Global Core Banking Systems Market By Deployment (SaaS/Hosted, Licensed), By Banking Type (Large Banks (Greater than USD 30 billion in Assets), Midsize Banks (USD 10 billion to USD 30 billion in Assets), Small Banks (USD 5 billion to USD 10 billion in Assets), Community Banks (Less than USD 5 billion in Assets), Credit Unions), By End-user (Retail Banking, Treasury, Corporate Banking, Wealth Management, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 175447

- Number of Pages: 203

- Format:

-

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Deployment Analysis

- Banking Type Analysis

- End-User Analysis

- Investment and Business Benefits

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

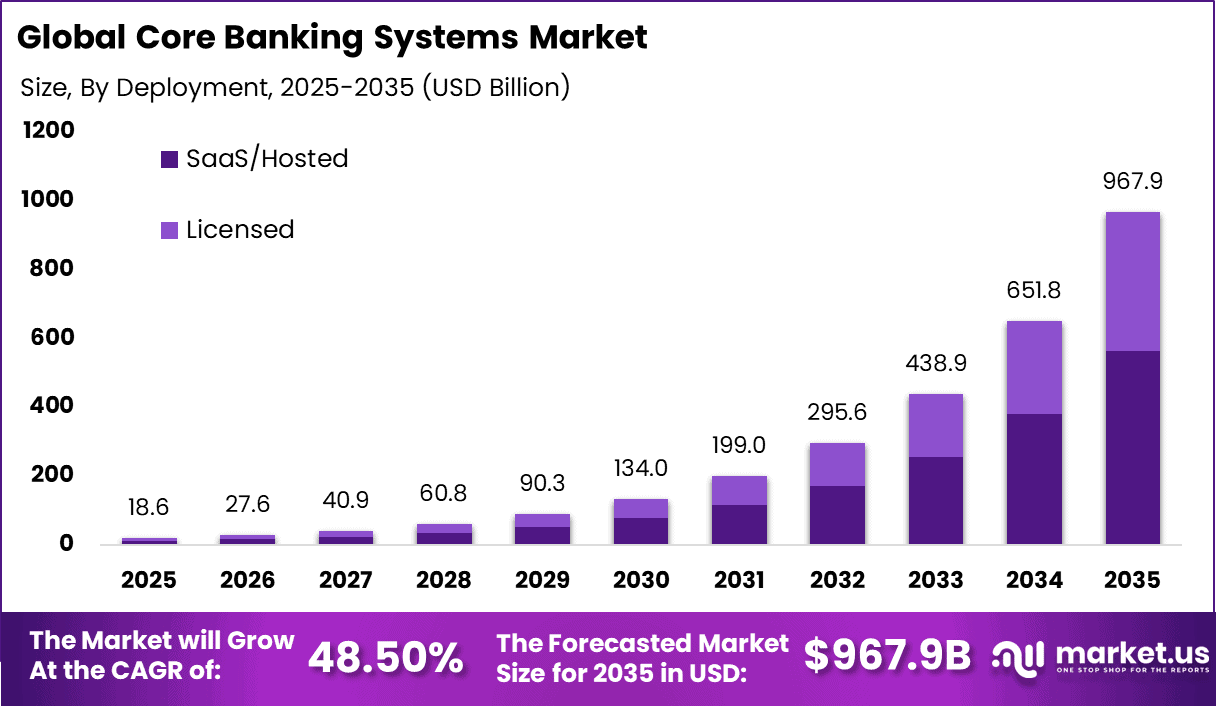

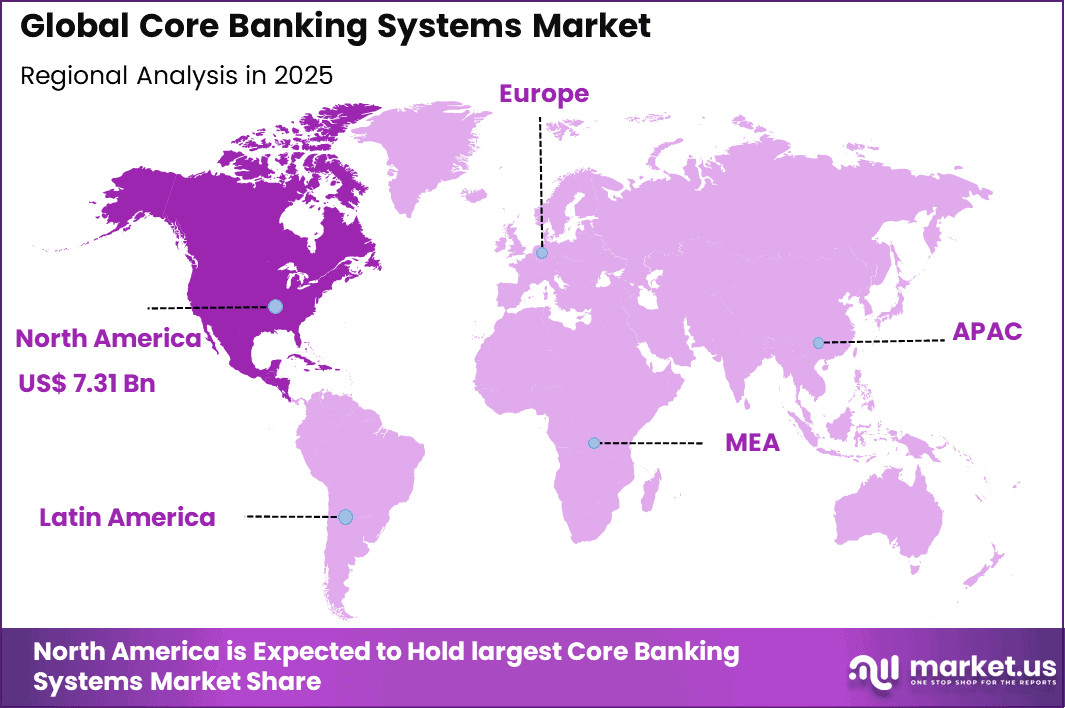

The Global Core Banking Systems Market generated USD 18.6 billion in 2025 and is predicted to register growth from USD 27.6 billion in 2026 to about USD 967.9 billion by 2035, recording a CAGR of 48.50% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 39.4% share, holding USD 7.41 Billion revenue.

The Core Banking Systems Market covers software platforms that manage essential banking operations such as deposits, loans, payments, customer accounts, and transaction processing. These systems form the operational backbone of retail, corporate, and digital banks. Core banking platforms enable real-time processing across branches, digital channels, and third-party integrations. Their reliability and scalability are critical to daily banking operations.

