Global Cycle Tourism Market By Group (Groups and Friends, Couples, Family, Solo), By Booking Mode (Direct, Travel Agent, Marketplace Booking), By Age Group (31 to 50 Years, 18 to 30 Years, Above 50 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136558

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

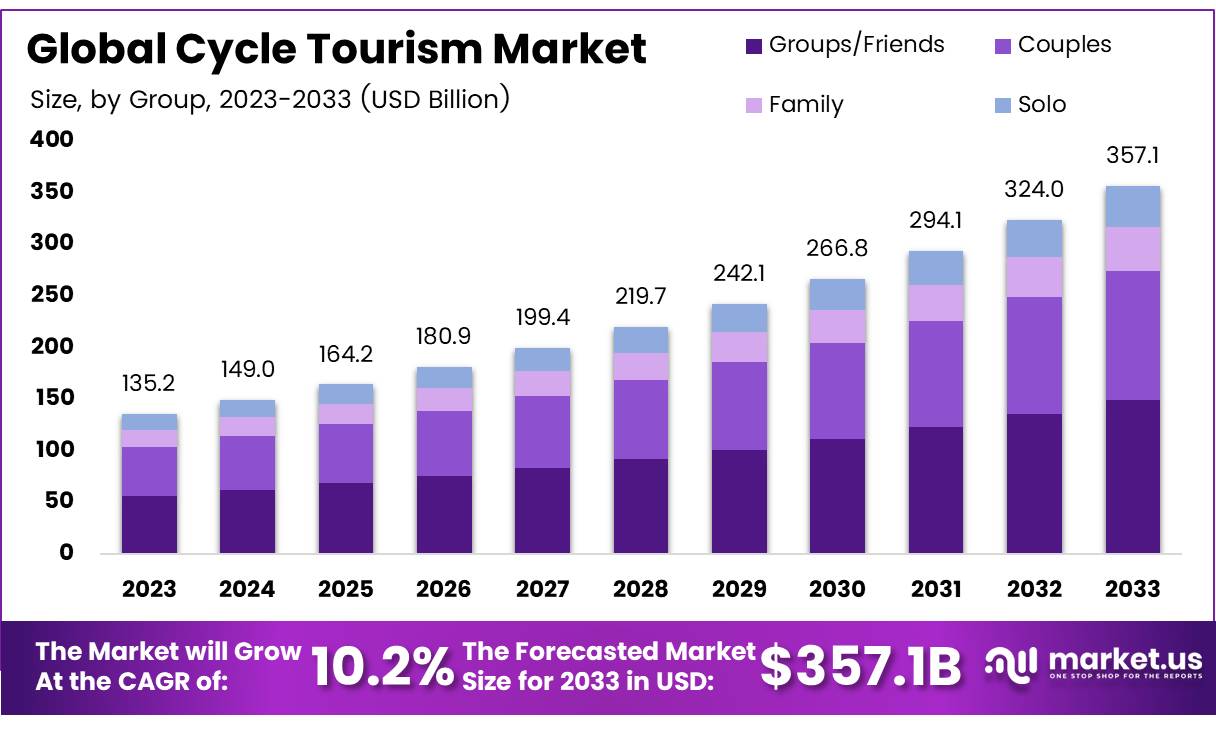

The Global Cycle Tourism Market size is expected to be worth around USD 357.1 billion by 2033, from USD 135.2 billion in 2023, growing at a CAGR of 10.2% during the forecast period from 2024 to 2033.

Cycle tourism refers to the practice of traveling with the primary intent of cycling as a recreational activity. It blends the joy of cycling with exploration, where tourists engage in cycling tours to discover new landscapes, cultures, and destinations. This form of tourism is typically characterized by the use of bicycles to navigate scenic routes, local attractions, and off-the-beaten-path areas.

Cyclists often travel with their bikes or rent them locally, depending on the infrastructure of the destination. Cycle tourism is increasingly popular as it offers an eco-friendly, healthy alternative to traditional tourism while providing an opportunity for local economies to capitalize on cycling routes, services, and accommodations tailored to cyclists.

The cycle tourism market encompasses all activities, services, and infrastructure that support cyclists during their travels. This includes bike rentals, guided tours, cycling-friendly accommodations, transportation logistics, and marketing initiatives aimed at attracting cycle tourists.

