Cytotoxicity Assays Market By Product Type (Cytotoxicity Assay Based Kits, Minimal Inhibitory Concentration Cytotoxicity Assay Kits, Fluorometric Cytotoxicity Based Assays Kits, ELISA Cytotoxicity Assays Kits, Crystal Violet Cytotoxicity Assays Kits, and Colorimetric Cytotoxicity Based Assays Kits), By Application (Nephrotoxicity, Immunohistochemistry, Cell Proliferation, Cardiotoxicity, Apoptosis, and Others), By End-user (Hospitals, Pharma & Biotech Companies, Diagnostics Centers, Academic & Research Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162996

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

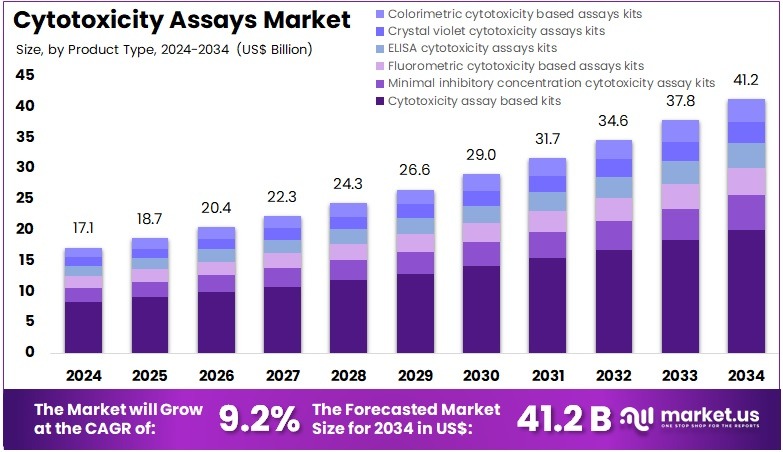

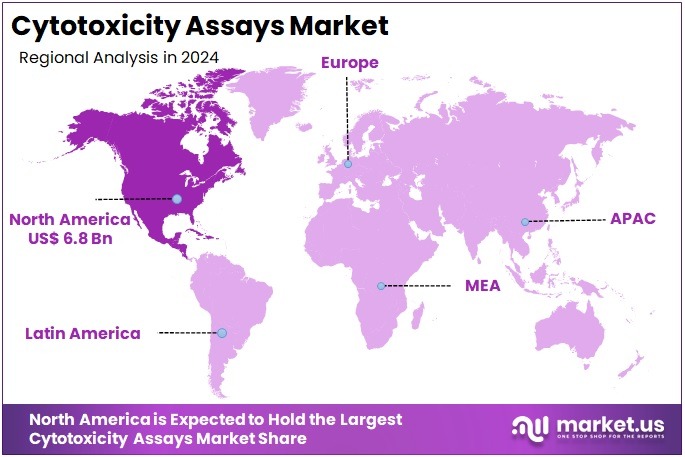

The Cytotoxicity Assays Market size is expected to be worth around US$ 41.2 billion by 2034 from US$ 17.1 billion in 2024, growing at a CAGR of 9.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.9% share and holds US$ 6.8 Billion market value for the year.

Increasing demand for biopharmaceutical safety drives the Cytotoxicity Assays Market, as developers prioritize robust testing to ensure drug candidate viability. Researchers apply these assays in preclinical studies to evaluate drug toxicity on cell lines, guiding candidate selection for clinical trials. These tests support immunotherapy development by assessing T-cell mediated cytotoxicity, optimizing therapeutic efficacy.

High-throughput platforms enable rapid screening of compound libraries, accelerating drug discovery timelines. In October 2024, Sphere Fluidics launched Cyto-Mine Chroma, an advanced single-cell analysis platform using picodroplet technology for precise cytotoxicity assessments. This innovation fuels market growth by enhancing single-cell toxicity evaluations critical for biopharmaceutical advancements.

Growing adoption of real-time analytics creates opportunities in the Cytotoxicity Assays Market, as laboratories seek efficient tools for dynamic cell viability monitoring. Pharmaceutical companies utilize luminescence-based assays to quantify cytotoxic effects in cancer drug screening, ensuring accurate potency measurements. These assays aid regenerative medicine by evaluating biomaterial compatibility with stem cells, supporting tissue engineering applications.

