Global Die Cutting Machines Market By Product Type (Platen Die Cutting Machines, Rotary Die Cutting Machines, and Other Die Cutting Machines), By Application (Medical & Pharmaceutical Industry, Automobile Industry, Textile Industry, and Industrial & Manufacturing) By Region and By Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: OCT 2024

- Report ID: 19733

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

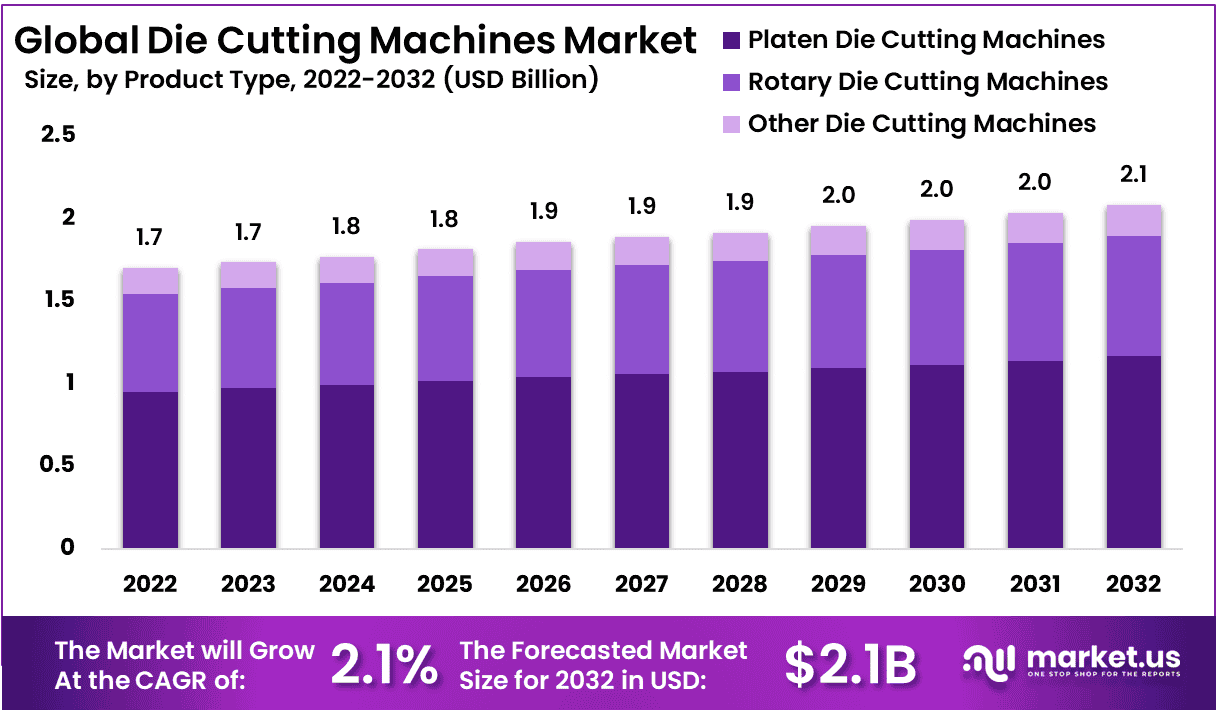

The Die Cutting Machines Market size is expected to be worth around USD 2.1 Billion by 2032, from USD 1.7 Billion in 2023, growing at a CAGR of 2.1% during the forecast period from 2023 to 2032.

The Die Cutting Machines Market is integral to industries such as packaging, automotive, textiles, and electronics. Die cutting machines are used to cut, shape, and trim materials like paper, plastic, fabric, and metal into specific designs, making them essential for mass production. The market has evolved with advancements in automation and precision technology, enabling manufacturers to meet diverse industrial demands.

Growth Factors include the increasing demand for efficient and cost-effective cutting solutions in packaging and automotive sectors. The rise of e-commerce has amplified the need for innovative packaging designs, further driving the demand for die cutting machines. Additionally, the automation of manufacturing processes and the need for precision cutting in electronics and textiles are key factors boosting market growth.

The opportunity lies in the growing trend of sustainability in packaging. Manufacturers are increasingly seeking eco-friendly cutting solutions to reduce waste and energy consumption. Additionally, the increasing adoption of automation and digital die cutting technologies in emerging markets presents growth opportunities for manufacturers to expand their footprint globally

The die-cutting machines market, while a smaller niche within the broader industrial machinery sector, is positioned for steady growth due to its integral role in manufacturing processes across industries such as packaging, automotive, and electronics. Though the segment is not as large as markets like semiconductors or construction machinery, it is expected to benefit from broader industrial automation trends and increased demand for precision manufacturing.

