Global Dermatophytic Onychomycosis Treatment Market By Product (Nail Paint and Tablets), By Type (OTC and RX,) By Route Of Administration (Topical and Oral), By Distribution Channel (Healthcare, Hospitality, Commercial, Institutional, Transportation, Industrial, Remediation & Restoration, and Household), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 95278

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

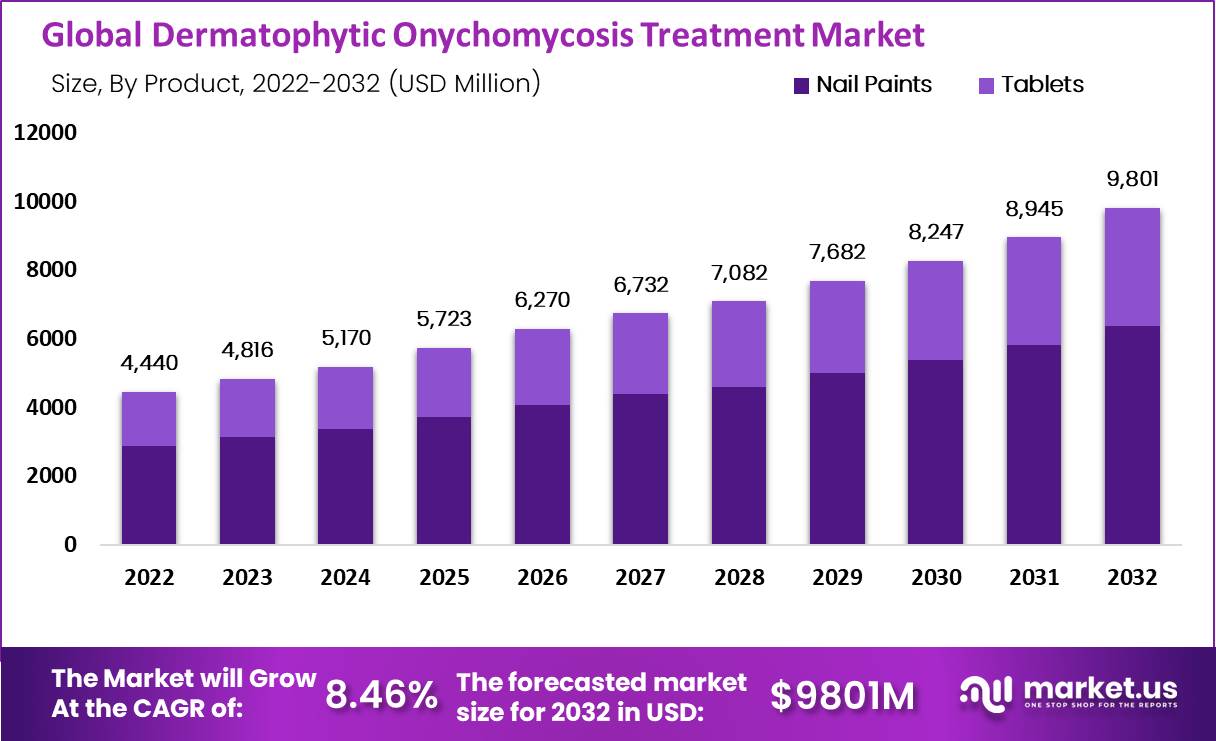

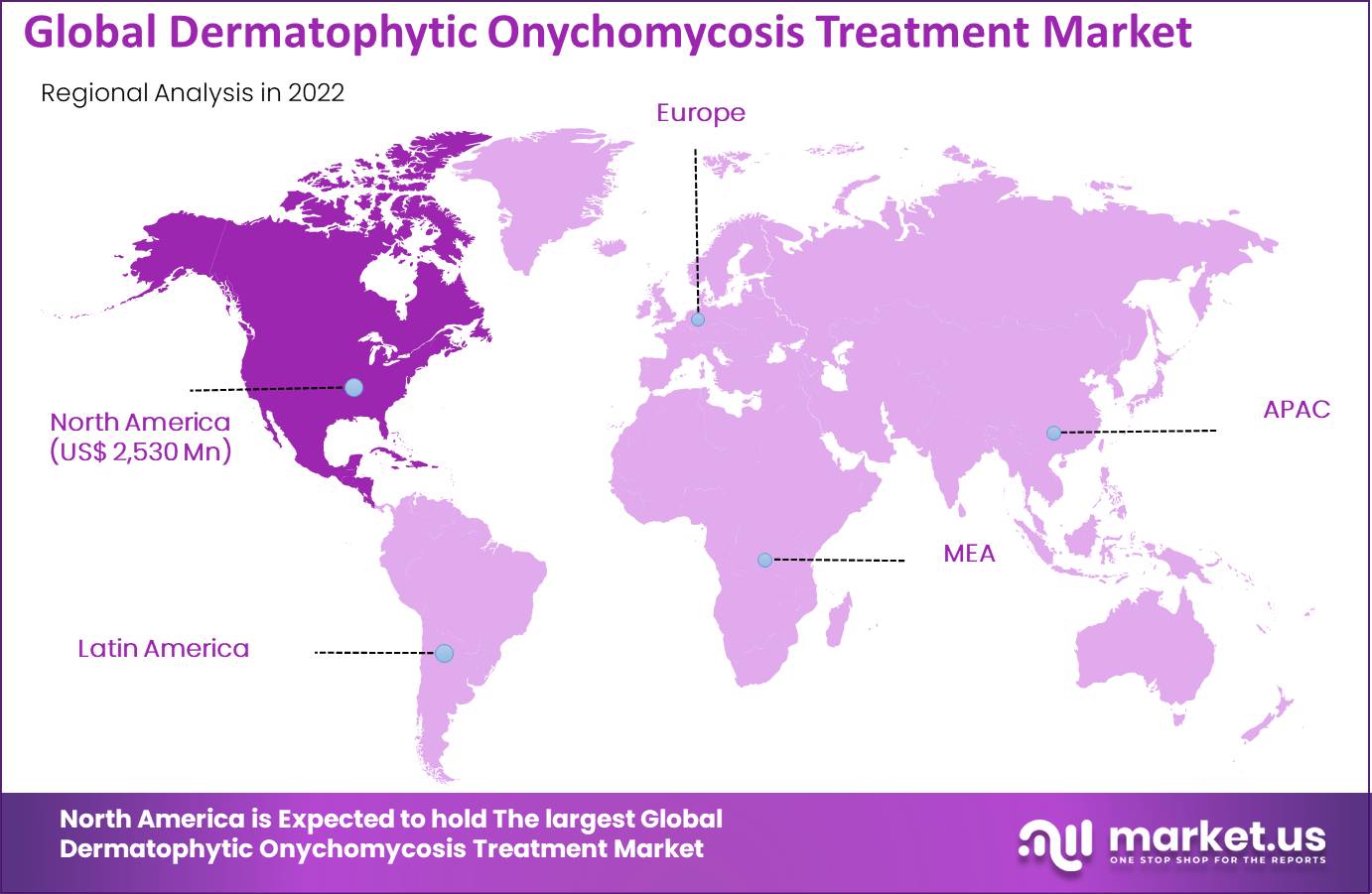

The global dermatophytic onychomycosis treatment market size is expected to be worth around USD 9,801 million by 2032 from USD 4,440 million in 2022, growing at a CAGR of 8.46% during the forecast period from 2023 to 2032. North America held a dominant market position, capturing more than a 56% share and holds US$ 2530 Million market value for the year.

This is despite the rising incidence of diabetes and chronic nail fungus infections. The world is in a tense situation due to the emergence of the coronavirus. The world is in a state of emergency due to this health crisis. There is a silver lining to this dire situation: the new regulations and the nation’s commitment to fighting this deadly disease.

Many industries are struggling to recover from this disaster. The global onychomycosis market is expected to grow at 8.46% between 2022 and 2232. This is due to diabetes’ increasing prevalence around the world. Toenail fungus is a common problem in diabetic patients.

Key Takeaways

- Market Growth: The market is set to grow at a CAGR of 8.46%, reaching USD 9,801 million by 2032 from USD 4,440 million in 2022.

- Prevalence Factor: Onychomycosis affects 10% of the global population, with around 35-40 million Americans impacted, driving market growth.

- Water-Soluble Treatments: Availability of water-soluble antifungal treatments boosts market expansion.

- New Medication Approvals: Regulatory approvals, like Jublia, are expected to significantly impact market size and growth.

- Lack of Awareness: Limited awareness and knowledge about the condition hinder market growth.

- Treatment Side Effects: Potential side effects of drugs negatively affect the market.

- Innovative Therapeutics: Investment in R&D for advanced treatments drives market demand.

- Government Awareness: Government campaigns raise awareness and contribute to regional market development.

- North America: The largest market with a CAGR of 7.0% from 2023-2032. The U.S. leads in market development, with increased research and clinical trials by companies like Pfizer Inc.