Portable testing devices expand access to cytotoxicity testing in smaller research facilities, broadening market reach. In June 2024, Promega Corporation introduced the MyGlo Reagent Reader, a cost-effective 96-well plate reader for luminescence assays, enhancing real-time data collection for cytotoxicity studies. This development drives market expansion by improving accessibility and precision in laboratory workflows.

Rising integration of automation propels the Cytotoxicity Assays Market, as advanced systems streamline high-volume testing demands. Academic institutions employ these assays to study cellular responses to environmental toxins, advancing toxicological research. These tests support personalized medicine by assessing patient-derived cell sensitivity to chemotherapeutics, tailoring treatment plans.

Trends toward multiplex assays combine cytotoxicity with other endpoints, optimizing data yield in single experiments. Automated platforms enhance reproducibility in quality control for biologics manufacturing, meeting regulatory standards. These technological advancements position the market for sustained growth by fostering efficiency and innovation in diverse research and clinical applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 17.1 billion, with a CAGR of 9.2%, and is expected to reach US$ 41.2 billion by the year 2034.

- The product type segment is divided into cytotoxicity assay based kits, minimal inhibitory concentration cytotoxicity assay kits, fluorometric cytotoxicity based assays kits, ELISA cytotoxicity assays kits, crystal violet cytotoxicity assays kits, and colorimetric cytotoxicity based assays kits, with cytotoxicity assay based kits taking the lead in 2023 with a market share of 48.5%.

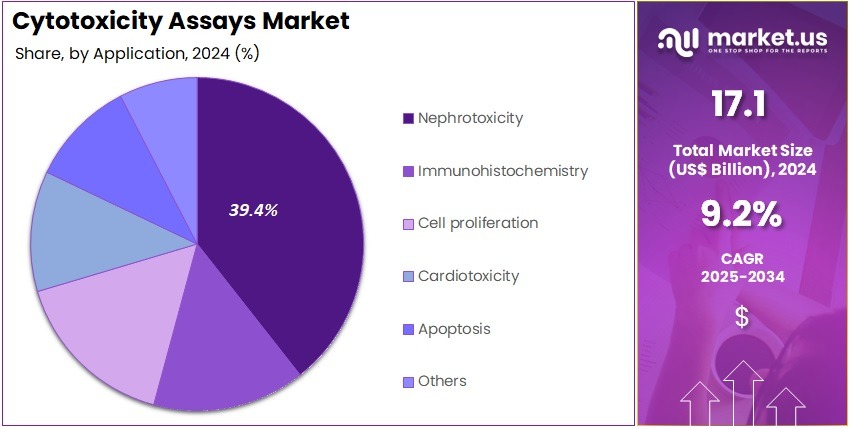

- Considering application, the market is divided into nephrotoxicity, immunohistochemistry, cell proliferation, cardiotoxicity, apoptosis, and others. Among these, nephrotoxicity held a significant share of 39.4%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, pharma & biotech companies, diagnostics centers, academic & research laboratories, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 45.9% in the market.

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

Cytotoxicity assay based kits account for 48.5% of the Cytotoxicity Assays market and are expected to dominate due to their widespread use in evaluating cell viability, drug toxicity, and compound screening. These kits offer ready-to-use, standardized reagents that simplify workflows in both research and clinical applications. The pharmaceutical and biotechnology industries increasingly adopt these kits for high-throughput drug screening and toxicity profiling of new molecules.

The growing demand for accurate and reproducible results in preclinical testing is projected to drive adoption. Advancements in assay sensitivity and automation compatibility enhance testing efficiency and throughput. Hospitals and diagnostic laboratories rely on these kits for assessing cytotoxic responses in cancer and nephrotoxicity-related studies. The integration of real-time cell monitoring systems with cytotoxicity assays is improving precision and data reliability.

Continuous innovations, such as multiplexed assay formats that allow simultaneous evaluation of multiple parameters, further strengthen market growth. Regulatory emphasis on in vitro toxicity testing to reduce animal usage supports the demand for assay kits. The affordability, simplicity, and adaptability of these products ensure their continued preference in laboratories worldwide. As personalized medicine and drug discovery expand, cytotoxicity assay kits are anticipated to remain at the core of toxicity evaluation strategies.

