Global Demand Planning Solutions Market Size, Share, Industry Analysis Report By Component (Solutions (Demand Planning and Optimization, Demand Sensing and Forecasting, Pricing and Promotion Analysis, Others), Services (Professional Services, Managed Services)), By Deployment (On-Premises, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Industry (BFSI, IT & Telecom, Healthcare, Retail & e-Commerce, Automotive, Food & Beverages, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157262

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

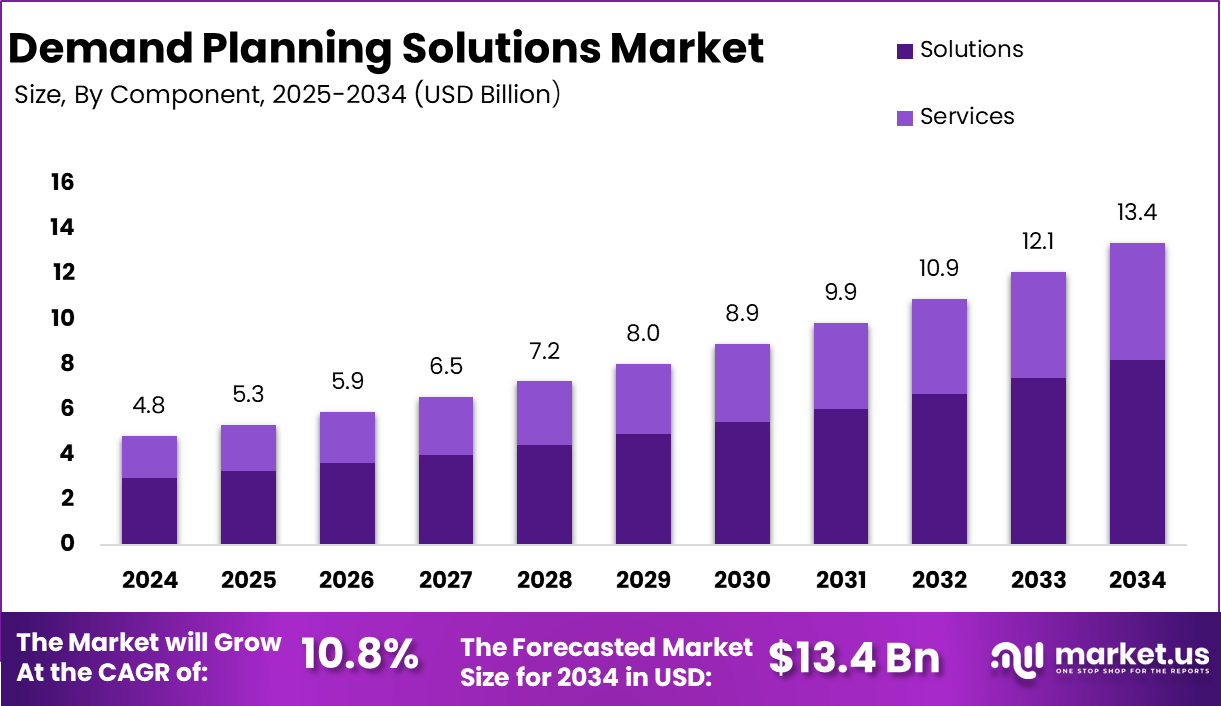

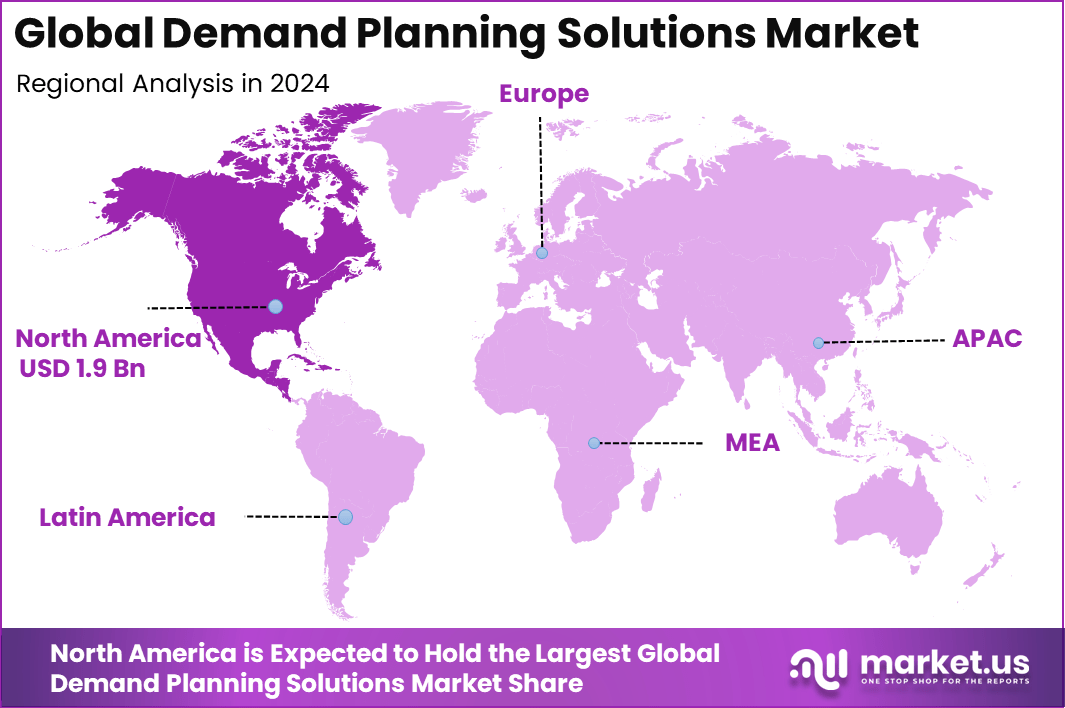

The Global Demand Planning Solutions Market size is expected to be worth around USD 13.4 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.2% share, holding USD 1.9 Billion revenue.

The Demand Planning Solutions Market refers to systems that help companies predict customer demand and manage inventory, production, and supply chain operations more effectively. These solutions are used to gather and analyze historical sales data, market trends, and seasonal patterns. The goal is to improve product availability while minimizing stockouts or excess inventory. These tools support coordination across departments such as sales, operations, finance, and procurement.

The growth of this market can be attributed to the rising need for accurate forecasting and efficient inventory control. As global supply chains face more uncertainty, businesses are seeking reliable planning tools to maintain service levels while keeping costs low. Increasing market competition has also created pressure to improve customer satisfaction and reduce lead times. This has made demand planning a critical operational function in several industries.

Key Takeaway

- By component, Solutions dominated the market with a 61.2% share.

- By deployment, On-Premises led with 52.4% share.

- By enterprise size, Large Enterprises were the primary adopters, accounting for 65.9% share.

