Global Diamond Market Report By Type (Natural, Synthetic), By Application (Jewelry & Ornaments, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 98748

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

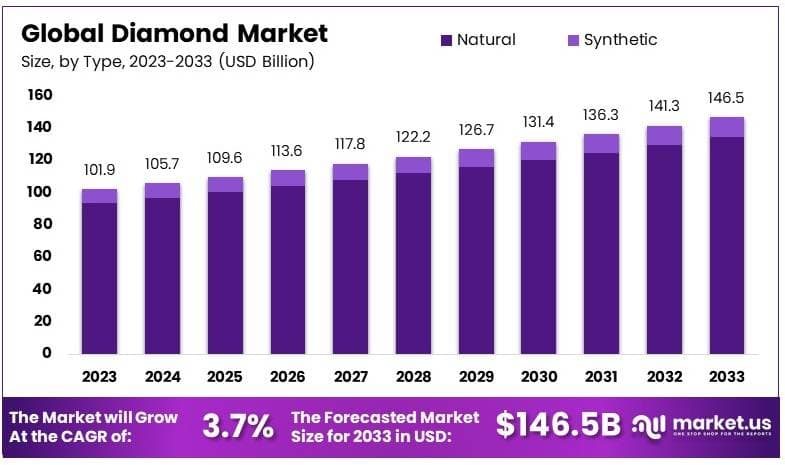

The Global Diamond Market size is expected to be worth around USD 146.5 Billion by 2033, from USD 101.9 Billion in 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2033.

Diamonds are precious stones made of carbon atoms arranged in a crystal structure. They are formed under high temperature and pressure conditions deep within the Earth. Known for their hardness and brilliance, diamonds are widely used in jewelry and industrial applications such as cutting tools.

The diamond market includes the exploration, mining, processing, and sale of diamonds, both as gemstones and for industrial use. It covers activities from mining companies extracting diamonds to retailers selling finished jewelry products. The market is influenced by global demand, production levels, and economic conditions.

The diamond market remains robust and dynamic, with growth opportunities driven by both natural and lab-grown segments. Diamonds continue to be a preferred choice in the luxury goods sector, particularly in jewelry.

Survey by Missoma highlight that over 50% of U.S. adults prefer diamond jewelry when gifting, underscoring its dominance in consumer preferences. Engagement rings remain the most popular diamond product, with social media showing over 5.2 million hashtag mentions for #diamondring, reflecting its cultural and emotional significance.

The global production of lab-grown diamonds is expanding rapidly, reaching 10 million carats in 2023. China and the United States lead in production, supported by technological advancements that enhance quality and variety.

This growth is particularly appealing to millennials and eco-conscious consumers who seek sustainable and affordable alternatives. As a result, lab-grown diamonds have become a significant growth driver within the overall diamond market.

According to the U.S. Geological Survey (USGS, 2024), Russia remains the top producer of natural industrial diamonds, contributing 18 million carats or approximately 41% of the global output.

Other key producers include the Democratic Republic of Congo (8 million carats, 18%), Botswana (7 million carats, 17%), South Africa (6 million carats, 13%), and Zimbabwe (4 million carats, 9%). These figures demonstrate the concentrated nature of the diamond mining industry, dominated by a few major players.

The Kimberley Process Certification Scheme covers 99.8% of the global rough diamond trade, ensuring that conflict diamonds are kept out of the market. Such regulations are crucial for maintaining ethical standards and consumer confidence in natural diamonds. The Diamond Producers Association emphasizes the importance of these measures for industry sustainability and reputation.

Moreover, the diamond industry significantly influences global and local economies. On a broader scale, the sector provides employment and contributes to economic growth in producing nations.

Locally, the industry plays a vital role in economies such as Botswana, where diamonds account for 80% of the country’s exports, demonstrating its critical importance. In Belgium, the Antwerp World Diamond Centre (AWDC) handles a substantial portion of global diamond trade, positioning it as a key hub for the industry.

The natural diamond market is nearing saturation in some regions, especially as lab-grown diamonds gain popularity. The increasing acceptance of synthetic alternatives challenges traditional producers, requiring strategic adaptations to remain competitive.

The competition is intensifying as major diamond-producing countries vie for market share, supported by national policies and investments aimed at enhancing mining efficiency and trade capabilities.

Key Takeaways

- The Diamond Market was valued at USD 101.9 Billion in 2023 and is expected to reach USD 146.5 Billion by 2033, with a CAGR of 3.7%.

- In 2023, Natural Diamonds dominated the type segment with 93.8%, due to their high demand in luxury jewelry markets.