As a growing segment within the global tourism industry, cycle tourism is being recognized for its potential to stimulate local economies, especially in regions with rich natural landscapes, historical sites, and low-carbon initiatives.

The cycle tourism market has witnessed significant growth in recent years, driven by a combination of factors including the rising awareness of environmental sustainability, health-consciousness, and the demand for more immersive, active travel experiences.

According to fieradelcicloturismo, over 56 million cycle-tourist visits were recorded in Italy in 2023, contributing an economic impact of €5.5 billion. This growth highlights the significant opportunity for tourism operators, local businesses, and destinations to capitalize on the cycle tourism trend. Similarly, ecobnb reports a constant increase in the number of cycle tourists in Italy, with 9 million cycle tourists recorded in 2022 alone.

Governments and local authorities have recognized the potential economic and environmental benefits of promoting cycling tourism. Public investments are being channeled into developing cycling infrastructure such as dedicated bike paths, secure parking, and cycle-friendly accommodations.

Additionally, many governments have introduced regulations to support eco-tourism, such as grants and subsidies for businesses offering sustainable services and infrastructure. In regions like the Netherlands, where 45% of the population uses bicycles as their primary mode of transport, the integration of cycling infrastructure into broader smart transportation and luxury tourism planning is seen as essential for maintaining the sector’s growth.

Moreover, cycling tourism presents opportunities to diversify offerings in regions traditionally dependent on other types of tourism. With the average leisure cycling speed being around 14.1 mph on pavement (bicycling), and average distances of 19.2 miles, cycle tourists seek well-planned, accessible routes, which provide room for growth in services like bike rentals, cycling tours, and destination marketing tailored to cycling enthusiasts.

Key Takeaways

- The global cycle tourism market is projected to grow from USD 135.2 billion in 2023 to USD 357.1 billion by 2033, with a CAGR of 10.2% during the forecast period.

- The Groups/Friends segment held a dominant 45.2% market share in 2023, driven by the increasing popularity of group travel and social cycling experiences.

