Global Corrugated Bulk Bins Market By Load Capacity(More Than 1500 Kg, 1000 -1500 Kg, Below 1000 Kg), By Type(Hinged, Pallet Packs, Others, By Format, Single Wall, Double Wall, Triple Wall, Others), By Application(Food & beverage, Automotive, Pharmaceutical, Chemical, Oil & Lubricant, Building & Construction, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 73452

- Number of Pages: 347

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

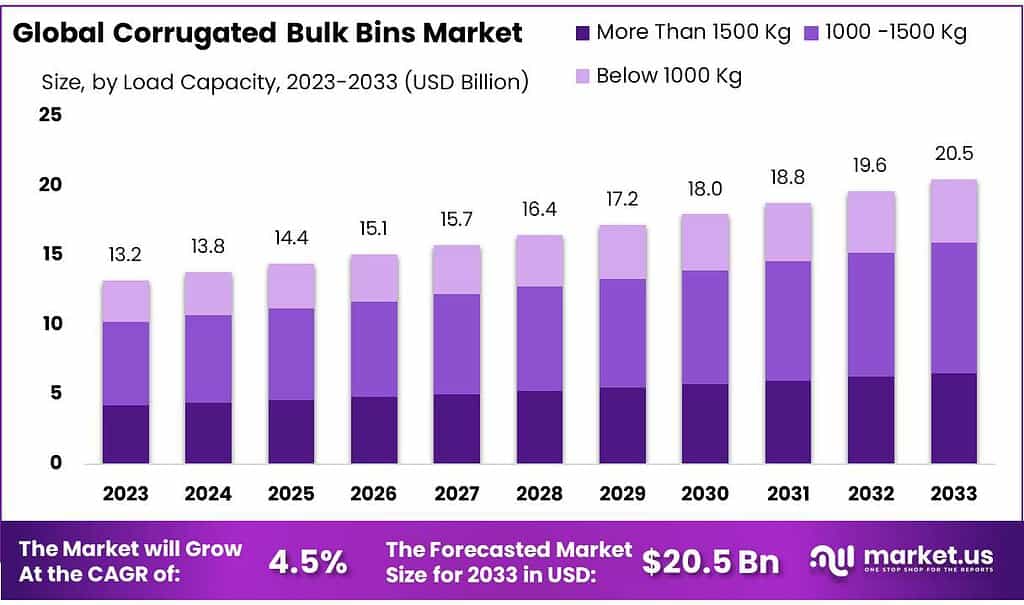

The global Corrugated Bulk Bins Market size is expected to be worth around USD 20.5 billion by 2033, from USD 13.2 billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2023 to 2033.

Corrugated bulk bins, commonly referred to as corrugated bins or bulk boxes, are large, durable containers designed for the storage, handling, and transportation of various goods in bulk quantities. These bins are typically made from corrugated fiberboard, a strong and rigid material known for its durability and sustainability.

Corrugated bulk bins are widely used across diverse industries for efficiently organizing and transporting bulk products such as fruits, vegetables, industrial components, and other commodities. The design of these bins includes fluted layers of paperboard that provide structural strength and support, making them suitable for heavy-duty applications. Corrugated bulk bins offer advantages such as cost-effectiveness, recyclability, and ease of customization, contributing to their widespread adoption in the packaging and logistics sectors.

By Load Capacity

In 2023, the segment of corrugated bulk bins with a load capacity ranging from 1000 to 1500 kg held a dominant market position, capturing more than a 45.6% share. This indicates that within the corrugated bulk bins market, the majority of bins were designed to accommodate a load capacity falling within the specified range of 1000 to 1500 kg.

The preference for this load capacity range suggests its alignment with the prevalent needs and requirements of industries relying on corrugated bulk bins for the storage, handling, and transportation of goods.

