Global Corrugated Board Market By Flute Type (A Flute, B Flute, C Flute, E Flute, F Flute, and Other Flute Type), By Board Style (Single Face, Single Wall, Double Wall, and Triple Wall), By End-User By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Jan 2024

- Report ID: 37794

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

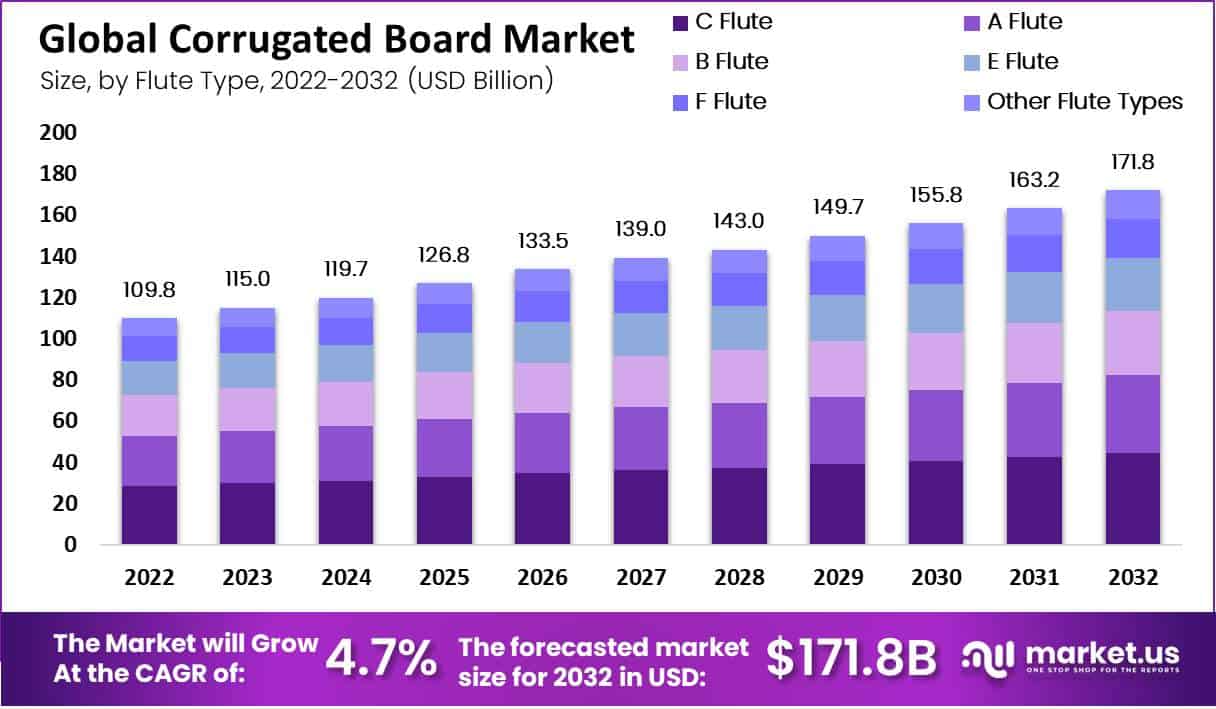

In 2022, the global corrugated board market accounted for USD 109.8 billion. This market is estimated to reach USD 171.8 billion in 2032 at a CAGR of 4.7% between 2023 and 2032. A corrugated board is a type of material used to package products like boxes, cartoons, and containers.

The expansion of the packaging sector, fueled by trends including the growing demand for e-commerce, increasing consumer spending, and rising packaging sustainability concerns, fuels the worldwide corrugated board market.

The market was driven by the globalization of the e-commerce sector and the growing demand for environmentally friendly packaging. In some industries, including those that deal with food and beverage, healthcare, cosmetics, and personal care, plastics are one of the most used materials for packaging.

The increased use of plastic has a negative effect on the environment; at that time, the corrugated board helped make the positive side for the environment.

