Global Data Compliance Monitoring Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Personal Data and Privacy Regulation Compliance, Financial Industry Regulation Compliance, Healthcare Data Regulation Compliance, Cross-Border Data Transfer Compliance, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare, Technology and Telecommunications, Retail and Consumer Goods, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 177726

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

- Data Compliance Monitoring Market size

- Key Takeaway

- Report Overview

- Key Data Compliance Monitoring Statistics

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End User Industry

- Regional Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Data Compliance Monitoring Market size

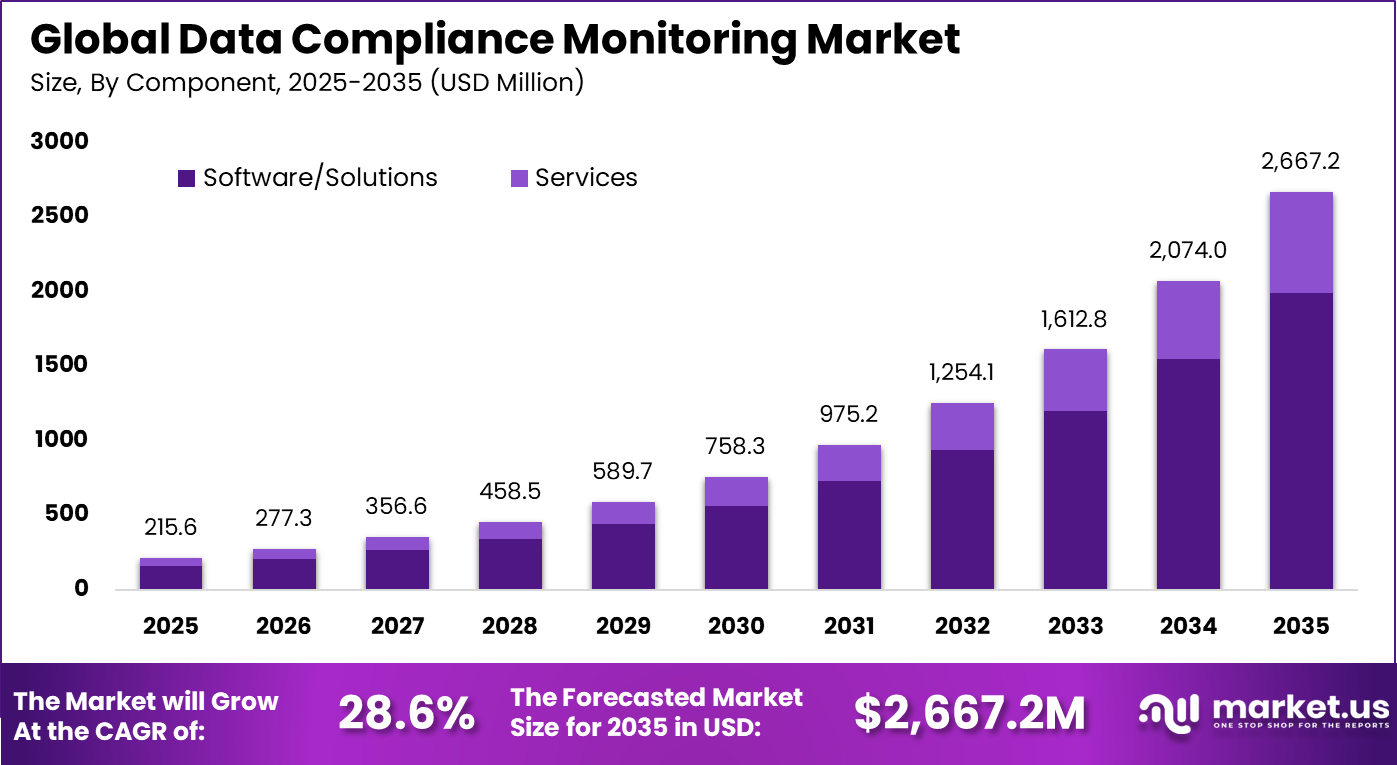

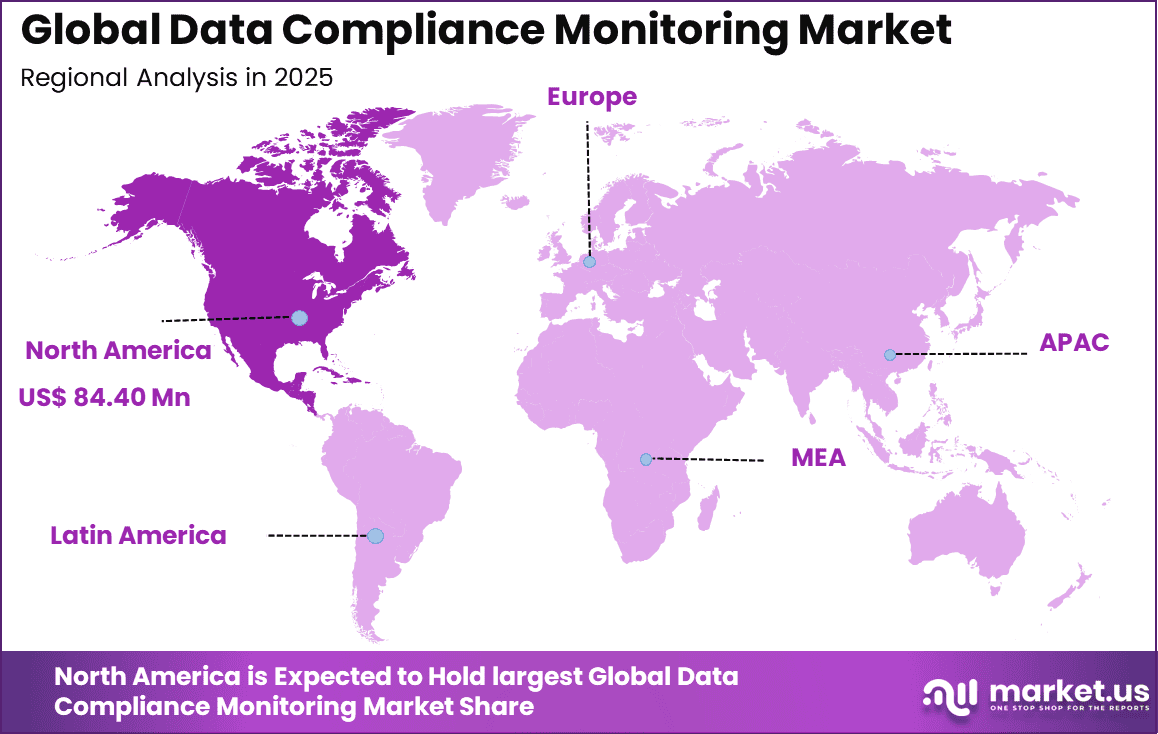

The Global Data Compliance Monitoring Market size is expected to be worth around USD 2,667.2 million by 2035, from USD 215.6 million in 2025, growing at a CAGR of 28.6% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 39.15% share, holding USD 84.40 million in revenue.

Data compliance monitoring in 2025 to 2026 is increasingly shaped by rapid AI adoption and evolving regulatory expectations. Around 90% of organizations are now developing AI specific compliance policies, while 58% report concern over frequent AI related compliance changes. This reflects growing awareness of governance gaps as AI systems are embedded deeper into business operations.

Risk exposure remains high across data environments. The average cost of a data breach has reached USD 4.88 million, with 74% of incidents linked to human error. Compliance readiness is also weakening, as only 14.3% of organizations are fully PCI compliant, marking a sharp decline compared to 2020. These trends underscore the need for continuous monitoring, automation, and stronger compliance controls.

Key Takeaway

- By component, software and solutions led the Data Compliance Monitoring Market with a 74.6% share, reflecting strong demand for automated regulatory tracking and reporting tools.

- By deployment mode, cloud based platforms dominated with a 83.2% share, supported by scalability and centralized compliance oversight across distributed operations.

- By organization size, large enterprises accounted for 87.4% of total adoption, driven by complex regulatory exposure and higher compliance obligations.

