Decorative Paints Market By Product Type (Water-based Paints, Solvent-based Paints, Powder Coatings), By Formulation (Emulsion-based Paints, Distemper, Enamel, Primer, Textures, Others), By Resin Type (Acrylic, Alkyd, Vinyl, Polyurethane, Others), By Sales Channel (Online, Offline), By Application (Residential, New Construction, Remodel and repaint, Non-residential, Commercial, Industrial, Infrastructure), By User Type (DIY, Professional), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133036

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Formulation Analysis

- By Resin Type Analysis

- By Sales Channel Analysis

- By Application Analysis

- By User Type Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

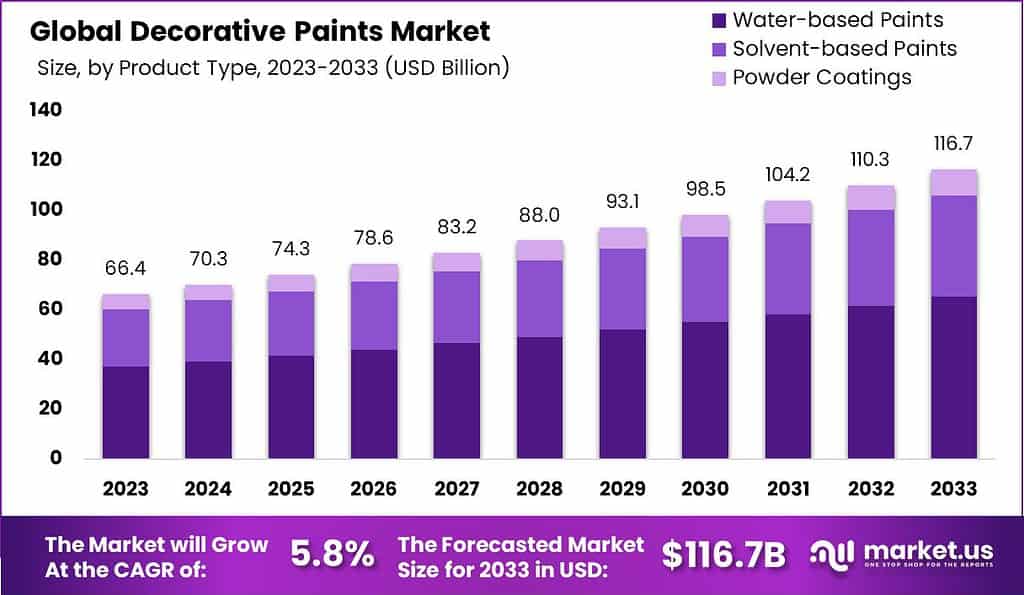

The Global Decorative Paints Market size is expected to be worth around USD 116.7 Billion by 2033, from USD 66.4 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

The “Decorative Paints Market” refers to a sector of the industry that focuses on producing and selling paints used to enhance the aesthetic appeal of interior and exterior surfaces. These paints are often used in homes, offices, and commercial buildings to improve their appearance with a variety of colors, finishes, and textures. The market includes a range of products such as emulsions, enamels, wood coatings, and others, tailored to meet the specific needs and preferences of consumers.

The market demand for decorative paints is currently experiencing growth and is expected to continue this trend in the coming years. These paints, used primarily in homes and commercial settings to enhance aesthetics, are gaining popularity due to the rising interest in interior decoration and home improvement. Factors like increasing urbanization and higher disposable incomes are driving this demand.

The market for decorative paints has been experiencing steady growth, driven by increasing demand in both residential and commercial sectors. This growth can be linked to rising urbanization, a surge in housing constructions, and renovation activities globally. As of recent data, the global decorative paints market is projected to expand at a compound annual growth rate (CAGR) of around 4.2% over the next five years.

