Global Cybersecurity in EdTech Market Size, Share Analysis Report By Component (Hardware, Software, Services), By Security Type (Endpoint Security, Cloud Security, Network Security, Application Security, Others), By Deployment (Cloud-based, On-premises), By Enterprise Size ( Small & Medium Enterprise Size (SME's), Large Enterprises), By Sector ( Preschool, K-12, Higher Education, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan. 2025

- Report ID: 137726

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- U.S. Cybersecurity in EdTech Market Size

- Component Analysis

- Security Type Analysis

- Deployment Analysis

- Enterprise Size Analysis

- Sector Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Impact of AI

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

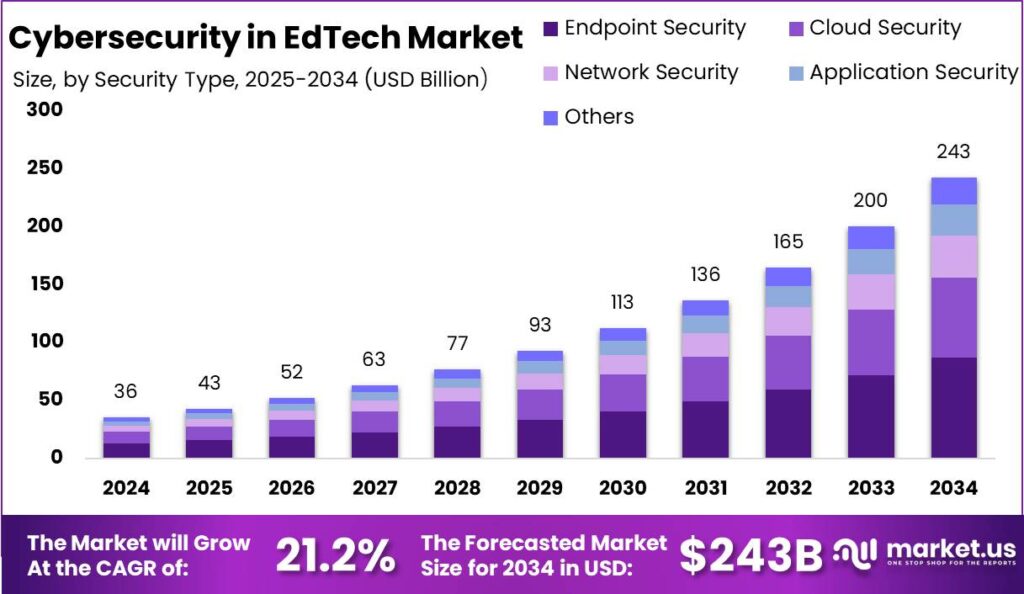

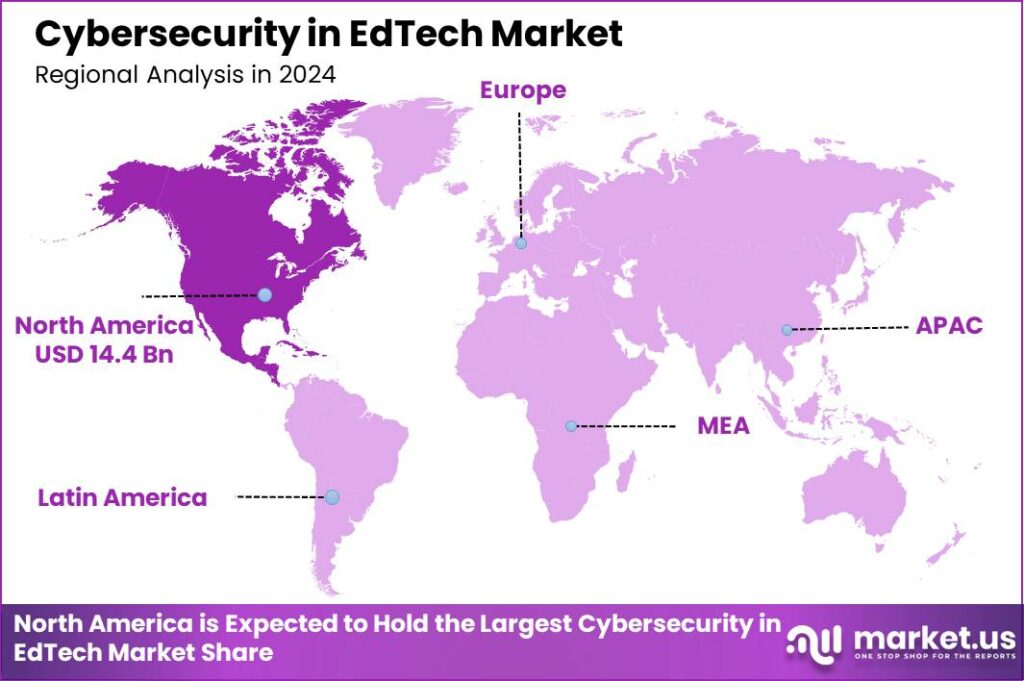

The Global Cybersecurity in EdTech Market size is expected to be worth around USD 243 Billion By 2034, from USD 36 billion in 2024, growing at a CAGR of 21.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.2% share, holding USD 14.4 Billion revenue.

Cybersecurity in educational technology (EdTech) involves protecting digital teaching and learning systems from unauthorized access, breaches, and other cyber threats. This area is critical because schools accumulate vast amounts of sensitive information about students and staff, and increasingly utilize technology for learning and administration. Ensuring robust cybersecurity measures are in place helps protect this data from cyber attacks, which have become more prevalent and sophisticated over time.

The EdTech cybersecurity market has grown significantly, driven by the rising need to safeguard educational environments from cyber threats. This market segment involves various stakeholders, including software developers, educational institutions, and cybersecurity firms, all working towards enhancing digital security measures within educational settings. The focus extends beyond protecting data to ensuring that educational technologies deliver reliable, uninterrupted educational services.

The major driving factors for cybersecurity in EdTech include the increasing use of digital platforms for education, the rising number of cyber threats, and stringent regulatory requirements to protect student data. Educational institutions are expanding their digital footprints, from online learning platforms to cloud-based services, necessitating robust cybersecurity solutions to manage potential vulnerabilities and threats.

