Global Corrosion Inhibitors Market Size, Share, And Industry Analysis Report By Compound (Organic, Inorganic), By Type (Water-based Corrosion Inhibitors, Oil-based Corrosion Inhibitors, Volatile Corrosion Inhibitors), By End-use (Oil and Gas, Power Generation, Chemicals, Metals Processing, Pulp and Paper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174236

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

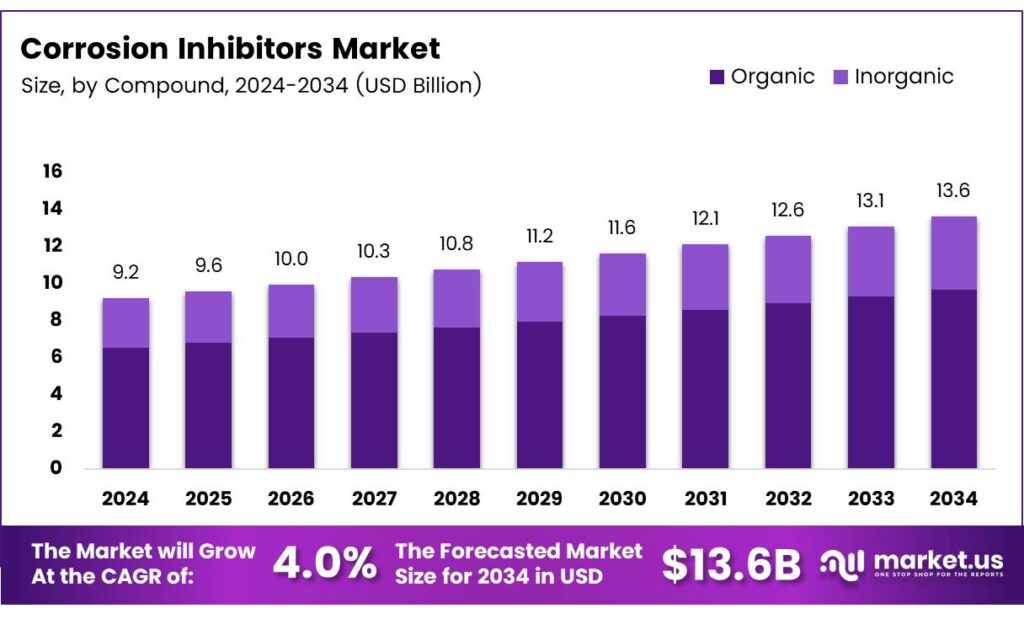

The Global Corrosion Inhibitors Market size is expected to be worth around USD 13.6 billion by 2034, from USD 9.2 billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

The Corrosion Inhibitors Market is a critical support system for industrial asset protection. Broadly, corrosion inhibitors are specialty chemicals added to aggressive environments to slow metal degradation. As industries expand infrastructure lifecycles, demand steadily grows across oil and gas, chemicals, water treatment, and manufacturing operations.

The corrosion inhibitors market addresses both preventive maintenance and cost-avoidance strategies. Companies increasingly prioritize operational continuity, therefore shifting spending from repair to protection. This transition supports long-term contracts, recurring chemical consumption, and higher adoption in pipelines, refineries, boilers, and cooling systems operating under harsh chemical conditions.

- A technological opportunity exists in performance optimization. According to published corrosion science studies from ScienceDirect and Elsevier journals, protection efficiency increases with inhibitor concentration and exposure time. In controlled acidic environments, efficiency peaked at 91.8% using a 0.5 mM concentration at 30 °C, confirming strong cost-to-performance advantages for optimized dosing strategies.

Corrosion inhibitor effectiveness depends on operating conditions. As per ISO 8044-1989, inhibitors reduce corrosion without changing other corrosive agents and can achieve 95–99% efficiency in mild or neutral environments. However, rising temperatures reduce performance, with tests between 30–60 °C showing lower efficiency at higher heat levels.

