Cystatin C Testing Market By Product Type (Kits, and Instruments & Regents), By Test (ELISA Based Tests, Colorimetric Assay Based Tests, Enzymatic Tests, Point of Care Tests, and Others), By Application (Diagnosis Use, and Research & Development), By End-user (Hospitals & Clinics, Academic Research Institutes, Diagnostic Laboratories, and Renal Care Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161106

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

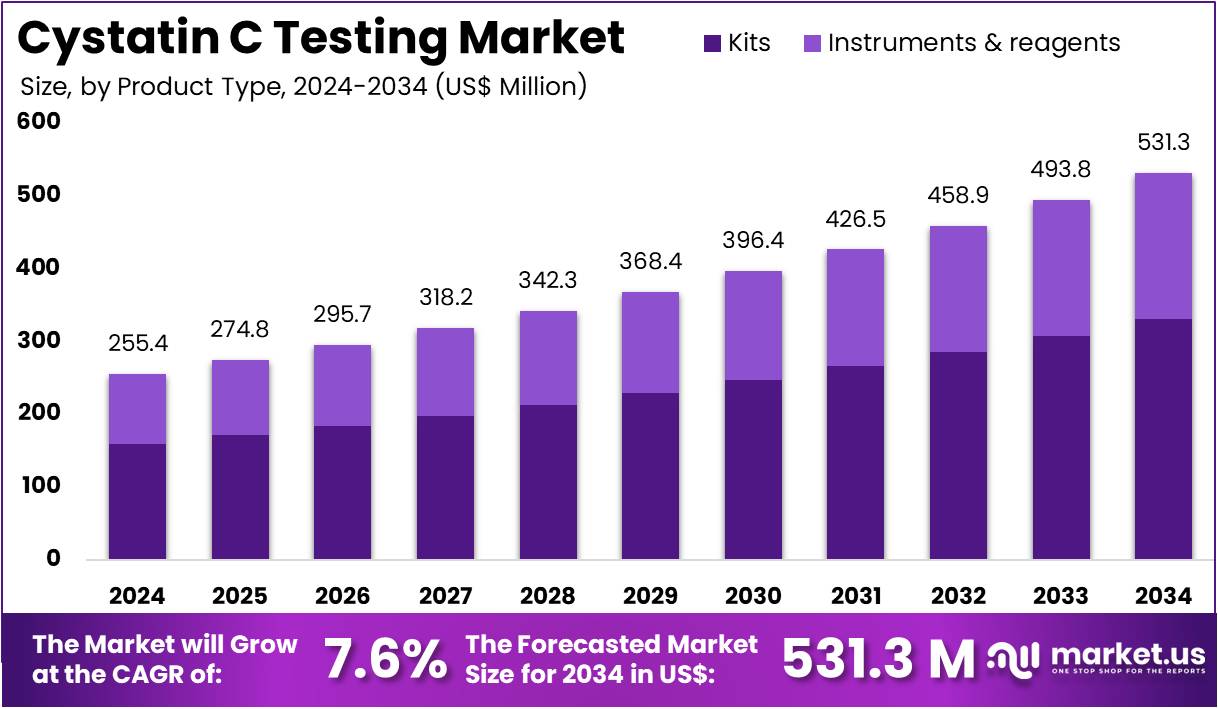

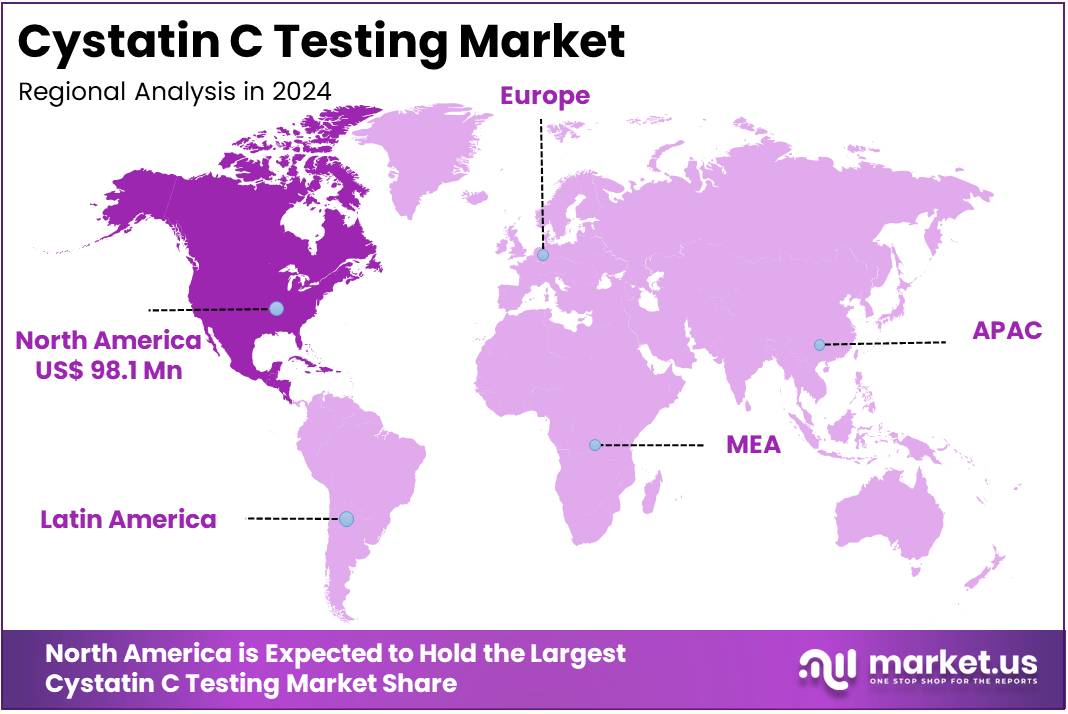

The Cystatin C Testing Market Size is expected to be worth around US$ 531.3 million by 2034 from US$ 255.4 million in 2024, growing at a CAGR of 7.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.4% share and holds US$ 98.1 Million market value for the year.

Rising prevalence of chronic kidney disease propels the Cystatin C Testing market as clinicians seek superior biomarkers for precise glomerular filtration rate estimation. Nephrologists increasingly apply cystatin C assays in early-stage CKD screening, offering reliable results unaffected by muscle mass variations in elderly patients. This driver accelerates with the demand for accurate monitoring, where testing guides dosage adjustments for renally cleared drugs in transplant recipients.

Laboratories utilize these assays for pediatric applications, assessing kidney function in congenital anomalies without reliance on age-dependent creatinine norms. In 2021, Monogram Health raised USD 160 million in Series B funding to integrate advanced testing like cystatin C into care models for CKD patients. According to the CDC, 37 million adults live with CKD, emphasizing the vital need for enhanced diagnostic precision across renal applications.

