Global Cyclopentane Market By Purity (Below 90%, 90% to 95%, 96% to 99.9%), By Function (Blowing Agent and Refrigerant Solvent and Reagent, Others), By Application (Refrigerators (Residential, Commercial), Containers and Sippers, Personal Care Products, Electrical and Electronics, Insulating Construction Material, Fuel and Fuel Additives, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 16441

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

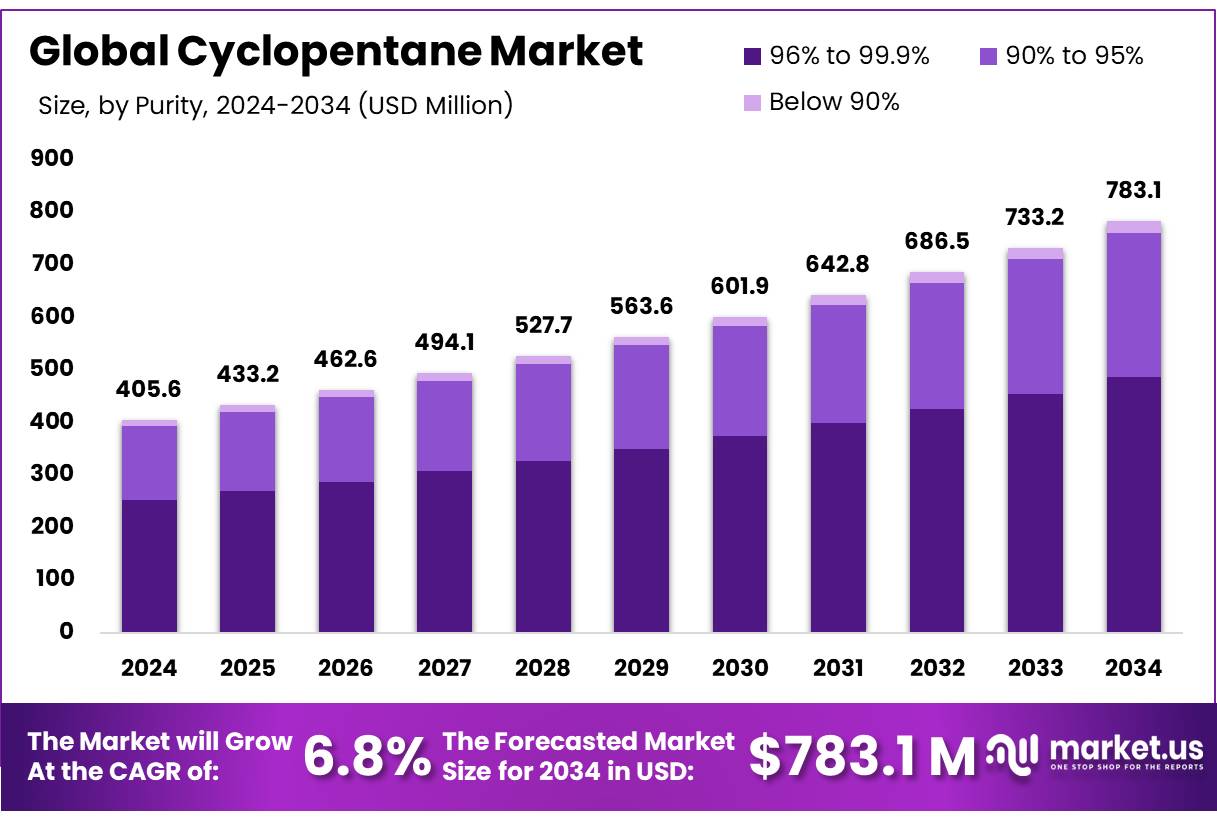

The Global Cyclopentane Market size is expected to be worth around USD 783.1 Million by 2034, from USD 405.6 Million in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

Cyclopentane is an eco-friendly compound increasingly used in various industries for its environmental benefits and practical applications. It is used as a green-blowing agent in the production of polyurethane insulating foam, which is essential in products like refrigerators, freezers, water heaters, insulated pipes, and construction panels. Cyclopentane also plays a role as a lubricant in sensitive applications such as computer hard drives and outer space equipment. It is also used in the manufacturing of resins, adhesives, and pharmaceutical intermediates, and serves as an additive in gasoline to improve fuel performance.