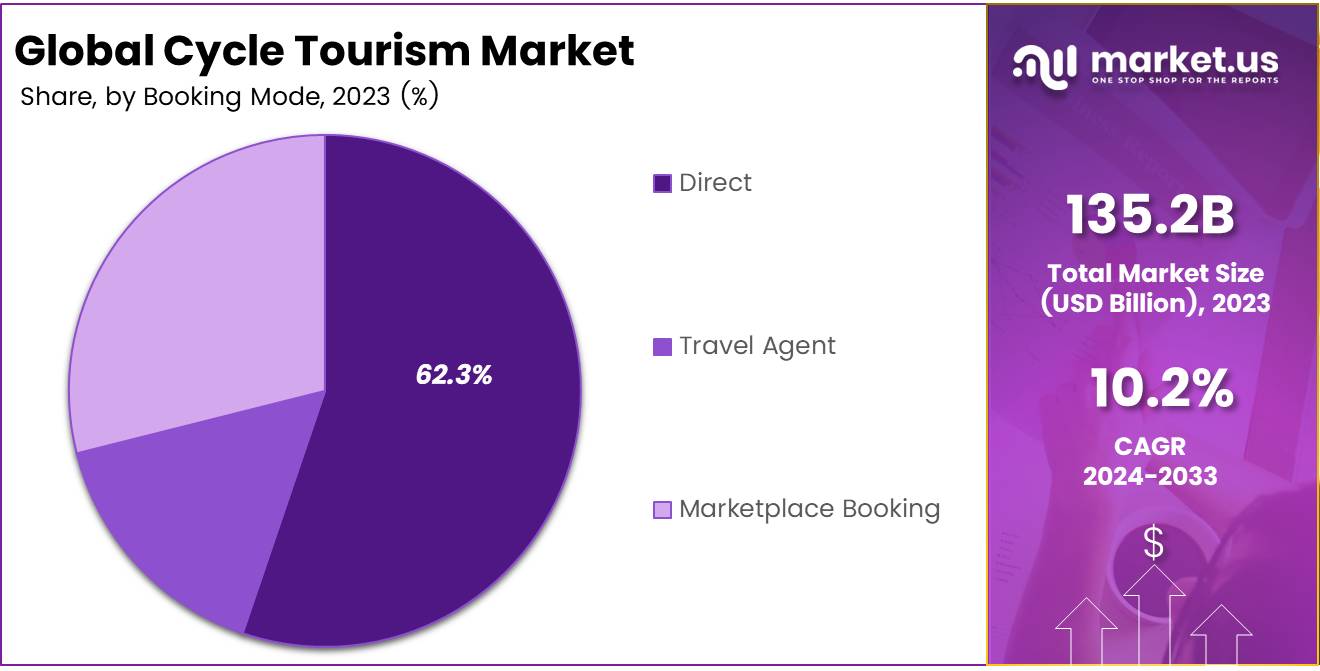

- The Direct Booking segment led the market in 2023, accounting for 62.3% of the share, highlighting consumer preference for flexibility, personalized services, and bypassing intermediaries.

- The 31 to 50 years age group accounted for 48.1% of the market share in 2023, driven by rising health awareness, disposable income, and demand for eco-friendly travel.

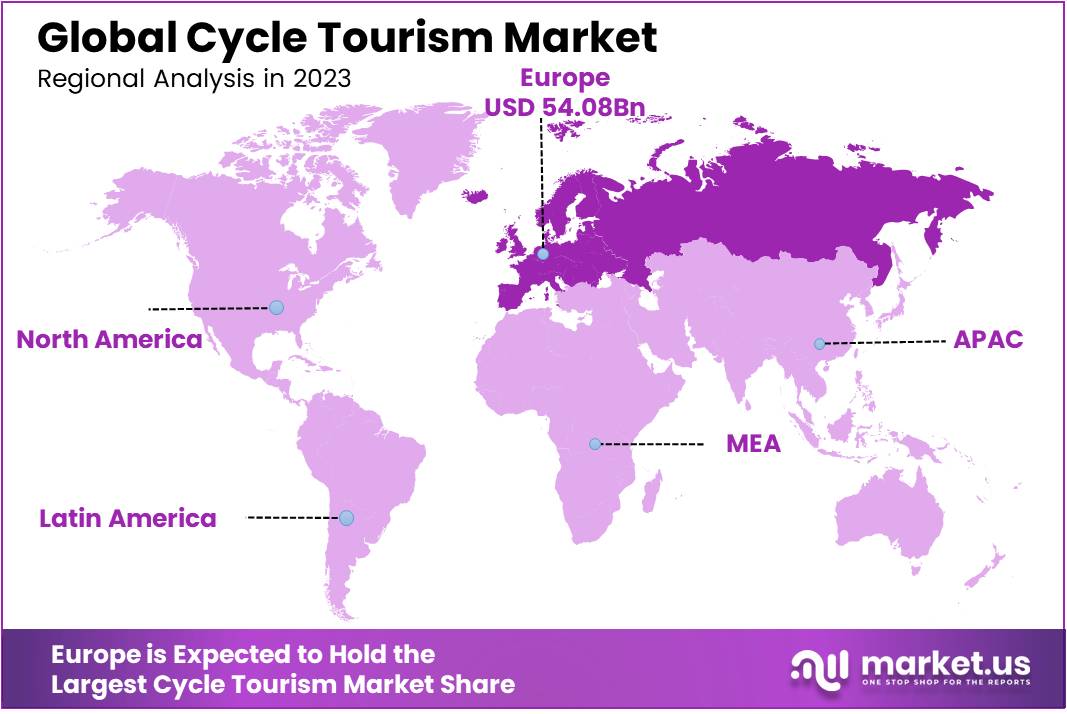

- Europe dominated the global cycle tourism market in 2023, holding a 40.1% market share, valued at USD 54.08 billion.

Group Analysis

Groups/Friends Lead Cycle Tourism Market with 45.2% Share in 2023

In 2023, Groups/Friends held a dominant market position in the By Group Analysis segment of the Cycle Tourism Market, with a 45.2% share.

This category is primarily driven by the growing trend of group travel and social cycling experiences, where multiple participants engage in cycling activities for leisure or adventure. Group cycling tours are often organized for both recreational and fitness purposes, which has fueled the market’s demand within this segment.

Couples followed as the second largest group, capturing a significant portion of the market. The desire for intimate, shared experiences combined with cycling has made this segment increasingly popular. Couples prefer more personalized tours and often engage in cycling vacations that combine scenic routes with romantic experiences.