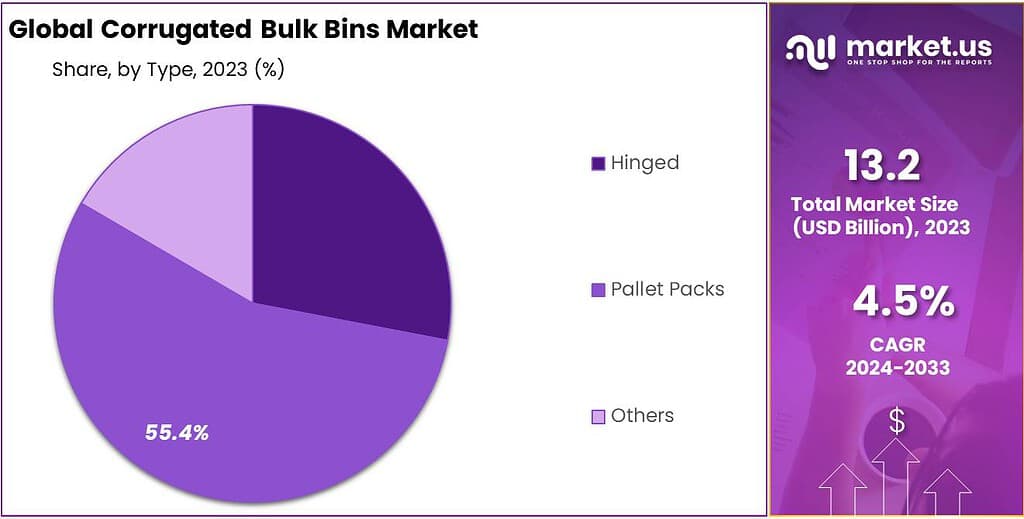

By Type

In 2023, the segment of corrugated bulk bins categorized as Pallet Packs held a dominant market position, capturing more than a 55.4% share. This indicates a significant preference for Pallet Packs within the corrugated bulk bins market, showcasing their popularity among industries for storage and transportation needs.

The robust market share suggests that Pallet Packs are a preferred choice, possibly due to their efficiency, convenience, and suitability for various applications in managing and transporting bulk goods.

By Format

In 2023, the segment of corrugated bulk bins classified as Double Wall held a dominant market position, capturing more than a 42.7% share. This indicates a notable preference for Double Wall configurations within the corrugated bulk bins market, showcasing their popularity in providing enhanced strength and durability.

The significant market share suggests that double-wall bins are favored, possibly due to their ability to withstand heavier loads and offer increased protection for bulk goods during storage and transportation.

By Application

In 2023, the Food & Beverage segment held a dominant market position in the corrugated bulk bins market, capturing more than a 28.7% share. This signifies a substantial preference for corrugated bulk bins within the food and beverage industry, indicating their widespread use for packaging and transporting goods in this sector.

The significant market share suggests that corrugated bulk bins are extensively adopted for the storage and transportation of food and beverage products, emphasizing their role in maintaining product integrity and ensuring efficient logistics within the industry.

Market Key Segmentation

By Load Capacity

- More Than 1500 Kg

- 1000 -1500 Kg

- Below 1000 Kg

By Type

- Hinged

- Pallet Packs

- Others

By Format

- Single Wall

- Double Wall

- Triple Wall

- Others

By Application

- Food & beverage

- Automotive

- Pharmaceutical

- Chemical

- Oil & Lubricant

- Building & Construction

- Others

Market Drivers

Sustainability and Eco-Friendly Practices:

The primary driver for the Corrugated Bulk Bins market is the growing emphasis on sustainability and eco-friendly packaging solutions. With increasing awareness of environmental concerns, businesses are opting for packaging materials that are recyclable and biodegradable. Corrugated bulk bins, being made from renewable and recyclable materials, align with these sustainability goals, driving their adoption across various industries.

Rise in Global Trade and Logistics:

Another significant driver is the surge in global trade and logistics activities. As the global economy continues to expand, the need for efficient and cost-effective transportation and storage solutions becomes critical. Corrugated bulk bins provide a lightweight yet robust packaging solution for transporting goods in bulk, reducing shipping costs and ensuring the safety of products during transit.

Market Restraints

Limited Load-Bearing Capacity:

A key restraint in the Corrugated Bulk Bins market is the limited load-bearing capacity compared to some alternative materials. While corrugated bulk bins are suitable for many applications, there are scenarios, especially in heavy industries, where materials with higher load-bearing capabilities might be preferred. This limitation poses challenges in certain industries where heavier products need to be transported or stored.

