Global Cranial Fixation and Stabilization Devices Market Analysis By Product [Cranial Fixation Devices (Screws, Meshes, Others), Cranial Stabilization Devices (Skull Clamps, Horseshoe Headrests, Others)], By Material Type (Resorbable Fixation Systems, Nonresorbable Fixation Systems), By End-User (Hospitals, Ambulatory Surgical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 48746

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

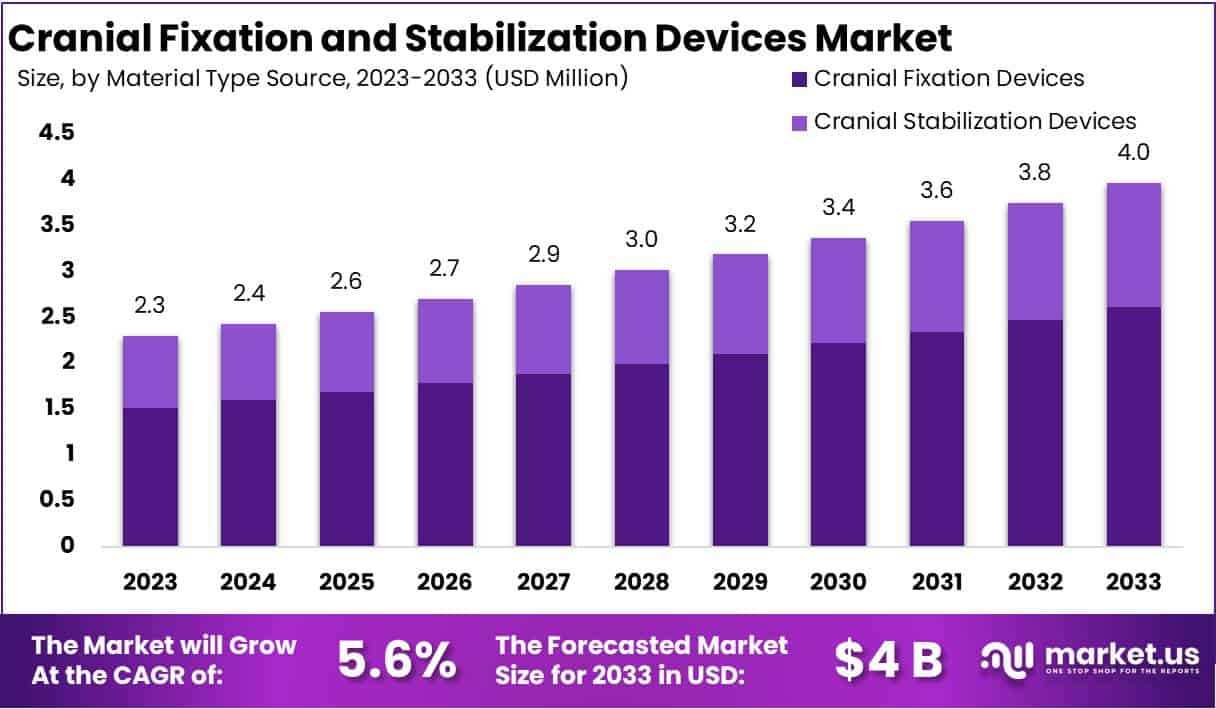

The Global Cranial Fixation and Stabilization Devices Market size is expected to be worth around USD 4 Billion by 2033, from USD 2.3 Billion in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Cranial fixation and stabilization devices are specialized medical tools designed to secure the skull during and after neurosurgical procedures. These devices play a critical role in ensuring patient safety and surgical outcomes in operations addressing neurological disorders. They include a range of clamps, screws, plates, and other systems that stabilize the skull bones.

The market for cranial fixation and stabilization devices is witnessing significant growth, driven by the increasing prevalence of neurological disorders and advancements in neurosurgery. Hospitals are the primary end-users, attributed to the growing number of neurosurgeries conducted globally. Meanwhile, ambulatory surgical centers are gaining popularity for their role in facilitating minimally invasive surgeries. Research institutions are also key players, delving into the development of new biomaterials and techniques that could revolutionize neurosurgical practices.