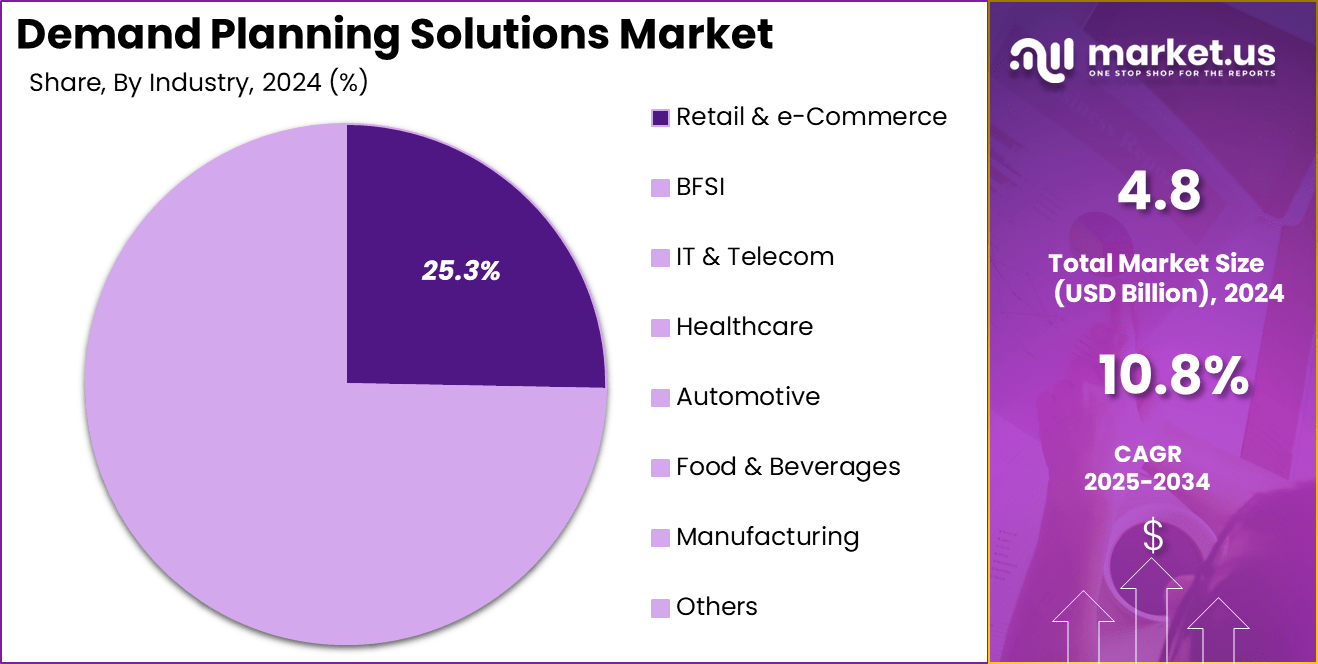

- By industry, Retail & e-Commerce held the largest share at 25.3%.

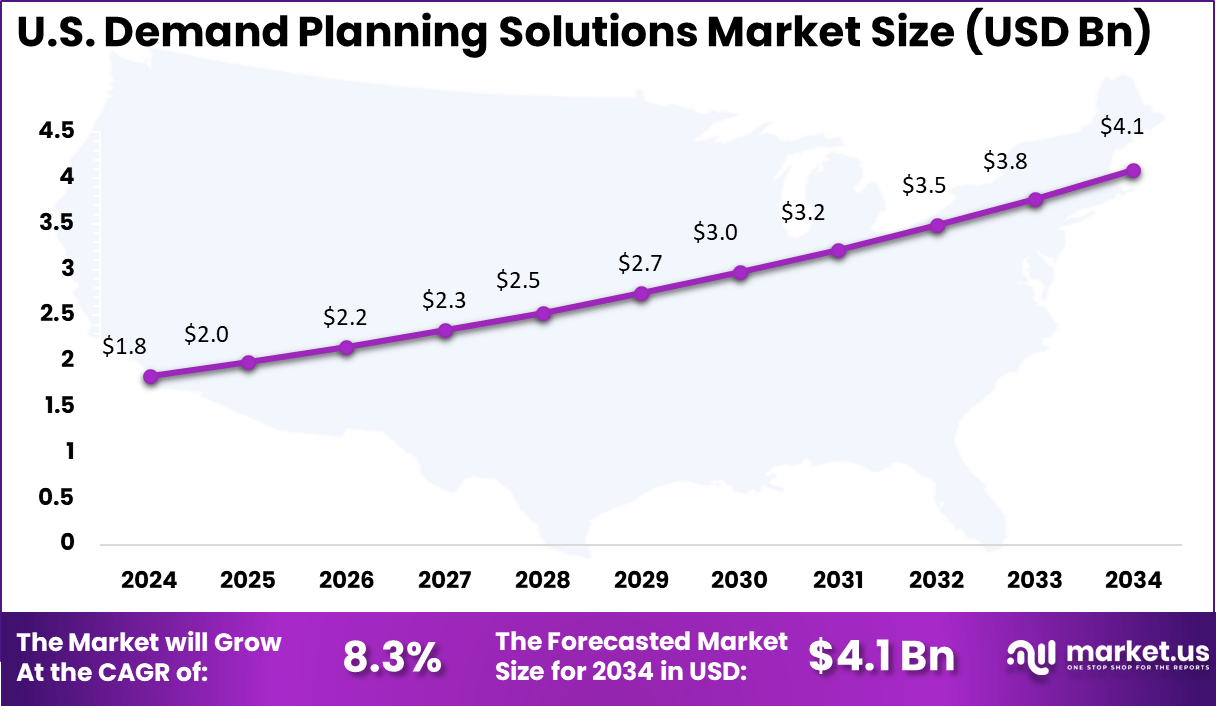

- Regionally, North America led with 40.2% share, while the U.S. market was valued at USD 1.85 Billion, growing at a CAGR of 8.3%.