Application Analysis

Nephrotoxicity applications represent 39.4% of the market and are expected to dominate as kidney toxicity assessment becomes a vital part of drug safety evaluation. Pharmaceutical companies increasingly perform nephrotoxicity assays to detect drug-induced renal damage early in the development process. The high incidence of renal disorders and the use of nephrotoxic drugs in oncology, antibiotics, and pain management are driving market growth.

Hospitals and research centers depend on cytotoxicity assays to assess kidney cell viability and drug safety across various therapeutic classes. Advances in in vitro kidney cell models and 3D cell culture systems have improved assay predictability and accuracy. The focus on developing renal-safe drugs through preclinical toxicity screening is anticipated to boost demand. Regulatory agencies emphasize nephrotoxicity testing as part of safety assessments for new chemical entities.

Collaborations between pharmaceutical firms and academic institutions for early toxicity detection technologies further enhance segment expansion. Increasing patient awareness and hospital screening programs for drug-related renal complications contribute to broader adoption. The integration of automated cytotoxicity platforms and image-based analysis tools is improving nephrotoxicity testing precision. As the global burden of chronic kidney disease rises, nephrotoxicity testing remains essential for drug safety and patient care optimization.

End-User Analysis

Hospitals hold 45.9% of the end-user segment and are projected to sustain dominance due to their central role in diagnostic testing, patient monitoring, and therapeutic evaluation. Hospitals use cytotoxicity assays to monitor adverse drug reactions, evaluate chemotherapy safety, and study cellular responses to treatment. The rise in personalized and targeted therapies in oncology and nephrology is increasing the need for precise cytotoxicity testing in hospital laboratories.

The adoption of automated analyzers and standardized assay kits improves turnaround time and result accuracy. Hospitals benefit from partnerships with diagnostic companies for customized toxicity testing solutions tailored to clinical requirements. Growing patient admissions related to organ toxicity, cancer treatments, and metabolic disorders contribute to higher testing volumes. The availability of multidisciplinary research and clinical expertise supports assay implementation in hospital-based labs.

Hospitals also participate in collaborative studies for drug safety profiling, enhancing the scope of cytotoxicity assay use. The expansion of advanced healthcare infrastructure and integration of digital data management systems improve efficiency and quality control. Preventive screening initiatives in hospitals are driving early detection of drug-induced toxicity. As healthcare systems emphasize precision medicine, cytotoxicity testing is anticipated to become increasingly integrated into hospital diagnostic workflows.

Key Market Segments

By Product Type

- Cytotoxicity Assay Based Kits

- Minimal Inhibitory Concentration Cytotoxicity Assay Kits

- Fluorometric Cytotoxicity Based Assays Kits

- Elisa Cytotoxicity Assays Kits

- Crystal Violet Cytotoxicity Assays Kits

- Colorimetric Cytotoxicity Based Assays Kits

By Application

- Nephrotoxicity

- Immunohistochemistry

- Cell Proliferation

- Cardiotoxicity

- Apoptosis

- Others

By End-user

- Hospitals

- Pharma & Biotech Companies

- Diagnostics Centers

- Academic & Research Laboratories

- Others

Drivers

Rising Incidence of Cancer is Driving the Market

The persistent increase in cancer diagnoses worldwide has significantly accelerated the adoption of cytotoxicity assays, which are essential for evaluating the therapeutic potential of anticancer agents by measuring their ability to selectively induce cell death in malignant cells. These assays, encompassing methods like MTT and LDH release, enable high-throughput screening of compounds, identifying those that minimize off-target toxicity while maximizing tumoricidal efficacy. This driver is particularly pronounced in oncology drug discovery, where the need to assess novel modalities such as immunotherapies and targeted inhibitors demands robust in vitro models to predict clinical outcomes.

Healthcare research priorities, influenced by epidemiological data, emphasize its integration into early-phase pipelines to streamline candidate selection and reduce attrition rates. The assays’ versatility in quantifying apoptosis, necrosis, and proliferation inhibition further enhances their utility across diverse tumor types, from solid malignancies to hematologic cancers. Public funding initiatives underscore its critical role in bridging preclinical validation with translational success, fostering investments in assay optimization.