The regulatory landscape for cranial fixation and stabilization devices is marked by stringent standards set by authorities such as the FDA and CE Mark, crucial for ensuring the safety and efficacy of these medical tools. Compliance with these rigorous guidelines is indispensable, yet it notably lengthens the product’s journey to market. According to the Medical Device Innovation Consortium (MDIC), the regulatory approval process can add an average of 7 to 10 years to the development cycle of new medical devices. This extended timeline reflects the industry’s commitment to patient safety, emphasizing the critical balance between fostering rapid innovation and adhering to the highest safety and efficacy standards.

Globally, the cranial fixation and stabilization devices sector is primarily fueled by leading exports from the United States, Germany, Japan, France, and Switzerland, which collectively account for a significant share of the global market. These nations are at the forefront of medical technology, contributing extensively to the sector’s growth. On the flip side, the Asia Pacific region is rapidly emerging as a pivotal market, driven by its expanding healthcare infrastructure and surging economic prosperity. This shift is substantiated by a report indicating a robust annual growth rate of over 7% in the region’s medical device market. Such dynamics underscore the evolving landscape of global demand and the strategic importance of the Asia Pacific market in the cranial fixation and stabilization devices industry.

The global demand for cranial surgeries is projected to surpass 4 million by 2030, driven by the rising prevalence of neurological disorders affecting over 1 billion individuals worldwide, as reported by the World Health Organization. This significant increase highlights the critical need for advanced neurosurgical interventions to address the growing health challenges posed by these conditions, underscoring the urgency for enhanced medical solutions and technologies in the field.

Investment in the cranial fixation and stabilization devices sector is surging, with venture capital exceeding near about $500 million in recent years, targeting startups at the forefront of technological advancements. Strategic partnerships between medical device giants and academic research institutions are driving innovation, a trend supported by government R&D initiatives with allocations surpassing approxmiatly $200 million annually. These efforts are complemented by public health campaigns designed to enlighten the public about neurological conditions, showcasing a robust commitment to evolving neurosurgical practices and improving patient care.

Key Takeaways

- Market Size: Expected to reach USD 4 billion by 2033, growing at a 5.6% CAGR from 2023’s USD 2.3 billion.

- Dominant Segment: Cranial Fixation Devices secured over two-thirds of the market share in 2023, crucial for skull stabilization.