Key Takeaways

- Market Growth: In 2022, the global corrugated board market was valued at USD 109.8 billion, and it is projected to reach USD 171.8 billion in 2032, with a compound annual growth rate (CAGR) of 4.7% between 2023 and 2032.

- Corrugated Board’s Purpose: Corrugated boards are essential materials used for packaging products such as boxes, cartons, and containers. The market’s expansion is driven by factors like the increasing demand for e-commerce, growing consumer spending, and rising concerns about packaging sustainability.

- E-commerce Boost: The globalization of the e-commerce sector and the demand for environmentally friendly packaging have driven the corrugated board market. It is considered an eco-friendly alternative to materials like plastics, which have a negative impact on the environment.

- Online Shopping Demand: Corrugated board packaging has experienced significant growth due to the popularity of online shopping. It offers durability, lightweight properties, and excellent protection for products during transportation and handling.

- Cost-Efficient Solution: Corrugated boards are a cost-effective packaging solution, especially when compared to materials like plastic or wood. This cost efficiency has attracted small and mid-sized enterprises, contributing to market growth.

- Recycling Challenges: While corrugated cardboard can be recycled, it may not be as efficiently recycled as materials like plastic and metal. This can deter clients who prioritize sustainability, potentially leading to the use of alternative materials.

- Flute Type Significance: The C-flute type dominated the market in 2022, with a 26% market share. C-Flute is known for providing cushioning and sustainability, making it a popular choice for packaging needs.

