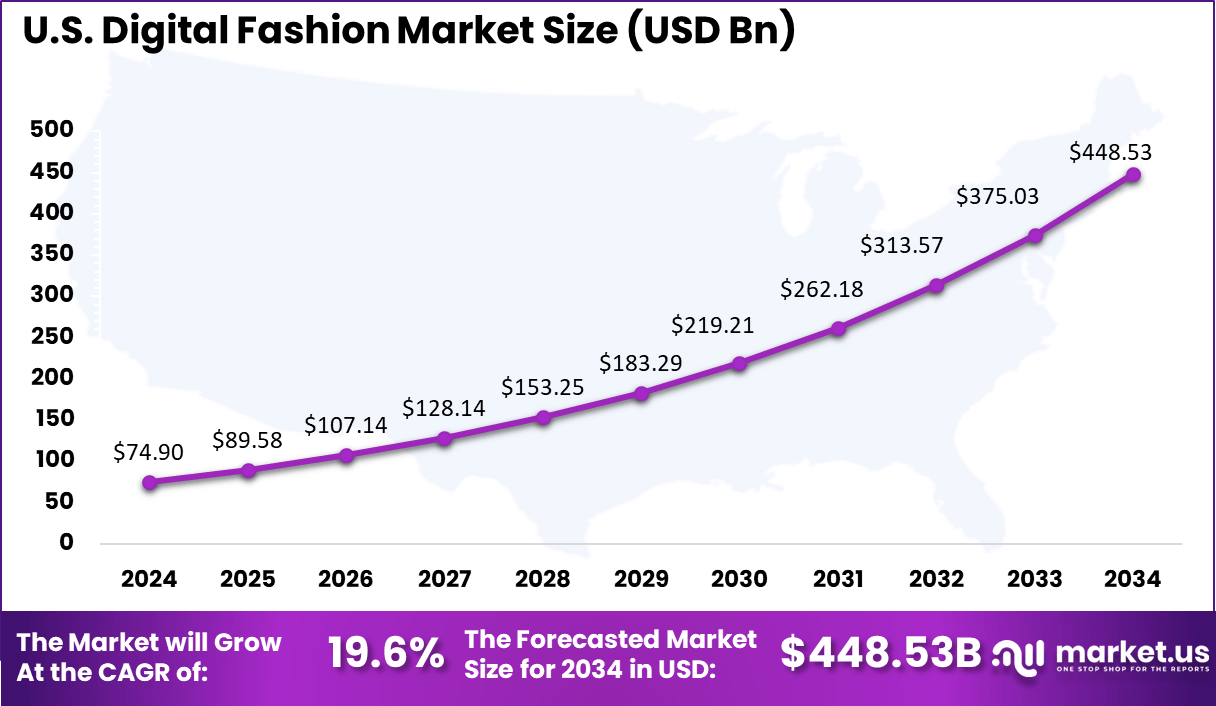

- The U.S. Digital Fashion Market Size was valued at US$ 74.9 billion in 2024, with a robust CAGR of 19.6%.

- In 2024, North America held a dominant market position in the Global Digital Fashion Market, capturing more than a 37.4% share.

U.S. Market Size

The US Digital Fashion Market is valued at approximately USD 74.90 Billion in 2024 and is predicted to increase from USD 89.58 Billion in 2025 to approximately USD 448.53 Billion by 2034, projected at a CAGR of 19.6% from 2025 to 2034.

The leadership of the United States in the digital fashion market can be attributed to several strategic factors. Firstly, the robust digital infrastructure and widespread adoption of cutting-edge technologies provide an optimal environment for digital fashion platforms and designers to innovate and scale.

The US is home to leading technology companies and a mature e-commerce ecosystem, which enhances the integration of advanced digital tools in fashion retail, such as virtual reality (VR) and augmented reality (AR), for immersive shopping experiences.

Secondly, the significant investment in digital innovation within the fashion industry in the US drives further growth. Venture capital firms and private investors are keen to support emerging digital fashion startups, recognizing the potential for substantial returns. This financial backing is crucial for research and development and for accelerating the adoption of new technologies.

In 2024, North America held a dominant market position in the global Digital Fashion Market, capturing more than a 34.7% share. The growth is driven in the region by the technology adoption rate and thus, the internet penetration rate. Adding to this is the advantage of a good bouquet of digital fashion technologies provided by various providers, and the ecosystem offers a hand of well-informed customers.