Time-based performance insights further shape market decision-making. Inhibition efficiency improves with exposure time but declines after 24 h, while corrosion rates slightly increase during prolonged acidic exposure. These findings encourage continuous injection models and monitoring solutions, strengthening long-term market demand for corrosion inhibitors and related services.

Key Takeaways

- The Global Corrosion Inhibitors Market is projected to grow from USD 9.2 billion in 2024 to USD 13.6 billion by 2034, at a 4.0% CAGR.

- Organic corrosion inhibitors dominate the market by compound, holding a leading share of 71.6%.

- Water-based corrosion inhibitors lead by type with a market share of 59.1%, driven by environmental compliance.

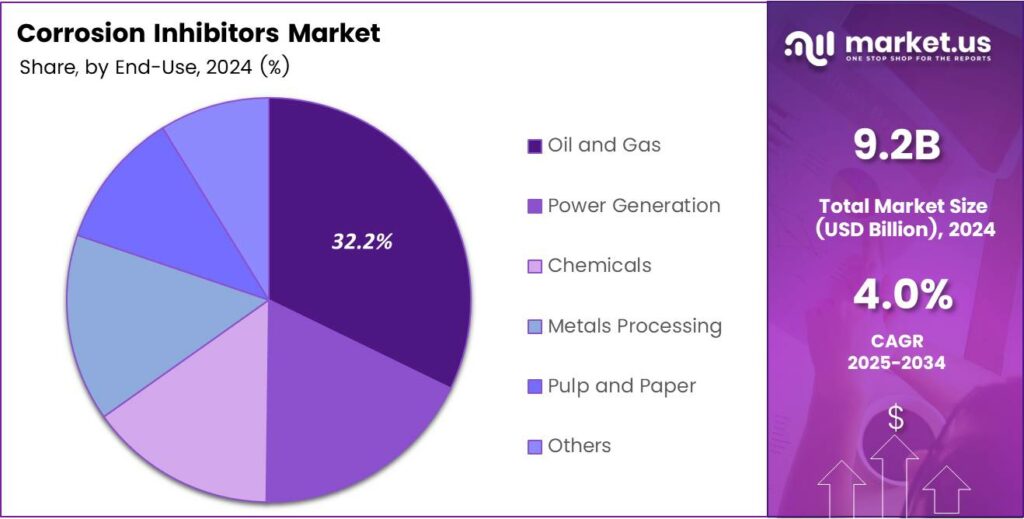

- The Oil and Gas sector is the largest end-use segment, accounting for 32.2% of total market demand.