As companies seek to optimize production efficiency and reduce waste, die-cutting technologies are increasingly viewed as vital to lean manufacturing operations. This heightened focus on operational efficiency provides a favorable environment for die-cutting machine adoption.

India’s government initiatives, particularly the Production Linked Incentive (PLI) scheme for electronics manufacturing, indirectly create growth opportunities for the die-cutting machine sector. The 2024 Union Budget allocated Rs 6,903 crore to semiconductor projects, which is expected to drive demand for advanced manufacturing equipment, including die-cutting machines, within semiconductor assembly units.

Additionally, the Rs 6,125 crore provisioned for large electronics in the FY2024-25 budget highlights the expansion of India’s electronics manufacturing ecosystem, a key market for industrial machinery. This ecosystem growth signals increased capital investment in automated and precision machinery, which includes die-cutting technologies.

Further, India’s electronics production growth of 400% between 2014 and FY22-23, bolstered by the PLI scheme, underscores the sector’s rapid expansion. As electronics have become the country’s fifth-largest export, machinery essential to electronics production, including die-cutting machines, stands to gain.

The increased allocation of Rs 21,936 crore to the Ministry of Electronics and Information Technology (MeitY) reflects the broader industrial uplift, which could enhance the demand for specialized machinery in key industries, driving growth for the die-cutting machine market in the coming years.

Key Takeaway

- The Die Cutting Machines market is projected to grow from USD 1.7 billion in 2023 to USD 2.1 billion by 2032, at a modest CAGR of 2.1%, driven by automation, precision cutting demand, and expanding applications across packaging, automotive, and electronics sectors.

- Platen Die Cutting Machines held over 56% of the market share due to their precision and efficiency in high-volume tasks across packaging and printing industries.

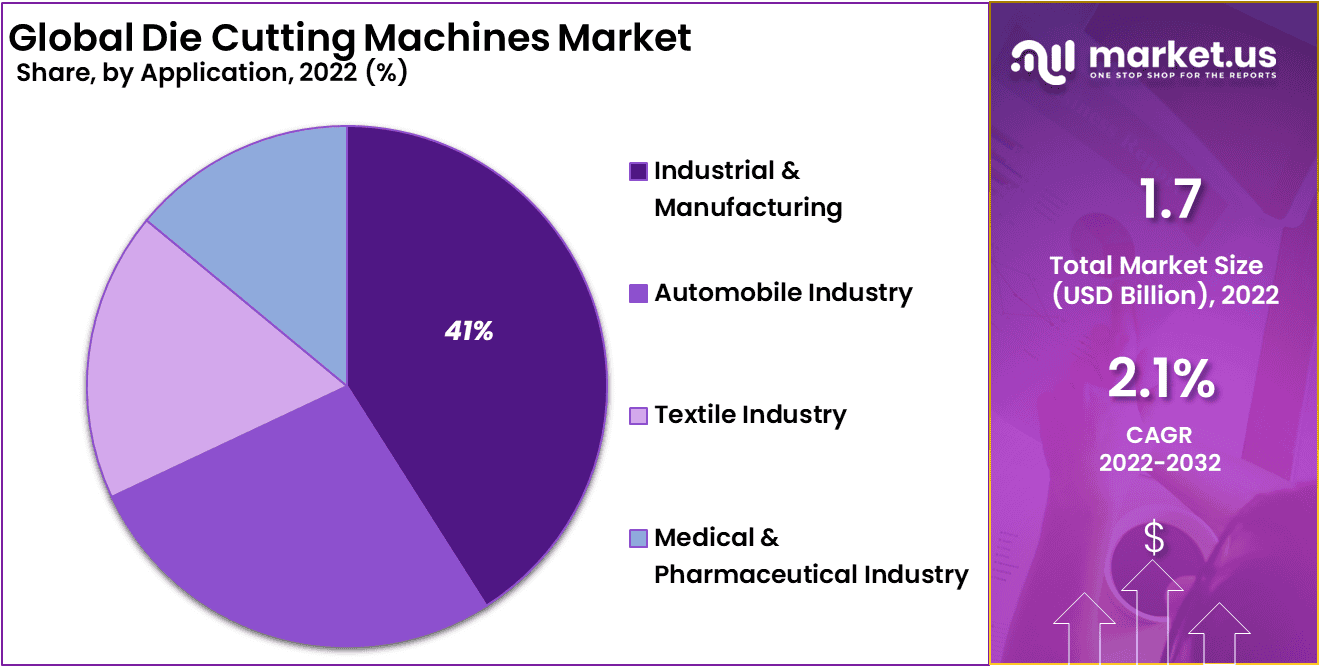

- The Industrial & Manufacturing sector dominated with more than 41% of the total market share in 2023, driven by increasing demand for precision-cut components in electronics and packaging.