- Europe: Expected to grow at a CAGR of 5.0%, with the UK and the U.S. playing a significant role in regional market development due to government awareness campaigns.

- Asia Pacific: Experiencing the highest market growth, with contributions from developing countries in advancing healthcare services. Initiatives, such as the launch of Jublia in Hong Kong, drive market opportunities in this region.

Product Analysis

Nail Paints Generate the Maximum Revenue and Increasing Prescription for Jublia.

The market can be divided into two segments based on product type: nail paints and tablets. The market is expected to be dominated by nail paints during the forecast period. The segment will be boosted by the increasing use of topical nail paints as compared to oral antifungal drugs and increased uptake of Jublia.

The nail paints market has seen a decline in sales, particularly in Japan, due to the COVID-19 pandemic. Owing to increasing government efforts to switch from generic drugs to tablets, the tablet segment will grow. Additionally, griseofulvin and terbinafine are the gold standard for oral drugs used in the treatment of dermatophytic ophthalmis. This will likely favor tablets during the forecast period.

Route of Administration Analysis

Significant growth of topical segment due to increasing R & D

The market can be divided into topical and oral based on the mode of administration. In 2022, the largest market share was held by the topical segment. The growth of tablets is expected to be accelerated by increased research into the development of topical medications.

Oral medications are more effective than topical treatments due to their higher penetration and greater efficacy. This is why the segment has seen a significant increase in growth over the forecast period. The oral segment’s revenue is expected to decrease in 2020-2021, however, since most oral antifungals are only available through prescription.

