Global Data Distribution Service (DDS) Market Size, Share Analysis Report By Solution (Software, Services), By Enterprise Size (Small & Medium Enterprise Size, Large Enterprises), By Sector (Telecommunications and Networks, Defense, Virtualisation & Cloud, Energy, Mining, Industrial Internet of Things (IIoT) and Robotics, Public and Private Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152895

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

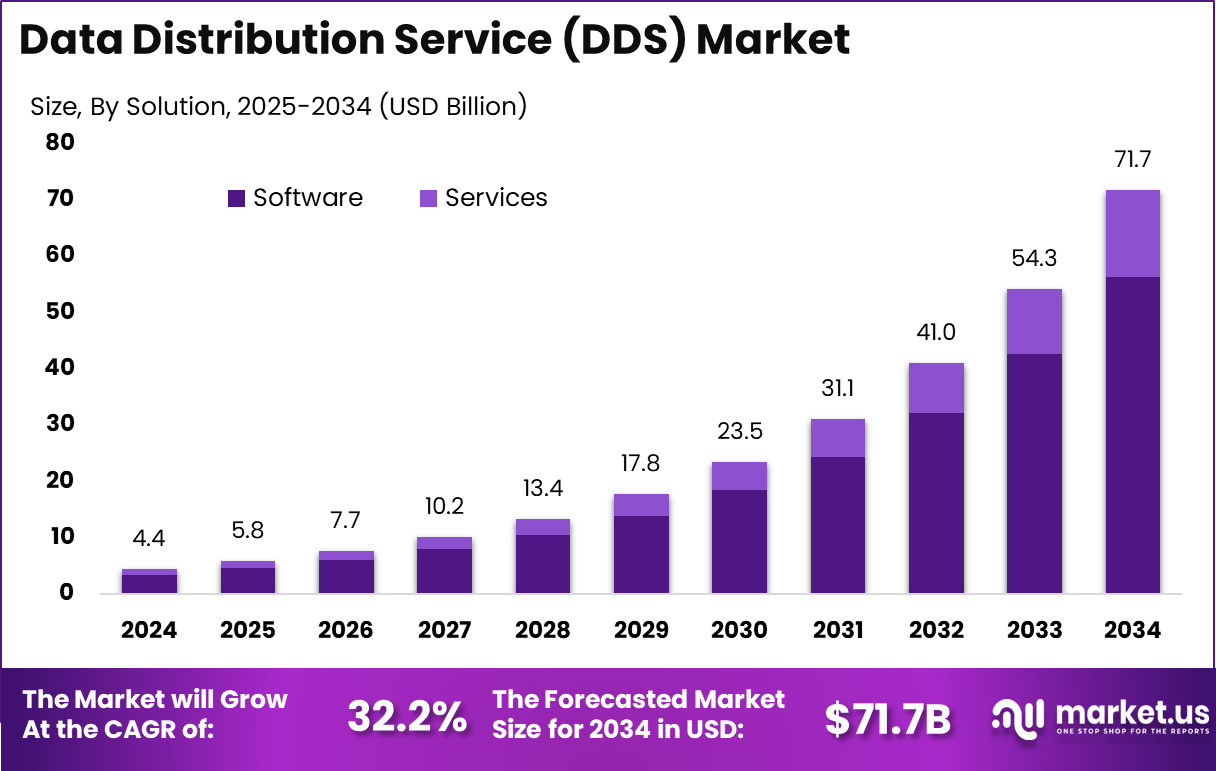

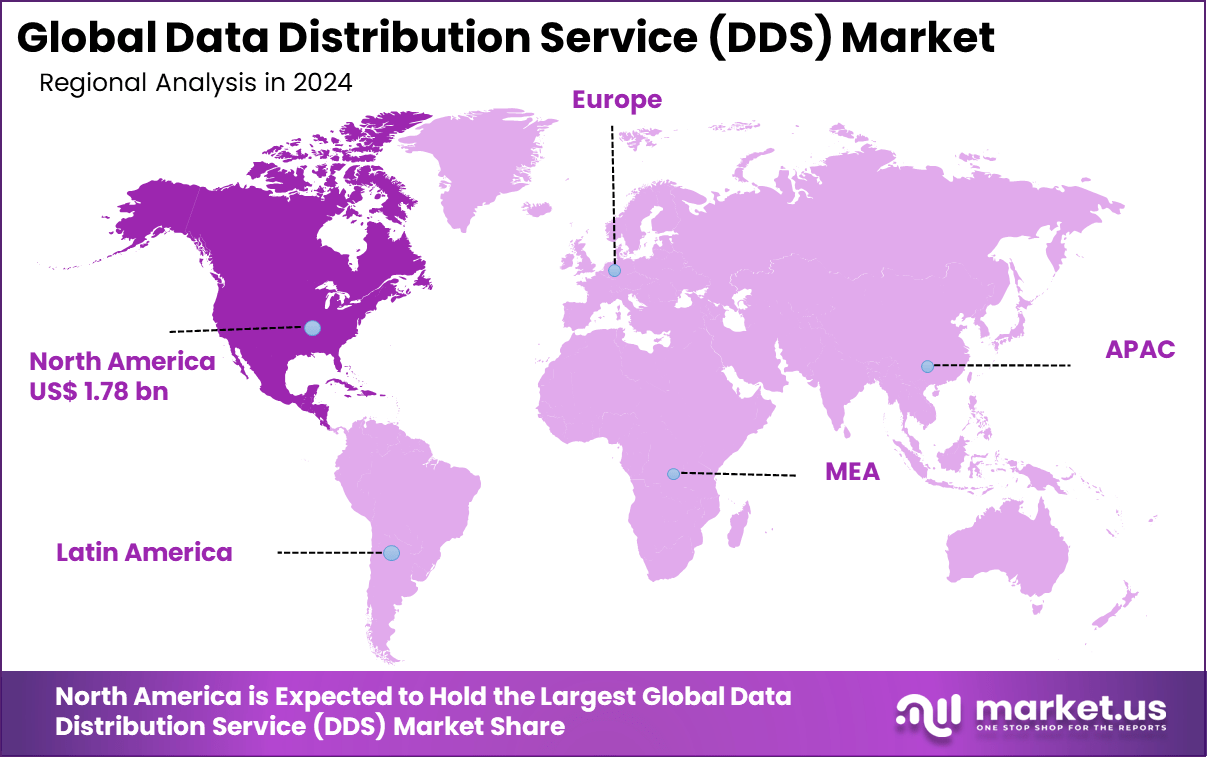

The Global Data Distribution Service (DDS) Market size is expected to be worth around USD 71.7 billion by 2034, from USD 4.4 billion in 2024, growing at a CAGR of 32.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.5% share, holding USD 1.78 billion in revenue.

The DDS market is built around the need for reliable, real-time communication between embedded devices and distributed systems. DDS is a middleware standard that simplifies machine-to-machine communication, especially where low latency and swift data delivery are critical. Originally conceived to power demanding environments such as aerospace, industrial automation, and autonomous systems, DDS is now widely recognized for its ability to facilitate high-performance, decentralized data sharing at scale.

Scope and Forecast

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 71.7 Bn CAGR (2025-2034) 32.2% Largest market in 2024 North America [40.5% market share] A major driving factor for the DDS market is the transformation of industries towards digital, connected operations. Organizations require cost-effective and robust communication solutions that support real-time data flows for robotics, healthcare devices, energy management, and transportation systems. This fast-paced digitalization, where everything from sensors to controllers must communicate seamlessly, increases demand for middleware solutions that can guarantee performance, security, and scalability.

For instance, In September 2024, SafeAI collaborated with Real-Time Innovations (RTI) to advance autonomous solutions by integrating RTI’s Data Distribution Service (DDS) into SafeAI’s autonomous heavy equipment. This integration enhances real-time data exchange and communication, aiming to improve safety, scalability, and operational performance. The partnership underscores the importance of DDS in building reliable, real-time communication systems for autonomous vehicles and machinery.