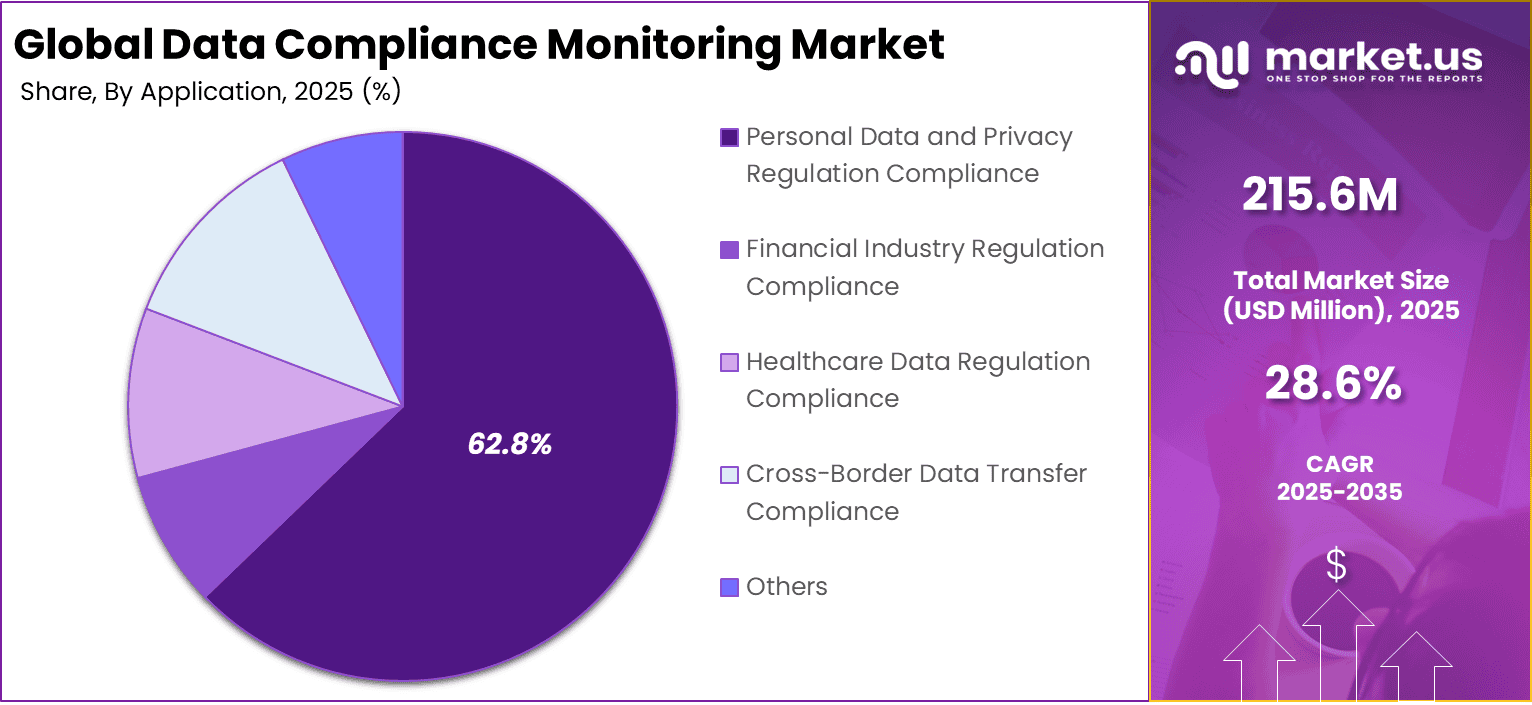

- By application, personal data and privacy regulation compliance represented 62.8% of the market, reflecting growing focus on data protection laws and governance standards.

- By end user industry, Banking, Financial Services, and Insurance held a 38.9% share, supported by strict financial compliance requirements.

