Global Dental Services Market Analysis By Type (Dental Implants, Orthodontics, Periodontics, Endodontics, Cosmetic Dentistry, Laser Dentistry, Dentures, Oral & Maxillofacial Surgery, Others), By End-use (Hospitals, Dental Clinics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 60995

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

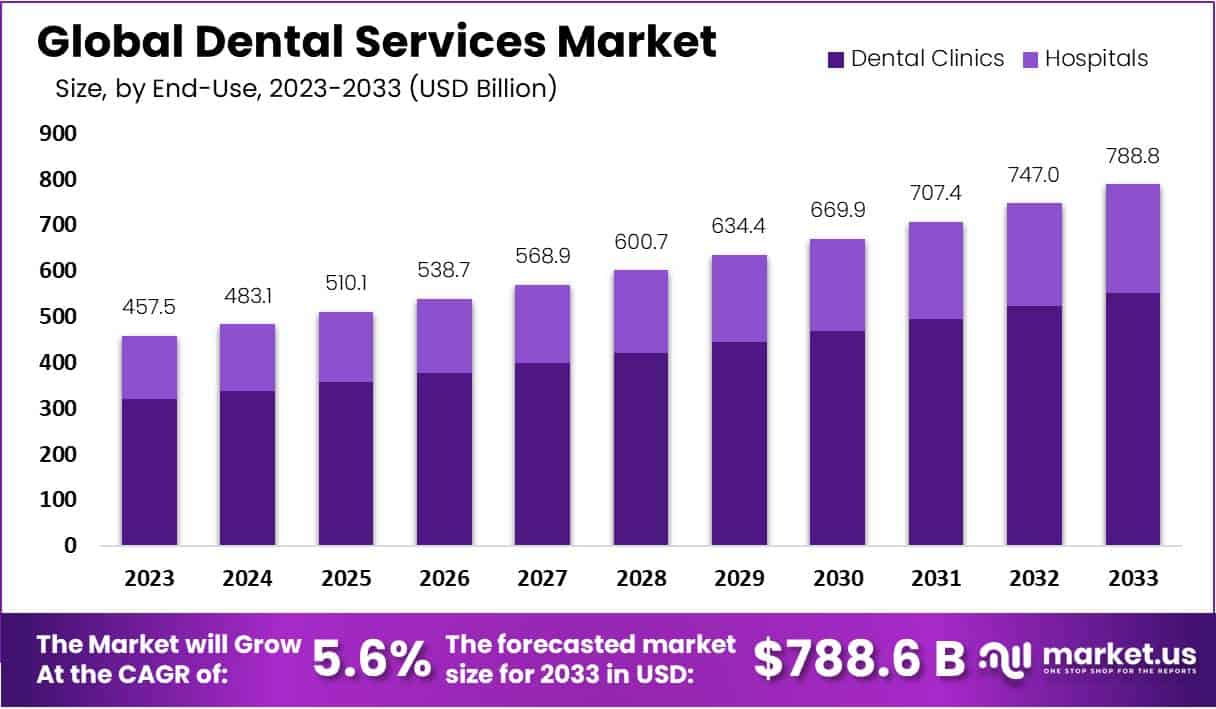

The Dental Services Market Size is projected to show significant growth, with an anticipated value of approximately USD 788.8 billion by the year 2033, compared to the recorded USD 457.5 billion in 2023. This represents a steady Compound Annual Growth Rate (CAGR) of 5.6% expected during the forecast period spanning from 2024 to 2033.

Dental services encompass a comprehensive range of healthcare provisions dedicated to preserving oral health and addressing dental concerns. Offered by skilled professionals, including dentists, dental hygienists, and technicians, these services cover preventive care like routine check-ups and cleanings, along with diagnostic measures such as X-rays. Restorative dentistry, a critical component, involves the identification and management of oral diseases, employing procedures like fillings and crowns.