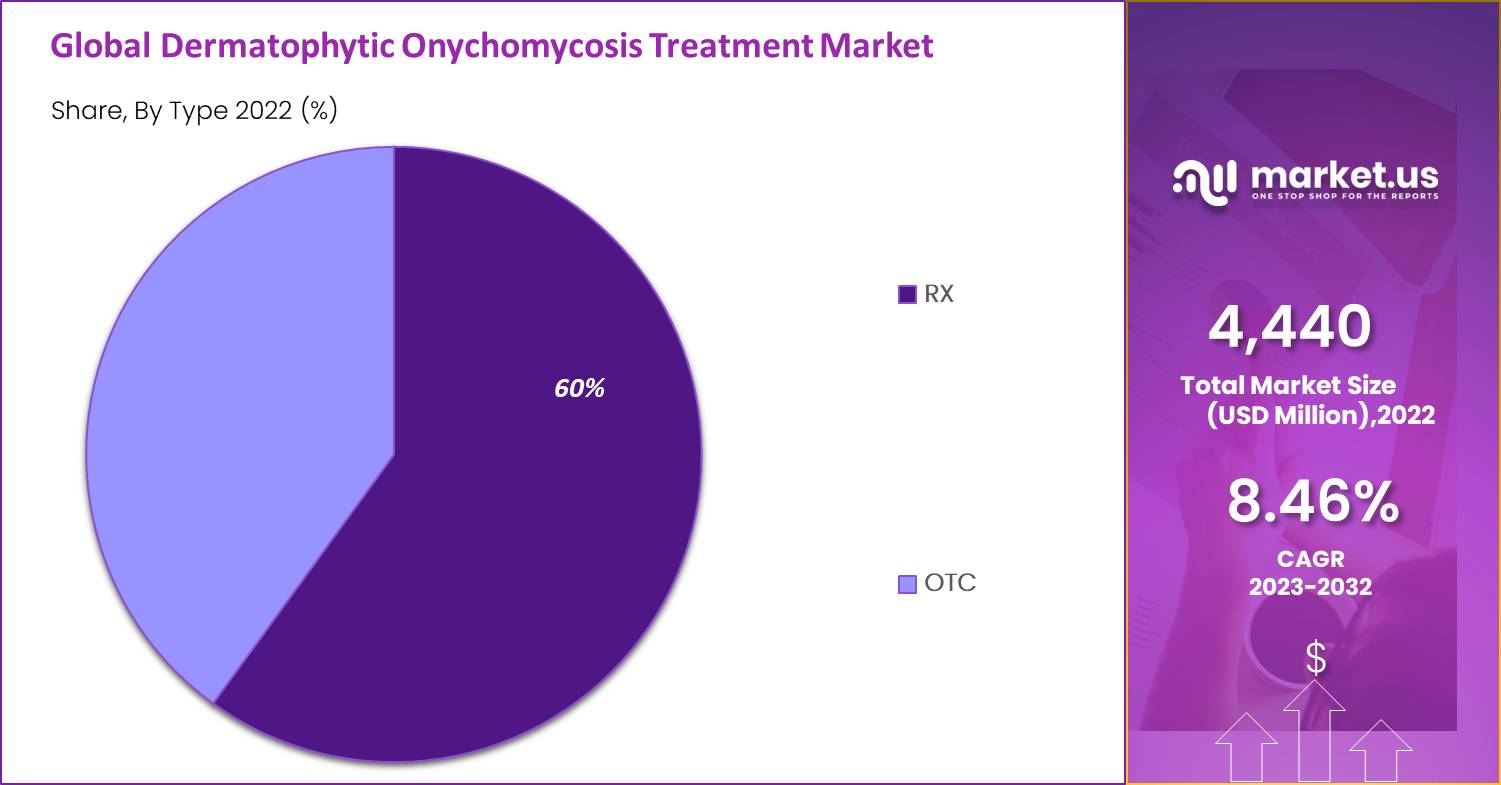

Type Analysis

OTC segment is dominating the market

The market can be divided into two types based on its type: over-the-counter and prescribed. The main factors driving the growth of the prescribed segment are favorable health reimbursement, a growing number of podiatrists and a rising prevalence of onchomycosis.

The prescribed segment has been negatively affected by decreased hospital visits and a government decision to close non-emergency OPDs at hospitals. OTC dominated the market, primarily due to the shift towards nail polishes and the increasing sales of ciclopirox for treatment of omchomycosis.

Distribution Channel Analysis

The retail pharmacies segment is the largest and generates the most revenue due to the growing sales of over-the-counter drugs and the increasing prevalence of conditions such as diabetes and fungal nail infections.

In terms of distribution channel analysis, major factors of the market for a certain product or service is divided into main segments: Hospital segment, Dermatology and pediatric Clinics, Retail Pharmacies, Mail Order Pharmacies and Online Sales, and Drug Stores and other additional segment.

However, the hospitals and clinics segment is also expected to grow, particularly as a result of the COVID-19 pandemic, as more people are seeking medical treatment and care in these settings. Additionally, the online channels segment is also expected to see significant growth during the forecast period, as more consumers turn to online pharmacies for their medicine needs.

Key Market Segments

Based on Product

- Nail Paints

- Tablets

Based on Type

- RX

- OTC

Based on Route of Administration

- Topical

- Oral

Based on Distribution Channel

- Hospitals

- Dermatology and pediatric Clinics

- Retail Pharmacies

- Mail Order Pharmacies and Online Sales

- Drug Stores

Drivers

Rising Prevalence of dermatophyte and onychomycosis to drive the market

According to the analysis, the growing preference for topical treatments is expected to play an important role in the development of the market over the forecast period. A survey of dermatologists and podiatrists was conducted in the US. Seven out of ten doctors opted not to prescribe oral terbinafine because of the potential liver damage.

Onychomycosis, which is a growing problem in the toenail area, is another factor that has contributed to market growth. According to a study, around 10% of the global population is affected by onychomycosis. 35-40 million Americans are infected. This will likely favor market growth.

The market is also being driven by the growing geriatric population

This group is more susceptible to chronic diseases like circulatory disorders and has a weaker immune system. Due to increased exposure to public pools and the use of tight, contaminated, or soiled clothing, shoes, and socks, onychomycosis has become a major problem among adults and millennials.

Availability of water-soluble antifungal treatments

The market is also seeing rapid growth due to the availability of water-soluble antifungal treatments that can be administered orally. They prevent secondary bacterial infections and inhibit the growth of fungus. The market is expected to grow due to other factors such as the widespread use of nail polishes and ointments for nail hygiene and the improvements in healthcare infrastructure.

Increasing approval of medication by regulatory authorities

Market size is expected to increase significantly due to the increasing approval of medication by regulatory authorities. Bausch Health Companies Inc., and their dermatology company, Ortho Dermatologics, gain FDA approval in 2020 for a subject Supplemental New Drug Application (SNDA) for Jublia topical solution (10%) to treat onychomycosis (fungal infection of your toenails). These factors will be beneficial to the market over the forecast period.

Restraints

Lack of information and knowledge about the dermatophytic onychomycosis condition

One of the major obstacles impacting the market growth for onychomycosis treatment is the lack of knowledge and awareness among individuals regarding the condition. Many people tend to overlook or ignore the common symptoms, such as discoloration, thickening, and separation of the nails from the nail bed, which can lead to undiagnosed cases.

