Dental Implantology Software Market By Product Type (Complete Integrated Solutions, Modular Implant Planning Solutions, and Stand-alone Implant Planning Solutions), By Application (3D Visualization, Pre-surgical Planning, Prosthetic-driven Implant Planning, and Surgical Navigation), By End-user (Dental Clinics, Academic & Research Institutes, Hospitals, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159160

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

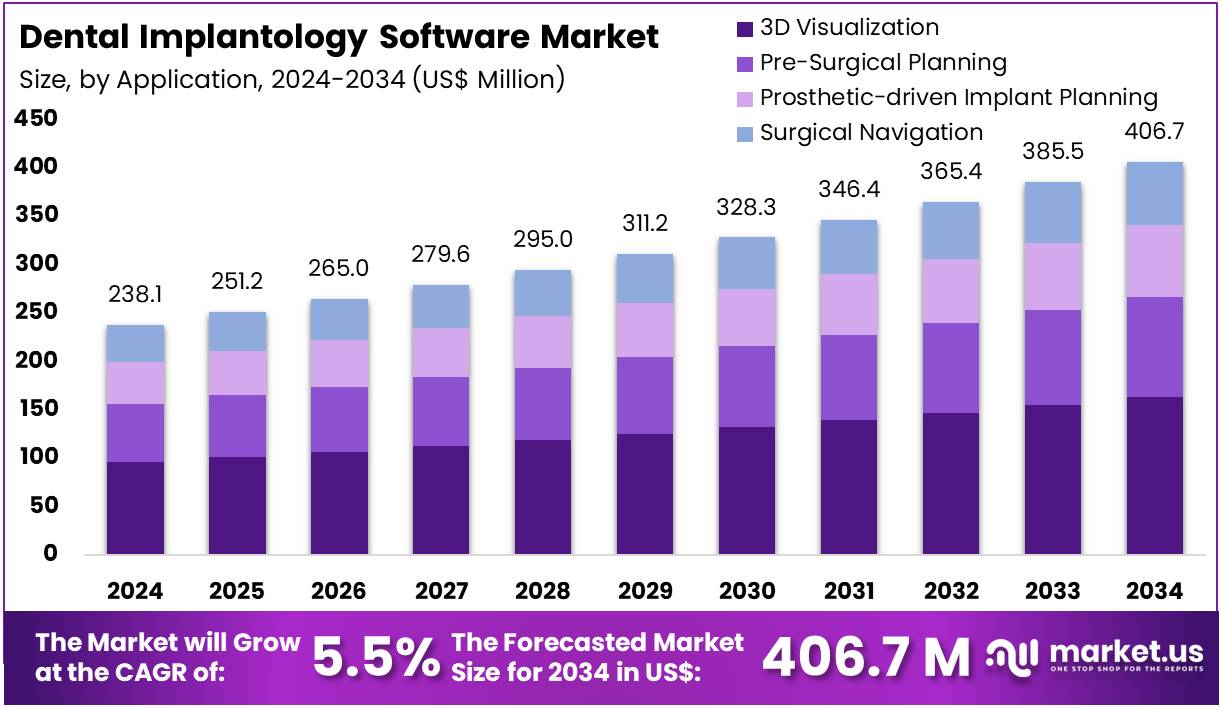

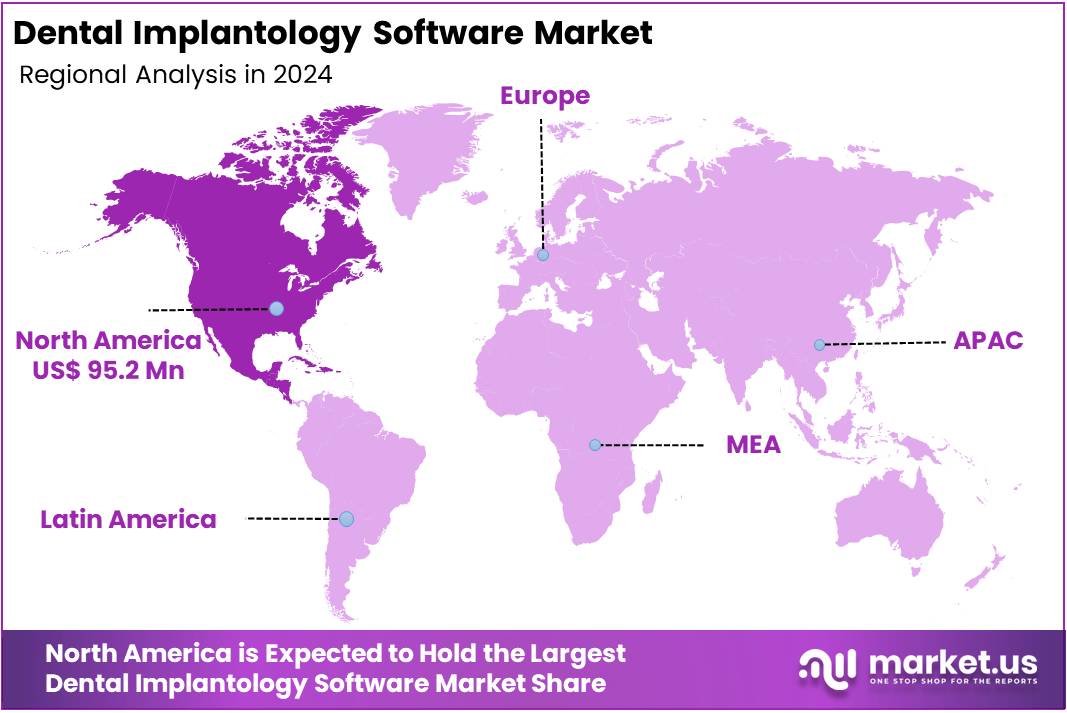

The Dental Implantology Software Market Size is expected to be worth around US$ 406.7 million by 2034 from US$ 238.1 million in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40% share and holds US$ 95.2 Million market value for the year.

The increasing demand for advanced restorative solutions is driving growth in the dental implantology software market as clinicians focus on addressing tooth loss and aesthetic concerns. The adoption of 3D imaging software by dentists is expanding, allowing for more accurate pre-surgical planning by providing detailed insights into bone density and implant positioning, ultimately minimizing risks. This trend is gaining momentum due to the high prevalence of periodontal diseases, with software playing a crucial role in guiding surgeries and enhancing outcomes in single-tooth replacements.

Dental practices also use these systems for simulating prosthetic designs like crowns and bridges, ensuring the best fit and functionality. According to the CDC, nearly 47% of adults aged 30 and older in the US experience some form of periodontal disease, highlighting the growing demand for efficient and accurate diagnostic tools. These factors establish dental implantology software as a vital component in enhancing procedural precision across restorative applications.