Vulnerability to Harsh Environmental Conditions:

Corrugated bulk bins may be vulnerable to harsh environmental conditions such as excessive moisture or prolonged exposure to the elements. While advancements in water-resistant coatings have addressed some of these concerns, the inherent nature of corrugated materials makes them more susceptible to damage in challenging weather conditions. This limitation necessitates careful consideration of the intended use and environmental factors.

Market Opportunities

E-Commerce Packaging Solutions:

A significant opportunity for the Corrugated Bulk Bins market lies in providing packaging solutions for the booming e-commerce industry. With the rise of online shopping, there is an increasing demand for packaging that ensures the safe delivery of products. Corrugated bulk bins offer a cost-effective and sustainable option for e-commerce businesses to package and transport goods securely.

Integration of Smart Packaging Technologies:

The opportunity to integrate smart packaging technologies presents an exciting avenue for corrugated bulk bins. RFID (Radio-Frequency Identification) or QR code technology can be incorporated into the design, enabling enhanced tracking and traceability of products during transit. This not only adds value in terms of supply chain visibility but also aligns with the broader trend of digitalization in logistics.

Market Trends

Customization and Branding Opportunities:

A notable trend in the Corrugated Bulk Bins market is the increasing focus on customization and branding. Companies are recognizing the potential of bulk bins not only as functional packaging but also as a means to enhance brand visibility. Customized printing on corrugated bulk bins allows businesses to convey their brand message, product information, and logos effectively, contributing to a visually appealing and marketable packaging solution.

Innovation in Design for Enhanced Functionality:

There is a growing trend towards innovation in the design of corrugated bulk bins to enhance functionality. Manufacturers are exploring designs that offer easy assembly, collapsibility for efficient storage when not in use, and features like access flaps for convenient loading and unloading. These design innovations contribute to the versatility and adaptability of corrugated bulk bins across diverse industries.

Regional Analysis

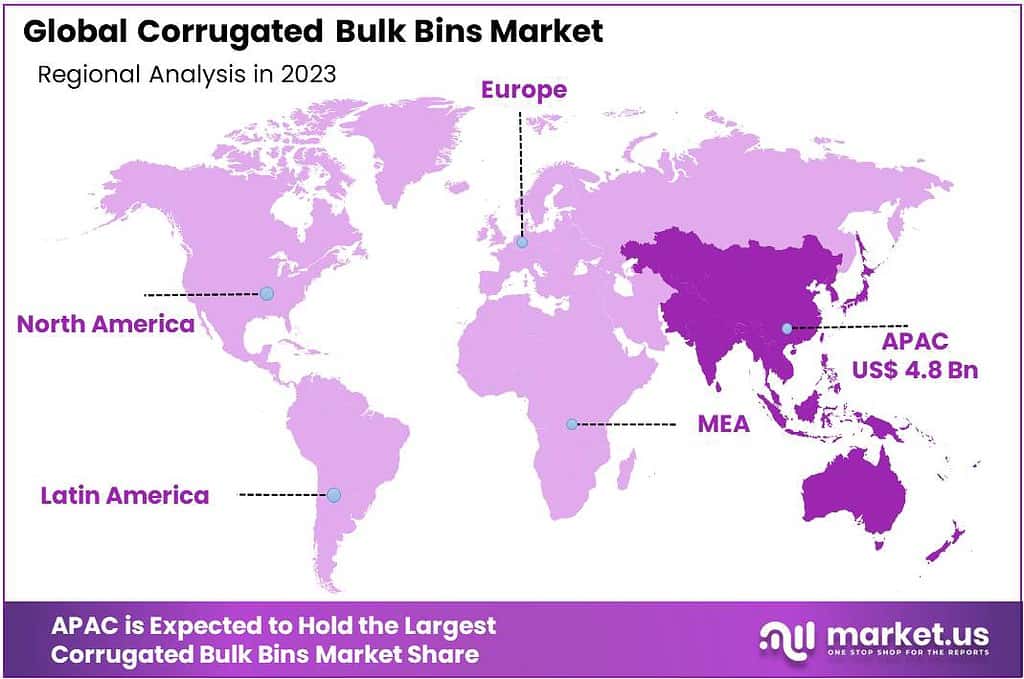

In 2023, Asia Pacific (APAC) emerged as the dominant player in the Corrugated Bulk Bins market, securing a substantial revenue share exceeding 36.5%. This dominance is a result of robust regulatory backing for renewable energy initiatives, particularly notable in the US and Canada. In these regions, government incentives and policies have propelled the adoption of Corrugated Bulk Bins, making them an appealing and practical choice for both producers and consumers.