As global industries shift toward more sustainable and low-emission solutions, the demand for cyclopentane continues to grow. Their halogen-free composition and zero ozone depletion potential align with international environmental standards, making them an important component in manufacturing and energy-efficient technologies.

Key Takeaways

- The global Cyclopentane market was valued at US$ 405.6 million in 2024.

- The global Cyclopentane market is projected to grow at a CAGR of 6.8% and is estimated to reach US$ 783.1 million by 2034.

- Among Purity, 96% to 99.9% accounted for the largest market share of 62.1%.

- Among Functions, Blowing Agent & Refrigerant accounted for the majority of the market share at 64.3%.

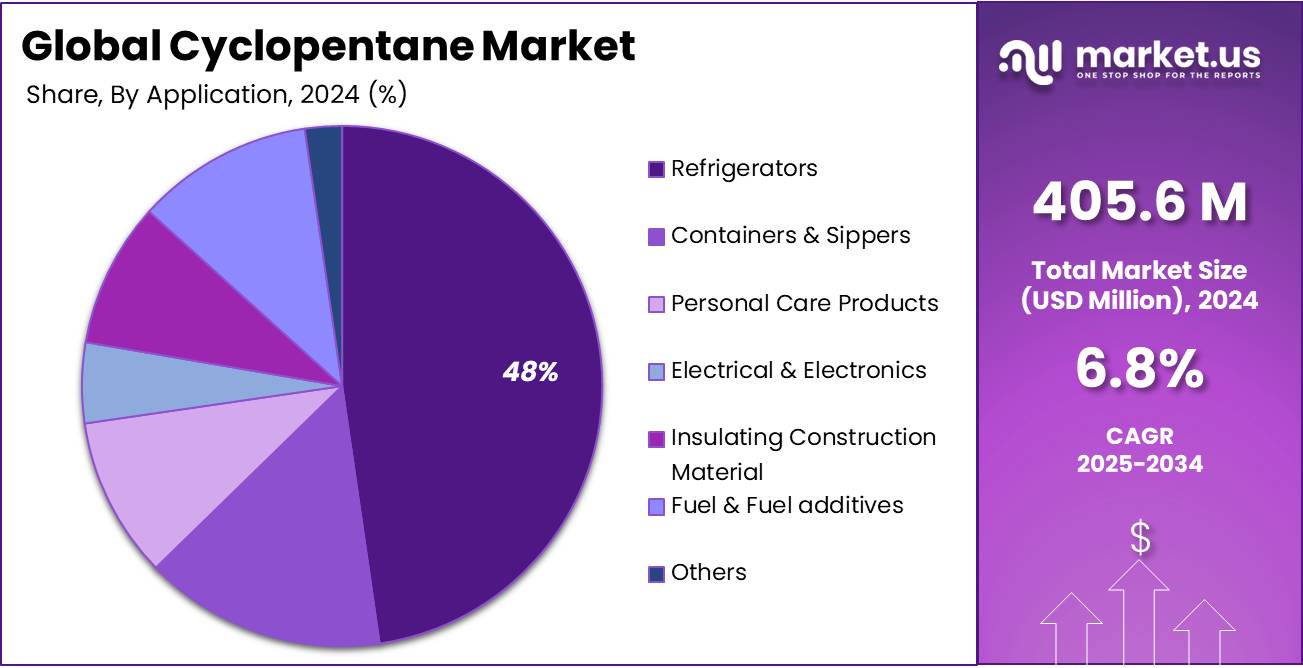

- By Application, Refrigerators accounted for the largest market share of 47.4%.