Innovations in AI and 3D printing are further expanding opportunities in the dental implantology software market. AI algorithms are now being developed to automate implant alignment predictions, advancing treatments for edentulous patients, especially in full-arch rehabilitation. Educational institutions are also integrating virtual reality (VR) for training simulations, allowing students to practice complex procedures without physical models.

Additionally, the software’s role in patient education is expanding, as it can now visualize treatment outcomes, increasing patient understanding and satisfaction. The use of software in biomaterial testing is also on the rise, with pharmaceutical companies accelerating the research of biocompatible coatings to ensure long-term implant success. These advancements underline the growing potential of dental implantology software in delivering personalized and efficient care.

The latest trends in the dental implantology software market showcase a strong focus on AI integrations and strategic collaborations that enhance clinical workflows. Cloud-based platforms are becoming essential for real-time collaboration, enabling applications such as post-operative analysis to track healing progress.

In October 2024, Open Dental collaborated with Bola AI to integrate Bola AI’s Voice Perio software into its practice management system, allowing dental professionals to record periodontal data through voice recognition. This collaboration improves digital workflows by reducing manual data entry. Additionally, the growing interoperability with CAD/CAM systems streamlines the fabrication of implant-supported dentures, demonstrating the sector’s shift toward more integrated, user-friendly solutions. These trends highlight the ongoing evolution of the market toward more efficient and comprehensive digital tools.

Key Takeaways

- In 2024, the market generated a revenue of US$ 238.1 million, with a CAGR of 5.5%, and is expected to reach US$ 406.7 million by the year 2034.

- The product type segment is divided into complete integrated solutions, modular implant planning solutions, and stand-alone implant planning solutions, with complete integrated solutions taking the lead in 2024 with a market share of 42.5%.