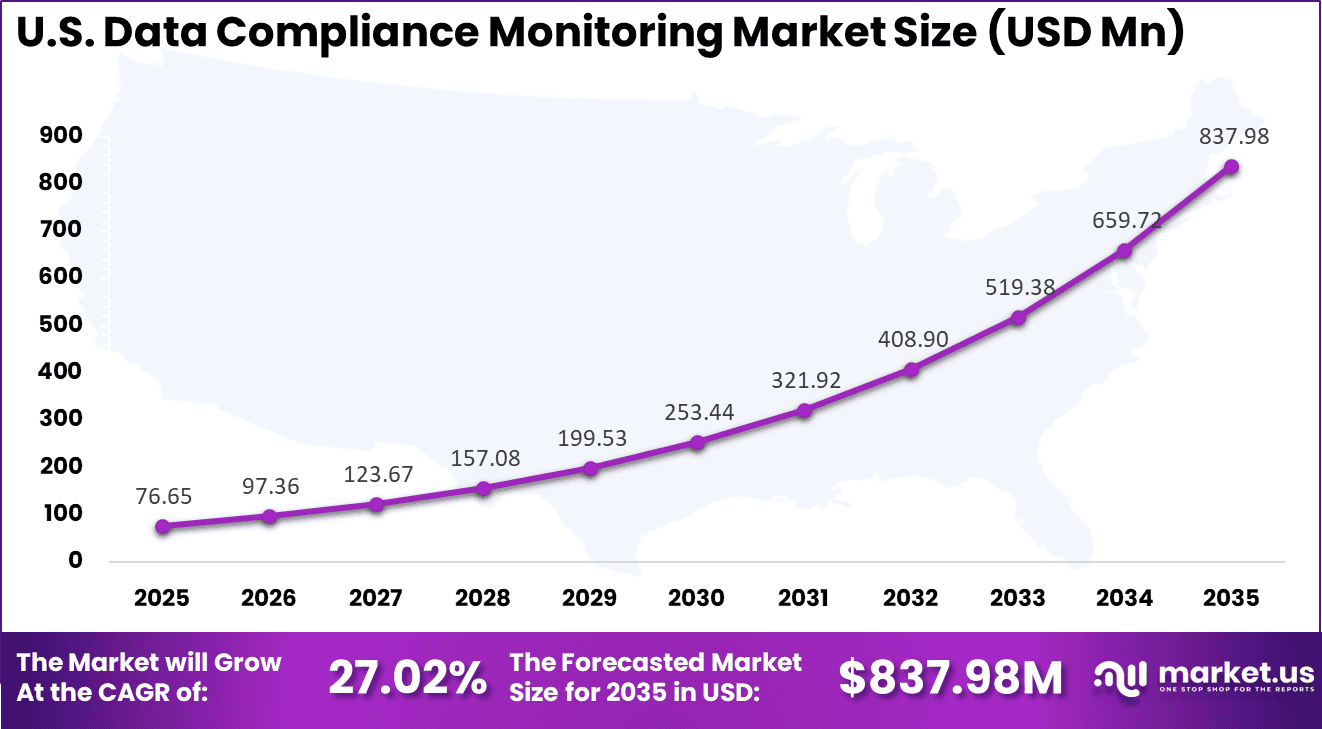

- Regionally, North America accounted for 39.15% of the market, with the US valued at USD 76.65 million and recording a CAGR of 27.02%, driven by expanding regulatory enforcement and digital risk management initiatives.

Report Overview

The Data Compliance Monitoring Market refers to tools and platforms that continuously track, assess, and enforce adherence to data protection, privacy, and regulatory requirements across enterprise data environments. These solutions monitor how data is collected, stored, accessed, processed, and shared, ensuring alignment with applicable laws and internal governance policies.

Data compliance monitoring has become critical as organizations manage sensitive personal, financial, and operational data at scale. It is positioned as a continuous control mechanism rather than a one time audit activity. Market adoption has been supported by the rise in personal data usage across digital platforms. Organizations process sensitive customer and employee data across multiple systems. Continuous monitoring reduces the risk of violations and penalties.

One of the primary driving factors is the expansion of data protection and privacy regulations worldwide. Organizations are subject to multiple overlapping rules that govern data usage and retention. Keeping track of compliance obligations manually is increasingly difficult. Monitoring tools automate oversight and reduce the risk of violations. Another key driver is the growth of distributed and cloud based data architectures. Data is no longer confined to centralized systems. It flows through analytics platforms, applications, and external partners.

Key Data Compliance Monitoring Statistics

- Around 71% of executives consider AI beneficial for compliance management, yet 89% express concerns about data security when deploying AI systems.

- Approximately 76% of organizations plan to obtain an AI audit or certification within the next 24 months, reflecting rising governance expectations.

- Nearly 98% of organizations report at least one third party vendor that has previously experienced a data breach, highlighting supply chain risk exposure.

- In 2023, about 168 million records were exposed, stolen, or improperly disclosed, emphasizing the scale of data risk.