Market demand for cybersecurity solutions in education is driven by the need to protect sensitive data related to students, staff, and research. As educational institutions continue to integrate technology into their operations, the importance of cybersecurity is increasingly recognized as essential for maintaining trust and operational continuity.

Investing in cybersecurity brings significant business benefits for educational institutions, including enhanced protection of intellectual property, compliance with data protection regulations, and improved trust from students, parents, and staff. Moreover, robust cybersecurity measures can prevent financial losses associated with data breaches and other security incidents, making it a critical investment for the sustainability of educational operations.

According to Survey, cybersecurity in EdTech is crucial for protecting sensitive student and institutional data. Educational institutions manage vast amounts of personal information, making them attractive targets for cyberattacks. Notably, 71% of secondary schools reported experiencing a cybersecurity breach or attack in the past year. Alarmingly, one in three education devices contains sensitive data, underscoring the need for robust security measures.

Sysgroup highlights that by prioritizing cybersecurity, EdTech companies can foster trust among schools, parents, and students. Data loss remains the top concern for 82% of schools dealing with cybercrime. Moreover, 37% of schools worry about the reputational damage that cyberattacks could cause, demonstrating the far-reaching impact of security breaches.

The importance of strong cybersecurity measures extends to ensuring uninterrupted access to EdTech platforms and services. Losing access to network-connected IT systems would cause significant disruption for 97% of schools, emphasizing how critical it is to maintain operational continuity. Encouragingly, 75% of primary schools and 81% of secondary schools have implemented a cybersecurity policy, reflecting growing awareness of the issue.

Key Takeaways

- The global Cybersecurity in EdTech Market is forecasted to grow significantly, expected to reach a valuation of USD 243 billion by 2034, up from USD 36 billion in 2024, registering a robust CAGR of 21.2% during the forecast period (2025-2034).

- In 2024, North America dominated the market with a revenue share of over 40.2%, generating approximately USD 14.4 billion.