The increasing acceptance of online purchases, personalized and virtual experiences, and the apparent early adoption of technology applications such as virtual and augmented realities to create markets within the fashion domain have been other growth factors. Also, social media influences consumers and an increasing North American interest in virtual avatars and the metaverse, hence a stronger contribution to the growth and dominant position of the market.

For instance, in March 2025, The Japanese fashion label Beams is coming up with its e-commerce site catering to the North American consumer. This marks the formal entry of the brand into the North American market, with its original menswear and womenswear collections being showcased alongside select items from other brands.

Beams America, established in September 2024, is being handled online by a partnership with Pacific Fashion. The planned physical retail presence in the U.S. beyond the digital arena has been outlined by Beams, along with a pop-up store in Los Angeles that runs from March 7 through April 20, 2025.

Platform Analysis

In 2024, the Digital Fashion Platforms segment held a dominant market position, capturing more than a 52.6% share. This leadership can be attributed to several pivotal factors. Firstly, the increasing integration of augmented reality (AR) and virtual reality (VR) technologies has significantly enhanced the consumer experience on digital fashion platforms.

These technologies allow users to virtually try on outfits, fostering a more interactive and engaging shopping experience. This adaptation has not only improved customer satisfaction but also increased sales conversions, as consumers are more likely to purchase after visualizing how the clothes fit and look in a virtual environment.

Secondly, the rise of digital-only fashion items, which exist solely in the digital realm, has bolstered the growth of this segment. These items, often used in virtual worlds and online games, cater to the growing demand from a new generation of consumers who spend considerable time in digital landscapes. This trend has been further amplified by collaborations between digital fashion platforms and popular gaming platforms, where exclusive digital apparels are offered, creating a lucrative revenue stream.

Furthermore, the pandemic accelerated the shift towards online platforms, with digital fashion platforms benefiting immensely. Traditional shoppers turned online, and digital platforms that offered unique, customizable experiences saw significant growth. This shift is supported by a broader trend of digitalization in retail, where convenience and speed are prioritized by consumers.

Technology Analysis

In 2024, the Virtual Try-On segment held a dominant market position, capturing more than a 48.9% share. This prominence in the digital fashion market can largely be attributed to its ability to enhance customer engagement and satisfaction significantly.

Virtual Try-On technology allows consumers to see themselves wearing different outfits virtually before making a purchase decision. This not only minimizes the uncertainty associated with online shopping but also reduces return rates, a critical concern for retailers. By enabling a ‘try before you buy’ experience in a virtual setting, this technology addresses one of the fundamental drawbacks of online fashion retail.

Furthermore, the adoption of Virtual Try-On technology has been accelerated by advances in artificial intelligence and machine learning, which have improved the accuracy and realism of these virtual fittings. Consumers can now enjoy a highly personalized shopping experience from the comfort of their homes, which closely mimics the in-store experience.

This technology has proven particularly popular among millennials and Gen Z consumers, who value speed, convenience, and personalization in their shopping experiences. Additionally, as sustainability becomes a growing concern, Virtual Try-On technologies offer an eco-friendly alternative to traditional shopping methods. By reducing the need for physical samples and minimizing returns, these technologies help lower the carbon footprint associated with the fashion industry.

Application Segment Analysis

In 2024, the Online Fashion Design segment held a dominant market position, capturing more than a 42.6% share. This leadership is primarily driven by the increasing digitalization of the fashion industry, where designers are leveraging online platforms to innovate and streamline the design process.

Online fashion design tools have enabled designers to create, modify, and visualize clothing items quickly and efficiently, significantly reducing the time and costs associated with traditional design methods. These platforms offer robust functionality that includes fabric simulation, pattern creation, and 3D visualization, allowing for a more dynamic design process that can adapt quickly to changing fashion trends.

Moreover, the proliferation of online fashion design platforms has democratized the fashion design industry, making it accessible to a broader range of aspiring designers and small fashion labels. This accessibility has spurred innovation and diversity in fashion offerings, resonating well with consumers seeking unique and personalized clothing items.

The segment’s growth is further bolstered by educational institutions incorporating these tools into their curricula, preparing the next generation of fashion designers with essential digital skills. Additionally, the integration of cloud-based technologies in online fashion design platforms has facilitated collaboration among designers, suppliers, and retailers, enabling a more seamless production workflow.

End Users Segment Analysis

In 2024, the Consumers segment held a dominant market position, capturing more than a 35.8% share. This segment’s leadership can be attributed to the burgeoning interest in digital fashion among the general population, driven by the increasing influence of social media and the growing importance of digital identity.