The National Cancer Institute reports that the rate of new cancer cases reached 445.8 per 100,000 men and women per year based on 2018–2022 data, with projections indicating sustained elevations into 2024 that necessitate expanded diagnostic and therapeutic evaluation tools. This incidence metric highlights the escalating clinical burden, directly correlating with heightened reagent procurements for cytotoxicity evaluations.

Technological adaptations, such as real-time kinetic monitoring, refine its precision, accommodating variable cell lines and drug concentrations. Economically, its deployment averts costly late-stage failures, justifying allocations for scalable platforms in academic and industrial settings. Collaborative consortia harmonize protocols, ensuring reproducibility across international trials. This oncogenic escalation not only amplifies assay utilization but also cements its foundational status in precision oncology workflows.

Restraints

Complexity in Assay Standardization and Interpretation is Restraining the Market

The intricate challenges in standardizing cytotoxicity assays and interpreting their outputs continue to limit their widespread implementation, as variations in cell lines and experimental conditions yield inconsistent results that complicate comparative analyses. These assays, while diverse in endpoints, often suffer from endpoint-specific biases, such as metabolic interference in MTT protocols or substrate limitations in LDH measurements, undermining reliability in heterogeneous tumor models. This restraint is exacerbated by the stochastic nature of cell death, where single-timepoint assessments fail to capture dynamic responses, leading to false positives or negatives in drug screening.

Laboratories must navigate rigorous validation requirements, including inter-laboratory reproducibility testing, which inflates timelines and resource demands for assay adoption. The lack of physiological relevance in 2D monocultures further erodes confidence, prompting shifts toward costlier 3D alternatives without established benchmarks. Regulatory guidelines, while essential for safety, impose exhaustive controls that deter smaller entities from innovating bespoke protocols.

The National Institutes of Health highlights that different cell lines respond variably to the same chemicals in viability assays, with no single line proving conclusive, a challenge persisting through 2022 analyses. Such discrepancies contribute to underutilization, as investigators favor molecular surrogates over comprehensive cytotoxicity profiling.

Training gaps among technicians amplify interpretive errors, favoring empirical over quantitative assessments. Efforts to develop unified scoring systems advance gradually, hindered by endpoint heterogeneity. These standardization barriers not only curtail throughput but also impede the market’s alignment with predictive toxicology imperatives.

Opportunities

Integration of 3D Organoid Models is Creating Growth Opportunities

The incorporation of three-dimensional organoid cultures into cytotoxicity assays has unlocked substantial expansion avenues, offering biomimetic platforms that more accurately recapitulate tumor microenvironments for enhanced predictive validity. These models, derived from patient-derived tissues, enable spatiotemporal assessment of drug penetration and resistance mechanisms, surpassing traditional 2D limitations in mimicking stromal interactions and hypoxia gradients.

Opportunities proliferate in personalized medicine pipelines, where organoid-derived assays facilitate bespoke screening, tailoring therapies to individual genomic profiles. Pharmaceutical consortia are subsidizing validations for high-content imaging integrations, bridging gaps in scalability for multiplexed evaluations. This dimensionality addresses translational shortfalls, positioning organoids as prophylactics against clinical mismatches in oncology trials.

Fiscal incentives for advanced modeling catalyze procurements, diversifying toward automated co-culture systems. The National Cancer Institute supported studies in 2022 demonstrating that organoid models quantitatively monitor NK cell-mediated cytotoxicity against breast cancer cells, validating their efficacy for preclinical immunotherapy assessments. This application exemplifies replicable frameworks, with extensions projecting amplified reagent demands in therapeutic profiling.

Innovations in matrix alternatives, such as hyaluronan hydrogels, mitigate ethical and reproducibility concerns, broadening accessibility. As digital twins evolve, organoid outputs unlock predictive simulation revenues. These 3D integrations not only diversify assay repertoires but also entrench the market within holistic disease modeling architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the cytotoxicity assays market, leading them to delay high-throughput screening platform upgrades while focusing on core viability reagent production amid reduced biotech funding. U.S.-China export controls and Baltic Sea shipping disruptions are restricting supplies of fluorescent dyes from European suppliers, extending assay sensitivity trials and raising certification costs for global toxicology networks. To overcome these challenges, some developers are partnering with Michigan-based dye manufacturers, adopting validation standards that expedite FDA approvals and attract drug discovery grants.