- Around 52% of risk and compliance professionals dedicate a large portion of their time to monitoring regulatory adherence.

- Effective privacy compliance programs can generate up to 1.6x return on investment, while the financial impact of non compliance can be 2.65x higher.

- Since 2018, cumulative fines under the General Data Protection Regulation have reached USD 6.17 billion, reflecting strict enforcement.

- About 50% of companies continue to rely on spreadsheets or non integrated tools for managing third party vendors.

- Nearly 67% of third party vendors remain unmanaged due to limited internal resources.

- Only 46% of organizations take corrective action to address identified vulnerabilities, indicating gaps in risk remediation processes.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Increasing global data privacy regulations and enforcement actions +7.2% Europe, North America Short to medium term Rising frequency of data breaches and compliance violations +6.1% Global Short term Expansion of cloud computing and cross-border data flows +5.4% Global Medium term Growing adoption of AI-driven compliance analytics +4.9% North America, Europe Medium term Demand for automated audit trails and regulatory reporting +4.3% Global Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline High implementation and data mapping complexity -4.6% Global Short to medium term Integration challenges with legacy IT systems -3.9% North America, Europe Medium term Limited compliance budgets among SMEs -3.3% Asia Pacific, Latin America Medium term Evolving and fragmented global regulatory landscape -2.8% Global Medium term Shortage of skilled compliance and data governance professionals -2.4% Global Medium to long term By Component

Software and solution based offerings accounted for 74.6% of adoption, reflecting enterprise preference for flexible and scalable tools. These solutions integrate with existing data infrastructure to monitor policy adherence continuously. Centralized dashboards simplify oversight across departments. This reduces compliance management complexity.

Software platforms support automated rule updates as regulations change. Organizations avoid manual reconfiguration efforts. This improves responsiveness to new compliance requirements. As regulations evolve, software driven solutions remain dominant. Customization further strengthens adoption. Enterprises configure controls based on jurisdiction and data type.

For Instance, in September 2025, IBM enhances zSecurity and Compliance Center with Concert integration. This feeds Z-specific compliance data into a unified view, simplifying regulatory checks across enterprises. The software unifies siloed tools for better risk management and posture tracking, aiding software component growth.

By Deployment Mode

Cloud based deployment represented 83.2% of usage, driven by scalability and ease of access. Cloud platforms enable centralized monitoring across distributed data environments. Organizations benefit from faster implementation and lower infrastructure costs. This aligns with cloud first compliance strategies. Cloud delivery supports real time alerts and reporting.

Compliance teams can act immediately when issues arise. Updates are deployed without downtime. This improves response efficiency. Security maturity in cloud environments has improved trust. Strong encryption and access controls protect sensitive compliance data. As a result, cloud based deployment has become the preferred model.

For instance, in June 2025, Forcepoint launches the Data Security Cloud platform. This AI-powered suite unites DSPM, DLP, and more for data visibility across clouds, with adaptive controls that scale dynamically. It simplifies management for hybrid environments, driving cloud deployment as firms seek real-time protection without heavy infrastructure.

By Organization Size

Large enterprises accounted for 87.4% of adoption due to their complex regulatory exposure. These organizations operate across multiple regions with varying data laws. Continuous monitoring is required to maintain compliance consistency. Automated systems reduce manual burden. Large enterprises also face higher penalties for violations.

Proactive monitoring helps reduce financial and reputational risk. Standardized workflows improve governance. This supports strong adoption within this segment. Investment capacity further enables advanced compliance tools. Large organizations integrate monitoring with governance and security platforms. This reinforces their leading position.

For Instance, in November 2025, BigID launches a standalone CMP Express consent platform. This AI-classified tool deploys instantly for website privacy, suiting large-scale ops with self-service ease. It helps enterprises handle DSARs and consents at volume, supporting their dominance in advanced monitoring.

By Application

Personal data and privacy regulation compliance accounted for 62.8% of usage. Privacy laws require strict controls over data collection, storage, and access. Monitoring tools track adherence to these requirements in real time. This reduces violation risk. Automated checks detect unauthorized access or policy breaches early.

Response teams can act before issues escalate. This protects consumer trust and brand reputation. Privacy compliance remains the most critical application area. As data privacy expectations rise, monitoring intensity has increased. Organizations prioritize continuous oversight over periodic audits. This drives sustained demand in this segment.