Key factors influencing the market include technological advancements in paint products, such as the development of eco-friendly and durable paints, and a growing consumer preference for aesthetically pleasing interiors. The Asia-Pacific region leads in market share, attributed largely to rapid economic growth in countries like China and India, which are witnessing significant investment in infrastructure and real estate. Akzo Nobel announced its plan to reduce around 2,000 positions globally as part of its steps to reduce cost and enhance the efficiency of its functions.

Government regulations have a significant impact on the decorative paints market, particularly concerning environmental standards. The U.S. Environmental Protection Agency (EPA) outlines specific requirements and recommendations for greener paints and coatings. These include reducing toxic substances like ammonia and VOCs, encouraging the use of recycled content, and ensuring the durability and sustainability of paint products

Import and export dynamics are critical in understanding the global reach and logistical challenges of the decorative paints market. Tools and resources provided by platforms like Trade.gov offer insights into navigating trade barriers, understanding anti-dumping and countervailing duties, and exploring foreign markets effectively

Government and private investments play a crucial role in stimulating market growth. Initiatives such as federal procurement for environmentally preferable purchasing highlight the push towards sustainable products, which is particularly relevant for the paints and coatings industry

The decorative paints market is also shaped by various industry activities such as mergers, acquisitions, and partnerships. These activities often aim to leverage market positioning, enhance technological advancements, and expand into new markets, thus driving innovation and competitive advantage.

Key Takeaways

- The Global Decorative Paints Market size is expected to be worth around USD 116.7 Billion by 2033, from USD 66.4 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

- Water-based paints dominated the Decorative Paints Market with a 56.1% share.

- Emulsion-based Paints dominated the Decorative Paints Market with a 35.5% share.

- Acrylic dominated the Decorative Paints Market with a 45.2% share by resin type.

- Offline channels dominate 73.4% of the Decorative Paints Market.

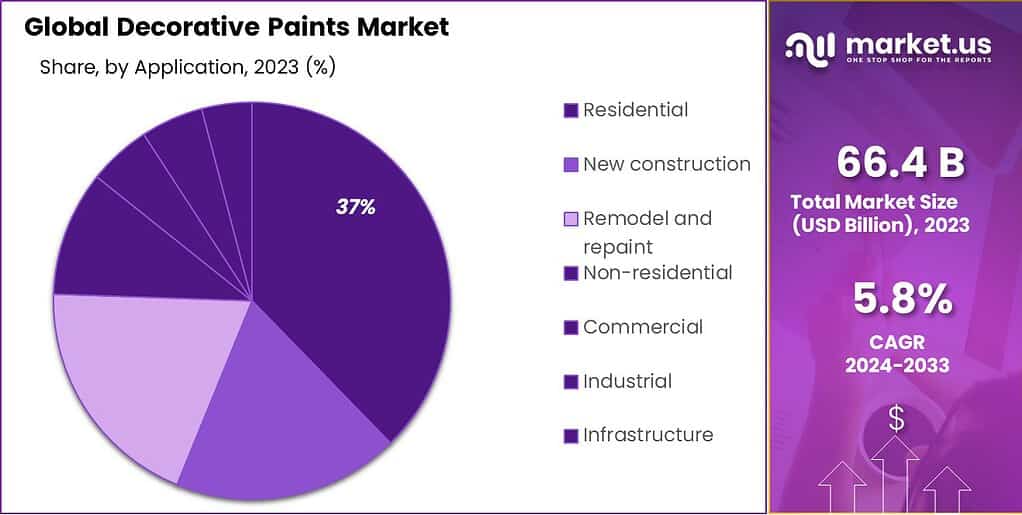

- The Residential segment dominated the Decorative Paints Market with a 37.3% share.