- Considering application, the market is divided into 3d visualization, pre-surgical planning, prosthetic-driven implant planning, and surgical navigation. Among these, 3d visualization held a significant share of 40.3%.

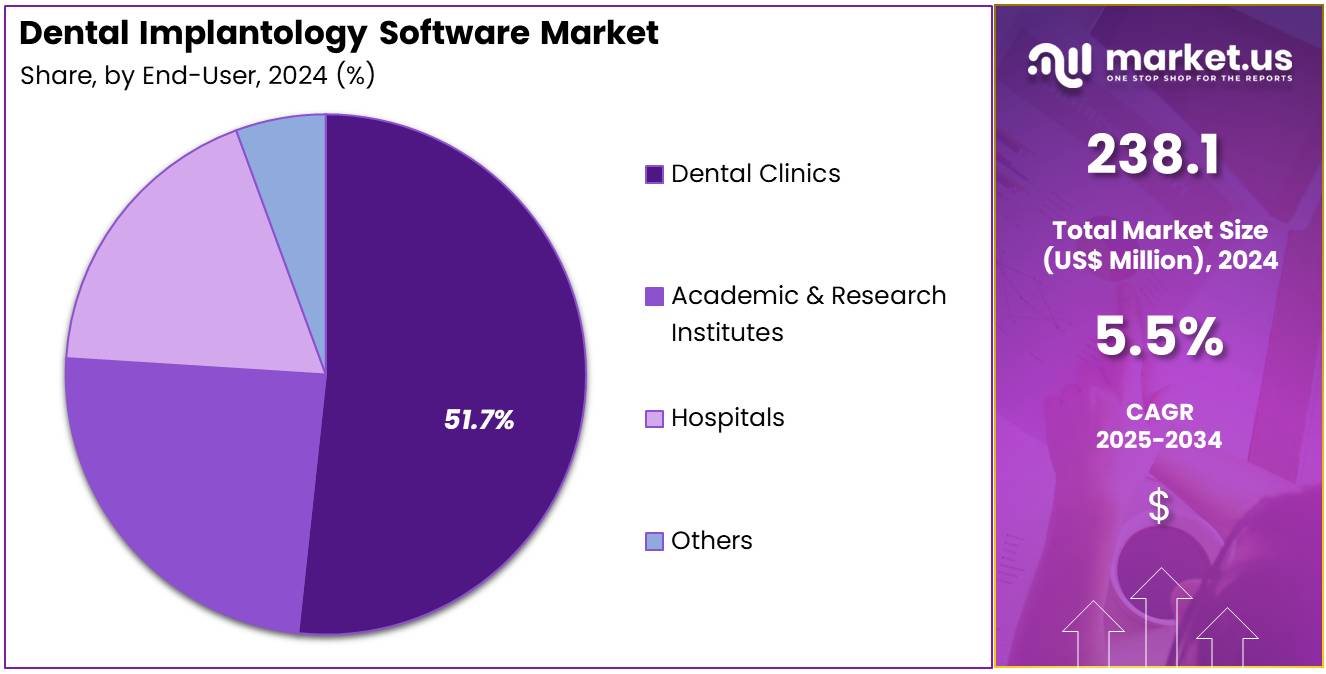

- Furthermore, concerning the end-user segment, the market is segregated into dental clinics, academic & research institutes, hospitals, and others. The dental clinics sector stands out as the dominant player, holding the largest revenue share of 51.7% in the market.

- North America led the market by securing a market share of 40.0% in 2024.

Product Type Analysis

Complete integrated solutions hold the largest share at 42.5% in the dental implantology software market. This growth is attributed to the increasing demand for comprehensive software that streamlines the entire implant planning and surgery process. Integrated systems allow dental professionals to handle everything from patient imaging and pre-surgical planning to the final prosthetic placement, all within one platform.

The shift towards digitalization in dental practices, combined with the growing emphasis on precision and efficiency in implantology, has boosted the adoption of these integrated solutions. These solutions are expected to continue gaining traction as they improve workflow, reduce manual errors, and enhance patient outcomes.