Key Takeaway

- The Global Data Distribution Service (DDS) market is expected to reach approximately USD 71.7 billion by 2034, expanding at an impressive 32.2% CAGR between 2025 and 2034, driven by the growing need for real-time data sharing across distributed systems.

- In 2024, North America led the market with a 40.5% share, generating about USD 1.78 billion in revenue, supported by early adoption in critical industries such as defense, healthcare, and telecommunications.

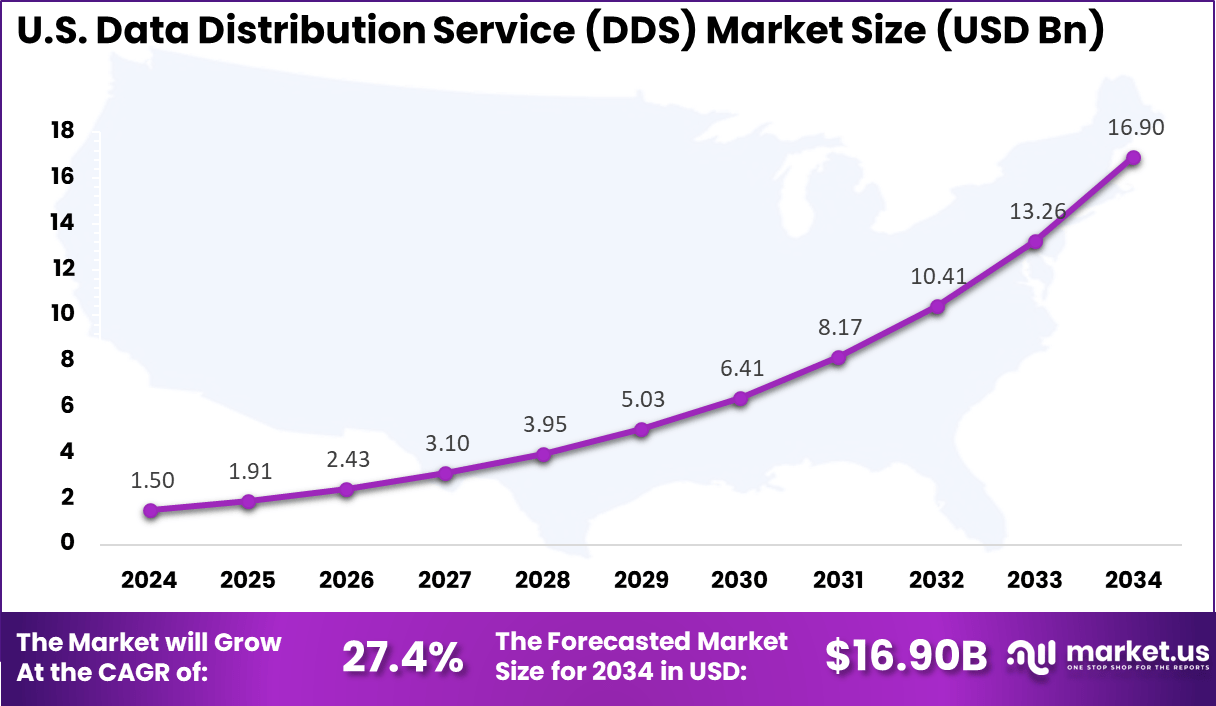

- The United States alone contributed around USD 1.50 billion in 2024 and is forecast to grow at a solid 27.4% CAGR, reflecting its strong ecosystem of technology providers and end-users.

- By solution, the Software segment dominated with a commanding 78.5% share, reflecting high demand for middleware platforms enabling seamless data exchange.

