Global Crypto Making AI Market Size, Share and Analysis Report By Component (Solutions, Services), By Deployment Mode (Cloud-based/SaaS, Desktop/On-premises), By Application (Automated Trading & Arbitrage, Predictive Analytics & Investing, Risk Management & Portfolio Optimization, Others), By End-User (Retail Investors & Traders, Institutional Investors & Funds, Crypto Exchanges & Market Makers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175095

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Deployment Mode Analysis

- Application Analysis

- End-User Analysis

- Regional Analysis

- Investment Opportunities

- Business Benefits

- Investor Type Impact Matrix

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

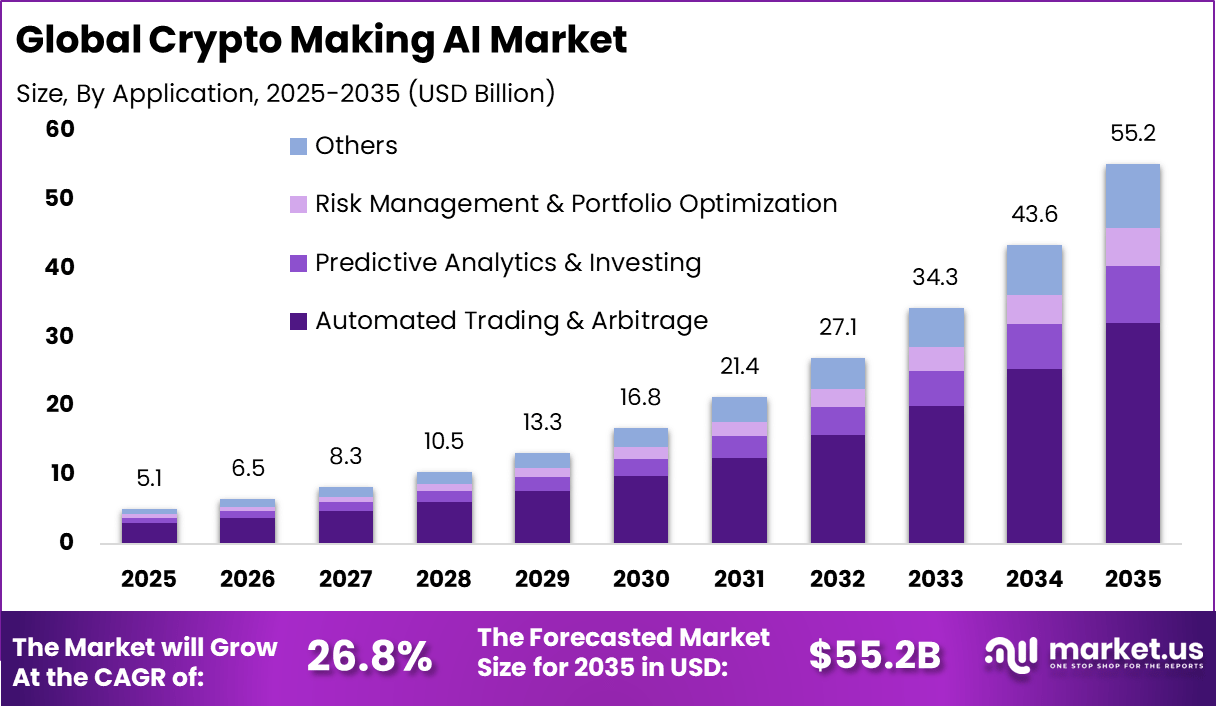

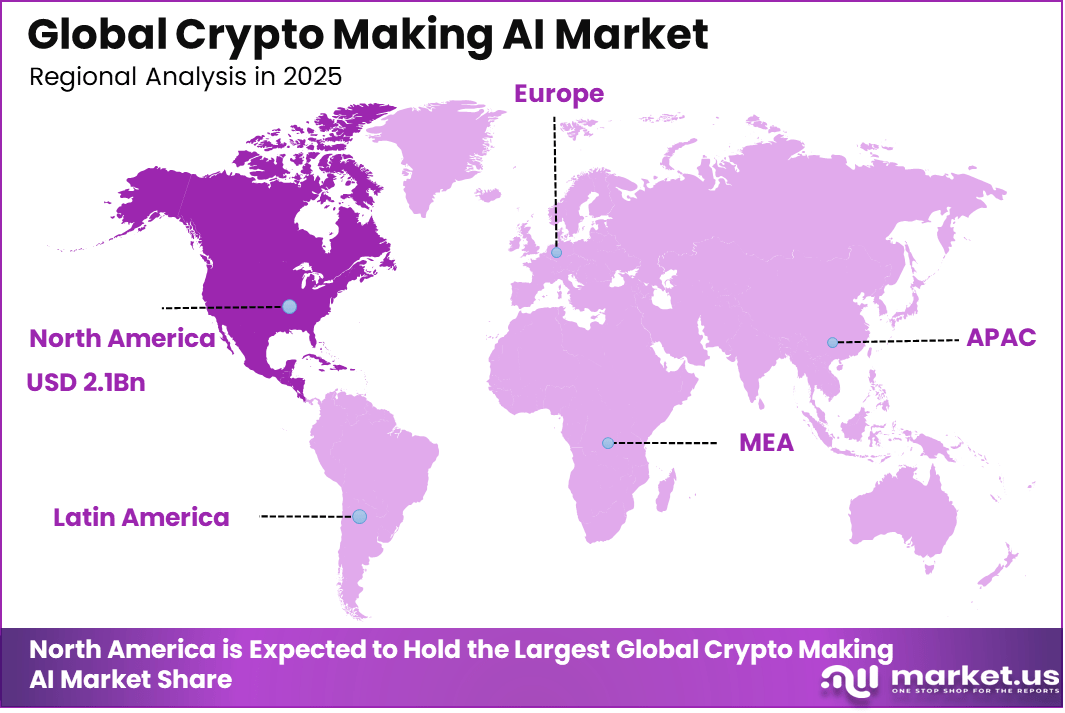

The Global Crypto Making AI Market size is expected to be worth around USD 55.2 Billion By 2035, from USD 5.1 billion in 2025, growing at a CAGR of 26.8% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 42.6% share, holding USD 2.1 Billion revenue.

The crypto making AI market refers to the use of artificial intelligence technologies in the creation, management, and optimization of cryptocurrency assets and blockchain projects. AI is leveraged to design more efficient algorithms, improve mining processes, enhance security, and predict market trends. This includes the development of AI-powered mining hardware, AI-driven trading bots, and intelligent blockchain solutions. Adoption spans cryptocurrency miners, traders, financial institutions, and blockchain developers.

This market development has been influenced by the increasing complexity and volatility of the cryptocurrency market. As digital assets grow in value and adoption, there is a greater need for tools that can handle the complexity of mining, trading, and investment strategies. Traditional methods are often too slow or inefficient to respond to real-time market fluctuations. AI technologies can provide faster, smarter decision-making, improving performance and increasing returns.

One major driving factor of the crypto making AI market is the need for optimized mining processes. Cryptocurrency mining requires significant computational power, which leads to high energy consumption and operational costs. AI can optimize mining algorithms, improve hardware efficiency, and reduce unnecessary energy use. These optimizations make mining more sustainable and cost-effective, encouraging greater adoption in the industry.

Top Market Takeaways

- Software/Solutions led the market with 84.2% share, reflecting the strong demand for AI-driven tools that support trading automation and market analysis.

- Cloud-based/SaaS deployment dominated with a 71.5% share, driven by the flexibility, scalability, and accessibility of cloud solutions for crypto investors.

- Automated Trading & Arbitrage applications captured 58.3%, showcasing AI’s key role in optimizing trading strategies and capturing price differences across exchanges.

- Retail Investors & Traders represented 62.7% of the end-user market, indicating widespread adoption among individual investors seeking AI tools for efficient trading.