Orthodontic services focus on correcting misaligned teeth using methods like braces, aligners, and more. Additionally, dental care extends to periodontal treatments, oral surgery procedures, cosmetic enhancements, and specialized pediatric dentistry, ensuring a holistic approach to oral well-being. Regular dental check-ups contribute significantly to overall health by facilitating early issue detection and prevention, underscoring the interconnection between oral and systemic health.

The dental services market has witnessed sustained growth driven by factors such as an aging population, increased oral health awareness, and advancements in dental technology. Digital dentistry and CAD/CAM have enhanced diagnostic and treatment capabilities, while dental implants and cosmetic procedures like teeth whitening have gained popularity.

The industry is closely linked to oral care products, with toothpaste and mouthwash demand reflecting oral hygiene awareness. Regulatory standards and licensing ensure procedure quality, and the availability of dental insurance influences service utilization. The global market varies based on regional demographics, economic conditions, and healthcare infrastructure. The COVID-19 pandemic impacted the sector, fostering the adoption of tele-dentistry for remote consultations.

Key Takeaways

- Market Growth Projection: Dental Services Market anticipates a robust growth from USD 457.5 billion in 2023 to an estimated USD 788.8 billion by 2033, reflecting a steady 5.6% CAGR.

- Type Dominant: In 2023, Dental Implants secured over 23% market share, leading as the most significant segment in the dental services landscape.

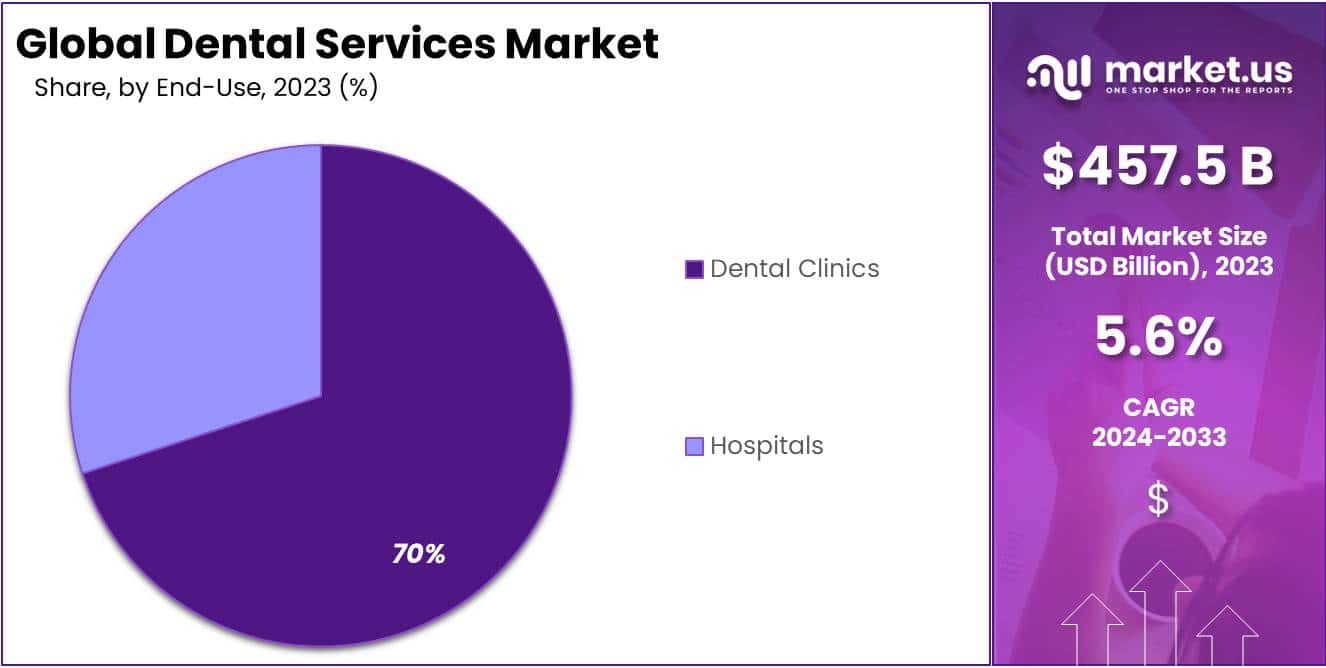

- End-Use Dominant: Dental Clinics emerged as the market leader in 2023, commanding over 70% share, highlighting their pivotal role in routine oral healthcare.