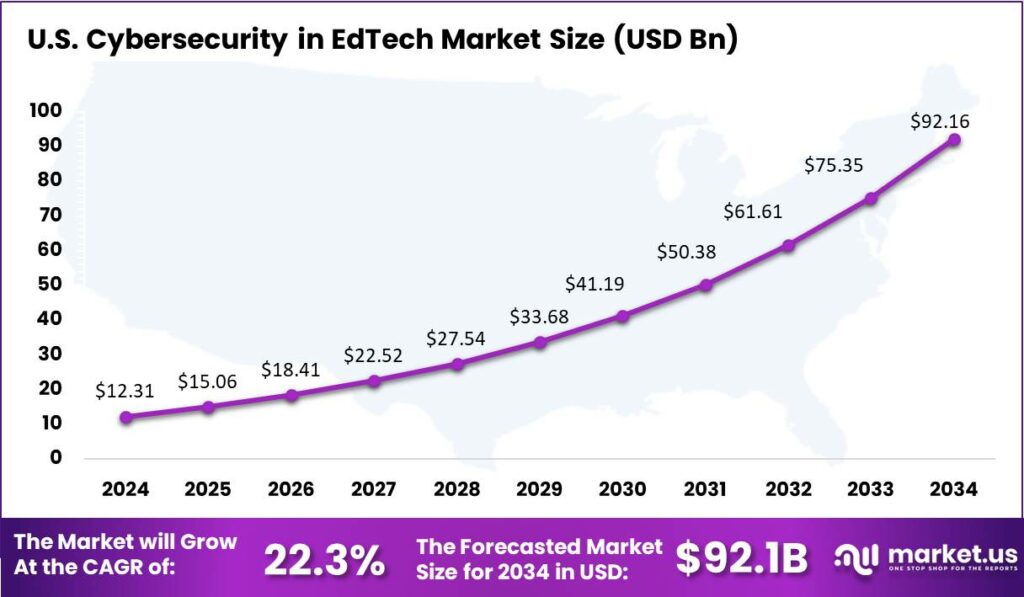

- Within North America, the U.S. Cybersecurity in EdTech Market stood out, contributing USD 12.31 billion in 2024 and growing at an impressive CAGR of 22.3%.

- The Hardware segment led the global market in 2024, capturing more than 47.4% of the total market share.

- The Endpoint Security segment held a strong position, accounting for over 35.9% of the global market share in 2024.

- The On-premises deployment model remained a preferred choice in 2024, commanding a dominant share of more than 62.6%.

- Large enterprises accounted for the largest share in 2024, dominating with over 70.2% of the market share.

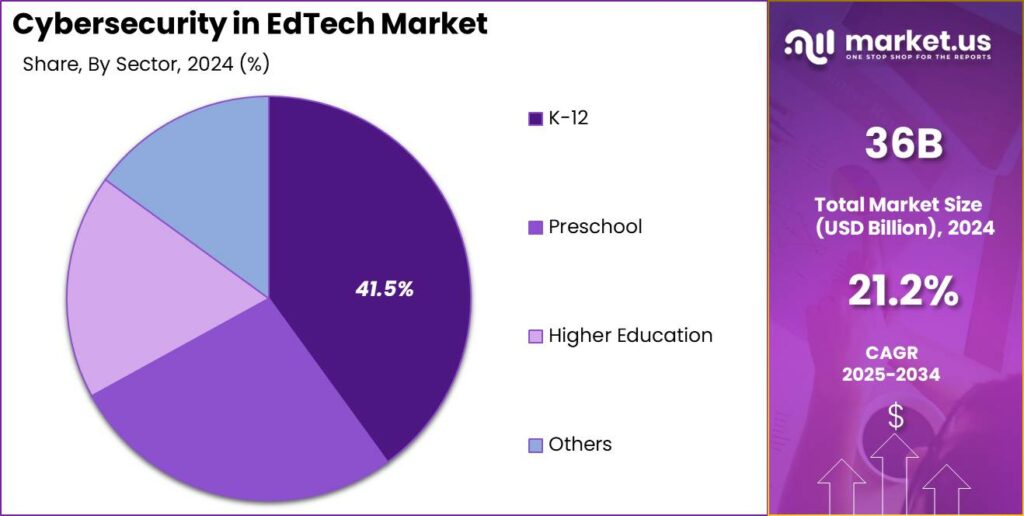

- Among end-users, the K-12 segment led the market, holding a substantial share of more than 41.5% in 2024.

U.S. Cybersecurity in EdTech Market Size

In 2024, the US cybersecurity market in the education technology sector reached a notable size of USD 12.31 billion with a robust compound annual growth rate (CAGR) of 22.3%. This growth is driven by several key factors that underline why the US is at the forefront in this industry.

