Global Crude Oil Flow Improvers Market By Product (Asphaltene Inhibitors, Paraffin Inhibitors, Hydrate Inhibitors, and Scale Inhibitors), By Application (Transportation, Extraction, and Refinery), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 37935

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

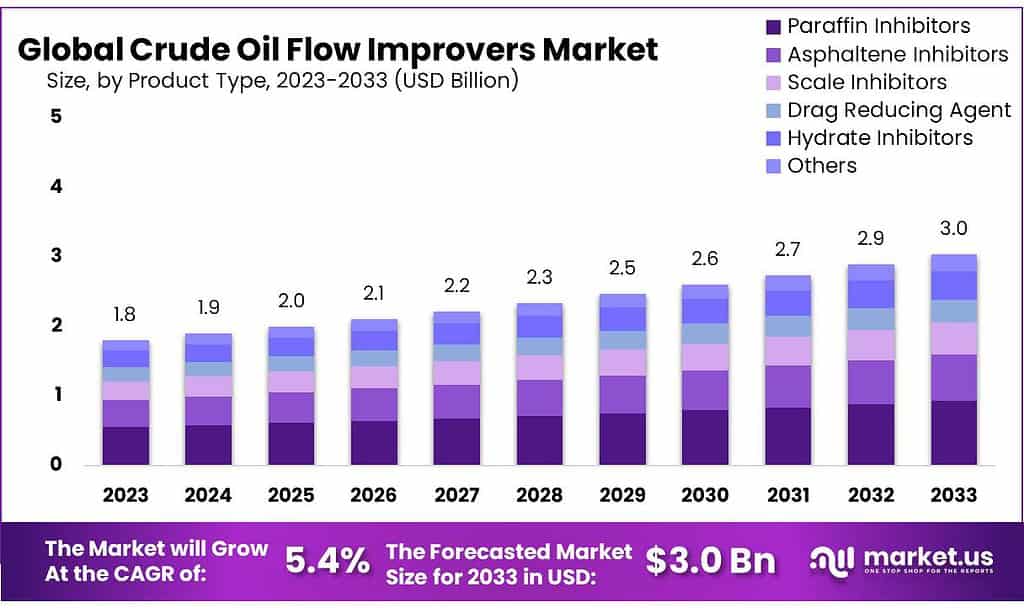

The Crude Oil Flow Improvers Market size is expected to be worth around USD 3.0 billion by 2033, from USD 1.8 Bn in 2023, growing at a CAGR of 5.4%

Demand for these products is expected to rise due to the increasing acceptance of horizontal drilling techniques and hydraulic fracturing. This market is also driven by the demand for specialty products that enhance fluid drift in different stages of the petroleum value chain.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The market is anticipated to grow significantly, reaching an estimated worth of USD 3.0 billion by 2033, up from USD 1.8 billion in 2023, at a compound annual growth rate (CAGR) of 5.4%.

- Product Dominance: Paraffin Inhibitors emerged as the dominant segment in 2023, securing over 30.5% of the market share. These inhibitors play a crucial role in preventing paraffin wax buildup, ensuring smoother oil flow in pipelines.