Modern core banking systems are evolving from legacy, branch-centric architectures to centralized and modular platforms. This transition supports real-time access, faster product launches, and improved customer service. As banking services become increasingly digital, core systems are no longer back-office tools but strategic enablers. This shift elevates their importance across the financial services ecosystem.

One major driving factor is the rapid shift toward digital banking and omni-channel service delivery. Customers expect seamless access to banking services through mobile, web, and branch channels. Legacy systems often struggle to support these expectations due to rigid architectures. This gap drives banks to modernize or replace core banking platforms.

Cloud computing is a key technology influencing core banking system adoption. Cloud-based platforms offer scalability, cost efficiency, and faster deployment compared to traditional on-premise systems. They also support continuous updates and improved resilience. These advantages drive growing interest in cloud-native core systems.

Demand for core banking systems is driven by both system replacement and expansion needs. Many financial institutions operate on aging platforms that are costly to maintain and difficult to upgrade. These institutions seek modern systems to reduce operational risk and technical debt. Replacement demand is therefore a major contributor.

Top Market Takeaways

- By deployment, SaaS/hosted solutions captured 58.2% of the core banking systems market, offering scalable, cost-effective platforms with rapid updates and cloud flexibility.

- By banking type, large banks with over USD 30 billion in assets held 40.6%, modernizing legacy systems for complex operations and regulatory compliance.

