Global Credit Monitoring Services Market Size, Share, Industry Analysis Report By Service Type (Basic Credit Monitoring Services; Advanced Credit Monitoring Services; Identity Theft Protection Services; Credit Scoring Services; Others), By Enterprise Size (Large Enterprises; Small and Medium Enterprises), By End-User (Individuals; Businesses; Financial Institutions; Others), By Distribution Channel (Direct Sales; Third-Party Providers; Online Platforms), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168790

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Role of Generative AI

- By Service Type

- By Enterprise Size

- By End-User

- By Distribution Channel

- Regional Insight

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

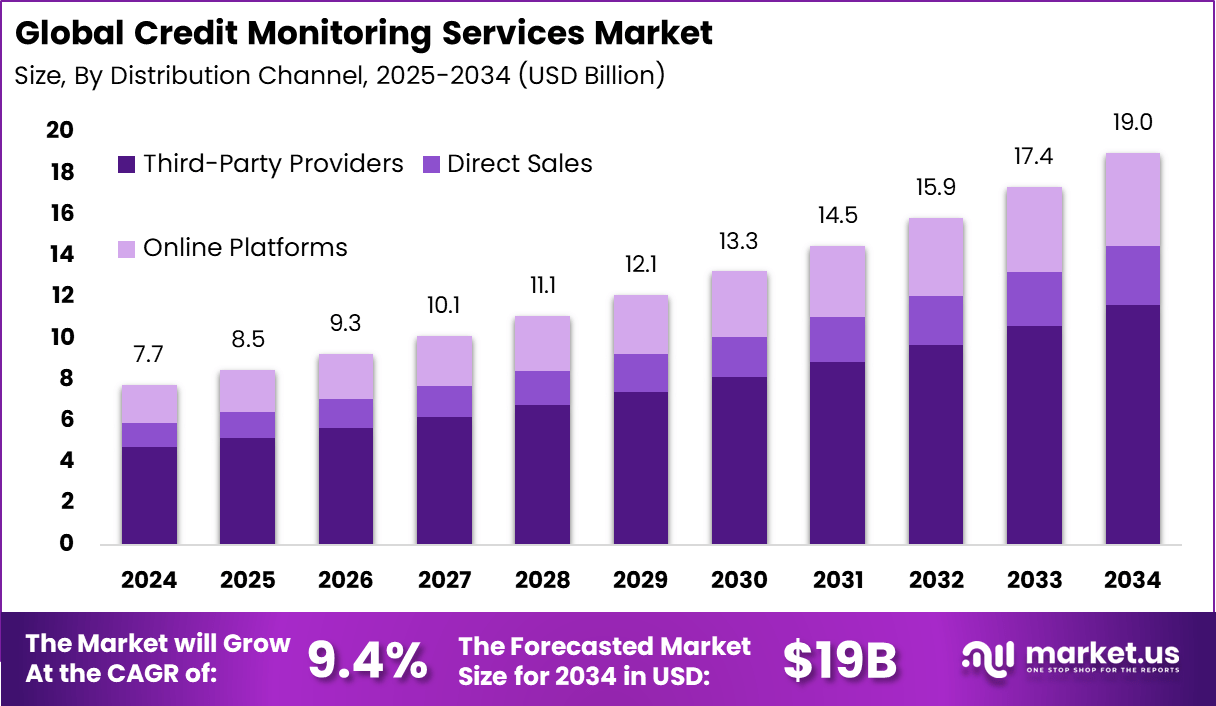

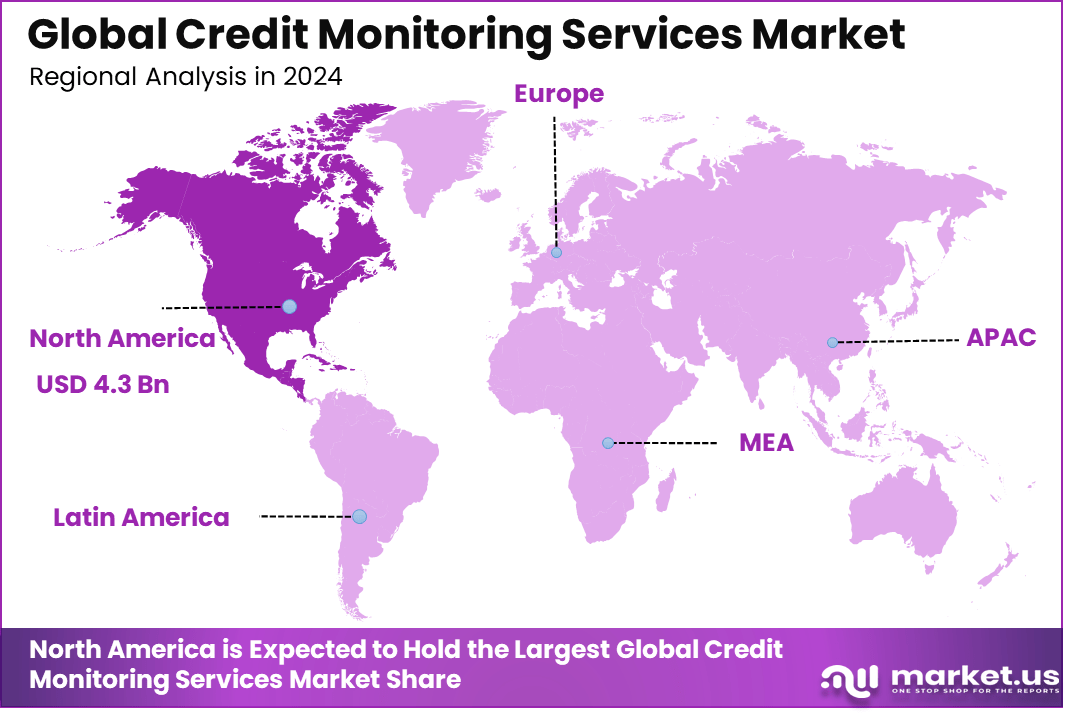

The Global Credit Monitoring Services Market generated USD 7.7 billion in 2024 and is predicted to register growth from USD 8.5 billion in 2025 to about USD 19 billion by 2034, recording a CAGR of 9.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 56.7% share, holding USD 4.3 Billion revenue.

The credit monitoring services market has expanded as consumers and businesses adopt digital tools to track credit activity, detect fraud and maintain financial health. Growth reflects rising use of online banking, greater exposure to identity theft and increasing reliance on credit based transactions. Credit monitoring platforms now support continuous alerts, score tracking and comprehensive financial reporting across multiple credit bureaus.

For instance, In March 2024, around 119 million Indians monitored their CIBIL score, marking a strong 51% rise from last year. This sharp increase was influenced mainly by Gen Z and Millennials, whose growing use of digital credit tools reflects a deeper awareness of personal finance and a shift toward more informed credit behaviour.