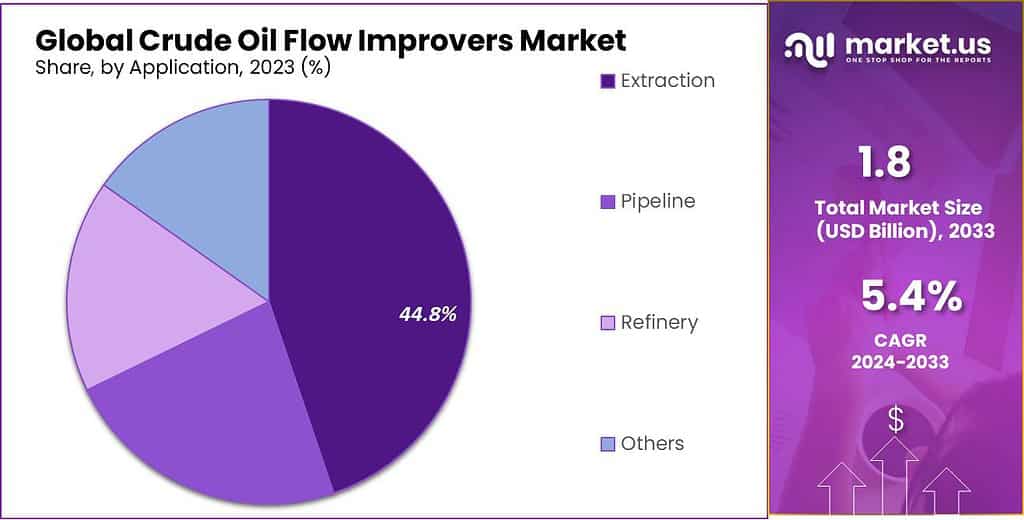

- Application Emphasis: The Extraction segment took the lead in 2023, capturing more than 44.8% of the market. Flow improvers play a pivotal role in optimizing oil flow during the extraction phase, enhancing productivity in crude oil recovery from reservoirs.

- Market Drivers: Factors driving market growth include the surge in hydraulic fracturing activities, government support for oil and gas development, innovations like low-dose hydrate inhibitors reducing chemical usage, and rising energy needs in the automotive sector.

- Market Restraints: Volatility in crude oil prices, environmental concerns, stringent regulations from bodies like the EPA, and geopolitical tensions pose challenges to market expansion and innovation.

- Opportunities: Growing demand for crude oil, especially with paraffin and asphaltene inhibitors, presents significant growth opportunities. These inhibitors play crucial roles in mitigating flow challenges caused by hydrocarbons, fostering market expansion.

- Challenges: Tailoring inhibitors to diverse crude oil compositions, adapting to price fluctuations, meeting environmental regulations, and navigating economic and geopolitical uncertainties are key challenges faced by market players.

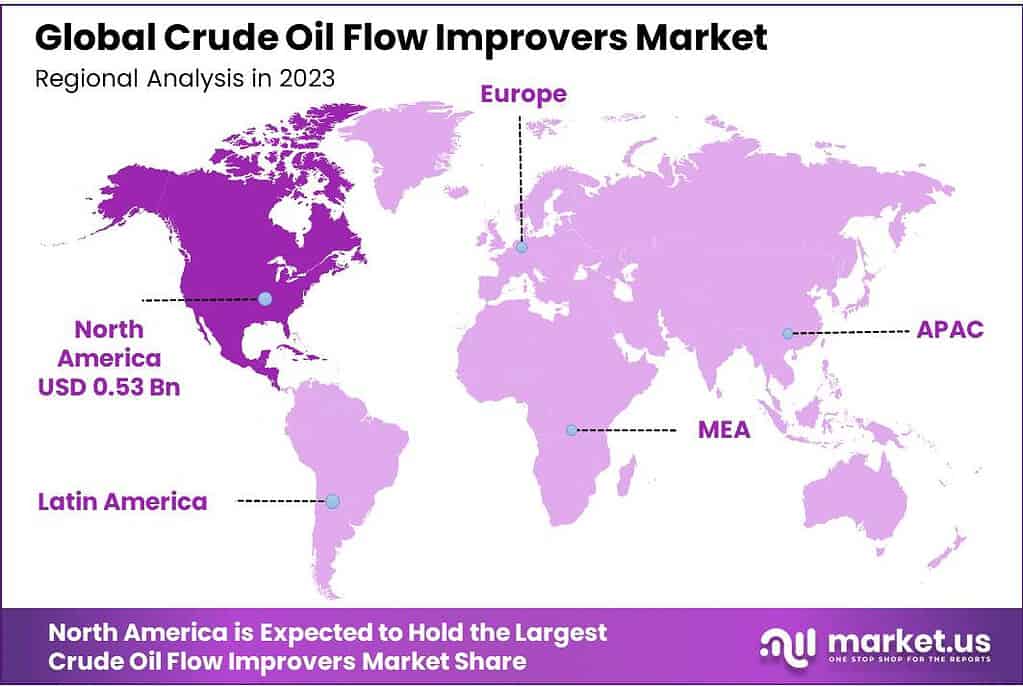

- Regional Insights: North America held the highest revenue share in 2023, while Asia Pacific is the fastest-growing market due to increased exploration activities. Middle East & Africa show moderate growth, especially in addressing fluid flow issues related to offshore extraction.