Families, while a smaller segment, are also an emerging consumer group. Parents seeking family-friendly vacations that incorporate healthy and active experiences are increasingly turning to cycle tourism as an ideal solution. Family cycle tours are often characterized by shorter, less strenuous routes designed for all ages.

Solo travelers, although representing the smallest portion of the market, continue to demonstrate steady growth. The appeal of independent cycling trips allows for personal exploration and flexibility, with solo cyclists often seeking a deeper connection to nature and local cultures.

Booking Mode Analysis

Direct Booking Dominated the Cycle Tourism Market in 2023, Capturing a 62.3% Share

In 2023, Direct Booking held a dominant market position in the By Booking Mode segment of the Cycle Tourism Market, with a 62.3% share. This trend highlights the increasing consumer preference for direct interaction with service providers, allowing for greater flexibility and customization in booking cycle tours.

Travel Agent bookings, while still significant, accounted for a smaller share of the market. This method is preferred by consumers seeking expert guidance or customized travel arrangements, particularly in regions where specialized knowledge is required for cycle tours. However, this segment’s growth has been limited as more travelers opt for digital solutions.

The Marketplace Booking segment, which includes third-party platforms, continues to see gradual growth, though it represents a smaller portion of the market. These platforms offer convenience and comparison features but face increasing competition from more direct and personalized booking options.

Group Analysis

In 2023, the 31 to 50 Years Age Group Led the Cycle Tourism Market with a 48.1% Share

In 2023, the 31 to 50 years age group held a dominant market position in the By Age Group Analysis segment of the cycle tourism market, accounting for 48.1% of the total market share. This demographic has emerged as a key driver for the growth of cycle tourism, driven by several factors, including increasing health awareness, disposable income, and a growing preference for eco-friendly travel options.

The 31 to 50 age group is typically characterized by professionals and active individuals seeking balanced vacations that combine adventure and relaxation, making cycling an attractive option for both leisure and fitness. Moreover, this age group demonstrates higher purchasing power, enabling them to invest in quality cycling equipment, tours, and accommodations.

The trend of experiential travel, where travelers seek unique and memorable experiences, has further contributed to the appeal of cycle tourism among this demographic.

As a result, they are increasingly choosing cycle tourism as an alternative to traditional forms of leisure travel, leading to a notable increase in demand for cycling tours, especially in destinations known for their natural landscapes and cycling-friendly infrastructure.

The 31 to 50 years segment is expected to maintain its leadership position in the coming years, owing to continued trends in health-conscious travel and sustainable tourism.

Key Market Segments

By Group

- Groups/Friends

- Couples

- Family

- Solo

By Booking Mode

- Direct

- Travel Agent

- Marketplace Booking

By Age Group

- 31 to 50 Years

- 18 to 30 Years

- Above 50 Years

Drivers

Rising Health Consciousness Driving Cycle Tourism Growth

The growing awareness of the importance of health and well-being is significantly contributing to the expansion of the cycle tourism market. As people become more conscious of their physical fitness, there is an increasing shift toward outdoor activities such as cycling.

Cycling, being both a form of exercise and a recreational activity, is seen as a convenient and effective way to stay fit. This trend is particularly prevalent among millennials and health-conscious individuals who are looking for active, engaging ways to spend their vacations.

Alongside this, the increasing focus on environmental sustainability is another key factor driving the market. As consumers seek ways to reduce their carbon footprints, cycling offers an eco-friendly alternative to traditional forms of transport. With its zero-emission nature, cycling aligns with the rising preference for sustainable tourism options.

Additionally, governments worldwide are enhancing their support for cycle tourism by investing in cycling infrastructure, such as dedicated bike lanes and cycling paths, which improve the safety and accessibility of destinations. This infrastructure development is making cycling tourism more attractive to both local and international tourists.

Furthermore, the overall rise of adventure tourism, which includes activities like hiking, cycling, and kayaking, has also benefited cycle tourism.

As travelers seek unique, nature-focused experiences, cycling provides an ideal blend of adventure, exploration, and physical activity, further fueling market growth. These factors combined position cycle tourism as an increasingly popular and sustainable option for today’s active and environmentally-conscious traveler.