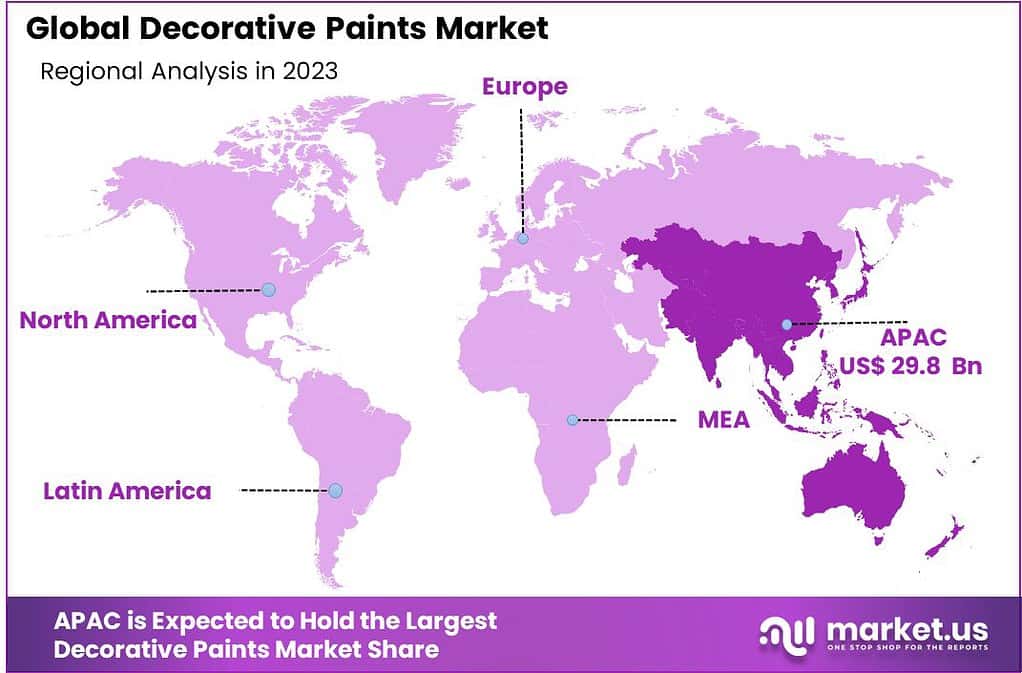

- Asia Pacific dominates the decorative paints market, holding 45.2% share, valued at $29.8 billion.

By Product Type Analysis

Water-based paints dominated the Decorative Paints Market with a 56.1% share.

In 2023, Water-based Paints held a dominant market position in the By Product Type segment of the Decorative Paints Market, capturing more than a 56.1% share. This significant market share can be attributed to the growing environmental concerns and stringent regulatory standards promoting low-VOC and non-toxic materials in the paint industry. Water-based paints, known for their reduced environmental impact compared to solvent-based options, have seen increased adoption across both residential and commercial sectors.

Following water-based paints, Solvent-based Paints also maintained a noticeable presence in the market. Although these paints offer robust application properties and high durability, their market share has been constrained by regulatory pressures and a shifting preference toward more sustainable solutions. Solvent-based paints are gradually being reformulated or replaced by safer alternatives in many applications.

Lastly, Powder Coatings represent a smaller, yet important, portion of the decorative paints market. Characterized by their absence of solvents and notable cost-effectiveness in terms of application, powder coatings are increasingly favored in industrial applications. They provide a durable and high-quality finish, driving their adoption in appliances, automotive components, and heavy-duty machinery. Despite their advantages, the market penetration of powder coatings is limited by the need for specialized application equipment and the challenges associated with color changing during the application process.

Together, these product types underline a diverse and evolving Decorative Paints Market, where sustainability and innovation continue to drive market dynamics and consumer choices.

By Formulation Analysis

Emulsion-based Paints dominated the Decorative Paints Market with a 35.5% share.

In 2023, Emulsion-based Paints held a dominant market position in the By Formulation segment of the Decorative Paints Market, capturing more than 35.5% share. This significant market share can be attributed to the product’s superior attributes such as higher durability, better finish, and water-resistant properties which make them a preferred choice for both interior and exterior applications.