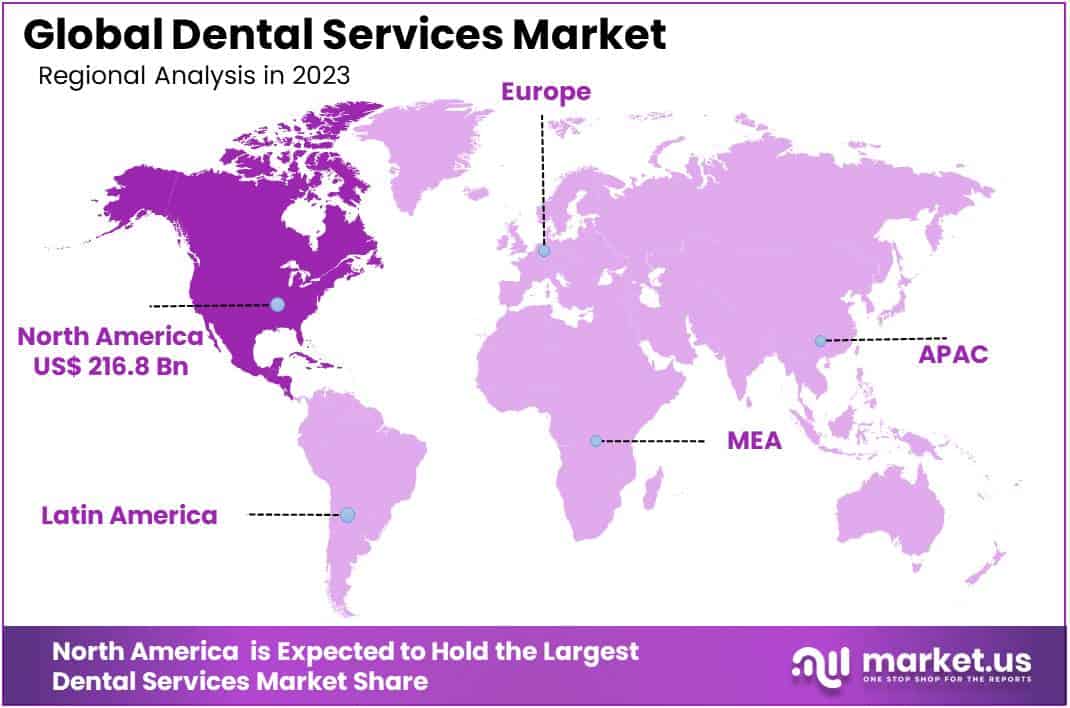

- Regional Supremacy: North America dominated the market in 2023, holding a commanding 47.4% share with a substantial value of USD 216.8 billion.

- Technological Advancements: Adoption of digital dentistry and CAD/CAM systems is driving technological innovations, enhancing treatment outcomes, and attracting a growing patient base.

- Growing Aging Population: The global aging demographic contributes to increased demand for dental services, aligning with a rise in comprehensive oral healthcare needs.

- Insurance Impact: Expanding dental insurance coverage positively influences market growth, making dental services more affordable and encouraging regular check-ups.

- Opportunity: Integration of tele-dentistry presents a significant growth opportunity, allowing remote consultations and expanding access to dental care.

- Market Restraint: High costs of certain dental treatments pose a significant barrier, limiting accessibility, especially for those without adequate insurance coverage.

- Key Trend : Increasing preference for minimally invasive dental procedures is notable, driven by patient demand for faster recovery and reduced discomfort.

Type Analysis

In 2023, the dental services market showcased a notable dominance with the Dental Implants segment, securing a leading market share of over 23%. Dental implants are at the forefront, providing a sturdy foundation for replacement teeth and addressing the growing demand for durable and natural-looking solutions.

