Global Cruise Market By Type (Ocean Cruises, River Cruises), By Application (Daily Commute, Touring), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 22103

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

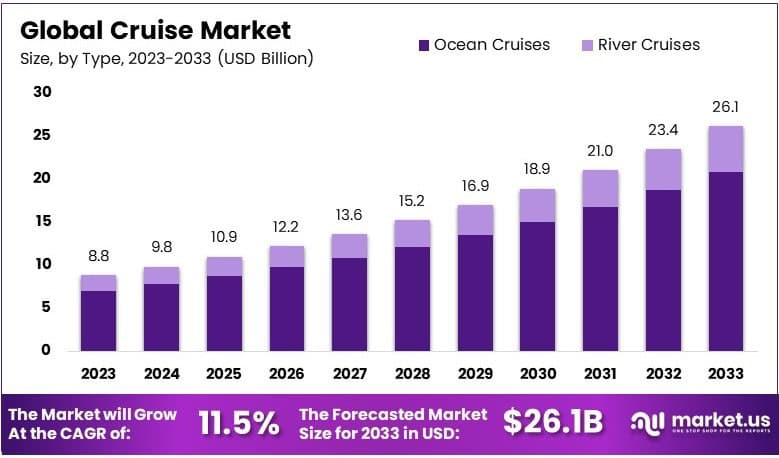

The Global Cruise Market size is expected to be worth around USD 26.1 Billion by 2033, from USD 8.8 Billion in 2023, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

A cruise is a voyage, typically aboard a large passenger ship, for leisure or tourism. It often includes a variety of entertainment, dining, and recreational activities, with stops at multiple destinations. Cruises cater to different segments, from luxury to family-oriented experiences, and vary in duration and destination options.

The cruise market refers to the global industry that encompasses the operation of cruise ships, offering travel experiences to passengers. This market includes cruise operators, port facilities, and supporting industries like travel agencies and tour operators. It is driven by consumer demand for leisure travel and is influenced by economic, regulatory, and technological factors.

The cruise market is poised for sustained growth, driven by rising demand for both luxury and family-oriented experiences. The luxury travel segment continues to thrive, with brands like Regent Seven Seas and Oceania Cruises attracting high-net-worth individuals (HNWIs) who seek personalized services.

Additionally, river cruising in Europe and Asia is expanding, supported by growing interest from U.S. travelers. According to AmaWaterways, over 50% of its passengers come from the U.S., underscoring the North American market’s central role.

Market competitiveness is high, with top players like Carnival Corporation, Royal Caribbean, and MSC Cruises dominating the sector. The cruise industry is also witnessing market saturation, especially in traditional destinations, which has led operators to diversify offerings. Technological innovation, including eco-friendly designs, will help drive future growth.

The shift toward sustainability aligns with both consumer preferences and stricter government regulations on emissions, particularly with the International Maritime Organization’s directive to reduce CO2 emissions by 70% by 2050.

Demand for cruises remains strong, particularly in the luxury segment, as affluent travelers increasingly seek bespoke travel experiences. Regent Seven Seas reports that over 40% of its passengers are aged 50 and above, with an average spend of $15,000 per person on extended voyages.

Additionally, the increase in the number of billionaires, especially in the U.S. and China, presents a significant opportunity for luxury cruise lines. The rise of family cruising, with brands like Disney Cruise Line seeing 4 million passengers in 2022, also contributes to market expansion.

Governments are actively supporting the cruise industry through investments in infrastructure and stricter environmental regulations. For instance, Canada has committed $35 million to modernize cruise port facilities on the east coast.

Additionally, the U.S. EPA’s emission standards, aimed at reducing sulfur emissions by 90% by 2025, push cruise operators toward greener solutions. These investments and regulations are reshaping the market landscape, fostering sustainability while driving growth.

Key Takeaways

- The Cruise Market was valued at USD 8.8 Billion in 2023, and is expected to reach USD 26.1 Billion by 2033, growing at a CAGR of 11.5% during the forecast period from 2024 to 2033.

- In 2023, Ocean Cruises dominate the market with 79.7% of the market share due to their luxury offerings and high demand from emerging markets.