The growth of the market can be attributed to rising cases of identity fraud, increased consumer awareness of credit management and stronger demand for real time financial visibility. Consumers value instant alerts that notify them of suspicious activity. Businesses adopt monitoring solutions to safeguard employee accounts and reduce exposure to financial risks. Wider digital payment adoption further strengthens market momentum.

Rising identity theft cases, with 1.4 million reports to the FTC last year, push more people toward monitoring for quick detection. Cyber fraud complaints jumped 33% recently, making proactive protection a must amid data breaches affecting billions of records. Strict privacy laws and the shift to online transactions, now routine for 80% of millennials, further fuel this need as folks seek tools for real-time oversight.

Demand comes from everyday users worried about fraud after high-profile breaches exposed 272 million unique SSNs, plus businesses needing to check client risks. Younger groups lead adoption, with Gen Z at 72% favoring digital finance tools that include monitoring. Emerging areas see fast uptake due to growing credit use and 2.2% global identity fraud rates, though free bank options slow some paid sign-ups.

Top Market Takeaways

- Identity theft protection services accounted for 41.3%, indicating that most users are choosing credit monitoring for personal risk reduction rather than general financial alerts.

- Large enterprises represented 86.4% of total adoption, showing that corporate users continue to invest heavily in proactive security and compliance-driven monitoring.