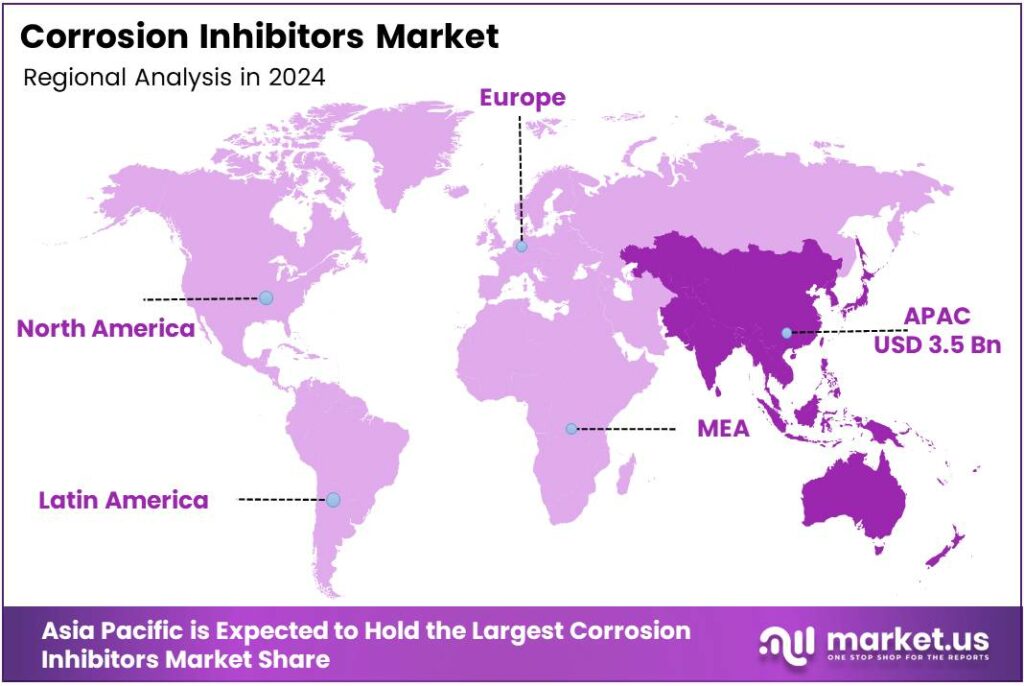

- Asia Pacific is the dominant regional market with a share of 38.5%, valued at USD 3.5 billion.

By Compound Analysis

Organic compounds dominate with 71.6% due to their higher efficiency and formulation flexibility.

In 2025, Organic held a dominant market position in the By Compound Analysis segment of the Corrosion Inhibitors Market, with a 71.6% share. These inhibitors are widely adopted due to better film-forming ability, compatibility with complex systems, and effectiveness across varied temperatures, making them suitable for oilfield, industrial water, and chemical processing environments.

Inorganic corrosion inhibitors continue to play an important supporting role. They are mainly preferred in controlled systems where cost efficiency, simplicity, and long-term stability matter. Although their usage is more regulated, they remain relevant in power plants, cooling systems, and traditional industrial setups requiring consistent corrosion control.

By Type Analysis

Water-based corrosion inhibitors lead with 59.1% driven by environmental compliance and ease of application.

In 2025, Water-based Corrosion Inhibitors held a dominant market position in the By Type Analysis segment of the Corrosion Inhibitors Market, with a 59.1% share. These inhibitors are preferred due to low toxicity, easy handling, and suitability for large-scale industrial water systems, aligning well with tightening environmental and safety requirements.

Oil-based Corrosion Inhibitors remain essential in applications where moisture resistance is critical. They provide strong surface protection in harsh operating environments, especially in upstream oil operations and metal storage. Their usage continues steadily where long-lasting protective films are required.

Volatile Corrosion Inhibitors serve niche yet important roles. They are mainly used in enclosed spaces, packaging, and storage applications. Their ability to protect metal surfaces without direct contact supports demand in precision components and export-oriented metal goods.

By End-use Analysis

Oil and gas dominate with 32.2% due to continuous exposure to corrosive environments.

In 2025, Oil and Gas held a dominant market position in the End-use Analysis segment of the Corrosion Inhibitors Market, with a 32.2% share. High exposure to moisture, acids, and extreme temperatures drives steady demand across drilling, production, and pipeline operations.

Power Generation relies on corrosion inhibitors to protect boilers, turbines, and cooling systems. Consistent operation and asset longevity make inhibitors essential in both conventional and thermal power facilities. Chemicals use corrosion inhibitors to maintain process efficiency and equipment safety. Exposure to aggressive chemicals increases the need for reliable corrosion protection solutions.

Metals Processing depends on inhibitors to protect surfaces during manufacturing and finishing operations, helping reduce material loss and downtime. Pulp and Paper applications require inhibitors to manage corrosion caused by moisture and chemical treatments, supporting smoother plant operations.

