Global Digital Business Card Market Size, Share, Industry Analysis Report By Platform (Android, iOS, Windows), By User Type (Business User, Enterprise User, Individual User), By Vertical (IT and Telecommunication, Marketing Agencies, BFSI, Sales Entrepreneurs, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct. 2025

- Report ID: 160113

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Digital Business Card Statistics

- User Priorities

- Analysts’ Viewpoints

- Role of generative AI

- Investment and Business Benefits

- Effectiveness Statistics

- Cost and Environmental Impact

- Platform and Industry Trends

- US Market Size

- By Platform

- By User Type

- By Vertical

- Key Market Segment

- Emerging Trends

- Growth Factors

- Drivers

- Restraints

- Market Opportunities

- Challenges

- SWOT Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

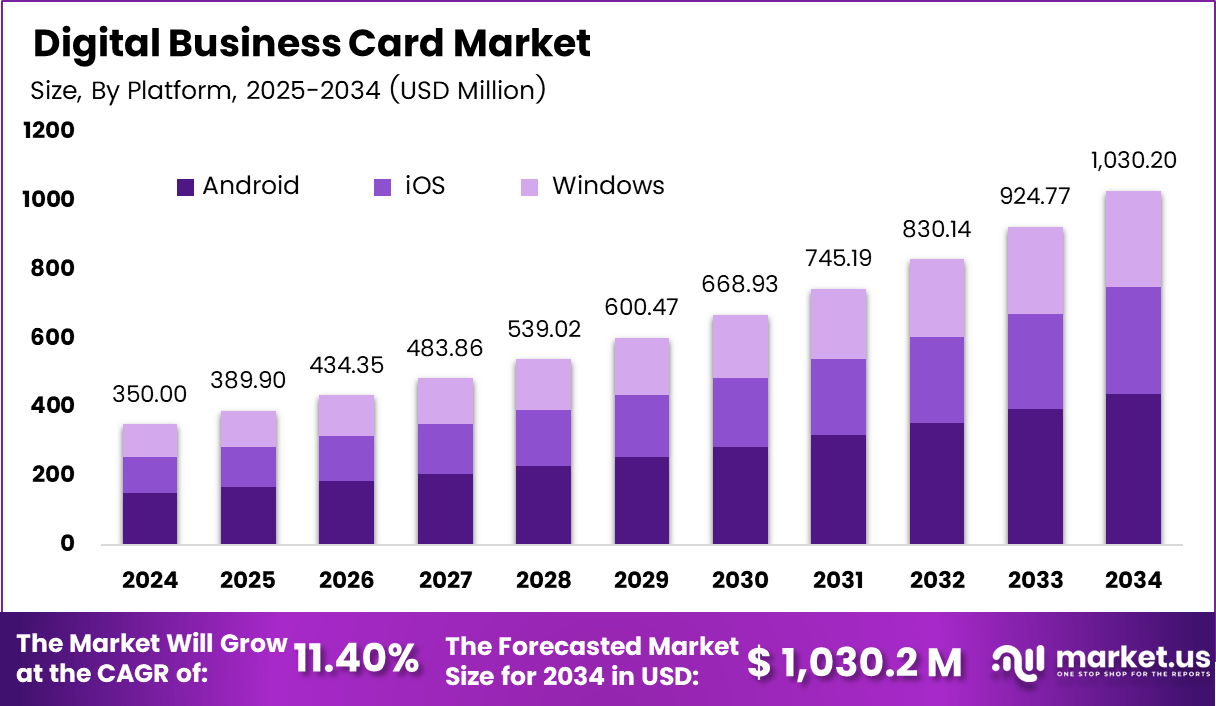

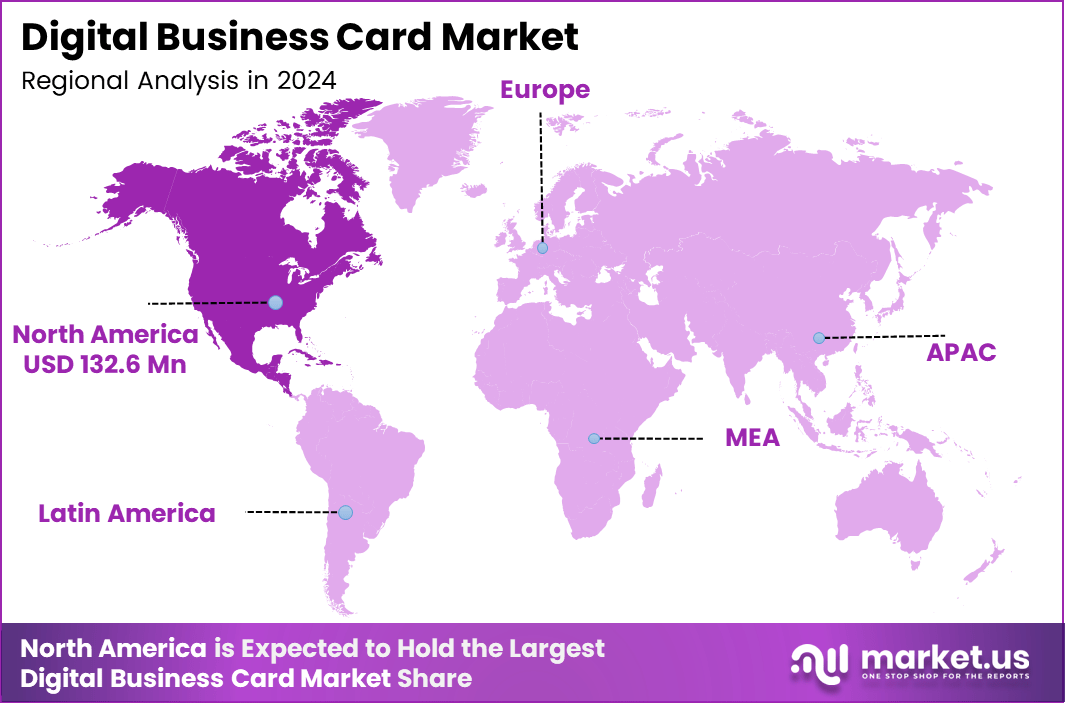

The Digital Business Card Market size is expected to be worth around USD 1,030.2 Million by 2034, from USD 350.0 Million in 2024, growing at a CAGR of 11.40% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.9% share, with revenue of USD 132.6 million.

The Digital Business Card Market includes platforms, software, and services that allow individuals and organizations to create, share, and manage contact information electronically instead of using physical paper cards. These digital cards often support features such as clickable links, social profiles, vCard export, NFC or QR code sharing, analytics, branding, and integration with CRM or networking apps. They are used in sales, networking, marketing, events, recruiting, and professional branding.