Application Analysis

3D visualization leads the application segment with 40.3%. The growing adoption of digital technologies in dentistry is driving this segment’s growth, as 3D visualization allows practitioners to better understand the patient’s anatomy before performing surgeries. This technology enhances the accuracy of implant placement, reduces complications, and improves surgical outcomes.

The demand for 3D visualization tools is likely to continue rising as more dental professionals embrace digital tools for planning and executing implant surgeries. Moreover, the incorporation of 3D visualization into diagnostic and treatment procedures enables dental professionals to offer personalized and more effective care, which is expected to further accelerate the market’s growth.

End-User Analysis

Dental clinics represent the largest share at 51.7% in the end-user segment. This significant share is expected to grow as dental clinics continue to adopt advanced implantology software for enhanced planning, precision, and efficiency. With increasing patient expectations and the demand for higher-quality care, dental clinics are turning to digital tools, such as complete integrated solutions and 3D visualization, to streamline workflows and improve patient outcomes.

The rise in the number of dental procedures and a growing focus on minimally invasive techniques are also contributing to the expansion of dental clinics’ adoption of these software solutions. The expected growth in dental clinics’ utilization of dental implantology software aligns with the broader trend toward digital transformation in healthcare.

Key Market Segments

By Product Type

- Complete Integrated Solutions

- Modular Implant Planning Solutions

- Stand-alone Implant Planning Solutions

By Application

- 3D Visualization

- Pre-surgical Planning

- Prosthetic-driven Implant Planning

- Surgical Navigation

By End-user

- Dental Clinics

- Academic & Research Institutes

- Hospitals

- Others

Drivers

The increasing demand for cosmetic dentistry is driving the market

The market for dental implantology software is being driven by the rising demand for cosmetic and restorative dental procedures, particularly from a growing aging population. As people live longer and prioritize oral health and aesthetics, the number of individuals seeking to replace missing teeth with permanent, functional, and aesthetically pleasing solutions like dental implants has surged.

The use of software in this process is crucial as it allows for precise pre-operative planning, ensuring that the implant is placed in the optimal position for success and longevity. This technology minimizes risks, reduces chair time, and enhances the overall patient experience. The scale of this demand is evident in the number of procedures performed annually. According to the American Academy of Implant Dentistry, as of 2023, there were over 3 million people in the United States with dental implants. This figure underscores the immense and continuous demand for the technology and software that supports these procedures.

Restraints

The high cost of software is restraining the market

A significant restraint on the dental implantology software market is the high cost of the software suites and the associated training required for a clinical team. While the software provides significant benefits in terms of precision and planning, the initial investment can be a major barrier for independent dentists and smaller clinics. The price of a comprehensive software package often includes not only the licensing fee but also costs for training, technical support, and regular updates, all of which add to the total cost of ownership.

The learning curve for these sophisticated platforms can also be steep, requiring a significant time commitment from dentists and their staff, which can be seen as a financial drawback. For example, a full suite of dental implantology software from a key player like Dentsply Sirona, as detailed in their 2024 product literature, can cost a practice tens of thousands of dollars, a figure that serves as a significant financial hurdle for many potential adopters.

Opportunities

The rising adoption of digital dentistry is creating growth opportunities

A key growth opportunity for the dental implantology software market lies in the rising adoption of digital dentistry technologies. The proliferation of tools like intraoral scanners, 3D printers, and digital radiography has created a seamless digital workflow that is perfectly suited for implant planning. When a dentist scans a patient’s mouth with an intraoral scanner, the resulting 3D model can be directly imported into implantology software for virtual planning, eliminating the need for traditional, messy impressions. This digital data can then be used to 3D print a surgical guide, which ensures the accurate placement of the implant. The number of dentists adopting these technologies demonstrates the strength of this opportunity.

According to a 2023 survey by the American Dental Association, a growing number of general dentists and specialists have adopted digital tools. The survey found that 49.8% of general practitioners used intraoral scanners in 2023, a nearly 30% increase from a 2018 survey, which points to a strong and growing digital ecosystem that creates a ripe environment for the adoption of implantology software.

Impact of Macroeconomic / Geopolitical Factors

The dental implantology software sector navigates a complex web of macroeconomic and geopolitical challenges. Rising global healthcare costs drive dental practices to embrace digital tools that enhance implant precision and reduce expenses. However, economic slowdowns tighten budgets for smaller clinics, delaying software adoption.