Growing integration of artificial intelligence expands significant opportunities in the Cystatin C Testing market. Developers create AI-enhanced platforms that combine cystatin C data with genomic profiles, supporting predictive analytics for diabetic nephropathy progression. Health systems explore these tools for cardiovascular risk stratification, correlating cystatin C elevations with subclinical heart damage in at-risk cohorts.

Opportunities also emerge in oncology, where assays monitor nephrotoxicity from chemotherapy agents to personalize treatment regimens. In 2023, the National Kidney Foundation invested in Klinrisk, an AI company advancing early CKD detection through risk prediction systems that incorporate cystatin C metrics. The World Health Organization projects CKD to rank as the fifth leading cause of death by 2040, underscoring the potential for innovative testing to optimize patient management.

Recent trends in the Cystatin C Testing market highlight biomarker synergies and technological refinements to bolster diagnostic panels. Innovators emphasize multiplex assays that pair cystatin C with inflammatory markers, aiding applications in autoimmune disorders like lupus nephritis for comprehensive profiling. Trends also include point-of-care devices for rapid cystatin C quantification, streamlining workflows in dialysis units for immediate adjustments.

In October 2023, UCLA researchers discovered ERK protein’s role in cancer pathways, highlighting biomarkers like cystatin C’s value in integrated oncology diagnostics. Industry reports indicate a 25% rise in cystatin C adoption for eGFR calculations in 2023, reflecting momentum toward multifaceted disease insights. These developments drive a cohesive evolution toward adaptive, evidence-based testing frameworks.

Key Takeaways

- In 2024, the market generated a revenue of US$ 255.4 million, with a CAGR of 7.6%, and is expected to reach US$ 531.3 million by the year 2034.