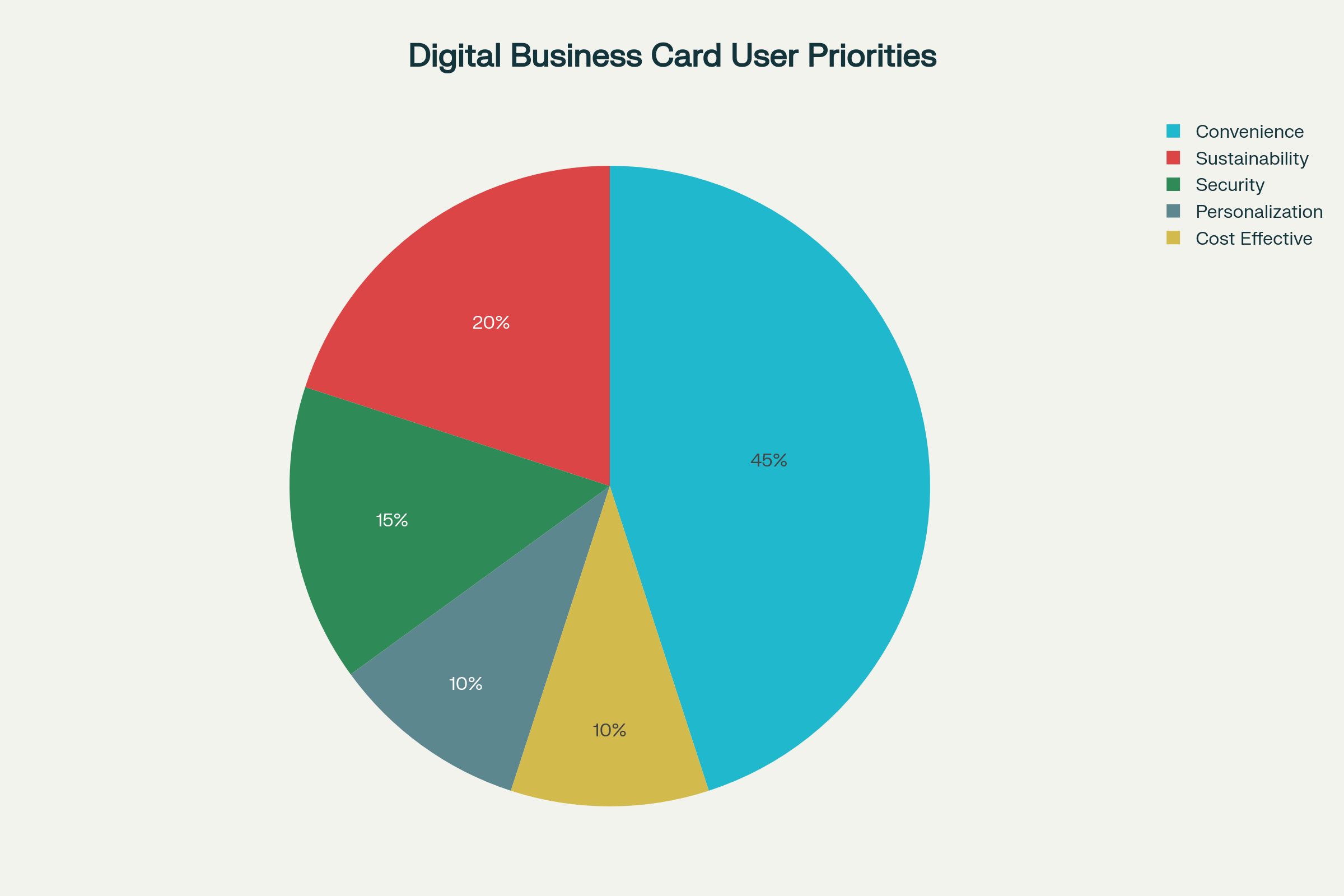

Top driving factors behind the digital business card market include the global shift toward sustainability, with around 88% of traditional paper cards discarded within a week, causing environmental waste. The convenience of instant, contactless information sharing appeals to 45% of users who value ease of contact management. Security features, such as multi-factor authentication, are important to 15% of users, while personalization and cost-effectiveness drive another 20%.

The COVID-19 pandemic sharply reduced paper card printing by over 70% as demand for hygienic, digital solutions surged, emphasizing remote and virtual networking needs. Integration with CRM, AI-powered analytics, and interactive multimedia features further enhance user experience and productivity, boosting adoption across industries embracing digital-first strategies.

Key Takeaways

- Android platform dominates with 58.4%, driven by its widespread global smartphone penetration.

