Global Cypermethrin Insecticide Market Size, Share, And Business Benefits By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Pest Type (Insects, Mites, Others), By Formulation (Emulsifiable Concentrate (EC), Wettable Powder (WP), Liquid, Others), By Application (Foliar Spray, Seed Treatment, Soil Treatment, Post-Harvest, Others), By Distribution Channel (Direct Sales, Distributors/Retailers, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152324

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Crop Type Analysis

- By Pest Type Analysis

- By Formulation Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

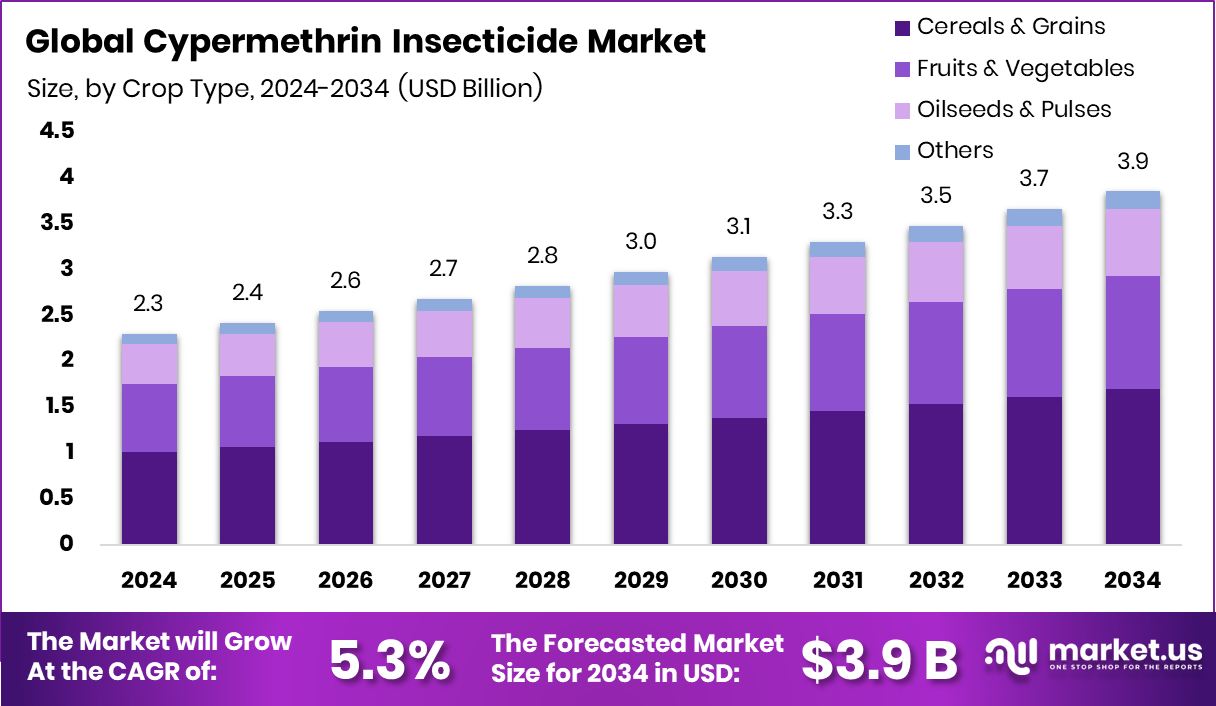

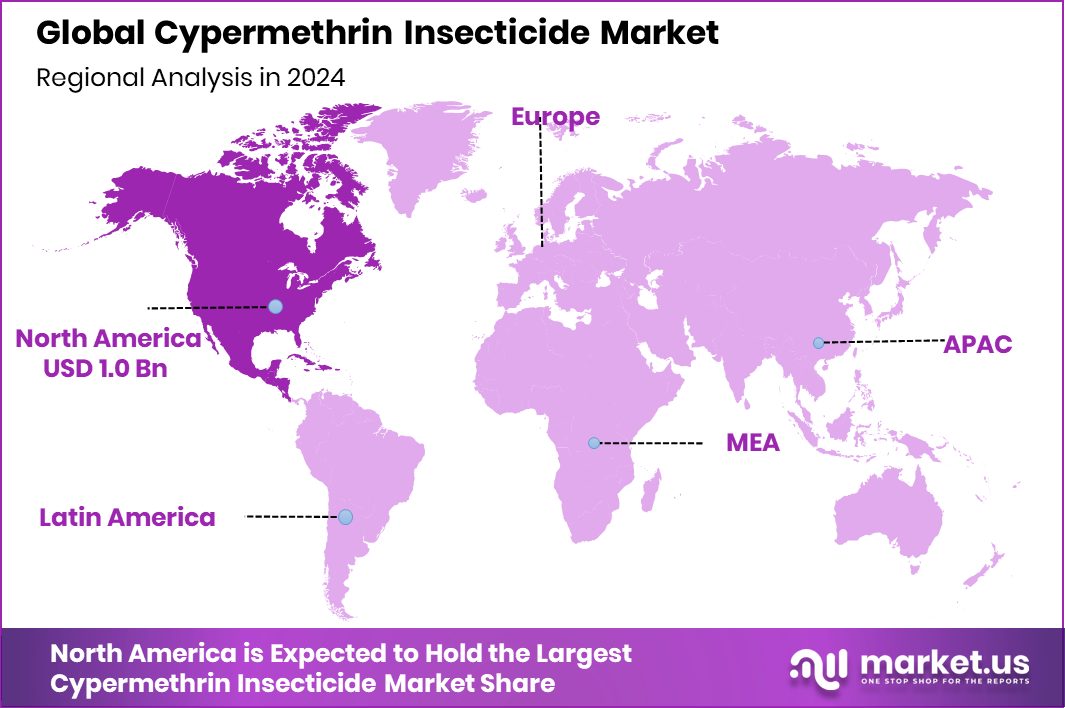

Global Cypermethrin Insecticide Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.3 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034. High adoption in agriculture and pest control supported North America’s USD 1.0 billion dominance.

Cypermethrin is a synthetic pyrethroid insecticide widely used for controlling pests in agricultural, commercial, and residential settings. It acts by targeting the nervous system of insects, leading to paralysis and death upon contact or ingestion. This compound is highly effective against a broad range of pests such as aphids, beetles, caterpillars, mosquitoes, and cockroaches. Its quick knockdown effect, low toxicity to humans when used properly, and relatively stable residual activity make it a preferred choice among farmers and pest control professionals.

