Dental Cement Market By Product Type (Permanent and Temporary), By Material (Resin Based, Zinc-oxide Eugenol, Zinc Phosphate, Polycarboxylate, Glass Ionomer, and Others), By Application (Luting, Pulpal Protection, Restorations, and Surgical Dressing), By End-user (Dental Clinics and Hospitals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154565

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

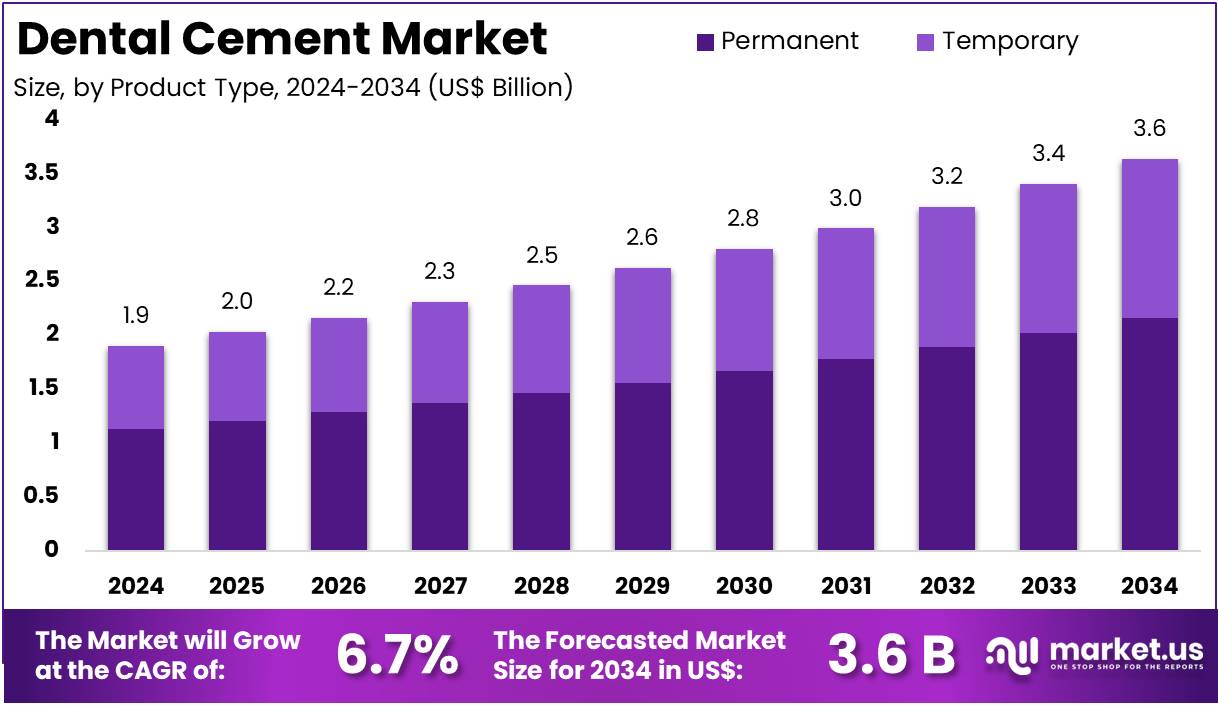

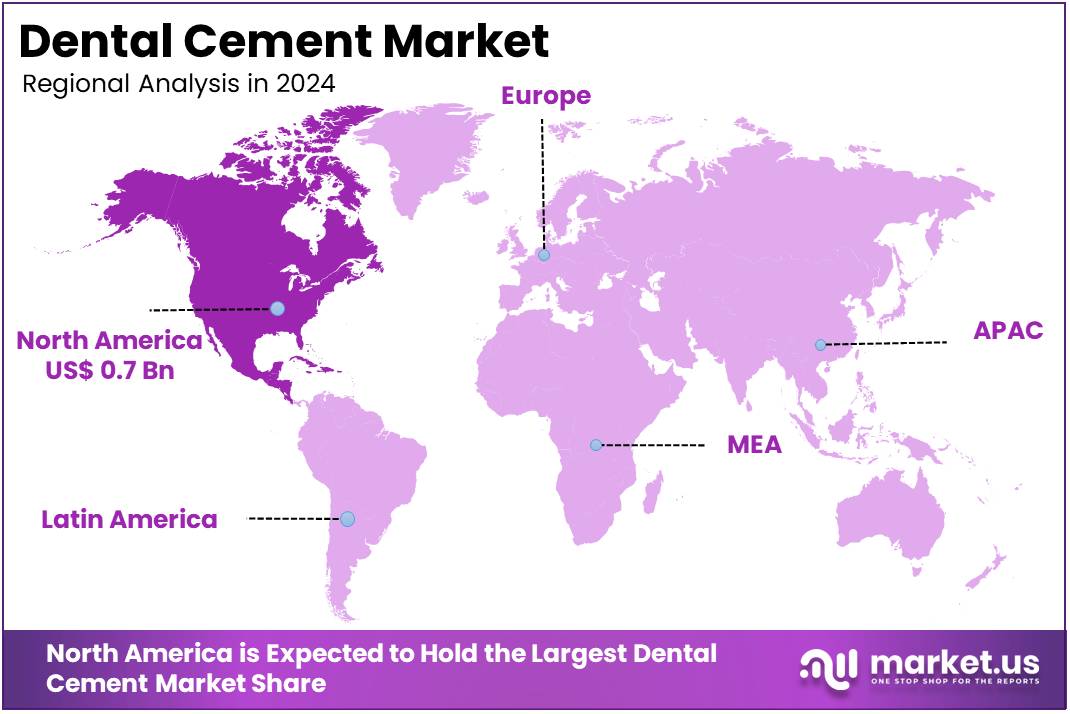

The Dental Cement Market Size is expected to be worth around US$ 3.6 billion by 2034 from US$ 1.9 billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.4% share and holds US$ 0.7 Billion market value for the year.

The dental adhesive market is experiencing robust expansion, primarily driven by the increasing global prevalence of dental diseases. According to the World Health Organization’s data, oral ailments affect nearly 3.5 billion people, with untreated dental caries in permanent teeth being the most widespread condition. This extensive burden of oral health issues generates a consistent and substantial demand for restorative procedures, thereby fueling the need for reliable dental adhesives. Moreover, a rising incidence of dental caries in pediatric populations and growing public awareness regarding proactive oral hygiene are significant factors propelling this market forward.

Technological progress is a critical force shaping the industry, presenting new avenues for enhanced patient care. Innovations in material science have led to the development of high-performance adhesives, such as bioactive and resin-based compounds, which offer superior bonding, durability, and aesthetic qualities. This evolution is particularly vital given the widespread need for restorative interventions; for instance, severe periodontitis affects over 1 billion people globally, creating a persistent demand for robust and long-lasting restorative solutions. These modern materials not only enhance efficiency but also streamline clinical workflows, reducing chair time for both dental professionals and their patients.

