Global Cyber Warfare Market By End-User Industry (Defense, Government, Aerospace, Homeland, Corporate, Other End-User Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 110644

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

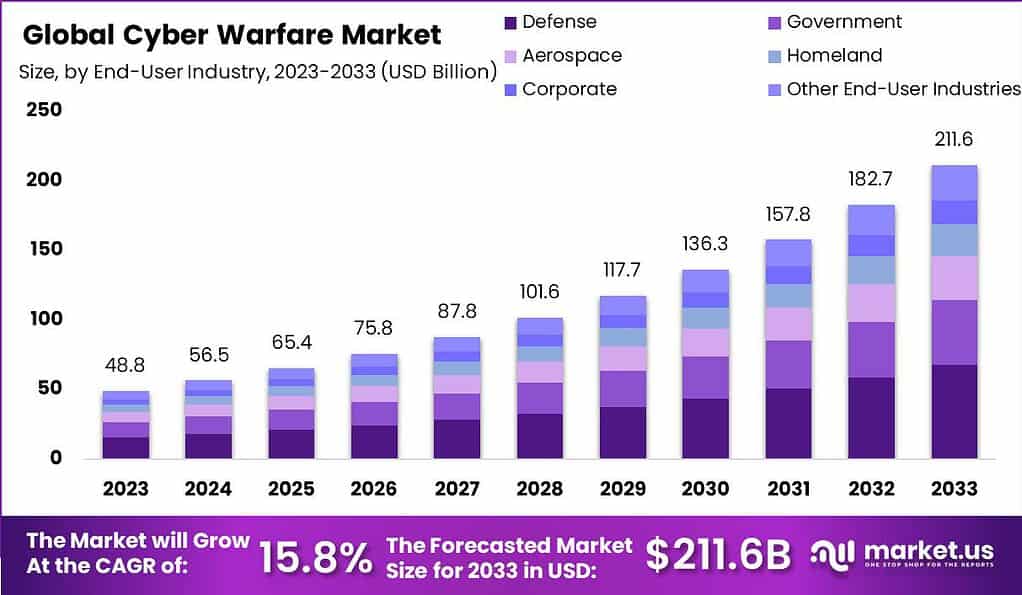

The Global Cyber Warfare Market is likely to secure a valuation of USD 56.5 billion in 2024, with a CAGR of 15.8% during the forecast period 2024-2033. The global market is anticipated to capture a valuation of USD 211.6 billion by 2033.

Cyberwarfare refers to the use of technology, particularly computers and networks to conduct hostile acts in cyberspace. It is the use of vulnerabilities in the digital world and the application of offensive strategies to disrupt and damage or gain access to networks, information systems and infrastructure. Cyberwarfare encompasses a variety of actions, such as attacks on data, hacking, denial of-service attacks, espionage and the spreading of malware.

Note: Actual Numbers Might Vary In Final Report

The cyber warfare market is a reference to the industry that deals with development, deployment, as well as security against cyberwarfare actions. It encompasses a broad range of players, including government agencies, defense organizations cybersecurity firms and intelligence agencies as well as technology companies. This market has been driven by growing dependence on the cyber infrastructure, the rising complexity and frequency of cyber-attacks, and the growing awareness that the impact of cyber-attacks on security of the nation.

Key Takeaways

- Market Growth Projection: Global Cyber Warfare Market is projected to be worth USD 211.6 billion by 2033. It will also have an impressive CAGR at 15.8% Between 2024-2033.

- Definition of Cyberwarfare: Cyberwarfare refers to the use of technology, primarily networks and computers for engaging in criminal activities in cyberspace. This may include exploiting vulnerabilities and conducting hacking, denial of-service attacks, espionage, as well as the spread of malware.