Increasing demand for safer therapeutics is directing NIH allocations into advanced LDH release panels, boosting adoptions in preclinical labs. U.S. tariffs of 20% on imported laboratory equipment and components, effective March 2025, are elevating costs for Asian-sourced cell culture media and substrates, squeezing margins for research institutions and occasionally stalling international assay collaborations. In response, developers are leveraging CHIPS Act incentives to build Ohio synthesis facilities, introducing luminescent boosters and enhancing expertise in real-time viability metrics.

Latest Trends

Sphere Fluidics’ Launch of Cyto-Mine Chroma is a Recent Trend

The unveiling of advanced single-cell screening platforms has exemplified a pivotal advancement in cytotoxicity assay workflows during 2025, emphasizing automated functional assessments to expedite therapeutic candidate identification. Sphere Fluidics’ Cyto-Mine Chroma, leveraging picodroplet microfluidics, facilitates multiplexed viability evaluations, capturing subtle cytotoxic responses in heterogeneous populations with minimal manual intervention. This trend embodies a shift toward integrated automation, where the platform’s upgrade modules support real-time imaging and isolation, optimizing for diverse endpoints like apoptosis induction.

Regulatory validations confirm its analytical fidelity, accelerating adoptions in biopharma pipelines amid demands for scalable precision. This capability aligns with computational synergies, linking outputs to downstream analytics for enhanced interpretability. The platform counters throughput limitations, prioritizing resilient configurations for variable assay matrices.

Sphere Fluidics announced the launch of Cyto-Mine Chroma and its Early Access Program at SLAS2025 in January 2025, enhancing cytotoxicity assessments through high-throughput single-cell analysis. Such milestones underscore viability, as early implementations affirm equivalence to traditional methods.

Observers anticipate guideline endorsements, elevating its role in regulatory dossiers. Longitudinal validations reveal variance reductions, streamlining resource deployments. The trajectory foresees modular expansions, anticipating cross-disciplinary applications. This microfluidic refinement not only accelerates screening efficiency but also synchronizes with biotherapeutic innovation mandates.

Regional Analysis

North America is leading the Cytotoxicity Assays Market

In 2024, North America accounted for 39.9% of the global cytotoxicity assays market, propelled by rigorous regulatory requirements under ISO 10993-5 for biocompatibility evaluation of medical devices, which necessitated widespread adoption of in vitro assays like MTT and LDH release to assess cellular viability prior to clinical deployment.

Pharmaceutical developers increasingly relied on high-throughput platforms to screen novel therapeutics for off-target toxicity, enabling efficient prioritization of candidates in oncology pipelines, where real-time imaging assays reduced animal testing by facilitating 3D spheroid models for tumor microenvironment simulation.

The National Institute of Environmental Health Sciences’ funding initiatives supported alternative method validations, fostering collaborations among academic labs to refine organ-on-chip systems for predictive toxicology, aligning with ethical mandates to minimize vertebrate use in safety assessments.

Demographic factors, including rising chronic exposures to environmental toxins, amplified demand for assays in population health studies, with point-of-care formats appealing to clinical researchers for rapid neurotoxic profiling. These developments underscored the region’s leadership in transitioning to humane, scalable toxicity evaluation paradigms. The National Institute of Environmental Health Sciences awarded grants of up to US$400,000 annually from 2022 through 2024 for test method developers focusing on in vitro cytotoxicity and related assays.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National authorities in Asia Pacific project the cytotoxicity assays sector to thrive during the forecast period, as regulatory frameworks harmonize with global standards to accelerate biopharmaceutical validations in emerging biotech hubs. Officials in South Korea and Australia channel resources toward high-content screening kits, equipping research institutes to evaluate nanomaterial impacts on hepatic cell lines amid industrial expansions.

Diagnostic innovators partner with governmental labs to calibrate luminescence-based platforms, anticipating refined predictions of immunotoxicity in vaccine development for endemic pathogens. Oversight bodies in China and India subsidize 3D culture models, positioning university facilities to assess regenerative therapy risks without extensive animal cohorts. Administrative systems anticipate embedding assay data into digital validation portals, expediting approvals for gene-edited crops in tropical agriculture.