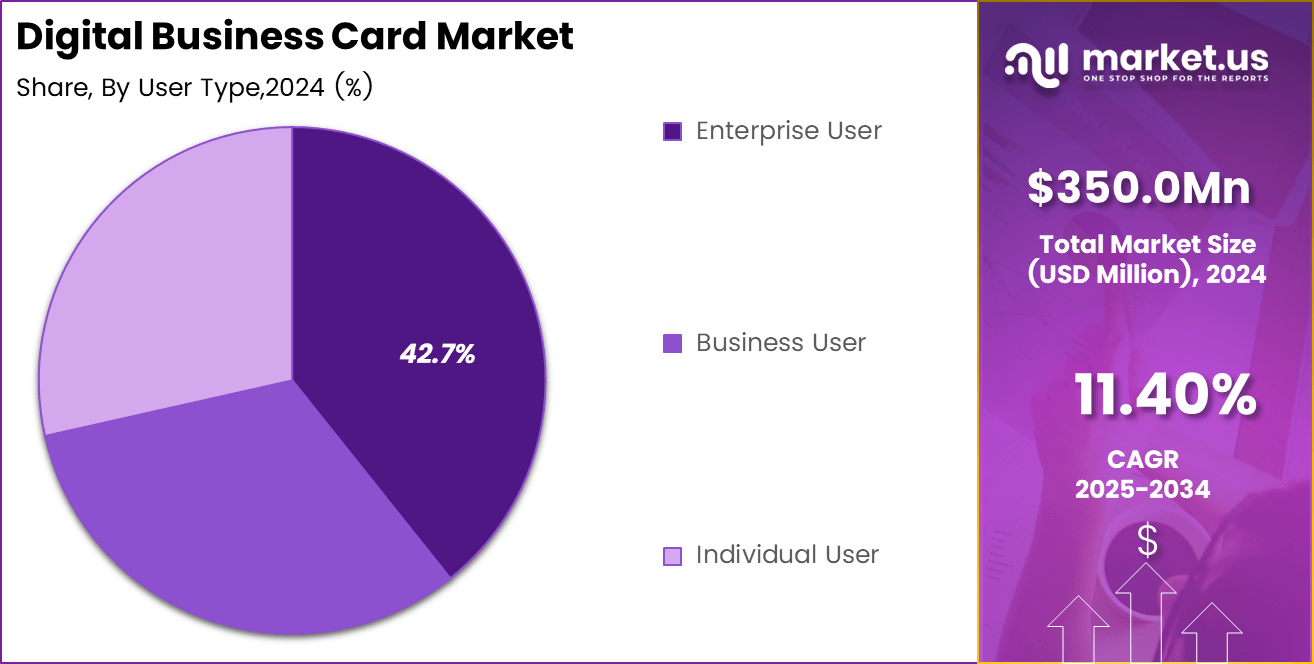

- Enterprise users account for 42.7%, as organizations adopt digital cards for networking and brand visibility.

- IT & Telecommunication vertical leads with 34.6%, reflecting its focus on digital-first engagement and tech adoption.

- North America holds 37.9%, supported by high digital adoption in professional networking.

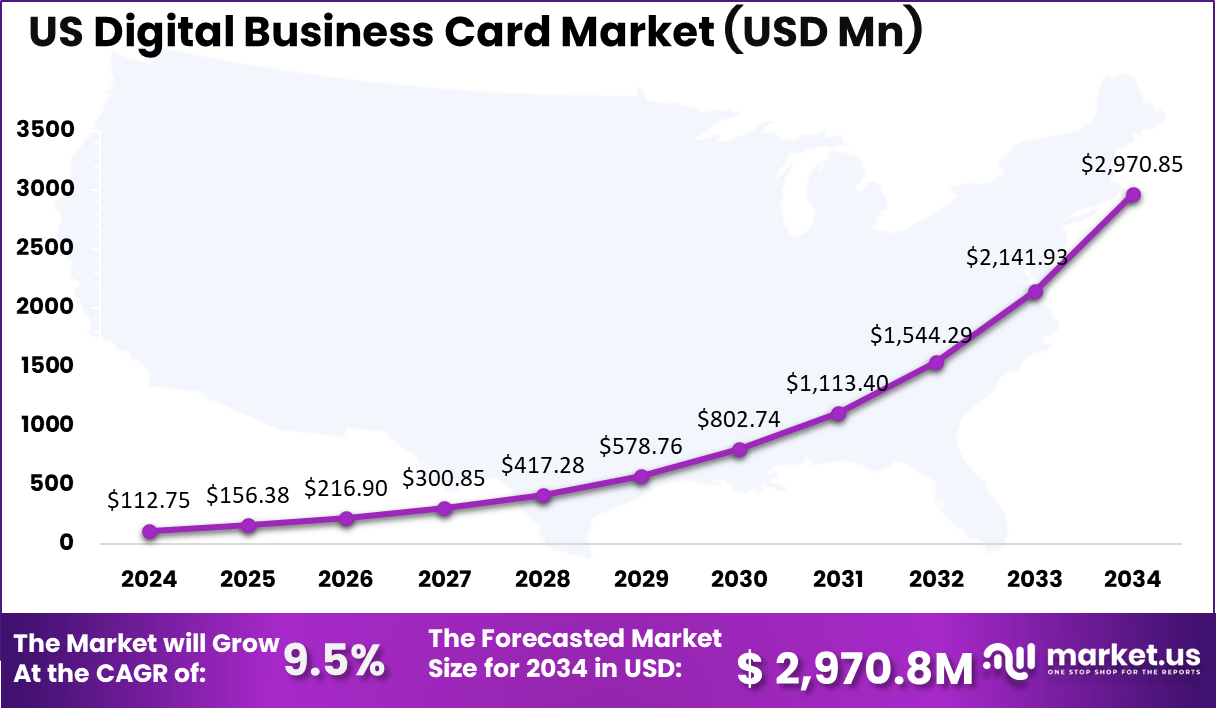

- The US market reached USD 112.75 million and is expanding at a steady CAGR of 9.5%, underscoring consistent enterprise and professional usage.