Following emulsion-based paints, Distemper accounted for a considerable portion of the market. Often selected for its cost-effectiveness and ease of application, distemper is commonly used in residential properties, particularly in budget-conscious projects. It offers a range of finishes from matte to glossy, appealing to varying consumer preferences.

Enamel paints, known for their hard and glossy finish, also captured a notable market share. Their robustness and resistance to moisture and wear make them ideal for surfaces that require frequent cleaning or are exposed to harsh weather conditions. This makes enamel paints particularly popular in commercial and industrial settings.

Primers, essential for preparing surfaces for painting, held a strategic position in the market. By improving paint adhesion and increasing the durability of the paint coat, primers ensure better finish quality and longevity of the surface treatment, which is crucial for both residential and commercial applications.

Textures, offering a unique aesthetic and tactile quality to surfaces, have seen increasing adoption. These products are favored for their ability to add dimension and depth to walls, catering to the growing consumer demand for personalized and distinctive interior designs. The versatility of textures in mimicking materials like stone, wood, and fabric contributes to their popularity.

By Resin Type Analysis

Acrylic dominated the Decorative Paints Market with a 45.2% share by resin type.

In 2023, Acrylic held a dominant market position in the By Resin Type segment of the Decorative Paints Market, capturing more than a 45.2% share. This resin type is favored for its durability, water resistance, and exceptional color retention, making it a preferred choice for both indoor and outdoor applications. Acrylic paints also boast a shorter drying time and a lower environmental impact than alternative resin types, which has significantly contributed to their market supremacy.

Following acrylic, alkyd resins accounted for a significant portion of the market. Alkyd-based paints are valued for their robust finish and resistance to wear, often used in high-traffic areas where durability is paramount. However, the longer drying times and higher levels of volatile organic compounds (VOCs) compared to acrylic paints limit their appeal in environmentally conscious markets.

Vinyl resins also play a crucial role in the decorative paints market, particularly in commercial and institutional settings, due to their cost-effectiveness and ease of application. These paints are generally favored for large-scale projects where budget constraints are a consideration.

Polyurethane finishes are well-regarded for their superior hardness and resistance to chemical erosion, making them ideal for floors and other surfaces that require tough paint solutions. The market demand for polyurethane is driven by its application in both residential and industrial sectors, where long-lasting protection is essential.

By Sales Channel Analysis

Offline channels dominate 73.4% of the Decorative Paints Market.

In 2023, The Decorative Paints Market was markedly influenced by sales channel dynamics, where the Offline segment held a dominant position. Capturing more than a 73.4% share, offline channels such as brick-and-mortar stores and dedicated paint showrooms remained consumers’ preferred purchasing route. This preference is attributed to the tactile buying experience they offer, allowing customers to see, touch, and compare colors and textures firsthand—a significant advantage over online alternatives.

On the other hand, the Online segment, though smaller, is growing steadily. Accounting for the remaining market share, online sales are driven by the increasing convenience of digital platforms, where consumers can quickly browse an extensive range of products.

Enhancements in online visualization tools and augmented reality apps, which help simulate paint effects on virtual room setups, also contribute to this segment’s growth. Despite these advances, the tactile needs and immediate procurement advantages provided by offline channels continue to ensure their dominance in the decorative paints market.

By Application Analysis

The Residential segment dominated the Decorative Paints Market with a 37.3% share.

In 2023, Residential held a dominant market position in the By Application segment of the Decorative Paints Market, capturing more than a 37.3% share. This segment’s prominence is driven by increasing consumer expenditure on home improvement and a rising trend toward aesthetic enhancements in living spaces. The residential sector’s robust demand is supported by both new construction and remodeling and repaint activities.

New construction, benefiting from urbanization and population growth, particularly in emerging economies, contributed significantly to the market. It involves the application of decorative paints in newly built residential properties, aligning with modern construction standards and consumer preferences for sustainable and eco-friendly materials.