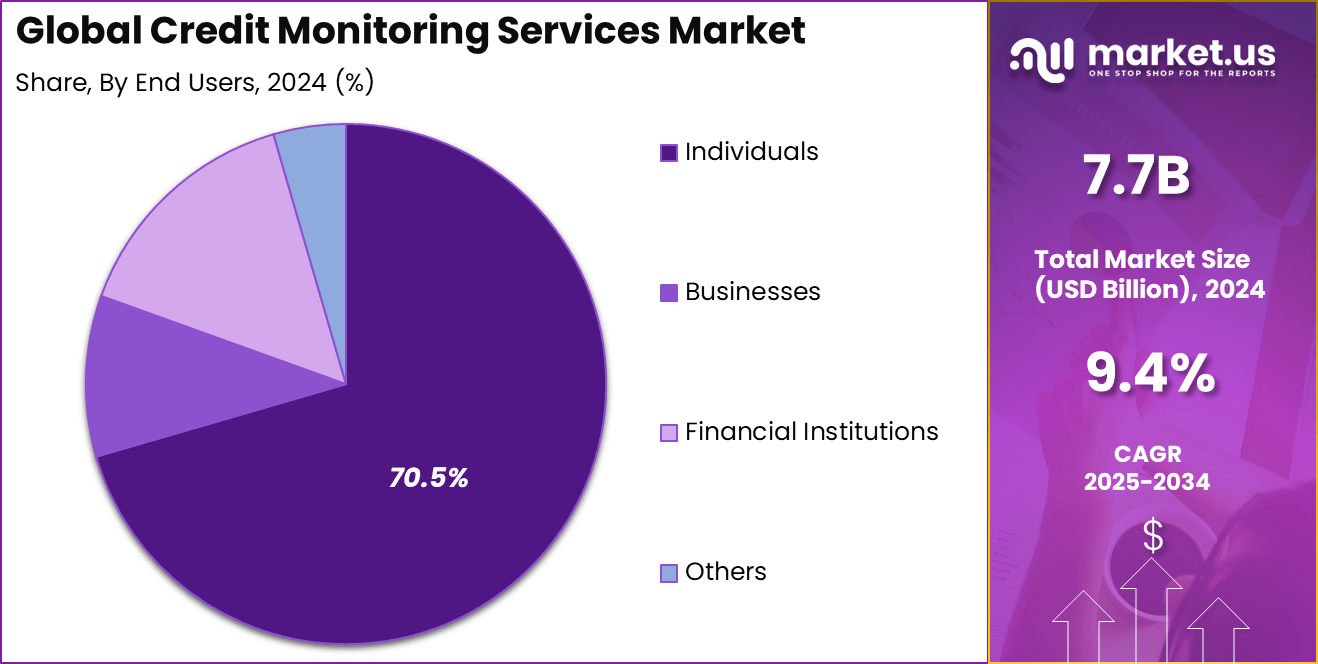

- Individuals made up 70.5% of end-users, reflecting strong consumer demand as digital fraud risks become more visible in daily financial activity.

- Third-party providers held 61.2%, suggesting that customers still rely on specialized external platforms instead of traditional financial institutions.

- North America captured 56.7%, supported by strong digital financial adoption and higher awareness of fraud prevention tools.

