Global Data Center Energy Storage Market Size, Share, Statistics Analysis Report By Data Center Type (Tier 1, Tier 2, Tier 3, Tier 4), By End-Use Industry (BFSI, IT and Telecommunications, Government, Manufacturing, Healthcare, Other End-Use Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 133198

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

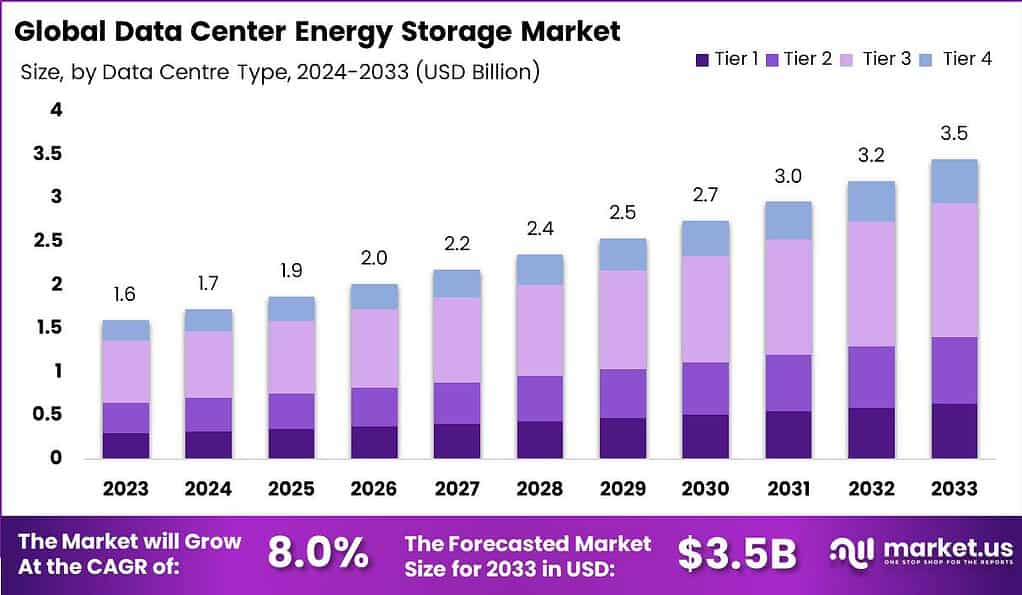

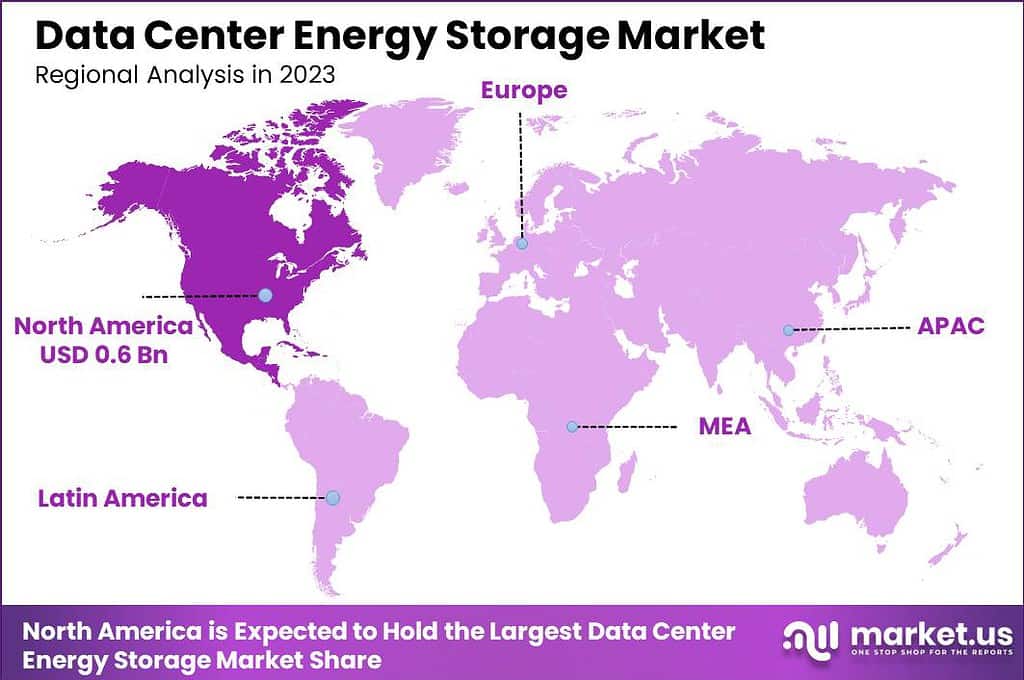

The Global Data Center Energy Storage Market size is expected to be worth around USD 3.5 Billion By 2033, from USD 1.6 Billion in 2023, growing at a CAGR of 8.00% during the forecast period from 2024 to 2033. In 2023, North America dominated the Data Center Energy Storage market, accounting for over 38.2% of the market share and generating USD 0.6 billion in revenue.

Data center energy storage refers to the systems and solutions used to store energy for use in data centers, which are critical facilities that host computer systems and associated components such as telecommunications and storage systems. These storage solutions are crucial for managing power supply and ensuring uninterrupted operation, particularly during power outages or fluctuations.

Data center energy storage systems can include batteries, flywheels, ultracapacitors, and even thermal storage options. The goal is to enhance energy efficiency, maintain continuous power supply, and reduce operational costs associated with energy use.

The data center energy storage market is witnessing substantial growth, fueled by several factors. As the demand for digital services and cloud computing rises, the need for expanded data centers grows, driving the demand for reliable energy storage solutions. The increasing emphasis on sustainability and reducing carbon footprints is prompting data centers to adopt environmentally friendly energy storage technologies.

Regulatory pressures and incentives to improve energy efficiency in data centers also play a critical role in driving innovations and investments in this market. Moreover, advancements in battery technology, such as lithium-ion and solid-state batteries, are making energy storage more viable and attractive for large-scale data center operations.