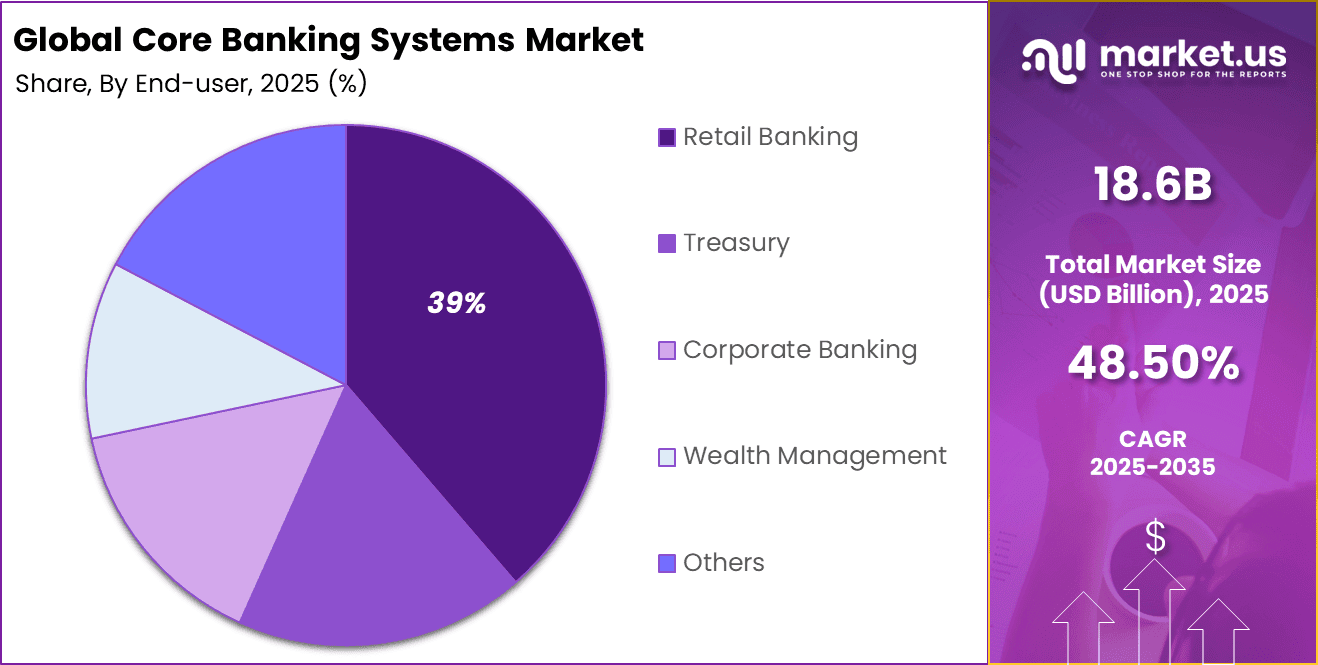

- By end-user, retail banking led at 38.7%, focusing on digital channels, customer personalization, and transaction processing efficiency.