The cypermethrin insecticide market refers to the global trade, production, and application of cypermethrin-based pest control products across various sectors such as agriculture, public health, and urban pest control. The market includes both technical grade and formulation products, distributed through agrochemical suppliers, cooperatives, and retail networks. According to an industry report, Manitoba commits $13 million to launch a Global AgTech Hub in Downtown Winnipeg.

The primary growth of the cypermethrin market can be attributed to rising pest infestation levels due to changing climatic conditions and increased monoculture farming. Farmers are adopting chemical pest control solutions more aggressively to prevent crop losses and ensure yield stability. According to an industry report, Maine Grains in Skowhegan Plans Growth Backed by $700,000 in Grant Funding.

The growing demand for high-quality food crops, coupled with the need to reduce pre- and post-harvest losses, is driving consistent demand for cypermethrin. It is preferred for its cost-effectiveness and compatibility with existing spraying technologies. Additionally, increased urbanization and consumer awareness regarding hygiene have led to more usage in public health and residential pest control applications. According to an industry report, Cereal Grower Groups Pledge $13.4 Million to Support Canada’s GATE Agri-Tech Initiative.

Key Takeaways

- Global Cypermethrin Insecticide Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.3 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034.

- Cypermethrin insecticide dominates cereals and grains protection, accounting for 44.1% of crop-specific market demand.

- Insect control remains the core focus, with 87.4% of cypermethrin usage targeting various insect pests.

- Emulsifiable Concentrate (EC) is the most preferred formulation, covering 48.3% of the market share.