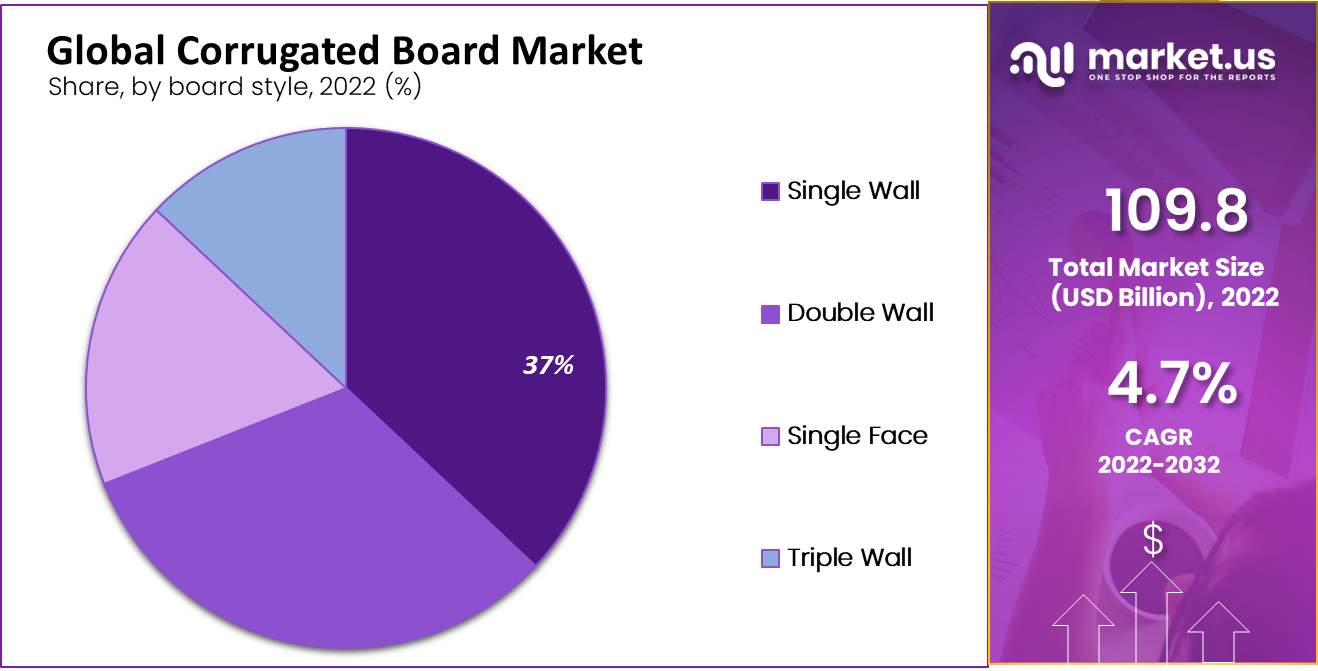

- Board Style Trends: Single-wall corrugated boards held a significant share of the market, with a 37% market share. They are known for their strength and durability, making them suitable for shipping and retail packaging.

- End-User Preferences: The Food & Beverages segment accounted for the largest revenue share in 2022. Corrugated boards are favored in this industry due to their strength and suitability for packaging food and beverages.

- Emerging Technologies: Corrugated boards are adapting to new technologies and business models. Sustainable packaging options are in demand, and the material’s adaptability to online shopping is contributing to market growth.

- Increasing Consumption of Packaged Food: The rise in packaged food consumption is boosting the food and beverage industry, which, in turn, benefits corrugated board packaging. Custom-shaped corrugated boxes are becoming popular for retail and e-commerce packaging.

- Customization and Personalization: Customization and personalization are gaining importance in the corrugated board industry, with brands using unique package designs, personalized messaging, and custom-shaped boxes to stand out.

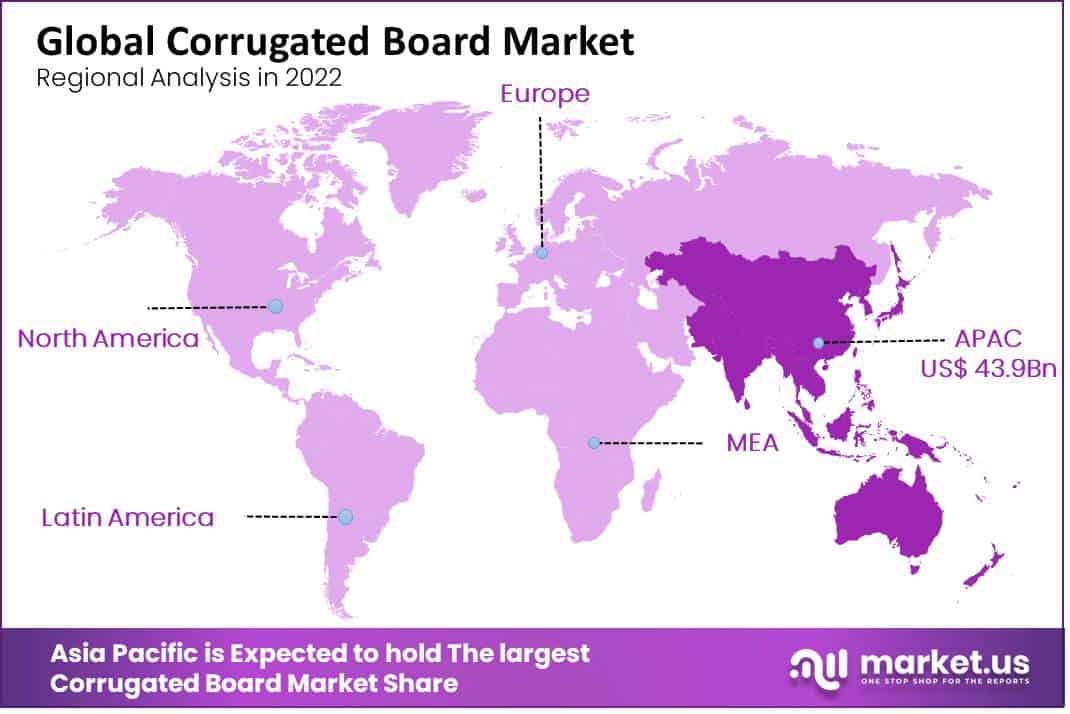

- Regional Dominance: Asia Pacific accounted for the largest revenue share in 2022, Asia Pacific is the most lucrative market in the global corrugated board market, with a 40% market share in 2022.