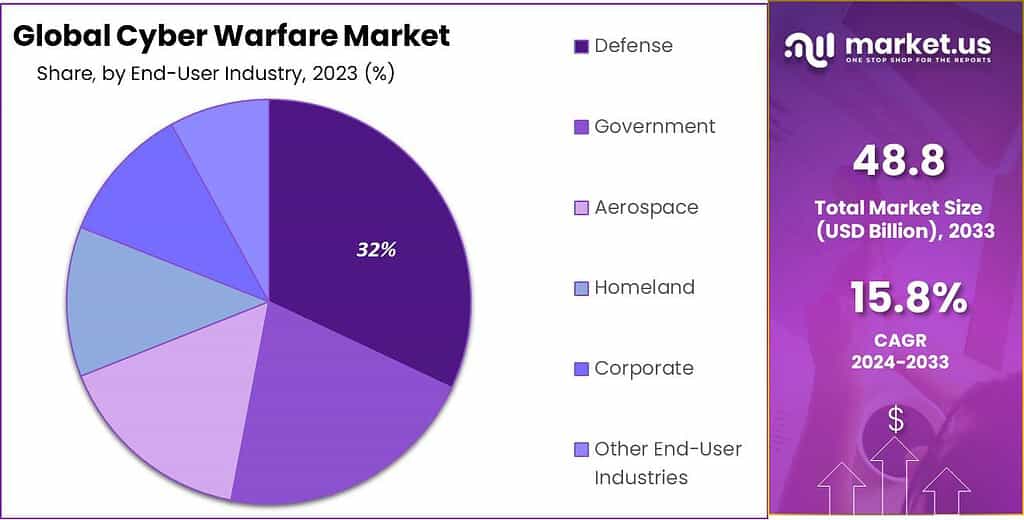

- End-User Industry Analysis: In 2023, the Defense segment dominated the market, with a market share exceeding 32%. This was driven by increased cybersecurity investments to protect sensitive military information and infrastructure.

- Driving Factors: Increasing Cyber Threats: The rise in cyberattacks in terms of frequency and complexity is a major driver.

- Restraining Factors: Complex Threat Landscape: The constantly evolving and complex nature of cyber threats is a significant challenge.

- Growth Opportunities: AI and Machine Learning Integration: AI and machine learning in cybersecurity present significant growth opportunities.

- Challenges: Evolving Attack Techniques: Cyber attackers continuously adapt their techniques.

- Key Market Trends: Rise of Ransomware Attacks: Ransomware attacks have surged, emphasizing the need for robust data protection and incident response.

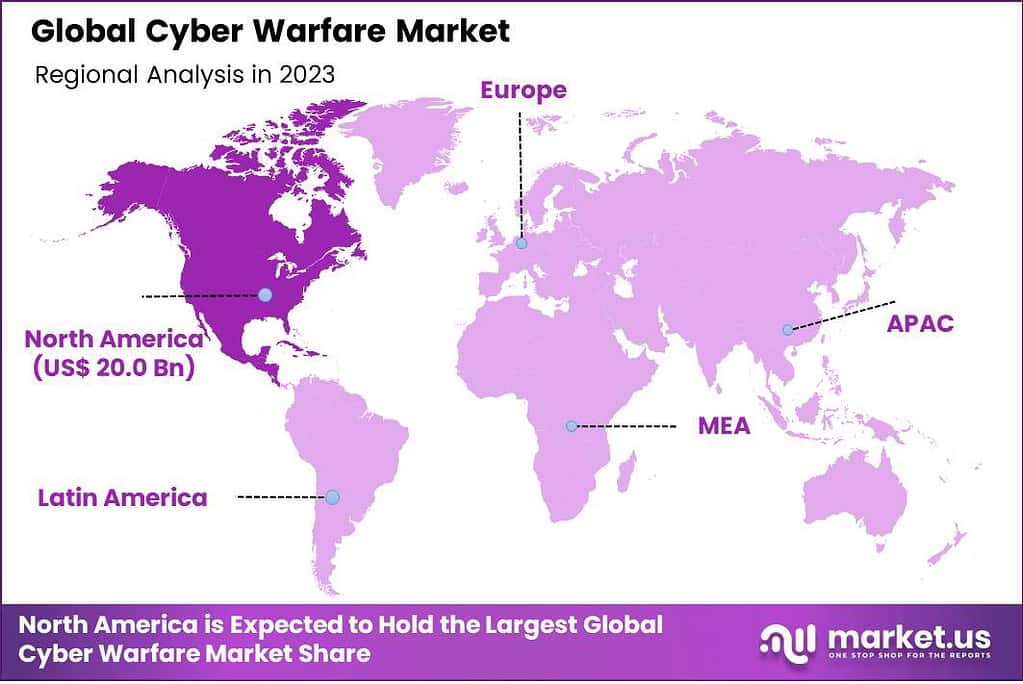

- Regional Analysis: North America: Dominated the market in 2023 due to advanced cybersecurity infrastructure and extensive investments.