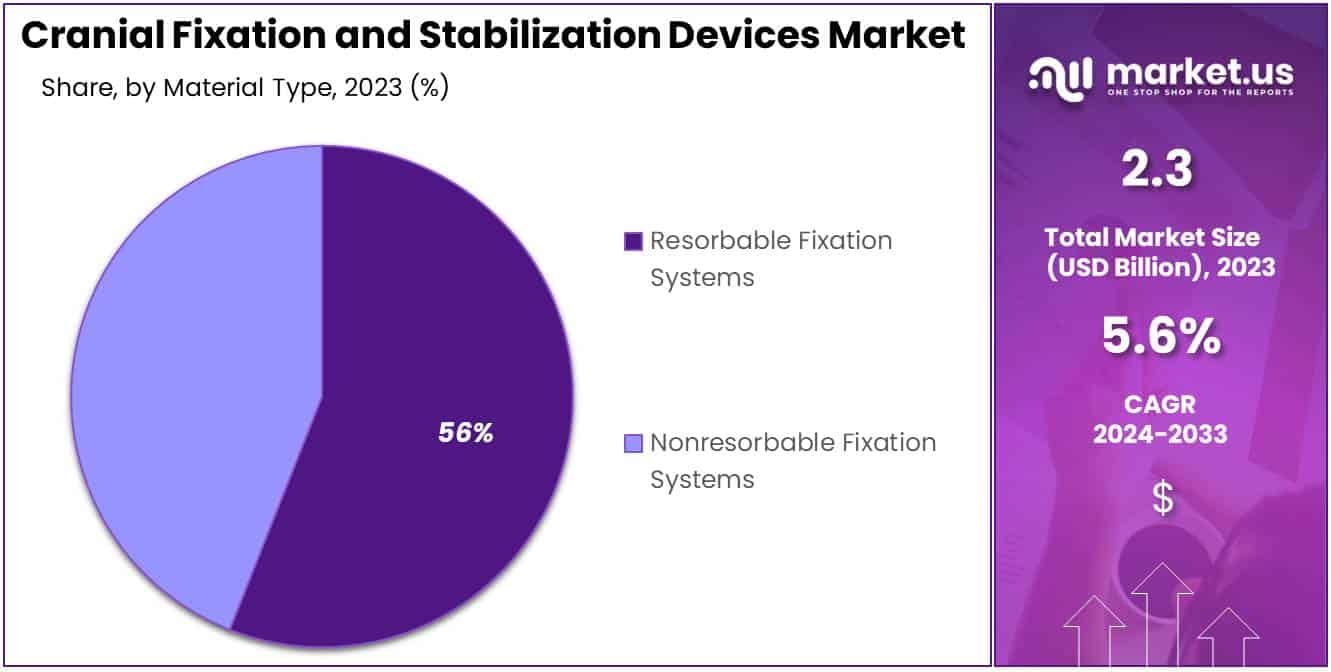

- Material Innovation: Resorbable Fixation Systems held 56% market share in 2023, gradually dissolve, eliminating second surgeries, popular in pediatric cases.

- End-User Dynamics: Hospitals drove 62% market share in 2023, while Ambulatory Surgical Centers (ASCs) show steady growth.

- Market Drivers: Increasing neurological disorders and traumatic brain injuries globally drive market growth, fueled by aging populations and accidents.

- Market Restraints: High costs hinder growth, especially in low- and middle-income countries, highlighting economic and healthcare system disparities.

- Innovation Opportunities: Advancements like biocompatible materials and 3D printing offer custom implants and enhance surgical outcomes.

- Emerging Trends: Minimally Invasive Surgeries (MIS) adoption rises, reducing hospitalization times and infection rates, driving demand for specialized devices.

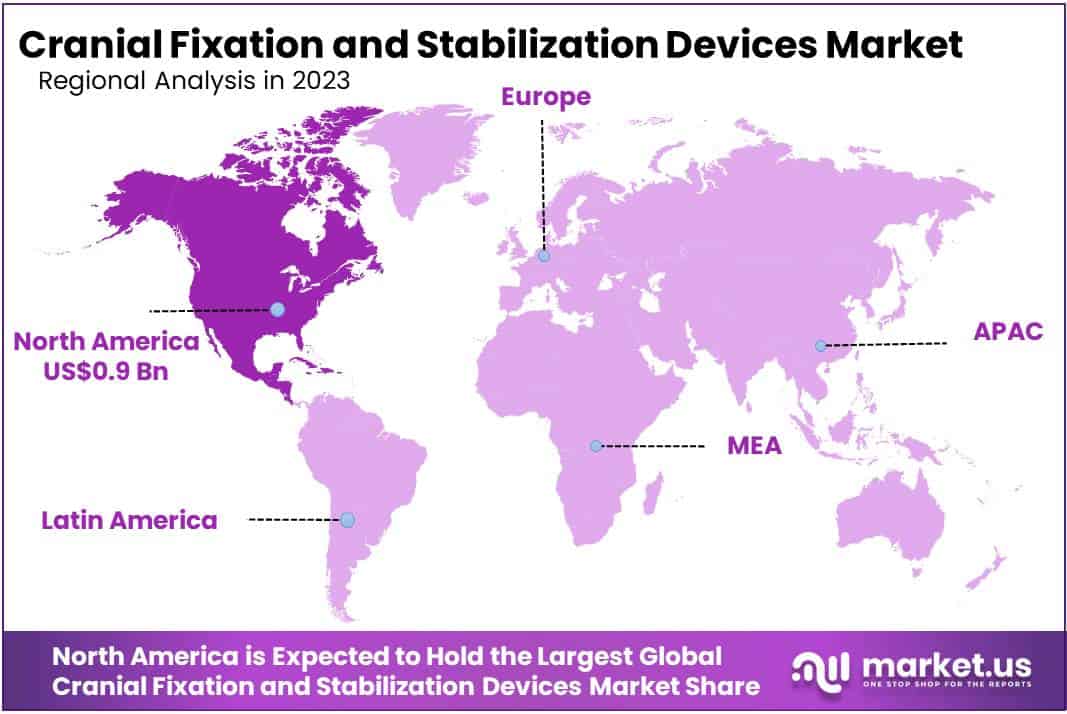

- Regional Analysis: North America dominates with 42% market share in 2023, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Product Analysis

In 2023, the Cranial Fixation Devices segment emerged as a dominant force in the Cranial Fixation and Stabilization Devices Market, securing over two-thirds of the market share. This commanding position is primarily due to the widespread use of cranial fixation devices in neurosurgery, where they play a crucial role in stabilizing the skull post-trauma or surgery.

This segment encompasses various products like screws, meshes, and other fixation devices, tailored to meet the specific needs of different cranial procedures. The demand for these devices stems from their vital role in maintaining the structural integrity of the skull after operations, which is vital for patient recovery.

