Global Diabetic Foot Ulcer Treatment Market By Treatment Type (Wound-care Dressings, Wound-care Devices, Active Therapies, Others), By Ulcer Type (Neuropathic Ulcers, Ischemic Ulcers, and Neuro-ischemic Ulcers), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Homecare Settings), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132948

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

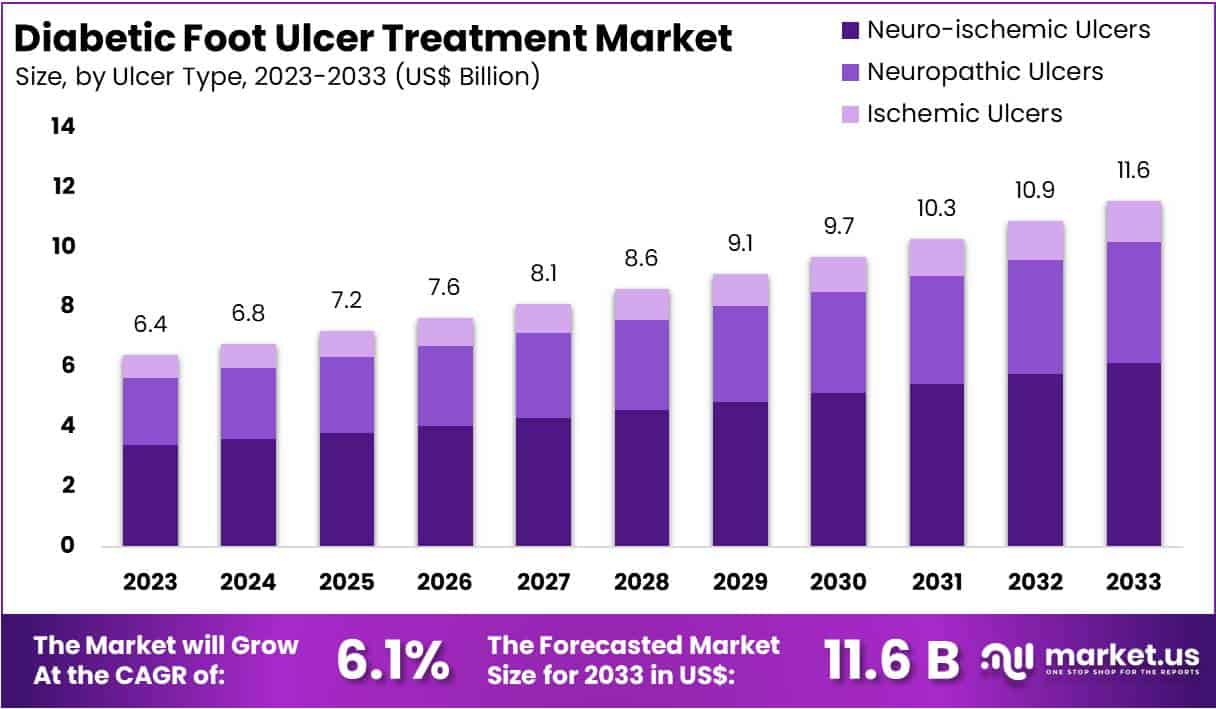

The Global Diabetic Foot Ulcer Treatment Market size is expected to be worth around US$ 11.6 Billion by 2033, from US$ 6.4 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The global diabetic foot ulcer (DFU) treatment market is experiencing significant growth, driven by several key factors. The increasing prevalence of diabetes worldwide has led to a higher incidence of DFUs, necessitating effective treatment solutions. Technological advancements in wound care, such as bioengineered skin substitutes and negative pressure wound therapy, have enhanced healing outcomes, further propelling market expansion.

The ageing global population, which is more susceptible to diabetes and its complications, contributes to the rising demand for DFU treatments. However, the market faces challenges, including the high cost of advanced wound care products and limited awareness in developing regions, which may impede growth.

Despite these obstacles, ongoing research and development efforts and supportive government initiatives are expected to foster innovation and improve accessibility to DFU treatments, sustaining market growth in the foreseeable future.

- According to the U.S. Centers for Disease Control and Prevention, in 2021, the global prevalence of diabetes among individuals aged 20 to 79 was estimated at 10.5%, equating to approximately 536.6 billion people. Projections indicate this figure may rise to 12.2% (783.2 billion) by 2045. Notably, urban areas exhibited a higher prevalence (12.1%) compared to rural regions (8.3%). High-income countries reported a prevalence of 11.1%, whereas low-income countries had a lower prevalence of 5.5%. The most significant relative increase in diabetes prevalence between 2021 and 2045 is anticipated in middle-income countries, with an expected rise of 21.1%, compared to 12.2% in high-income and 11.9% in low-income countries.