There’s a growing demand for data center energy storage solutions across various sectors, particularly in industries where data security and uptime are critical. Financial services, healthcare, and e-commerce are among the top sectors driving this demand. With the growing volume of data, the need for reliable energy solutions to prevent power instability and optimize energy use in data centers is becoming essential.

For instance, In May 2024, Singapore committed ~USD 288.4 million to its National Quantum Strategy, reinforcing its position as a leader in emerging technologies. Alongside this, it launched the Green Data Centre Roadmap, aiming to promote sustainable digital growth while advancing AI and computing. The plan highlights governance measures, including a framework for generative AI and a collaboration with Rwanda to develop AI safety guidelines

The integration of renewable energy sources with data center energy storage presents significant market opportunities. As renewable energy becomes more prevalent, data centers have the unique opportunity to become more self-sufficient and environmentally friendly. Innovations in battery technology, such as lithium-ion and solid-state batteries, offer new possibilities for energy storage solutions that are more efficient, compact, and have longer lifespans.

The data center energy storage market is set to expand in the coming years, driven by the global surge in data traffic. As data centers scale their operations to meet demand, they must also minimize their environmental impact. This expansion is further fueled by regulatory pressures and incentives encouraging the adoption of green technologies, pushing the industry towards more sustainable energy solutions.

Key Takeaways

- The Global Data Center Energy Storage Market is expected to reach USD 3.5 billion by 2033, up from USD 1.6 billion in 2023, growing at a CAGR of 8.00% from 2024 to 2033.

- In 2023, the Tier 3 segment led the Data Center Energy Storage market, holding more than 44.7% of the market share.