As consumers spend more time in virtual spaces, including social platforms and augmented reality environments, digital fashion has become a crucial element for personal expression in these realms. This trend has been particularly pronounced among younger demographics who seek innovative ways to showcase their style and personality digitally.

Additionally, the adoption of digital fashion by consumers is facilitated by technological advancements in virtual and augmented reality. These technologies have made it possible for consumers to interact with fashion items in immersive environments, providing a new level of engagement that traditional online shopping experiences cannot offer.

As these technologies become more accessible, consumer participation in digital fashion is expected to increase, reinforcing the segment’s dominant position in the market. Moreover, the pandemic accelerated the shift towards digital engagements and transactions, further embedding digital fashion into consumer habits.

With environmental concerns also on the rise, many consumers turn to digital fashion as a sustainable alternative, avoiding the physical production processes that contribute to environmental degradation. This combination of technological, societal, and environmental factors ensures that the consumer segment remains at the forefront of the digital fashion market.

Revenue Model Analysis

In 2024, the Subscription-Based segment held a dominant market position, capturing more than a 45.7% share. This leading stance is primarily driven by the segment’s ability to offer consistent revenue streams and enhanced customer retention strategies for digital fashion platforms.

Subscription models appeal to a broad audience by providing exclusive access to the latest digital fashion collections, special features, and early releases, which are highly valued in the fast-paced fashion industry. This model ensures that consumers are continually engaged and incentivized to renew their subscriptions, thereby creating a predictable and stable revenue flow for businesses.

Moreover, subscription services are particularly attractive in the digital fashion industry due to their ability to cater to niche markets with specialized preferences. Consumers who subscribe are often seeking unique, customizable experiences that stand out from the conventional retail offerings. By fulfilling these specialized needs, digital fashion platforms can foster a loyal user base willing to pay a premium for distinctiveness and personalization.

The growth of the Subscription-Based segment is also supported by the integration of advanced technologies such as AI and machine learning, which help tailor recommendations and improve user experiences based on individual style preferences and behavioral data. As platforms continue to enhance their technological capabilities, the appeal of subscription services is expected to grow, maintaining its lead in the revenue models within the digital fashion market.

Key Market Segments

By Platform

- Digital Fashion Platforms

- E-commerce Platforms

- Social Media Platforms

By Technology

- Virtual Try-On

- Augmented Reality

- 3D Modeling

By Application

- Online Fashion Design

- Custom Clothing Creation

- Virtual Fashion Shows

By End User

- Consumers

- Fashion Designers

- Fashion Retailers

By Revenue Model

- Subscription-Based

- Transaction-Based

- Advertising-Based

Drivers

The Rise of Digital Fashion

The digital fashion industry is propelled by the convergence of technology and fashion, particularly through the increasing integration of virtual and augmented reality (VR and AR) into everyday consumer experiences. This shift is largely driven by the demands of a tech-savvy generation that seeks immersive and personalized online shopping experiences.

As brands strive to cater to these preferences, technologies like AR that enable virtual try-ons are revolutionizing e-commerce by reducing the uncertainty of online shopping and consequently, the rate of product returns. This innovation enhances customer satisfaction and loyalty by providing a more engaging and interactive shopping experience.

Restraint

Consumer Adoption and Production Challenges

Despite the promising prospects of digital fashion, its widespread adoption faces significant hurdles. One major restraint is the high production cost associated with advanced technologies needed for creating digital garments and the integration of AR and VR into retail platforms.

Additionally, consumer hesitance remains a barrier, as traditional shoppers may be slow to embrace wearing digital clothing in virtual environments. These factors require fashion brands to invest heavily in consumer education and to develop more cost-effective production techniques to lower entry barriers for average consumers.

Opportunities

Sustainability and Market Expansion

Digital fashion presents a substantial opportunity to address environmental concerns associated with the traditional fashion industry, which is known for its substantial waste and pollution levels. By shifting towards virtual garments, which require no physical materials, production, or shipping, brands can significantly reduce their carbon footprint.

Furthermore, the global reach of digital fashion, unrestricted by physical logistics, opens up new markets and demographic segments, including the gaming community and users of virtual platforms like the Metaverse, thereby broadening the consumer base.

Challenges

Technological Integration and Consumer Trust

Integrating sophisticated technologies such as blockchain for authenticity verification and smart contracts for ethical practices poses a challenge due to the complexity and nascent nature of these technologies. Additionally, gaining consumer trust in digital-only garments and ensuring their perceived value matches that of physical products is challenging.

Brands must navigate these technical and perceptual obstacles by fostering transparency, enhancing consumer interaction with digital products, and continuously innovating to improve the user experience in digital spaces.