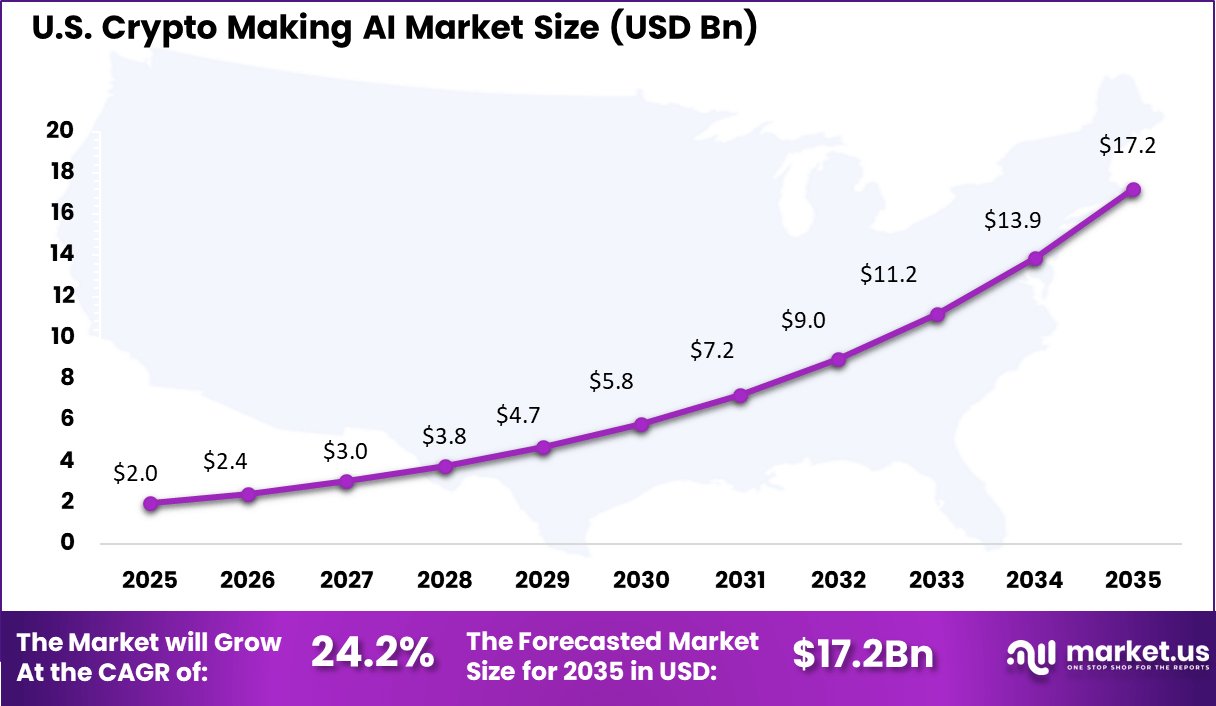

- North America held a 42.63% share, with the U.S. market valued at USD 1.97 billion in 2025, expanding at a 24.22% CAGR, fueled by growing interest in AI for crypto trading.

Quick Market Facts

- AI was the best-performing sector in crypto in 2024, achieving an 84% average log return.

- AI agents led the sector with a 186% return, followed by decentralized compute networks at 41%.

- AI-powered trading bots accounted for approximately 40% of the daily cryptocurrency trading volume in 2023.

- Around 62% of cryptocurrency hedge funds integrated AI for asset management in 2024.

- Top applications of AI in crypto include fraud detection, which reduced scams by 30%, automated trading, and sentiment analysis.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growing interest in cryptocurrency Increased retail and institutional investments ~7.2% Global Short Term Demand for algorithmic trading AI driven efficiency in cryptocurrency trading ~6.5% Global Short Term Expansion of decentralized finance (DeFi) Arbitrage opportunities in DeFi platforms ~5.8% Global Mid Term Need for real time market analysis AI enhancing trading decisions and execution ~5.1% Global Mid Term Growth of retail trading platforms Access to AI tools for individual traders ~4.0% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Market volatility Unpredictable fluctuations in cryptocurrency prices ~5.6% Global Short Term Regulatory uncertainty Changing regulations around AI and cryptocurrency ~4.3% North America, Europe Short Term Data privacy concerns Concerns over user data in AI powered platforms ~3.5% Global Mid Term Algorithm performance limitations AI models underperforming in volatile markets ~2.7% Global Mid Term Dependence on third party platforms Vulnerability to service disruptions ~2.1% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High cost of AI powered tools Premium pricing for advanced algorithms ~6.1% Emerging Markets Short to Mid Term Limited access to quality data Inconsistent cryptocurrency market data ~5.0% Global Mid Term Skills gap in AI and cryptocurrency Lack of expertise in combining AI with crypto ~4.2% Global Mid Term Security concerns Cybersecurity risks in trading platforms ~3.3% Global Long Term Regulatory hurdles Impact of stricter government regulations ~2.5% North America, Europe Long Term Component Analysis

Software and Solutions – 84.2%

Software and solutions account for 84.2% of the crypto making AI market, reflecting the software-driven nature of automated crypto systems. These platforms integrate data ingestion, model execution, and decision logic within unified environments. Users rely on software solutions to manage trading strategies, risk controls, and execution processes efficiently.