- Key Market Players: Major players in the corrugated board market include International Paper, Georgia-Pacific, WestRock Company, Packaging Corporation of America, and others.

Driving Factors

As online shopping continues to gain in popularity, corrugated board packaging has experienced rapid expansion as an essential solution. Online purchases require durable yet lightweight solutions – which corrugated board delivers. The corrugated board has seen tremendous growth thanks to online retail platforms and provides excellent product protection during transportation and handling.

Corrugated board’s cushioning properties and structural integrity make it the ideal packaging material for fragile and valuable goods, particularly electronics, food & beverage, and pharmaceutical companies that rely on reliable packaging solutions to safeguard their products.

As these industries demand reliable packaging solutions to safeguard their products, the corrugated board has seen increased usage. The corrugated board offers an inexpensive packaging solution when compared with alternatives such as plastic or wood, being relatively cheap to produce and light enough for transportation costs to be kept down.

Due to this cost-efficiency, corrugated board packaging has attracted small and mid-sized enterprises that further fuel market expansion.

Restraining Factors

Although corrugated cardboard can be recycled, it cannot be recycled as effectively as other materials like plastic and metal. Because of this, corrugated boards are less appealing to clients who place a high value on sustainability and environmental friendliness; due to this, companies can decide to use different materials, thereby decreasing the market for corrugated boards.

The potential for expansion in the global market for corrugated boards is constrained by a number of reasons. One of these factors is the growing tendency towards digitization, which has resulted in a drop in demand for tangible packing materials like corrugated boards. The necessity for conventional packaging solutions declines as more businesses move their activities online, which has a detrimental effect on the demand for corrugated boards.

The rising price of the raw resources required to make corrugated boards is another restraint. Due to variables including inflation, scarcity as well and environmental requirements, the price of products like paper and glue has been rising. Due to this, the overall cost of production has increased, which has an impact on the final price of corrugated boards.

By Flute Type Analysis

The C Flute Segment Accounted for the Largest Revenue Share in the Corrugated Board Market in 2022.

Based on flute type, the C-flute type segment dominates the corrugated board market with a 26% market share. One of the most popular flute types in the corrugated board industry is the C-Flute.

For products that need protection during shipping, C-Flute offers mild cushioning. The flexibility provided by the flute’s height serves to absorb shock and shield the product inside from damage.

C-Flute is an eco-friendly choice for packaging because it is manufactured from recyclable materials and renewable resources. Due to the advantages of C-Flute and other corrugated board solutions in terms of sustainability, more businesses are doing so.

Because C-Flute has good stacking strength, it can support the weight of other boxes when they are stacked on top of it. It can therefore be used for storage and transportation.

The A Flute Segment is the Fastest Growing Type Segment in the Corrugated Board Market.

The A Flute type segment is projected as the fastest growing segment in the corrugated board market. With flutes that measure 4.8 mm in height, this flute type is the oldest and includes the largest flutes.

It is perfect for delivering delicate or fragile things since it provides excellent cushioning. A flute is a good choice for packaging that needs high-quality graphics because of its outstanding printing surface.

This flute type, which has a height of 3.6 mm, is regardless as being the most adaptable. It is appropriate for a variety of uses, including shipping boxes, retail packaging as well and point-of-purchase displays, and it offers good cushioning and stacking strength. With a height of 1.6 mm, the flutes in this type are the smallest. It offers great printability and is perfect for packaging that demands top-notch graphics.

By Board Style Analysis

The Single Wall Holds a Significant Share of the Board Style Segment in the Corrugated Board Market.

Based on board style, the single wall segment dominates the corrugated board market with a 37% market share. A single-wall corrugated board is ideal for shipping and transporting goods because of its strength and durability. The outer and inner liners bring extra support and strength, while the corrugated medium layer offers protection and cushioning.