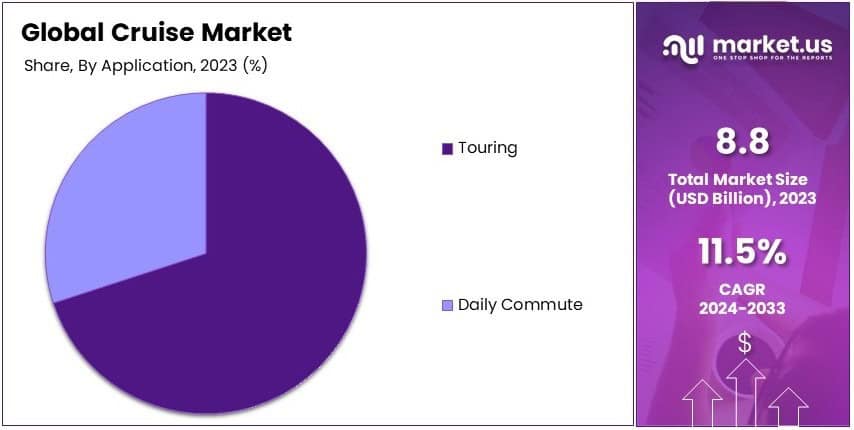

- In 2023, Touring Cruises dominate and are growing due to demand for niche, immersive travel experiences with cultural and adventure itineraries.

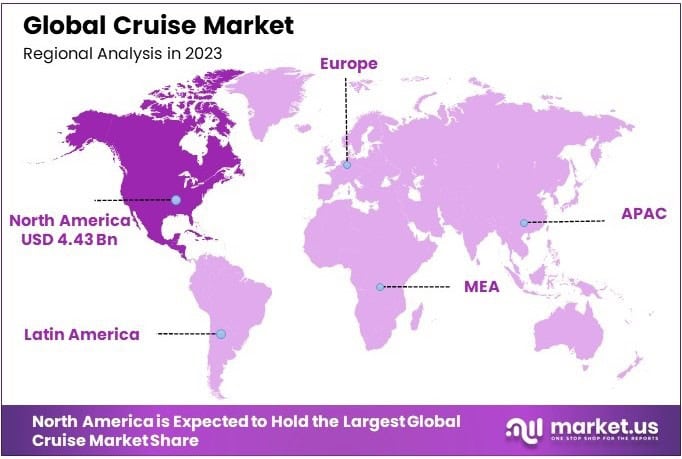

- In 2023, North America dominates the market with 50.3% market share, benefiting from high demand and advanced tourism infrastructure in the region.

Cruise Industry Latest Investments

- AD Ports Group: On June 2024, AD Ports Group, based in the UAE, announced an investment of $4.7 million to upgrade and enhance Egypt’s cruise terminal infrastructure. The investment is aimed at modernizing the facilities to accommodate increasing cruise tourism demand in the region.

- Disney Cruise Line: On September 2024, Disney Cruise Line unveiled plans for a new addition to its fleet with the D23 Horizon, set to expand its offerings in the cruising industry. The ship will include innovative features, including family-friendly amenities and immersive Disney-themed experiences.

- PhilaPort: On October 2024, PhilaPort introduced its Strategic Plan 2040, focusing on the development of enhanced cruise and warehouse facilities to strengthen the port’s competitive position. The plan includes expanding cruise terminal capabilities and improving infrastructure to accommodate a growing volume of travelers and cargo.

- Royal Caribbean: On October 2024, Royal Caribbean announced the acquisition of Costa Maya, a popular cruise port in Mexico’s Caribbean region, with plans to transform it into a world-class destination. The redevelopment will include enhanced amenities, attractions, and services aimed at offering a superior cruise experience.

Cruise Industry Technological Advancements

- Singapore Cruise Center: On November 2024, the Singapore Cruise Center (SCC) partnered with SITA to improve its ferry travel experience through cutting-edge technology. The collaboration includes deploying SITA’s Airport Management and Check-in solutions to streamline passenger processes, enhance operational efficiency, and ensure smoother travel for customers.

- Cordelia Cruises: On August 2024, Cordelia Cruises introduced innovative cellular technology from WMSS to enhance guest experiences on board. The new technology enables faster and more reliable connectivity for guests while traveling, addressing the growing demand for seamless digital experiences on cruise ships.

- Marella Cruises: On October 2024, Marella Cruises partnered with Speedcast and Eutelsat Group to introduce OneWeb’s low Earth orbit (LEO) technology across its fleet, enhancing connectivity onboard. This advanced satellite technology allows Marella Cruises to offer faster and more stable internet services, ensuring an exceptional digital experience for passengers.

- Virgin Voyages: On September 2024, Virgin Voyages is set to revolutionize the cruise industry with its adoption of advanced revenue management technology aimed at optimizing pricing strategies. The innovative system uses artificial intelligence (AI) to adjust pricing dynamically, ensuring that the cruise line maximizes revenue while offering competitive rates to passengers.