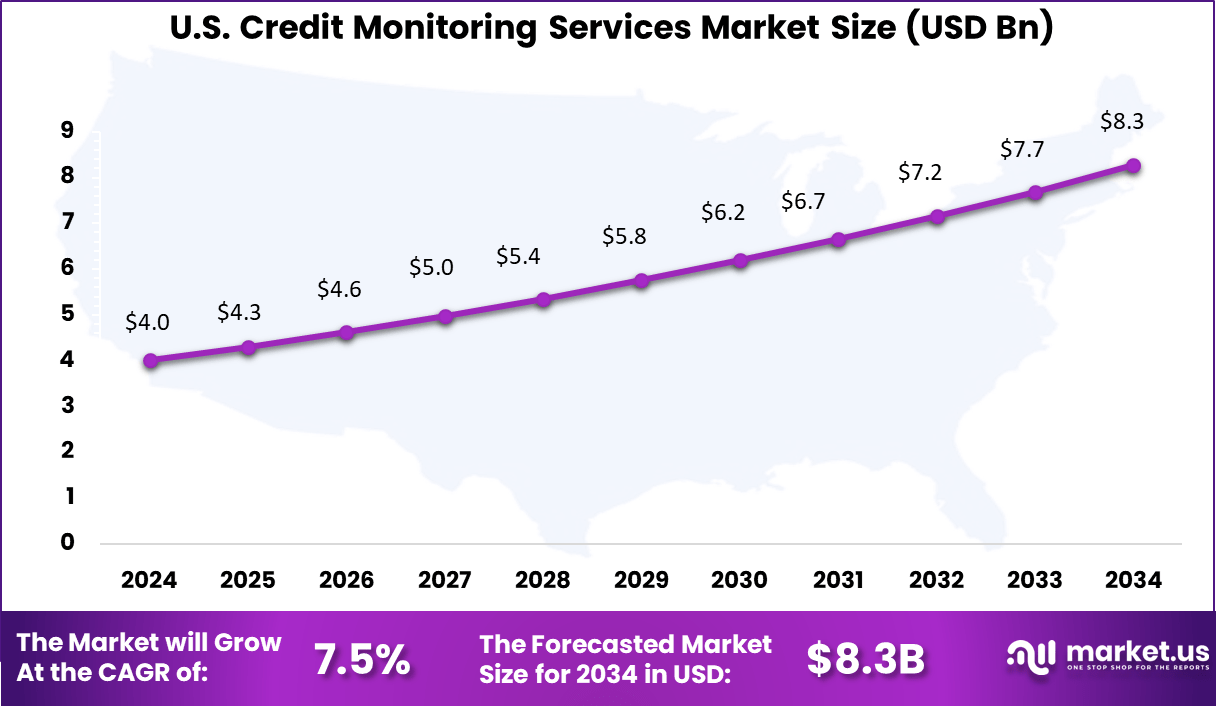

- The U.S. market reached 4.01 Bn, which shows steady spending on personal credit protection across both consumers and enterprises.

- A CAGR of 7.5% indicates that the overall market is expanding at a stable pace as cybersecurity concerns continue to influence financial behavior.

Role of Generative AI

Generative AI plays a key part in credit monitoring by improving risk checks and spotting fraud faster. Surveys show nearly 60% of credit teams focus on portfolio monitoring with this tech, while over 40% use it for application reviews and reporting. It also boosts predictive power, with studies noting up to 20% better results in key measures compared to older methods.

The tech helps create synthetic data to fill gaps in records and simulates economic shifts for stronger alerts. Banks report processing scenarios 250 times quicker, cutting errors by 24% in some cases. This makes monitoring more reliable for everyday users watching their credit.

By Service Type

Identity theft protection services claim the top spot with 41.3% of the credit monitoring market. These services focus on real-time alerts and recovery tools that shield users from fraudulent activities tied to stolen personal data.

Banks and financial firms push them heavily because they address rising cyber threats and data breaches that hit consumers daily. People turn to these options for peace of mind, especially after high-profile hacks that expose credit details.

Advancements in detection tech keep this segment growing strong. Machine learning now scans patterns across credit reports and dark web sources faster than ever. Users value the quick notifications that let them freeze accounts or dispute charges right away. This focus on proactive defense fits perfectly with how folks manage their finances in a digital world full of risks.

By Enterprise Size

Large enterprises dominate at 86.4%, as they roll out credit monitoring to protect employee data and corporate accounts on a massive scale. These companies face strict rules on data security, so they invest in tools that cover thousands of users at once. Bulk contracts make sense for them, cutting costs while ensuring compliance across global operations. HR teams often bundle it with benefits packages to boost worker trust.

Scale brings advantages like custom dashboards and integrated risk analytics. Big firms use the data to spot trends in fraud attempts early. As remote work expands, these enterprises lean harder on monitoring to safeguard sensitive info spread across devices and locations. Their heavy adoption sets the pace for service improvements that trickle down to smaller players too.

By End-User

Individuals make up 70.5% of the market, drawn by affordable plans that track credit scores and flag suspicious changes. Everyday people sign up after life events like buying a home or spotting odd charges on statements. Free trials hook them, but ongoing alerts build loyalty as they see real value in avoiding financial headaches. Apps make it simple to check anytime from a phone.