Growth Factors

The digital fashion market is experiencing rapid growth driven by several key factors. One of the primary catalysts is the integration of augmented reality (AR) and virtual reality (VR) technologies, which enhance the online shopping experience by allowing consumers to try on clothes virtually before making a purchase.

These technologies help bridge the gap between digital and physical fashion, making online shopping more interactive and engaging. Furthermore, the rise of social media and its use as a platform for fashion brands to engage with a larger audience has significantly contributed to the growth of the digital fashion sector. Brands are leveraging platforms like Instagram, Facebook, and TikTok to showcase their digital fashion collections, driving visibility and consumer interest.

Emerging Trends

Several emerging trends are shaping the future of digital fashion. Virtual fashion shows have gained popularity, providing a platform for designers to showcase their collections to a global audience without the constraints of physical events.

This approach not only reduces the carbon footprint associated with traditional fashion shows but also allows for greater creativity and innovation in presenting collections. Moreover, the customization of digital avatars and the personalization of digital apparel have become prominent, particularly among Gen Z consumers who value uniqueness and personal expression in their digital presence.

Business Benefits

Digital fashion offers numerous business benefits, including cost reduction and market expansion. By moving towards digital collections, brands can significantly cut down on production and logistics costs associated with physical garments. This shift not only leads to a more sustainable business model by reducing waste but also allows brands to experiment more freely with designs and styles without the financial risk of unsold inventory.

Additionally, digital fashion opens up new revenue streams through virtual goods and NFTs, catering to a market of tech-savvy consumers who spend considerable time in digital environments and are looking for new ways to express their identities online.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The digital fashion market is experiencing rapid growth, driven by technological advancements and changing consumer preferences. Key players in this market are at the forefront of innovation, blending fashion with digital technology to create new experiences for consumers.

One of the market leaders, Alibaba Group, in December 2024, invested over US$70 million (or 100 billion won) in Ably Corp., a leading online fashion platform in South Korea. This investment is the very first for Alibaba in a Korean e-commerce platform and gives it a stake of 5% in Ably.

Nike, Inc. has been a pioneer in digital fashion, notably through its acquisition of RTFKT Studios. This move has allowed Nike to expand its presence in virtual sneakers and NFTs, appealing to a younger, tech-savvy audience.

Adidas AG has ventured into the metaverse by launching virtual wearables and NFTs, partnering with platforms such as Decentraland and The Sandbox. These initiatives demonstrate Adidas’s strategy to engage with consumers in immersive digital environments.

Top Key Players in the Market

- Shopify

- Klarna

- Stripe

- NCR Corporation

- PayPal

- Snap Inc.

- Global Payments

- Tencent

- Meta Platforms

- Amazon.com

- Alibaba Group

- Adyen

- Worldpay

- ByteDance

- Square

- Others

Recent Developments

- In February 2025, Stripe completed the acquisition of Bridge, expanding its financial infrastructure capabilities. Stripe announced that businesses processed more than $31 billion from Black Friday through Cyber Monday in December 2024, demonstrating the platform’s substantial handling of payment volumes during peak shopping times.

- In March 2024, Marubeni Corporation announced its participation in “WEAR GO LAND,” a project to experiment with a digital fashion mall in the metaverse. This initiative is being undertaken in collaboration with Mitsui Fudosan Co., Ltd. and V-stay Co., Ltd., to test the viability of virtual spaces in the field of fashion retail.

Report Scope

Report Features Description Market Value (2024) USD 250.6 Bn Forecast Revenue (2034) USD 1,714.0 Bn CAGR (2025-2034) 21.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Digital Fashion Platforms, E-commerce Platforms, Social Media Platforms), By Technology (Virtual Try-On, Augmented Reality, 3D Modeling), By Application (Online Fashion Design, Custom Clothing Creation, Virtual Fashion Shows), By End User (Consumers, Fashion Designers, Fashion Retailers), By Revenue Model (Subscription-Based, Transaction-Based, Advertising-Based) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Shopify, Klarna, Stripe, NCR Corporation, PayPal, Snap Inc., Global Payments, Tencent, Meta Platforms, Amazon.com, Alibaba Group, Adyen, Worldpay, ByteDance, Square, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Shopify

- Klarna

- Stripe

- NCR Corporation

- PayPal

- Snap Inc.

- Global Payments

- Tencent

- Meta Platforms

- Amazon.com

- Alibaba Group

- Adyen

- Worldpay

- ByteDance

- Square

- Others