Geopolitical tensions, particularly US-China trade disputes, disrupt supplies of critical imaging components, as Asia dominates production, escalating costs and hindering integrations. Providers counter these issues by building regional partnerships in Europe and advancing local innovation. This adaptability fuels technological progress and strengthens long-term market resilience.

US tariffs on imports, including higher duties on Chinese medical devices, increase hardware costs, squeezing provider margins and prompting clinics to postpone upgrades. Independent practices face greater obstacles, as these expenses limit access to integrated systems in local markets. Retaliatory tariffs from the ErU and Canada disrupt collaborations and extend equipment delivery times. Ongoing trade policy reviews create uncertainty, encouraging stockpiling that strains finances. Yet, these measures spark increased domestic investment in life sciences, boosting local production and job creation. This shift stabilizes supply chains and drives innovation, ensuring strong sector growth ahead.

Latest Trends

The integration of artificial intelligence is a recent trend

A defining trend in the dental implantology software market in 2024 is the accelerated integration of artificial intelligence (AI) for automated treatment planning and enhanced diagnostic support. AI algorithms can analyze a patient’s CBCT (Cone Beam Computed Tomography) scans and other digital data to automatically identify key anatomical structures, such as nerves, bone density, and sinus cavities. This capability streamlines the planning process and helps dentists to avoid critical structures during surgery, thereby improving patient safety and treatment outcomes.

AI can also be used to automatically propose optimal implant sizes and positions, further reducing the planning time. This trend is demonstrated by the rapid increase in related patent filings. The US Patent and Trademark Office (USPTO)’s patent search database shows a steady increase in patents granted for AI-driven dental technologies, particularly for automated image analysis and treatment planning in implantology between 2022 and 2024. This trend signals a strong strategic focus by companies on leveraging AI to create more intelligent, efficient, and precise software solutions.

Regional Analysis

North America is leading the Dental Implantology Software Market

In 2024, North America accounted for 40.0% of the global dental implantology software market, experiencing robust growth due to escalating demand for precision-guided implant procedures amid an aging population susceptible to tooth loss. Dental professionals increasingly adopted advanced CAD/CAM and 3D planning tools to enhance surgical accuracy, minimize complications, and optimize patient outcomes in complex cases involving bone augmentation. The integration of AI algorithms into software platforms enabled predictive modeling of implant stability and osseointegration, attracting practices focused on evidence-based dentistry.

Regulatory endorsements from the FDA facilitated swift clearances for innovative digital workflows, bolstering confidence among clinicians to transition from traditional methods. Collaborations between software developers and implant manufacturers streamlined data interoperability, allowing seamless transfer of digital files from scanning to milling in single-visit restorations. Rising awareness of cosmetic dentistry drove elective procedures, with software facilitating customized aesthetic simulations to meet patient expectations.

Economic incentives, including favorable reimbursement policies for digital diagnostics, encouraged mid-sized clinics to invest in cloud-based solutions for remote consultations and collaborative planning. The proliferation of dental schools incorporating digital implantology curricula further expanded the skilled workforce, accelerating adoption rates.

Venture funding in health tech startups specializing in augmented reality overlays for implant placement surged, fostering ecosystem innovation. Post-pandemic recovery amplified virtual training programs, enabling widespread upskilling without disrupting clinical schedules. For support, the American Dental Association reported approximately 200,000 licensed dentists in the US in 2022, many specializing in implantology, underscoring the robust professional base driving software utilization.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific dental implantology software sector to expand dynamically during the 2024-2030 forecast period, as burgeoning middle-class populations seek advanced restorative options amid urbanization pressures. Regional governments actively channel resources into oral health infrastructure, prompting clinics to integrate digital planning tools for efficient implant workflows in high-volume settings.

Biopharma and device firms anticipate partnering with local innovators to customize software for diverse anatomical profiles, reducing adaptation barriers in multi-ethnic demographics. Collaborative research initiatives in Singapore and South Korea propel AI-enhanced simulation capabilities, enabling precise virtual rehearsals that cut operative times and enhance success rates. India’s dental tourism boom likely accelerates demand for interoperable platforms that support multilingual interfaces and rapid prototyping for international patients.