- The product type segment is divided into kits and instruments & regents, with kits taking the lead in 2024 with a market share of 62.4%.

- Considering test, the market is divided into ELISA based tests, colorimetric assay based tests, enzymatic tests, point of care tests, and others. Among these, ELISA based tests held a significant share of 45.8%.

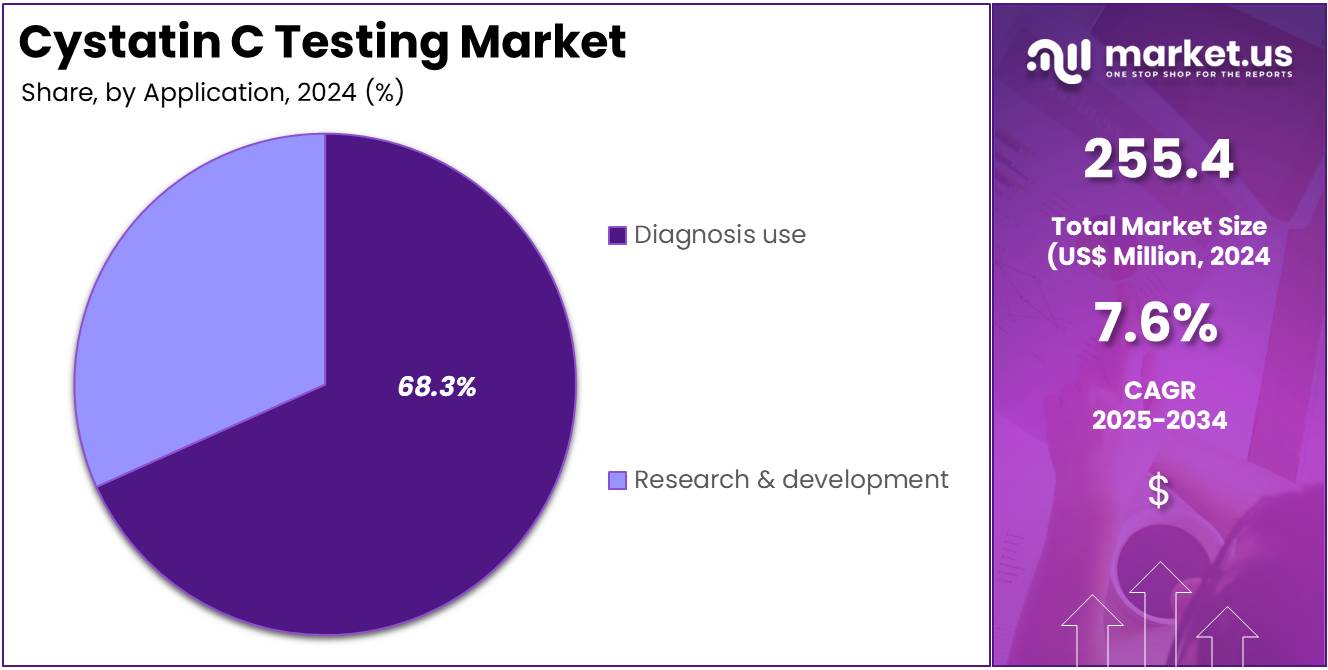

- Furthermore, concerning the application segment, the market is segregated into diagnosis use and research & development. The diagnosis use sector stands out as the dominant player, holding the largest revenue share of 68.3% in the market.

- The end-user segment is segregated into hospitals & clinics, academic research institutes, diagnostic laboratories, and renal care centers, with the hospitals & clinics segment leading the market, holding a revenue share of 43.1%.

- North America led the market by securing a market share of 38.4% in 2024.

Product Type Analysis

Kits dominate the Cystatin C Testing market, accounting for 62.4% of the share, and are expected to maintain a leading position due to their ease of use, affordability, and versatility in testing. The increasing prevalence of kidney-related diseases, such as chronic kidney disease (CKD), is driving the demand for diagnostic kits that can quickly and accurately measure Cystatin C levels. Kits offer a user-friendly and cost-effective solution for routine and point-of-care testing in various healthcare settings. Their widespread adoption in hospitals, diagnostic laboratories, and research environments contributes to their dominance in the market.