Key Market Segments

By Compound

- Organic

- Inorganic

By Type

- Water-based Corrosion Inhibitors

- Oil-based Corrosion Inhibitors

- Volatile Corrosion Inhibitors

By End-use

- Oil and Gas

- Power Generation

- Chemicals

- Metals Processing

- Pulp and Paper

- Others

Emerging Trends

Shift Toward Eco-Friendly and High-Performance Formulations Shapes Market Trends

A key trend in the corrosion inhibitors market is the move toward environmentally friendly products. Industries prefer inhibitors with low toxicity, high biodegradability, and reduced environmental impact. This trend is strong in water treatment, food processing, and offshore operations.

- Regulators are tightening lead limits, which pushes utilities to optimize corrosion control and use proven inhibitor programs more carefully. In the U.S., the Lead and Copper Rule Improvements (LCRI) finalized in the Federal Register lowered the lead action level from 0.015 mg/L to 0.010 mg/L.

Another important trend is customization. End users now demand inhibitors designed for specific metals, fluids, and operating conditions. Tailored solutions improve performance and reduce chemical consumption, making them more cost-effective over time.

Drivers

Rising Industrial Infrastructure and Asset Protection Needs Drive Market Growth

The corrosion inhibitors market is strongly driven by the need to protect expensive industrial assets. Industries such as oil and gas, power generation, chemicals, and water treatment operate metal equipment under harsh conditions. Exposure to moisture, heat, acids, and salts increases corrosion risks. Using inhibitors helps slow metal loss, reduce leaks, and extend equipment life.

- AMPP (the professional body formed from NACE and SSPC) highlights that the annual global cost of corrosion exceeds USD 2.5 trillion, and that applying known corrosion control practices can save a meaningful share of that burden—often cited as up to 35% of costs when best practices are used at scale.

Growing investments in pipelines, refineries, storage tanks, and cooling systems also support demand. These assets are designed for long service periods, making corrosion prevention a priority from the planning stage itself. In many industries, maintenance costs linked to corrosion are higher than initial equipment costs, which encourages preventive chemical use.

Restraints

Environmental and Regulatory Compliance Challenges Limit Market Expansion

One major restraint in the corrosion inhibitors market is the growing environmental concern. Some traditional inhibitors contain toxic or heavy metal components that raise disposal and safety issues. Their use is increasingly restricted, especially in water systems and sensitive environments.

- Strict regulations on chemical usage and wastewater discharge also create compliance challenges. In the U.S., OSHA’s Chromium (VI) standard sets a permissible exposure limit of 5 micrograms per cubic meter (5 µg/m³) as an 8-hour time-weighted average, and also defines an action level of 2.5 µg/m³.

Cost sensitivity in developing regions is another restraint. Although inhibitors reduce long-term maintenance costs, their upfront expense is sometimes seen as avoidable. Small industrial operators may delay adoption, choosing short-term savings over preventive protection.

Growth Factors

Expansion of Energy, Water, and Chemical Processing Sectors Creates New Opportunities

Growth opportunities for corrosion inhibitors are rising with the expansion of energy and water infrastructure. New power plants, desalination facilities, and wastewater treatment systems rely heavily on metal components exposed to corrosive conditions. This creates steady demand for long-term protection solutions.

The shift toward renewable energy also opens new use areas. Solar plants, wind turbines, and energy storage systems use steel structures and cooling circuits that need corrosion control. Inhibitors tailored for these systems offer strong growth potential.

Product innovation adds further opportunity. Industries increasingly seek multifunctional inhibitors that control corrosion, scaling, and microbial growth at the same time. Suppliers offering efficient, low-dose, and application-specific solutions can gain strong market traction.

Regional Analysis

Asia Pacific Dominates the Corrosion Inhibitors Market with a Market Share of 38.5%, Valued at USD 3.5 Billion

Asia Pacific leads the global corrosion inhibitors market due to rapid industrial expansion and infrastructure development. In this region, the market accounts for 38.5% of global demand, with a total value of USD 3.5 billion, supported by strong activity in oil & gas, power generation, and manufacturing. Rising urbanization and large-scale construction projects continue to accelerate metal usage, increasing corrosion protection needs.