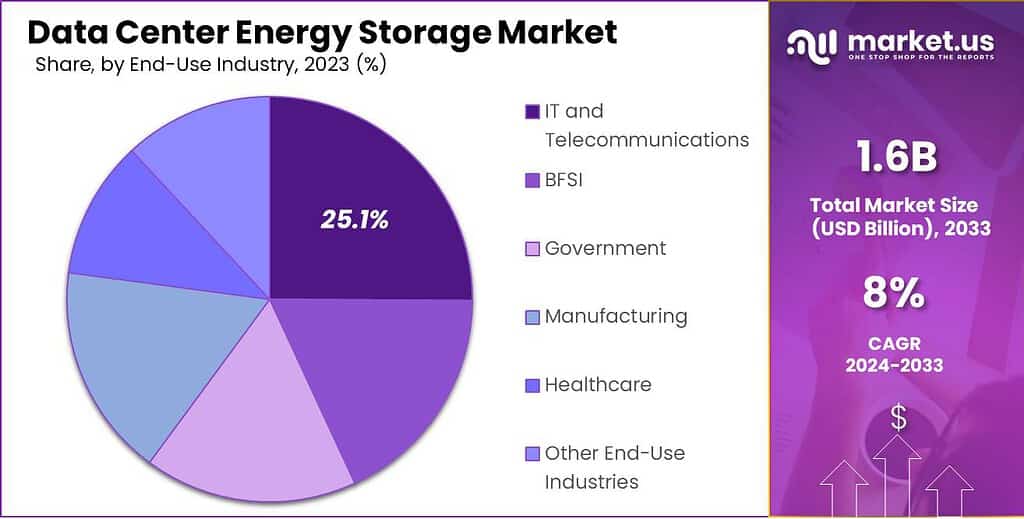

- The IT and Telecommunications segment dominated the market in 2023, accounting for over 25.1% of the Data Center Energy Storage market share.

- North America was the leading region in 2023, capturing more than 38.2% of the market share and generating USD 0.6 billion in revenue.

Data Center Type Analysis

In 2023, the Tier 3 segment held a dominant market position within the Data Center Energy Storage market, capturing more than a 44.7% share. This segment’s leadership can be attributed to several factors that resonate with the needs of modern data center operations that require high availability without excessive costs.

Tier 3 data centers offer a significant balance between redundancy and cost, making them ideal for businesses seeking high uptime without the complexity and expense of Tier 4 data centers. Tier 3 data centers are designed to ensure continuous operation with a minimum of 99.982% availability.

This is achieved through maintaining systems that allow for any planned maintenance activity of power and cooling systems without disrupting the IT operations. This feature is particularly appealing to companies that require high uptime but are sensitive to the higher costs associated with Tier 4 facilities.

The energy storage solutions in Tier 3 data centers not only enhance operational reliability but also contribute to energy efficiency. These facilities often integrate advanced energy storage systems that help manage power consumption more effectively, especially during peak demand times.

End-Use Industry Analysis

In 2023, the IT and Telecommunications segment held a dominant position in the Data Center Energy Storage market, capturing more than a 25.1% share. This leadership is largely attributed to the critical need for uninterrupted power supply in maintaining 24/7 operations and connectivity across global networks.

The increasing reliance on cloud-based solutions and data-intensive applications such as streaming services, IoT, and artificial intelligence has driven the IT and Telecommunications industry to upgrade their infrastructure and energy storage systems play a crucial role in these upgrades.

Moreover, the push towards 5G technology and the expansion of mobile network infrastructure have necessitated robust energy solutions. Energy storage systems in data centers ensure that the growing number of data transmission points are supported by sufficient power backup options, enhancing overall system reliability and reducing latency in data transmission.

Energy storage systems are integral, allowing data centers to more effectively integrate renewable energy sources like solar and wind. This not only helps in reducing operational costs over time but also aligns with global initiatives to lower carbon emissions, marking the IT and Telecommunications sector as a leader in adopting energy storage solutions.

Key Market Segments

By Data Center Type

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By End-Use Industry

- BFSI

- IT and Telecommunications

- Government

- Manufacturing

- Healthcare

- Other End-Use Industries

Driver

Escalating Energy Demands from AI and Cloud Computing

The rapid expansion of artificial intelligence (AI) and cloud computing has significantly increased the energy requirements of data centers. AI applications, particularly those involving machine learning and deep learning, necessitate substantial computational power, leading to higher electricity consumption.

Training large AI models can consume as much energy as several hundred households over a year. This surge in energy demand has prompted data center operators to seek efficient energy storage solutions to ensure reliable power supply and mitigate operational costs.