The growing awareness of the importance of early kidney function assessment further supports the uptake of Cystatin C testing kits. As Cystatin C is emerging as a key biomarker for kidney function, the demand for these kits is expected to rise, especially in resource-constrained settings where ease of use and affordability are paramount. Additionally, advancements in kit design, such as improvements in sensitivity and speed, are likely to fuel further growth in this segment.

Test Analysis

ELISA-based tests hold 45.8% of the share in the Cystatin C Testing market and are expected to continue leading the test segment due to their high accuracy, sensitivity, and ability to process a large number of samples. ELISA (Enzyme-Linked Immunosorbent Assay) tests are widely used for measuring Cystatin C concentrations in blood samples, making them a preferred choice for both diagnostic and research applications. The growing need for early detection of kidney function impairment is anticipated to drive demand for ELISA-based tests, especially in hospitals and diagnostic laboratories.

The ELISA method is expected to maintain its dominance due to its proven reliability, ease of automation, and low cost per test, making it an attractive option for both high-throughput testing and clinical research. With advancements in ELISA technology, such as enhanced multiplexing capabilities and reduced test times, this segment is likely to expand further. The integration of ELISA tests with point-of-care platforms and their adoption in global healthcare initiatives are expected to reinforce their market position.

Application Analysis

Diagnosis use represents the largest application segment with 68.3% of the market share and is expected to continue growing as the demand for accurate and reliable kidney function tests rises. Cystatin C has emerged as a valuable biomarker for assessing renal function, and its use in diagnostic settings is increasing, especially in diagnosing chronic kidney disease (CKD) and assessing the risk of acute kidney injury (AKI).

Healthcare providers are increasingly using Cystatin C testing as a supplement to traditional biomarkers like creatinine for a more precise evaluation of glomerular filtration rate (GFR). The increasing global burden of kidney-related diseases, along with a greater focus on early detection and personalized treatment, is expected to drive the growth of this segment. Additionally, diagnostic use in point-of-care settings, where rapid results are required, is anticipated to increase the adoption of Cystatin C testing. With more healthcare systems incorporating Cystatin C into their diagnostic protocols, this segment is likely to see sustained growth.

End-User Analysis

Hospitals and clinics represent 43.1% of the end-user segment and are expected to remain the primary drivers of market growth for Cystatin C testing due to the high volume of patient diagnoses and treatments conducted in these settings. Hospitals are increasingly adopting Cystatin C tests as part of their routine diagnostic workflows to assess kidney function in at-risk patients, especially those with diabetes, hypertension, or a family history of kidney disease. The growing focus on patient-centric care, which includes proactive health monitoring and early disease detection, is likely to further boost the adoption of Cystatin C testing in hospitals and clinics.

Additionally, the integration of Cystatin C testing with electronic health records (EHRs) and clinical decision support systems (CDSS) is expected to enhance the accuracy and speed of diagnosis. As healthcare systems shift toward precision medicine and data-driven approaches, hospitals and clinics will play a critical role in the continued growth of this market segment. Furthermore, as kidney disease awareness grows, hospitals and clinics are anticipated to increase their use of Cystatin C testing for more accurate and earlier diagnosis.

Key Market Segments

By Product Type

- Kits

- Instruments & Regents

By Test

- ELISA Based Tests

- Colorimetric Assay Based Tests

- Enzymatic Tests

- Point of Care Tests

- Others

By Application

- Diagnosis Use

- Research & Development

By End-user

- Hospitals & Clinics

- Academic Research Institutes

- Diagnostic Laboratories

- Renal Care Centers

Drivers

Rising Global Burden of Chronic Kidney Disease (CKD) is driving the market

The increasing global prevalence of kidney disorders, particularly Chronic Kidney Disease (CKD), is the primary factor driving the demand for more accurate and early diagnostic tools like Cystatin C testing. Traditional methods using serum creatinine are known to be less reliable, as creatinine levels can be influenced by factors such as muscle mass, age, sex, and diet, which often delays the diagnosis of early-stage renal impairment.

Cystatin C, a protein produced by all nucleated cells at a constant rate, offers a superior, muscle mass-independent marker for estimating the glomerular filtration rate (eGFR), making it invaluable for early detection, monitoring disease progression, and adjusting drug dosages. The sheer scale of the patient population suffering from CKD underscores the critical need for advanced testing.