- According to the World Health Organization, by 2030, one in six people globally will be aged 60 or over. From 2020’s count of 1 billion, this demographic is set to increase to 1.4 billion. By 2050, the population of those 60 and older is expected to double to 2.1 billion. Moreover, the number of people aged 80 and above is projected to triple by 2050, reaching 426 million.

Key Takeaways

- The global diabetic foot ulcer treatment market was valued at US$ 6.4 billion in 2023 and is anticipated to register substantial growth of US$ 11.6 billion by 2033, with 6.1% CAGR.

- In 2023, the wound-care dressings segment took the lead in the global market, securing 42% of the total revenue share.

- Based On Ulcer Type, the neuro-ischemic ulcers segment played a crucial role, capturing 53% of the market revenue.

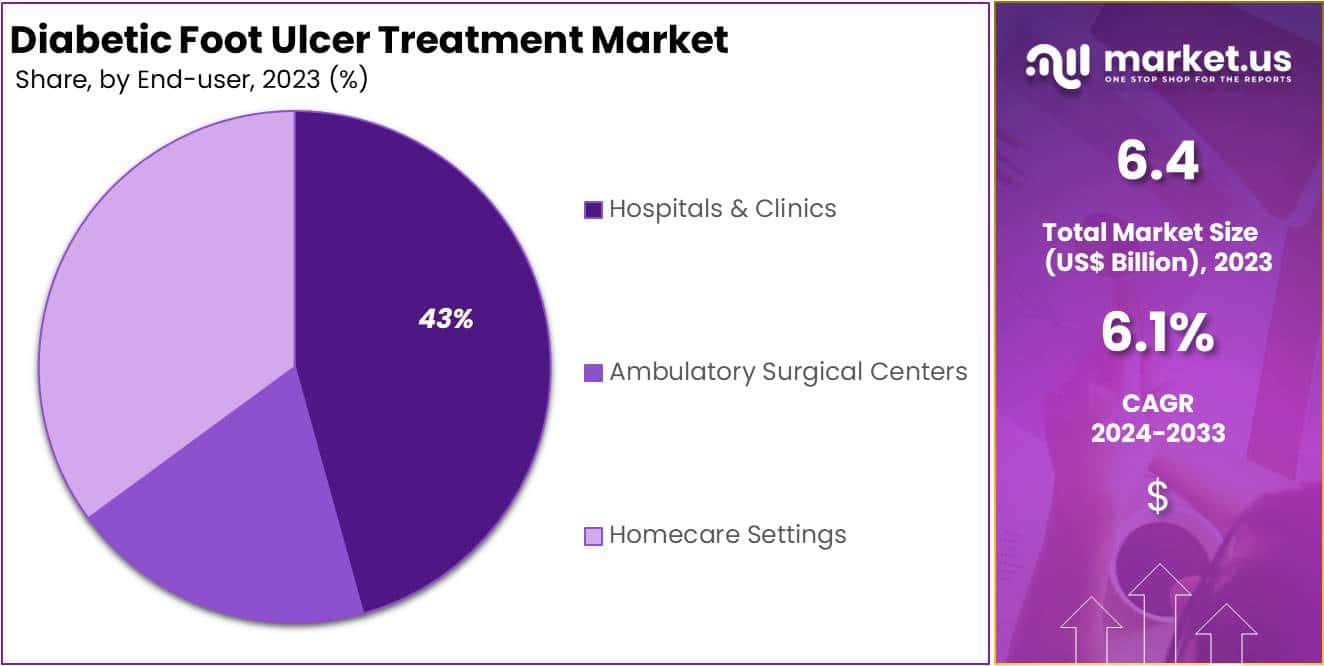

- Among end-user segments, hospitals & clinics emerged as the dominant segment, capturing 43% of the total revenue.