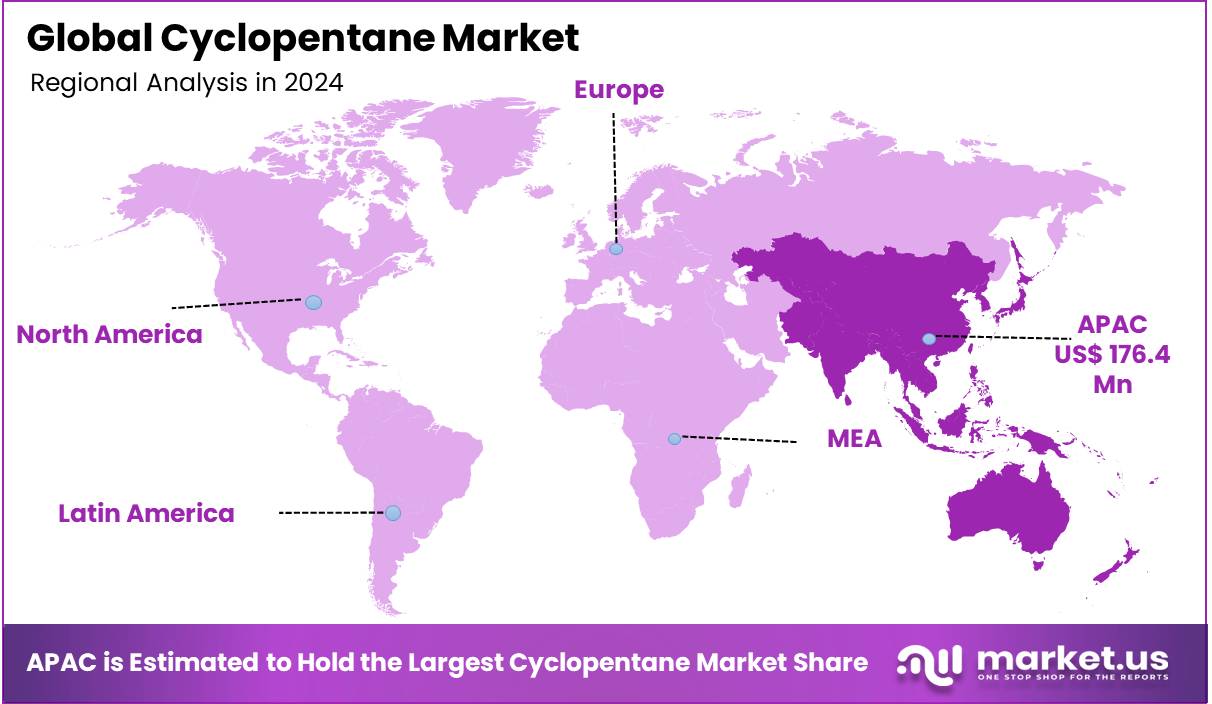

- Asia Pacific is estimated as the largest market for Cyclopentanewith a share of 43.5% of the market share.

- The global cyclopentane market is driven by rising demand for eco-friendly blowing agents and insulation materials across refrigeration, construction, and automotive sectors.

Purity Analysis

High-Purity Cyclopentane 96% to 99.9% Leads Market in 2024 Due to Superior Insulation Performance.

The Cyclopentane market is segmented based on purity into Below 90%, 90% to 95%, and 96% to 99.9% In 2024, the 96% to 99.9% segment held a significant revenue share of 62.1%. Due to its widespread use in high-performance applications such as refrigeration insulation foams, construction materials, and advanced polymer manufacturing. This high-purity grade offers superior thermal insulation, chemical stability, and low environmental impact, making it the preferred choice in industries that demand efficiency, safety, and regulatory compliance. Additionally, the shift toward low-GWP blowing agents in compliance with international environmental standards, such as the Montreal Protocol, has further accelerated demand for high-purity cyclopentane in environmentally conscious applications.

Function Analysis

Blowing Agent & Refrigerant Segment Dominates Cyclopentane Market Share in 2024 Due to Rising Demand for Eco-Friendly Insulation in Refrigeration and Construction.

Based on function, the market is further divided into blowing agents & refrigerants, solvents & reagents, and others. The predominance of the blowing agent & refrigerant, commanding a substantial 64.3% market share in 2024. Due to increasing demand for environmentally friendly insulation materials in the refrigeration and construction industries, where cyclopentane serves as a low-GWP alternative to traditional blowing agents such as HCFCs and HFCs. Its excellent thermal insulation properties have made cyclopentane the preferred choice for manufacturers aiming to reduce their carbon footprint. The growth of cold-chain logistics, energy-efficient appliances, and green building practices further supports the strong market position of this segment.