For instance, according to a 2022 report from the Centers for Disease Control and Prevention (CDC), more than one in seven U.S. adults, an estimated 37 million people, were affected by CKD. Furthermore, the rise in conditions like diabetes and hypertension, which are major risk factors for kidney damage, continues to swell the high-risk population. The higher clinical sensitivity of Cystatin C testing in these at-risk groups is significantly bolstering its adoption in clinical practice.

Restraints

High Relative Cost of the Assay is restraining the market

A significant constraint on the widespread adoption of Cystatin C testing is the relatively higher cost associated with the assay compared to the established and inexpensive serum creatinine test. While the clinical benefits of Cystatin C-namely its increased accuracy and reliability in diverse patient populations—are well-documented, the financial implications present a major barrier for routine, population-wide screening, particularly in healthcare systems with strained budgets or in developing economies.

The reagents and specialized equipment required for Cystatin C immunoassays are inherently more costly than the chemical methods used for creatinine measurement. According to a review article published by Wolters Kluwer Health, Inc. in 2022, the cost of reagents used in the Cystatin C test was reported to be more than three times the cost of reagents used for the creatinine test, highlighting a substantial difference in direct operational expense. This cost disparity limits its routine incorporation into standard renal function panels, often relegating its use to specialized or confirmatory testing rather than primary screening, thereby slowing the overall market growth.

Opportunities

Increased Clinical Adoption in Pediatric and Emergency Settings is creating growth opportunities

A key growth opportunity for the Cystatin C testing market lies in its expanding application in specialized clinical settings where the limitations of serum creatinine are pronounced, such as pediatrics and emergency departments. In pediatric patients, especially neonates and children with rapidly changing muscle mass, creatinine-based GFR estimation is highly inaccurate, leading to challenges in diagnosing and managing kidney disease. Cystatin C’s independence from muscle mass makes it an ideal, non-invasive biomarker for this vulnerable group.

Furthermore, in emergency and intensive care units, the rapid diagnosis of Acute Kidney Injury (AKI) is crucial, and Cystatin C has been shown to detect changes in GFR much earlier than creatinine. The existing research clearly supports this utility; a review in MDPI in 2024 noted that evidence from various studies indicates Cystatin C provides a more accurate assessment of kidney function in children, particularly for the early detection of AKI in pediatric intensive care units. This superior performance in critical and specialized patient demographics creates a distinct and essential market segment with high potential for increased adoption.

Impact of Macroeconomic / Geopolitical Factors

Global economic uncertainties and rising fuel costs are pushing developers in the renal biomarker assay market to scale back automation upgrades, prioritizing core reagent formulations to manage tight budgets. Trade barriers between major Asian exporters and Western importers, along with disruptions in Black Sea logistics, are delaying shipments of calibration standards, extending assay development timelines and increasing quality control costs for distributed labs.

In response, proactive teams are partnering with Canadian bio-reagent hubs to secure consistent supplies and tailor assays to meet local regulatory requirements. As the focus on chronic kidney disease surveillance intensifies, grants are flowing into high-throughput platforms, increasing utilization in primary care settings.

The U.S. Section 232 inquiry into imported diagnostic consumables, which began on September 25, 2025, suggests that duties of up to 25% could be imposed on Asian-sourced pipettes and buffers. These potential tariffs would increase input costs, creating affordability challenges for community clinics and limiting technology transfers from overseas research and development arms. This uncertainty has cast doubt on supply chain planning and, in some cases, has halted the expansion of point-of-care testing menus.

The growing risk of these tariff hikes is prompting manufacturers to rethink their strategies. In response, enterprising firms are leveraging federal adjustment assistance to develop domestic synthesis routes. By focusing on innovations like enzyme-linked variants and enhancing precision metering capabilities, these companies are increasing their independence from overseas suppliers. This strategic shift not only aims to reduce costs but also supports the growth of more localized, reliable solutions that cater to the needs of both community clinics and broader healthcare systems.

Latest Trends

Integration into Major Clinical Practice Guidelines in 2024 is a recent trend

A recent and pivotal trend accelerating the adoption of Cystatin C testing is its formal integration into major international clinical practice guidelines for the management of Chronic Kidney Disease (CKD). These updated guidelines elevate the status of Cystatin C from an optional alternative to a recommended, essential biomarker, often alongside creatinine, for a more precise estimation of GFR. This institutional endorsement is a powerful driver, as it directly influences laboratory protocols, physician ordering practices, and ultimately, reimbursement decisions globally.