Orthodontics, another pivotal segment, focuses on correcting teeth misalignment, with a significant market presence. Emphasizing the importance of a straight and aligned smile, orthodontic services have gained popularity, contributing to the overall market landscape.

Periodontics, specializing in the prevention and treatment of gum diseases, emerged as a key player in the dental services market. With a focus on maintaining oral health beyond just teeth, periodontics addresses issues related to gums, ensuring a comprehensive approach to dental care.

Endodontics, dealing with the pulp and nerves inside the tooth, played a crucial role in preserving natural teeth. Root canal treatments and related services under endodontics contributed substantially to the market, offering solutions to alleviate pain and maintain dental integrity.

Cosmetic Dentistry, catering to aesthetic concerns, witnessed a surge in demand as individuals sought procedures to enhance their smiles. Teeth whitening, veneers, and other cosmetic interventions became integral components of the dental services market, emphasizing the significance of appearance in dental care.

Laser Dentistry, with its minimally invasive procedures, carved a niche for itself in the market. The adoption of advanced laser technologies in various dental treatments showcased a commitment to patient comfort and efficient procedures, influencing the overall market dynamics.

Dentures, addressing tooth loss and providing functional solutions, maintained a steady market presence. As a viable option for those seeking removable tooth replacements, dentures contributed to the diverse array of services offered in the dental landscape.

Oral & Maxillofacial Surgery, encompassing a range of surgical procedures, held a crucial position in the market. From wisdom tooth extraction to complex jaw surgeries, this segment played a vital role in ensuring optimal oral health through surgical interventions.

The market also saw the emergence of various other services, contributing collectively to the dynamic dental services landscape. These encompassed a spectrum of offerings, from preventive care to specialized treatments, showcasing the comprehensive nature of the dental services market in meeting diverse patient needs.

End-Use Analysis

In 2023, the Dental Clinics segment emerged as the frontrunner in the dental services market, solidifying its dominance with a commanding share exceeding 70%. This segment, comprising neighborhood dental practices and specialized clinics, witnessed robust growth driven by factors that resonate with accessibility and personalized care.

Dental Clinics, being the primary go-to for routine check-ups, preventive care, and various dental procedures, established themselves as the cornerstone of oral healthcare. Their prominence is buoyed by the convenience they offer, often located within communities and easily accessible for routine visits. Patients find comfort in the personalized attention and familiarity of these clinics, fostering a strong foundation for sustained market leadership.

Hospitals, while a significant player in the dental services landscape, held a noteworthy but comparatively smaller share. In 2023, they constituted the remaining market fraction, serving a crucial role in addressing more complex dental cases and emergencies. Hospitals, with their multidisciplinary approach, cater to a broader spectrum of healthcare needs, positioning themselves as comprehensive healthcare hubs.

The Dental Clinics segment’s ascendancy can be attributed to the evolving preferences of patients seeking a more tailored and approachable dental experience. The convenience of scheduling appointments, shorter waiting times, and a focus on patient-centric care contribute to the sustained growth of this segment.

Looking ahead, the Dental Clinics segment is poised to maintain its stronghold, driven by its ability to provide personalized and community-centric oral healthcare services. As oral health awareness continues to rise, the role of dental clinics as accessible and reliable partners in maintaining dental well-being is expected to further solidify their market dominance.

Key Market Segments

Type

- Dental Implants

- Orthodontics

- Periodontics

- Endodontics

- Cosmetic Dentistry

- Laser Dentistry

- Dentures

- Oral & Maxillofacial Surgery

- Others

End-use

- Hospitals

- Dental Clinics

Drivers

Increasing Awareness and Focus on Oral Health

Growing awareness among the population about the importance of oral health is driving the demand for dental services. Rise in preventive dental care measures, leading to a higher number of regular check-ups and treatments.

Technological Advancements in Dentistry

Adoption of advanced technologies such as digital dentistry, CAD/CAM systems, and laser dentistry is improving treatment outcomes and attracting more patients. Technological innovations are streamlining processes, enhancing diagnostics, and providing more precise treatment options.