Remodeling and repainting, another critical component, involves the revitalization of existing residential structures. This segment has seen growth, fueled by homeowner initiatives to maintain or increase property value and adapt to changing style trends. The shift towards more frequent interior updates reflects a dynamic consumer approach to residential aesthetics, driven by social media influence and a heightened focus on personalized living environments.

In the non-residential sector, which encompasses commercial, industrial, and infrastructure applications, different dynamics are observed. The commercial segment, which includes businesses and public facilities, prioritizes durability and aesthetic appeal in paint applications, aiming to attract and retain clientele and tenants. As businesses adapt to evolving consumer expectations and environmental regulations, eco-friendly and visually appealing solutions are increasingly in demand.

The industrial segment focuses on specialized paints that resist harsh conditions and chemicals, supporting maintenance and safety standards. This market’s growth is propelled by industrial expansion and the need for compliance with stringent environmental regulations.

Lastly, the infrastructure segment uses decorative paints to enhance the visual appeal and longevity of public and private infrastructure projects, including bridges, roads, and transportation facilities. The emphasis on sustainability and long-term cost savings through durable applications is a key driver for this segment.

By User Type Analysis

Professionals dominated the Decorative Paints Market with a 54.3% share.

In 2023, Professionals held a dominant market position in the Professional user type segment of the Decorative Paints Market, capturing more than a 54.3% share. This substantial market share underscores the trust and reliance that professional painters and contractors place on high-quality decorative paints, reflecting their preferences for durability, aesthetic appeal, and application ease. These professionals, who require consistent and reliable results for their commercial and residential projects, tend to choose premium brands that promise superior coverage and longevity.

The DIY segment, though smaller in comparison, has been steadily growing. Enthusiastic homeowners driven by DIY trends and the desire to personalize their living spaces have increasingly turned to decorative paints as a cost-effective solution to transform their environments. This shift is supported by online tutorials and advancements in easy-to-use paint products, which are making DIY projects more accessible to the general public.

Key Market Segments

By Product Type

- Water-based Paints

- Solvent-based Paints

- Powder Coatings

By Formulation

- Emulsion-based Paints

- Distemper

- Enamel

- Primer

- Textures

- Others

By Resin Type

- Acrylic

- Alkyd

- Vinyl

- Polyurethane

- Others

By Sales Channel

- Online

- Offline

By Application

- Residential

- New Construction

- Remodel and repaint

- Non-residential

- Commercial

- Industrial

- Infrastructure

By User Type

- DIY

- Professional

Driving factors

Urbanization and Infrastructure Development: Expanding the Canvas for Decorative Paints

Urbanization plays a pivotal role in driving the growth of the decorative paints market. As more people migrate to urban areas, the demand for new housing and commercial buildings rises significantly. This surge in construction activity directly boosts the demand for decorative paints, used both externally and internally to protect and beautify these structures.

Infrastructure development, another facet of urbanization, similarly influences the market. Projects like new roads, bridges, and public buildings require vast quantities of paint, further expanding the market. For instance, in emerging economies, rapid urbanization has been closely linked to increased per capita paint consumption, highlighting the scale of impact on the decorative paints sector.

Environmental Awareness and Sustainability Concerns: Steering Innovations in Paint Formulations

In recent years, growing environmental awareness and sustainability concerns have reshaped many industries, including decorative paints. Consumers and regulators are increasingly demanding eco-friendly products, which has led to innovations in paint formulations.

Water-based paints, which have lower volatile organic compounds (VOCs) than solvent-based alternatives, are gaining popularity due to their reduced environmental impact. This shift is not only a response to regulatory pressures but also aligns with a broader consumer preference for sustainability.

The development and adoption of paints that minimize environmental damage while delivering quality and durability are key factors that support market growth. By integrating these eco-conscious options, manufacturers can tap into a more environmentally aware customer base, thereby expanding their market reach.

