Dental Hygiene Instrument Market By Product Type (Scalers & Curettes, Probes & Explorers, Mirrors, Dental Forceps, and Others), By Application (Plaque & Tartar Removal, Oral Surgery, Orthodontics, Preventive Dental Care, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157315

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

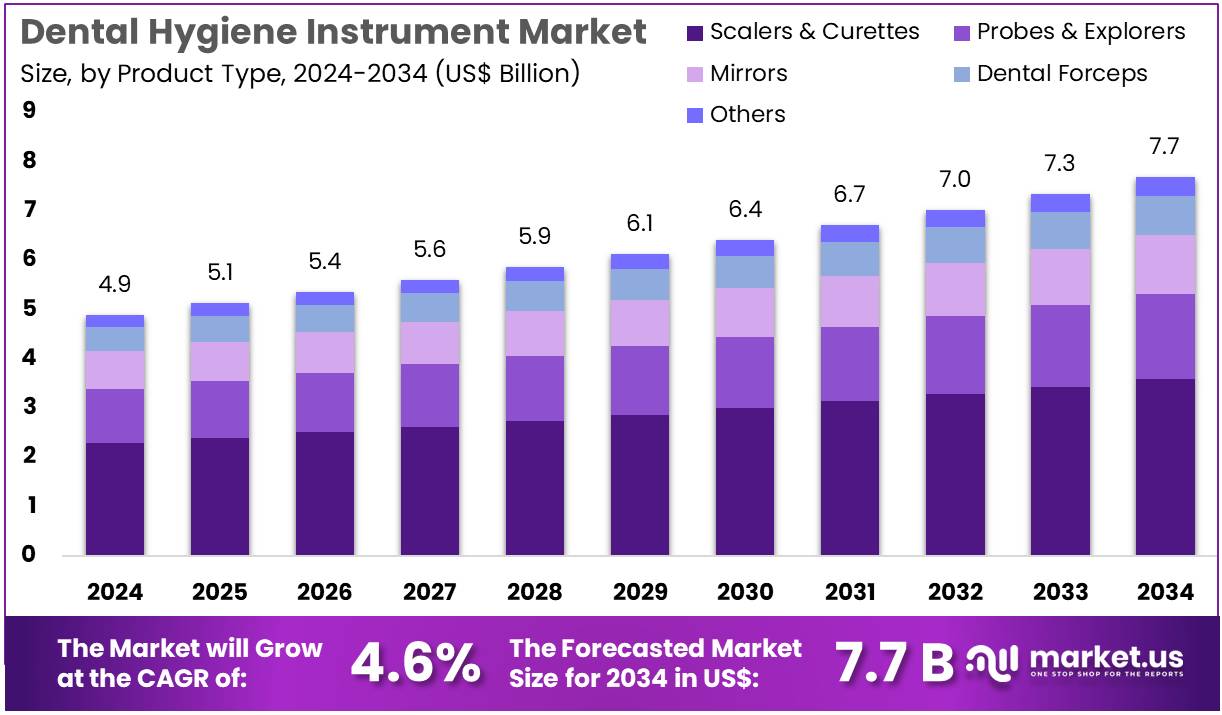

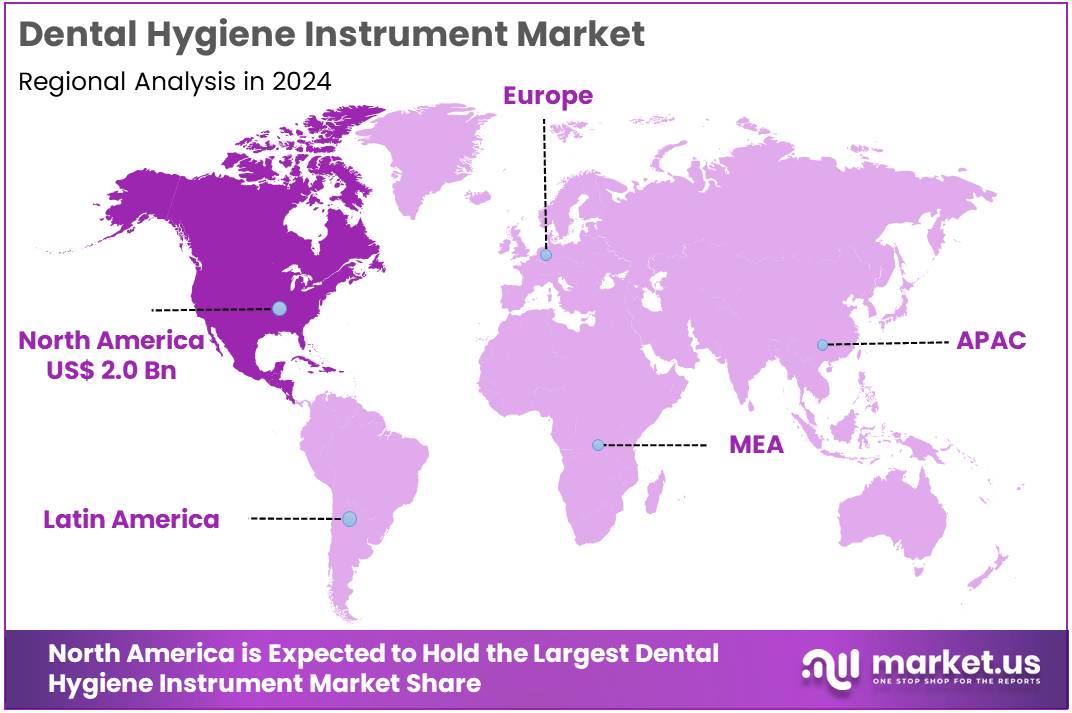

The Dental Hygiene Instrument Market Size is expected to be worth around US$ 7.7 billion by 2034 from US$ 4.9 billion in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.8% share and holds US$ 2 Billion market value for the year.

Rising global prevalence of oral diseases and a heightened focus on preventive dentistry are key drivers for the dental hygiene instrument market. These instruments, ranging from simple hand scalers to advanced ultrasonic systems, are essential for professional dental cleanings and home care, playing a critical role in preventing and treating conditions like periodontal disease and dental caries.

The World Health Organization (WHO) reported in 2022 that oral diseases affect nearly half of the world’s population, with severe periodontal diseases alone estimated to impact over 1 billion people worldwide. This immense disease burden creates a consistent and growing demand for effective instruments that support both clinical and personal oral hygiene.

Growing product innovation and a shift towards gender- and age-specific solutions are significant trends shaping the market. Manufacturers are developing specialized products that address the unique oral health challenges of different demographics. For