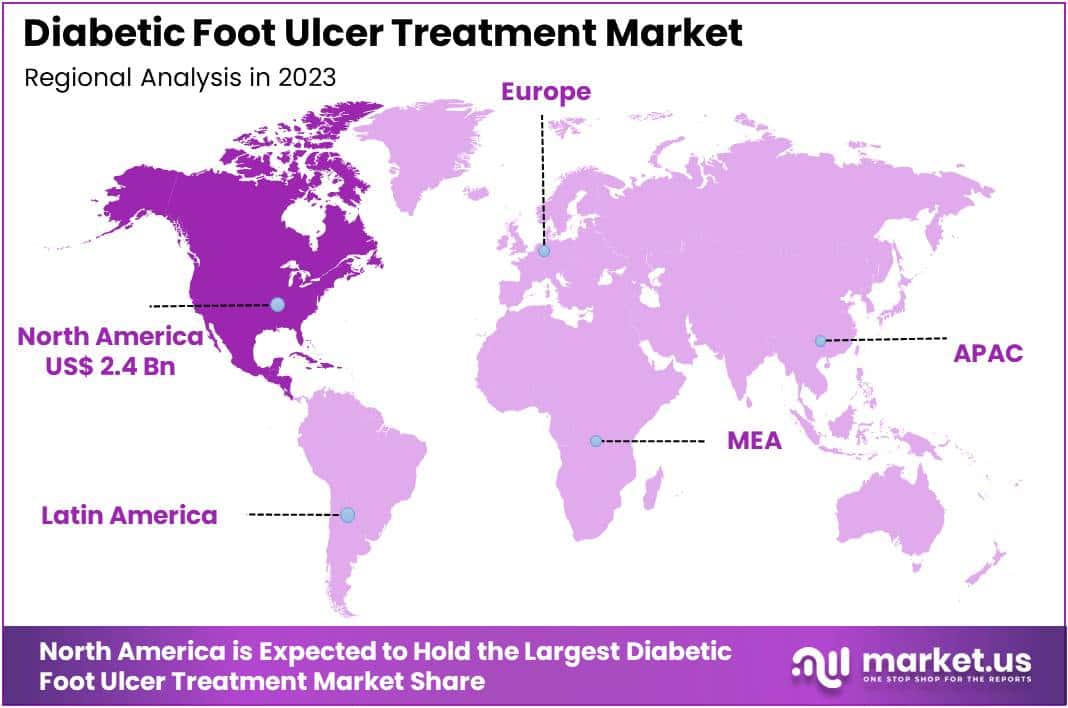

- North America maintained its leading position in the global market with a share of over 38% of the total revenue.

Treatment Type Analysis

The market is fragmented by treatment type into wound-care dressings, wound-care devices, active therapies, and others. Wound-care dressings dominated the global diabetic foot ulcer treatment market, capturing a significant market share of 42% in 2023.

Wound-care dressings have emerged as the dominant segment in the global diabetic foot ulcer (DFU) treatment market due to their critical role in managing wound healing. These dressings, including hydrocolloids, alginates, and foam dressings, provide an optimal moist environment that promotes faster healing, protects the wound from external contaminants, and manages exudate effectively.

The widespread adoption of wound-care dressings is attributed to their affordability, ease of use, and availability across healthcare settings. They are often the first line of treatment in DFU management, making them a preferred choice among healthcare professionals.

Ulcer Type Analysis

Based on the ulcer type, the market fractionates into neuro-ischemic ulcers, neuropathic ulcers and ischemic ulcers. An indispensable role is performed by the neuro-ischemic ulcers segment apprehending a large market revenue share of 53% in the year 2023.

The neuro-ischemic ulcers segment dominates the global diabetic foot ulcer (DFU) treatment market due to the high prevalence of this ulcer type among diabetic patients. Neuro-ischemic ulcers result from a combination of peripheral neuropathy and ischemia, conditions commonly associated with long-term diabetes. These ulcers are particularly challenging to treat due to reduced blood flow and loss of protective sensation, which increases the risk of infection and delays wound healing.

The dominance of this segment is driven by the growing diabetic population and the rising incidence of comorbidities such as peripheral arterial disease (PAD). Treatment often requires a multidisciplinary approach, including advanced wound-care products, revascularization procedures, and infection management.

End-user Analysis

Based on end users, the market fractionates into hospitals & clinics, ambulatory surgical centers and home care settings. Amongst these, hospitals & clinics dominated the global Diabetic Foot Ulcer Treatment market capturing a significant market share of 43% in 2023.

The hospitals and clinics segment dominates the global diabetic foot ulcer (DFU) treatment market, driven by the comprehensive care provided in these settings. Hospitals and clinics serve as primary treatment centers for DFUs, offering a wide range of services, including advanced wound care, surgical interventions, and infection management.

The dominance of this segment is attributed to the availability of specialized healthcare professionals, such as podiatrists and vascular surgeons, as well as access to advanced diagnostic tools and therapeutic technologies. These facilities are equipped to handle complex cases, including those requiring revascularization or amputation prevention.