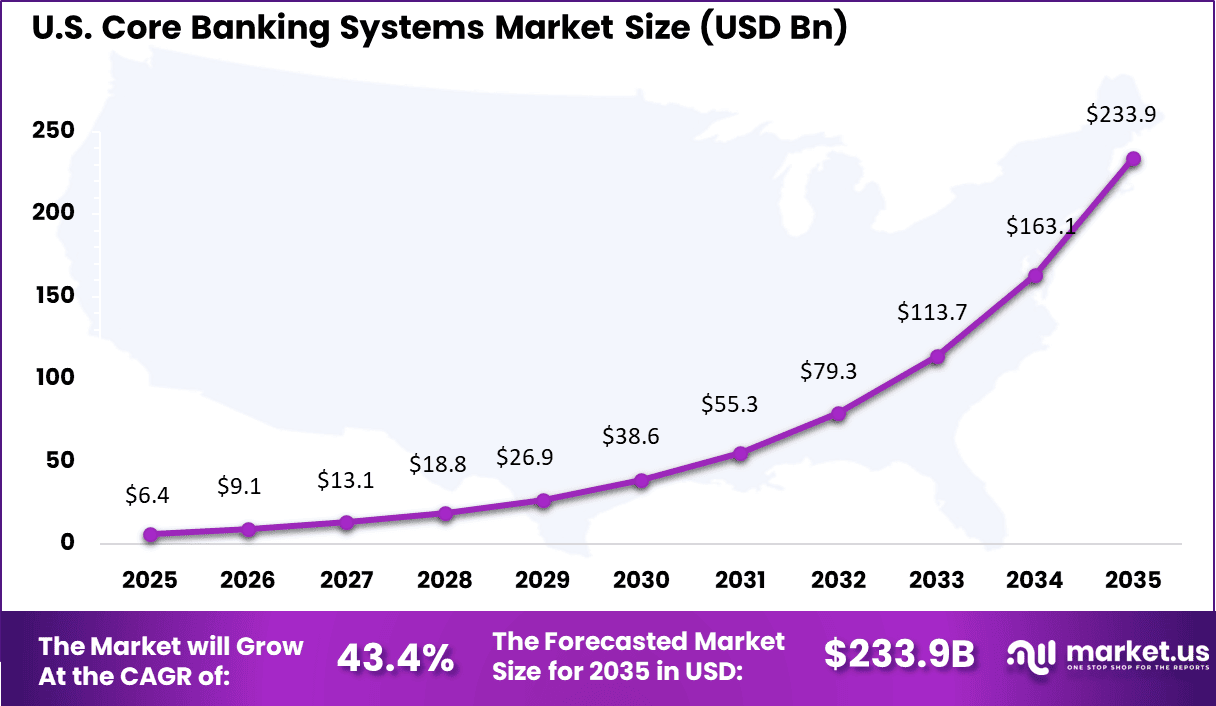

- North America accounted for 39.4% of the global market, with the U.S. valued at USD 6.36 billion and growing at a CAGR of 43.4%.

Key Insights Summary

Core Banking Adoption Rates (2026)

- About 68% of banks globally have adopted cloud native platforms for core banking operations as of early 2026.

- Around 78% of banks have deployed SaaS based core banking platforms to support AI adoption and real time data processing, resulting in up to 30% reduction in operational costs.

- More than 50% of banking institutions have either adopted modern core systems or have active plans to do so within the next two years.

- Nearly 89% of digital only banks and neobanks launch with fully cloud based core infrastructure.

Usage and Workload Statistics

- Around 60% of banks have migrated at least 30% of critical workloads to the cloud by 2026.

- Legacy infrastructure maintenance continues to consume about 70% of bank technology budgets, limiting modernization speed.

- SaaS and hosted deployment models are projected to hold 67.54% market share by late 2026.

- On premises systems remain in use among some large banks due to regulatory and data residency requirements.

- About 82% of financial institutions operate using hybrid or multi cloud strategies.

Modernization Impact and Efficiency Gains

- Core banking modernization delivers 35% to 38% improvement in operational efficiency.

- Loan processing times decline by 42% following modernization.

- Transaction processing times reduce by 53% with modern core platforms.

- Migration to SaaS based systems can generate long term cost savings of up to 40%.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Accelerated migration from legacy core systems to cloud-native platforms +12.4% North America, Europe Short to medium term Rapid expansion of digital banks and fintech-led banking models +10.6% Europe, Asia Pacific Medium term Demand for real-time payments and instant account processing +9.1% Global Short to medium term Regulatory push for transparency, reporting, and compliance automation +8.3% Europe, North America Medium term Growing adoption of Banking-as-a-Service and open banking models +6.8% North America, Asia Pacific Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline High migration cost and operational risk during core replacement -8.6% Global Short to medium term Complexity of integrating legacy data and workflows -7.2% Global Medium term Shortage of skilled core banking and cloud specialists -6.1% Asia Pacific, Latin America Medium term Long decision cycles in large traditional banks -5.0% Europe, North America Medium term Data security and system resilience concerns -4.2% Global Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Core banking software providers Very High Medium Global Strong recurring SaaS and license growth Cloud infrastructure and platform providers Very High Medium North America, Europe Strategic backbone of banking modernization Fintech and digital bank operators High Medium Europe, Asia Pacific Competitive differentiation and scale Private equity firms Medium Medium North America, Europe Modernization-led consolidation plays Venture capital investors High High North America Focus on cloud-native and API-first cores Deployment Analysis

SaaS and hosted deployment accounts for 58.2% of the Core Banking Systems market, showing a clear shift away from traditional on-premises systems. Banks adopt hosted core banking platforms to reduce infrastructure burden and improve system flexibility. These platforms allow banks to access core functions such as account management, transaction processing, and reporting through secure cloud environments.