Application Analysis

Refrigerator Application Held Leading Share in 2024, Driven by Demand for Energy-Efficient Cooling Solutions

Among applications, the cyclopentane market is classified into refrigerators, containers & sippers, personal care products, electrical & electronics, insulating construction material, fuel & fuel additives, and others. In 2024, Refrigerators held a dominant position with a 47.4% share. Due to the increasing demand for energy-efficient and environmentally friendly cooling appliances. Cyclopentane is widely used as a blowing agent in the production of polyurethane foam insulation in refrigerators, offering excellent thermal insulation and a low global warming potential (GWP). With growing regulatory pressure to reduce the use of ozone-depleting substances such as HCFCs, manufacturers are increasingly adopting Cyclopentane as a sustainable alternative. Additionally, the expansion of the cold chain industry and rising demand for household and commercial refrigeration systems in developing regions have further fueled the growth of this segment.

Key Market Segments

By Purity

- Below 90%

- 90% to 95%

- 96% to 99.9%

Based on Function

- Blowing Agent & Refrigerant

- Solvent & Reagent

- Other Functions

By Applications

- Refrigerators

- Residential

- Commercial

- Containers & Sippers

- Personal Care Products

- Electrical & Electronics

- Insulating Construction Material

- Fuel & Fuel Additives

- Other Applications

Driving Factors

Expansion of the Refrigeration Industry

The rapid growth of the refrigeration industry is a key driver of the global cyclopentane market. Increasing demand for cold-chain logistics, particularly in sectors such as food and beverages, pharmaceuticals, and chemicals, is fueling the need for efficient and sustainable refrigerants and insulation materials. Traditional refrigeration systems use chlorofluorocarbons which contribute to global warming and ozone depletion. In addition, cyclopentane has emerged as a popular blowing agent in insulation foams. It provides a sustainable alternative to harmful substances like CFCs and HCFCs, supporting environmental sustainability.

- According to the U.S. Environmental Protection Agency, a typical food retail store leaks approximately 25% of its refrigerant each year, contributing significantly to environmental degradation. This drives demand for eco-friendly alternatives like cyclopentane, used in insulation to reduce emissions and improve efficiency.

Additionally, rising industrialization in developing regions and expanding global trade are significantly boosting the demand for temperature-controlled storage and transportation solutions. This surge drives the need for advanced refrigeration systems that can efficiently preserve perishable goods and sensitive materials. Cyclopentane, with its high thermal conductivity, low global warming potential (GWP), and dual role as both a refrigerant and a foam-blowing agent, is increasingly favored for such applications. Its use enhances energy efficiency and supports sustainable practices, making it an ideal choice for both domestic and industrial refrigeration systems in a growing global market.

- According to the World Trade Organization, international trade in physical goods reached $25.3 trillion in 2022, with projections showing 1.7% growth in 2023 and 3.2% growth in 2024. A significant portion of this trade involves perishable products requiring temperature control, driving the need for eco-friendly insulation materials like cyclopentene in refrigeration systems.

Restraining Factors

Rising Risk Of Flammability

The rising risk of flammability is a key factor restraining the global growth of the cyclopentene market. As a highly flammable substance, cyclopentene poses significant safety risks during production, storage, transportation, and end-use applications. These risks necessitate strict handling protocols, specialized equipment, and increased safety investments, which can raise operational costs and limit its adoption, especially among small and medium companies.

Furthermore, the government’s stricter regulations from various regions have imposed stringent safety standards for flammable chemicals, which can limit the use of cyclopentene in certain industries. Furthermore, the risk of accidents, fire hazards, and potential liability concerns may be shifting manufacturers towards safer alternatives, despite the clear environmental advantages offered by cyclopentene. These safety challenges can act as a barrier to widespread adoption, especially in industries with stringent operational risk standards.

Growth Opportunities

Government Subsidies For Green Material.

Growing government support through incentives and subsidies is creating significant opportunities for the expansion of the cyclopentene market, particularly in key sectors such as refrigeration and insulation. Governments across various regions are adopting sustainable industrial practices to promote environmental stability and move toward carbon neutrality. Subsidies are playing a vital role in driving green innovation, encouraging enterprises to invest in eco-friendly materials and technologies. As a result, the rising trend of government-backed support for green materials is a major factor fueling the global growth of the cyclopentene market.