Market growth also receives strong support from demographic shifts, specifically the expanding global geriatric population. With United Nations projections indicating that the share of individuals aged 65 and older will double to 20.7% by 2074, the demand for extensive dental care, including prosthodontics and restorations, is set to increase commensurately. This demographic trend, combined with a rising number of dental clinics and practitioners, ensures a robust and expanding patient base.

As patients increasingly seek both preventive care and cosmetic enhancements, the demand for high-performance adhesives that provide better bonding and aesthetic appeal continues to surge, making them ideal for a diverse array of applications, from permanent restorations to orthodontic appliances. The global average for complete tooth loss, for instance, is approximately 7% among people aged 20 or older, but this figure rises to a much higher 23% for those aged 60 and above, underscoring the critical need for advanced restorative solutions within an aging demographic.

Key Takeaways

- In 2024, the market for dental cement generated a revenue of US$ 1.9 billion, with a CAGR of 6.7%, and is expected to reach US$ 3.6 billion by the year 2034.

- The product type segment is divided into permanent and temporary, with permanent taking the lead in 2023 with a market share of 59.4%.

- Considering material, the market is divided into resin based, zinc-oxide eugenol, zinc phosphate, polycarboxylate, glass ionomer, and others. Among these, resin based held a significant share of 36.9%.

- Furthermore, concerning the application segment, the market is segregated into luting, pulpal protection, restorations, and surgical dressing. The luting sector stands out as the dominant player, holding the largest revenue share of 39.8% in the dental cement market.