The most economical choice in the corrugated board market is the single-wall, corrugated board. It is a more appealing alternative for businesses trying to cut expenses associated with the packaging because it is less expensive to manufacture than double or triple wall board. In addition, single-wall corrugated board is perfect for retail packaging and point-of-purchase displays because it offers a smooth and consistent surface for printing and graphics.

By End-User Analysis

The Food and beverages Segment Accounted for the Largest Revenue Share in Corrugated Board Market in 2022.

Based on end-users, Food & Beverages dominates the corrugated board market with a 21% market share. Single-wall corrugated board is suitable for shipping and transporting goods because of its superior strength and durability. The outer and inner liners bring extra support and strength, while the corrugated medium layer offers protection and cushioning. The most economical choice in the corrugated board market is the single-wall, corrugated board.

It is a more appealing alternative for businesses trying to cut expenses associated with the packaging because it is less expensive to manufacture than double or triple wall board. Single-wall corrugated board is perfect for retail packaging and point-of-purchase displays because it offers a smooth and consistent surface for printing and graphics.

The Transportation and logistics Segment is Fastest fastest-growing type Segment in the Corrugated Board Market.

Due to its strength, durability, and stackability, corrugated board packaging is widely used in the transportation and logistics sector. In the logistics and transportation sector, corrugated board is most frequently used to make shipping boxes.

They come in a variety of shapes and sizes to accommodate diverse products and are intended to safeguard goods during handling and transportation. Products are protected during handling and transit by corrugated board dunnage. It is offered in a variety of shapes, including pads, cushions, and dividers, and it can be tailored to meet certain product needs.

Key Market Segments

Based on Flute Type

- A Flute

- B Flute

- C Flute

- E Flute

- F Flute

- Other Flute Types

Based on Board Style

- Single Face

- Single Wall

- Double Wall

- Triple Wall

Based on End-User

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Automotive

- Transportation & Logistics

- Other End-Users

Growth Opportunity

New Emerging Technologies and Business Models Create the Opportunity for Podcasters.

Customers are searching for sustainable packaging choices as they become more ecologically concerned. Corrugated board is an excellent material for conscious consumers because it is manufactured from renewable resources, is easily recycled, and is very sustainable.

With more and more people shopping online, the e-commerce sector is expanding quickly. Since the corrugated board studies lightweight and can be tailored to fit a variety of products. It is the perfect material for e-commerce packing.

More people are choosing packaged foods and beverages, contributing to growth in the food and beverage business. Because it offers excellent protection and can be printed with eye-catching graphics, corrugated board is a popular material for food and beverage packaging.

Manufacturers of corrugated boards are continuously coming up with fresh packaging ideas to fulfill the demands of diverse sectors. For instance, custom-shaped corrugated boxes are becoming more and more common for retail and e-commerce packaging, providing customers with a distinctive and memorable unboxing experience.

Latest Trends

Increasing Consumption of Packaged Food

More people are choosing packaged foods and beverages, which is contributing to growth in the food and beverage business. Because it offers excellent protection and can be printed with eye-catching graphics, corrugated board is a popular material for food and beverage packaging.

Manufacturers of corrugated boards are continuously coming up with fresh packaging ideas to fulfill the demands of diverse sectors. For instance, custom-shaped corrugated boxes are becoming more and more common for retail and e-commerce packaging, providing customers with a distinctive and memorable unboxing experience.

In the corrugated board industry, customization and personalization are gaining importance as firms seek to differentiate themselves from the competition by providing distinctive and memorable package designs. Personalized messaging, printing on the interior of the box, and custom-shaped boxes are just a few ways that brands stand out from the competition.

The production of corrugated boards is changing due to automation and Industry 4.0 technologies, which make it more productive, economical, and sustainable. Robotics, AI, and machine learning innovations are being used to streamline production procedures, cut waste as well as enhance quality assurance.