Investment and Business Benefit

Investment Opportunities in the market are significant as organizations seek solutions that deliver both short-term cost efficiencies and long-term strategic advantages. Growing digital transformation efforts and the continual introduction of new technologies make this space attractive to investors focused on modernization of core business operations.

Business Benefits from demand planning are robust and multifaceted. These solutions enable greater forecast accuracy, improved inventory management, better financial planning, and increased supply chain agility. As businesses become more data-driven, they benefit from enhanced decision support, reduced operational costs, and higher levels of customer satisfaction.

The Regulatory Environment requires businesses to ensure accuracy and transparency in their demand forecasts. Compliance with inventory and supply chain standards is reinforced in regulated industries such as healthcare and food supply. Stringent requirements around data handling, privacy, and reporting further encourage adoption of demand planning systems as businesses look to avoid penalties and adapt quickly to regulatory changes.

U.S. Market Size

The U.S. demand planning solutions market is experiencing significant growth, driven by several key factors. One major driver is the increasing adoption of artificial intelligence (AI) and machine learning in demand forecasting. For instance, the U.S. Department of Energy’s 2024 report highlights the integration of AI to enhance grid management, which parallels advancements in demand planning solutions.

Additionally, the rise of e-commerce and omnichannel retailing has amplified the need for accurate demand forecasting. In response, companies like Autone have secured substantial investments to develop AI-powered platforms that optimize inventory and demand planning processes. On October 16, 2024, Autone raised $17 mn in a Series A funding round led by General Catalyst.

The funds will be used to accelerate product development and expand operations across the U.S. and Europe. However, a significant restraint is the high cost associated with implementing advanced demand planning solutions, which can be prohibitive for small and medium-sized enterprises.

In 2024, North America held a dominant market position in the Global Demand Planning Solutions Market, capturing around a 40.2% share. The North American demand planning solutions market is witnessing robust growth, primarily driven by the increasing complexity of supply chains and the growing emphasis on real-time inventory management.

One major driver is the adoption of advanced analytics and AI-powered predictive models to optimize demand planning. The U.S. Department of Commerce reported in 2024 that nearly 68% of large manufacturers are investing in AI-driven supply chain solutions to reduce forecasting errors and improve operational efficiency, highlighting the government’s focus on digital transformation in industrial sectors.

Canada has also seen a surge in digital supply chain initiatives, with Innovation, Science and Economic Development Canada funding several projects in 2023 aimed at integrating AI and IoT in manufacturing and retail supply chains to enhance demand forecasting accuracy.

A second driver is the significant investment in cloud-based demand planning platforms by North American enterprises. In July 2024, Toronto-based startup LogiPlan raised $12 million in a funding round led by BDC Capital, aimed at expanding its cloud-based solutions across the continent, demonstrating investor confidence in scalable demand planning technologies.

Component Analysis

In 2024, the solutions segment accounted for 61.2% of the market share in 2024, reflecting the strong enterprise focus on advanced software platforms that automate and optimize demand forecasting processes. These solutions integrate historical sales data, real-time analytics, and machine learning algorithms to enhance forecast accuracy, streamline production scheduling, and reduce inventory costs.

Organizations are prioritizing best-in-class solutions that scale across divisions and integrate easily with existing supply chain management platforms, supporting agile decision-making and rapid response to market fluctuations. Growing adoption is driven by the need for analytics-driven transformation in supply chains – companies rely on comprehensive solutions to consolidate siloed data and generate actionable insights for inventory planning, procurement, and resource allocation.

As industries face higher volatility post-pandemic, the emphasis on solutions stems from their proven ability to anchor business continuity and sustain cost savings through forecast-driven, proactive planning across product lines and geography.