Restraints

Weather Dependency and Limited Awareness Restrain Market Growth

Cycle tourism faces notable constraints, with weather dependency being a significant challenge. Unfavorable weather conditions such as rain, extreme heat, or cold can severely limit the appeal and feasibility of cycle tourism, particularly in regions with unpredictable climates. This can lead to seasonal fluctuations in demand, with some areas experiencing a decline in participation during adverse weather periods.

Furthermore, many potential tourists may be deterred by concerns over the unpredictability of weather, affecting their decision to engage in cycling tours. Another limitation is the lack of awareness and information about cycling tourism routes and packages in certain regions.

In many areas, people are unaware of the cycling infrastructure or the availability of organized cycling tours. This results in a lack of market penetration, particularly in regions where cycling tourism has not yet been fully developed or promoted. Without sufficient promotional efforts, tourists may not be informed of the opportunities for cycle tourism in these areas, leading to underutilization of potential routes and facilities.

This lack of awareness can also impact the willingness of local businesses and governments to invest in the necessary infrastructure, further stalling growth in the market. Thus, both weather conditions and insufficient awareness pose significant barriers to the widespread adoption and growth of the cycle tourism market.

Growth Factors

Growth Opportunities in the Cycle Tourism Market

The cycle tourism market presents several growth opportunities driven by evolving consumer preferences and innovations in cycling technology.

One of the most promising segments is e-bike tourism, where the increasing popularity of electric bikes enables less experienced cyclists, as well as older individuals, to explore longer distances and more challenging routes with reduced physical strain. This trend has the potential to expand the customer base and attract new participants to the cycling tourism market.

Additionally, the development of themed cycling routes, such as wine, heritage, or wildlife trails, caters to niche audiences seeking unique and tailored experiences. This segmentation provides opportunities for tourism providers to create specialized packages that align with specific interests, thereby enhancing the overall appeal.

Moreover, the integration of digital tools, including smart fitness apps, GPS, and route-planning software, can significantly enhance the customer experience, offering convenience and personalized recommendations. These technologies allow travelers to navigate seamlessly, creating new business opportunities for service providers, such as guided tours and real-time updates.

Finally, luxury travel is gaining traction, as affluent travelers increasingly seek high-end, all-inclusive cycling experiences.

Offering premium accommodations, gourmet dining, and exclusive guided tours can appeal to this demographic, presenting a lucrative avenue for growth in the cycle tourism market. Together, these opportunities provide significant potential for businesses to diversify offerings and attract a wide range of consumers.

Emerging Trends

Personalized Cycling Packages Drive Growth in Cycle Tourism due to Increased Demand for Tailored Experiences

The cycle tourism market is being shaped by several key trends, with a notable shift towards personalized cycling packages. Tour operators are now focusing on offering customized cycling tours that cater to various fitness levels, interests, and experience. This shift reflects the growing demand for more personalized and immersive travel experiences.

Alongside this, there is a rising integration of multimodal transport, allowing cycle tourists to combine their cycling routes with trains, buses, and other forms of sustainable transport.

This integration makes it easier for cyclists to plan longer trips and visit multiple destinations, contributing to the expansion of cycle tourism. Social media and influencer marketing also play a crucial role in promoting cycling destinations, with influencers showcasing unique routes and travel experiences that attract a younger, tech-savvy audience.

Additionally, cycling is increasingly being viewed as a social activity, with tourists seeking group tours, cycling clubs, and community-based events. This shift is influencing tour packages, with many cyclists now preferring shared experiences over solo trips.

Overall, these trends indicate a strong shift towards more flexible, socially engaging, and environmentally conscious cycling tourism, driven by individual preferences and the need for sustainable, multi-destination travel. As the market continues to grow, these factors are likely to shape the future of cycle tourism in the coming years.

Regional Analysis

Europe leads the cycle tourism market with 40.1% share valued at USD 54.08 billion

The global cycle tourism market is characterized by distinct regional dynamics, with Europe being the dominant region, holding 40.1% of the market share, valued at USD 54.08 billion.

Europe benefits from its extensive cycling infrastructure, well-developed cycling trails, and cultural integration of cycling as a recreational activity. Countries such as France, the Netherlands, and Germany play a significant role in driving the region’s market growth, with scenic routes, historical trails, and the increasing adoption of eco-tourism practices boosting cycle tourism.