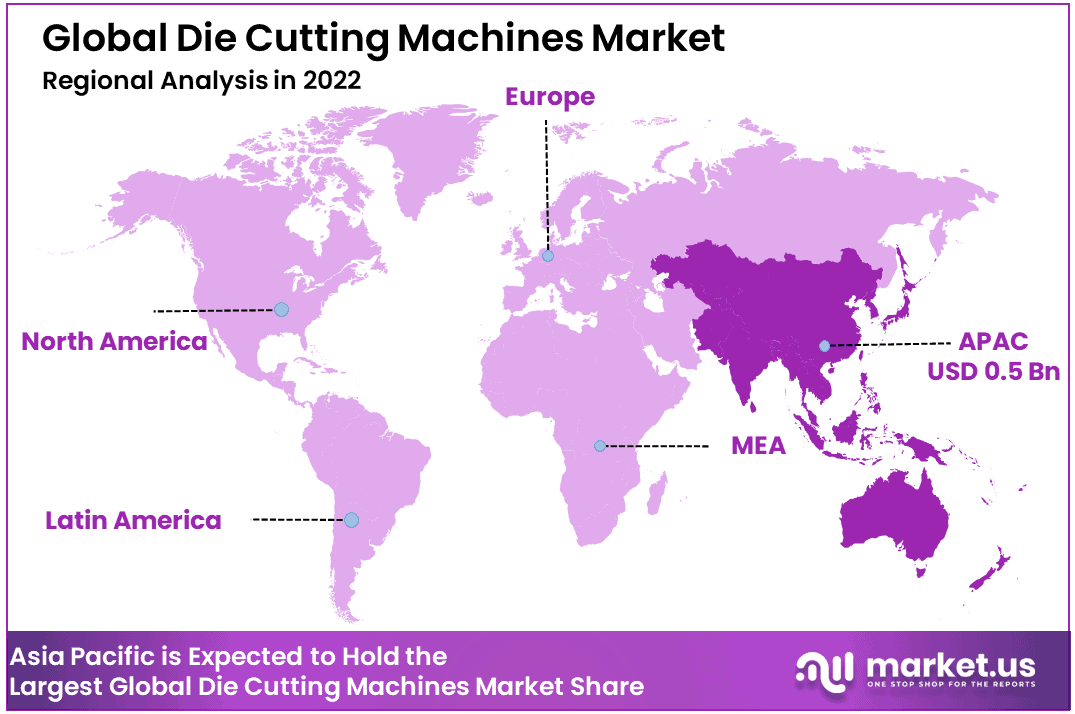

- Asia-Pacific holds the largest market share at 31%, fueled by the region’s expanding manufacturing sector, particularly in packaging and electronics.

- Restraint: High capital and operational costs limit market expansion, particularly for SMEs, restricting the adoption of advanced die-cutting technologies.

Product Type Analysis

Key Market Segments

Based on Product Type

- Platen Die Cutting Machines

- Rotary Die Cutting Machines

- Other Die Cutting Machines.

Based on Application

- Medical & Pharmaceutical Industry

- Automobile Industry

- Textile Industry

- Industrial & Manufacturing

Driver

Expansion of the Packaging Industry

The die cutting machines market, as packaging plays a pivotal role in nearly every consumer product sector. With the packaging industry projected to reach over USD 1 trillion by 2030, fueled by e-commerce growth, sustainability initiatives, and consumer preference for innovative packaging solutions, the demand for precision cutting, faster production cycles, and customizable designs has surged.

The die cutting process is essential for producing packaging materials such as cartons, corrugated boxes, and labels, which are in increasing demand across industries like food & beverage, healthcare, electronics, and personal care. In 2023, the packaging industry accounted for nearly 40% of the demand for die cutting machines.

This direct correlation emphasizes how the expansion of packaging is a core growth engine for the die cutting machines market, as manufacturers invest in technologies that support flexible packaging options, eco-friendly materials, and high-volume output.

Moreover, the rise of smart packaging solutions, which require intricate and precise cutting for sensors and advanced features, amplifies the need for technologically advanced die cutting machines. As sustainability becomes a key focus, there is an increasing shift toward eco-friendly packaging materials such as paperboard and biodegradable plastics, both of which necessitate specialized die cutting techniques.