Personal use keeps evolving with features like score simulators and identity locks. Younger users especially like gamified interfaces that teach good credit habits. This segment thrives on trust built over time, as consistent protection turns one-time users into long-term subscribers. Direct-to-consumer marketing via ads and partnerships with banks fuels steady uptake.

By Distribution Channel

Third-party providers lead with 61.2%, offering specialized platforms that big banks and retailers tap into for their customers. These vendors handle the tech heavy lifting, from AI-driven scans to global compliance checks. Flexibility lets them tailor services for different regions and user needs without partners rebuilding from scratch. Partnerships grow fast as everyone wants cutting-edge tools without the full development cost.

Independence gives third parties an edge in innovation speed. They roll out updates like biometric logins or blockchain verification quicker than in-house teams. Clients appreciate the white-label options that blend seamlessly into their own apps. This channel’s strength lies in bridging gaps for organizations short on expertise, keeping the whole market moving forward.

Regional Insight

North America holds 56.7% of the credit monitoring market, thanks to high awareness of identity risks and strong consumer protection laws. Frequent data breaches here push both businesses and people toward proactive monitoring. Tech hubs drive early adoption of advanced features like AI alerts and multi-bureau tracking. Regulators encourage it too, tying it to financial security standards.

The United States anchors the region with USD 4.01 billion in activity and a 7.5% CAGR. Steady growth comes from rising smartphone use for personal finance and corporate mandates post-cyber incidents. Service providers here test new ideas first, influencing global trends. Focus on user-friendly designs and quick response times keeps demand climbing as threats get smarter.

Emerging Trends

AI-Driven Personalization and Real-Time Alerts

Credit monitoring services are increasingly leaning into artificial intelligence to offer personalized insights that go beyond basic score tracking. These systems now analyze spending patterns and predict potential risks before they hit, sending instant notifications through apps or email to keep users one step ahead. This shift makes financial oversight feel less like a chore and more like a helpful companion in daily money management.

Mobile integration takes this further by embedding monitoring tools right into banking apps, where users get seamless updates on credit changes alongside their balances. Biometric features, such as fingerprint or face scans, add a layer of security to access these services, appealing to those wary of data breaches. Overall, these trends reflect a move toward proactive, user-friendly tools that fit into fast-paced digital lives.

Growth Factors

Surge in Cyber Threats and Identity Fraud

The sharp rise in cyber attacks and identity theft has become a major push for credit monitoring services, as people seek ways to protect their financial details from sneaky threats. With more personal data exposed online every day, consumers turn to these services for ongoing vigilance that spots suspicious activity early. This growing awareness turns what was once an optional service into a must-have for peace of mind.

Digital banking’s boom plays a big role too, with round-the-clock online transactions creating more entry points for fraud. Services that provide real-time insights help users make smarter choices, like avoiding risky loans or spotting errors on reports. As reliance on apps grows, especially in regions with high mobile use, demand for these protective layers keeps climbing steadily.

Key Market Segments

By Service Type

- Basic Credit Monitoring Services

- Advanced Credit Monitoring Services

- Identity Theft Protection Services

- Credit Scoring Services

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises

By End-User

- Individuals

- Businesses

- Financial Institutions

- Others

By Distribution Channel

- Direct Sales

- Third-Party Providers

- Online Platforms

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Cyber Threats and Digital Adoption

Cyber threats like identity theft and data breaches are fueling demand for credit monitoring services as individuals and businesses prioritize proactive protection. With online transactions now routine, people want tools that flag unusual activity instantly, turning potential disasters into manageable alerts. This need grows stronger in a world where personal data faces constant risks from hackers and scams.

Widespread digital banking and mobile finance apps amplify this driver by making credit health a daily concern. Users rely on seamless monitoring to catch score dips or errors before they affect loans or purchases. As smartphone usage spreads globally, especially among younger demographics, these services become essential for maintaining financial stability.

Restraint Analysis

Privacy Concerns and Data Overload

Privacy worries act as a key restraint, with many users hesitant to share sensitive financial details with third-party monitoring services. Fears of data misuse or further breaches make some stick to manual checks rather than automated systems. Building trust requires clear policies on how information gets handled and protected.