Additionally, reluctance to seek treatment due to lack of awareness also contributes to the market’s decline. Another factor hindering the market is the potential side effects of the treatment drugs. These factors are expected to show adverse effect to negatively impact the market in the forecast period.

Opportunity Analysis

The government’s increasing awareness campaigns can be credited with the development of the regional marketplace and boost the market growth

Over the past eight years, the global market for condition dermatophytic omycosis therapeutics has growing fast at a CAGR 10.3%. Dermatophytic Onychomycois is a very common nail associated disorder, causes the nail to be removed from their nail bed. Nearly half size of all nail deformities are caused by a fungal infection criterion. Onychomycosis is a common condition in over 10% people, but it is more happened in older adults. Over 20% is the most common in compared to those over 60 years old and 50% for those above 70 years.

The condition called Peripheral immunologic disorders, diabetes mellitus, and vascular diseases are the main causes of high rate among adults. Onychomycosis risk is 1.9% higher in diabetic patients than compared to the general population. In patients with human immunodeficiency viruse infection, the affecting rate is 15% to 40. The prevalence of dermatophytic mycosis in the Asian countries is around growth rate 4%-5%, comparison between 10% to 12 in North America and up to 17% for some European countries.

Trends

Innovative and upcoming launches increase the investment and demand for this condition

Due to the increasing prevalence of the disease, pharmaceutical companies have invested significant amounts in R&D in order to develop new therapeutics. Many available topical treatments do not penetrate deeply into the nail bed, so they cannot cure the condition completely. Diverse players have made significant investments in order to develop new drugs to address the increasing demand for this condition. Hexima, for instance, is currently conducting a phase I/IIa clinical trial on HXP124.

This plant defensing antifungal molecule is used in the treatment of dermatophytes. HXP124 had a higher penetration rate than Jublia or Kerydin. These factors will provide remunerative expansion opportunities in the future. Hallux, an American-based player, completed a US$ 7.1 million Series A which will enable it to conduct Phase II clinical studies of its drug/device combination for onychomycosis.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 56% share and holds US$ 2530 Million market value for the year.

The market analysis shows that the North America market size onychomycosis market is likely to be the largest in the global market over the forecast period. From 2023-2032, the region will experience a CAGR between and 7.0%. In the assessment period, the U.S. is expected to make the largest contribution to the development of the industry. The increasing number of players who study the disease can explain the dominance of the regional market.

Pfizer Inc., for instance, announced in October 2020 that it had begun clinical trials on onychomycosis. The first phase was focused on determining if the AN2690 topical treatment is effective in treating onychomycosis. Open-label studies were conducted to determine the safety and pharmacokinetics for the tavaborole topical solution at 5% to treat distal onychomycosis (tongue disease) in children and adolescents. The increasing prevalence of diabetes is another factor that has contributed to market growth.

According to the CDC, 1 in 10 American diabetes. 37.3 million Americans have it. These stats will be of benefit to the market during the forecast period. According to the study, the European onychomycosis market will grow at a CAGR 5.0% over the forecast period. The United Kingdom and The U.S. market share analysis is expected to play a major role in developing the region market over the forecast period. The government’s increasing awareness campaigns can be credited with the development of the regional marketplace. The British Association of Dermatologists provides patient information leaflets on fungal infections of nails.

These factors will be beneficial to the Europe market size of onychomycosis over the forecast period. According to the study Asia Pacific will experience the highest market growth over the forecast period. This rapid growth of the region’s market can be attributed in part to the contributions of many developing countries to the advancement and improvement of healthcare services. In 2020, Kaken Pharmaceuticals Co. Ltd. announced the launch Jublia in Hong Kong for dermatophytic mycosis treatment. These initiatives will be a driving force in APAC’s market opportunities during the forecast period.

Key Regions

North America

- The US

- Canada

- Mexico

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the high incidence of dermatophytic mycosis in North America and the growing geriatric population, North America will be the dominant region in the global dermatophytic omycosis treatment market attractiveness analysis and opportunities.

Emerging key players and their key factors are focused on a variety of strategic policies to develop their respective businesses in foreign markets. November 2021 was the day Sanofi made the announcement of the acquisition of Kadmon Holdings. This acquisition will further enhance the portfolio’s growth and expansion. Sanofi completed its acquisition of Kadmon by merging a wholly-owned subsidiary of Sanofi with Kadmon.