Digital Business Card Statistics

- User and Business Adoption

- 42% increase in adoption after COVID-19 due to demand for contactless and virtual solutions.

- 82% of remote workers say digital cards make networking easier in virtual settings.

- Engagement and Retention

- Recipients are 55% more likely to retain contact information from digital cards than traditional ones.

- Cards with QR codes achieve a 19% higher engagement rate.

- NFC-enabled cards deliver a 50% higher retention rate than QR code-based cards due to ease of use.

- Efficiency and Cost Savings

- Businesses spend 45% less time on contact management with digital cards.

- Automated data capture helps generate 16% more leads.

- Faster follow-ups enable a 14% increase in conversions.

- 68% of small businesses report cost savings on printing after switching to digital cards.

User Priorities

According to wavecnct, Around 45% of users adopt digital business cards for convenience, valuing easy sharing and device integration without physical exchanges. About 20% are driven by sustainability, since going digital reduces paper waste. Nearly 15% prioritize security, using controlled sharing to protect personal details. Personalization appeals to 10%, as interactive features help improve professional image. Another 10% choose digital cards for cost-effectiveness, avoiding ongoing printing and distribution expenses.

Analysts’ Viewpoints

Demand analysis reveals that digital business cards appeal mainly to enterprises, startups, and professionals who require efficient and customizable networking tools. NFC and QR code-based sharing methods, combined with seamless mobile app interfaces, are increasingly preferred over physical cards. These technologies allow users to update contact information in real-time and embed interactive portfolios, videos, or documents, which traditional cards cannot offer.

The prevalence of smartphones with about 70% market share held by Android devices highlights the need for platform-focused digital card solutions. In India alone, 46.5% of the population owns smartphones, contributing to the rapid adoption of digital cards as part of digital transformation efforts in professional networking. Key reasons for adopting digital business cards include environmental sustainability, convenience, and enhanced networking capabilities.

Digital cards reduce paper waste and resource consumption, appealing to 88% of professionals aware of eco-friendly alternatives. The ability to instantly share, update, and manage contact information enhances productivity for 45% of users prioritizing convenience. Professionals benefit from advanced features such as CRM integration, AI analytics for lead management, and multimedia attachments, which enrich networking experiences and improve brand presence.

Role of generative AI

The role of generative AI in digital business cards is transforming how professionals manage and share their information. AI enables real-time updates of contact details, syncing data automatically from sources like LinkedIn and email, ensuring that cards are always current without the need for reprinting.

In fact, AI-driven digital cards can increase lead conversion rates by over 500% by personalizing interactions and optimizing follow-ups, making networking more efficient than ever before. These AI features include dynamic content that adapts to the recipient’s interests and context-based suggestions on when and how to share cards, significantly enhancing engagement and connection quality.

Investment and Business Benefits

Investment opportunities in the digital business card market are abundant due to growing interest from enterprises looking to digitize networking and branding efforts. Companies focusing on NFC, QR code technologies, and app-based services stand to benefit from expanding smartphone penetration and sustainable business policies.

Innovation in AI-driven customization, augmented reality features, and real-time analytics presents new avenues for differentiation and market expansion. Governments’ push for digital identity solutions and paperless transactions also creates a favorable environment for investment in this sector. Despite high initial costs and some lack of awareness in developing regions, the overall investment landscape remains promising with strong growth trajectories.

Business benefits of adopting digital business cards include cost savings, improved networking efficiency, enhanced brand image, and better data management. Digital cards eliminate recurring printing costs and reduce reliance on physical materials. They enable instant contact exchange and updates, decreasing errors from outdated information.

Integrations with CRM systems and AI tools allow businesses to track engagement and nurture leads more efficiently. Additionally, digital cards support sustainability goals, enhancing corporate social responsibility profiles among environmentally conscious clients and partners. These advantages make digital cards an increasingly attractive solution for companies of all sizes aiming to modernize their communication strategies.