The sheer volume of alerts from constant monitoring often overwhelms users, leading to alert fatigue where important warnings get ignored. Services struggle to balance thoroughness with simplicity, as too many notifications dilute their value. Simplifying interfaces and customizing alerts remain critical to overcoming this hurdle.

Opportunity Analysis

Expansion into Emerging Markets

Credit monitoring services have a clear opportunity to tap into emerging markets where financial inclusion is rising but fraud risks loom large. In regions with growing middle classes and digital economies, affordable tools can empower first-time credit users to build healthy profiles. Tailored offerings for local needs open doors to underserved populations.

Partnerships with banks and fintech platforms create another avenue, bundling monitoring with everyday services for broader reach. As governments push digital IDs and open banking, these integrations can deliver value through shared data ecosystems. This approach not only scales access but also fosters long-term user loyalty.

Challenge Analysis

Regulatory Compliance and Interoperability

Navigating diverse regulations across regions poses a major challenge, as varying data protection laws complicate service rollout and operations. Providers must adapt to rules like strict consent requirements without slowing innovation. Harmonizing compliance globally tests resources and agility.

Interoperability between different credit bureaus and platforms adds friction, making it hard for services to provide a unified view of user data. Fragmented systems lead to incomplete insights, frustrating users who expect comprehensive coverage. Standardizing data exchange protocols will be key to resolving this ongoing issue.

Competitive Analysis

Experian, Equifax, CheckMyFile, and TransUnion lead the credit monitoring services market with extensive consumer data networks, real-time credit alerts, and comprehensive identity protection tools. Their platforms offer continuous score tracking, fraud detection, and detailed credit reports. These companies focus on accuracy, secure data handling, and user-friendly analytics dashboards.

Norton LifeLock, IdentityForce, PrivacyGuard, Aura, Zander, ID Watchdog, and IdentityIQ strengthen the competitive landscape with robust identity protection suites that integrate credit monitoring with dark-web scanning, breach alerts, and financial account monitoring. Their solutions target individuals seeking proactive defense against digital fraud. These providers emphasize multi-layered security, fast notifications, and flexible subscription options.

Kroll, Epiq, McAfee, Bitdefender, CreditLadder, Jovia Financial, Nav, and other participants expand the market with specialized credit tools, dispute support services, and financial wellness solutions. Their offerings include credit-building assistance, business credit monitoring, and tailored advisory features. These companies help users improve credit visibility, detect anomalies, and make informed financial decisions.

Top Key Players in the Market

- Experian

- Equifax

- CheckMyFile

- TransUnion

- Norton LifeLock

- IdentityForce

- PrivacyGuard

- Aura

- Zander

- ID Watchdog

- IdentityIQ

- Kroll

- Epiq

- McAfee

- Bitdefender

- CreditLadder

- Jovia Financial

- Nav

- Others

Recent Developments

- In October 2025, Experian picked up KYC360 to sharpen its tools against fraud and financial crime. This move adds strong customer lifecycle management to help with ongoing checks and smoother onboarding for banks.

- In May 2025, Equifax teamed up with Render to launch Clear Decision, a platform blending credit data and open banking info. Lenders get better views on affordability to cut fraud and speed up decisions.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Bn Forecast Revenue (2034) USD 19 Bn CAGR(2025-2034) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Basic Credit Monitoring Services; Advanced Credit Monitoring Services; Identity Theft Protection Services; Credit Scoring Services; Others), By Enterprise Size (Large Enterprises; Small and Medium Enterprises), By End-User (Individuals; Businesses; Financial Institutions; Others), By Distribution Channel (Direct Sales; Third-Party Providers; Online Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Experian; Equifax; CheckMyFile; TransUnion; Norton LifeLock; IdentityForce; PrivacyGuard; Aura; Zander; ID Watchdog; IdentityIQ; Kroll; Epiq; McAfee; Bitdefender; CreditLadder; Jovia Financial; Nav; Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Credit Monitoring Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Credit Monitoring Services MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Experian

- Equifax

- CheckMyFile

- TransUnion

- Norton LifeLock

- IdentityForce

- PrivacyGuard

- Aura

- Zander

- ID Watchdog

- IdentityIQ

- Kroll

- Epiq

- McAfee

- Bitdefender

- CreditLadder

- Jovia Financial

- Nav

- Others