AI-powered software enables continuous market monitoring and rapid response to price movements. Built-in analytics and automation reduce the need for manual intervention. This improves consistency and operational speed.

As crypto markets remain highly dynamic, demand for robust software solutions continues to rise. Platform flexibility and upgradeability support long-term use. This keeps software as the dominant component in the market.

Deployment Mode Analysis

Cloud-Based and SaaS – 71.5%

Cloud-based and SaaS deployment holds a 71.5% share, driven by scalability and ease of access. Cloud platforms allow users to deploy AI models without managing local infrastructure. This lowers entry barriers for a wide range of market participants. Cloud deployment supports real-time data processing and global market access.

Updates and model improvements can be implemented seamlessly. This ensures systems remain aligned with changing market conditions. The preference for cloud-based models is also influenced by cost efficiency. Subscription-based access supports flexible usage. Cloud and SaaS deployment remains the preferred approach in this market.

Application Analysis

Automated Trading and Arbitrage – 58.3%

Automated trading and arbitrage account for 58.3% of application demand, making it the primary use case. AI systems identify price inefficiencies across exchanges and execute trades at high speed. This reduces latency and improves execution accuracy. Arbitrage strategies rely on continuous monitoring of multiple markets.

AI enhances detection of short-lived opportunities that are difficult to capture manually. Automation improves consistency in trade execution. As trading volumes grow, reliance on automated strategies increases. Speed and precision become competitive advantages. This application segment continues to drive market adoption.

End-User Analysis

Retail Investors and Traders – 62.7%

Retail investors and traders represent 62.7% of end-user demand, highlighting growing individual participation in AI-driven crypto trading. User-friendly platforms make advanced AI tools accessible to non-institutional users. This expands the user base significantly. Retail users adopt AI tools to manage volatility and reduce emotional decision making.

Automated strategies provide structured trading approaches. This improves discipline and consistency. As retail crypto participation increases, demand for AI tools continues to grow. Education and platform usability support adoption. Retail users remain the largest end-user segment.

Regional Analysis

Market Share 42.63% | United States USD 1.97 Billion | CAGR 24.22%

North America holds a 42.63% share of the crypto making AI market, supported by advanced digital infrastructure and high crypto adoption. The region benefits from a strong ecosystem of technology developers and trading platforms. Regulatory clarity also supports structured market participation.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America High adoption of cryptocurrency trading 37.8% USD 1.94 Bn Advanced Europe Strong institutional interest and market development 29.5% USD 1.52 Bn Advanced Asia Pacific High retail investor activity in digital currencies 21.3% USD 1.09 Bn Developing to Advanced Latin America Growing crypto adoption as alternative investment 7.2% USD 0.37 Bn Developing Middle East and Africa Early stage crypto trading infrastructure 4.2% USD 0.22 Bn Early

The United States contributes USD 1.97 billion in market value, driven by active retail trading and technology innovation. Users seek advanced tools to navigate volatile crypto markets. AI solutions align well with these needs. A CAGR of 24.22% reflects strong growth momentum across the region. Increasing adoption of automated trading supports expansion. North America remains a key region for crypto making AI solutions.

Investment Opportunities

Investment opportunities in the crypto-making AI market exist in AI-driven mining optimization solutions. Miners and hardware manufacturers are increasingly investing in AI technologies to improve hardware efficiency and reduce power consumption. Solutions that make mining more sustainable and profitable are highly attractive to investors, as the energy-intensive nature of mining requires ongoing innovation. The potential for cost reduction and increased profitability makes AI-driven mining technologies a key investment area.

Another opportunity lies in AI-powered trading solutions. As the cryptocurrency market grows, demand for intelligent trading tools that can analyze large volumes of market data and make split-second decisions increases. AI-based trading bots and platforms that can maximize profits through algorithmic trading are highly attractive investment targets. The growing popularity of cryptocurrency trading and the rise of institutional investors offer significant expansion opportunities in this space.

Business Benefits

AI-powered solutions in the crypto-making market improve operational efficiency by automating complex tasks such as mining optimization and trading. This reduces the need for manual intervention and lowers labor costs. Automation increases throughput and profitability, allowing businesses to scale without increasing resource investment. Operational efficiency gains are critical in a highly competitive market.