example, in February 2023, Frimline Private Limited introduced Dente91 She, a toothpaste formulated specifically for women. This product was designed to address dental issues such as gingivitis and tooth sensitivity that can be exacerbated by hormonal changes throughout a woman’s life. This type of product specialization, combined with advancements in ergonomics and materials, is expanding the market’s reach and enhancing the user experience for both dental professionals and consumers.

Increasing accessibility to advanced technology and a greater emphasis on oral-systemic health are creating new opportunities for market expansion. The link between poor oral health and systemic conditions like cardiovascular disease and diabetes is well-documented, which is driving a more holistic approach to patient care.

The US National Center for Health Statistics (NCHS) reports that in 2024, approximately 47% of adults aged 30 or older had some form of periodontal disease, a figure that highlights the critical need for professional dental services. Furthermore, innovations in portable and automated instruments, such as smart toothbrushes and water flossers, are empowering consumers to maintain a higher standard of oral hygiene at home, further fueling the market’s growth.

Key Takeaways

- In 2024, the market for dental hygiene instrument generated a revenue of US$ 4.9 billion, with a CAGR of 4.6%, and is expected to reach US$ 7.7 billion by the year 2034.

- The product type segment is divided into scalers & curettes, probes & explorers, mirrors, dental forceps, and others, with scalers & curettes taking the lead in 2024 with a market share of 46.8%.