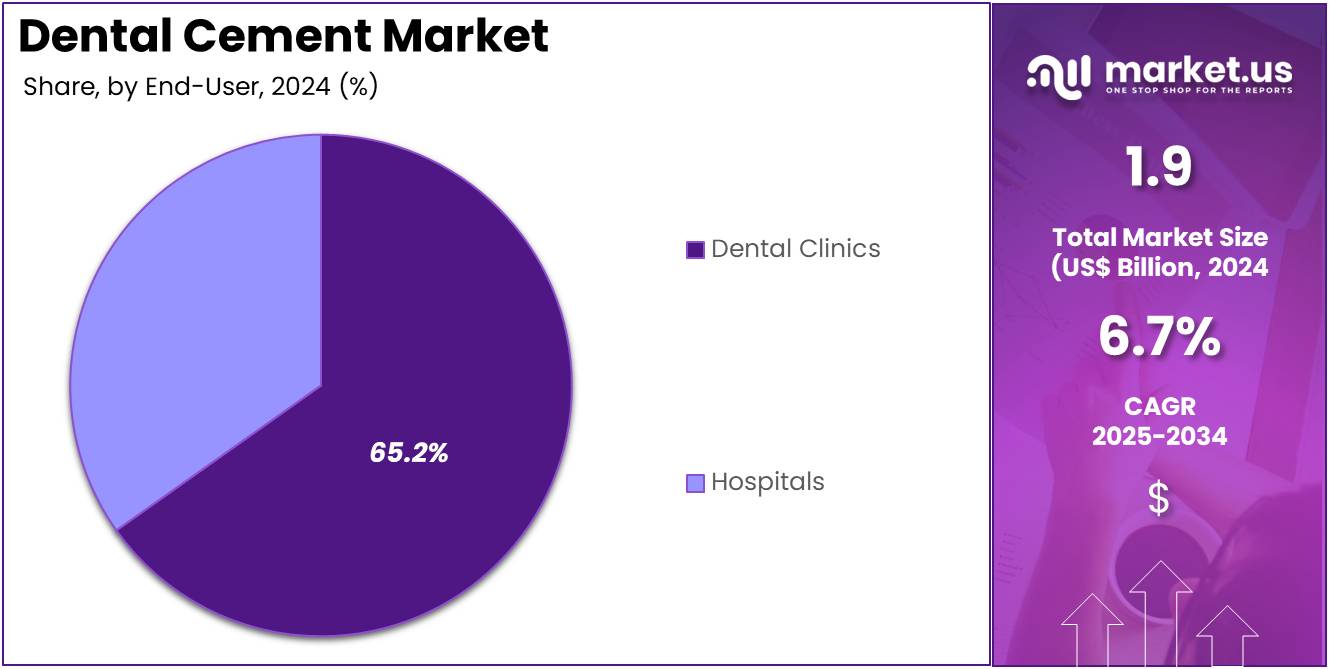

- The end-user segment is segregated into dental clinics and hospitals, with the dental clinics segment leading the market, holding a revenue share of 65.2%.

- North America led the market by securing a market share of 39.4% in 2023.

Product Type Analysis

Permanent dental cements hold the largest market share at 59.4%. This segment’s sustained growth is attributed to the durable and robust bonds they provide for long-term dental restorations, including crowns, bridges, and inlays. The rising demand for aesthetic and long-lasting dental solutions, combined with advancements in cement formulations, is a key driver for this segment.

Composed of materials such as resin-based compounds or glass ionomer, these cements offer superior strength and moisture resistance, making them the preferred choice for lasting dental procedures. As the global population ages and the emphasis on enhancing oral healthcare quality increases, the demand for permanent dental cements is expected to remain strong, especially given their ability to meet the dual patient needs of functionality and aesthetic appeal.

Material Analysis

Within the material segment of the dental cement market, resin-based cements account for a 36.9% share. This growth trajectory is expected to persist due to their superior adhesive properties, enhanced aesthetics, and improved biocompatibility compared to traditional cements. These materials are becoming the preferred choice for applications requiring precise bonding, such as inlays, onlays, and veneers.

The increased popularity of resin-based cements is a direct result of advancements in dental adhesive technologies, which offer better sealing capabilities and mitigate the risk of secondary caries. The growing demand for cosmetic dental restorations further fuels the adoption of resin-based materials, as they can be precisely color-matched to natural dentition. As dental professionals prioritize long-term, aesthetically pleasing patient outcomes, resin-based cements are poised to maintain their dominant position in the market.