Rising Demand for Interior Decoration: Enhancing Aesthetic Appeal

The rising interest in interior decoration is another significant driver of the decorative paints market. As living standards improve and disposable incomes increase, individuals are more inclined to invest in home decor to reflect personal style and enhance living spaces. This trend is evident in the proliferation of home improvement shows and magazines, which inspire consumers to undertake their own decoration projects.

The demand for a variety of paints, offering a range of colors, textures, and finishes, has grown accordingly. Moreover, the seasonal redecoration trends further fuel this demand, as consumers seek to update their interiors with new themes and colors regularly. This ongoing interest in aesthetic enhancement directly correlates with increased sales in the decorative paints sector.

Restraining Factors

Raw Material Price Volatility: A Barrier to Stable Growth

The cost of raw materials is a crucial factor in the production of decorative paints. These materials typically include titanium dioxide, solvents, resins, and additives, the prices of which are subject to global market fluctuations. Volatility in these prices can lead to inconsistent production costs, forcing paint manufacturers to adjust their pricing strategies frequently. Such adjustments can alienate budget-sensitive consumers and may cause market instability.

When raw material prices rise, manufacturers often pass these costs onto consumers, potentially decreasing demand. Conversely, when prices are low, while beneficial for production costs, it can lead to fierce price competition among manufacturers, eroding profit margins. This cycle of volatility can restrain market growth by creating an unpredictable operating environment and discouraging long-term investments and innovations.

Infrastructure Constraints: Limiting Market Expansion and Efficiency

Infrastructure constraints significantly impact the decorative paints market by affecting both supply chain efficiency and market expansion capabilities. In regions with underdeveloped transportation and logistics infrastructure, manufacturers face challenges in distributing their products effectively, limiting their ability to reach potential markets and delaying delivery times.

This inefficiency not only increases operational costs but also affects customer satisfaction, which is crucial for market growth. Furthermore, limited access to advanced manufacturing facilities can hinder the production capacity and the ability of companies to innovate, thus restraining the market’s growth potential.

Impact of Climate Change: Influencing Product Demand and Sustainability Measures

Climate change poses a multifaceted challenge to the decorative paints market. Increasingly, extreme weather conditions demand more durable and adaptable paint solutions, prompting manufacturers to invest in research and development of products that can withstand such conditions. While this represents a potential growth opportunity, the associated costs and technical challenges can be prohibitive, particularly for smaller players in the market.

Additionally, the growing regulatory and consumer focus on environmental sustainability compels manufacturers to shift towards eco-friendly raw materials and production processes, which may involve higher costs and complex technology integrations. This transition, while beneficial for long-term sustainability and compliance with global regulations, can be a restraining factor in terms of immediate financial impact and operational adjustments.

Growth Opportunity

Rising Disposable Incomes

Increased disposable incomes globally are a primary driver for the decorative paints market. As more individuals have greater financial freedom, there is a notable shift towards spending on home improvement projects, including repainting and interior decoration.

This trend is especially prominent in emerging economies, where a burgeoning middle class is likely to spend more on enhancing their living spaces, thereby boosting demand for decorative paints.

Sustainability and Eco-Friendly Products

Environmental concerns are increasingly influencing consumer choices, leading to a surge in demand for eco-friendly and sustainable products. Paint manufacturers are responding by developing products with lower volatile organic compounds (VOCs) and greater environmental certifications.

This shift not only aligns with regulatory requirements but also appeals to the environmentally conscious consumer, offering a substantial growth avenue for brands that prioritize sustainability.

Personalization and Customization

The desire for personalized and customized living spaces is another significant trend shaping the decorative paints market. Consumers are seeking products that offer a wide range of colors, textures, and finishes, allowing for a more tailored approach to home decor. Paint companies that innovate in providing customizable options and unique aesthetic solutions are likely to capture a larger share of the market.