Among these products, screws have been particularly influential in driving market growth, thanks to their reliability and ease of use in securing bone flaps or implants. Meshes, offering flexibility and coverage for larger defects, also contribute significantly to the segment’s expansion.

Conversely, the Cranial Stabilization Devices segment, which includes tools like skull clamps and horseshoe headrests, held a smaller market share. Despite this, these devices are essential in neurosurgery for providing stability and precise positioning of the head during procedures.

Several factors contribute to the growth of the cranial fixation and stabilization devices market, including technological advancements, rising neurological disorders, and an increase in accidents and trauma cases requiring neurosurgery. Furthermore, ongoing innovation in product design and materials aims to enhance safety and efficacy, further driving market growth.

Material Type Analysis

In 2023, the Resorbable Fixation segment took a commanding position in the Cranial Fixation and Stabilization Devices Market’s Material Type Segment, holding over 56% of the market share. This dominance is attributed to the segment’s innovative products, which gradually dissolve in the body, eliminating the need for a second surgery.

These systems are particularly popular in pediatric neurosurgery and among patients sensitive to permanent implants due to their ability to accommodate growth and reduce long-term complications.

While Resorbable Fixation is gaining traction, Nonresorbable Fixation Systems still maintain a significant market presence. They are favored for their strength and stability, especially in adult patients and cases requiring long-term support. However, the necessity for secondary surgery to remove these implants is a drawback compared to resorbable options.

Market dynamics are influenced by factors like technological advancements and evolving preferences of healthcare providers and patients. Ongoing research aims to enhance the performance and safety of resorbable materials, expected to further shift the market towards these systems.

The global increase in neurological disorders and neurosurgeries contributes to market growth. Both resorbable and nonresorbable systems are anticipated to see increased demand as healthcare systems advance, aiming for better patient outcomes. Overall, the market reflects a trend towards patient-friendly surgical solutions while acknowledging the varied needs across patient populations and surgical requirements.

End-User Analysis

In 2023, hospitals emerged as the frontrunners in the End-User Segment of the Cranial Fixation and Stabilization Devices Market, holding a commanding share of over 62%. This dominance reflects the critical role hospitals play in handling complex neurosurgical procedures and trauma care, where cranial fixation and stabilization devices are extensively utilized.

Equipped with cutting-edge infrastructure and a team of multidisciplinary healthcare professionals, hospitals are well-equipped to manage various neurosurgical cases, ranging from traumatic brain injuries to brain tumors and congenital anomalies. Consequently, they drive the majority of demand for cranial fixation and stabilization devices, being the primary purchasers and users of such equipment.

Although Ambulatory Surgical Centers (ASCs) hold a smaller market share, their significance in delivering neurosurgical care is on the rise. These centers offer a convenient alternative for patients not requiring overnight hospitalization, with advancements in minimally invasive techniques expanding their scope of procedures and driving demand for cranial fixation and stabilization devices.

Market dynamics in the End-User Segment are influenced by factors like healthcare infrastructure, reimbursement policies, and patient preferences. While hospitals remain the cornerstone of neurosurgical care, ASCs are experiencing steady growth due to increasing demand for outpatient options and cost-effective healthcare models, alongside technological advancements.

Key Market Segments

Product

- Cranial Fixation Devices

- Screws

- Meshes

- Others

- Cranial Stabilization Devices

- Skull Clamps

- Horseshoe Headrests

- Others

Material Type

- Resorbable Fixation Systems

- Nonresorbable Fixation Systems

End-User

- Hospitals

- Ambulatory Surgical Centers

Drivers

Increasing Incidences of Neurological Disorders and Traumatic Brain Injuries

The surge in neurological disorders and traumatic brain injuries globally acts as a primary driver for the expansion of the Cranial Fixation and Stabilization Devices Market. The World Health Organization (WHO) reports that neurological disorders, including brain tumors, hydrocephalus, epilepsy, and Parkinson’s disease, affect millions worldwide, necessitating advanced surgical interventions.

For instance, the global incidence of traumatic brain injuries is estimated at approximately 69 million cases annually, as per the Lancet Neurology. This growing patient pool, combined with demographic shifts towards an aging population more prone to neurodegenerative diseases and the rise in accidents and sports injuries, significantly fuels the demand for cranial fixation and stabilization devices. These devices are crucial for supporting surgeries aimed at treating such conditions, thereby driving market growth as healthcare providers seek more sophisticated neurosurgical tools to improve patient outcomes.