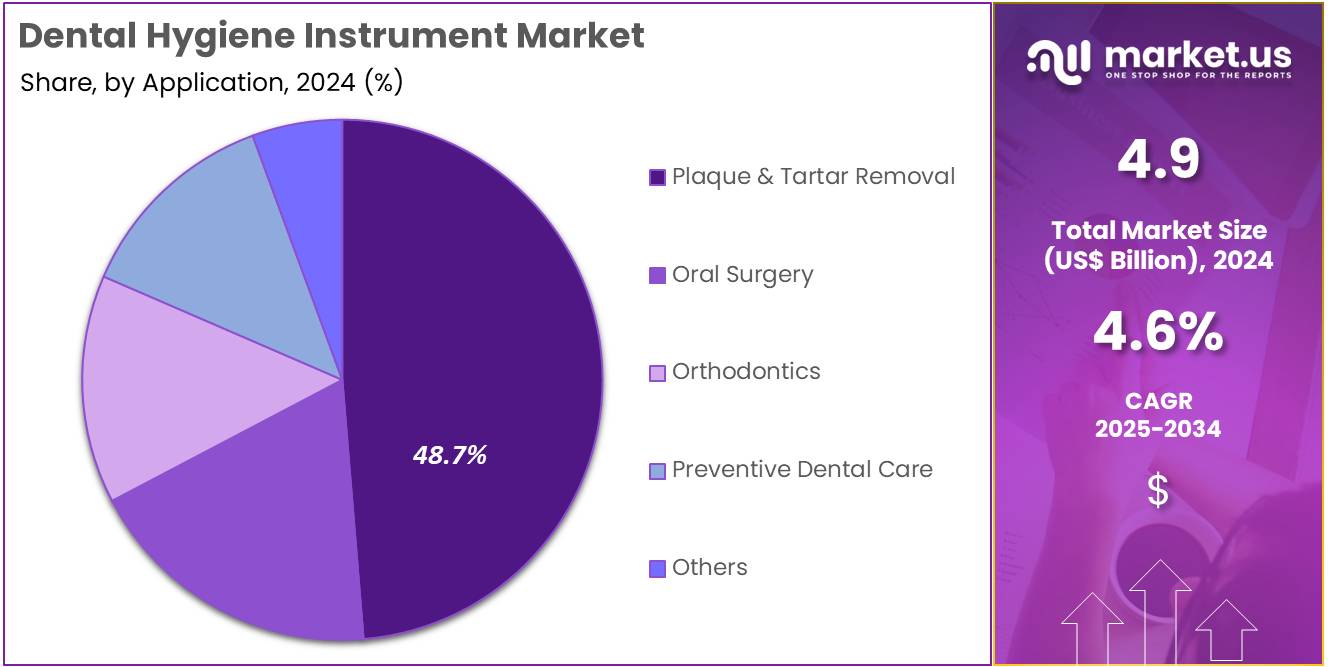

- Considering application, the market is divided into plaque & tartar removal, oral surgery, orthodontics, preventive dental care, and others. Among these, plaque & tartar removal held a significant share of 48.7%.

- North America led the market by securing a market share of 39.8% in 2024.

Product Type Analysis

Scalers and curettes hold a 46.8% share in the product type segment. Their growth is projected due to rising gum diseases worldwide. Dentists prefer them for precise plaque and tartar removal. Technological advances in stainless steel and ergonomic designs are anticipated to boost adoption. Urban dental clinics are likely to increase purchases. Government oral health programs, including HHS initiatives in the US, are expected to promote usage.

Rising disposable income and dental insurance coverage are projected to make routine visits more common. Key players like Hu-Friedy and Dentsply Sirona are expanding portfolios with durable, high-quality instruments. Dental schools are expected to train students with these instruments. Cosmetic dentistry trends and preventive care awareness are projected to sustain demand. Tele-dentistry and patient monitoring tools are likely to encourage check-ups. Minimally invasive dental procedures are anticipated to favor these instruments.

The versatility for periodontal therapy is expected to increase usage. WHO preventive oral care campaigns are likely to support adoption. Workshops and training courses are projected to reinforce market growth. Aging populations with higher dental care needs are expected to drive demand. Ergonomic instrument designs are anticipated to attract more professionals. Patient satisfaction with precision tools is projected to influence clinic purchases. Overall, scalers and curettes are expected to remain dominant due to efficiency, innovation, and awareness.

Application Analysis

Plaque and tartar removal leads the application segment with a 48.7% share. Rising dental caries and periodontal diseases are expected to drive demand. Preventive dental programs globally are projected to encourage routine cleaning. Dental insurance expansion is likely to improve accessibility. Clinics are anticipated to invest in ultrasonic scalers and LED-enhanced instruments for efficiency. The aging population with higher gum issues is projected to increase procedure frequency. Awareness campaigns by WHO and national societies are expected to reinforce demand.

Cosmetic dentistry trends are likely to support frequent cleaning. Urbanization and higher disposable income are projected to drive clinic visits. Tele-dentistry initiatives are anticipated to boost preventive check-ups. Minimally invasive procedures are expected to require effective tartar control. Training workshops are likely to improve practitioner adoption of advanced techniques. Research linking oral health to systemic diseases is projected to raise importance. Collaboration between dental product manufacturers and clinics is expected to sustain growth.

Patients seeking pain-free treatments are anticipated to increase procedure uptake. Digital oral health tracking tools are projected to encourage regular visits. Subsidized government dental programs are likely to increase access. Preventive care awareness in schools is expected to boost long-term demand. Overall, plaque and tartar removal is projected to drive the market due to preventive care emphasis and technological adoption.