Firstly, the increasing digitalization of educational institutions and the integration of advanced technologies have heightened the importance of cybersecurity. Educational entities are progressively recognizing cyber threats as inevitable risks that need comprehensive preparedness strategies. This shift in perspective is crucial for maintaining continuity in educational services and safeguarding sensitive data against cyberattacks.

Secondly, the commitment to cybersecurity in the US education sector is exemplified by its prioritization among K-12 EdTech leaders. It remains their top concern, with concerted efforts to implement robust cybersecurity measures and practices. The overwhelming majority of districts recognize the benefits of AI in enhancing educational outcomes, which simultaneously increases the complexity of cybersecurity needs.

Furthermore, cybersecurity compliance in education is not just about protecting data but also about maintaining an institution’s reputation and adhering to strict regulatory requirements. Effective cybersecurity strategies in education encompass risk identification, secure data storage, access management, and continuous monitoring of user activities.

In 2024, North America held a dominant market position in the cybersecurity sector within educational technology, capturing more than a 40.2% share, translating to a significant revenue of USD 14.4 billion. This leading role can be attributed to several key factors that distinguish the region from others globally.

Firstly, the advanced technological infrastructure and the high adoption rates of digital education platforms across North American schools and universities create a large demand for cybersecurity solutions. Educational institutions in this region are among the earliest adopters of new technologies, including cloud computing and mobile learning, which inherently increase the potential cyber threat landscape. This has necessitated robust cybersecurity measures to protect vast amounts of sensitive educational data.

Moreover, the regulatory environment in North America further drives the cybersecurity market. The United States, in particular, has stringent data protection laws that mandate rigorous cybersecurity measures in educational institutions. These regulations not only enforce a standard of data protection but also drive innovation and investment in the cybersecurity industry as schools and higher education institutions strive to comply with these norms.

Additionally, the presence of major cybersecurity firms and startups in the region provides easy access to cutting-edge technologies and expertise in the education sector. These companies often collaborate directly with educational institutions to tailor cybersecurity solutions that address unique threats faced by the sector. The proactive approach of these enterprises in developing and implementing advanced security measures contributes significantly to the high market share observed in North America.

Component Analysis

In 2024, the Hardware segment in the Cybersecurity in EdTech market held a dominant position, capturing more than a 47.4% share. This prominence can be attributed to several key factors that underscore the critical role of hardware in cybersecurity measures within educational technology.

Firstly, the rapid expansion of hardware such as interactive displays, tablets, and laptops has been crucial. These devices are foundational to digital learning, offering the necessary infrastructure for accessing and engaging with educational content. As schools and universities increasingly rely on digital platforms, the need for robust cybersecurity hardware solutions to protect these devices from cyber threats has grown significantly.

Moreover, the growth of this segment is driven by the continuous innovations and integration of advanced technologies like virtual reality (VR) headsets and interactive whiteboards. These technologies not only enhance the learning experience but also require enhanced security measures to protect the sensitive data they handle. As educational institutions adopt these advanced hardware solutions, the demand for corresponding cybersecurity measures increases to safeguard against data breaches and cyberattacks.

Additionally, the substantial investments in the Hardware segment reflect its crucial role in facilitating effective cybersecurity practices. With the education sector increasingly targeted by cyber threats, educational institutions are investing heavily in cybersecurity hardware to preemptively secure their digital environments. This proactive approach is vital in maintaining the integrity and security of educational data and systems.

Overall, the robust growth of the Hardware segment in the Cybersecurity in EdTech market is a direct response to the increasing digitalization of the education sector and the corresponding need for secure, reliable, and advanced hardware to support and protect educational technologies.

Security Type Analysis

In 2024, the Endpoint Security segment held a dominant market position in the Cybersecurity in EdTech market, capturing more than a 35.9% share. This leadership is driven by a combination of factors that highlight its crucial role in safeguarding educational technology environments.

Endpoint Security is increasingly vital due to the proliferation of devices such as laptops, tablets, and other personal devices used in educational settings. The rise of remote learning and Bring Your Own Device (BYOD) policies expand the potential attack surfaces for cyber threats, making Endpoint Security an essential safeguard against these vulnerabilities.