Implementing advanced energy storage systems enables data centers to manage peak loads effectively, integrate renewable energy sources, and enhance overall energy efficiency. Thus, the escalating energy demands driven by AI and cloud computing serve as a primary catalyst for the adoption of robust energy storage solutions in data centers.

Restraint

High Capital Expenditure and Economic Viability

Despite the clear benefits, the adoption of energy storage systems in data centers is often hindered by substantial initial capital expenditures. Technologies such as lithium-ion batteries, while effective, require significant investment for procurement and maintenance. Additionally, the economic viability of these systems is influenced by factors like energy prices, regulatory policies, and technological advancements.

Moreover, the rapid pace of technological change can render existing systems obsolete, posing a financial risk for operators. Therefore, the high upfront costs and economic uncertainties act as significant restraints to the widespread implementation of energy storage solutions in data centers.

Opportunity

Integration of Renewable Energy Sources

The global shift towards sustainability presents a significant opportunity for data centers to integrate renewable energy sources through advanced energy storage systems. By harnessing solar, wind, or other renewable energies, data centers can reduce their carbon footprint and operational costs.

Energy storage systems play a crucial role in this integration by addressing the intermittent nature of renewables, ensuring a stable and reliable power supply. For instance, during periods of low renewable generation, stored energy can be utilized to maintain operations without relying on fossil fuels.

This not only aligns with environmental goals but also enhances energy security and resilience. As regulatory frameworks increasingly favor green energy adoption, data centers have a strategic opportunity to leverage energy storage solutions for sustainable growth and competitive advantage.

Challenge

Technological Complexity and Reliability Concerns

Implementing energy storage systems in data centers introduces technological complexities and reliability concerns. The integration of storage solutions requires sophisticated energy management systems capable of balancing loads, optimizing energy use, and ensuring seamless operation during power fluctuations.

Additionally, concerns regarding the lifespan, efficiency, and safety of storage technologies, such as battery degradation over time, pose challenges. For example, thermal management is critical to prevent overheating and potential failures. Furthermore, the rapid evolution of energy storage technologies necessitates continuous monitoring and potential upgrades, adding to operational complexities.

Emerging Trends

Data centers are the backbone of the digital world, powering everything from social media to cloud computing.

One notable trend is the integration of renewable energy sources. Many data centers are now incorporating solar and wind power to reduce their carbon footprint. Additionally, there’s a growing emphasis on sustainability. Data centers are adopting energy-efficient designs to minimize environmental impact.

Battery Energy Storage Systems (BESS) are also gaining traction. These systems store energy during off-peak times and supply it during peak demand, enhancing energy efficiency and reliability. Schneider Electric highlights that BESS can provide additional backup power, decrease reliance on diesel generators, and support the increased use of renewables.

The rise of artificial intelligence (AI) has further amplified energy demands. AI applications require substantial computational power, leading to increased energy consumption. To address this, companies are exploring advanced energy storage solutions and optimizing energy usage to support AI workloads efficiently.

Business Benefits

Implementing advanced energy storage solutions in data centers offers several significant business advantages. Energy storage systems can lead to substantial cost savings. By storing energy during off-peak periods when electricity rates are lower and utilizing it during peak times, data centers can reduce energy expenses. This practice, known as energy arbitrage, helps in managing operational costs effectively.

Moreover, integrating renewable energy sources through advanced storage solutions aligns with corporate sustainability goals. Utilizing clean energy not only reduces carbon emissions but also enhances the company’s reputation among environmentally conscious consumers and partners.

Additionally, energy storage systems can improve power quality and stability. They help in smoothing out fluctuations in power supply, protecting sensitive equipment from potential damage, and ensuring consistent performance.

Regional Analysis

In 2023, North America held a dominant market position in the Data Center Energy Storage market, capturing more than a 38.2% share with a revenue generation of USD 0.6 billion.

This leading stance can be attributed to several strategic factors, predominantly the region’s advanced technological infrastructure and the presence of major tech corporations that demand robust data center capabilities.

The growth in North America is further propelled by significant investments in cloud services and data center expansions by key industry players. These companies are focusing on building energy-efficient and reliable data centers to support the vast amount of data generated by consumers and businesses.