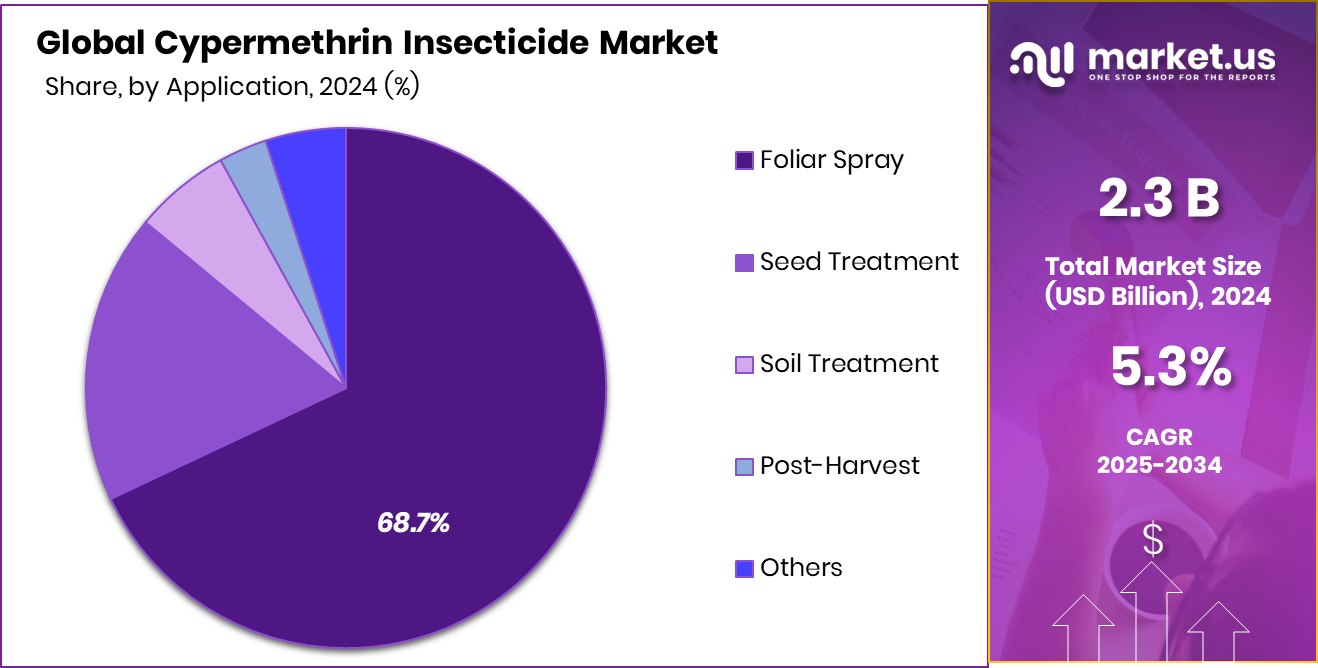

- Foliar spray application leads usage patterns, representing 68.7% of cypermethrin insecticide application methods globally.

- Distributors and retailers control 62.3% of the cypermethrin market’s distribution channel across all regions.

- The North American market was valued at approximately USD 1.0 billion in 2024.

By Crop Type Analysis

Cypermethrin insecticide dominates the cereals and grains segment with a 44.1% market share.

In 2024, Cereals and Grains held a dominant market position in the Crop Type segment of the Cypermethrin Insecticide Market, with a 44.1% share. This strong performance was primarily driven by the high vulnerability of cereal crops such as wheat, maize, and rice to pest infestations, particularly during key growth stages.

Cypermethrin’s fast action and broad-spectrum efficacy made it a preferred choice among cereal farmers seeking to protect crop quality and prevent yield losses. The relatively low cost and ease of application further encouraged its widespread adoption, especially in regions where cereal cultivation forms the backbone of agricultural output.

Cereals and grains also saw greater insecticide penetration due to the increasing emphasis on food security and higher productivity under limited arable land. Governments and agricultural agencies promoted pest management programs that prioritized staple crops, further supporting demand. In addition, the consistent global trade of cereals has raised concerns around storage pests, pushing the use of cypermethrin in post-harvest treatments.

The segment’s market leadership is expected to remain stable, supported by the continued importance of cereal crops in both subsistence and commercial farming systems. This trend underlines cypermethrin’s critical role in safeguarding staple food production in an increasingly pest-challenged environment.

By Pest Type Analysis

Insect control remains key, with 87.4% usage in pest management applications.