Moreover, the evolution of cyber threats, which are growing in complexity and frequency, necessitates robust security solutions that can proactively detect and respond to incidents. Endpoint Security systems, including Endpoint Detection and Response (EDR) tools, are critical as they provide real-time monitoring and advanced threat detection capabilities.

These systems are designed to identify and mitigate threats before they can cause significant damage, addressing the urgent need for dynamic and responsive security measures in educational institutions. Additionally, the adoption of advanced technologies like AI and machine learning within Endpoint Security solutions enhances their effectiveness.

These technologies help in recognizing patterns and predicting potential breaches, improving the overall security posture of educational environments. This integration of cutting-edge technologies ensures that educational institutions can stay ahead of potential cyber threats, thereby maintaining the integrity and confidentiality of their digital resources.

The increasing importance and strategic deployment of Endpoint Security are underscored by its growth in market share and technological integration, reflecting its critical role in the broader cybersecurity strategy within the EdTech sector.

Deployment Analysis

In 2024, the On-premises segment of the Cybersecurity in EdTech market maintained a dominant position, securing more than a 62.6% share. This strong preference for on-premises solutions in educational cybersecurity can be attributed to several key factors that underscore its continued relevance and importance.

Firstly, the on-premises approach provides institutions with direct control over their security systems and data. This control is critical in a sector that handles sensitive information such as student records, research data, and financial information. By managing their cybersecurity infrastructure in-house, educational institutions ensure that they have immediate access to their security systems and can tailor them to specific needs without relying on third-party cloud providers.

Additionally, on-premises solutions are perceived as more secure against certain types of cyber threats that are becoming increasingly sophisticated. For many educational institutions, the physical security of data – where access can be tightly controlled and monitored – is crucial. This perception helps mitigate concerns over data breaches and unauthorized access, which are significant given the vast amount of personal and sensitive data held by these institutions.

Moreover, with growing cyber threats, schools and universities are increasingly aware of the limitations and vulnerabilities associated with cloud-based solutions, such as susceptibility to internet disruptions and third-party breaches. On-premises systems often offer a level of security robustness that cloud solutions can struggle to match, especially in terms of customized security protocols that align with specific institutional policies and regulatory requirements.

Enterprise Size Analysis

In 2024, the Large Enterprises segment within the Cybersecurity in EdTech market held a commanding lead, capturing more than a 70.2% share. This dominance can be attributed to several key factors that uniquely position large enterprises at the forefront of cybersecurity innovations and implementations in the educational technology sector.

Large enterprises typically have more substantial financial resources to allocate towards cybersecurity. This financial capability allows them to invest in advanced security infrastructures, including sophisticated monitoring systems, comprehensive cybersecurity policies, and regular audits. These investments are crucial in an era where cyber threats are becoming more complex and frequent, requiring robust defenses to safeguard sensitive educational data.

Moreover, the scale of large enterprises enables them to leverage economies of scale in purchasing and implementing security solutions, which can be cost-prohibitive for smaller institutions. They often have the capacity to employ specialized cybersecurity teams dedicated to managing and enhancing security protocols, further strengthening their defense mechanisms against potential cyber threats.

Additionally, large educational institutions tend to have more extensive IT infrastructures and store larger volumes of sensitive data, making them more attractive targets for cyberattacks. This heightened risk compels them to prioritize advanced cybersecurity measures to protect their assets and maintain their reputation. By doing so, they set industry standards for cybersecurity practices, leading innovation and adoption of new technologies that smaller entities may eventually follow.

Sector Analysis

In 2024, the K-12 segment of the Cybersecurity in EdTech market held a dominant position, capturing more than a 41.5% share. This significant market presence is largely due to several critical factors that underscore the unique challenges and high stakes involved in protecting young learners’ data.

Firstly, K-12 institutions are increasingly integrating technology into all aspects of education, from administration to classroom learning, which elevates the need for robust cybersecurity measures. The proliferation of digital platforms used for learning and the vast amounts of sensitive data managed by schools necessitate stringent security to protect against cyber threats and data breaches.

Moreover, cybersecurity in K-12 education is not just about safeguarding information but also about ensuring that educational environments are safe and trusted places for students. With the growing sophistication of cyber threats, districts are continuously enhancing their security practices to prevent disruptions to the educational process and protect against the loss of critical data.

Lastly, the regulatory requirements for data protection in the education sector also drive the focus on cybersecurity. Schools must comply with various laws and regulations designed to protect student information, compelling them to prioritize investments in cybersecurity solutions and training.