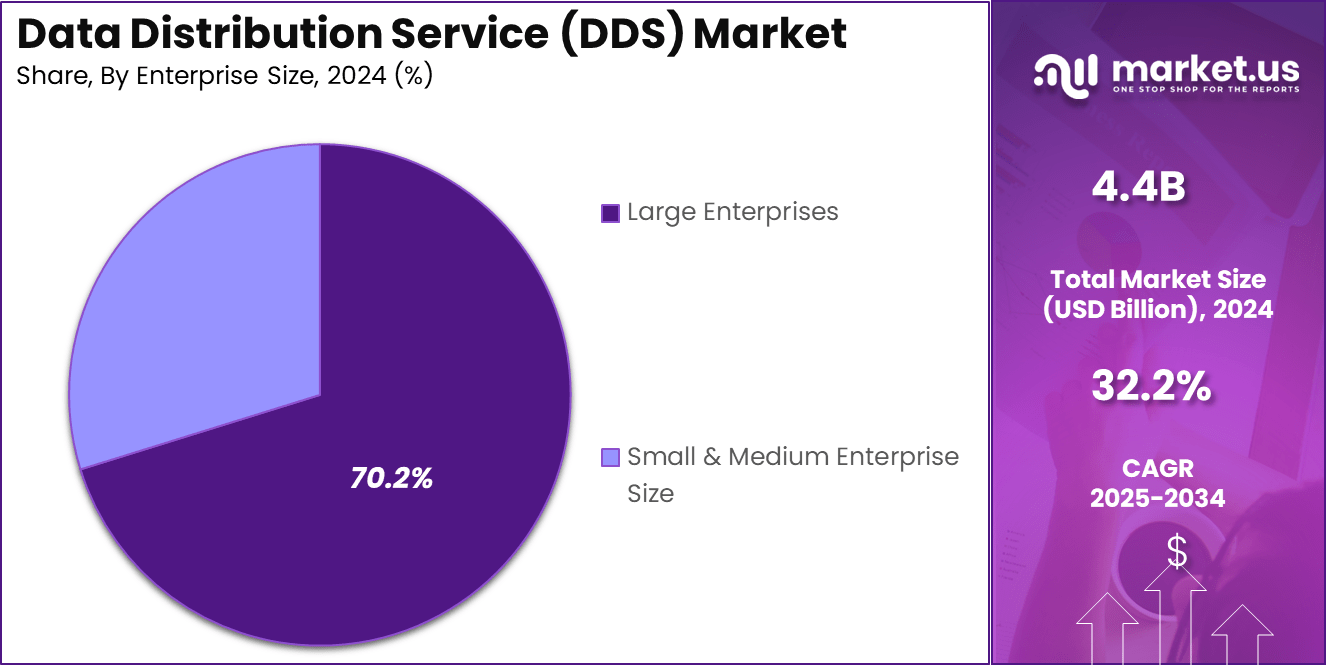

- By enterprise size, Large Enterprises accounted for 70.2% of the market, underscoring their need to manage complex and high-volume data flows efficiently.

- By sector, Telecommunications and Networks emerged as the largest contributor, holding about 34.5% share, driven by the rising deployment of 5G networks and IoT devices demanding low-latency communication.

U.S. DDS Market Size

The market for Data Distribution Service (DDS) within the U.S. is growing tremendously and is currently valued at USD 1.50 billion, the market has a projected CAGR of 27.4%. The U.S. DDS market is expanding rapidly due to the country’s digital transformation, with increasing adoption of cloud-based and real-time data solutions across industries.

Demand for low-latency, reliable data exchange is growing in sectors like healthcare, finance, manufacturing, and autonomous systems. Factors such as the expansion of IT infrastructure, widespread IoT device use, investments in big data, and the integration of edge computing and AI are driving this growth, as businesses aim to derive actionable insights and enhance operational agility.

For instance, in July 2023, Frontier was awarded a $94 million U.S. Navy indefinite-delivery/indefinite-quantity (IDIQ) contract to provide ship data distribution systems hardware. This contract highlights the growing use of advanced Data Distribution Service (DDS) solutions in military applications, particularly in the U.S. defense sector.

In 2024, North America held a dominant market position in the Data Distribution Service (DDS) Market, capturing more than a 40.5% share, holding USD 1.78 billion in revenue. This dominance is due to its advanced digital infrastructure, widespread adoption of cloud and data center technologies, and the presence of leading tech providers.

The region’s focus on digital transformation, real-time and IoT solutions, and ongoing investments in automation and modernization have significantly boosted the demand for DDS platforms. Additionally, North America benefits from a mature high-speed data distribution ecosystem, strong regulatory support, and substantial R&D activity, positioning it as a global leader in DDS innovation and implementation.