In North America, the renewable energy sector showcased its maturity and technological advancement, reaching record-breaking levels in clean power PPAs. The signing of nearly 20 GW in 2022 underscores the region’s commitment to sustainable energy practices. Simultaneously, Europe experienced the fastest growth rate in the Styrenic Polymers market, achieving an impressive 36.6% Compound Annual Growth Rate (CAGR) during the forecasted period.

Forecasts suggest that Europe is on track to surpass North America in market share, driven by stringent environmental regulations and ambitious renewable energy targets set by the European Union. Notably, 2023 marked a record-breaking year for the European Power Purchase Agreement (PPA) market, witnessing contracted renewable power volumes exceeding 16.2 GW. Projections for 2024 anticipate further growth, with the European PPA market expected to exceed 20 GW. This surge in demand for renewable PPAs in Europe aligns with the escalating corporate commitment to sustainability, reflecting companies’ objectives to curtail their carbon footprint and ensure a sustainable energy future.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

In the Corrugated Bulk Bins market, several key players contribute to its dynamics and growth. These companies play pivotal roles in shaping the market landscape. Here’s a brief analysis of some key players in the Corrugated Bulk Bins market:

Market Key Players

- International Paper Company

- Mondi Group

- WestRock Company

- DS Smith Plc

- Smurfit Kappa Group

- Georgia-Pacific LLC

- Pratt Industries, Inc.

- Greif, Inc.

- Orora Packaging Australia Pty Ltd

- Packaging Corporation of America

- Cascades Inc.

- Sonoco Products Company

- KapStone Paper and Packaging Corporation

- Rengo Co., Ltd.

- UFP Technologies, Inc.

Report Scope

Report Features Description Market Value (2023) US$ 13.2 Bn Forecast Revenue (2033) US$ 20.5 Bn CAGR (2024-2033) 4.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Load Capacity(More Than 1500 Kg, 1000 -1500 Kg, Below 1000 Kg), By Type(Hinged, Pallet Packs, Others, By Format, Single Wall, Double Wall, Triple Wall, Others), By Application(Food & beverage, Automotive, Pharmaceutical, Chemical, Oil & Lubricant, Building & Construction, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape International Paper Company, Mondi Group, WestRock Company, DS Smith Plc, Smurfit Kappa Group, Georgia-Pacific LLC, Pratt Industries, Inc., Greif, Inc., Orora Packaging Australia Pty Ltd, Packaging Corporation of America, Cascades Inc., Sonoco Products Company, KapStone Paper and Packaging Corporation, Rengo Co., Ltd., UFP Technologies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Corrugated Bulk Bins Market?Corrugated Bulk Bins Market size is expected to be worth around USD 20.5 billion by 2033, from USD 13.2 billion in 2023

What is the CAGR for the Corrugated Bulk Bins MarketThe Corrugated Bulk Bins Market expected to grow at a CAGR of 4.5% during 2023-2032.Who are the key players in the Corrugated Bulk Bins Market?International Paper Company, Mondi Group, WestRock Company, DS Smith Plc, Smurfit Kappa Group, Georgia-Pacific LLC, Pratt Industries, Inc., Greif, Inc., Orora Packaging Australia Pty Ltd, Packaging Corporation of America, Cascades Inc., Sonoco Products Company, KapStone Paper and Packaging Corporation, Rengo Co., Ltd., UFP Technologies, Inc.

Corrugated Bulk Bins MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Corrugated Bulk Bins MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- International Paper Company

- Mondi Group

- WestRock Company

- DS Smith Plc

- Smurfit Kappa Group

- Georgia-Pacific LLC

- Pratt Industries, Inc.

- Greif, Inc.

- Orora Packaging Australia Pty Ltd

- Packaging Corporation of America

- Cascades Inc.

- Sonoco Products Company

- KapStone Paper and Packaging Corporation

- Rengo Co., Ltd.

- UFP Technologies, Inc.