Global Chip Antenna Market by Type (LTCC Chip, Dielectric Chip Antenna), by Application (WLAN/Wi-Fi, Bluetooth, Dual Band/Multi Band, GPS/GNSS), by End User (Consumer Electronics, Automotive, Healthcare, Telecommunication, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 128558

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways:

- Type Segment Analysis

- Application Segment Analysis

- End User Segment Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

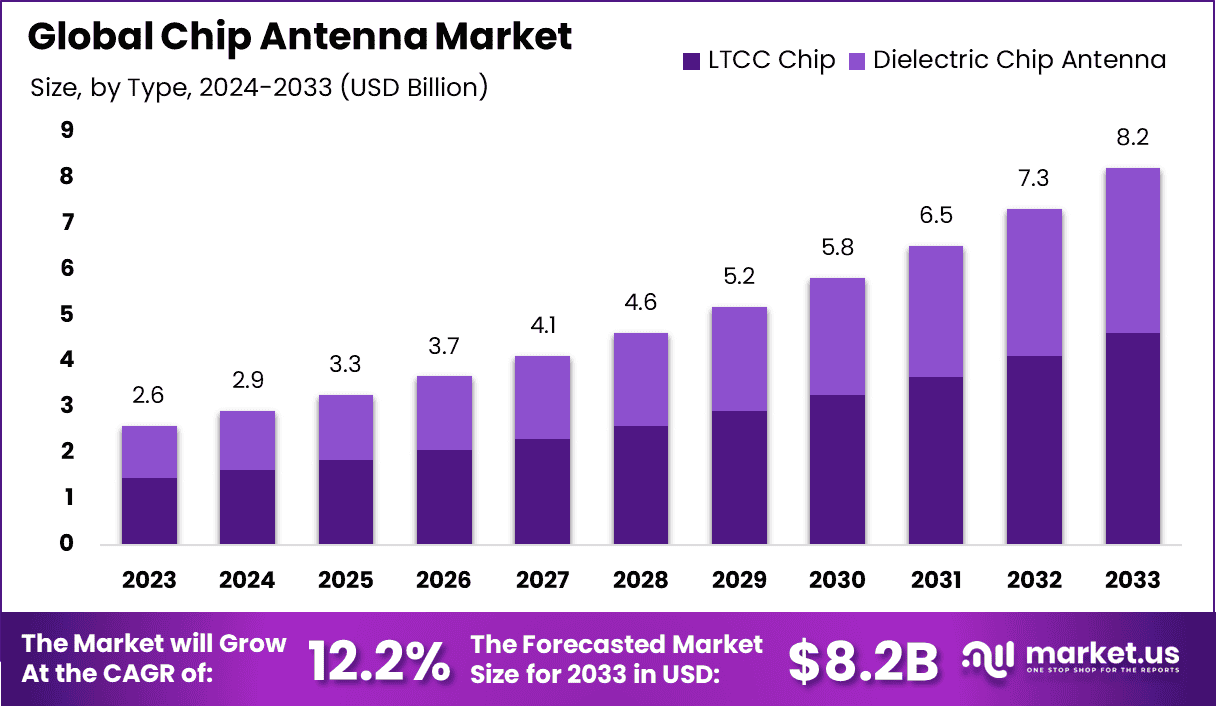

The global chip antenna market size is expected to be worth around USD 8.22 billion by 2033, from USD 2.6 billion in 2023, growing at a CAGR of 12.2% during the forecast period from 2024 to 2033.

The chip antenna market is experiencing significant growth, driven by the increasing adoption of wireless communication technologies in various sectors. The increase in Internet of Things applications, smart devices, and consumer electronics is propelling demand for compact and efficient chip antennas.

The miniaturization trend in electronics, coupled with advancements in material and design, is enhancing the performance and integration of chip antennas. Emerging applications in automotive, further fuel market expansion.

However, challenges such as high manufacturing costs and technical limitations in antenna design pose hurdles. The competitive landscape is marked by continuous innovation, with key players investing in R&D to offer advanced solutions.

One of the key factors contributing to this growth is the rising trend of miniaturization in consumer electronics and wireless devices. By 2025, nearly 60% of IoT devices are expected to use chip antennas, as they offer a smaller form factor compared to traditional antennas, making them ideal for space-constrained applications. This trend is also evident in the automotive sector, where chip antennas are being increasingly integrated into advanced driver-assistance systems (ADAS) and in-vehicle communication systems.