By meeting the packaging sector’s rising demand for efficiency, customization, and environmental responsibility, the die cutting machines market is set to witness sustained growth, with packaging companies continuing to adopt advanced cutting solutions to keep pace with evolving consumer expectations and regulatory pressures.

Restraint

High Initial Investment and Operational Costs

The high capital expenditure associated with die cutting machines poses a significant barrier to market growth, particularly for small and medium-sized enterprises (SMEs) that dominate the manufacturing landscape. Advanced die cutting machines, equipped with automation features, multi-functionality, and precision control systems, can require investments ranging from several hundred thousand to over USD 1 million.

This substantial upfront cost restricts accessibility, especially for new entrants and companies in price-sensitive markets. In addition to the initial capital investment, ongoing operational costs such as maintenance, energy consumption, and skilled labor further limit adoption rates.

The requirement for specialized operators and frequent upgrades to keep pace with technological advancements increases the total cost of ownership. This cost factor slows the overall market expansion as many businesses hesitate to invest without a clear and rapid return on investment (ROI), particularly in sectors where profit margins are thin.

Furthermore, these high costs can delay the adoption of newer, more efficient technologies, as companies may prefer to prolong the lifecycle of older machinery rather than invest in expensive upgrades. This dynamic creates a gap between technological innovation and market penetration, limiting the pace of growth in the die cutting machines market. The pressure to remain competitive with low-cost manual alternatives, particularly in developing markets, further exacerbates this restraint

Opportunity

Technological Advancements

Technological advancements stand out as a primary growth driver in the die cutting machines market for 2024. With increasing demand for precision, efficiency, and customization, manufacturers are investing in new technologies such as laser die cutting and digital finishing systems. These innovations offer significant improvements over traditional methods by delivering higher accuracy, faster turnaround times, and greater design flexibility.

Laser die cutting, for instance, eliminates the need for physical dies, enabling faster changeovers between designs and reducing material waste. This technology is particularly advantageous for industries like packaging, where rapid prototyping and short production runs are becoming the norm due to rising consumer demand for personalized products. Moreover, digital die cutting systems allow manufacturers to integrate real-time monitoring and control, improving production efficiency and reducing errors.

Additionally, the incorporation of IoT and AI technologies into die cutting machines is streamlining the manufacturing process, enabling predictive maintenance, and reducing downtime. These smart technologies are enhancing machine performance and offering manufacturers actionable data to optimize operations.

As a result, companies that adopt these advanced technologies will not only improve their operational efficiency but also position themselves to meet the growing demand for high-quality, customizable products, unlocking substantial growth potential in 2024 and beyond.

Trends

Increasing Demand for Precision and Customization

In 2024, the rising demand for precision and customization will be a key trend shaping the die cutting machines market. Industries such as packaging, textiles, and automotive are increasingly shifting towards more personalized products, requiring intricate and precise cutting capabilities. Customers are no longer satisfied with standard designs; instead, they are seeking unique, tailor-made solutions to differentiate their products and enhance brand identity.

Die cutting machine manufacturers are responding to this shift by developing machines that offer enhanced precision and flexibility. Advanced technologies, such as digital die cutting and laser die cutting, are making it possible to execute complex designs with minimal margins for error, meeting the high standards of customization demanded by the market. These machines enable rapid design changes, smaller production runs, and intricate cuts, all while maintaining high efficiency.

In packaging, for instance, the surge in e-commerce is pushing brands to deliver customized and sustainable packaging options, further driving demand for high-precision die cutting machines. As companies across sectors prioritize personalization to attract customers, manufacturers that can deliver precision-cut solutions with faster turnaround times will be well-positioned to capture this growing market segment.

Regional Analysis

The Asia-Pacific region holds the largest market share in the global die cutting machines market, accounting for 31% of the total market in 2024

The global die cutting machines market exhibits varied growth patterns across key regions, driven by different industrial demands and economic dynamics. Asia-Pacific dominates the market, accounting for the largest share at 31%.The region’s growth is fueled by the expanding manufacturing sector, particularly in countries like China, Japan, and India, where the demand for efficient production systems is high.

With a thriving packaging industry and increasing automation adoption, Asia-Pacific is projected to maintain its lead, contributing significantly to the market’s overall value, which is expected to surpass USD 0.5 billion by 2024. North America is also a prominent market, driven by advanced manufacturing technologies and a strong emphasis on automation across sectors like automotive, electronics, and healthcare. The region’s focus on precision and customization aligns with the increasing demand for high-quality, tailored products.