In 2024, Insects held a dominant market position in the By by-pest type segment of the Cypermethrin Insecticide Market, with an 87.4% share. This substantial share reflects the wide-ranging effectiveness of cypermethrin in controlling various insect species that pose a serious threat to agricultural productivity and public health.

The high prevalence of insects such as aphids, caterpillars, beetles, and mosquitoes across diverse climatic zones has led to increased dependence on cypermethrin-based treatments due to its rapid knockdown action and residual efficacy.

The insect segment’s dominance was further reinforced by its significant application across crop protection, household pest control, and vector management programs. In agricultural fields, particularly those cultivating cereals and grains, insect infestations remain a leading cause of yield reduction. Cypermethrin, due to its broad-spectrum activity, continues to be the first line of defense for farmers combating pest outbreaks.

Additionally, growing concerns around vector-borne diseases have led to higher usage of cypermethrin in public health campaigns, further boosting demand under the insect pest category. The consistency in its usage pattern, coupled with its proven track record against a variety of insect species, supports the continued market leadership of the insect segment in the cypermethrin insecticide industry.

By Formulation Analysis

Emulsifiable Concentrate (EC) formulations lead the market, accounting for a 48.3% share.

In 2024, Emulsifiable Concentrate (EC) held a dominant market position in the By Formulation segment of the Cypermethrin Insecticide Market, with a 48.3% share. The widespread preference for EC formulations can be attributed to their ease of use, effective dispersion in water, and strong residual action on target surfaces.

Farmers and pest control operators continue to favor EC due to its consistent performance in controlling a wide range of insect pests across field and stored crop environments. Its liquid nature allows for simple mixing and application, especially through conventional spraying equipment, making it suitable for large-scale agricultural practices.

The segment’s leadership is also supported by the high efficacy of EC formulations in contact and stomach action, which enhances pest mortality rates shortly after application. Moreover, the adaptability of EC to various climatic conditions and cropping systems has played a critical role in its continued dominance.

Users also benefit from its compatibility with other agrochemicals, allowing integrated use within broader pest management strategies. With a 48.3% market share, the emulsifiable concentrate formulation remains the most widely adopted format within the cypermethrin insecticide market, driven by operational efficiency, reliable pest control performance, and user familiarity across the agricultural and domestic sectors

By Application Analysis

Foliar spray is the most preferred application method, holding a 68.7% share.

In 2024, Foliar Spray held a dominant market position in the By Application segment of the Cypermethrin Insecticide Market, with a 68.7% share. This leading position is primarily attributed to the method’s high effectiveness in delivering immediate action against insect pests directly on plant surfaces.

Foliar spraying allows for uniform distribution of the insecticide, enabling rapid absorption and direct contact with pests, which is particularly important in controlling active infestations during critical crop growth stages.

Farmers continue to rely on foliar application due to its compatibility with standard spraying equipment and its proven efficiency in various farming environments. The method supports real-time pest management, allowing quick responses to sudden outbreaks, especially in crops where pest pressure is high. The 68.7% share reflects its widespread acceptance across smallholder and commercial farming operations.

Moreover, foliar spray enhances the contact action of cypermethrin, ensuring fast knockdown of pests, which is essential for minimizing crop damage. Its dominance in the application segment is also reinforced by the ease of use, cost-effectiveness, and lower labor intensity compared to more complex application methods.

By Distribution Channel Analysis

Distribution is largely driven by retailers and distributors with 62.3% market control.

In 2024, Distributors/Retailers held a dominant market position in the By Distribution Channel segment of the Cypermethrin Insecticide Market, with a 62.3% share. This leadership is largely driven by the widespread presence of agrochemical distributors and local retailers who serve as the primary point of access for farmers, pest control operators, and rural consumers. These channels play a crucial role in the supply chain by ensuring the timely availability of cypermethrin insecticides, especially in remote and high-demand agricultural regions.

The 62.3% market share reflects the trust and dependency built over the years between end-users and local distributors or retailers, who often provide not only products but also guidance on usage and dosage. Their ability to offer product variety, smaller pack sizes, and flexible credit options further enhances their appeal among small and medium-scale farmers.