The telecommunications sector is another major driver of the chip antenna market. The rollout of 5G networks requires compact, high-performance antennas to support faster data speeds and low latency. By 2026, the demand for chip antennas in 5G devices is expected to account for over 35% of the market, as telecom companies expand their infrastructure and more consumers upgrade to 5G-enabled devices.

Despite the growing demand, the market faces challenges such as the complexity of designing chip antennas for high-frequency applications. However, advancements in materials and manufacturing techniques are helping to overcome these hurdles. In 2024, investments in R&D for advanced antenna materials are projected to reach $150 million globally, as companies seek to improve antenna efficiency, bandwidth, and signal strength in smaller packages.

Key Takeaways:

- The global chip antenna market size is expected to be worth around USD 8.22 Billion by 2033, from USD 2.6 Billion in 2023, growing at a CAGR of 2% during the forecast period from 2024 to 2033.

- In 2023, the LTCC Chip segment held a dominant market position, capturing more than a 56.2% share of the chip antenna market.

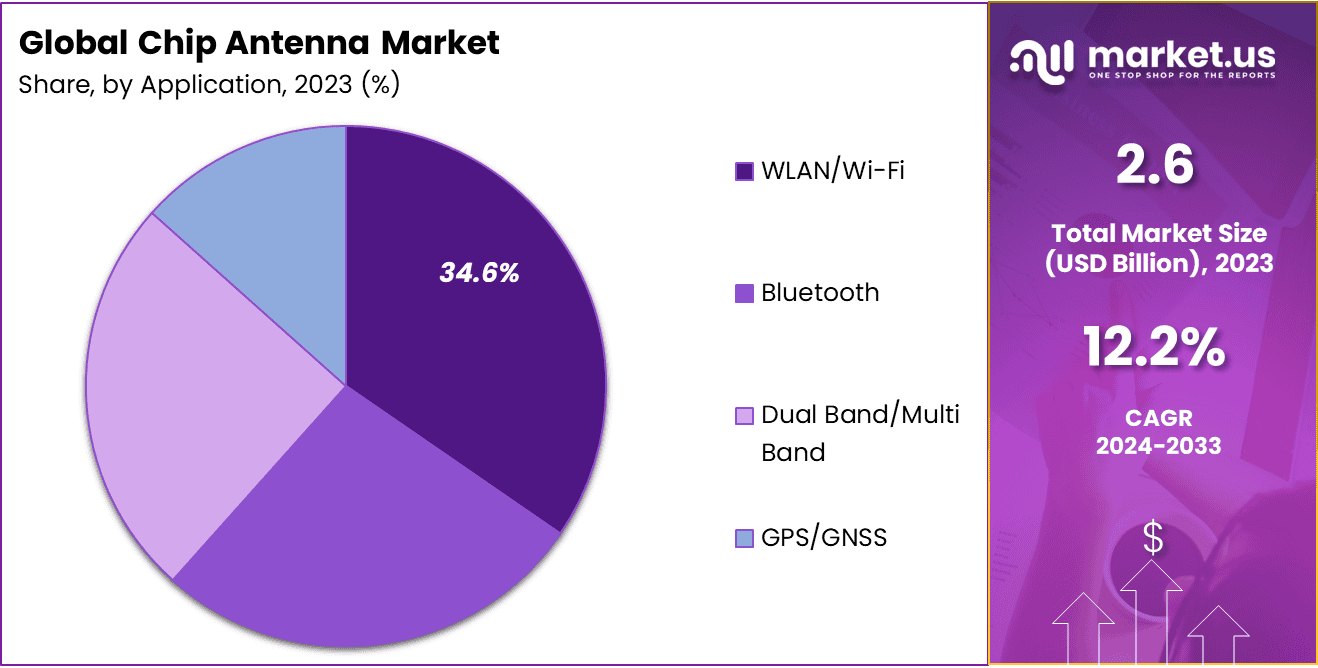

- In 2023, the WLAN/Wi-Fi segment held a dominant market position, capturing more than a 34.6% share of the chip antenna market.

- In 2023, the telecommunication segment held a dominant market position, capturing more than a 27.8% share of the chip antenna market.