Aging Population and Dental Care Needs

The aging population globally is contributing to an increased demand for dental services, as older individuals often require more extensive dental care. Rise in geriatric population with a focus on maintaining oral health is boosting the market.

Expanding Dental Insurance Coverage

Growing access to dental insurance coverage is encouraging people to seek regular dental check-ups and treatments. Improved reimbursement policies are making dental services more affordable, positively impacting market growth.

Restraints

High Treatment Costs

The high cost of certain dental treatments and procedures can be a significant barrier, especially for individuals without adequate insurance coverage. Economic constraints in some regions may limit the affordability of advanced dental services.

Shortage of Skilled Dental Professionals

There is a shortage of skilled and specialized dental professionals in some areas, leading to a gap in service provision. Limited access to quality dental care due to uneven distribution of dental professionals.

Fear and Anxiety Associated with Dental Visits

Dental phobia and anxiety are common reasons for people avoiding dental visits, impacting the overall utilization of dental services. Efforts to address patient fears through innovative approaches are crucial for market expansion.

Impact of COVID-19 Pandemic

Disruptions caused by the COVID-19 pandemic have affected the regular provision of dental services, with lockdowns and safety concerns leading to reduced patient visits. Ongoing challenges related to infection control and maintaining a safe environment for both patients and staff.

Opportunities

Tele-dentistry and Digital Health Solutions

The integration of tele-dentistry and digital health solutions presents a significant growth opportunity, allowing remote consultations and expanding access to dental care. Increasing acceptance of virtual consultations and follow-ups.

Emerging Markets and Untapped Geographies

Expansion into emerging markets and untapped geographies provides opportunities for market players to reach new patient demographics. Rising disposable income in developing regions contributing to increased spending on dental services.

Cosmetic Dentistry and Aesthetic Procedures

Growing demand for cosmetic dentistry and aesthetic procedures offers a lucrative avenue for market growth. Increasing focus on smile enhancement and appearance-driven dental treatments.

Preventive and Personalized Dental Care

The shift towards preventive and personalized dental care creates opportunities for services like preventive screenings, personalized treatment plans, and customized oral health education. Emphasis on patient education and engagement for long-term oral health maintenance.

Trends

Integration of Artificial Intelligence (AI) in Dentistry

The incorporation of AI in diagnostics, treatment planning, and patient management is a key trend, enhancing the efficiency and accuracy of dental services. AI-driven solutions for predictive analytics and treatment outcome assessment.

Focus on Minimally Invasive Procedures

Increasing preference for minimally invasive dental procedures is a notable trend, driven by patient demand for faster recovery and less discomfort. Advancements in materials and technologies supporting minimally invasive treatments.

Green Dentistry Practices

Growing awareness of environmental sustainability is driving the adoption of green dentistry practices, including eco-friendly materials and energy-efficient technologies. Patients showing interest in eco-conscious dental care providers.

Collaboration and Partnerships in the Dental Industry

Collaborations between dental service providers, technology companies, and insurance providers are on the rise, leading to comprehensive and integrated healthcare solutions. Partnerships to enhance the overall patient experience and improve service delivery.

Regional Analysis

In 2023, North America has solidified its dominance in the Dental Services Market, boasting a commanding market position with an impressive 47.4% share and a substantial market value of USD 216.8 billion. This regional supremacy is attributed to various factors that collectively contribute to the thriving dental services sector in North America.

North America stands out as a center for cutting-edge dental technology and innovation. The region consistently embraces the latest advancements in dental services, including digital imaging, CAD/CAM technology, and laser dentistry. This commitment to technological progress not only improves the quality of dental care but also attracts a larger number of patients seeking advanced and efficient treatment options.

The significant market value in North America is closely tied to the region’s robust healthcare expenditure. With a strong healthcare infrastructure and a population that prioritizes dental health, the demand for comprehensive dental services remains consistently high. This inclination for healthcare spending ensures a continuous flow of resources into the dental services sector.