For instance, in February 2025, Pivotree and DDS distributor Data Solutions announced a partnership to deliver advanced DDS solutions across North America. This collaboration highlights the region’s dominance in the DDS market, driven by the demand for scalable, real-time communication solutions in industries like retail, healthcare, and logistics.

Solution Analysis

In 2024, The Software segment held a dominant market position, capturing a 78.5% share of the Global Data Distribution Service (DDS) Market. This dominance is due to the increasing need for scalable, flexible, and real-time data communication platforms that can be seamlessly integrated into various applications.

DDS software solutions are preferred across industries for their ability to handle complex data distribution with low latency, customizable Quality of Service (QoS), and cross-platform compatibility. Moreover, the growing adoption of cloud-native and edge computing architectures has further accelerated the use of DDS software, enabling smooth interoperability in distributed, real-time systems.

For Instance, in November 2024, RTI became the first DDS provider to meet all major automotive software safety standards. This achievement underscores RTI’s commitment to delivering high-performance, reliable DDS solutions that comply with stringent safety requirements, making them ideal for automotive applications where safety, real-time communication, and scalability are critical.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 70.2% share of the DDS Market. The demand is surging due to the growing volume of data and increased investments in digital transformation and cloud-based solutions. These organizations require robust, scalable, and secure DDS platforms to manage complex IT infrastructures, facilitate real-time data exchange, and support automation for improved operational efficiency.

Large enterprises across industries such as aerospace, defense, automotive, and healthcare increasingly require DDS to ensure reliable, low-latency data exchange across their distributed systems, enabling enhanced decision-making, automation, and operational efficiency at scale.

For instance, In November 2024, XPENG Motors adopted RTI Connext Drive® for its future E/E architecture to enhance real-time data communication in advanced vehicle systems. This move supports XPENG’s focus on greater automation, scalability, and performance in its next-generation electric vehicles, showcasing the growing use of DDS in the automotive sector.

Sector Analysis

In 2024, The Telecommunications and Networks segment held a dominant market position, capturing a 34.5% share of the Global Data Distribution Service (DDS) Market. This dominance is due to the increasing demand for real-time, high-performance communication solutions within the telecommunications industry.

DDS is essential for managing the vast amounts of data exchanged across complex, distributed network systems, enabling low-latency, reliable communication. The sector’s rapid growth, driven by the expansion of 5G networks, IoT devices, and the need for efficient, scalable data distribution, has further fueled the adoption of DDS solutions.

For Instance, in July 2020, Real-Time Innovations (RTI) announced a partnership with SoC-e to integrate RTI’s Data Distribution Service (DDS) with SoC-e’s Time-Sensitive Networking (TSN) technology. This collaboration aims to enhance communication performance in distributed systems by combining DDS’s real-time data distribution with TSN’s deterministic networking features.

Key Market Segments

By Solution

- Software

- Cloud-Based

- On-Premises

- Services

- Implementation & Integration Services

- Consulting & Training Services

- Support & Maintenance Services

By Enterprise Size

- Small & Medium Enterprise Size

- Large Enterprises

By Sector

- Telecommunications and Networks

- Defense

- Virtualisation & Cloud

- Energy

- Mining

- Industrial Internet of Things (IIoT) and Robotics

- Public and Private Transportation

- Others

Emerging Trend

Integration with Edge Computing

One of the most noticeable trends in Data Distribution Service is its growing synergy with edge computing. As industries deploy an increasing number of connected devices, DDS is pivotal in enabling real-time data flow closer to the source of data generation.

This shift toward edge architectures means data processing is handled right where it is created – dramatically reducing latency and improving the responsiveness of smart factories, autonomous vehicles, and urban infrastructure. By operating efficiently at the edge, DDS empowers organizations to make instant decisions based on live data, unlocking new capabilities for automation and digital transformation.

Key Market Driver

Demand for Real-Time Data Exchange

A major reason behind the rise of DDS is the urgent industry demand for real-time, reliable data exchange across distributed systems. Whether it’s smart manufacturing, transportation, or healthcare, organizations now rely on instant information to enhance safety, efficiency, and innovation. DDS stands out because it guarantees high-speed data transmission and consistent communication, meeting the needs of mission-critical environments that cannot tolerate delays or interruptions.