Meanwhile, Europe is characterized by strong innovation in machinery, particularly in Germany and Italy, where automation in industrial processes is widespread. The region’s focus on sustainable packaging solutions further boosts demand for advanced die cutting machines.

In Latin America, the market is growing steadily, supported by rising industrialization in Brazil and Mexico. However, economic challenges in the region may moderate growth compared to other regions.

Lastly, the Middle East & Africa is an emerging market for die cutting machines, with infrastructure development and expanding industrial sectors in countries like the UAE and South Africa contributing to modest but promising market growth in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global die cutting machines market in 2024 is characterized by a competitive landscape, with several key players driving technological innovation, market penetration, and strategic growth. Bobst Group SA and Heidelberger Druckmaschinen AG are two of the most prominent companies, recognized for their robust portfolios of high-performance die cutting machines. These companies have consistently invested in automation and precision technologies, ensuring they maintain a strong market presence, especially in sectors such as packaging and printing.

Asahi-Seiki Manufacturing Co. Ltd. and Koenig & Bauer AG are also pivotal players, known for offering advanced machinery with a focus on efficiency and customization. Their cutting-edge solutions cater to the increasing demand for precision, particularly in the automotive and electronics industries, where intricate die-cut components are essential.

Sanwa Mfg. Co. Ltd. and Duplo International Limited stand out in niche segments, delivering specialized equipment for medium and small-scale manufacturers. Their focus on cost-effective yet technologically sophisticated machines helps them maintain a competitive edge in emerging markets.

Shandong Century Machinery Co. Ltd. and IIJIMA MFG Co. Ltd. are key contributors to the Asia-Pacific market, providing machinery that caters to the region’s burgeoning industrial sectors. Local companies like Dalian Yutong and Wenhong Machinery are also expanding rapidly, benefiting from regional demand growth.

These players, alongside other regional and global competitors, continue to shape the future of the die cutting machines market, focusing on innovation, customer-centric solutions, and expanding into new geographical markets to capture a larger share of the growing demand.

Top Key Players in the Market

- Bobst Group SA

- Heidelberger Druckmaschinen AG

- Asahi-Seiki Manufacturing Co. Ltd.

- Koenig & Bauer AG

- Sanwa Mfg. Co.Ltd.

- Duplo International Limited

- Shandong Century Machinery Co. Ltd

- IIJIMA MFG Co. Ltd

- Dalian Yutong

- Wenhong Machinery

- Other Key Players

Recent Developments

- In 2023, S. Walter Packaging Group (SWPG): SWPG enhanced its production by installing two BOBST VISIONCUT 106 LER machines at its Milwaukee division. These machines decrease setup times and boost productivity, supporting SWPG’s expanding custom packaging sector.

- In 2024, DS Smith France: DS Smith introduced the Highcon Beam 3 system into its French operations, a move aimed at meeting increasing demands for quick, flexible, and sustainable packaging solutions. The system offers precise laser cutting, improving turnaround times for clients.

- In 2024, Highcon: Highcon launched its Beam 3 and Vulcan systems, designed to enhance production speed and quality by 50%. These systems cater to industries needing complex, large-format die-cutting, solidifying Highcon’s leadership in digital die-cutting technology.

Report Scope

Report Features Description Market Value (2023) US$ 1.7 Bn Forecast Revenue (2032) US$ 2.1 Bn CAGR (2023-2032) 2.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type-Platen Die Cutting Machines, Rotary Die Cutting Machines, and Other Die Cutting Machines; By Machine Type-Manual, Semi-Automatic, and Automatic; By Application-Medical & Pharmaceutical Industry, Automobile Industry, Textile Industry, and Industrial & Manufacturing; Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC, Latin America: Brazil, Mexico, and Rest of Latin America, Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa Competitive Landscape Bobst Group SA, Heidelberger Druckmaschinen AG, Asahi-Seiki Manufacturing Co. Ltd., Koenig & Bauer AG, Sanwa Mfg. Co.Ltd., Duplo International Limited, Shandong Century Machinery Co. Ltd, IIJIMA MFG Co. Ltd, Dalian Yutong, Wenhong Machinery, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Die Cutting Machines MarketPublished date: OCT 2024add_shopping_cartBuy Now get_appDownload Sample

Die Cutting Machines MarketPublished date: OCT 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bobst Group SA

- Heidelberger Druckmaschinen AG

- Asahi-Seiki Manufacturing Co. Ltd.

- Koenig & Bauer AG

- Sanwa Mfg. Co.Ltd.

- Duplo International Limited

- Shandong Century Machinery Co. Ltd

- IIJIMA MFG Co. Ltd

- Dalian Yutong

- Wenhong Machinery

- Other Key Players