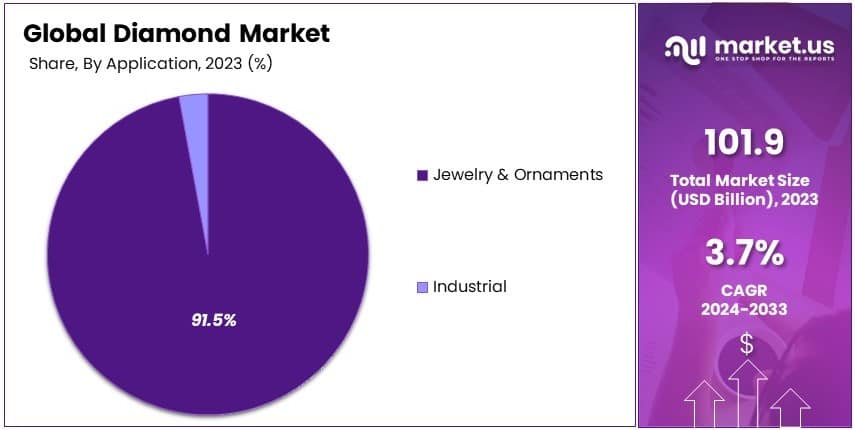

- In 2023, Jewelry and Ornaments led the application segment with 91.5%, driven by increasing global consumption of luxury items.

- In 2023, North America held the dominant market share at 52.6%, valued at USD 53.60 Billion, due to a high concentration of luxury consumers.

Type Analysis

Natural diamonds dominate with 93.8% due to their perceived authenticity and enduring value.

The diamond market can be distinctly segmented by type into two main categories: natural and synthetic diamonds. The natural diamonds segment overwhelmingly dominates the market, accounting for 93.8% of the market share.

This dominance can be attributed to a strong consumer preference for natural diamonds, which are often perceived as symbols of luxury and status. These gems are prized for their unique characteristics and the traditional belief that they represent an unbreakable bond, particularly in engagement and wedding jewelry.

Natural diamonds are formed over billions of years under the earth’s crust, making each stone uniquely intricate. The rarity and the time-intensive process required to mine and prepare these stones significantly contribute to their high market value. Moreover, natural diamonds are often associated with a heritage of craftsmanship and artistry that is highly valued in markets across the globe.

On the other hand, the synthetic diamonds segment, though smaller, plays a crucial role in the market. These lab-grown diamonds are becoming increasingly popular due to advancements in technology that allow for mass production at lower costs.

Synthetic diamonds offer similar physical and chemical properties as natural diamonds at a fraction of the cost, which appeals to a segment of consumers looking for affordability and ethical sourcing. This sub-segment is poised for growth, driven by technological advancements and increasing consumer awareness about the environmental and ethical implications of natural diamond mining.

The growth of synthetic diamonds also reflects broader market trends towards sustainability and ethical consumerism, positioning them as a strategic area for future market expansion and innovation. As technology improves and production costs decrease, synthetic diamonds are expected to increase their market share, challenging the dominance of natural diamonds.

Application Analysis

Jewelry and ornaments dominate with 91.5% due to high consumer demand for diamond-based adornments.

In the application segment of the diamond market, jewelry and ornaments hold the lion’s share, accounting for 91.5% of the market. This segment’s dominance is primarily driven by the high demand for diamond-based adornments in various cultural contexts, where diamonds are synonymous with luxury and elegance.

Diamonds are a staple in bridal jewelry across many cultures, which sustains their demand in the jewelry segment. The enduring appeal of diamonds in fashion, luxury, and spiritual jewelry also supports robust sales in this segment.

Diamonds used in jewelry and ornaments are typically graded on their aesthetic qualities, including cut, color, clarity, and carat weight, which are critical factors in determining their market value. The craftsmanship involved in diamond jewelry also adds substantial value, with high-end brands and artisan jewelers enhancing the market’s growth through distinctive designs and exceptional quality.

Conversely, the industrial application of diamonds, though smaller in comparison, is vital for the market. Diamonds’ remarkable hardness and thermal conductivity make them indispensable in various industrial applications, including cutting, grinding, drilling, and as components in high-precision instruments.

The industrial segment, although a minor part of the diamond market by revenue, is significant for its specialized applications that leverage the physical properties of diamonds, especially synthetic ones.

Key Market Segments

By Type

- Natural

- Synthetic

By Application

- Jewelry & Ornaments

- Industrial

Drivers

Economic Growth and Technological Innovations Drive Diamond Market Expansion

The Diamond Market is experiencing significant growth driven by several key factors. Increasing consumer demand for luxury goods plays a pivotal role as more individuals seek high-end products to signify status and success. This trend is further supported by rising disposable incomes in emerging economies, where a growing middle class has more spending power to invest in luxury items like diamonds.