These solutions also improve decision-making accuracy. AI can analyze large volumes of market data, identify trends, and execute trades based on predefined parameters, which reduces human error and emotional bias in trading. In mining, AI can optimize hardware usage and energy efficiency, leading to reduced costs and higher profits. Business outcomes benefit from more accurate, data-driven decisions.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Retail investors and traders Very High ~62.7% Profit from trading and arbitrage Frequent platform usage Cryptocurrency exchanges High ~17.8% Integration of AI for trading efficiency Platform based adoption Hedge funds and institutional investors High ~11.0% High frequency trading algorithms Strategic deployment Financial technology providers Moderate ~6.5% Enhancing trading tools and platforms Partnership with exchanges Government and regulators Low ~2.0% Regulatory oversight of crypto trading Policy formulation Driver Analysis

The crypto making AI market is being driven by the increasing integration of artificial intelligence into the creation, optimisation, and management of digital assets and blockchain protocols. AI technologies enhance efficiency in generating new cryptocurrencies, automating smart contract development, and optimising tokenomics through predictive modelling and adaptive algorithms.

Blockchain developers and organisations seek AI‑enabled tools to reduce manual coding effort, improve security posture, and support rapid deployment of crypto assets that align with network performance and community dynamics. As interest in decentralised finance, tokenisation, and Web3 ecosystems grows, demand for intelligent platforms that streamline crypto creation and governance continues to strengthen.

Restraint Analysis

A significant restraint in the crypto making AI market relates to regulatory uncertainty and the potential for misuse of automated crypto creation tools. Authorities in many jurisdictions are still refining legal frameworks for digital asset issuance, token classifications, and compliance obligations, which can lead to hesitancy among developers and enterprises to adopt AI‑powered crypto generation solutions.

Additionally, the complexity of aligning AI‑generated crypto logic with evolving security standards and best practices introduces technical risk, as flaws in automated smart contract creation can expose networks to vulnerabilities or economic exploits. These concerns can slow market uptake until clearer governance and compliance models emerge.

Opportunity Analysis

Emerging opportunities in the crypto making AI market are linked to the expansion of tools that support personalised, purpose‑built token ecosystems and adaptive governance models. AI platforms that enable predictive analysis of token performance, demand forecasting, and community behaviour can help developers design crypto assets that better align with use case objectives and market dynamics.

There is also potential for integration with decentralised autonomous organisation infrastructures, where AI contributions assist in proposal evaluation, consensus formulation, and incentive optimisation. As decentralised applications proliferate across gaming, finance, supply chain, and identity domains, intelligent crypto creation tools that lower technical barriers and improve design quality can attract broader participation.

Challenge Analysis

A central challenge confronting this market involves balancing automated AI outputs with human oversight, interpretability, and ethical design principles. While AI can generate code structures, token frameworks, and economic models at scale, human experts must validate that outputs align with strategic goals, ethical constraints, and practical usability criteria.

Ensuring transparency of AI decision‑making, preventing biased or unsafe code generation, and embedding robust risk controls into automated workflows require rigorous testing and governance oversight. In the absence of clear explainability, stakeholders may be reluctant to trust AI‑driven crypto creation for high‑stake or financial‑critical deployments.

Emerging Trends

Emerging trends in the crypto making AI landscape include the use of generative models to assist in smart contract drafting, automated security testing, and dynamic tokenomics simulation. Developers are exploring hybrid AI workflows that combine automated generation with contextual prompts, allowing tailored asset design that reflects project vision and community needs.

There is also growing interest in AI‑assisted auditing tools that analyse contracts post‑generation for vulnerabilities, compliance gaps, and optimisation opportunities. Integration with visual design interfaces and low‑code/no‑code crypto builders is expanding accessibility for creators with limited programming expertise.

Growth Factors

Growth in the crypto making AI market is supported by the expanding adoption of decentralised finance and blockchain solutions that require scalable, secure, and adaptable digital asset frameworks. Advances in AI, natural language understanding, and pattern recognition enhance the capability to produce high‑quality crypto code and predictive insights that inform design decisions.

Increasing participation from developers, entrepreneurs, and enterprises seeking to tokenise assets or launch decentralised applications reinforces demand for intelligent tooling that accelerates creation cycles and reduces technical friction. As tooling matures and ecosystem education improves, AI‑powered approaches to crypto generation are expected to play a central role in driving innovation and lowering entry barriers within the broader decentralised economy.