- Key Players: Major companies like Schlumberger, Halliburton, Baker Hughes, ExxonMobil, and others dominate the market, engaging in mergers, acquisitions, and expanding product portfolios to gain market share.

Product Analysis

In 2023, the crude oil flow improvers market saw Paraffin Inhibitors emerge as the dominant segment, securing a significant share of over 30.5%. Paraffin Inhibitors play a crucial role in the oil industry by mitigating the buildup of paraffin wax, a substance that often precipitates within pipelines during crude oil transportation.

These inhibitors effectively prevent the wax from solidifying and clogging the pipelines, ensuring smoother and uninterrupted oil flow. Their ability to address this common issue in oil pipelines makes Paraffin Inhibitors indispensable, enabling a more efficient and streamlined transportation process for crude oil, thereby reducing operational disruptions and maintenance costs.

As well as Paraffin Inhibitors, the crude oil flow improvers market includes asphaltene inhibitors, scale inhibitors, drag-reducing agents, and other specialized products that enhance oil flow such as asphaltene deposition, scale formation resistance drag resistance crystallization that contribute to overall efficiency and reliability of oil transportation systems.

These different segments all serve important roles in improving crude oil flow by targeting issues like asphaltene deposition scale formation drag resistance crystallization contributing to overall system efficiency & reliability

However, Paraffin Inhibitors stand out as essential tools in maintaining efficient oil transportation networks.

Their ability to prevent paraffin wax buildup reduces risks such as blockages and flow disruptions significantly, guaranteeing seamless transportation of crude oil from production sites to refineries and end users alike. Their continued presence within the crude oil flow improvers market indicates their essential role.

Application Analysis

In 2023, the Crude Oil Flow Improvers market saw the Extraction segment taking the lead, capturing an impressive share of more than 44.8%. This dominance underscores the critical role of flow improvers during the initial extraction phase of crude oil. These flow improvers play a pivotal role in optimizing the flow of oil from reservoirs, especially in situations where crude oil’s natural viscosity poses challenges to extraction.

By reducing viscosity and alleviating flow issues, these additives ensure a smoother extraction process, enabling efficient retrieval of crude oil from reservoirs. The dominance of the Extraction segment highlights the significance of seamless oil flow right from the commencement of the extraction process, contributing significantly to the overall productivity and effectiveness of oil extraction operations.

The crude Oil Flow Improvers market includes multiple subsegments beyond Extraction; Pipeline, Refinery, and other applications all play an essential part in oil transportation and refining processes, but Extraction stands out due to its emphasis on optimizing extraction stage processes – its prime goal is ensuring efficient crude oil recovery from reservoirs into refining plants for further refinement or transportation processes.

Effective flow improvers play an integral part in this early phase, helping facilitate optimal recovery rates from reservoirs which then move through to refineries or transportation networks.

The commanding position of the Extraction segment within the Crude Oil Flow Improvers market signifies the importance of these additives in streamlining the initial extraction processes, enhancing productivity, and ensuring an efficient supply of crude oil for subsequent refining and distribution stages in the oil industry.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Product

- Asphaltene Inhibitors

- Paraffin Inhibitors

- Hydrate Inhibitors

- Scale Inhibitors

By Application

- Transportation

- Extraction

- Refinery

Drivers

The market for crude oil flow improvers is experiencing growth driven by several key factors. One significant driver is the surge in hydraulic fracturing activities, amplifying the demand for crude oil flow improvers.

Governments across several nations are supporting hydraulic fracturing initiatives, providing financial aid, investment provisions, and tax incentives to facilitate oil and gas resource development. This support positively contributes to market expansion by fostering a conducive environment for increased production.

Innovation advancements, particularly the introduction of low-dose hydrate inhibitors, are significantly reducing chemical additive usage requirements and mitigating risks related to plugs and blockages, thus driving market expansion with efficient oil flow solutions.

Rising energy needs within the automotive sector are another contributor to its global expansion. Rising crude oil demand coupled with the unfeasibility of electric vehicle use means companies are turning towards non-traditional methods of meeting this energy consumption demand; when combined with government financial assistance or equipment provisioning programs, this shift drives market expansion worldwide.

Additionally, improving living and working standards in developing nations are fuelling the expansion of the crude oil flow improvers market. An increasing need for fuel as energy demands surge prompting advanced techniques being deployed within this market is contributing to its expansion – all these factors acting together are driving its global expansion trajectory.