Additionally, the expansion of e-commerce platforms has made diamond products more accessible to a broader audience, breaking geographical barriers and enhancing market reach. Technological advancements in diamond processing also contribute to market growth by improving the quality and reducing the cost of diamond production, making diamonds more appealing to consumers.

These factors create a robust environment for the Diamond Market, fostering both demand and supply dynamics that propel the industry forward. As economies continue to grow and technology evolves, the Diamond Market is well-positioned to capitalize on these driving forces.

Restraints

Ethical Concerns and High Costs Restrain Diamond Market Growth

Despite the positive growth trends, the Diamond Market faces several restraining factors that hinder its expansion. Ethical concerns and sustainability issues are at the forefront, with consumers increasingly demanding transparency in diamond sourcing to avoid conflict diamonds.

The high cost of diamonds remains a significant barrier, limiting accessibility for a broader customer base and making it challenging to compete with more affordable alternatives.

Market volatility and price fluctuations add another layer of complexity, as unpredictable changes in diamond prices can deter investment and affect consumer purchasing decisions.

Furthermore, competition from synthetic diamonds presents a substantial challenge, offering consumers a less expensive and ethically appealing alternative. These factors collectively create obstacles for the Diamond Market, requiring industry players to address ethical standards, manage costs, and innovate.

Opportunity

Emerging Markets and Online Expansion Provide Opportunities in Diamond Market

The Diamond Market is poised for substantial growth through various opportunities. Penetrating emerging markets presents a significant opportunity, as rising incomes and a growing appetite for luxury goods in regions like Asia and Africa drive demand for diamonds.

Innovations in diamond jewelry design also open new avenues, allowing brands to cater to diverse consumer preferences and stay ahead of fashion trends. Strategic partnerships and collaborations enable companies to leverage each other’s strengths, enhancing market presence and expanding distribution networks.

Additionally, the expansion into online retail platforms offers vast potential to reach a global audience, providing consumers with convenient access to a wide range of diamond products. These opportunities allow businesses to tap into new customer bases and enhance their competitive edge.

Challenges

Regulatory Compliance and Supply Chain Issues Challenge Diamond Market Growth

The Diamond Market encounters several challenges that complicate its growth trajectory. Regulatory compliance and trade restrictions pose significant hurdles, as varying international laws and regulations can limit market access and increase operational costs for businesses.

Supply chain disruptions, whether due to geopolitical tensions or logistical inefficiencies, can impede the smooth flow of diamonds from mines to consumers. This affects both availability and pricing, creating instability in the market.

Intense competition among key players further intensifies the battle for market share, forcing companies to continually innovate and differentiate their offerings. Fluctuating raw material prices add another layer of uncertainty, as changes in the cost of mining and processing diamonds can impact profitability.

Growth Factors

Investment and Certification Enhance Growth Prospects in Diamond Market

Growth in the Diamond Market is further supported by several key factors. Growing investment demand for diamonds as alternative assets provides a stable revenue stream, as investors seek tangible and valuable commodities to diversify their portfolios.

The expansion of luxury retail outlets broadens market reach, making diamond products more accessible to affluent consumers. Enhancements in diamond certification processes ensure greater transparency and trust, allowing consumers to make informed purchasing decisions.

Rising awareness of diamond quality and grading empowers consumers to understand the value of their purchases, fostering greater confidence. These growth factors collectively strengthen the Diamond Market, driving sustained expansion and increased overall demand.

Emerging Trends

Sustainability and Innovation Are Latest Trending Factors in Diamond Market

Current trends in the Diamond Market are significantly influenced by sustainability and innovation. The growing popularity of lab-grown diamonds reflects a shift towards more sustainable and ethically produced alternatives, appealing to environmentally conscious consumers.

Customization in jewelry is also on the rise, allowing consumers to personalize their diamond purchases and driving demand for unique pieces. The integration of smart technology in diamond products, such as embedding diamonds with tracking features, adds value and appeals to tech-savvy buyers.

Additionally, sustainable diamond mining practices are gaining traction, with companies adopting greener methods to reduce environmental impact. These trends highlight the market’s evolution towards sustainability and technological advancement.

Regional Analysis

North America Dominates with 52.6% Market Share

North America leads the Diamond Market with a commanding 52.6% share, amounting to USD 53.60 billion. This dominance is fueled by high consumer demand for luxury goods, strong disposable incomes, and an expanding retail network. The presence of major diamond retailers and manufacturers further supports the region’s leadership position.

Regional characteristics such as stable economic growth, high consumer spending, and a preference for premium, ethically sourced diamonds contribute to the market’s performance. Additionally, North America benefits from advanced technological innovations in diamond cutting and certification, enhancing product quality and consumer confidence.

North America’s dominance in the Diamond Market is expected to remain strong. Continued consumer interest in luxury goods, along with advancements in lab-grown diamonds, will likely support future growth in this region.