Regional Analysis

Asia Pacific accounted for the Largest Revenue Share in the Global Corrugated Board Market in 2022.

Asia Pacific is estimated to be the most lucrative market in the global corrugated board market, with the largest market share of 40%. The largest and fastest-growing market for corrugated board is in the Asia Pacific area, driven by rising demand from sector like food and beverage, e-commerce, and retails.

The need for corrugated board packaging is also being fueled by rapid urbanization and an expanding middle class in nations like China and India.

The high level of automation. With effective logistics and the demand for environmentally friendly packaging options, the North American region was the fastest-growing market for the corrugated board market.

The biggest market in this region for corrugated boards is the United States, Canada, and Mexico. The market in this region is expanding as a result of the movement towards sustainable packaging and the implementation of strict environmental rules.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global market is vast and dispersed. Therefore, the market’s participants—from small to large manufacturers are fiercely competitive at all levels. Additionally, the market is distinguished by the existence of numerous well-known, century-old public companies.

However, manufacturing firms frequently engage in rivalry with other businesses that make comparable goods that could serve as corrugated board replacements. Services, product quality, cost, and price are the main determinants of market rivalry.

Market Key Players

- International Paper

- Georgia-Pacific

- WestRock Company

- Packaging Corporation of America

- Stora Enso

- Oji Holdings Corporation

- Smurfit Kappa

- Port Townsend Paper Company

- Mondi

- DS Smith

- Other key Players

Recent Developments

- In January 2021, Georgia-Pacific revealed that it had successfully sold DS Smith, a top supplier of corrugated packaging, its Europac business, and a Spanish developer of packaging solutions.

- In November 2020, To concentrate on its core paper and packaging business, WestRock announced that it will sell its Home, Health, and Beauty division to Silgan Holdings Inc.

Report Scope

Report Features Description Market Value (2022) USD 109.8 Bn Forecast Revenue (2032) USD 171.8 Bn CAGR (2023-2032) 4.70% Base Year for Estimation 2022 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Flute Type (A Flute, B Flute, C Flute, E Flute, F Flute, and Other Flute Types) By Board Style (Single Face, Single Wall, Double Wall, and Triple Wall)

By End-User (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Automotive, Transportation & Logistics, and Other End-Users)

Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape International Paper, Georgia-Pacific, WestRock Company, Packaging Corporation of America, Stora Enso, Oji Holdings Corporation, Smurfit Kappa, Port Townsend Paper Company, Mondi, DS Smith and Other key Players.

Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Corrugated Board Market?In 2022, the global Corrugated Board Market was valued at USD 109.8 Billion.

What will be the market size for Corrugated Board Market in 2032?In 2032, the Corrugated Board Market will reach USD 171.8 Billion.

What CAGR is projected for the Corrugated Board Market?The Corrugated Board Market is expected to grow at 4.7% CAGR (2023-2032).

List the segments encompassed in this report on the Corrugated Board Market?Market.US has segmented the Corrugated Board Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Flute Type, market has been segmented into A Flute, B Flute, C Flute, E Flute ,F Flute and Other Flute Types. By Board Style, the market has been further divided into Single Face, Single Wall, Double Wall and Triple Wall.

Which segment dominate the Corrugated Board industry?With respect to the Corrugated Board industry, vendors can expect to leverage greater prospective business opportunities through the C Flute segment, as this dominate this industry.

Name the major industry players in the Corrugated Board Market.International Paper, Georgia-Pacific, WestRock Company, Packaging Corporation of America, Stora Enso, Oji Holdings Corporation and Other Key Players are the main vendors in this market.

-

-

- International Paper

- Georgia-Pacific

- WestRock Company

- Packaging Corporation of America

- Stora Enso

- Oji Holdings Corporation

- Smurfit Kappa

- Port Townsend Paper Company

- Mondi

- DS Smith

- Other key Players