In March 2024, the Kidney Disease: Improving Global Outcomes (KDIGO) organization published its revised 2024 Clinical Practice Guideline for the Evaluation and Management of Chronic Kidney Disease. This update emphasizes the critical importance of cystatin C as a key biomarker for estimating glomerular filtration rate (GFR) and for guiding personalized treatment decisions based on the patient’s specific kidney function. This reinforces cystatin C’s growing role in clinical practice, further driving the demand for its inclusion in diagnostic testing for chronic kidney disease management. This development signifies a major step toward standardizing the use of Cystatin C as a core component of renal function assessment, ensuring that its superior accuracy is leveraged for improved patient care, medication dosing, and risk stratification.

Regional Analysis

North America is leading the Cystatin C Testing Market

In 2024, North America secured a 38.4% share of the global Cystatin C Testing market, driven by enhanced clinical endorsements for its superior sensitivity in glomerular filtration rate estimation, particularly among pediatric and elderly patients where creatinine limitations prove insufficient. Nephrologists increasingly incorporated the biomarker into routine chronic kidney disease screenings, yielding more reliable early detections that inform timely interventions and avert progression to end-stage renal failure.

Updated protocols from professional societies emphasized its utility in drug dosing adjustments for nephrotoxic agents, aligning with precision medicine paradigms in transplant evaluations. Laboratory networks expanded throughput capacities to accommodate surging orders, facilitated by automated immunoassay platforms that deliver results within hours.

Demographic trends toward an octogenarian bulge amplified testing volumes in primary care, correlating with federal initiatives to curb dialysis dependencies through proactive monitoring. These evolutions demonstrated the area’s resolve in elevating diagnostic fidelity for renal health. A study from Johns Hopkins University Pathology revealed that 69% of cystatin C test requests occurred alongside creatinine testing within a 24-hour window from January to March 2024, indicating integrated usage patterns.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health authorities throughout Asia Pacific project the Cystatin C Testing sector to intensify during the forecast period, as heightened CKD surveillance mandates necessitate refined biomarkers to navigate diverse metabolic profiles in expansive demographics. Ministries in Thailand and Vietnam funnel investments into centralized labs, outfitting regional hubs with high-sensitivity assays to stratify risks in diabetes-endemic zones. Diagnostic developers ally with state agencies to calibrate equations for local variants, anticipating sharper prognostications for hypertensive nephropathy in migrant cohorts.

Oversight bodies in New Zealand and Mongolia pioneer point-of-care adaptations, positioning field teams to assess filtration impairments during outreach campaigns. Governments anticipate embedding the metric into national registries, alleviating interpretive variances through standardized reference intervals.

Indigenous researchers cultivate hybrid models fusing it with urinary markers, harmonizing with public databases to forecast polycystic outcomes. These integrations foster a vigilant matrix for renal stewardship. A comprehensive framework published in Kidney International Reports documented CKD prevalence variations of 4.7% to 17.4% across the Asia-Pacific region in 2023, highlighting the imperative for advanced testing modalities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent firms in the renal function diagnostics arena accelerate expansion by engineering high-sensitivity immunoassays that integrate with automated analyzers, enabling labs to process higher volumes for early CKD detection. They cultivate alliances with global nephrology societies to sponsor educational campaigns, elevating clinician adoption and guideline endorsements for biomarker use.

Innovators direct capital toward point-of-care adaptations, crafting portable kits that deliver results in under 15 minutes for remote clinics. Executives target acquisitions of assay developers to incorporate multiplex panels, combining cystatin C with other markers for comprehensive profiling. They advance into high-prevalence regions like Southeast Asia and the Middle East, negotiating with ministries to embed solutions in national screening programs. Moreover, they structure outcome-based pricing models with hospitals, linking fees to improved patient stratification to secure long-term contracts.

Roche Diagnostics, a cornerstone of the Roche Group established in 1896 and headquartered in Basel, Switzerland, pioneers in vitro diagnostics with a focus on innovative testing for chronic diseases. The division equips laboratories worldwide with the Elecsys cystatin C assay, a fully automated electrochemiluminescence method that supports precise GFR estimation in diverse populations.