Type Analysis

Ocean Cruises dominate with 79.7% due to a combination of luxury offerings, innovative itineraries, and high demand from emerging markets.

The ocean cruise segment dominates the global cruise market, accounting for 79.7% of the total cruise market share. This dominance can be attributed to the vast network of ocean cruise routes and the increasing popularity of large, luxury cruise ships. These cruises offer a wide array of destinations, often encompassing multiple countries and continents, which appeals to travelers seeking diverse vacation experiences.

The growth of the ocean cruise market is driven by the rising demand for longer, more luxurious voyages and all-inclusive cruise packages. Additionally, advancements in cruise ship technology, including environmental sustainability measures and improved onboard amenities, have further bolstered this segment’s growth.

The river cruise segment, though much smaller compared to ocean cruises, is steadily growing due to its appeal to a different group of travelers. River cruises typically offer more intimate, culturally immersive experiences compared to the larger ocean-going vessels.

While it represents a smaller portion of the market, the river cruise industry has seen consistent growth in recent years. Travelers opting for river cruises tend to be older, often retirees, who seek a more relaxed, scenic journey through historic and picturesque locations along major rivers such as the Danube, Rhine, and Nile.

The increasing popularity of river cruises can also be attributed to the expanding fleet of luxury river cruise vessels, which offer upscale amenities and more personalized service. The segment is attracting affluent travelers looking for a quieter, more refined travel experience.

Applications Analysis

Touring Cruises are growing due to a demand for niche, immersive travel experiences with cultural and adventure-focused itineraries.

The touring segment within the cruise market is one of the most rapidly growing areas, as consumers are increasingly looking for enriching, all-inclusive vacation experiences. Touring cruises often combine the experience of traveling by sea with excursions that explore historic sites, cultural landmarks, and scenic vistas.

Touring cruises typically involve itineraries that focus on specific themes, such as wine tours, adventure expeditions, or historical explorations. This focus on niche experiences allows touring cruises to cater to specific traveler preferences, making them a highly targeted and appealing option. The rising interest in adventure tourism and experiential travel has been a key factor driving growth in this sub-segment.

The daily commute segment in the cruise market is less prominent compared to leisure-focused cruising but plays a crucial role in certain regions, especially where water transport is used for daily travel. This sub-segment includes short-distance commuter services between cities or islands, especially in areas where the geography makes land transport less feasible.

Though it accounts for a smaller share of the market compared to tourism-focused segments, the daily commute segment has remained steady due to its necessity in certain urban environments. The demand for commuter cruises is primarily driven by the cost-effectiveness and convenience they offer, allowing commuters to avoid the often congested roads and bridges.

Key Market Segments

By Type

- Ocean Cruises

- River Cruises

By Applications

- Daily Commute

- Touring

Drivers

Consumer Preferences for Luxury and Experience Drives Market Growth

The growing demand for luxury travel experiences is one of the primary driving forces behind the expansion of the cruise market. Consumers increasingly seek unique, all-inclusive vacation options, with a focus on high-end amenities, personalized services, and exotic destinations.

This shift in consumer preferences has led to an increase in demand for luxury cruises, particularly those offering exclusive onboard experiences, gourmet dining, and premium entertainment options.

Cruise operators have responded by investing in larger and more luxurious ships equipped with state-of-the-art technology and exclusive features, such as spas, fine dining restaurants, and private suites.

Furthermore, travelers are increasingly interested in experiences that combine relaxation with adventure, leading to a rise in demand for themed cruises that focus on cultural immersion, nature exploration, and unique ports of call. As these preferences continue to evolve, cruise lines are expanding their offerings to meet the desires of affluent customers, thus driving significant market growth.

Restraints

Environmental Sustainability Challenges Restraints Market Growth

Environmental concerns and regulatory requirements present significant challenges to the cruise market’s growth. The cruise industry faces increasing pressure to reduce its carbon footprint and adopt sustainable practices, particularly in light of rising public awareness about climate change.

Although cruise operators have made strides in improving fuel efficiency and reducing waste, the environmental impact of large ships remains a point of contention.

Additionally, the high operational costs associated with adopting more sustainable technologies can be a deterrent for some companies, especially smaller operators. Furthermore, stricter regulations in key markets, such as the European Union and North America, require substantial investments in emission-reducing technologies, which can create financial burdens. These factors collectively restrain the growth of the market by increasing operational costs and limiting the profitability of cruise lines.