Key Market Segments

By Product Type

- Scalers & Curettes

- Probes & Explorers

- Mirrors

- Dental Forceps

- Others

By Application

- Plaque & Tartar Removal

- Oral Surgery

- Orthodontics

- Preventive Dental Care

- Others

Drivers

The rising prevalence of periodontal disease and the emphasis on preventative care are driving the market

The dental hygiene instrument market is experiencing significant growth, primarily driven by the increasing global prevalence of periodontal disease and a growing emphasis on preventative oral healthcare. As populations age, the incidence of chronic conditions like gum disease and tooth decay rises, creating a continuous need for professional dental cleanings and examinations.

Periodontal disease, in particular, is a major public health concern that requires consistent treatment with specialized instruments to remove plaque and tartar buildup from below the gumline. A 2024 fact sheet from the US Centers for Disease Control and Prevention (CDC) reported that nearly half, or 42.2%, of all adults aged 30 and older have periodontitis. This widespread need for therapeutic and preventative care creates a robust and constant demand for a wide range of hand instruments and powered devices used by dental hygienists to maintain the oral health of their patients.

Restraints

The high initial cost of advanced instruments and maintenance expenses are restraining the market

A significant restraint on the market is the substantial initial investment required to acquire advanced dental hygiene instruments and the ongoing costs associated with their maintenance and repair. While many of the new instruments, such as ultrasonic scalers and air polishers, offer enhanced efficiency and patient comfort, their price point can be prohibitive for smaller private practices. These instruments often require specialized training for staff, which adds to the overall operational expense.

For instance, according to the American Dental Association’s (ADA) 2023 Survey of Dental Practice, the average dental practice spent approximately US$28,500 on new capital equipment in 2022. This high capital expenditure, coupled with the recurring costs of sterilization, sharpening for hand instruments, and component replacement for powered devices, can create a significant financial barrier to adoption, particularly in an environment of rising overhead costs within the dental industry.

Opportunities

The development of minimally invasive technologies is creating growth opportunities

The market is presented with significant opportunities through the continuous innovation in product development, specifically the creation of instruments that enable minimally invasive procedures. Patients today are increasingly seeking dental experiences that are less painful, more comfortable, and require less time in the dental chair. Manufacturers are responding by developing new instruments that reduce discomfort and minimize tissue damage during procedures like scaling and root planing. This trend is a strategic adaptation to a key consumer demand.

A growing number of dental practices are adopting technologies such as air polishers and ultrasonic instruments that can remove plaque and stain more gently and effectively than traditional hand scalers. According to a 2023 report from the US Department of Health and Human Services (HHS) on dental care, the shift toward minimally invasive techniques, particularly for pediatric and elderly populations, has been a key factor in improving patient acceptance and compliance with treatment. This focus on patient comfort and experience will continue to drive innovation and adoption across the market.

Impact of Macroeconomic / Geopolitical Factors

The dental hygiene instrument market is navigating a complex macroeconomic and geopolitical landscape that impacts both consumer behavior and the stability of its supply chain. In 2023, US national dental care expenditures amounted to US$174 billion, a 2.5% increase from the previous year, highlighting a robust domestic market. However, geopolitical factors and trade policies create significant hurdles. According to the International Trade Administration, dental equipment imported from China can be subject to tariffs as high as 25%, directly increasing the procurement costs for dental practices.

Despite these headwinds, the market’s fundamental drivers remain strong. The American Dental Association’s Health Policy Institute reported that consumer dental spending in the US increased by 3% in May 2025 alone, demonstrating sustained demand. This consistent demand, combined with manufacturers’ strategic efforts to diversify their supply chains, helps the industry absorb rising costs and ensures a more resilient supply of essential dental instruments.

Latest Trends

The integration of advanced imaging and AI into hygiene instruments is a recent trend

A significant trend in 2024 is the accelerated integration of advanced imaging and artificial intelligence (AI) into dental hygiene instruments, transforming them from simple tools into sophisticated diagnostic aids. New technologies, such as intraoral scanners and AI-powered software, are now being used to create high-resolution digital impressions of a patient’s mouth, which can then be analyzed by an AI algorithm. This allows for the early and precise detection of plaque buildup, gingivitis, and periodontal disease with a level of accuracy that surpasses the human eye.

This integration is no longer a future concept but a present reality. A 2023 study published in the Journal of the American Dental Association noted that the use of digital imaging and intraoral scanners has reached a tipping point, with over 50% of dental practices in the United States now utilizing this technology. This trend signifies a major shift in the role of hygiene instruments from purely mechanical to a symbiotic relationship with advanced diagnostics, offering a more personalized and preventative approach to oral care.