Regional Mentions:

- Europe: Europe is a significant player in the Diamond Market, driven by strong demand for luxury products and increasing consumer awareness about sustainability. The region’s focus on ethical sourcing and craftsmanship has solidified its presence in the market.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the Diamond Market, particularly in countries like China and India. Rising disposable incomes and the expansion of e-commerce channels are major factors boosting demand in this region.

- Middle East & Africa: The Middle East and Africa are key regions in the Diamond Market, benefiting from high demand for luxury jewelry. Dubai and other major markets drive consumption, with a focus on high-end, bespoke diamond pieces.

- Latin America: Latin America shows steady growth in the Diamond Market, supported by increasing consumer interest in luxury goods and investments in retail expansion. Countries like Brazil are emerging as important markets for diamonds.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The diamond market is dominated by a mix of established companies and emerging players. These companies focus on diamond exploration, mining, manufacturing, and technology-driven innovations, covering both natural and synthetic diamonds. The market is driven by demand for high-quality diamonds for both industrial and jewelry purposes.

Key players offer a wide range of products, from rough and polished natural diamonds to synthetic diamonds. Some companies also provide advanced diamond-based products for industrial applications such as cutting tools and semiconductors.

Companies maintain their competitive edge through vertical integration, managing operations from exploration to retail. Partnerships and collaborations with luxury brands and distributors are common. Emerging players focus on niche markets, including synthetic diamonds and sustainable mining practices.

The market’s geographical presence is vast, with key players operating in major diamond-producing regions like Africa, Canada, Russia, and Asia. Companies target global consumers, with a focus on North America, Europe, and emerging markets in Asia.

Innovation is centered around sustainable mining, advanced synthetic diamond technology, and enhancing the quality of industrial diamonds. Some companies are also investing in traceability and blockchain technology to ensure ethical sourcing.

Top Key Players in the Market

- Endiama E.P.

- De Beers Group

- Henan Huanghe Whirlwind

- Tsodilo Resources Limited

- Scio Diamond Technology Corporation

- Diamcor Mining Inc.

- Lucapa Diamond Company Limited

- Gem Diamonds Limited

- Rockwell Diamonds

- Anglo American plc

- Petra Diamonds

- Lucara Diamond Corp.

- Trans Hex Group Ltd

- Applied Diamond Inc.

- LiLiang Diamond Co.

- Other Key Players

Recent Developments

- Rapaport and DMCC: In September 2024, Rapaport Diamond Corporation and DMCC hosted Dubai’s largest polished diamond auction at the Dubai Diamond Exchange. The event featured over 50,000 carats of diamonds across 3,200 lots, showcasing Dubai’s growing influence as a global diamond trading hub.

- Signet Jewelers and De Beers: In May 2024, Signet Jewelers partnered with De Beers to highlight the attributes of natural diamonds for a new generation of U.S. couples. This collaboration anticipates a 25% increase in engagements over the next three years, focusing on diverse demographics through digital content, in-store experiences, and staff training.

- Malabar Gold & Diamonds: In October 2024, Malabar Gold & Diamonds launched two renovated showrooms at Lulu Hypermarket in Kuwait and Gold Souq in Dubai as part of its global expansion strategy. The showrooms offer over 20,000 jewelry designs, enhancing customer experience with diverse collections for various occasions.

- Tanishq and De Beers: In August 2024, De Beers Group and Tanishq formed a strategic partnership to promote natural diamond jewelry in India, now the second-largest market for natural diamonds. The collaboration focuses on consumer education and marketing campaigns to showcase the rarity and value of natural diamonds, targeting India’s growing middle class.

Report Scope

Report Features Description Market Value (2023) USD 101.9 Billion Forecast Revenue (2033) USD 146.5 Billion CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural, Synthetic), By Application (Jewelry & Ornaments, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Endiama E.P., De Beers Group, Henan Huanghe Whirlwind, Tsodilo Resources Limited, Scio Diamond Technology Corporation, Diamcor Mining Inc., Lucapa Diamond Company Limited, Gem Diamonds Limited, Rockwell Diamonds, Anglo American plc, Petra Diamonds, Lucara Diamond Corp., Trans Hex Group Ltd, Applied Diamond Inc., LiLiang Diamond Co., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Endiama E.P.

- De Beers Group

- Henan Huanghe Whirlwind

- Tsodilo Resources Limited

- Scio Diamond Technology Corporation

- Diamcor Mining Inc.

- Lucapa Diamond Company Limited

- Gem Diamonds Limited

- Rockwell Diamonds

- Anglo American plc

- Petra Diamonds

- Lucara Diamond Corp.

- Trans Hex Group Ltd

- Applied Diamond Inc.

- LiLiang Diamond Co.

- Other Key Players