In addition, retail outlets often maintain strong relationships with agro-input companies, enabling them to stock newer formulations and ensure consistent product availability during peak farming seasons. Distributors and retailers also support last-mile connectivity, which is essential in regions where direct-to-farm delivery remains limited.

Key Market Segments

By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds and Pulses

- Others

By Pest Type

- Insects

- Mites

- Others

By Formulation

- Emulsifiable Concentrate (EC)

- Wettable Powder (WP)

- Liquid

- Others

By Application

- Foliar Spray

- Seed Treatment

- Soil Treatment

- Post-Harvest

- Others

By Distribution Channel

- Direct Sales

- Distributors/Retailers

- Online Retail

- Others

Driving Factors

Rising Pest Attacks Increase Product Use Globally

One of the main driving factors for the growth of the cypermethrin insecticide market is the increasing frequency of pest attacks on crops around the world. Farmers are facing higher risks of crop damage due to changes in weather, poor soil conditions, and the spread of resistant insect species.

Cypermethrin, known for its fast-acting and broad-spectrum insect control, is becoming a preferred solution for many farmers to protect their crops and reduce losses. As global food demand rises, especially in densely populated countries, protecting harvests has become even more important. This has led to a steady rise in the use of insecticides like cypermethrin in both commercial farming and smaller farms to ensure better yield and food quality.

Restraining Factors

Health and Environment Concerns Limit Product Expansion

One of the major restraining factors for the cypermethrin insecticide market is the growing concern over its potential impact on human health and the environment. Although cypermethrin is considered low in toxicity when used correctly, prolonged exposure or misuse can lead to harmful effects on humans, animals, and beneficial insects like bees. In some regions, residues in food products and water sources have raised regulatory red flags.

As a result, governments and environmental bodies are pushing for stricter regulations on its usage. This has led to limited approvals or bans in certain countries, especially in sensitive ecological zones. These environmental and health concerns are creating pressure on manufacturers and users, ultimately slowing down the wider adoption of cypermethrin.

Growth Opportunity

Eco‑Friendly Formulations Offer Major Growth Potential

One significant growth opportunity for the cypermethrin insecticide market lies in the development of eco‑friendly and reduced‑residue formulations. As consumers and regulators worldwide demand safer crop protection solutions, manufacturers have the chance to innovate with emulsifiable concentrates and micro‑emulsion systems designed to lower chemical runoff and residue levels on food.

These cleaner formulations would appeal to farmers aiming to meet stricter export standards and organic-adjacent practices, without sacrificing pest control effectiveness. Furthermore, offering user-friendly packaging sizes and biodegradable additives can enhance market acceptance, particularly among smallholder farmers who seek both affordability and safety.

Latest Trends

Shift Toward Integrated Pest Management Boosts Demand

A key trend shaping the cypermethrin insecticide market is the growing shift toward Integrated Pest Management (IPM) practices. Farmers are now combining chemical, biological, and mechanical pest control methods to reduce pesticide overuse while maintaining crop health. In this approach, cypermethrin is often used as a targeted solution during peak pest outbreaks due to its fast action and effectiveness.

The trend is gaining traction as governments and agricultural bodies promote sustainable farming practices. Cypermethrin fits well into IPM systems because of its compatibility with other methods and its ability to deliver quick results with lower application volumes. This balanced approach helps maintain soil health, reduce resistance development in insects, and support long-term productivity, making it a rising trend in modern agriculture.

Regional Analysis

In 2024, North America held a 44.9% share in Cypermethrin Insecticide Market.

In 2024, North America emerged as the dominating region in the Cypermethrin Insecticide Market, accounting for a significant 44.9% market share, which translated to an estimated USD 1.0 billion in value. This leadership was largely supported by the region’s advanced agricultural practices, widespread pest control usage, and strict crop protection standards.

Farmers across the United States and Canada increasingly adopted cypermethrin-based formulations to combat a wide range of insect pests affecting both field crops and horticulture, reinforcing the region’s strong market presence.

In Europe, moderate demand was observed, driven by regulated pesticide usage and growing awareness of integrated pest management. However, stringent environmental policies restricted the overuse of chemical insecticides, maintaining a balanced growth pace. The Asia Pacific region displayed rising adoption, especially across countries with intensive farming practices, although exact figures were not specified.