Application Analysis

Luting cements hold a 39.8% share within the application segment, and this growth is expected to continue. Luting agents are critical for dental procedures involving the fixation of crowns, bridges, and other restorative devices. They create a secure, thin bond between the restoration and the tooth surface, ensuring reliable adhesion while still allowing for placement adjustments. The increasing need for dental restorations, particularly among the aging population, is a primary driver for the adoption of luting cements.

Innovations in luting systems, which enhance retention and prolong the lifespan of restorations, are also contributing to market growth. As the industry seeks more precise and efficient dental procedures, luting cements are valued for their versatility and dependability in both permanent and temporary applications.

End-User Analysis

Dental clinics dominate the end-user segment, with a 65.2% market share. This position is expected to be maintained as dental clinics remain the principal setting for a broad spectrum of dental procedures that utilize cements. The expansion of advanced restorative services in clinics, coupled with rising patient demand for aesthetic and functional restorations, is driving this segment’s growth.

Clinics are projected to experience increased demand for permanent and resin-based cements due to their superior bonding capabilities, which are essential for durable restorations. As demographic trends show an aging population and more individuals seek dental care for both cosmetic and health-related reasons, the need for cement-based dental services is anticipated to rise. The growing emphasis on preventive care and cosmetic treatments in dental clinics further reinforces their position as the leading end-user in the dental cement market.

Key Market Segments

By Product Type

- Permanent

- Temporary

By Material

- Resin based

- Zinc-oxide eugenol

- Zinc phosphate

- Polycarboxylate

- Glass ionomer

- Others

By Application

- Luting

- Pulpal Protection

- Restorations

- Surgical Dressing

By End-user

- Dental Clinics

- Hospitals

Drivers

Increasing Prevalence of Dental Diseases is Driving the Market

The escalating global incidence of dental disorders, such as caries and periodontal diseases, is a primary driver for the increased demand for these materials. These conditions necessitate a range of restorative and prosthetic procedures, which in turn fuels the consumption of dental adhesives for luting and restorative applications.

Data from the World Health Organization (WHO) in 2023 estimated that severe periodontal diseases affect approximately 19.0% of the global adult population, representing over 1.0 billion cases. This substantial disease burden directly translates into a constant and significant need for dental care interventions. A 2024 report from the Centers for Disease Control and Prevention (CDC) further highlights the issue, with nearly 21% of adults aged 20–64 years having one or more permanent teeth with untreated decay.

This demonstrates a persistent clinical workload that sustains the demand for materials essential in securing crowns, bridges, and other restorations. The increasing awareness of oral hygiene and the importance of routine dental checkups further contribute to the early detection and treatment of these issues, creating a sustained demand for dental materials.

Restraints

High Cost of Dental Materials and Procedures is Restraining the Market

The market’s growth faces a significant constraint due to the high cost associated with both the materials themselves and the overall dental procedures. The advanced research and development required to produce high-performance, biocompatible, and aesthetic dental adhesives often leads to a premium price point, which is subsequently passed on to the final products. This elevated cost can deter a substantial portion of the population, particularly in developing and low-income regions, from seeking necessary dental care.

A 2024 survey from Healthwatch England revealed that more than one in five people, or 21%, avoided going to the dentist due to cost, a notable increase from 15% in January 2023. This is a clear indicator of the financial barriers faced by consumers. A late 2023 report from the Australian Institute of Health and Welfare (AIHW) highlighted a significant global issue: almost four in ten adults aged 15 and older either postponed or completely avoided dental visits due to the high cost of services. This lack of access and affordability directly impacts the demand for these materials by leading to delayed or forgone treatments.

Opportunities

Rise in Aesthetic and Cosmetic Dentistry is Creating Growth Opportunities

The burgeoning demand for aesthetic and cosmetic dental procedures presents a significant growth opportunity. Patients are increasingly seeking restorations that not only offer functional durability but also provide a seamless, natural appearance. This shift in consumer preference has spurred the development and adoption of specialized, tooth-colored materials, such as translucent resin-based and glass ionomer adhesives, that are aesthetically compatible with natural dentition. This trend is particularly evident in developed markets, where disposable incomes are higher.