Regional Mentions:

In North America, the market is witnessing a steady growth trajectory, supported by rising demand for outdoor activities and active vacations. The United States and Canada are enhancing their cycling infrastructure, with bike-friendly cities and expanding cycling trails, contributing to the growing popularity of cycle tourism.

The Asia Pacific region, though emerging, is expected to show substantial growth in the coming years. Countries like Japan, China, and India are beginning to recognize the potential of cycle tourism, supported by improving infrastructure and rising urban cycling culture. As disposable incomes grow and more tourists seek adventure travel options, Asia Pacific is expected to witness an increase in cycle tourism participation.

Latin America and Middle East & Africa remain underdeveloped markets for cycle tourism but hold significant growth potential. While infrastructure for cycle tourism is still limited, there are early signs of growth driven by increasing interest in eco-tourism and sustainable travel. Both regions are expected to see gradual expansion as more investments are made in infrastructure and as the global cycle tourism trend spreads.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global cycle tourism market has seen substantial growth, with several key players emerging as leaders in providing specialized cycling tours. These companies cater to the growing demand for active travel experiences, with a particular focus on adventure and sustainable tourism.

SpiceRoads Cycling stands out with its extensive portfolio of cycle tours in Asia and beyond. The company’s offerings, which range from leisure rides to challenging mountain biking expeditions, align well with the increasing interest in multi-destination cycling trips. Their emphasis on high-quality customer experiences and niche routes positions them as a strong contender in the market.

Sarracini Travel is another significant player, recognized for tailoring cycling packages to diverse traveler needs. Their expertise lies in curating bespoke cycling holidays, which resonate with affluent travelers seeking unique, immersive cycling experiences in scenic locations worldwide.

Arbutus Routes, specializing in bike tours across North America and Europe, has effectively capitalized on the trend of eco-friendly travel. Their focus on sustainability and cycling infrastructure ensures that their customers enjoy not only adventure but also a minimal environmental footprint.

World Expeditions and Exodus Travels are major operators in the adventure travel sector, both offering a broad spectrum of cycling trips that appeal to cyclists of all skill levels. Their integrated approach to adventure tourism, including logistical support and local insights, solidifies their position as global leaders in the cycle tourism market.

Other prominent players such as Intrepid Travel, G Adventures, Himalayan Glacier Adventure, and Austin Adventures continue to innovate by combining cycling with other adventure tourism activities, creating diversified offerings for the growing market of health-conscious and experience-driven travelers. These companies are well-positioned to capitalize on the increasing demand for sustainable travel options and active, immersive vacations.

Top Key Players in the Market

- SpiceRoads Cycling

- Sarracini Travel

- Arbutus Routes

- World Expeditions

- Travel + Leisure Holdco, LLC

- Exodus Travels Limited.

- Intrepid Travel

- G Adventures

- Himalayan Glacier Adventure and Travel Company

- Austin Adventures

Recent Developments

- In February 2024, Saudi-backed SRJ Sports Investments is reportedly close to finalizing a €250 million deal to launch a new cycling league aimed at expanding the sport’s global reach.

- In July 2023, the French government unveiled a €2 billion initiative to enhance cycling infrastructure, aiming to reduce car dependency and promote sustainable transportation alternatives.

- In June 2023, Sault Ste. Marie committed $2.3 million to the development of a mountain bike trail network, enhancing outdoor recreational opportunities and boosting tourism in the region.

Report Scope

Report Features Description Market Value (2023) USD 135.2 billion Forecast Revenue (2033) USD 357.1 billion CAGR (2024-2033) 10.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Group (Groups and Friends, Couples, Family, Solo), By Booking Mode (Direct, Travel Agent, Marketplace Booking), By Age Group (31 to 50 Years, 18 to 30 Years, Above 50 Years) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SpiceRoads Cycling, Sarracini Travel, Arbutus Routes, World Expeditions, Travel + Leisure Holdco, LLC, Exodus Travels Limited., Intrepid Travel, G Adventures, Himalayan Glacier Adventure and Travel Company, Austin Adventures Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SpiceRoads Cycling

- Sarracini Travel

- Arbutus Routes

- World Expeditions

- Travel + Leisure Holdco, LLC

- Exodus Travels Limited.

- Intrepid Travel

- G Adventures

- Himalayan Glacier Adventure and Travel Company

- Austin Adventures