For Instance, in November 2025, OneTrust was recognized in the IDC MarketScape for Data Privacy Compliance Software. The platform excels in consent management, regulatory intelligence, and AI-ready privacy tools. With over 350 patents, it helps organizations navigate global privacy mandates like GDPR effectively.

By End User Industry

Banking, financial services, and insurance represented 38.9% of adoption due to strict regulatory oversight. These institutions handle large volumes of sensitive financial and personal data. Compliance failures can have severe consequences. Monitoring systems provide essential control. Financial regulators require detailed reporting and evidence of compliance.

Automated monitoring supports audit readiness. This reduces regulatory risk. BFSI organizations therefore invest heavily in compliance technologies. Digital transformation has increased data complexity in BFSI. Continuous monitoring helps manage this scale. The sector remains a primary end user industry.

For Instance, in July 2025, Proofpoint’s India data center targets BFSI data sovereignty. The cloud setup delivers compliant email protection and DLP for financial services, meeting strict banking regulations. It strengthens human-centric security amid rising threats in high-stakes sectors.

Regional Analysis

North America accounted for 39.15% of market adoption, supported by strong regulatory frameworks and advanced IT infrastructure. Organizations in the region prioritize proactive compliance management. High cloud adoption has further supported market growth.

For instance, in October 2025, Forcepoint expanded its Self-Aware Data Security Platform to enterprise databases with AI Mesh Data Classification for structured data. The update unifies risk visibility, adaptive enforcement, and automated compliance reporting across hybrid environments, reinforcing North American technological superiority in data compliance monitoring.

The United States leads the region with market value of USD 76.65 Mn and a CAGR of 27.02%. Financial institutions and large enterprises are key adopters. Investment in compliance automation remains strong. Ongoing innovation continues to strengthen regional leadership. Integration with security and governance platforms has improved effectiveness.

For instance, in January 2026, OneTrust, based in Atlanta, Georgia, was named a Leader in the IDC MarketScape: Worldwide Data Privacy Compliance Software 2025 Vendor Assessment. This recognition highlights OneTrust’s AI-ready governance platform, which excels in innovation, unified compliance management, and consent automation, solidifying U.S. leadership in data compliance monitoring solutions.

Emerging Trends Analysis

An emerging trend in the data compliance monitoring market is the integration of privacy management and consent tracking. Organisations increasingly need to manage user consent across data usage activities and ensure that data practices align with individual rights. Monitoring platforms that track consent status and link it to data usage improve transparency and compliance posture.

Another trend is the convergence of compliance monitoring with broader data observability and security solutions. Rather than standalone tools, compliance features are being embedded within unified observability platforms that combine performance monitoring, security analytics, and governance checks. This convergence reduces tool sprawl and improves operational cohesion.

Growth Factors Analysis

One of the key growth factors for the data compliance monitoring market is the increasing cost and visibility of non-compliance consequences. Significant fines, legal actions, and brand damage associated with data breaches or regulatory violations create strong motivation for robust monitoring. Organisations are investing in compliance frameworks to avoid costly outcomes.

Another growth factor is the rise of data driven business models that require strong governance foundations. As analytics, AI, and digital services expand, organisations generate and process sensitive data at scale. Compliance monitoring ensures that these activities occur within legal and ethical bounds, reinforcing trust with customers and regulators.

Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Data governance and compliance software providers Very High Medium North America, Europe Strong recurring SaaS growth Cloud service providers High Medium Global Embedded compliance services GRC and cybersecurity vendors High Medium Global Cross-sell opportunity Private equity firms Medium Medium North America, Europe Consolidation of niche compliance platforms Venture capital investors Very High High North America Innovation in AI-powered compliance monitoring Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline AI-driven data classification and monitoring engines +7.5% Real-time compliance detection Global Short to medium term Automated regulatory mapping and rule engines +6.2% Multi-jurisdiction compliance Europe, North America Medium term Cloud-native compliance monitoring platforms +5.1% Scalability and flexibility Global Medium term Continuous risk scoring and policy enforcement tools +4.3% Proactive risk management Global Medium to long term Integrated audit trail and reporting dashboards +3.6% Regulatory transparency Global Long term Opportunity Analysis

A significant opportunity in the data compliance monitoring market lies in automation and artificial intelligence. AI driven solutions can detect potential compliance violations, anomalous access patterns, or suspicious data flows without manual rule authoring. Predictive insights and automated alerts improve responsiveness and reduce reliance on manual oversight. Organisations seeking continuous assurance value intelligent monitoring capabilities.