For example, a 2024 report indicated that dental hospitals and clinics recorded the highest revenue share of 62.1% in the cosmetic dentistry market, driven by rising patient demand for aesthetic procedures and advanced technologies. In the US, a 2023 survey by the British Orthodontic Society reported a 76% increase in adults seeking tooth-aligning treatments after the pandemic. The continuous innovation in material science to enhance bonding strength, longevity, and aesthetic appeal positions manufacturers to capitalize on this growing consumer desire for visually pleasing and long-lasting dental work.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical conditions are fundamentally influencing the operational landscape for manufacturers and suppliers. Global inflation is elevating the costs of raw materials, energy, and logistics, which in turn increases the price of dental products. This inflationary pressure can compress profit margins and lead to higher prices for dental practices, potentially impacting patient affordability and the volume of elective procedures.

Concurrently, geopolitical tensions can disrupt complex global supply chains. A reliance on specific regions for critical components or finished products leaves manufacturers vulnerable to trade disputes, sanctions, or logistical challenges, necessitating a more diversified sourcing and localized production strategy. The industry must navigate this intricate environment by prioritizing operational efficiency and strategic procurement. Companies with resilient supply chains and the capacity to mitigate these cost pressures are better positioned for stability and profitability, demonstrating that an agile approach can drive positive outcomes.

The imposition of new duties on a variety of imported dental products and raw materials from countries such as China, Europe, and Mexico has increased the landed cost of these goods. This rise in cost is then passed down the supply chain, affecting distributors’ margins and ultimately leading to higher prices for dental practices and patients. A March 2025 letter from the American Dental Association (ADA) and other professional groups highlighted that these tariffs could lead to increased costs, potentially forcing practices to reduce staff or raise patient prices, which negatively impacts access to care.

Conversely, these tariffs are providing a competitive advantage to US-based manufacturers who are insulated from these import duties. As a result, many clinics are beginning to shift their purchasing toward domestically produced goods to ensure a more stable supply and predictable pricing. This dynamic is fostering domestic manufacturing and encouraging companies to invest in local production capabilities to bypass the tariff burden and strengthen their market position. The industry is responding with adaptive measures, seeking out new suppliers and optimizing logistics, which demonstrates a resilient path forward.

Latest Trends

Increasing Adoption of Minimally Invasive Dentistry Is a Recent Trend

A notable trend observed in 2024 and 2025 is the growing emphasis on minimally invasive dentistry (MID), which aims to preserve as much natural tooth structure as possible. This approach favors the use of materials that require less preparation and offer strong, reliable adhesion. A January 2025 survey of US pediatric dentists found that 39.3% cited minimally invasive dentistry approaches for managing early childhood dental caries, which indicates a significant shift toward this treatment philosophy.

Furthermore, the development of bioactive and self-adhesive materials reflects this trend, as these products possess properties like moisture tolerance and the ability to chemically bond to tooth structure, which streamlines the clinical workflow and improves patient outcomes.

For example, a November 2024 development by a key industry player introduced a new dental material line that uses a low-polymerization-shrinkage monomer to enhance adhesion, reducing shrinkage by 28%. This advancement, along with others in the field, reflects a broader industry movement toward more efficient, patient-friendly procedures that reduce the need for extensive drilling and preparation while still ensuring the longevity of the restoration.

Regional Analysis

North America is leading the Dental Cement Market

The North American dental cement market, constituting 39.4% of the global share, demonstrated robust expansion in 2024. This growth trajectory was propelled by several factors, including the widespread incidence of oral health conditions, a prominent aging demographic, and a strong market emphasis on cosmetic and restorative procedures.

Data from the American Dental Association’s Health Policy Institute revealed that dental visits among the US population increased in 2022, reaching pre-pandemic levels and signaling a healthy recovery in patient utilization. This heightened activity in dental practices directly stimulated demand for restorative materials, such as those used for crowns and bridges.

Additionally, the Centers for Disease Control and Prevention documented an increase in the number of practicing dentists per capita from 2011 to 2021, reflecting the industry’s enhanced capacity to serve a growing patient base. The market also benefited from product innovations, exemplified by Dentsply Sirona’s 2022 introduction of Calibra Bio Bioceramic luting cement, which provides advanced solutions for extending the life of dental restorations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The dental adhesive market in the Asia Pacific region is poised for substantial future growth. This is driven by several macroeconomic and social shifts, including a rise in public awareness of oral hygiene, increasing consumer purchasing power, and the continued development of modern dental infrastructure. A 2022 World Health Organization report for the South-East Asia Region highlighted the persistent burden of oral disease, estimating 526 million cases of untreated permanent dental caries in individuals over the age of five, which sustains a significant need for restorative treatments. The aging population in countries such as Japan is another key demographic catalyst, as this group requires more frequent and comprehensive dental care.