Restraints

The crude oil flow improvers market encounters several constraints that pose challenges to its growth trajectory. One significant restraint is the volatility in crude oil prices coupled with escalating environmental concerns.

Fluctuations in oil prices, influenced by global economic recessions and conflicts among major oil-producing countries like Iran, Saudi Arabia, and Russia, present hurdles to market expansion. The shift toward natural gas as an alternative and the impact of economic downturns further hinder market growth, restraining the overall development of automotive carbon thermoplastic.

Stringent regulations from regulatory bodies like the Environmental Protection Agency (EPA) further hinder market expansion. Continuous pressure from these organizations to regulate and restrict chemicals used in onshore and offshore activities hinders the development of crude oil flow improvers.

Recent updates to standards and guidelines set by the EPA regarding extraction effluent discharge have created stringent policies on wastewater disposal from drilling and production activities – compliance with these regulations requires considerable time and resources, posing obstacles to industry expansion while creating additional compliance burdens.

These constraints highlight the challenges faced by the crude oil flow improvers market, affecting its potential for expansion and hindering the development of innovative solutions within the industry. The market’s response to price fluctuations and strict regulatory frameworks reflects the complexities and hurdles that impede its seamless growth and operational effectiveness.

Opportunities

The increasing demand for crude oil hydrocarbons has created substantial opportunities for paraffin and asphaltene inhibitors within the crude oil flow improvers market. Paraffin inhibitors play a critical role in mitigating the challenges posed by long-chain hydrocarbon paraffins in crude oil, which tend to impede flow, increase power consumption, and reduce pump efficiency.

These inhibitors prevent wax buildup on processing equipment, wellbore walls, and pipelines by altering the wax appearance temperature, thereby enhancing flow efficiency and often referred to as pour point dispersants or cold flow improvers.

Similarly, asphaltene, present in heavy crude oils, precipitates into deposits causing flow disruptions in pipelines. Asphaltene inhibitors effectively prevent the aggregation and precipitation of asphaltenes, ensuring smooth flow within channels, preventing choke points, and maintaining operational efficiency.

Rising crude oil demand serves as an impetus to the growth of the crude oil flow improvers market. Widely used across both oil and gas industries, flow improvers have seen increasing adoption due to an escalation in demand; with new and existing refineries taking on more production as demand exceeds the capacity of other non-renewable energy sources –

thus necessitating efficient transportation, exploration, and refinement processes as demand exceeds the capacity of renewable energies such as natural gas or coal; their logistics-friendly distribution makes them indispensable components in oil industry operations worldwide – indispensable components essential in their proper functioning operation!

The emerging opportunities for paraffin and asphaltene inhibitors, coupled with the increasing demand for crude oil, pave the way for significant growth in the crude oil flow improvers market. Their vital role in enhancing flow efficiency and ensuring uninterrupted oil transportation presents promising prospects for the industry’s expansion and innovation.

Challenges

The crude oil flow improvers market encounters several challenges that impede its seamless growth and development. One prominent challenge revolves around the complex nature of paraffin and asphaltene inhibitors, pivotal components within the market. These inhibitors are essential for ensuring efficient oil flow by mitigating issues caused by paraffin and asphaltenes, which tend to impede flow and cause operational disruptions.

However, their effectiveness often depends on diverse and varying crude oil compositions, making it challenging to create universally applicable inhibitors that suit all types of crude oil. Developing inhibitors tailored to specific oil compositions remains a significant challenge within the industry.

Market players also face difficulties due to fluctuating crude oil prices and environmental considerations associated with oil and gas activities. Fluctuations in crude oil prices impact market stability, impacting investment decisions and long-term planning decisions.

Furthermore, environmental regulations force companies to create eco-friendly solutions while meeting regulatory standards – creating an ongoing challenge in maintaining operational efficiency, environmental sustainability, and compliance.

Global economic and geopolitical forces, including conflicts among major oil-producing nations, also impact market stability. Turbulence in global economies and geopolitical tensions create uncertainty and present market participants with new challenges and uncertainty.