SaaS deployment also supports faster upgrades and easier compliance with changing regulatory requirements. From an operational standpoint, SaaS and hosted models help banks lower capital expenditure and move toward predictable operating costs.

System updates, security patches, and performance improvements are handled centrally, reducing IT workload. The strong share of this segment reflects banks’ focus on agility, scalability, and faster time to market for new banking products and services.

Banking Type Analysis

Large banks with assets above USD 30 billion account for 40.6% of the market, highlighting strong adoption among institutions with complex operations. These banks manage high transaction volumes, diverse product portfolios, and large customer bases. Modern core banking systems help them centralize operations and standardize processes across branches and regions. This improves efficiency and operational visibility.

Large banks also face high regulatory scrutiny and require robust reporting and risk management capabilities. Advanced core banking platforms support compliance, data accuracy, and audit readiness. The strong presence of this segment reflects the need for reliable and scalable core systems to support enterprise-level banking operations.

End-User Analysis

Retail banking represents 39% of end-user demand, making it the largest application area for core banking systems. Retail banks rely on core platforms to manage savings accounts, loans, payments, and customer transactions. A modern core system ensures real-time processing and consistent customer experience across digital and branch channels.

Retail banking operations also require frequent product updates and customer-centric features. Core banking systems enable faster launch of new offerings and support digital banking services. The strong share of this segment reflects ongoing digital transformation in retail banking and growing demand for efficient and responsive banking platforms.

Investment and Business Benefits

Investment opportunities exist in modular core banking platforms that support phased modernization. Banks prefer solutions that allow gradual migration rather than full system replacement. Modular systems reduce disruption and implementation risk. This creates sustained demand for adaptable solutions.

There is also opportunity in managed services and system integration offerings. Core banking transformation requires planning, customization, and long-term support. Service providers that assist throughout the lifecycle add significant value. This service-driven approach supports recurring revenue models.

For banks, modern core banking systems improve service reliability and customer experience. Real-time processing enables faster transactions and account updates. Improved system performance reduces downtime and operational errors. These benefits strengthen customer trust and satisfaction.

From an internal perspective, modern systems enhance transparency and control. Centralized data improves reporting and decision-making. Automation reduces manual processing and error rates. These efficiencies support sustainable operational performance.

Emerging Trends Analysis

An emerging trend in the core banking systems market is the shift toward real time processing capabilities. Real time payments and instant account updates are becoming standard expectations. Core platforms are evolving to support continuous transaction processing rather than batch based operations. This trend improves customer experience and operational responsiveness.

Another trend is increased focus on interoperability through open interfaces. Open banking frameworks encourage secure data sharing with third party services. Core systems are being designed to support standardized interfaces that allow controlled data access. This trend supports innovation and ecosystem expansion.

Growth Factors Analysis

One key growth factor for the core banking systems market is the expansion of digital financial services across emerging economies. Increased access to banking services creates demand for scalable and reliable core platforms. As more users enter the formal banking system, transaction volumes grow. Core systems are essential to support this expansion.

Another growth factor is the need for operational efficiency and cost control. Automated processing reduces manual intervention and error rates. Core banking platforms help banks streamline operations and improve service consistency. This efficiency driven demand supports long term market growth.

Key Market Segments

By Deployment

- SaaS/Hosted

- Licensed

By Banking Type

- Large Banks (Greater than USD 30 billion in Assets)

- Midsize Banks (USD 10 billion to USD 30 billion in Assets)

- Small Banks (USD 5 billion to USD 10 billion in Assets)

- Community Banks (Less than USD 5 billion in Assets)

- Credit Unions

By End-user

- Retail Banking

- Treasury

- Corporate Banking

- Wealth Management

- Others

Regional Analysis

North America accounted for 39.4% share, supported by large scale modernization of banking infrastructure and rapid shift toward digital first financial services. Banks and financial institutions across the region have increasingly replaced legacy core systems with modern, flexible platforms to support real time processing, open banking, and new digital products.