Regional Analysis

North America is leading the Dental Hygiene Instrument Market

The North American market for dental hygiene instruments held a commanding 39.8% share of the global market in 2024. This leadership is directly attributable to a highly developed healthcare infrastructure, a high prevalence of dental diseases, and a strong public awareness of oral health. The US and Canada have a significant burden of oral diseases, which drives a consistent and critical need for professional dental cleanings and examinations. The Centers for Disease Control and Prevention (CDC) reported in 2022 that over 13% of children aged 5-19 years had untreated dental caries, a figure that highlights the ongoing need for preventative and restorative care.

Furthermore, a substantial portion of adults have periodontal disease. A 2022 report from the Canadian Dental Association found that approximately 7 out of 10 people in Canada are likely to experience gum disease at some point in their lives, a condition that necessitates regular dental care. The market is also propelled by the continuous introduction of new, technologically advanced instruments that improve efficiency and patient comfort.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific dental hygiene instrument market is anticipated to experience robust growth during the forecast period. This is largely a result of rapidly improving healthcare infrastructure, a significant and rising middle-class population, and increasing government initiatives focused on improving oral health. The World Health Organization (WHO) has highlighted the substantial and growing burden of oral diseases in the region, with dental caries and periodontal disease being particularly prevalent.

For instance, in China, a 2023 study published in the journal BMC Oral Health found that the prevalence of dental caries among children aged 12 was over 62%, a figure that underscores the immense need for preventative dental care. The market’s expansion is further supported by rising consumer awareness of oral hygiene and the growing number of dentists and dental clinics. In India, for example, the government’s National Oral Health Programme is actively promoting oral health education and providing access to basic dental care, which is likely to increase the demand for professional hygiene services and the instruments required to provide them.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the dental hygiene instrument market are driving growth through several key strategies. They are heavily investing in integrating advanced technologies like digital scanners and AI-powered diagnostic tools to enhance precision and efficiency. Companies are also pursuing strategic acquisitions to expand their portfolios and gain access to new technologies, such as CAD/CAM systems and 3D printing. Furthermore, they are broadening their market reach by targeting emerging economies and focusing on educational initiatives that promote a shift toward preventive care. This combination of technological innovation and market expansion is essential for maintaining a competitive edge.

Dentsply Sirona, a global dental equipment and consumables manufacturer, holds a significant position in the market. The company’s business model is centered on providing comprehensive, integrated solutions that cover the entire dental workflow, from diagnosis to treatment. Dentsply Sirona’s strategy involves leveraging its extensive R&D capabilities to develop cutting-edge products like the CEREC system for single-visit dentistry. The company also focuses on providing robust educational platforms for dental professionals, solidifying its role as a key partner for dental practices worldwide and ensuring its market leadership.

Top Key Players in the Dental Hygiene Instrument Market

- 3M

- BIOLASE inc

- Carestream health

- Colgate Palmolive Co

- Danaher

- Dentsply Sirona

- GC corporation

- ICPA Health

- Straumann

- Young Innovations

Recent Developments

- In December 2023: Young Innovations, a US-based dental product manufacturer, completed the acquisition of Salvin Dental Specialties, Inc. This move expands Young Innovations’ portfolio to include regenerative biomaterials, surgical instruments, supplies, and equipment specifically designed for implant dentistry. The acquisition strengthens the company’s capabilities in offering advanced solutions for dental professionals.

- In November 2023: ICPA Health, a Mumbai-headquartered pharmaceutical firm specializing in oral care, launched Plakoff, a premium electric water flosser. The handheld device delivers a powerful water jet to efficiently clean the spaces between teeth and along the gumline. With a 14% share of India’s Rs 1,050 crore prescription dental market, ICPA Health reaches nearly 70% of dental surgeons nationwide through its extensive franchise network, reinforcing its presence in professional oral healthcare.

Report Scope

Report Features Description Market Value (2024) US$ 4.9 billion Forecast Revenue (2034) US$ 7.7 billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Scalers & Curettes, Probes & Explorers, Mirrors, Dental Forceps, and Others), By Application (Plaque & Tartar Removal, Oral Surgery, Orthodontics, Preventive Dental Care, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, BIOLASE inc, Carestream health, Colgate Palmolive Co, Danaher, Dentsply Sirona, GC corporation, ICPA Health, Straumann, Young Innovations. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dental Hygiene Instrument MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Dental Hygiene Instrument MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- BIOLASE inc

- Carestream health

- Colgate Palmolive Co

- Danaher

- Dentsply Sirona

- GC corporation

- ICPA Health

- Straumann

- Young Innovations