The aging demographic in North America further contributes to the demand for dental services. As the population ages, there is a natural increase in dental issues and the need for specialized care. This demographic trend directly correlates with the expanding market size, as dental services cater to a growing segment of the population with diverse oral healthcare needs.

The prevalent aesthetic consciousness in North America drives a significant demand for cosmetic and aesthetic dentistry services. Patients often seek services such as teeth whitening, veneers, and orthodontic treatments to enhance their smiles. The emphasis on oral aesthetics significantly contributes to the revenue generated within the dental services market in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Dental Services Market is characterized by a blend of private and public sector involvement, technological advancements, and a commitment to making dental care accessible and effective. The collaboration and distinctive strategies employed by the key players contribute to the ongoing evolution of the dental services landscape.

InterDent Inc. plays a crucial role in the market, emphasizing the importance of dental practice partnerships. Their collaborative model involves working closely with dental professionals to enhance the quality of care and operational efficiency. This approach fosters a supportive environment for dentists and contributes to improved patient experiences.

National Health Service England, as a key player, plays a pivotal role in the public healthcare sector. They focus on ensuring access to dental services for the general population, emphasizing preventive care and community outreach. Their initiatives are integral in addressing oral health on a larger scale, aligning with the broader goals of public health.

In addition to these key players, there are various other contributors shaping the Dental Services Market. These may include regional dental care providers, dental product manufacturers, and educational institutions fostering dental professionals. The diversity of players underscores the dynamic nature of the market, with each entity playing a unique role in promoting oral health.

Market Key Players

- Aspen Dental Management Inc.

- InterDent Inc.

- National Health Service England

- The British United Provident Association Limited

- Apollo White Dental

- Abano Healthcare Group Limited

- Coast Dental

- Dental Service Group

- Axis Dental

- Integrated Dental Holdings

- Pacific Dental Service

- Gentle Dental of New England

Recent Developments

- In May 2023, Henry Schein, a global leader in the distribution of dental and medical products and solutions, announced its acquisition of Patterson Dental, a leading dental distributor in North America, for $2.4 billion. This acquisition is expected to create a combined company with over $24 billion in annual revenue and a strong presence in both the United States and Canada.

- In March 2023, Dentsply Sirona, a global leader in dental technologies, announced the launch of its next-generation CEREC Primescan intraoral scanner. The Primescan is the fastest and most accurate intraoral scanner on the market, and it features a new AI-powered technology that can automatically detect margins and generate high-quality scans in just seconds.

- In February 2023, Align Technology, the maker of Invisalign clear aligners, announced its acquisition of Vivatooth, a developer of AI-powered dental imaging software, for $500 million. This acquisition is expected to help Align Technology develop new AI-powered tools for orthodontists and dental labs.

- In January 2023, Straumann Group, a global leader in implant systems and dental restorations, announced a strategic partnership with Medline Industries, a global leader in medical supplies and services. This partnership is expected to provide Straumann Group with access to Medline’s vast distribution network and help Medline Industries expand its offerings into the dental market.

Report Scope

Report Features Description Market Value (2023) USD 457.5 Bn Forecast Revenue (2033) USD 788.8 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Dental Implants, Orthodontics, Periodontics, Endodontics, Cosmetic Dentistry, Laser Dentistry, Dentures, Oral & Maxillofacial Surgery, Others), By End-use (Hospitals, Dental Clinics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Aspen Dental Management Inc., InterDent Inc., National Health Service England, The British United Provident Association Limited, Apollo White Dental, Abano Healthcare Group Limited, Coast Dental, Dental Service Group, Axis Dental, Integrated Dental Holdings, Pacific Dental Service, Gentle Dental of New England Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aspen Dental Management Inc.

- InterDent Inc.

- National Health Service England

- The British United Provident Association Limited

- Apollo White Dental

- Abano Healthcare Group Limited

- Coast Dental

- Dental Service Group

- Axis Dental

- Integrated Dental Holdings

- Pacific Dental Service

- Gentle Dental of New England