Demand has been driven by rising customer expectations for instant payments, seamless digital experiences, and personalized financial services. Strong regulatory oversight and need for operational resilience have further encouraged investment in advanced core banking architectures.

The U.S. market reached USD 6.36 Bn and is projected to grow at a 43.4% CAGR, reflecting aggressive investment in digital banking transformation. Adoption has been driven by the need to support high transaction volumes, real time payments, and rapid rollout of new banking services. Core banking systems in the U.S. have enabled banks to improve processing efficiency, enhance security, and meet evolving regulatory requirements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Demand for Real-Time, Digital Banking Services

A primary driver for the core banking systems market is the rising demand for real-time digital banking services that support seamless customer interactions. Financial institutions globally are under pressure to deliver faster transaction processing, account services, and integrated online and mobile banking experiences.

Core banking systems act as the central hub for these functions, allowing banks to process customer transactions, update account information, and manage financial products in a unified environment that supports real-time data flows and improved customer satisfaction. This demand is intensified by digital transformation initiatives within banks seeking to compete with fintech challengers and meet evolving consumer expectations for anytime, anywhere access to financial services.

Modern platforms with API-driven architectures and cloud capabilities help institutions respond to this shift while reducing manual processes and improving operational efficiency. This shift to digital-first banking models is reflected in the accelerated adoption of core banking solutions by both traditional and neobank segments.

Restraint Analysis

Infrastructure Cost and Legacy System Barriers

A significant restraint on the core banking systems market is the high cost and complexity associated with upgrading infrastructure, especially in institutions that rely on legacy technology. Many banks still operate on decades-old systems that were not designed to support modern digital services.

Integrating new core systems with these legacy platforms requires careful data migration, system redesign, and compatibility assurance, which can be costly and time consuming. These infrastructure challenges are compounded by the need for skilled technical staff capable of managing complex transitions from old systems to modern architectures.

Smaller banks and financial institutions with limited budgets or in-house expertise may delay or scale back modernization efforts, slowing the overall market growth for core banking solutions. The cost and risk associated with replacing long-standing systems remain a key hurdle for widespread adoption.

Opportunity Analysis

Cloud Adoption and Modular Core Platforms

An important opportunity in the core banking systems market lies in the growing adoption of cloud-based and modular core platforms. Cloud deployment offers banks flexibility to scale operations and reduce upfront infrastructure investment by shifting to subscription or outsourced models.

These systems also support continuous updates, enhanced security measures, and integration with third-party services, which helps institutions respond quickly to market changes and customer demands. Modular core banking architectures that allow banks to implement specific functions such as payments, lending, or customer onboarding independently create further opportunities for customised services.

Institutions can adopt new features in phases, reducing disruption and aligning investment with strategic goals. This approach also encourages collaboration with fintechs and third-party developers, expanding service offerings and improving competitiveness in an increasingly digital landscape.

Challenge Analysis

Security and Compliance Burdens

A persistent challenge in the core banking systems market is maintaining robust security and compliance as systems evolve. Core banking solutions handle sensitive financial and personal data, and institutions must protect this information against cyber threats and meet stringent regulatory requirements.

As banks add new digital channels and connect with external partners, the risk of cyberattacks and data breaches increases, necessitating advanced security controls and constant monitoring. Regulatory compliance also places ongoing demands on core systems as laws and standards evolve across different regions.

Banks must ensure that their platforms can adapt to changes in data protection, reporting, and audit requirements without disrupting services. Balancing the need for strong defence mechanisms and regulatory adherence while maintaining system performance and user experience remains a long-term operational challenge for market participants.