Deployment Analysis

In 2024, the On-premises deployment remained the dominant approach in 2024, taking 52.4% share of the market. Organizations in sectors such as manufacturing, healthcare, and regulated industries prioritize on-premises solutions for enhanced control over sensitive data, compliance with regulatory requirements, and direct oversight of software configurations.

On-premises demand planning systems also enable deep customization, higher integration with proprietary IT systems, and robust performance, especially in environments with strict data governance policies. Despite the rise of cloud deployment and SaaS models, many large enterprises continue to invest in on-premises infrastructure for critical planning functions.

The preference is driven by security mandates, the need for localized data storage, and concerns over latency or connectivity in distributed operations. In several legacy-heavy verticals, hybrid approaches are also emerging, blending on-premises reliability with selective adoption of cloud-based analytics or visualization tools to maximize flexibility and performance

Enterprise Size Analysis

In 2024, Large enterprises represented the largest user segment, comprising 65.9% of the demand planning solutions market in 2024. Their dominance can be attributed to the scale and complexity of global supply chains, extensive product portfolios, and multi-layered sourcing networks that require robust forecasting systems and statistically driven planning tools.

Large organizations are increasingly investing in advanced demand planning to enhance cross-functional collaboration between supply chain managers, finance teams, and business units, safeguarding against disruptions and capitalizing on new opportunities. Continuous digital transformation efforts, growing investments in predictive analytics, and the ability to leverage massive internal datasets further accelerate adoption among large enterprises.

These organizations seek scalable platforms that support multi-geography planning, multilingual interfaces, and integration with ERP, CRM, and warehouse management systems. High spending among enterprise customers reflects the premium placed on reliability, regulatory compliance, and strategic agility in supply chain and demand management.

Industry Analysis

In 2024, Retail and e-commerce accounted for 25.3% of the overall market in 2024, driven by the sector’s rapid digitization and growing reliance on accurate forecasting to manage inventory and meet customer demand.

Retailers and online merchants leverage demand planning solutions to align procurement with sales trends, optimize assortment planning, and support omnichannel fulfillment strategies. The integration of AI-driven analytics and automation enables businesses to respond quickly to seasonal fluctuations, promotional cycles, and evolving consumer behaviors in a highly competitive market.

In the U.S., e-commerce sales exceeded USD 1.2 trillion in 2024, prompting AI-based demand planning adoption to prevent stockouts and manage seasonal peaks. In the United Kingdom, online retail accounted for 29% of total retail in 2023, motivating major retailers to implement predictive pricing and inventory management tools. In China, the Ministry of Commerce reported in 2023 that over 60% of top e-commerce firms integrated demand forecasting systems for fast-moving consumer goods.

The growth in e-commerce and shift to digital shopping habits have pushed retailers to invest in platforms that provide granular, SKU-level forecasts and support for complex supply chain scenarios. Demand planning solutions are now central to ensuring product availability, minimizing stockouts, and optimizing last-mile delivery, underpinning superior customer experiences and improved profit margins for major retail players and online marketplaces.

Key Market Segments

By Component

- Solutions

- Demand Planning and Optimization

- Demand Sensing and Forecasting

- Pricing and Promotion Analysis

- Others

- Services

- Professional Services

- Managed Services

By Deployment

- On-Premises

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Industry

- BFSI

- IT & Telecom

- Healthcare

- Retail & e-Commerce

- Automotive

- Food & Beverages

- Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rise of E-commerce and Omnichannel Retailing

The rise of e-commerce and omnichannel retailing continues to drive demand planning solutions globally. In the U.S., the Department of Commerce reported in 2024 that e-commerce sales reached USD 1.2 trillion, prompting major retailers such as Walmart and Target to implement AI-powered demand planning systems to manage omnichannel inventories.

In the United Kingdom, the Office for National Statistics highlighted that online retail accounted for 29% of total retail sales in 2023, pushing companies like Tesco and ASOS to adopt predictive forecasting platforms to handle high-volume transactions and seasonal demand surges. In Japan, the Ministry of Economy, Trade and Industry emphasized in 2023 that leading consumer electronics and apparel chains integrated demand sensing and inventory optimization tools to synchronize in-store and online operations efficiently.