Restraints

High Cost of Neurosurgery and Associated Devices

A significant restraint on the global cranial fixation and stabilization devices market is the burgeoning incidences of neurological disorders and traumatic brain injuries, juxtaposed with economic and healthcare system disparities. The Global Burden of Disease Study indicates neurological disorders are among the leading causes of disability-adjusted life years (DALYs), amounting to 276 million globally. Additionally, traumatic brain injuries contribute to about 69 million cases annually, as per the International Brain Injury Association. These statistics underscore a growing patient demographic in need of neurosurgical procedures that rely on cranial fixation and stabilization devices.

However, the high costs associated with these medical interventions pose a significant barrier, particularly in low- and middle-income countries where healthcare spending is constrained. This dichotomy not only emphasizes the demand for such devices but also highlights the economic and accessibility challenges that hinder market growth, especially in regions struggling to provide advanced medical care to their populations.

Opportunities

Technological Advancements and Innovation

The opportunity for the global cranial fixation and stabilization devices market lies in technological advancements and innovations, notably through the integration of biocompatible materials and 3D printing technologies. These advancements are revolutionizing the production of devices that are not only more effective but also customized to meet individual patient needs. For instance, the use of 3D printing has enabled the creation of implants tailored to the specific anatomical requirements of patients, significantly improving surgical outcomes.

According to a report by the Global Neurosurgery Association, the application of these innovative technologies has the potential to reduce surgical time by up to 30%, enhancing the efficiency of procedures and patient recovery times. Furthermore, the advancements in minimally invasive surgery techniques are expanding the devices’ applicability across a broader spectrum of neurological conditions, thereby broadening the market reach and improving patient care on a global scale.

Trends

Increasing Adoption of Minimally Invasive Surgeries

The global cranial fixation and stabilization devices market is witnessing a significant trend with the increasing adoption of minimally invasive surgeries (MIS). This shift towards MIS is driven by its advantages, including reduced hospitalization times, lower risk of infections, and faster recovery periods when compared to traditional open surgical approaches.

According to a report by the American Hospital Association, MIS procedures have been shown to reduce hospital stay by up to 50% and decrease infection rates by approximately 30%, showcasing the tangible benefits of these techniques. This trend is catalyzing the demand for advanced cranial fixation and stabilization devices that are tailored for MIS, leading to innovations in device development and an expanded application range. As the healthcare sector and patients lean more towards less invasive options, the market for these specialized devices is poised for growth, steering both the evolution and uptake of novel and improved technologies in cranial surgeries.

Regional Analysis

In 2023, North America emerged as the dominant force in the Cranial Fixation and Stabilization Devices Market, seizing over 42% of the global market share, with a value of USD 0.9 billion. This was attributed to advanced healthcare infrastructure, substantial healthcare expenditure, and robust regulatory support for medical device innovation.

The United States played a pivotal role in this regional supremacy due to its large population and sophisticated healthcare system. Renowned medical research institutions and leading neurosurgical centers fueled innovation and adoption of advanced surgical techniques.

Europe also claimed a significant share in the global market, led by countries like Germany, France, and the United Kingdom. Their well-established healthcare infrastructure, favorable reimbursement policies, and growing geriatric population drove demand for neurosurgical interventions and related devices.

While Asia-Pacific held a smaller market share, it experienced rapid growth driven by expanding healthcare infrastructure and increasing awareness about neurosurgical procedures, especially in China, India, and Japan.

Latin America and the Middle East & Africa regions showed steady growth, albeit slower, due to improving healthcare infrastructure and rising disposable income. However, challenges like healthcare accessibility and regulatory hurdles constrained growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the realm of Cranial Fixation and Stabilization Devices, several key players dominate the market, each contributing unique expertise and innovation to the field. Integra LifeSciences Corporation leads the pack with its extensive range of devices tailored to neurosurgical needs. Renowned for reliability and precision, Integra’s offerings cover a wide spectrum of cranial procedures, from trauma cases to complex reconstructions.

Medtronic Plc, a global medical technology giant, commands attention with its comprehensive suite of cranial fixation solutions. Leveraging cutting-edge research and development, Medtronic’s devices prioritize both surgical efficacy and patient safety. Their commitment to advancing neurosurgical techniques makes them a formidable presence in the market.