This was in accordance with Section 251 of Delaware’s General Corporation Law. Kadmon will continue to be the surviving corporation while Sanofi will become an indirect, wholly–owned subsidiary. The Centre for Disease Control and Prevention and adverse event estimates that nail fungus, or dermatophytic mycosis, affects approximately 26 million Americans each year. To expand their market analysis reach and address the limitations of current therapies to treat dermatophytic mycosis, major players are creating new products.

The company such as Bausch Health and Pfizer are holding the Leading Positioning the Market

Bausch Health held the largest market share in terms of dermatophytic omycosis drug market revenue owing to Jublia’s higher sales. In 2019, Jublia earned a total revenue of US$ 110.0 Mn. It has a cure rate of between 15-18%, which is higher than other nail lacquers. The company’s dominant share is due to this and Jublia’s favorable reimbursement. Pfizer ranks second on the market due to increasing demand for Kerydin. Both companies’ market shares are expected to fall due to the loss of Jublia’s patent and the economic crisis caused by COVID-19.

Listed below are some of the most prominent Dermatophytic Onychomycosis Treatment market players.

Market Key Players

- Bausch Health Companies

- Celtic Pharma

- Galderma S.A.

- Johnson & Johnson

- Anacor pharmaceuticals Inc.

- Pfizer Inc.

- GlaxoSmithKline Plc

- Novartis AG

- Topica Pharmaceuticals Inc.

- Bayer AG

- Moberg Pharma AB

- Allergen Inc.

- Cipla Ltd

- Reddy’s Laboratories Ltd

- Sanofi S.A.

- Merz Pharma.

- Medimetriks Pharmaceuticals Inc.

- NovaBiotics Inc.

- ZimVie Inc.

- Wieland Dental

- Teva Pharmaceutical Industries Ltd.

- Cardinal Health Inc.

- Zimmer Biomet

- Lumenis Ltd

- Blueberry Therapeutics

- Viatris Inc.

- Valeant Pharmaceuticals International Inc.

- Almirall S.A.

- Other players.

Recent Development

- In December 2021, Pfizer Inc. and Arena Pharmaceuticals Inc. have announced an agreement whereby Pfizer will acquire Arena, which is a clinical-stage company that develops innovative therapies for a variety of immuno-inflammatory diseases. In addition, several key players are now focusing on different marketing strategies and market dynamics such as spreading awareness about natural ingredients, which is boosting the target products’ growth. Future insights into the industry.

- In 2014 approval for Efinaconazole, a topical product for dermatophytic mycosis of Valeant Pharmaceuticals received a Food and Drug Administration (FDA).

Report Scope

Report Features Description Market Value (2022) USD 4,440 Mn Forecast Revenue (2032) USD 9,801 Mn CAGR (2023-2032) 8.46% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Product- Nail Paints and Tablets; Based on Product- RX and OTC; Based on Route of Administration- Topical and Oral; and Based on Distribution Channel- Hospitals, Dermatology and pediatric Clinics, Retail Pharmacies, Mail Order Pharmacies and Online Sales, and Drug Stores Regional Analysis North America – The US, Canada, Mexico; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Eastern Europe – Russia, Poland, The Czech Republic, Greece Rest of Eastern Europe; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA. Competitive Landscape Bausch Health Companies, Celtic Pharma, Galderma S.A., Johnson & Johnson, Anacor pharmaceuticals, Inc., Pfizer Inc., GlaxoSmithKline Plc, Novartis AG, Topica Pharmaceuticals, Inc., Bayer AG, Moberg Pharma AB, Allergen, Inc., Cipla Ltd, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dermatophytic Onychomycosis Treatment MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Dermatophytic Onychomycosis Treatment MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Bausch Health Companies

- Celtic Pharma

- Galderma S.A.

- Johnson & Johnson

- Anacor pharmaceuticals Inc.

- Pfizer Inc.

- GlaxoSmithKline Plc

- Novartis AG

- Topica Pharmaceuticals Inc.

- Bayer AG

- Moberg Pharma AB

- Allergen Inc.

- Cipla Ltd

- Reddy’s Laboratories Ltd

- Sanofi S.A.

- Merz Pharma.

- Medimetriks Pharmaceuticals Inc.

- NovaBiotics Inc.

- ZimVie Inc.

- Wieland Dental

- Teva Pharmaceutical Industries Ltd.

- Cardinal Health Inc.

- Zimmer Biomet

- Lumenis Ltd

- Blueberry Therapeutics

- Viatris Inc.

- Valeant Pharmaceuticals International Inc.

- Almirall S.A.

- Other players.