Addressing these challenges requires ongoing research and development efforts to develop efficient inhibitors suitable for diverse crude oil compositions, as well as adapting to volatile market conditions while adhering to regulatory frameworks and guaranteeing environmental sustainability. For this market segment to remain successful and thrive over the long term.

Regional Analysis

North America held the highest revenue share at over 29.6% in 2023. The vast majority of investments are made to expand into emerging markets in North America, Asia Pacific, the Middle East & Africa. Multinational companies plan to increase their global presence in lucrative markets and take advantage of factors such as low labor costs and availability of resources, along with liberal environmental norms.

The Asia Pacific crude oil flow improvements industry is the fastest-growing in terms of revenue. Forecasts show that the region’s market will grow at an annual CAGR of 6%. This market’s growth is primarily due to the growing number of exploration activities.

Because of its demand in the region’s upstream sector, the Middle East & Africa is expected to grow moderately during the forecast period. To address the fluid flow issues that are related to offshore extraction of hydrocarbon, there have been several offshore contracts. This is why the COFI market has a stronghold and will continue to grow.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Some of the industry’s major players are BASF, Halliburton, Schlumberger, and Nalco. Due to the presence of numerous multinationals with a long history of pioneering in the manufacture and supply of oilfield chemicals across various industry value chains, the global COFI market has become highly competitive.

By supplying raw materials and manufacturing the finished products, the companies integrate throughout the value chain. This reduces the overall cost of purchasing raw materials from small businesses. The companies can integrate across the value chain to increase their profit margins and attain optimum economies. This will ensure that the industry’s products are sustainable.

The demand for flow improvers in operations such as transportation, extraction, and refining is increasing. Major players have begun to increase their product portfolios and global footprint through mergers and acquisitions to reach a wider sector and gain more market share.

Маrkеt Кеу Рlауеrѕ

- Schlumberger

- Halliburton

- Baker Hughes

- National Oil Varco

- ExxonMobil

- British Petroleum

- Total S.A.

- Weatherford International

- Clariant

- Lubrizol Specialty Products, Inc.

- BASF SE

- Nalco Champion

- Infineum

- Evonik Industries

- Dorf Ketal Chemicals India Private Limited

Recent Developments

In 2022, Baker Hughes, an American energy services company, announced their signing of an agreement to acquire Altus Intervention – a global facility with over four decades of industry experience in downhole oil and gas technology and well intervention services – today.

In 2022, Baker Hughes and Saudi Industrial Investments Company Dussur recently announced a joint venture, designed to supply industrial and oilfield chemicals throughout Saudi Arabia (KSA).

Report Scope

Report Features Description Market Value (2023) USD 1018.9 Million Forecast Revenue (2033) USD 1724.0 Million CAGR (2023-2032) 5.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Asphaltene Inhibitors, Paraffin Inhibitors, Hydrate Inhibitors, Scale Inhibitors), By Application(Transportation, Extraction, Refinery) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Schlumberger, Halliburton, Baker Hughes, National Oil Varco, ExxonMobil, British Petroleum, Total S.A., Weatherford International, Clariant, Lubrizol Specialty Products, Inc., BASF SE, Nalco Champion, Infineum, Evonik Industries, Dorf Ketal Chemicals India Private Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are crude oil flow improvers (COFI)?Crude oil flow improvers are additives used to enhance the flow characteristics of crude oil during transportation through pipelines. They prevent issues like pipeline blockages, paraffin or asphaltene deposition, and improve overall oil flow.

How do crude oil flow improvers work?COFIs modify the properties of crude oil, reducing its viscosity and altering its flow behavior. They inhibit the agglomeration of waxy substances (like paraffins) or the deposition of asphaltenes, which can hinder pipeline flow.

Why are crude oil flow improvers necessary?During oil transportation through pipelines, the temperature changes and pressure drops can cause the crude oil to solidify or form deposits, obstructing the pipeline flow. COFIs prevent these issues, ensuring a consistent and smooth oil flow.

Crude Oil Flow Improvers MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Crude Oil Flow Improvers MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Schlumberger

- Halliburton

- Baker Hughes

- National Oil Varco

- ExxonMobil

- British Petroleum

- Total S.A.

- Weatherford International

- Clariant

- Lubrizol Specialty Products, Inc.

- BASF SE

- Nalco Champion

- Infineum

- Evonik Industries

- Dorf Ketal Chemicals India Private Limited