- Key Players: Top key players in the Cyber Warfare Market include BAE Systems, Cisco Systems Inc., DXC Technology Company, RTX, Booz Allen Hamilton Inc., General Dynamics Corporation, Intel Corporation, L3Harris Technologies Inc., IBM, and Airbus.

End-User Industry Analysis

In 2023, the Defense segment emerged as a dominant force in the Cyber Warfare Market, commanding a substantial market share of over 32%. This strong foothold can be attributed to the heightened emphasis on safeguarding sensitive military information and infrastructure from cyber threats. Government agencies and defense organizations worldwide have significantly increased their cybersecurity budgets, investing in advanced technologies and strategies to fend off cyberattacks. This segment’s growth is underpinned by a continuous evolution of cyber threats, necessitating robust cybersecurity measures within defense sectors.

Simultaneously, the Government segment also made significant strides, accounting for a notable share of the market. Governments worldwide recognize the critical role of cybersecurity in safeguarding national interests and data integrity. Their proactive approach to countering cyber threats has resulted in substantial investments in cybersecurity solutions and infrastructure. In 2023, this segment showcased substantial growth, driven by the growing sophistication of cyberattacks and the need for rapid response and prevention.

The Aerospace industry, known for its reliance on advanced technologies and data-driven operations, constituted another vital segment in the Cyber Warfare Market. With the increasing integration of digital systems in aerospace operations, the sector faced elevated cybersecurity risks. Consequently, aerospace companies prioritized cybersecurity investments to protect their data and maintain the safety and efficiency of their systems. This segment’s growth in 2023 was fueled by the aerospace industry’s commitment to safeguarding sensitive information and intellectual property from cyber threats.

Within the Homeland segment, homeland security and law enforcement agencies have experienced heightened vulnerability to cyberattacks due to their growing dependence on digital infrastructure for operations. In response to this threat, substantial investments have been directed toward cybersecurity solutions to safeguard critical infrastructure and ensure public safety. The Homeland segment exhibited noteworthy growth in 2023 as these agencies recognized the urgency of fortifying their cyber defenses.

Corporate entities across various industries also played a pivotal role in the Cyber Warfare Market. In the year 2023, corporations acknowledged the potentially catastrophic consequences of cyberattacks, including financial losses and damage to reputation. Consequently, businesses spanning various sectors, including finance, healthcare, and manufacturing, allocated considerable resources to enhance their cybersecurity defenses. This segment’s growth was marked by a heightened awareness of the importance of cybersecurity for sustaining business continuity.

Furthermore, various other end-user industries recognized the imperative of cybersecurity in the digital age. They made substantial investments in cybersecurity solutions to protect their operations, data, and customer trust.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- Increasing Cyber Threats: The relentless rise in cyberattacks, both in terms of frequency and sophistication, is a major driving force. Governments, defense organizations, and corporations are compelled to invest in cyber warfare capabilities to counter evolving threats effectively.

- Digital Transformation: The ongoing digital transformation across industries has expanded the attack surface for cyber threats. As businesses and government sectors adopt more digital technologies, the demand for cybersecurity solutions and strategies to protect sensitive data and critical infrastructure escalates.

- Regulatory Compliance: Stringent cybersecurity regulations and compliance requirements have become a significant driver. Organizations must adhere to these regulations, fostering the need for advanced cybersecurity solutions to meet compliance standards and avoid potential fines.

- Geopolitical Tensions: Heightened geopolitical tensions as well as the use of cyberwarfare as a method of state-sponsored attacks are the main drivers on the market. Nations are investing heavily into defensive and offensive cyber defenses to defend their security interests in cyberspace.

Restraining Factors

- Complexity of Threat Landscape: The constantly evolving and complex nature of cyber threats can be a significant restraining factor. Organizations may struggle to keep up with emerging threats and may find it challenging to implement effective cybersecurity measures.

- Budget Constraints: Limited budgets, especially for smaller organizations, can hinder their ability to invest in robust cyber warfare solutions. This can leave them vulnerable to cyberattacks and limit market growth in certain segments.