Opportunity

Expanding Cruise Networks Provides Opportunities

The expansion of cruise routes and the growing accessibility of new destinations present significant opportunities for the cruise market. As new ports open in previously unexplored regions, such as Asia and Africa, cruise operators have the chance to tap into untapped customer bases and diversify their itineraries.

Additionally, the growth of river cruising in less-developed regions has become an attractive opportunity for cruise lines to diversify their offerings and attract different customer segments.

The expansion of cruise fleets and the introduction of smaller, more agile ships are also helping operators serve niche markets, such as luxury travelers and adventure seekers. As more destinations become accessible by cruise, the market can attract a wider range of customers seeking unique and customized experiences.

Furthermore, partnerships between cruise lines and travel agencies offer further opportunities for joint promotions and package deals, increasing consumer awareness and driving bookings.

Challenges

High Operational Costs and Economic Instability Challenges Market Growth

The cruise industry faces several challenges that may hinder its growth, particularly related to high operational costs and economic volatility. Operating large vessels with high fuel consumption, maintenance needs, and staffing requirements often results in significant expenses for cruise lines.

Furthermore, economic downturns can directly impact consumer spending on discretionary items, such as leisure travel, making the cruise market vulnerable to shifts in the economic environment.

Economic instability in key markets, such as the US and Europe, may cause potential customers to reduce their travel budgets or opt for more affordable vacation options.

In addition, fluctuations in fuel prices and changes in exchange rates can increase operational costs, creating financial uncertainty for operators. These factors, while temporary, can put pressure on cruise companies, potentially limiting their ability to expand their services or invest in new ships and technologies.

Growth Factors

Technological Advancements Is Growth Factors

Technological advancements are playing a crucial role in driving the growth of the cruise market. Innovations in shipbuilding, such as the development of larger, more fuel-efficient vessels, are reducing operational costs while enhancing the overall cruise experience.

The integration of advanced technologies like smart cabins, Internet of Things (IoT) devices, and artificial intelligence (AI) is improving customer service and streamlining onboard operations.

Moreover, the use of big data and predictive analytics is helping cruise lines better understand customer preferences, leading to more personalized services and tailored itineraries.

Additionally, technological improvements in navigation, safety, and entertainment are further enhancing the appeal of cruises to a broader audience. As technology continues to evolve, it will provide cruise operators with more efficient ways to reduce costs, improve service offerings, and cater to the changing demands of customers.

Emerging Trends

Wellness and Sustainability Trends Are Latest Trending Factors

Recent trends in wellness and sustainability are increasingly shaping the future of the cruise industry. As consumers become more health-conscious, cruise lines are responding by incorporating wellness programs, spa services, and fitness facilities into their offerings. These wellness-focused experiences cater to travelers seeking holistic, rejuvenating vacations that prioritize mental and physical well-being.

Additionally, there is a growing demand for sustainable cruising options, with customers favoring cruise lines that prioritize eco-friendly practices, such as using renewable energy sources, minimizing waste, and reducing carbon emissions.

The trend toward sustainable tourism is prompting cruise operators to invest in cleaner technologies and environmentally friendly ship designs, as well as offering more environmentally responsible excursions. As wellness and sustainability become more central to consumer preferences, these trends will continue to influence the cruise market’s offerings and expansion.

Regional Analysis

North America Dominates with 50.3% Market Share

North America holds a commanding share of the global cruise market, with a market share of 50.3% and a value of USD 4.43 billion in 2023. This dominance is driven by a combination of factors, including strong consumer demand for cruise vacations, particularly from the U.S. and Canada. The region’s advanced infrastructure, well-developed tourism industry, and favorable regulatory environment further enhance its position.

The United States, as the world’s largest cruise market, benefits from a high concentration of cruise ports, offering a wide variety of destinations and itineraries for consumers. U.S. cruise lines like Carnival and Royal Caribbean continue to lead the market in both passenger numbers and fleet size.

Additionally, Canada has experienced growth, with 1.3 million Canadian passengers taking cruises in 2022, marking a 20% increase from the previous year as travel restrictions eased. This resurgence reflects a pent-up demand for cruise vacations and is expected to contribute to the region’s continued dominance.

In 2023, North America’s dominance is further supported by government initiatives. For example, the U.S. Environmental Protection Agency (EPA) has implemented stricter air quality standards under the Cruise Vessel Environmental Standards Act, which aims to reduce sulfur emissions by 90% and nitrogen oxide emissions by 80% by 2025. These regulations are pushing the industry toward greater sustainability while maintaining a competitive edge for North American cruise lines.