Major Restraint

Complexity and Cost of Implementation

The initial cost and complexity of bringing DDS into an organization can be daunting, especially for smaller enterprises. Many businesses hesitate due to the specialized knowledge required to integrate DDS seamlessly with their existing systems.

Adapting infrastructure, training teams, and managing ongoing maintenance all contribute to this barrier. Companies often need to balance the promise of robust real-time capabilities with practical budgetary constraints and the challenge of overcoming a steep learning curve.

Opportunity

The Rise of Next-Generation Networks

The widespread adoption of 5G and advancements in network technologies have opened up a golden opportunity for DDS. With the ultra-low latency and immense bandwidth promised by next-generation networks, DDS can reach its full potential in supporting applications requiring high-speed, high-volume data movement.

For businesses focused on smart mobility, connected health, or real-time industrial control, coupling DDS with advanced network infrastructure offers a pathway to unlock new service models and business strategies.

Persistent Challenge

Security Vulnerabilities

Despite its technical strengths, ensuring the security of DDS remains a top concern. Public-facing DDS deployments have been found exposing sensitive information due to misconfigurations or outdated components.

As mission-critical systems depend more on DDS, the risks associated with unauthorized access, data leakage, or unpatched vulnerabilities become significant. This challenge calls for continuous vigilance, robust security practices, and collaboration across industry players to keep data distribution both safe and resilient.

Key Players Analysis

Real-Time Innovations and ADLINK Technology lead the DDS market with reliable, low-latency platforms for industrial, autonomous, and defense applications. Milsoft Utility Solutions and Apex Logic focus on scalable, interoperable solutions tailored for utilities and mission-critical systems. Their strong R&D and partnerships support their competitive positions.

eProsima and EUROCONTROL serve niche markets like aerospace and simulation with lightweight, standards-compliant DDS. Trend Micro adds value by integrating cybersecurity into DDS, meeting secure data needs in smart infrastructure. These players effectively target emerging real-time communication demands.

KONGSBERG and S2E Software Systems specialize in robust DDS for defense, maritime, and industrial sectors. Other emerging players offer cost-efficient, domain-specific solutions, driving innovation and expanding market reach. Together, these companies sustain growth as real-time systems adoption rises.

Top Key Players in the Market

- Real-Time Innovations

- ADLINK Technology Inc.

- Milsoft Utility Solutions

- Apex Logic, Inc.

- eProsima

- EUROCONTROL

- Trend Micro Incorporated

- KONGSBERG

- S2E Software Systems

- Others

Recent Developments

- In September 2024, eProsima launched Fast DDS 3.0, a significant update to its DDS implementation. This release enhances performance and scalability, reinforcing eProsima’s commitment to providing high-performance networking middleware for distributed systems, fully compliant with the DDS standard.

- In June 2024, at COMPUTEX 2024, ADLINK showcased advancements in edge AI solutions, emphasizing their application in smart manufacturing, healthcare, and transportation. By leveraging NVIDIA’s platforms, ADLINK demonstrated low-latency features essential for real-time data processing, aligning with DDS’s capabilities in distributed systems.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Software, Services), By Enterprise Size (Small & Medium Enterprise Size, Large Enterprises), By Sector (Telecommunications and Networks, Defense, Virtualisation & Cloud, Energy, Mining, Industrial Internet of Things (IIoT) and Robotics, Public and Private Transportation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Real-Time Innovations, ADLINK Technology Inc., Milsoft Utility Solutions, Apex Logic, Inc., eProsima, EUROCONTROL, Trend Micro Incorporated, KONGSBERG, S2E Software Systems, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Distribution Service (DDS) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Data Distribution Service (DDS) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Real-Time Innovations

- ADLINK Technology Inc.

- Milsoft Utility Solutions

- Apex Logic, Inc.

- eProsima

- EUROCONTROL

- Trend Micro Incorporated

- KONGSBERG

- S2E Software Systems

- Others