- Lack of Skilled Workforce: A shortage of skilled cybersecurity professionals is a critical constraint. Finding and retaining talent with expertise in cyber warfare can be a challenge, affecting an organization’s ability to defend against threats effectively.

- Data Privacy Concerns: Balancing the need for cybersecurity with data privacy concerns is a delicate challenge. Striking the right balance between protecting data and ensuring privacy compliance can be a restraining factor, especially in highly regulated industries.

Growth Opportunities

- AI and Machine Learning Integration: The integration of artificial intelligence (AI) and machine learning in cybersecurity presents significant growth opportunities. These technologies can enhance threat detection and response capabilities, making them essential for future growth.

- Cloud Security Solutions: As more businesses move their operations to the cloud, the demand for robust cloud security solutions grows. Cyber warfare companies can seize opportunities by providing cloud-specific security services.

- IoT Security: With the proliferation of Internet of Things (IoT) devices, there is a growing need for IoT security solutions. This segment offers substantial growth potential as more devices become connected.

- International Collaboration: Collaborative efforts between countries and organizations to combat cyber threats create growth opportunities. Joint initiatives and partnerships can lead to the development of innovative solutions and standards.

Challenges

- Evolving Attack Techniques: Cyber attackers continuously adapt their techniques, making it challenging for defenders to stay ahead. The dynamic nature of cyber threats poses a persistent challenge.

- Supply Chain Vulnerabilities: Supply chain attacks have become a major concern. Securing the entire supply chain, from vendors to partners, is a complex challenge for organizations.

- Zero-Day Vulnerabilities: Identifying and mitigating zero-day vulnerabilities remains a significant challenge. These vulnerabilities are exploited by attackers before patches are available, leaving systems exposed.

- Attribution and Deterrence: Attributing cyberattacks to their source and implementing effective deterrence measures are ongoing challenges. The anonymity of cyberspace complicates efforts to hold malicious actors accountable.

Key Market Trends

- Rise of Ransomware Attacks: Ransomware attacks, where attackers demand a ransom to unlock compromised systems, have surged. This trend emphasizes the need for robust data protection and incident response.

- Nation-State Cyber Warfare: Nation-states engaging in cyber warfare is a prominent trend. Governments are increasingly open about their offensive cyber capabilities and are actively using them in geopolitical conflicts.

- Emphasis on Threat Intelligence: Threat intelligence sharing and analysis have gained prominence. Organizations and governments are pooling resources to better understand and counter cyber threats collectively.

- Cybersecurity Regulations: Stricter cybersecurity regulations are being enacted globally. Compliance with these regulations is a prevailing trend, shaping cybersecurity strategies and investments.

Key Market Segments

End-User Industry

- Defense

- Government

- Aerospace

- Homeland

- Corporate

- Other End-User Industries

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 41% share. This robust presence can be attributed to the region’s advanced cybersecurity infrastructure and extensive investments in cyber warfare capabilities. The United States, in particular, remains at the forefront of cyber warfare developments, driven by government initiatives and a thriving cybersecurity industry.

The demand for Cyber Warfare Market in North America was valued at USD 20.0 billion in 2023 and is anticipated to grow significantly in the forecast period. The presence of major cybersecurity firms, research institutions, and defense organizations further solidifies North America’s position as a cybersecurity leader. The region’s continuous focus on cybersecurity innovation and its commitment to safeguarding critical infrastructure contribute significantly to its market dominance.

Europe, in 2023, maintained a substantial presence in the Cyber Warfare Market, accounting for a notable share. The region’s market growth is driven by increasing cybersecurity awareness among European nations and a growing emphasis on protecting critical digital assets. European countries are actively investing in cyber warfare capabilities to defend against evolving threats, particularly in the context of geopolitical tensions. The European Union’s cybersecurity initiatives and collaborations with industry stakeholders also play a pivotal role in fostering growth within the region’s cyber warfare market.

The Asia-Pacific region exhibited remarkable growth in the Cyber Warfare Market in 2023. With a rapidly expanding digital landscape and a surge in cyber threats, countries across APAC are prioritizing cybersecurity investments. China, India, Japan, and South Korea are notably advancing their cyber warfare capabilities, propelled by the region’s economic growth and technological progress, which intensify the demand for robust cybersecurity solutions. APAC’s emergence as a prominent player in the global cyber warfare arena is underpinned by its commitment to securing critical infrastructure and sensitive data.