- For instance, the UN Environment Programme (UNEP), UN Development Programme (UNDP), UN Industrial Development Organization (UNIDO), and the World Bank jointly implement the Multilateral Fund (MLF) under the Montreal Protocol, providing funding to developing countries for phasing out ozone-depleting substances (ODS), including HCFCs. The fund supports the adoption of eco-friendly alternatives like cyclopentane, which has zero ozone depletion potential and low global warming potential. For example, India has proposed funding for SMEs to shift from HCFCs to cyclopentane, avoiding more expensive options like HFOs while promoting sustainable industrial practices.

Furthermore, Proklima is a German initiative and a globally active program of the GIZ (German Agency for International Cooperation) that supports ozone protection and climate-friendly technologies in developing countries. It focuses on the transition to natural refrigerants and green alternatives in foam production. Proklima provides policy advice, technical training, and technology transfer to promote sustainable industrial practices.

- For instance, in Iran, Proklima facilitated the adoption of natural foam-blowing agents such as pentane through workshops and hands-on training, ensuring their safe and effective implementation.

Through these subsidies and initiatives, governments can promote the adoption of green materials like cyclopentane, accelerating the transition toward environmentally sustainable industrial practices. This proactive government involvement not only drives green innovation but also fuels the growth of the global cyclopentene markets, especially in key sectors such as refrigeration, insulation, and manufacturing.

Trending Factors

Technological Advancements in Cyclopentene Blends and Production

Technological advancements in cyclopentene production and blending are playing a crucial role in driving the future growth of the global cyclopentene market. Innovations in synthesis methods and catalytic processes have led to more efficient and environmentally sustainable production, while the adoption of advanced techniques like ring-opening metathesis polymerization (ROMP) has enabled the creation of high-performance polymers with superior thermal and mechanical properties.

Additionally, these advancements have also expanded the use of cyclopentene in eco-friendly blowing agent formulations and in blending with other monomers to enhance insulation and chemical resistance. As a result, cyclopentene is gaining traction in high-growth sectors such as automotive, construction, packaging, and electronics. With industries increasingly focusing on sustainable and energy-efficient materials, technological progress in cyclopentene applications and blends is expected to significantly support market expansion in the coming years.

Geopolitical Impact Analysis

Geopolitical Trade Tensions and Environmental Regulations Are Reshaping The Global Cyclopentene Market By Disrupting Supply Chains And Accelerating The Shift Toward Sustainable Materials.

Geopolitical factors include trade policies, regulatory frameworks, and international collaborations. Tensions between major economies play a significant role in shaping the global cyclopentene market, trade wars or political instability, can disrupt the supply chains of critical chemicals, including cyclopentene.

- For instance, a recent announcement by President Trump regarding a 10% tariff on imports from all countries, including chemical products, highlights how geopolitical decisions can directly impact the global cyclopentene market.

In a cyclopentane market, such trade policies can lead to increased production costs, supply chain disruptions, and market uncertainty, particularly for industries that rely on cross-border chemical sourcing. These tariffs may disrupt international trade, accelerating manufacturers to seek local alternatives or shift production strategies, potentially slowing the market’s growth in regions heavily dependent on imports.

Furthermore, global efforts to manage climate change and strengthen environmental regulations are boosting the demand for sustainable materials such as cyclopentene. Countries that prioritize carbon neutrality and green industrial practices may introduce incentive programs, tax breaks, or subsidies to encourage the use of low-GWP materials like cyclopentene. In addition, regions with progressive environmental policies, particularly within the European Union and North America, can experience rapid growth in cyclopentene adoption.

Regional Analysis

In 2024, Asia Pacific dominated the global Cyclopentane market, accounting for 43.5% of the total market share, Driven by rapid industrialization, growing demand for sustainable materials, and favorable government support. Key economies such as China, India, Japan, and South Korea are witnessing increased application of cyclopentene across industries including automotive, construction, refrigeration, and electronics, due to its low environmental impact and versatile chemical properties.