Effectiveness Statistics

- Improved engagement: Digital cards with QR codes see a 19–20% higher engagement rate.

- Conversion rates: Faster follow-ups and automated lead capture drive a 14–27% increase in conversions.

- Enhanced follow-up: Contacts are 35% more likely to respond when using digital cards.

- Higher retention: Recipients are 55% more likely to retain information from digital cards versus paper ones.

- Interactive features: Built-in analytics confirm that interactive elements significantly improve engagement.

- Customization options: Preferred by 17.9% of users.

- Digital card URL: Preferred by 17.7% of users.

- Contact forms: Preferred by 14.7% of users for easy data collection.

Cost and Environmental Impact

- Paper waste: About 88% of paper business cards are discarded within a week.

- Environmental toll: Traditional card production consumes millions of trees, along with high levels of water and energy.

- Cost savings: Businesses report up to a 90% reduction in printing costs after switching to digital cards.

- Sustainability image: Digital cards strengthen brand reputation with environmentally conscious customers.

Platform and Industry Trends

- Android dominance: Android-based digital cards held a 44.5% revenue share in 2024.

- Regional leadership: North America accounted for 46.2% of the global market in 2022.

- Industry usage: The IT and software sector represented nearly 40% of market value in 2023.

- Real estate adoption: 63% of real estate firms increased digital marketing budgets in 2023, supporting wider digital card use.

- NFC growth: NFC-enabled digital cards are expanding rapidly, with a 12.51% CAGR projected between 2023 and 2030.

US Market Size

The US Digital Business Card Market is set to experience significant growth over the coming decade. In 2024, the market size is valued at USD 112.75 million, reflecting a solid foundation for Digital Business Card Market adoption. By 2034, this market is projected to expand substantially to USD 2,970.85 million, driven by increasing digitalization and demand for innovative networking tools.

The Digital Business Card Market is expected to grow at a CAGR of 9.5%, indicating a steady and robust increase. This growth is supported by advancements in technology and a shift toward eco-friendly, efficient business practices, making digital business cards a popular choice across various industries.

North America represents 37.9% of the market, reflecting the region’s strong culture of early technology adoption and digital networking practices. Companies and professionals in the region are quick to move away from traditional paper-based modes, preferring modern solutions that provide convenience and sustainability benefits.

The widespread availability of digital platforms, along with strong usage of smartphones for professional networking, has fueled growth in this region. Enterprises, startups, and freelancers alike are leveraging digital cards to improve visibility and engagement in corporate and professional settings.

By Platform

In 2024, Android holds the largest share with 58.4% in the digital business card market. The wide adoption of Android devices across both developed and emerging markets is a major factor for its dominance. Android platforms offer flexibility and cost-effectiveness, which makes them suitable for a broad user base, from small businesses to enterprise-level organizations.

Another key driver for Android’s lead is its compatibility with a wide range of applications and integration features. Business card apps on Android often provide more customization and smooth syncing with cloud storage, CRM systems, and contact management tools. This combination of accessibility and versatility keeps Android at the forefront of digital business card adoption.

By User Type

In 2024, Enterprise users make up 42.7% of the market. Larger organizations prefer digital business cards as they streamline networking across global teams, reduce the cost of printing physical cards, and align with sustainability initiatives. For enterprises, digital business cards also allow easier updates, ensuring employees always have the most current company and personal details available when networking.

Enterprises increasingly use these solutions as a part of their broader digital engagement strategy. Integration with CRM platforms, marketing tools, and analytics systems makes digital business cards more than a replacement for paper cards. They serve as a data-rich networking tool that supports customer relationship management and enhances brand identity.

By Vertical

In 2024, The IT and telecommunication sector accounts for 34.6% of the market. Fast-paced digital adoption in this vertical creates a natural demand for digital networking solutions. IT professionals and telecom executives often work across distributed teams and global partners, where quick and efficient exchange of information is crucial.

Digital business cards also align with the tech-driven culture of this sector. They integrate seamlessly into other digital platforms, supporting fast communication, contact management, and data sharing. This makes them particularly valuable for IT and telecom professionals who prioritize efficiency and connectivity.