Latest Trends

Eco-Friendly Innovations

In 2024, the decorative paints market is witnessing a significant shift towards eco-friendly innovations. This trend is largely driven by increasing environmental awareness and stricter regulatory standards concerning volatile organic compounds (VOCs). Manufacturers are progressively adopting water-based and bio-based paint formulations, which offer reduced environmental impact while maintaining high-quality finishes.

The introduction of paints containing natural ingredients like lime and clay is not only appealing to environmentally conscious consumers but also aligns with global sustainability goals.

Increased Demand for Customization

Customization is becoming a pivotal factor in consumer purchasing decisions within the decorative paints sector. This trend reflects a broader shift towards personalization in consumer goods. In response, paint companies are expanding their offerings to include a wide range of colors and textures, and are investing in color-mixing technologies that allow consumers to create bespoke shades.

Retail innovations such as on-site color mixing systems are enhancing consumer engagement, enabling brands to deliver a more personalized shopping experience.

Technological Advancements in Coatings

The integration of advanced technologies into paint formulations and application processes is transforming the decorative paints market. Developments in nanotechnology and the incorporation of smart coatings that change color based on temperature or light are examples of how technology is being leveraged to add value to paint products.

Furthermore, the use of augmented reality apps to preview paint colors in real-time within consumers’ spaces is streamlining the decision-making process, thereby enhancing customer satisfaction and driving sales.

Regional Analysis

Asia Pacific dominates the decorative paints market, holding 45.2% share, valued at $29.8 billion.

In North America, the decorative paints market is characterized by advancements in eco-friendly and sustainable paint solutions, driven by stringent environmental regulations and consumer preference for green products. The market has witnessed steady growth, with the United States leading in terms of consumption and innovation. The presence of major manufacturers and a robust housing sector contribute significantly to regional demand.

Europe’s decorative paints market is bolstered by a strong emphasis on aesthetic enhancements in residential and commercial properties, coupled with high environmental standards. The region sees a significant adoption of water-based technologies due to VOC regulation compliance. European countries, particularly Germany, France, and the UK, display a mature market landscape with a focus on product innovation and sustainability.

Asia Pacific stands as the dominant region in the global decorative paints market, accounting for 45.2% with a valuation of $29.8 billion. The market is propelled by rapid urbanization, increasing disposable incomes, and the expanding real estate sector, particularly in China and India. This region benefits from both a large consumer base and increasing investments in infrastructure development, making it a pivotal area for market stakeholders.

The decorative paints market in the Middle East and Africa is emerging, driven by the construction boom in Gulf Cooperation Council (GCC) countries and increased urbanization in African nations. The demand in this region is characterized by a preference for luxury paints and finishes, supported by significant investments in commercial and residential construction projects.

Latin America’s market is evolving with an increasing demand for decorative paints influenced by urban renewal projects and a recovering economic climate. Countries like Brazil and Mexico are leading the market, with growth fueled by both residential and commercial construction activities. The region is witnessing a gradual shift towards water-based paints due to rising environmental awareness among consumers.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global decorative paints market exhibits robust competition among key players, driven by rising demand for aesthetic enhancement in residential and commercial spaces. Leading companies within this market include Akzo Nobel N.V., Asian Paints Limited, PPG Industries, Inc., and Sherwin-Williams Company, each distinguished by unique strategic approaches, regional advantages, and innovation capacities.

Akzo Nobel N.V. stands out as a global leader with extensive product diversity and a strong commitment to sustainable solutions. Known for its innovative eco-friendly products, Akzo Nobel leverages a substantial R&D budget to lead in low-VOC (volatile organic compounds) formulations, responding effectively to environmental regulations and shifting consumer preferences.