Key Segments Analysis

By Treatment Type

- Wound-care Dressings

- Antimicrobial Dressings

- Foam Dressings

- Film Dressings

- Alginate Dressings

- Hydrogel Dressings

- Other Dressings

- Wound-care Devices

- Negative Pressure Wound Therapy (NPWT)

- Ultrasound Therapy

- Hyperbaric Oxygen Therapy (HBOT)

- Others

- Active Therapies

- Skin Grafts & Substitutes

- Growth Factors

- Others

- Others

By Ulcer Type

- Neuropathic Ulcers

- Ischemic Ulcers

- Neuro-ischemic Ulcers

By End-user

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Homecare Settings

Drivers

Rising Prevalence of Diabetic Foot Ulcer

The rising prevalence of diabetic foot ulcers (DFUs) is a significant driver of growth in the global diabetic foot ulcer treatment market. DFUs are one of the most common and severe complications of diabetes, affecting approximately 15-25% of diabetic patients during their lifetime.

The increasing global burden of diabetes, fuelled by ageing populations, sedentary lifestyles, and unhealthy diets, has led to a corresponding rise in DFU cases. This growing prevalence underscores the urgent need for effective DFU management, driving demand for advanced wound-care products, therapies, and specialized healthcare services.

Furthermore, DFUs are associated with high morbidity and economic costs, including prolonged hospital stays and increased risk of amputations, amplifying the necessity for innovative treatment solutions.

- For instance, according to an article published by the International Wound Journal in 2023, the prevalence of diabetic foot ulcers is 6.3% as per the rare studies investigating its global epidemiology.

Restraints

High Cost of Treatment and Longer Duration of Recovery Period

The growth of the global diabetic foot ulcer (DFU) treatment market is significantly restricted by the high cost of treatment and the extended recovery period associated with DFUs. Advanced wound-care products, such as bioengineered skin substitutes and negative pressure wound therapy devices, are often expensive, limiting their accessibility, particularly in low- and middle-income regions.

Moreover, the long duration of treatment required for DFUs, which can span weeks or even months, further exacerbates the financial burden on patients and healthcare systems. This prolonged recovery period not only increases healthcare costs but also reduces patient compliance and contributes to poor clinical outcomes, including a higher risk of complications and amputations.

- For example, a 2023 article published in the Journal of Wound Care reported that a stage 4 diabetic foot ulcer requires an average of 190 days to heal.

Opportunities

Technological Advancements

Technological advancements are creating significant growth opportunities in the diabetic foot ulcer (DFU) treatment market. Innovations such as bioengineered skin substitutes, advanced wound dressings with antimicrobial properties, and negative pressure wound therapy (NPWT) have revolutionized DFU management by enhancing healing outcomes and reducing recovery times.

Additionally, the integration of digital health technologies, including telemedicine and remote monitoring devices, allows for continuous patient monitoring and early intervention, improving treatment efficacy and reducing the risk of complications. Advanced imaging techniques, such as thermography and AI-driven diagnostics, aid in early detection and precise assessment of DFUs, facilitating timely and targeted interventions.

- For instance, in April 2024, Smith+Nephew launched the RENASYS EDGE NPWT system, a lightweight, compact device designed for home care used to treat chronic wounds, including diabetic foot ulcers.

- For instance, in December 2023, Varco Leg Care introduced Ulser Soothe Max, a product specifically designed to help individuals suffering from foot ulcers, including those caused by varicose veins and diabetes.

Impact of Macroeconomic Factors / Geopolitical Factors

The Diabetic Foot Ulcer (DFU) Treatment Market is significantly influenced by macroeconomic and geopolitical factors. Economic downturns, inflation, and fluctuating healthcare budgets can limit patient access to advanced DFU therapies, particularly in low- and middle-income countries.

Conversely, economic growth and increased healthcare spending facilitate market expansion. Geopolitical instability, including conflicts and trade restrictions, disrupts supply chains, affecting the availability of critical treatment products like dressings, wound care devices, and biologics. Regulatory changes and sanctions in certain regions can delay product approvals and market entry.

Trends

Embracing Technology and Collaboration for Enhanced Care

The diabetic foot ulcer (DFU) treatment market is experiencing notable advancements. A significant trend is the shift from traditional wound care to advanced therapies, including antimicrobial dressings, negative pressure wound therapy (NPWT), and hyperbaric oxygen therapy, which enhance healing outcomes.

Technological innovations, such as plasma-activated hydrogel dressings, are emerging to address antibiotic-resistant pathogens in DFU treatment. The increasing prevalence of diabetes globally is driving demand for effective DFU management solutions. Additionally, strategic collaborations and investments by key industry players are accelerating the development and commercialization of novel treatment modalities.