Key Market Segment

By Platform

- Android

- iOS

- Windows

By User Type

- Business User

- Enterprise User

- Individual User

By Vertical

- IT and Telecommunication

- Marketing Agencies

- BFSI

- Sales Entrepreneurs

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Emerging Trends

Emerging trends in digital business cards include augmented reality (AR) integration, voice-enabled cards, and blockchain verification for credential security. These innovations are anticipated to reshape professional networking by adding immersive and trustworthy elements to digital interactions.

Statistics show that digital cards now convert contacts at a 300% higher rate than traditional paper cards, underscoring their growing popularity. A big trend is also the merging of digital business cards with CRM systems, enabling instant lead capture and streamlined customer management.

Growth Factors

Growth factors driving the digital business card market largely revolve around convenience, sustainability, and security. About 45% of users cite ease of sharing and saving contact information as the main reason for adoption, while 20% are motivated by eco-friendly benefits, as 88% of paper cards end up discarded within a week.

The pandemic accelerated demand for contactless networking solutions, resulting in a steep decline – over 70% – in paper card printing, while digital card usage surged. Increasing digital networking strategies in businesses further fuel market growth, with nearly 93% of organizations now prioritizing digital-first approaches.

Drivers

Increasing Demand for Eco-Friendly and Efficient Networking

The growth of digital business cards is mainly fueled by the rising need for contactless and environmentally friendly networking tools. As more people and companies adopt mobile technology, they look for ways to share contacts quickly and securely without using paper cards. This trend is supported by the advantages of digital cards, like instant sharing, easy updating, and the incorporation of features such as QR codes and augmented reality.

The market is also driven by the environmental benefits, as digital cards reduce paper waste and promote sustainability, aligning with global efforts for greener practices. With smartphone use expanding rapidly, especially in regions like APAC, the demand for digital business cards continues to grow significantly.

The convenience and cost-effectiveness of digital cards make them particularly attractive for small businesses and individual users. They save money and time by eliminating the costs related to printing and distribution of physical cards. As the digital ecosystem evolves, more industries see value in adopting such solutions to improve their networking strategies and project a modern, innovative image. Consequently, these factors are creating a strong foundation for ongoing market expansion.

Restraints

Data Privacy and Cost Barriers

One of the main restraints facing the digital business card market is data privacy concerns. As digital cards hold sensitive personal and professional information, users worry about the risk of data breaches and unauthorized access, which can deter adoption. Despite technological progress, many users remain hesitant to share their contact details digitally due to fears of hacking or misuse of data.

Privacy concerns, therefore, continue to act as a significant barrier to widespread acceptance, especially among corporate clients handling confidential information. Another restraint is the high initial investment required for NFC-enabled or augmented reality digital cards. Smaller businesses and startups often find these upfront costs unaffordable, which limits their willingness to transition from traditional cards.

Additionally, lack of awareness about the benefits of digital cards, especially in less developed regions, hampers market growth. Overcoming these barriers will require increasing consumer education and reducing technological costs. Without addressing these issues, the market may struggle to achieve its full potential.

Market Opportunities

Growth in Emerging Markets and Technological Innovations

Opportunities for the digital business card market are abundant, particularly in emerging economies and through technological advancements. As smartphone penetration increases in countries like India and China, the potential user base for digital cards expands rapidly.

The integration of technologies like NFC, QR codes, and augmented reality provides new ways to enhance user engagement and personalize digital cards. These innovations can make digital cards more interactive and appealing, leading to higher adoption rates in various sectors such as hospitality, real estate, and finance.

Furthermore, large-scale corporate and enterprise use presents substantial growth opportunities. Many big organizations are seeking digital solutions for contact management and branding, which boosts demand. Subscription models offering premium features and customization can attract a broader audience, encouraging ongoing revenue streams for providers.

Challenges

Security and Compatibility Issues

The primary challenge is ensuring the security and privacy of users’ data. With digital contact sharing, there is a real risk of cyber threats or hacking attacks that could compromise sensitive information. Data security remains a key concern for both individual users and organizations that need to protect confidential data.

Companies must implement robust security measures to alleviate these fears, but this adds complexity and cost to the deployment process. Another challenge is the lack of universal compatibility across different devices and platforms. Current technologies like NFC and QR codes face interoperability issues that can hinder smooth data exchange.

If users encounter difficulties in sharing or receiving digital cards, they may revert to traditional methods. Overcoming these technical and security challenges will be crucial for expanding the market and making digital business cards a primary networking tool in the digital age.