Given these factors, the K-12 sector’s significant share in the EdTech cybersecurity market is a reflection of the urgent need to implement comprehensive and advanced cybersecurity solutions to keep pace with evolving threats and regulatory requirements.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Security Type

- Endpoint Security

- Cloud Security

- Network Security

- Application Security

- Others

By Deployment

- Cloud-based

- On-premises

By Enterprise Size

- Small & Medium Enterprise Size (SME’s)

- Large Enterprises

By Sector

- Preschool

- K-12

- Higher Education

- Others

Driver

Increasing Emphasis on Cybersecurity due to Digital Transformation

The digital transformation within the education sector has significantly expanded the use of technology, thereby elevating the priority of cybersecurity in educational technology (EdTech). As schools increasingly adopt digital solutions for learning, administration, and communication, they become more vulnerable to cyber threats.

The reliance on digital technologies for critical functions makes robust cybersecurity measures indispensable. The integration of technologies such as cloud-based systems, remote learning tools, and increased data collection of student information necessitates enhanced security protocols to protect sensitive data from breaches and unauthorized access.

Restraint

Budget Constraints Limiting Cybersecurity Implementations

Despite the critical need for robust cybersecurity measures in the education sector, budget constraints significantly hinder the ability of schools to implement effective cybersecurity solutions. Many educational institutions face financial limitations that restrict their capacity to invest in advanced cybersecurity infrastructure. The lack of sufficient funds not only affects the acquisition of the latest security technologies but also impacts the ability to hire or train dedicated cybersecurity personnel.

Consequently, many schools operate without a full-time cybersecurity professional on staff, further exacerbating their vulnerability to cyberattacks. The financial strain on educational institutions, therefore, acts as a major restraint in the advancement and implementation of necessary cybersecurity measures in the EdTech sector.

Opportunity

Enhanced Funding and Legislative Support for Cybersecurity

Recent legislative actions and funding allocations present significant opportunities for bolstering cybersecurity in the education sector. Various states have enacted laws providing funding for cybersecurity improvements and workforce development, reflecting a growing recognition of the need for robust cybersecurity measures in schools.

These legislative efforts are aimed at enhancing the cybersecurity infrastructure of educational institutions, thereby improving their capability to defend against and respond to cyber threats. The availability of dedicated funding for cybersecurity not only aids in upgrading old systems but also supports the implementation of advanced cybersecurity tools and training programs, creating a more secure educational environment.

Challenge

Evolving Cyber Threats and Limited Cybersecurity Expertise

Educational institutions continue to grapple with the dual challenge of rapidly evolving cyber threats and a general scarcity of cybersecurity expertise. Cyber threats such as ransomware and phishing attacks are becoming more sophisticated, targeting schools during critical times such as the beginning and end of academic years when systems are most vulnerable.

The dynamic nature of these threats requires a continuous update of cybersecurity measures, which can be challenging for institutions that lack specialized knowledge and resources. Additionally, the shortage of skilled cybersecurity professionals makes it difficult for schools to stay ahead of threats, necessitating ongoing training and development to build and maintain competent cybersecurity teams.

Growth Factors

The EdTech cybersecurity market is experiencing rapid growth, driven by several key factors. The increasing demand for personalized learning experiences has led to the widespread adoption of technology in education, necessitating robust cybersecurity measures to protect sensitive data.

The use of digital platforms, mobile devices, and internet connectivity in education has expanded access to learning resources but also exposed educational institutions to cyber threats. This growth is underpinned by the integration of advanced technologies like AI and machine learning, which enhance the efficiency and effectiveness of cybersecurity solutions by automating threat detection and response processes.

Emerging Trends

Emerging trends in the EdTech cybersecurity sector include a heightened focus on securing cloud-based platforms, which are increasingly utilized for their flexibility and accessibility. The shift towards cloud deployments is significant, supported by the scalability and ease of integration with existing educational technologies.

Moreover, there is a rising trend of using analytics and AI to enhance cybersecurity measures, providing more proactive and predictive security solutions. The integration of AI helps in managing the vast amounts of data generated by online learning platforms, enabling more personalized and secure learning environments.