North America shows steady growth driven by aging infrastructure and strict asset maintenance standards. The region benefits from high adoption of advanced corrosion protection practices across pipelines, refineries, and water treatment facilities. Strong regulatory focus on safety and operational efficiency supports consistent demand. Technological upgrades in industrial maintenance further reinforce market stability.

Europe’s market growth is shaped by stringent environmental regulations and a strong focus on sustainable industrial operations. Industries increasingly adopt efficient corrosion control solutions to extend equipment life and reduce waste. Infrastructure renovation and renewable energy projects also contribute to demand. The region emphasizes long-term asset reliability and compliance-driven maintenance practices.

The U.S. market is influenced by ongoing upgrades to aging pipelines, bridges, and industrial facilities. Strong emphasis on operational safety and lifecycle cost reduction drives inhibitor usage. Industrial automation and maintenance optimization practices further support demand. Public and private investments in infrastructure resilience sustain long-term market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nouryon is viewed as a practical, formulation-focused supplier that benefits from steady demand in industrial water treatment, process industries, and specialty additives. Its strength is in tailoring inhibitor chemistries to customer operating conditions, helping end users balance protection performance with compliance and total cost.

Cortec Corporation stands out for corrosion protection know-how that is strongly tied to real-world packaging, storage, and asset preservation needs. From an analyst lens, its value proposition is ease of use—solutions that reduce maintenance headaches for manufacturers, logistics operators, and equipment owners across multiple climates.

Ashland is best positioned where customers need consistent performance, compatibility, and formulation flexibility across coatings, industrial fluids, and specialty chemical systems. The company’s approach typically leans toward high-value chemistries and application support, which matters when corrosion control must work alongside surfactants, polymers, and other additives.

Ecolab remains a leader in outcome-driven corrosion programs, especially where water quality, scale, microbiological activity, and corrosion interact in complex ways. Analysts often view its edge as the combination of chemical solutions with monitoring, service expertise, and site-level optimization, which can deliver measurable reliability improvements for industrial and commercial customers.

Top Key Players in the Market

- Nouryon

- Cortec Corporation

- Ashland

- Ecolab

- Henkel Ibérica, S.A.

- The Lubrizol Company

- BASF SE

- Dow

- DuPont de Nemours, Inc.

- Baker Hughes, a GE company LLC

Recent Developments

- In 2025, Nouryon highlighted its chemistry solutions for the oil and gas sector at the Permian Basin International Oil Show, including corrosion inhibition for drilling applications such as demulsification and viscosity control. The company announced five corrosion prevention resolutions for 2026, emphasizing VpCI technology to protect metals during shipment and storage.

- In 2024, Ecolab issued patent US12385143B2 for a corrosion inhibitor composition designed to mitigate alkaline carbonate stress corrosion cracking in oilfield systems. This composition utilizes hydrocarbon-functionalized polyamines to protect metal surfaces in environments containing sulfur, polysulfides, or carbonates.

Report Scope

Report Features Description Market Value (2024) USD 9.2 Billion Forecast Revenue (2034) USD 13.6 Billion CAGR (2025-2034) 4.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Compound (Organic, Inorganic), By Type (Water-based Corrosion Inhibitors, Oil-based Corrosion Inhibitors, Volatile Corrosion Inhibitors), By End-use (Oil and Gas, Power Generation, Chemicals, Metals Processing, Pulp and Paper, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Nouryon, Cortec Corporation, Ashland, Ecolab, Henkel Ibérica, S.A., The Lubrizol Company, BASF SE, Dow, DuPont de Nemours, Inc., Baker Hughes, a GE company LLC Customization Scope Customization for segments and region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Corrosion Inhibitors MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Corrosion Inhibitors MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Nouryon

- Cortec Corporation

- Ashland

- Ecolab

- Henkel Ibérica, S.A.

- The Lubrizol Company

- BASF SE

- Dow

- DuPont de Nemours, Inc.

- Baker Hughes, a GE company LLC