Roche channels substantial R&D into harmonization efforts with international reference standards, ensuring reproducibility across platforms. CEO Thomas Schinecker leads a network operating in over 100 countries, emphasizing digital integration for seamless data workflows. The organization collaborates with clinical trial networks to validate assays in real-world settings, advancing precision nephrology. Roche Diagnostics fortifies its leadership by merging analytical excellence with strategic ecosystem building to transform kidney health management.

Top Key Players in the Cystatin C Testing Market

- Thermo Fisher Scientific Inc

- Sysmex Corporation

- Siemens Healthineers AG

- Roche Diagnostics Limited

- Randox Laboratories

- DiaSorin

- Bio-Rad Laboratories Inc

- bioMérieux SA

- Beckman Coulter (Danaher Corporation)

- Agilent Technologies Inc.

- Abcam Plc

- Abbott Laboratories

Recent Developments

- In 2023: Healthy.io, a leader in smartphone-powered clinical-grade devices, raised USD 50 million to further its mission in transforming kidney care. This investment accelerates the company’s growth in the U.S. market, particularly with its FDA-cleared at-home kidney test. As Healthy.io’s technology enables at-home testing for kidney function, it is expected to increase demand for cystatin C-based testing. This expansion in at-home diagnostics aligns with the growing trend of decentralized healthcare, where cystatin C testing becomes an essential component for remote monitoring and early diagnosis, further driving market growth.

- In April 2025: Standard BioTools introduced a range of new proteomic innovations at the AACR 2025, including the SomaScan Select 3.7K Assay, Single SOMAmer Reagents, and the advanced CyTOF XT PRO system. The SomaScan Select 3.7K Assay, capable of measuring 3,700 unique human proteins, contributes significantly to the growing field of protein biomarker testing. As cystatin C is a key marker in kidney health and other diseases, this expansion of proteomic testing enhances the accessibility and application of cystatin C in both clinical and research settings, driving market demand for more comprehensive diagnostic testing.

- In March 2023: Siemens Healthineers introduced the Atellica IM Analyzer, offering a broad array of assays, including cystatin C, providing healthcare providers with a comprehensive solution for clinical diagnostics. This analyzer’s ability to include cystatin C testing in routine diagnostics helps detect kidney function issues at earlier stages. The Atellica system’s integration into clinical labs strengthens the cystatin C testing market, facilitating its widespread adoption and improving patient care in nephrology.

- In January 2023: Sysmex Corporation’s acquisition of Bio-Rad Laboratories’ clinical chemistry and immunoassay business bolstered its position in the cystatin C testing sector. By adding Bio-Rad’s established assays and technologies, Sysmex expands its footprint in renal health diagnostics. This strategic acquisition accelerates the development and distribution of cystatin C-based tests, providing diagnostic labs with enhanced tools for kidney disease management and fueling growth in the cystatin C testing market.

- In February 2024: Mito Health’s introduction of a health package, which includes cystatin C testing alongside 66 other biomarkers, is a key development in the proactive health management sector. By offering this combined package, Mito Health enables early detection of a range of diseases, including kidney disorders. This approach makes cystatin C testing more accessible to the public, facilitating wider use and growth in the cystatin C testing market by integrating it into comprehensive health assessments.

Report Scope

Report Features Description Market Value (2024) US$ 255.4 million Forecast Revenue (2034) US$ 531.3 million CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits, and Instruments & Regents), By Test (ELISA Based Tests, Colorimetric Assay Based Tests, Enzymatic Tests, Point of Care Tests, and Others), By Application (Diagnosis Use, and Research & Development), By End-user (Hospitals & Clinics, Academic Research Institutes, Diagnostic Laboratories, and Renal Care Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc, Sysmex Corporation, Siemens Healthineers AG, Roche Diagnostics Limited, Randox Laboratories, DiaSorin, Bio-Rad Laboratories Inc, bioMérieux SA, Beckman Coulter (Danaher Corporation), Agilent Technologies Inc., Abcam Plc, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc

- Sysmex Corporation

- Siemens Healthineers AG

- Roche Diagnostics Limited

- Randox Laboratories

- DiaSorin

- Bio-Rad Laboratories Inc

- bioMérieux SA

- Beckman Coulter (Danaher Corporation)

- Agilent Technologies Inc.

- Abcam Plc

- Abbott Laboratories