Latin America and the Middle East & Africa saw limited but steady uptake, primarily in regions where agriculture forms a large part of the economy. These regions continued to rely on cypermethrin as a cost-effective solution for pest control in cereal, grain, and vegetable crops.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global cypermethrin insecticide market was significantly influenced by four key players—Sumitomo Chemical Co., Ltd.; Syngenta AG; Adama Agricultural Solutions Ltd.; and UPL Limited—each contributing strategically to market dynamics through diversified offerings, formulation innovation, and distribution strength.

Sumitomo Chemical Co., Ltd., recognized for its commitment to chemical research, maintained a robust presence in cypermethrin products by advancing emulsifiable concentrate and micro-emulsion formulations. The company’s global production capacity and penetration across multiple regions allowed it to meet both commercial agriculture and urban pest control needs effectively.

Syngenta AG leveraged its strong science-based portfolio and integrated pest management (IPM) alignment to reinforce cypermethrin adoption among large-scale growers. The company’s tailored support services and agronomic advisory programs helped build long‑term customer trust. By strategically bundling cypermethrin with complementary crop protection tools, Syngenta enhanced product offering coherence and strengthened its share in high-value segments, especially within major grain- and vegetable-producing regions.

Adama Agricultural Solutions Ltd. focuses on cost-effective and accessible formulations for emerging and smallholder markets. The company’s competitive pricing and adaptable packaging sizes addressed affordability and ease-of-use constraints in developing economies. Adama’s localized distribution strategy and grassroots market engagement notably expanded availability in regions where smallholder farming dominates, supporting sustained uptake and incremental market penetration.

UPL Limited differentiated itself via global supply chain optimization and acquisition-driven expansion. Its broad agrochemical range allowed the bundling of cypermethrin with other crop protection agents, offering farmers simplified solutions and scalable product combinations. UPL’s strategic investments in sustainable and regulatory-compliant production further strengthened its market resilience in evolving regulatory environments.

Top Key Players in the Market

- FMC Corporation

- BASF SE

- Bayer AG

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- Adama Agricultural Solutions Ltd.

- UPL Limited

- Nufarm Limited

- Tagros Chemicals India Ltd.

- Heranba Industries Limited

- Jiangsu Yangnong Chemical Group

- Tagros Chemicals India

- Bharat Group

- Meghmani Organics

- Willowood Chemicals

Recent Developments

- In January 2025, Sumitomo Chemical completed the purchase of Philagro Holding S.A. (France) and Kenogard S.A. (Spain), both focused on the distribution of crop protection products—including cypermethrin-based insecticides—in Europe. This move strengthens their presence and control in key European markets through direct sales channels.

- In March 2025, FMC and Bayer partnered to introduce Isoflex™ active herbicide in Great Britain and the EU, pending EU registration. Registration in Great Britain occurred in 2024. The collaboration aims to help farmers manage resistant grass weeds in cereals and oilseed crops.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds and Pulses, Others), By Pest Type (Insects, Mites, Others), By Formulation (Emulsifiable Concentrate (EC), Wettable Powder (WP), Liquid, Others), By Application (Foliar Spray, Seed Treatment, Soil Treatment, Post-Harvest, Others), By Distribution Channel (Direct Sales, Distributors/Retailers, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape FMC Corporation, BASF SE, Bayer AG, Sumitomo Chemical Co., Ltd., Syngenta AG, Adama Agricultural Solutions Ltd., UPL Limited, Nufarm Limited, Tagros Chemicals India Ltd., Heranba Industries Limited, Jiangsu Yangnong Chemical Group, Tagros Chemicals India, Bharat Group, Meghmani Organics, Willowood Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cypermethrin Insecticide MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cypermethrin Insecticide MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- FMC Corporation

- BASF SE

- Bayer AG

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- Adama Agricultural Solutions Ltd.

- UPL Limited

- Nufarm Limited

- Tagros Chemicals India Ltd.

- Heranba Industries Limited

- Jiangsu Yangnong Chemical Group

- Tagros Chemicals India

- Bharat Group

- Meghmani Organics

- Willowood Chemicals