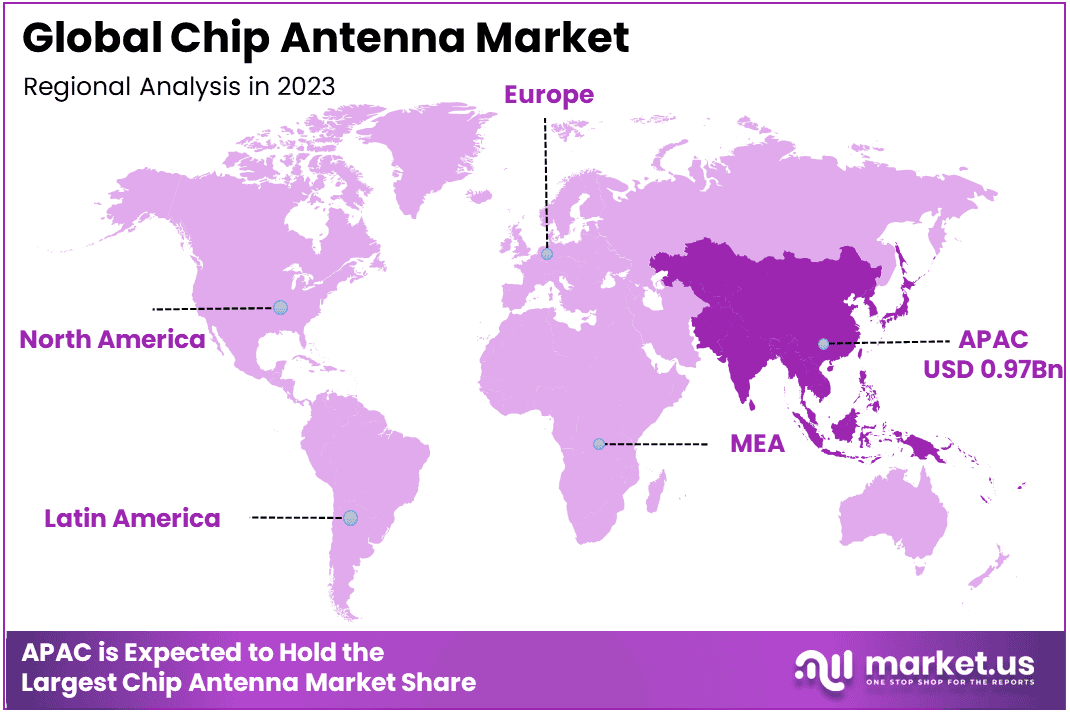

- In 2023, the Asia Pacific region held a dominant market position in the chip antenna market, capturing more than a 37.5% share.

Type Segment Analysis

In 2023, the LTCC Chip segment held a dominant market position, capturing more than a 56.2% share of the Chip Antenna Market. The LTCC (Low Co-Fired Ceramic) chip segment dominates the chip antenna market due to several key advantages. LTTC materials enable the production of highly reliable and compact antennas with superior performance characteristics, such as enhanced frequency stability and reduced signal loss.

The co-fired ceramic process allows for the integration of multiple layers and components, facilitating the creation of complex and high-frequency antennas within a small footprint. LTCC’s high thermal stability and resistance to environmental factors also contribute to its widespread adoption in demanding applications, such as automotive and telecommunications.

Additionally, LTCC chip antennas are favored for their excellent impedance matching and low manufacturing costs compared to alternative technologies. The combination of these benefits makes LTCC a preferred choice for manufacturing seeking efficient, high-performance, and cost-effective antenna solutions.

Application Segment Analysis

In 2023, the WLAN/Wi-Fi segment held a dominant market position, capturing more than a 34.6% share of the chip antenna market. The WLAN/Wi-Fi segment dominated the chip antenna market primarily due to the widespread adoption of wireless networking technologies across various consumers and industrial applications. WLAN/Wi-Fi is integral to modern connectivity, enabling seamless internet access in homes, offices, and public areas.

The proliferation of smart devices, including smartphones, tablets, laptops, and smart home products, drives consistent demand for reliable Wi-Fi connectivity. Chip antennas, due to their compact size and efficient performance are well-suited for these devices.

Furthermore, the growth of Internet of Things applications, which rely heavily on Wi-Fi standards, such as Wi-Fi 6 and the upcoming Wi-Fi 7, also contribute to the increased need for high-performance chip antennas.