These trends collectively contribute to the market’s growth and the improvement of patient care in DFU management.

Regional Analysis

North America, dominated the global diabetic foot ulcer treatment market with a revenue share of 38% commanding the in the year 2023. The region’s high prevalence of diabetes, particularly in the United States, significantly contributes to the demand for advanced DFU therapies.

Additionally, North America benefits from a well-established healthcare infrastructure, enabling widespread adoption of innovative treatments such as negative pressure wound therapy (NPWT), skin substitutes, and growth factors. The presence of key market players and continuous investments in research and development further bolster market dominance.

Moreover, strong reimbursement policies and growing awareness of diabetic foot complications among patients and healthcare professionals support market growth. Additionally, the increasing collaborations and rising awareness programs in the region to launch advanced treatments for DFU are expected to boost the region’s growth in the market.

- For instance, in June 2023, Siksika Health Services collaborated with Orpyx Medical Technologies and GMAK Consulting to initiate another pilot program aimed at improving foot health and decreasing the incidence of diabetic foot ulcers among Siksika Nation members with type 2 diabetes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

ConvaTec Group Plc is a significant contributor to the diabetic foot ulcer treatment market. They offer advanced wound care solutions tailored to manage moisture and prevent infections, enhancing healing processes. Their commitment to patient comfort and swift recovery makes them a trusted brand in the sector.

Acelity L.P., Inc. and 3M Health Care are also pivotal in shaping the market. Acelity is noted for its tailored solutions for severe ulcers, utilizing dressings and therapy systems vital for complex wound management. Meanwhile, 3M provides innovative products that merge technology with practicality, focusing on infection control and promoting a moist healing environment, backed by substantial research.

Coloplast Corp. and Smith & Nephew Plc focus on user-friendly and effective treatments. Coloplast prioritizes gentle care products that enhance patient comfort during the healing process. On the other hand, Smith & Nephew are pioneers in developing dressings that tackle the underlying causes of wound complications, striving to shorten healing times and elevate patient life quality. Additional market players, including startups, enrich the sector by introducing specialized and innovative wound care solutions.

Top Key Players in the Diabetic Foot Ulcer Treatment Market

- ConvaTec, Group Plc

- Acelity L.P., Inc.

- 3M Health Care

- Coloplast Corp.

- Smith & Nephew Plc

- B Braun Melsungen AG

- Medline Industries, LP.

- Molnlycke Health Care AB

- Medtronic Plc

- Essity Aktiebolag (publ).

- Integra LifeSciences

Recent Developments

- In April 2024: Smith+Nephew announced that the U.K. National Institute for Health and Care Excellence (NICE) reviewed the PICO Single Use Negative Pressure Wound Therapy System (sNPWT). NICE found that it provides better clinical outcomes than standard dressings to reduce the risk of surgical site infection.

- In March 2024: The U.S. FDA approved Convatec Inc.’s new medical device, InnovaBurn. This placental extracellular matrix device is specially designed for treating complex surgical wounds and burns, including partial thickness second-degree burns. It is also applicable for diabetic ulcers, enhancing the company’s product range.

- In August 2023: 3M introduced the 3M Veraflo Cleanse Choice Complete Dressing Kit alongside a software update for their 3M V.A.C. Ulta Therapy Unit. This launch aims to enhance the administration of Veraflo therapy for patients, providing more advanced and effective treatment options.

Report Scope

Report Features Description Market Value (2023) US$ 6.4 billion Forecast Revenue (2033) US$ 11.6 billion CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2019-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Wound-care Dressings, Wound-care Devices, Active Therapies, Others), By Ulcer Type (Neuropathic Ulcers, Ischemic Ulcers, and Neuro-ischemic Ulcers), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Homecare Settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ConvaTec, Group Plc, Acelity L.P., Inc., 3M Health Care, Coloplast Corp., Smith & Nephew Plc., B Braun Melsungen AG, Medline Industries, LP., Molnlycke Health Care AB, Medtronic Plc, Essity Aktiebolag (publ)., and Integra LifeSciences. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diabetic Foot Ulcer Treatment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Diabetic Foot Ulcer Treatment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ConvaTec, Group Plc

- Acelity L.P., Inc.

- 3M Health Care

- Coloplast Corp.

- Smith & Nephew Plc

- B Braun Melsungen AG

- Medline Industries, LP.

- Molnlycke Health Care AB

- Medtronic Plc

- Essity Aktiebolag (publ).

- Integra LifeSciences