Regional toxicologists pioneer CRISPR-integrated assays, coordinating with continental consortia to delineate endocrine disruptor effects in coastal ecosystems. These initiatives cultivate a sophisticated ecosystem for alternative toxicity profiling. Japan’s Agency for Medical Research and Development allocated 16.2 billion JPY to psychiatric and neurological R&D in fiscal year 2023, encompassing cytotoxicity evaluations for neurotherapeutics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the cell viability testing sector drive expansion by launching high-throughput luminescence kits that assess drug toxicity in 3D cell models, catering to accelerated oncology and immunotherapy pipelines. They forge co-development agreements with CROs to integrate assays into early-phase trials, expediting candidate validation and regulatory submissions. Enterprises channel funds into microfluidics-based platforms, enabling real-time cytotoxicity profiling with minimal sample volumes for biopharma labs.

Executives acquire niche reagent innovators to broaden multiplex capabilities, combining apoptosis and necrosis markers for comprehensive insights. They target growth in Asia-Pacific and Eastern Europe, aligning with regional R&D hubs to capture grant-funded opportunities. Additionally, they offer cloud-based analytics subscriptions, enhancing data interpretation and fostering long-term partnerships with research institutes.

Promega Corporation, founded in 1978 and headquartered in Madison, Wisconsin, develops innovative biotechnology tools for life sciences, specializing in luminescence and fluorescence-based assays for drug discovery and cellular research. The company delivers its CellTiter-Glo assay, a robust platform for quantifying ATP to assess cell health in diverse experimental settings.

Promega invests heavily in R&D to advance assay sensitivity and compatibility with automated systems. CEO William A. Linton leads a global operation spanning over 16 countries, emphasizing quality and sustainability. The firm collaborates with academic and industry partners to refine testing protocols, supporting precision medicine. Promega strengthens its market leadership by blending cutting-edge reagents with scalable solutions for global research demands.

Top Key Players in the Cytotoxicity Assays Market

- Sartorius AG

- Promega Corporation

- PerkinElmer, Inc.

- Lonza Group Ltd.

- GE Healthcare

- Danaher Corporation

- Creative Bioarray

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Abcam plc

Recent Developments

- In December 2024: Beckman Coulter Life Sciences launched the Cydem VT Automated Clone Screening System, a high-throughput microbioreactor platform for top clone identification. This system supports cytotoxicity testing in biologics development by expediting clone selection and optimizing screening for cell-based therapeutics, thereby driving the demand for automated assay solutions within the Cytotoxicity Assays Market.

- In February 2024: ARRALYZE unveiled CellShepherd, a miniaturized cell-based assay device enabling real-time monitoring of single-cell responses. Its ability to capture detailed cytotoxicity profiles across multiple cell types enhances drug discovery workflows and precision toxicology research. The platform’s high sensitivity and miniaturized format are fostering innovation in the Cytotoxicity Assays Market by promoting next-generation, real-time toxicity assessment technologies.

Report Scope

Report Features Description Market Value (2024) US$ 17.1 billion Forecast Revenue (2034) US$ 41.2 billion CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cytotoxicity Assay Based Kits, Minimal Inhibitory Concentration Cytotoxicity Assay Kits, Fluorometric Cytotoxicity Based Assays Kits, ELISA Cytotoxicity Assays Kits, Crystal Violet Cytotoxicity Assays Kits, and Colorimetric Cytotoxicity Based Assays Kits), By Application (Nephrotoxicity, Immunohistochemistry, Cell Proliferation, Cardiotoxicity, Apoptosis, and Others), By End-user (Hospitals, Pharma & Biotech Companies, Diagnostics Centers, Academic & Research Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sartorius AG, Promega Corporation, PerkinElmer, Inc., Lonza Group Ltd., GE Healthcare, Danaher Corporation, Creative Bioarray, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Abcam plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sartorius AG

- Promega Corporation

- PerkinElmer, Inc.

- Lonza Group Ltd.

- GE Healthcare

- Danaher Corporation

- Creative Bioarray

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Abcam plc