End User Segment Analysis

In 2023, the telecommunication segment held a dominant market position, capturing more than a 27.8% share of the Chip Antenna Market. The telecommunication segment dominates the chip antenna market due to the rapid expansion of mobile networks and increasing demand for seamless wireless connectivity. Telecommunication infrastructure, including 4G and 5G networks, requires high-performance, compact antennas for efficient signal transmission and reception.

Chip antennas are preferred in this sector for their small size, high integration capabilities, and excellent performance in constrained spaces. The proliferation of smartphones, tablets, and other communication devices further drives the demand for frequency demand for advanced chip antennas.

Additionally, the ongoing rollout of 5G networks and the growing need for higher data rates and improved signal quality amplify the reliance on chip antennae.

Key Market Segments

By Type

- LTCC Chip

- Dielectric Chip Antenna

By Application

- WLAN/Wi-Fi

- Bluetooth

- Dual Band/Multi Band

- GPS/GNSS

By End User

- Consumer Electronics

- Automotive

- Healthcare

- Telecommunication

- Others

Driving Factors

Advancements in wireless communication

Advancements in wireless communications particularly the development and expansion of 5G networks, have significantly driven the chip antenna market. As 5G technology rolls out globally, there is a growing demand for devices capable of supporting higher data rates, lower latency, and increased connectivity.

Chip antennas, with their compact size and higher performance, are essential for integrating these advanced communication capabilities into various devices, including smartphones, IoT devices, and automated systems.

The shift towards smaller, more portable devices further amplifies the need for efficient, space-saving antenna solutions. Additionally, the growing prevalence of Wi-Fi 6, Bluetooth 5.0, and other manufacturers to adopt chip antennas that can operate effectively across a broader range of frequencies.

Restraining Factors

Higher competition

Higher competition is a significant restraint in the chip antenna market due to the large number of players offering various antenna solutions. With the rise in demand for compact and efficient antennas, many companies have entered the market, leading to intense competition.

This crowded market makes it challenging for any single player to gain a significant market share. Companies are compelled to differentiate their products through innovation, pricing, and performance which can drive up research and development costs.

Additionally, competition from alternative antenna technologies such as the patch or PCB antennas adds further pressure on-chip antenna manufacturers. The need to offer competitive pricing while maintaining high-performance standards often hampers the profit margins, particularly for smaller companies or new startups.

Growth Opportunities

Expansion into new markets

Expansion into new markets presents a significant opportunity for the chip antenna market, driven by the increasing adoption of connected devices across various industries. Sectors like healthcare, agriculture, and smart cities are increasingly relying on IoT and wireless communication technologies to enhance efficiency, safety, and automation.

For instance, in healthcare, wearable devices and remote monitoring systems require compact, reliable antennas to ensure continuous connectivity. Similarly, smart agriculture solutions, including sensors for monitoring soil communication, create demand for efficient chip antennas.

As these industries continue to grow and integrate more sophisticated technology, the need for smaller, high-performance antennas will expand, providing chip antenna manufacturers with new avenues for growth. Additionally, the global push towards smart infrastructure and connected environments creates a sustained demand for chip antennas, particularly in regions investing heavily in digital transformation and smart technology deployment.

Challenging Factors

Regulatory compliance

Regulatory compliance is a significant challenge for the chip antenna market due to the complex and evolving nature of global wireless communication standards. Manufacturers must ensure that their chip antennas meet stringent regulations regarding electromagnetic interference, frequency allocation, and power limits, which vary across different regions and countries.

Keeping up with these regulations requires continuous adoption and monitoring as noncompliance can lead to fines, product recalls, or bans on market entry. Additionally, as new wireless technologies like 5G and Wi-Fi 6 are adopted, regulatory bodies may introduce new requirements further complicating the compliance landscape.

The need to adhere to diverse standards across multiple markets also increases the cost and time involved in product development, testing, and certification. For smaller manufacturers or those entering new regions, navigating these regulatory hurdles can be particularly challenging, limiting their ability to compete effectively in the global market.

Growth Factors

IoT Expansion: the proliferation of IoT devices across multiple sectors tends to increase the demand for compact and efficient chip antennas.

Automotive connectivity: The growing integration of wireless communication technologies in vehicles, such as GDP, Bluetooth, and Wi-Fi, fuels the demand for chip antennas.