In 2023, Latin America demonstrated its presence in the Cyber Warfare Market, contributing to the global landscape. The growth of the region is driven by the fact that governments are recognizing the importance of cybersecurity in a digital society. Countries that are located in Latin America are actively bolstering their cybersecurity defenses, especially in the areas of healthcare, finance and the government. Although the market share might be a bit smaller than other regions, the focus of Latin America on cybersecurity readiness is constantly developing its role in the global cyber war market.

The Middle East and Africa region made notable strides in the Cyber Warfare Market in 2023. With the increasing dependence on digital infrastructures and the increase in cyber threats, organizations and governments across regions are investing heavily in the most advanced cybersecurity strategies. In the Gulf Cooperation Council (GCC) countries in particular are leading the way in cybersecurity initiatives due to the necessity to safeguard vital infrastructure. In addition, the region’s geopolitical complexities contribute to the importance of cybersecurity in countries seeking to protect their interests in cyberspace.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The cyber warfare market comprises several key players that operate in various sectors, including governments, defense organizations, cybersecurity companies, and technology providers. These players contribute to the development, deployment, and defense against cyber warfare activities

Top Key Players

- BAE Systems

- Cisco Systems Inc.

- DXC Technology Company

- RTX

- Booz Allen Hamilton Inc.

- General Dynamics Corporation

- Intel Corporation

- L3Harris Technologies Inc.

- IBM

- Airbus

- Other Key Players

Recent Developments

- In April 2023, the cybersecurity startup Safe Security secured USD 50.1 million in its Series B funding round, with Sorenson Capital taking the lead. The startup affirmed its commitment to ongoing innovation, aiming to stay ahead in the market by leveraging its real-time, data-driven platform designed for managing and mitigating cyber risk.

- By August 2023, the Department of Homeland Security made an announcement regarding the availability of USD 374.10 million in grant funding for the Fiscal Year 2023 State and Local Cybersecurity Grant Program (SLCGP).

Report Scope

Report Features Description Market Value (2023) US$ 48.8 Bn Forecast Revenue (2033) US$ 211.6 Bn CAGR (2024-2033) 15.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By End-User Industry (Defense, Government, Aerospace, Homeland, Corporate, Other End-User Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape BAE Systems, Cisco Systems Inc., DXC Technology Company, RTX, Booz Allen Hamilton Inc., General Dynamics Corporation, Intel Corporation, L3Harris Technologies Inc., IBM, Airbus, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Cyber Warfare?Cyber Warfare refers to the use of technology, particularly computer systems and networks, to conduct hostile activities in cyberspace. It involves exploiting digital vulnerabilities and using offensive tactics to disrupt, damage, or gain unauthorized access to information systems and infrastructure.

How big is Cyber Warfare Market?The Global Cyber Warfare Market is likely to secure a valuation of USD 56.5 billion in 2024, with a CAGR of 15.8% during the forecast period 2024-2033. The global market is anticipated to capture a valuation of USD 211.6 billion by 2033.

What drives the Cyber Warfare Market?The Cyber Warfare Market is primarily driven by the increasing reliance on digital infrastructure, the growing frequency and sophistication of cyber threats, and the recognition of the potential impact of cyber warfare on national security.

Which countries are actively investing in Cyber Warfare capabilities?Countries like China, India, Japan, South Korea, and those in the Gulf Cooperation Council (GCC) region are actively investing in enhancing their cyber warfare capabilities.

what are key players in Cyber Warfare Market?Some of key players are BAE Systems, Cisco Systems Inc., DXC Technology Company, RTX, Booz Allen Hamilton Inc., General Dynamics Corporation, Intel Corporation, L3Harris Technologies Inc., IBM, Airbus, Other Key Players

-

-

- BAE Systems

- Cisco Systems Inc.

- DXC Technology Company

- RTX

- Booz Allen Hamilton Inc.

- General Dynamics Corporation

- Intel Corporation

- L3Harris Technologies Inc.

- IBM

- Airbus

- Other Key Players