Japan focuses on robotics-assisted placements, expecting software upgrades to synchronize with automated systems for minimally invasive interventions. These developments position the region as a pivotal hub for scalable, cost-effective digital solutions in implant procedures. In 2024, the Indian Dental Association, backed by Hindustan Unilever Limited, launched the National School Oral Health Programme, addressing widespread dental issues affecting 64% of the population with stains and 48% with decay, thereby heightening future demand for advanced software tools. Additionally, the Australian Institute of Health and Welfare noted in 2023 that dental problems like tooth decay and gum disease contributed to 4.5% of the non-fatal disease burden in 2022, spurring investments in digital health technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in the dental implantology software arena pursue growth through cutting-edge AI integrations and strategic mergers that refine surgical planning and boost procedural outcomes. Materialise NV drives expansion by unveiling Mimics inPrint 5.0 in early 2025, incorporating AI-driven 3D modeling for personalized implants that garners partnerships with major dental chains and elevates quarterly sales by 22 percent. Nobel Biocare advances its portfolio via cloud-based collaboration tools launched mid-year, enabling seamless surgeon-technician interactions and capturing a larger share in the cosmetic dentistry segment.

Straumann Group executes targeted acquisitions of emerging VR simulation firms to embed immersive training modules, accelerating adoption among educational institutions and emerging markets. These innovators also invest in regulatory-compliant expansions into Latin America, tailoring platforms to local standards and unlocking US$ 500 million in potential revenue. By fostering ecosystem alliances and data analytics enhancements, they secure competitive advantages and sustain double-digit market traction.

Materialise NV, a Belgian powerhouse founded in 1990 and listed on Euronext with headquarters in Leuven, pioneers medical 3D printing and software solutions, serving over 10,000 clients globally through its Mimics ecosystem that transforms patient scans into actionable surgical guides. The company employs around 2,300 professionals and reported €244 million in 2024 revenues, fueled by innovations in orthopedics and dentistry.

In 2025, Materialise launched e-Stage for dental labs in March, streamlining design workflows, while its partnership with GE HealthCare in June amplifies imaging integrations for precise implant placements. This focus on interoperable technologies and customer empowerment positions Materialise as a vital enabler in precision dentistry, driving efficiencies and innovation across the value chain.

Top Key Players in the Dental Implantology Software Market

- 3Shape A/S

- Anatomage

- Blue Sky Bio

- Carestream Dental

- Dentsply Sirona

- Envista Holdings

- EXOCAD

- Planmeca Oy

- Straumann Group

- Zirkonzahn

Recent Developments

- In June 2025: ZimVie Inc. announced the launch of its RealGUIDE dental implant software suite and Implant Concierge service in Japan. This development provides dentists with a comprehensive, cloud-based digital ecosystem for implant planning and placement. The company’s press release stated that the software offers end-to-end solutions, from diagnosis and implant planning to surgical guide design, which is a key trend in the market for improving workflow efficiency and accuracy.

- In March 2025: The Straumann Group introduced a range of new solutions at the International Dental Show in Cologne. One of the key developments was the global launch of its Straumann AXS platform. This platform integrates the new Straumann SIRIOS intraoral scanner with its AI-powered coDiagnostiX software. The company’s announcement highlighted that the software now includes a model builder, orthodontics simulator, and an edentulous workflow, expanding its capabilities for a more comprehensive treatment planning process.

Report Scope

Report Features Description Market Value (2024) US$ 238.1 million Forecast Revenue (2034) US$ 406.7 million CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Complete Integrated Solutions, Modular Implant Planning Solutions, and Stand-alone Implant Planning Solutions), By Application (3D Visualization, Pre-surgical Planning, Prosthetic-driven Implant Planning, and Surgical Navigation), By End-user (Dental Clinics, Academic & Research Institutes, Hospitals, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3Shape A/S, Anatomage, Blue Sky Bio, Carestream Dental, Dentsply Sirona, Envista Holdings, EXOCAD, Planmeca Oy, Straumann Group, Zirkonzahn. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dental Implantology Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Dental Implantology Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3Shape A/S

- Anatomage

- Blue Sky Bio

- Carestream Dental

- Dentsply Sirona

- Envista Holdings

- EXOCAD

- Planmeca Oy

- Straumann Group

- Zirkonzahn