Advancements in Wireless Technology: new wireless standards like Wi-Fi 6 and Bluetooth 5.0 require antennas that can operate across a broader range of frequencies.

Miniaturization trend: the push for smaller, more portable electronic devices drives the need for space-saving chip antennas.

Latest Trends

Multi-Band Antennas: Increasing demand for antennas that can operate across multiple frequency bands to support various wireless technologies in a single device.

High-frequency application: Growth in the use of chip antennas to meet the needs of compact devices like wearables and IoT gadgets.

Increasing demand for customization: Increasing requests for customized chip antennas tailored to specific applications, leading to more specialized product offerings.

Environmental Sustainability: Growing focus on developing eco-friendly chip antennas made from recyclable materials or with lower energy consumption in production.

Regional Analysis

Asia Pacific region is leading the market

In 2023, the Asia Pacific (APAC) region held a dominant market position in the chip antenna market, capturing more than a 37.5% share By 0.97 Billion. Asia Pacific’s dominance in the chip antenna market is driven by several factors, including its ongoing adoption of advanced technologies like 5G and IoT, which fuels demand for high-performance antennas. The region has growing tech companies and leading manufacturers who invest heavily in R&D, driving innovation in antenna design.

Additionally, the country’s developing infrastructure and strong consumer demand for smart devices, coupled with a supportive regulatory framework, further bolsters the market growth. The presence of key industries such as automotive and aerospace, also contributes to the region’s leading position in the global chip antenna market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Different key players in the chip antenna market are driving innovation and growth through various strategies, including product development, strategic partnerships, and geographic expansion.

One of the prominent key players in the market is Vishay Intertechnology Inc. The firm offers a wide range of electronic components including chip antennas. It is known for its reliability and performance across different frequencies.

Another prominent player in the market is Antenova Ltd., which specializes in antenna and RF solutions offering a range of chip antennas that are designed for performance in challenging situations. The firm is known for its innovative designs and quick adaption to new technologies.

Top Key Players in the Market

- YAGEO Group

- Partron Co., ltd

- Antenova Ltd.

- Taoglas

- Pulse Electronics

- Vishay Intertechnology, Inc.

- Ignion

- Sunlord

- Johanson Technology, inc.

- Mitsubishi Materials Corporation

- Other Key Players

Recent Developments

- In April 2024, AntennaWare announced to launch of an innovative new range of BodyWave UWB Antenna that offers unprecedented performance at a range of frequencies including 1.9GHz, 2.4GHz, and UWB.

- In February 2024, MediaTek launched T300 5G RedCap platform for IoT with a simple chip antenna design and integrated RF to extend the battery life in 5G devices, while reducing the development time and costs.

Report Scope

Report Features Description Market Value (2023) USD 2.6 billion Forecast Revenue (2033) USD 8.22 billion CAGR (2024-2033) 12.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (LTCC Chip, Dielectric Chip Antenna), by Application (WLAN/Wi-Fi, Bluetooth, Dual Band/Multi Band, GPS/GNSS), by End User (Consumer Electronics, Automotive, Healthcare, Telecommunication, Others) Region Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape YAGEO Group, Partron Co., ltd, Antenova Ltd., Taoglas, Pulse Electronics, Vishay Intertechnology, Inc., Ignion, Sunlord, johanson technology, inc., Mitsubishi Materials Corporation, Other Key Players. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a chip antenna?A chip antenna is a compact antenna used in wireless communication devices, designed to transmit and receive radio frequency signals in a small form factor, commonly used in IoT devices, smartphones, and other compact electronics.

What are the key factors driving the growth of the chip antenna Market?The growth of the chip antenna market is driven by the increasing adoption of IoT devices, the demand for miniaturized components in consumer electronics, and the expansion of 5G networks.

What are the current trends and advancements in the chip antenna Market?Current trends include the development of high-performance antennas for 5G applications, increased use of chip antennas in automotive and industrial sectors, and advancements in materials that improve antenna efficiency and signal strength.

-

-

- YAGEO Group

- Partron Co., ltd

- Antenova Ltd.

- Taoglas

- Pulse Electronics

- Vishay Intertechnology, Inc.

- Ignion

- Sunlord

- Johanson Technology, inc.

- Mitsubishi Materials Corporation

- Other Key Players