SWOT Analysis

Strengths

- Skilled workforce fosters innovation and efficiency

- A strong brand builds customer trust and loyalty

- Robust financial performance enables strategic investments

- Advanced technology streamlines operations, reducing costs

- Collaborative culture enhances teamwork and adaptability

- Established market presence provides a competitive edge

Weaknesses

- Inadequate technology infrastructure slows operations and innovation

- High employee turnover disrupts continuity and increases costs

- Limited marketing budgets hinder brand visibility

- Weak supply chain management risks delays and inefficiencies

- Lack of diversified revenue streams creates financial vulnerability

- Poor interdepartmental communication leads to misalignment

Opportunities

- Expanding into emerging markets taps new customer segments

- Leveraging AI and automation enhances product offerings and efficiency

- Strategic alliances boost resources and reach

- Growing demand for sustainability opens eco-friendly initiatives

- Favorable trade policies or subsidies support expansion

- Proactive pursuit of opportunities drives innovation and revenue

Threats

- Economic downturns reduce consumer spending, impacting revenue

- Aggressive competitors challenge market share with innovative offerings

- Evolving regulations demand costly compliance measures

- Supply chain disruptions increase costs and delays

- Cybersecurity breaches threaten data security and customer trust

- Rapid technological changes risk obsolescence without adaptation

Key Players Analysis

The Digital Business Card Market is driven by leading solution providers such as Blinq Technologies Pty Ltd., HiHello Inc., and Haystack. These companies offer customizable, app-based business card platforms that support NFC sharing, QR codes, and CRM integration. Their tools help professionals and enterprises replace traditional paper cards with contactless, trackable, and sustainable alternatives.

Emerging innovators like Mobilo, Popl, Itzme, and Spreadly GmbH focus on seamless digital identity exchange through mobile apps, smart cards, and wearable tech. Their platforms include features such as analytics, lead capture, branding options, and digital networking tools for corporate users, freelancers, and sales teams. These players are expanding into events, trade shows, and remote work environments.

Companies such as Tapt, Uniqode Phygital Inc. (Beaconstac), and Virtual Business Card provide niche and enterprise-ready solutions, with support for team management, API integration, and digital onboarding. They also enable secure information sharing across industries like real estate, consulting, education, and healthcare.

Top Key Players

- Blinq Technologies

- Haystack

- HiHello Inc.

- Itzmeś

- Mobilo

- Popl

- Spreadly GmbH

- Tapt

- Uniqode Phygital Inc. (Beaconstac)

- Virtual Business Card

- Others

Recent Development

- May 2025: Blinq Technologies announced a significant $25 million Series A funding round led by Touring Capital with participation from investors including HubSpot Ventures. The Melbourne-based platform now supports over 2.5 million users across 500,000 companies globally and is on track to surpass 50 million card shares in 2025.

- June 2025: HiHello Inc. secured $7.5 million in a Series A financing round led by Foundry Group with participation from Lux Capital and other prominent investors. HiHello emphasized building its modern digital business card platform for both individuals and businesses.

- July 2025: Haystack released Haystack Enterprise, a new offering aimed at helping organizations build, scale, and securely deploy production-grade AI applications. While not a digital business card provider per se, Haystack’s moves demonstrate growing AI integration that could influence future networking and business card solutions by enabling smarter connection and data management.

Report Scope

Report Features Description Market Value (2024) USD 350.0 Mn Forecast Revenue (2034) USD 1,030.2 Mn CAGR(2025-2034) 11.40%. Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Platform (Android, iOS, Windows), By User Type (Business User, Enterprise User, Individual User), By Vertical (IT and Telecommunication, Marketing Agencies, BFSI, Sales Entrepreneurs, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Blinq Technologies Pty Ltd., Haystack, HiHello Inc., Itzme, Mobilo, Popl, Spreadly GmbH, Tapt, Uniqode Phygital Inc. (Beaconstac), Virtual Business Card, and Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Digital Business Card MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Business Card MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Blinq Technologies Pty Ltd.

- Haystack

- HiHello Inc.

- Itzme

- Mobilo

- Popl

- Spreadly GmbH

- Tapt

- Uniqode Phygital Inc. (Beaconstac)

- Virtual Business Card

- Others