Additionally, in Australia, the Department of Industry, Science, Energy, and Resources funded programs in 2023 enabling retailers to implement centralized demand planning platforms, reducing stockouts and improving order fulfillment speed. Product launches have complemented this trend;

for instance, on 15 May 2024, Blue Yonder launched its Retail AI Demand Planning Platform in North America and Europe to enhance inventory prediction accuracy for omnichannel retailers. These government-backed initiatives, combined with investments in AI-enabled solutions, have significantly expanded the adoption of demand planning systems in the retail and e-commerce sector worldwide.

Restraint

High Implementation and Maintenance Costs

High implementation and maintenance costs continue to restrain the adoption of demand planning solutions, particularly among SMEs. In Germany, the Federal Ministry for Economic Affairs reported in 2023 that over 45% of mid-sized manufacturing companies delayed digital supply chain investments due to prohibitive software licensing and infrastructure costs.

In Brazil, the Ministry of Science, Technology, and Innovation indicated in 2023 that several local retailers postponed implementing on-premises planning solutions because of high IT deployment and maintenance expenses. Similarly, in Canada, the Canadian Ministry of Innovation, Science, and Industry highlighted that around 40% of small and medium enterprises struggle with IT budget constraints when integrating advanced predictive analytics into existing ERP systems.

On the investment side, SAP disclosed in October 2023 a USD 30 million program to subsidize on-premises deployment costs for large enterprises, signaling the high financial barriers for smaller companies. In South Korea, the Ministry of SMEs and Startups noted in 2024 that high hardware and software maintenance costs prevented approximately half of mid-sized enterprises from implementing demand planning solutions.

Opportunities

Utilization of Big Data and Predictive Analytics

The utilization of big data and predictive analytics offers substantial opportunities for market expansion. In the U.S., the National Institute of Standards and Technology (NIST) reported in 2024 that 68% of large retailers adopted predictive analytics tools to forecast demand across multiple distribution centers.

In Germany, the Federal Statistical Office highlighted in 2023 that integrating consumer purchasing trends and historical sales data into AI-enabled demand planning platforms increased forecast accuracy by over 20% for large retailers and manufacturers.

In India, the Ministry of Commerce and Industry promoted initiatives in 2023 to encourage FMCG companies to use big data analytics for improving inventory turnover and reducing stockouts. On the investment side, Oracle invested USD 50 million in March 2024 to enhance AI-driven predictive planning solutions for global e-commerce and manufacturing clients.

In Australia, the Department of Industry, Science, Energy, and Resources supported predictive analytics projects in 2023 to optimize inventory management in retail chains. By leveraging large datasets from multiple sources and predictive algorithms, companies can anticipate demand fluctuations, reduce operational inefficiencies, and expand adoption across diverse industries, creating a significant growth opportunity for demand planning solution providers worldwide.

Challenges

Managing Long Lead Times and Supplier Variability

Managing long lead times and supplier variability remains a key challenge for demand planning solutions. In the U.S., the Department of Commerce reported in 2024 that over 55% of manufacturing companies experienced supply chain disruptions due to extended lead times from international suppliers, necessitating improved demand planning tools.

In Mexico, the Ministry of Economy highlighted in 2023 that automotive manufacturers faced significant delays due to supplier variability, pushing companies to adopt scenario-based planning platforms to mitigate risk. In Germany, the Federal Ministry for Economic Affairs indicated that fluctuating raw material availability impacted 48% of industrial operations in 2023, emphasizing the need for dynamic inventory management and real-time demand adjustments.

In China, the Ministry of Commerce reported in 2023 that fast-moving consumer goods companies implemented advanced demand sensing systems to respond quickly to supplier disruptions and seasonal spikes. Investments have been made to address this;

for instance, in July 2023, IBM deployed USD 40 million to enhance its demand planning suite with features for supplier risk assessment and lead time simulation. These government-backed data and corporate initiatives highlight that while demand planning solutions provide mitigation tools, managing supply chain unpredictability remains a persistent operational challenge globally.