Impact of AI

AI’s impact on EdTech cybersecurity is transformative, offering both challenges and opportunities. AI technologies facilitate advanced threat detection systems that can anticipate and mitigate potential breaches more effectively than traditional methods. These systems analyze user behavior and access patterns to identify anomalies that may indicate a security threat.

However, the use of AI also introduces complexities in ensuring the security of the AI systems themselves, as they can become targets for cyberattacks. Therefore, while AI can significantly enhance the capability of cybersecurity defenses, it also requires new strategies to protect the AI systems from sophisticated cyber threats.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The cybersecurity market within the EdTech industry is growing rapidly as educational institutions adopt more digital tools and platforms. Key players in this field are those who provide solutions to safeguard sensitive data, protect online learning environments, and ensure compliance with privacy regulations.

Cisco has been a dominant player in the cybersecurity landscape, partly due to its strategic acquisitions to enhance its cybersecurity capabilities. In 2024, Cisco completed a significant acquisition of Splunk for $28 billion, marking the largest deal in its history. This acquisition is aimed at bolstering Cisco’s data analytics and cyber operation capabilities, positioning it to better manage the complex security needs of educational institutions and other sectors.

Thoma Bravo has made a notable impact through its acquisition strategy, focusing on expanding its cybersecurity portfolio. In 2024, Thoma Bravo acquired Darktrace for $5.3 billion, a move that highlights its commitment to investing in firms with advanced AI cybersecurity solutions. This acquisition is part of Thoma Bravo’s broader strategy to create a robust platform of cybersecurity services.

Mastercard has also been active in expanding its cybersecurity footprint, aiming to integrate comprehensive cybersecurity solutions into its services. The acquisition of Recorded Future for $2.65 billion underscores Mastercard’s strategy to enhance its capabilities in real-time cyber threat intelligence.

Top Key Players in the Market

- BAE Systems Plc

- Broadcom, Inc.

- Centrify Corporation

- Check Point Software Technology Ltd.

- Cisco Systems, Inc.

- FireEye, Inc.

- Fortinet, Inc.

- IBM Corporation

- Lockheed Martin Corporation

- LogRhythm, Inc.

- McAfee, LLC.

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Trend Micro Inc.

- Others

Recent Developments

- In December 2024, OPSWAT, a global leader in critical infrastructure protection, acquired Fend Incorporated, a company specializing in data diode technology. This move is designed to strengthen OPSWAT’s cybersecurity defenses for critical infrastructure, addressing the growing need for advanced protection in this sector.

- In December 2024, Magna5, a national leader in managed IT services and cybersecurity solutions, announced the acquisition of ThreatAdvice. This strategic acquisition aligns with Magna5’s growth strategy, expanding its geographic footprint and enhancing its managed security capabilities to better serve its clients.

- In October 2024, Sophos, backed by Thoma Bravo, announced its agreement to acquire Secureworks from Dell Technologies for $859 million in cash. This acquisition, expected to close in early 2025, aims to enhance Sophos’s product lineup for enterprise customers, enabling them to offer more comprehensive cybersecurity solutions.

Report Scope

Report Features Description Market Value (2024) USD 36 Bn Forecast Revenue (2034) USD 243 Bn CAGR (2025-2034) 21.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Security Type (Endpoint Security, Cloud Security, Network Security, Application Security, Others), By Deployment (Cloud-based, On-premises), By Enterprise Size ( Small & Medium Enterprise Size (SME’s), Large Enterprises), By Sector ( Preschool, K-12, Higher Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BAE Systems Plc, Broadcom Inc., Centrify Corporation, Check Point Software Technology Ltd., Cisco Systems Inc., FireEye Inc., Fortinet Inc., IBM Corporation, Lockheed Martin Corporation, LogRhythm Inc., McAfee LLC., Palo Alto Networks Inc., Proofpoint Inc., Sophos Ltd., Trend Micro Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cybersecurity in EdTech MarketPublished date: Jan. 2025add_shopping_cartBuy Now get_appDownload Sample

Cybersecurity in EdTech MarketPublished date: Jan. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BAE Systems Plc

- Broadcom, Inc.

- Centrify Corporation

- Check Point Software Technology Ltd.

- Cisco Systems, Inc.

- FireEye, Inc.

- Fortinet, Inc.

- IBM Corporation

- Lockheed Martin Corporation

- LogRhythm, Inc.

- McAfee, LLC.

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Trend Micro Inc.

- Others