With a strong emphasis on reducing downtime and improving energy management, energy storage solutions have become critical to these efforts. Initiatives aimed at reducing carbon footprints and enhancing energy independence make energy storage systems a viable solution for many data centers in the region. This regulatory support, coupled with incentives for using renewable energy sources, drives the market forward.

Investments in next-generation battery solutions, which promise greater efficiency and lower costs, are likely to keep North America at the forefront of this market’s expansion, ensuring continued growth and technological advancement.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the competitive landscape of the Data Center Energy Storage market, Schneider Electric SE stands out as a prominent leader. Known for its innovative solutions in energy and automation, Schneider Electric provides cutting-edge energy storage technologies that are crucial for modern data centers.

Eaton Corporation PLC is another key player in this market, specializing in power management solutions that cater specifically to the needs of large-scale data centers. Eaton’s energy storage solutions are focused on delivering high reliability and reducing downtime, which is critical for data center operations.

Mitsubishi Electric Corporation rounds out the trio of leaders in the Data Center Energy Storage market. This company offers a robust array of energy storage systems that are renowned for their durability and precision. Mitsubishi Electric’s solutions are tailored to enhance the operational efficiency of data centers, with a strong emphasis on minimizing energy loss and maximizing power usage effectiveness.

Top Key Players in the Market

- Schneider Electric SE

- Eaton Corporation PLC

- Mitsubishi Electric Corporation

- ABB Group

- Vertiv Group Corporation

- Delta Electronics, Inc.

- Toshiba Corporation

- Legrand Group

- Huawei Technologies Co., Ltd.

- Fuji Electric Co., Ltd.

- Other Key Players

Recent Developments

- In January 2024, Myers EPS acquired Storage Power Solutions, a provider of battery energy storage systems. This acquisition led to the launch of the EnerShed™ product line, offering scalable energy storage solutions starting from 60kW, catering to various market environments, including data centers.

- In August 2024, Legrand has continued its strategy of targeted acquisitions to enhance its data center services. Notably, the company acquired a French provider of data center services, adding approximately €13 million in annual sales.

- May 2024: Digital Edge partnered with Donghwa ES to launch a next-generation Hybrid Super Capacitor (HSC) energy storage system. This solution brings a sustainable and efficient alternative to traditional batteries, offering better redundancy for data centers and supporting the growing demands of AI and hyperscale workloads. The innovation addresses energy reliability with a future-forward approach.

- June 2024: Legrand announced the acquisition of Davenham (Ireland) and VASS (Australia) to strengthen its position in the data center market. This move is set to expand its power distribution capabilities and enhance its White Space offerings, catering to a wider range of customer needs.

- June 2024: Vertiv Group Corp. partnered with Ballard Power Systems to deliver hydrogen-powered fuel cell solutions for data centers in North America and EMEA. The collaboration combines Ballard’s zero-emission fuel cells with Vertiv’s infrastructure, including lithium-ion batteries and uninterruptible power systems, ensuring greener and more resilient backup power options for critical operations.

Report Scope

Report Features Description Market Value (2023) USD 1.6 Bn Forecast Revenue (2033) USD 3.5 Bn CAGR (2024-2033) 8.00% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Data Center Type (Tier 1, Tier 2, Tier 3, Tier 4), By End-Use Industry (BFSI, IT and Telecommunications, Government, Manufacturing, Healthcare, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schneider Electric SE, Eaton Corporation PLC, Mitsubishi Electric Corporation, ABB Group, Vertiv Group Corporation, Delta Electronics, Inc., Toshiba Corporation, Legrand Group, Huawei Technologies Co., Ltd., Fuji Electric Co., Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Center Energy Storage MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Data Center Energy Storage MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Schneider Electric SE

- Eaton Corporation PLC

- Mitsubishi Electric Corporation

- ABB Group

- Vertiv Group Corporation

- Delta Electronics, Inc.

- Toshiba Corporation

- Legrand Group

- Huawei Technologies Co., Ltd.

- Fuji Electric Co., Ltd.

- Other Key Players