By 2060, projections suggest that individuals aged 65 and older will make up 40% of Japan’s total population. The market is further energized by a growing consumer preference for cosmetic dentistry. Recent studies, such as one from June 2024 on the anti-staining properties of new resin materials like ZEN Universal Cement, underscore the industry’s focus on developing aesthetically superior and advanced solutions. Finally, regional events like IDEM 2024 in Singapore serve as important platforms for showcasing the latest technologies and fostering professional development, which contributes to the market’s positive momentum.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

To capitalize on market opportunities, key players in the dental cement market actively engage in several strategic initiatives. These companies concentrate on research and development to introduce innovative formulations, such as bioactive and self-adhesive products, that offer superior clinical performance and simplify procedures. They also pursue strategic acquisitions and collaborations to expand their product portfolios and geographical reach.

Product diversification is another core strategy, with companies developing a wide range of solutions to serve different applications, from permanent restorations to temporary applications, and materials, including resin-based and glass ionomer options. Furthermore, these industry leaders focus on robust marketing and educational programs to build brand recognition and inform dental professionals about the benefits of their advanced products.

A key player in this market is Dentsply Sirona, an American multinational company headquartered in Charlotte, North Carolina. Dentsply Sirona is a leading designer, manufacturer, and distributor of professional dental products and technologies. The company provides a comprehensive portfolio of solutions across various dental segments, including equipment, consumables, and specialty products, with its offerings distributed in over 120 countries. They have expanded their product lines with innovations like the Calibra Universal Self-Adhesive Cement, which simplifies workflows and improves cleanup, showcasing their commitment to enhancing efficiency and effectiveness for dental practitioners.

Top Key Players in the Dental Cement Market

- SUN MEDICAL CO., LTD

- SHOFU Dental GmbH

- SDI Limited

- Mitsui Chemicals

- MEDENTAL INTERNATIONAL

- Ivoclar Vivadent

- FGM Dental Group

- DMG America LLC

- Dentsply Sirona

- Danaher Corporation

- BISCO, Inc.

- 3M

Recent Developments

- In November 2024: Mitsui Chemicals, through its subsidiary SUN MEDICAL, introduced the i-TFC Luminous II dental material line. This series features post-and-core materials with a low-shrinkage monomer that reduces polymerization shrinkage by 28%, enhancing adhesion. The incorporation of SHOFU’s S-PRG filler marks the first collaboration between the companies, improving the durability and strength of bonding solutions, and driving advancements in the dental cement market.

- In July 2024: Shofu Dental Corporation unveiled BeautiLink SA, a resin cement designed for zirconia restorations, at the California Dental Association meeting. With zirconia becoming the material of choice for crowns, BeautiLink SA ensures superior retention and excellent marginal integrity, helping to meet the growing demand for high-performance dental cements in zirconia-based applications.

- In April 2024: SHOFU INC. and SUN MEDICAL CO., LTD. announced that Shofu Dental Brasil would begin distributing the Super-Bond dental adhesive in Brazil. This adhesive, renowned for its strong bonding capability since 1982, is expected to contribute to the rising demand for quality dental adhesives in Brazil’s growing market.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 billion Forecast Revenue (2034) US$ 3.6 billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Permanent and Temporary), By Material (Resin Based, Zinc-oxide Eugenol, Zinc Phosphate, Polycarboxylate, Glass Ionomer, and Others), By Application (Luting, Pulpal Protection, Restorations, and Surgical Dressing), By End-user (Dental Clinics and Hospitals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SUN MEDICAL CO., LTD, SHOFU Dental GmbH, SDI Limited, Mitsui Chemicals, MEDENTAL INTERNATIONAL, Ivoclar Vivadent, FGM Dental Group, DMG America LLC, Dentsply Sirona, Danaher Corporation, BISCO, Inc., 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SUN MEDICAL CO., LTD

- SHOFU Dental GmbH

- SDI Limited

- Mitsui Chemicals

- MEDENTAL INTERNATIONAL

- Ivoclar Vivadent

- FGM Dental Group

- DMG America LLC

- Dentsply Sirona

- Danaher Corporation

- BISCO, Inc.

- 3M