Asian Paints Limited, a dominant force in the Asia-Pacific region, particularly in India, benefits from a vast distribution network and deep brand loyalty. The company’s strategy focuses on tailoring products to local preferences, including climate-specific solutions. Its stronghold in emerging markets provides it with a stable revenue stream and positions it to capture growth from expanding middle-class populations.

PPG Industries, Inc. commands a significant share in the North American and European markets, with a diversified portfolio spanning architectural and industrial coatings. By emphasizing innovation and leveraging advanced technologies, such as smart coatings, PPG targets the premium segment with specialized products that enhance surface protection, aesthetics, and sustainability.

Sherwin-Williams Company leads with a vertically integrated model that optimizes supply chains and maintains quality control. Known for its high-performance products, Sherwin-Williams combines innovation with aggressive acquisition strategies, recently expanding its footprint in emerging markets to capture growing demand.

Overall, these key players’ emphasis on R&D, regional customization, and sustainable practices underscores their commitment to capturing market share in the competitive landscape of decorative paints.

Market Key Players

- Acro Paints Limited

- Akzo Nobel N.V.

- Asian Paints Limited

- BASF-SE

- Berger Paints India Limited

- Ecopaints Private Limited

- Esdee Paints Limited

- Indigo Paints Limited

- Jotun

- KANSAI Paints Co. Ltd

- NIPSEA GROUP (Nippon Paint)

- PPG Industries, Inc.

- RPM International Inc.

- Shalimar Paints Limited

- Sheenlac Paints Limited

- Sherwin-Williams Company

- Valspar Corporation

Recent Development

- In November 2024, Asian Paints reported a significant decline in second-quarter earnings and sales volumes, attributed to price reductions and adverse weather conditions. The company recorded a profit of ₹6.95 billion, falling short of analysts’ expectations of ₹10.19 billion. Net sales decreased by 5% to ₹80.03 billion, below the anticipated ₹85.06 billion. This downturn reflects weakened demand for premium products as consumers opt for more economical alternatives amid inflationary pressures.

- In October 2024, AkzoNobel, the manufacturer of Dulux paints, reported third-quarter results that missed sales and earnings forecasts. The company cited weak consumer demand and competitive pricing in China as primary factors. Revenue for the quarter declined by 3% to €2.67 billion, below the expected €2.76 billion. Operating income decreased by 27% due to higher operating and restructuring costs

Report Scope

Report Features Description Market Value (2023) USD 66.4 Billion Forecast Revenue (2033) USD 116.7 Billion CAGR (2024-2032) 5.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Water-based Paints, Solvent-based Paints, Powder Coatings), By Formulation (Emulsion-based Paints, Distemper, Enamel, Primer, Textures, Others), By Resin Type (Acrylic, Alkyd, Vinyl, Polyurethane, Others), By Sales Channel (Online, Offline), By Application (Residential, New Construction, Remodel and repaint, Non-residential, Commercial, Industrial, Infrastructure), By User Type (DIY, Professional) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Acro Paints Limited, Akzo Nobel N.V., Asian Paints Limited, BASF-SE, Berger Paints India Limited, Ecopaints Private Limited, Esdee Paints Limited, Indigo Paints Limited, Jotun, KANSAI Paints Co. Ltd, NIPSEA GROUP (Nippon Paint), PPG Industries, Inc., RPM International Inc., Shalimar Paints Limited, Sheenlac Paints Limited, Sherwin-Williams Company, Valspar Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Decorative Paints MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Decorative Paints MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Acro Paints Limited

- Akzo Nobel N.V.

- Asian Paints Limited

- BASF-SE

- Berger Paints India Limited

- Ecopaints Private Limited

- Esdee Paints Limited

- Indigo Paints Limited

- Jotun

- KANSAI Paints Co. Ltd

- NIPSEA GROUP (Nippon Paint)

- PPG Industries, Inc.

- RPM International Inc.

- Shalimar Paints Limited

- Sheenlac Paints Limited

- Sherwin-Williams Company

- Valspar Corporation