Competitive Analysis

Large enterprise-focused providers such as Edgeverve Systems Limited, Temenos Headquarters SA, and Oracle Corporation dominate the core banking systems market through full-suite platforms. Their solutions support retail, corporate, and universal banking operations. Strong capabilities in transaction processing, compliance, and scalability drive adoption. Fidelity National Information Services and Fiserv, Inc. strengthen this segment with deep payment and digital banking integration.

IT service and product-led banking specialists such as Tata Consultancy Services Limited, Intellect Design Arena Ltd, and Finastra International Limited focus on modular core systems and transformation programs. SAP SE and CGI support modernization through integration and managed services. These players are widely adopted during core replacement and regulatory-driven upgrades.

Cloud-native and next-generation providers such as Mambu GmbH, 10x Banking Technology Limited, and SDK.finance enable faster product launches and API-driven banking models. Backbase, nCino, and Jack Henry & Associates address digital-first and regional bank needs. Other vendors increase innovation and competition across global banking markets.

Top Key Players in the Market

- Edgeverve Systems Limited (Infosys)

- Temenos Headquarters SA

- Oracle Corporation

- Fidelity National Information Services

- Tata Consultancy Services Limited

- Fiserv, Inc.

- Intellect Design Arena Ltd

- Finastra International Limited

- Mambu GmbH

- 10x Banking Technology Limited

- SDK.finance

- Backbase

- nCino

- SAP SE

- CGI

- Alkami Technology

- Jack Henry & Associates

- DeshDevs

- Securepaymentz

- Sopra Banking Software

- Others

Future Outlook

Growth in the Core Banking Systems market is expected to continue as banks modernize legacy platforms to support digital services. Core systems are being upgraded to improve transaction speed, product flexibility, and regulatory compliance.

Rising demand for real time payments, digital channels, and open banking is supporting steady investment. Over time, cloud deployment, modular architecture, and API based integration are likely to improve scalability and reduce operating complexity.

Recent Developments

- October, 2025 – Wipro selected Oracle Cloud Infrastructure for modernizing its HR systems, cutting payroll processing time by 60% and boosting recruitment performance over 50% using Oracle Base Database Service.

- December, 2025 – Oracle Database@Google Cloud launched in India, enabling seamless multicloud modernization with low-latency access to Oracle AI Database and Google Cloud analytics.

- October, 2025 – Oracle Database@Azure hit general availability with Oracle Base Database Service, simplifying legacy database migrations and app modernization across Microsoft ecosystems.

- July, 2025 – Infosys Finacle launched Asset Liability Management Solution under EdgeVerve, providing banks enterprise-wide balance sheet views for better risk and compliance decisions.

Report Scope

Report Features Description Market Value (2025) USD 18.6 Billion Forecast Revenue (2035) USD 967.9 Billion CAGR(2025-2035) 48.50% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment (SaaS/Hosted, Licensed), By Banking Type (Large Banks (Greater than USD 30 billion in Assets), Midsize Banks (USD 10 billion to USD 30 billion in Assets), Small Banks (USD 5 billion to USD 10 billion in Assets), Community Banks (Less than USD 5 billion in Assets), Credit Unions), By End-user (Retail Banking, Treasury, Corporate Banking, Wealth Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Edgeverve Systems Limited (Infosys), Temenos Headquarters SA, Oracle Corporation, Fidelity National Information Services, Tata Consultancy Services Limited, Fiserv, Inc., Intellect Design Arena Ltd, Finastra International Limited, Mambu GmbH, 10x Banking Technology Limited, SDK.finance, Backbase, nCino, SAP SE, CGI, Alkami Technology, Jack Henry & Associates, DeshDevs, Securepaymentz, Sopra Banking Software, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Core Banking Systems MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Core Banking Systems MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

- Edgeverve Systems Limited (Infosys)

- Temenos Headquarters SA

- Oracle Corporation

- Fidelity National Information Services

- Tata Consultancy Services Limited

- Fiserv, Inc.

- Intellect Design Arena Ltd

- Finastra International Limited

- Mambu GmbH

- 10x Banking Technology Limited

- SDK.finance

- Backbase

- nCino

- SAP SE

- CGI

- Alkami Technology

- Jack Henry & Associates

- DeshDevs

- Securepaymentz

- Sopra Banking Software

- Others