Key Market Segments

By Component

- Solutions

- Algorithmic Trading & Execution Bots

- Market Sentiment & News Analysis Tools

- Quantitative Modeling & Strategy Backtesting

- Portfolio Management & Rebalancing

- Others

- Services

- Professional Services

- Strategy Development & Customization

- System Integration & Deployment

- Managed Trading & Advisory Services

- Others

- Professional Services

By Deployment Mode

- Cloud-based/SaaS

- Desktop/On-premises

By Application

- Automated Trading & Arbitrage

- High-Frequency Trading

- Cross-exchange Arbitrage

- Predictive Analytics & Investing

- Price & Trend Prediction

- Token & Project Evaluation

- Risk Management & Portfolio Optimization

- Others

By End-User

- Retail Investors & Traders

- Institutional Investors & Funds

- Crypto Exchanges & Market Makers

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Leading platforms such as Coinbase Global, Inc., 3Commas, and Cryptohopper focus on AI-driven automated trading and portfolio management. Their solutions support strategy automation, risk controls, and real-time market signals. Integration with major crypto exchanges strengthens usability. These players benefit from strong brand recognition and large user bases. Demand is driven by retail traders seeking efficiency and reduced manual trading complexity.

Mid-tier and strategy-focused providers such as Bitsgap, TradeSanta, and Pionex emphasize grid trading, arbitrage, and AI-assisted strategies. Trality and Hummingbot support advanced users and developers. These platforms attract users seeking customizable strategies and transparent performance logic. Adoption is supported by rising volatility and continuous crypto market activity.

Emerging and community-driven players such as Mudrex, Stacked, and Shrimpy focus on simplified AI-driven investing. Zignaly, HaasOnline, and Gunbot expand feature depth for active traders. Other vendors increase competition and innovation. This ecosystem supports steady growth and broader adoption of AI-powered crypto trading solutions.

Top Key Players in the Market

- Coinbase Global, Inc.

- 3Commas

- Cryptohopper

- Bitsgap

- TradeSanta

- Pionex

- Trality

- Hummingbot

- Mudrex

- Stacked

- Shrimpy

- Kryll.io

- Zignaly

- HaasOnline

- Gunbot

- Others

Recent Developments

- In February 2025, 3Commas rolled out “3Commas for Asset Managers,” a tool that automates trading across client accounts on major exchanges. It uses secure connections without sharing API keys and supports bulk strategies for pros managing multiple portfolios.

- Hummingbot teamed up with Bitget in September 2025 to add a perpetual futures connector, making open-source market-making and arbitrage easier on their platform. This helps deepen liquidity for derivatives traders using transparent strategies.

Report Scope

Report Features Description Market Value (2025) USD 5.1 Bn Forecast Revenue (2035) USD 55.2 Bn CAGR(2026-2035) 26.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment Mode (Cloud-based/SaaS, Desktop/On-premises), By Application (Automated Trading & Arbitrage, Predictive Analytics & Investing, Risk Management & Portfolio Optimization, Others), By End-User (Retail Investors & Traders, Institutional Investors & Funds, Crypto Exchanges & Market Makers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Coinbase Global, Inc., 3Commas, Cryptohopper, Bitsgap, TradeSanta, Pionex, Trality, Hummingbot, Mudrex, Stacked, Shrimpy, Kryll.io, Zignaly, HaasOnline, Gunbot, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are AI cryptocurrencies?AI cryptocurrencies are digital assets linked to blockchain projects that integrate artificial intelligence technologies, such as machine learning, data analytics, automation, and decentralized AI services.

What are the best 3 performing AI cryptocurrencies right now?Best 3 performing Artificial Intelligence cryptocurrencies right now are:

- UnifAI with +35.54%

- Story with +33.49%

- Akash Network with +14.10%

Which are the top 5 AI crypto coins of January 2026?Top 5 crypto AI projects Top 5 AI Crypto Coins of January 2026

- Near Protocol (NEAR)

- Internet Computer (ICP)

- Render (RENDER)

- Bittensor (TAO)

- The Graph (GRT)

-

-

- Coinbase Global, Inc.

- 3Commas

- Cryptohopper

- Bitsgap

- TradeSanta

- Pionex

- Trality

- Hummingbot

- Mudrex

- Stacked

- Shrimpy

- Kryll.io

- Zignaly

- HaasOnline

- Gunbot

- Others