Another opportunity is the expansion of compliance monitoring into emerging technologies such as IoT, edge computing, and machine learning systems. These environments produce large volumes of data and complex interactions that traditional monitoring approaches cannot easily cover. Tools that extend governance controls and monitoring into these domains support modern data ecosystems and regulatory expectations.

Challenge Analysis

A major challenge for the data compliance monitoring market is balancing comprehensive monitoring with user privacy and operational efficiency. Excessive monitoring can create performance overhead and raise internal privacy concerns. Organisations must define clear monitoring scopes and safeguard sensitive internal insights. Effective policy design and communication are essential to balance oversight and privacy.

Another challenge is keeping pace with evolving regulatory requirements. Data protection laws and standards are continuously updated in response to emerging risks. Monitoring tools must adapt quickly to new requirements, including jurisdictional nuances, consent frameworks, and data subject rights management. Ensuring tool agility and regulatory alignment is a continuous challenge.

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Personal Data and Privacy Regulation Compliance

- Financial Industry Regulation Compliance

- Healthcare Data Regulation Compliance

- Cross-Border Data Transfer Compliance

- Others

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare

- Technology and Telecommunications

- Retail and Consumer Goods

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Enterprise governance and privacy platform providers such as OneTrust, TrustArc, and BigID play a central role in the data compliance monitoring market. Their solutions focus on data mapping, consent management, and regulatory reporting. Automated workflows help organizations meet GDPR, CCPA, and sector-specific requirements. These vendors benefit from rising regulatory enforcement and cross-border data transfer controls.

Large enterprise software providers such as IBM, Microsoft, Oracle, and SAP integrate compliance monitoring into broader data and cloud ecosystems. SAS Institute and Informatica strengthen policy enforcement and metadata tracking. These players support enterprise-wide visibility across hybrid and multi-cloud environments. Adoption is strong among highly regulated industries.

Security and data protection specialists such as Protegrity, Exterro, RSA Security, Micro Focus, Proofpoint, and Forcepoint focus on encryption, access control, and monitoring of sensitive information. These vendors emphasize audit readiness and breach prevention. Other providers expand regional coverage and innovation, supporting steady growth in data compliance monitoring solutions globally.

Top Key Players in the Market

- OneTrust

- TrustArc

- IBM

- SAP

- Microsoft

- Oracle

- SAS Institute

- Protegrity

- Informatica

- BigID

- Exterro

- RSA Security

- Micro Focus

- Proofpoint

- Forcepoint

- Others

Recent Developments

- In October 2025, OneTrust partnered with Snowflake to deliver native data-level compliance intelligence directly in the Snowflake Trust Center. Leveraging over a decade of privacy expertise across hundreds of frameworks, it automates scanning for regulatory violations like GDPR and PCI DSS.

- In May 2025, IBM Cloud solidified its role in regulated industries with advanced zero-trust security and automated compliance monitoring via OpenPages and Cloud Security Compliance Center. Continuous identity verification and real-time regulatory adherence reduce audit risks for financial and healthcare sectors.

Report Scope

Report Features Description Market Value (2025) USD 215.6 Mn Forecast Revenue (2035) USD 2,667.2 Mn CAGR(2026-2035) 28.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Personal Data and Privacy Regulation Compliance, Financial Industry Regulation Compliance, Healthcare Data Regulation Compliance, Cross-Border Data Transfer Compliance, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare, Technology and Telecommunications, Retail and Consumer Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape OneTrust, TrustArc, IBM, SAP, Microsoft, Oracle, SAS Institute, Protegrity, Informatica, BigID, Exterro, RSA Security, Micro Focus, Proofpoint, Forcepoint, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Compliance Monitoring MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Data Compliance Monitoring MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- OneTrust

- TrustArc

- IBM

- SAP

- Microsoft

- Oracle

- SAS Institute

- Protegrity

- Informatica

- BigID

- Exterro

- RSA Security

- Micro Focus

- Proofpoint

- Forcepoint

- Others