The future of the North American cruise market looks promising, with continued investment in port infrastructure and the growing adoption of sustainable practices. The region is expected to maintain its leadership position as consumers increasingly prioritize environmentally responsible travel and seek out new and exciting cruise experiences.

Regional Mentions:- Europe: Europe is a strong contender in the global cruise market, with a focus on luxury and river cruising. The region’s rich cultural heritage and numerous coastal destinations make it a prime location for cruise tourism.

- Asia Pacific: Asia Pacific is emerging as a key market for the cruise industry, with rising disposable incomes and increasing tourism in countries like China and Japan. The growing demand for cruises is expected to drive future market expansion in this region.

- Middle East & Africa: The Middle East and Africa are expanding their cruise offerings, with ports like Dubai becoming major cruise hubs. The region’s investment in luxury tourism and infrastructure development supports this growth trend.

- Latin America: Latin America’s cruise market is growing, particularly in Brazil and Argentina. As tourism infrastructure improves, more passengers are choosing cruises as a preferred vacation option, contributing to regional growth.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Cruise Market is highly competitive, with several major players dominating the industry. Among these, the top four companies—Carnival Corporation & Plc, Royal Caribbean Group, MSC Cruises S.A., and Norwegian Cruise Line Holdings Ltd.—account for a significant portion of the market share. These companies lead the market through extensive fleets, a wide range of cruise offerings, and strong global brand recognition.

Carnival Corporation & Plc is the largest player in the global cruise industry, operating a fleet of over 100 ships across several well-known brands, including Carnival Cruise Line, Princess Cruises, and Holland America Line. The company’s extensive reach, catering to both budget and luxury cruise segments, allows it to capture a broad customer base.

Royal Caribbean Group is another major player, renowned for its innovative ships and luxury offerings. Its brands, including Royal Caribbean International and Celebrity Cruises, focus on providing high-end experiences with cutting-edge technology, such as smart ships with AI-based features.

MSC Cruises S.A. is one of the fastest-growing cruise lines, with a rapidly expanding fleet. The company focuses on offering luxury cruises with an emphasis on sustainability and eco-friendly operations. MSC’s ability to offer a wide variety of cruise experiences, from family-friendly to upscale, makes it a key player in both the European and global markets.

Norwegian Cruise Line Holdings Ltd. operates multiple brands, including Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. Known for its “Freestyle Cruising” concept, which allows passengers more flexibility and personalized experiences, Norwegian focuses on delivering high-quality service and luxurious itineraries to a global customer base.

These leading companies drive innovation and growth in the cruise market, continually expanding their fleets and introducing new offerings to meet consumer demand for luxury, adventure, and sustainability.

Top Key Players in the Market

- Carnival Corporation & Plc

- Royal Caribbean Group

- MSC Cruises S.A.

- Norwegian Cruise Line Holdings Ltd.

- Disney Cruise Line

- Genting Hong Kong Limited

- Fred. Olsen Cruise Lines

- Other Market Players

Recent Developments

- Cruise Saudi: On November 2024, Cruise Saudi introduced Aroya Cruises, a new luxury cruise line that will debut from Jeddah on December 16, 2024. This launch marks the first luxury cruise of its kind in the Arabian region, aiming to provide an exclusive cultural and travel experience along the Arabian Gulf.

- MSC Cruises: On November 2024, MSC Cruises previewed its latest vessel, the MSC World Americas, ahead of its official launch in Miami. This new ship offers a variety of high-end features, including modern promenades, advanced wellness areas, and unique entertainment options designed to cater to North American travelers.

- Carnival Cruise Line: On November 2024, Carnival Cruise Line introduced its newest ship, the Carnival Celebration, to the U.S. market. This ship boasts a range of innovative features, including new dining options, entertainment venues, and family-friendly experiences.

Report Scope

Report Features Description Market Value (2023) USD 8.8 Billion Forecast Revenue (2033) USD 26.1 Billion CAGR (2024-2033) 11.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ocean Cruises, River Cruises), By Application (Daily Commute, Touring) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Carnival Corporation & Plc, Royal Caribbean Group, MSC Cruises S.A., Norwegian Cruise Line Holdings Ltd., Disney Cruise Line, Genting Hong Kong Limited, Fred. Olsen Cruise Lines, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Carnival Corporation & Plc

- Royal Caribbean Group

- MSC Cruises S.A.

- Norwegian Cruise Line Holdings Ltd.

- Disney Cruise Line

- Genting Hong Kong Limited

- Fred. Olsen Cruise Lines

- Other Market Players