Depuy Synthes, under the umbrella of Johnson & Johnson, is synonymous with quality and innovation in cranial fixation. Their portfolio encompasses a diverse array of devices designed to address various neurosurgical challenges. From fracture management to cranial reconstruction, Depuy Synthes offers reliable solutions trusted by surgeons worldwide.

B. Braun SE, a prominent player in healthcare solutions, brings its expertise to the cranial fixation market with a focus on patient-centric design and safety. Their devices, ranging from fixation systems to specialized implants, reflect a dedication to improving surgical outcomes and patient care standards.

Additionally, other key players contribute to the dynamic landscape of cranial fixation and stabilization devices. While their market presence may vary, these players play vital roles in driving innovation and expanding access to advanced neurosurgical technologies. Together, these companies shape the future of cranial fixation, pushing boundaries and improving outcomes for patients worldwide.

Market Key Players

- Integra LifeSciences Corporation

- Medtronic Plc

- Depuy Synthes

- B. Braun SE

- Stryker Corporation

- Zimmer Biomet

- Integra Lifesciences

- KLS Martin

- Other Key Players

Recent Developments

- In October 2023, KLS Martin merged with KARL STORZ SE & Co. KG, forming a significant presence in the medical technology sector. This merger expanded their cranial fixation portfolio, positioning them as a leading player in the field.

- In September 2023, B. Braun SE launched the SECUREFIX® cranial plate system. This system provides a minimally invasive option for cranial fixation, featuring self-drilling screws for enhanced convenience and efficiency.

- In June 2023, Medtronic Plc introduced the SKYPOINT™ Cranial Fixation System. This system utilizes 3D-printed titanium implants for personalized cranial reconstruction. Additionally, in July 2023, Medtronic acquired Brainlab AG, allowing it to incorporate Brainlab’s cranial navigation and planning technologies into its offerings.

- In April 2023, Integra LifeSciences acquired Aesculap AG’s neurosurgery business, which bolstered its cranial fixation offerings by adding Aesculap’s cranioplasty solutions to its portfolio.

Report Scope

Report Features Description Market Value (2023) USD 2.3 Bn Forecast Revenue (2033) USD 4 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product [Cranial Fixation Devices (Screws, Meshes, Others), Cranial Stabilization Devices (Skull Clamps, Horseshoe Headrests, Others)], By Material Type (Resorbable Fixation Systems, Nonresorbable Fixation Systems), By End-User (Hospitals, Ambulatory Surgical Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Integra LifeSciences Corporation, Medtronic Plc, Depuy Synthes, B. Braun SE, Stryker Corporation, Zimmer Biomet, Integra Lifesciences, KLS Martin, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Cranial Fixation and Stabilization Devices market in 2023?The Cranial Fixation and Stabilization Devices market size is USD 2.3 billion in 2023.

What is the projected CAGR at which the Cranial Fixation and Stabilization Devices market is expected to grow at?The Cranial Fixation and Stabilization Devices market is expected to grow at a CAGR of 5.6% (2024-2033).

List the segments encompassed in this report on the Cranial Fixation and Stabilization Devices market?Market.US has segmented the Cranial Fixation and Stabilization Devices market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Cranial Fixation Devices (Screws, Meshes, Others), Cranial Stabilization Devices (Skull Clamps, Horseshoe Headrests, Others). By Material Type the market has been segmented into Resorbable Fixation Systems, Nonresorbable Fixation Systems. By End-User the market has been segmented into Hospitals, Ambulatory Surgical Centers.

List the key industry players of the Cranial Fixation and Stabilization Devices market?Integra LifeSciences Corporation, Medtronic Plc, Depuy Synthes, B. Braun SE, Stryker Corporation, Zimmer Biomet, Integra Lifesciences, KLS Martin, Other Key Players

Which region is more appealing for vendors employed in the Cranial Fixation and Stabilization Devices market?North America is expected to account for the highest revenue share of 42% and boasting an impressive market value of USD 0.9 billion. Therefore, the Cranial Fixation and Stabilization Devices industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Cranial Fixation and Stabilization Devices?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Cranial Fixation and Stabilization Devices Market.

Cranial Fixation and Stabilization Devices MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Cranial Fixation and Stabilization Devices MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Integra LifeSciences Corporation

- Medtronic Plc

- Depuy Synthes

- B. Braun SE

- Stryker Corporation

- Zimmer Biomet

- Integra Lifesciences

- KLS Martin

- Other Key Players