Latest Trends

Increased Use of Machine Learning and AI

The increased use of machine learning (ML) and AI is a defining trend shaping the demand planning solutions market. In the U.S., the Department of Commerce reported in 2024 that over 60% of large retailers integrated AI-based demand planning systems to optimize inventory, pricing, and promotion strategies.

In Japan, the Ministry of Economy, Trade and Industry emphasized in 2023 that top automotive manufacturers deployed machine learning-enabled forecasting platforms to reduce production inefficiencies and anticipate market demand. In France, the Ministry of Economy and Finance supported initiatives in 2023 for AI integration in supply chain planning for retail and e-commerce sectors, enhancing forecast accuracy and reducing stockouts.

On the investment front, SAP launched its ML-powered Demand Planning 2024 platform on 12 March 2024, while Oracle invested USD 50 million in February 2024 to expand AI-driven predictive solutions for global enterprises. In Australia, the Department of Industry promoted AI-focused training and deployment programs in 2023 to accelerate adoption across retail and manufacturing sectors.

Key Players Analysis

In the demand planning solutions market, large technology leaders such as Oracle Corporation, IBM Corporation, SAP SE, and Cognizant Technology Solutions Corp. play a central role. Their offerings are backed by advanced cloud infrastructure, artificial intelligence integration, and global delivery networks. These players focus on improving scalability and accuracy in forecasting for enterprises across industries.

Mid-sized firms including Blue Ridge Solutions Inc., Logility, Inc., John Galt Solutions, Inc., RELEX Oy, and Syncron AB contribute significantly to specialized demand planning applications. These companies are known for domain-specific solutions, especially in retail, consumer goods, and manufacturing sectors. Their flexibility and customer-focused approach position them as important partners for businesses seeking agile solutions.

New-generation providers such as Kinaxis, Anaplan, Blue Yonder, Aspire Systems, and Avercast are expanding their role with advanced analytics and cloud-native platforms. Their focus is on improving real-time decision-making, collaborative planning, and seamless integration with supply chain systems. These firms invest heavily in predictive analytics and machine learning capabilities, which are increasingly adopted by businesses seeking accurate demand forecasts.

Top Key Players in the Market

- Blue Ridge Solutions Inc.

- Cognizant Technology Solutions Corp.

- Aspire Systems

- Avercast

- Oracle Corporation

- IBM Corporation

- John Galt Solutions, Inc.

- RELEX Oy

- Logility, Inc.

- SAP SE

- Syncron AB

- Kinaxis

- Anaplan

- Blue Yonder

- Others

Recent Developments

- On 7 March 2025, Kinaxis introduced the RapidResponse Cloud 2.0 platform, offering enhanced real-time analytics and scenario-based simulations to optimize supply chain decision-making globally.

- On 22 February 2025, Oracle partnered with Cognizant Technology Solutions to co-develop an AI-driven demand planning solution for the automotive and electronics sectors, aimed at improving inventory management and reducing stockouts.

- On 18 January 2025, Blue Yonder launched its AI-powered Demand Planning Platform in North America, integrating machine learning algorithms for improved forecast accuracy across retail and manufacturing clients.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Bn Forecast Revenue (2034) USD 13.4 Bn CAGR(2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions (Demand Planning and Optimization, Demand Sensing and Forecasting, Pricing and Promotion Analysis, Others), Services (Professional Services, Managed Services)), By Deployment (On-Premises, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Industry (BFSI, IT & Telecom, Healthcare, Retail & e-Commerce, Automotive, Food & Beverages, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Blue Ridge Solutions Inc., Cognizant Technology Solutions Corp, Aspire Systems, Avercast, Oracle Corporation, IBM Corporation, John Galt Solutions, Inc., RELEX Oy, Logility, Inc., SAP SE, Syncron AB, Kinaxis, Anaplan, Blue Yonder, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Demand Planning Solutions MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Demand Planning Solutions MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Blue Ridge Solutions Inc.

- Cognizant Technology Solutions Corp.

- Aspire Systems

- Avercast

- Oracle Corporation

- IBM Corporation

- John Galt Solutions, Inc.

- RELEX Oy

- Logility, Inc.

- SAP SE

- Syncron AB

- Kinaxis

- Anaplan

- Blue Yonder

- Others