Furthermore, rising awareness of climate change and the adoption of low-GWP (global warming potential) materials are encouraging the replacement of conventional ozone-depleting substances such as CFCs and HCFCs. This adoption is expanding rapidly in regions of the food, pharmaceutical, and e-commerce industries. Additionally, the region’s well-developed chemical manufacturing infrastructure, especially in China and India, supports large-scale production and cost-effective supply of cyclopentene.

Also, investments in R&D and advanced production technologies are enhancing product quality and process efficiency, further contributing to market expansion. Furthermore, the government from these regions accelerates cyclopentane adoption by providing subsidies, tax benefits, and environmental regulations these factors make Asia-Pacific a high-growth region in the global cyclopentene market growth.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Market Players

Key Players In The Cyclopentane Market Dominate The Market Through Strategic Innovation And Regional Expansion.

In 2024 global Cyclopentane market dominated by key players like Maruzen Petrochemical Co., Ltd., Junyuan Petroleum Group, Chevron Phillips Chemical, SK geo centric Co., Ltd., Liaoning Yufeng Chemical Co., Ltd., Haldia Petrochemicals Limited, along with smaller but significant producers like Meilong Cyclopentane Chemical Co., Ltd., and Shandong Senzhihai New Material Co., Ltd. Jointly shaping the competitive landscape through production capacity, innovation, and regional expansion.

Companies such as Chevron Phillips and SK Geo-centric emphasized sustainable innovation, while firms such as Maruzen and Junyuan invested in production scaling. Strategic partnerships and regulatory compliance were also central to strengthening market positions and expanding into emerging regions.

Market Key Players

- HCS Group GmbH

- Maruzen Petrochemical Co., Ltd.

- Junyuan Petroleum Group

- Meilong Cyclopentane Chemical Co.,Ltd.

- Chevron Phillips Chemical

- SK geo centric Co., Ltd.

- Liaoning Yufeng Chemical Co., Ltd.

- Haldia Petrochemicals Limited

- YEOCHUN NCC CO., LTD.

- ZEON CORPORATION

- Puyang Zhongwei Fine Chemical Co., Ltd.

- INEOS

- Ataman Kimya

- Zhengzhou Meiya Chemical Products Co., Ltd

- Shandong Senzhihai New Material Co., Ltd.

- BSM

- Other Key Players

Recent Developments

- In April 2024 – BSM (Tongling) announced plans to invest ¥121 million in the construction of a new green material project to produce 12,100 tons of Cyclopentane series materials annually. Located in the Tongling Economic Development Zone, Anhui Province, the project will build a new Cyclopentane/Cyclopentene device and hydrogen production facilities.

Report Scope:

Report Features Description Market Value (2024) USD 405.6 Mn Forecast Revenue (2034) USD 783.1 Mn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Below 90%, 90% to 95%, 96% to 99.9%), By Function (Blowing Agent and Refrigerant Solvent and Reagent, Others), By Application (Refrigerators (Residential, Commercial), Containers and Sippers, Personal Care Products, Electrical and Electronics, Insulating Construction Material, Fuel and Fuel Additives, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Maruzen Petrochemical Co., Ltd., Junyuan Petroleum Group, Meilong Cyclopentane Chemical Co., Ltd., Chevron Phillips Chemical, SK geo centric Co., Ltd., Liaoning Yufeng Chemical Co., Ltd., Haldia Petrochemicals Limited, YEOCHUN NCC CO., Ltd., ZEON CORPORATION, Puyang Zhongwei Fine Chemical Co., Ltd., INEOS, Ataman Kimya, Zhengzhou Meiya Chemical Products Co., Ltd, Shandong Senzhihai New Material Co., Ltd., HCS Group GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- HCS Group GmbH

- Maruzen Petrochemical Co., Ltd.

- Junyuan Petroleum Group

- Meilong Cyclopentane Chemical Co.,Ltd.

- Chevron Phillips Chemical

- SK geo centric Co., Ltd.

- Liaoning Yufeng Chemical Co., Ltd.

- Haldia Petrochemicals Limited

- YEOCHUN NCC CO., LTD.

- ZEON CORPORATION

- Puyang Zhongwei Fine Chemical Co., Ltd.

- INEOS

- Ataman Kimya

- Zhengzhou Meiya Chemical Products Co., Ltd

- Shandong Senzhihai New Material Co., Ltd.

- BSM

- Other Key Players