Global Converted Flexible Packaging Market Size, Share, Growth Analysis By Product Type (Pouches, Labels, Films, Bags), By Material Type (Plastic, Aluminum, Biodegradable Materials, Paper), By Packaging Technology (Printed Packaging, Non-Printed Packaging, Smart Packaging), By End-Use (Food & Beverages, Pharmaceuticals, Personal Care, Home Care), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151465

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

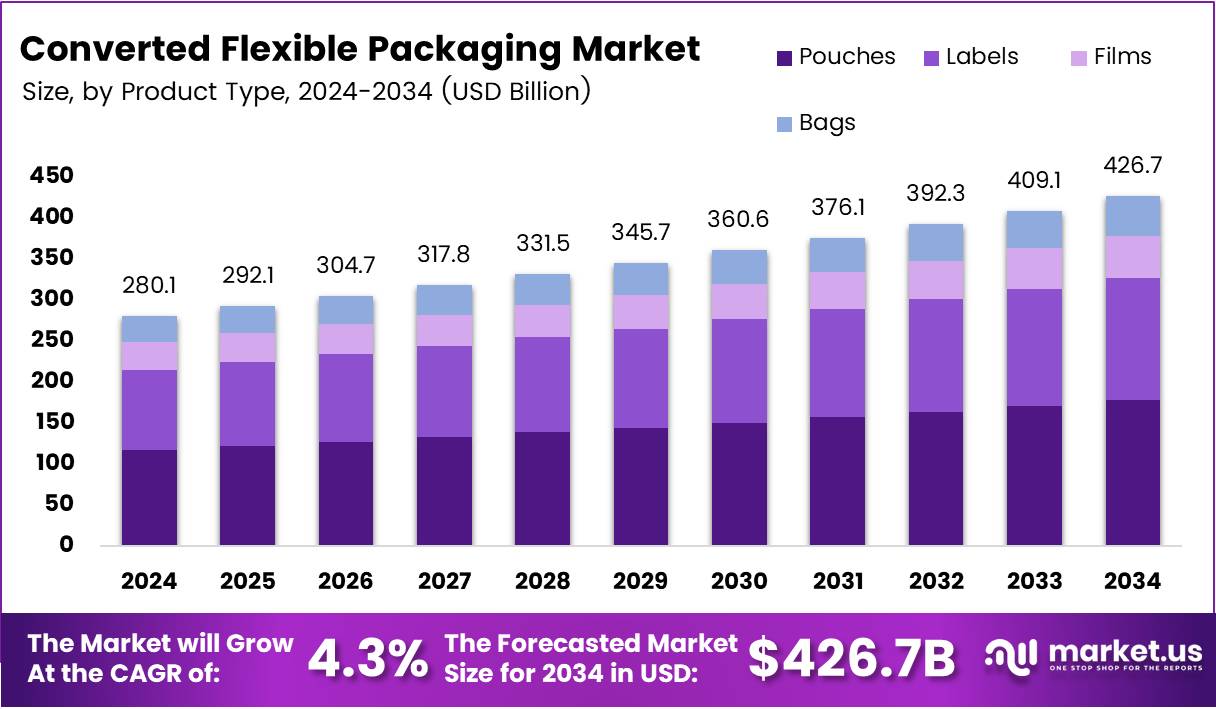

The Global Converted Flexible Packaging Market size is expected to be worth around USD 426.1 Billion by 2034, from USD 280.1 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The converted flexible packaging market has experienced significant growth in recent years, driven by the rising demand for lightweight and cost-effective packaging solutions. Flexible packaging refers to any package or container made from flexible or easily bendable materials like plastic, foil, paper, or a combination of these.

This packaging is increasingly favored over rigid alternatives, such as glass or metal, due to its lower material cost, ease of use, and convenience. According to Pakfactory, a study by Harris Poll revealed that 71% of respondents showed a clear preference for flexible packaging over rigid counterparts, reflecting its growing popularity across industries.

This market’s expansion is further fueled by the surge in e-commerce, which requires packaging solutions that can be easily stored, transported, and disposed of. Moreover, the rise in sustainability awareness among consumers has encouraged brands to adopt eco-friendly packaging alternatives.

According to Businesswaste, 141 million tonnes of plastic packaging are produced globally each year, and flexible packaging is becoming a significant player in addressing this environmental challenge. Many companies are shifting towards recyclable, biodegradable, or reusable materials, which aligns with growing consumer and regulatory pressures for sustainable packaging.

Government investment and regulatory frameworks also play a vital role in shaping the market. Many governments have introduced regulations promoting recycling and waste reduction, further pushing companies to innovate in their packaging solutions.

In the UK, for instance, 162,357 tonnes of aluminium packaging were recycled in 2023, with more than 81% of beverage cans being recycled (according to Ecosurety). These figures highlight the importance of recycling in packaging production, driving demand for flexible packaging materials that facilitate efficient recycling processes.

Flexibility in design is another critical advantage of this packaging type. Manufacturers are increasingly using it in various industries, including food, beverages, pharmaceuticals, and consumer goods, thanks to its ability to reduce transportation costs and improve shelf appeal. Furthermore, the global focus on reducing carbon footprints and adopting circular economy models presents substantial opportunities for companies in the converted flexible packaging market.

Looking ahead, the market is expected to continue expanding as sustainability becomes a central pillar of packaging innovation. Governments are likely to introduce more stringent recycling regulations, pushing the industry towards more eco-friendly solutions. In summary, the converted flexible packaging market is witnessing rapid growth, driven by evolving consumer preferences, advancements in material technology, and supportive regulatory frameworks.

Key Takeaways

- The Global Converted Flexible Packaging Market size is expected to reach USD 426.1 Billion by 2034, growing at a CAGR of 4.3% from 2025 to 2034.

- In 2024, Pouches held a dominant market position in the By Product Type Analysis segment.

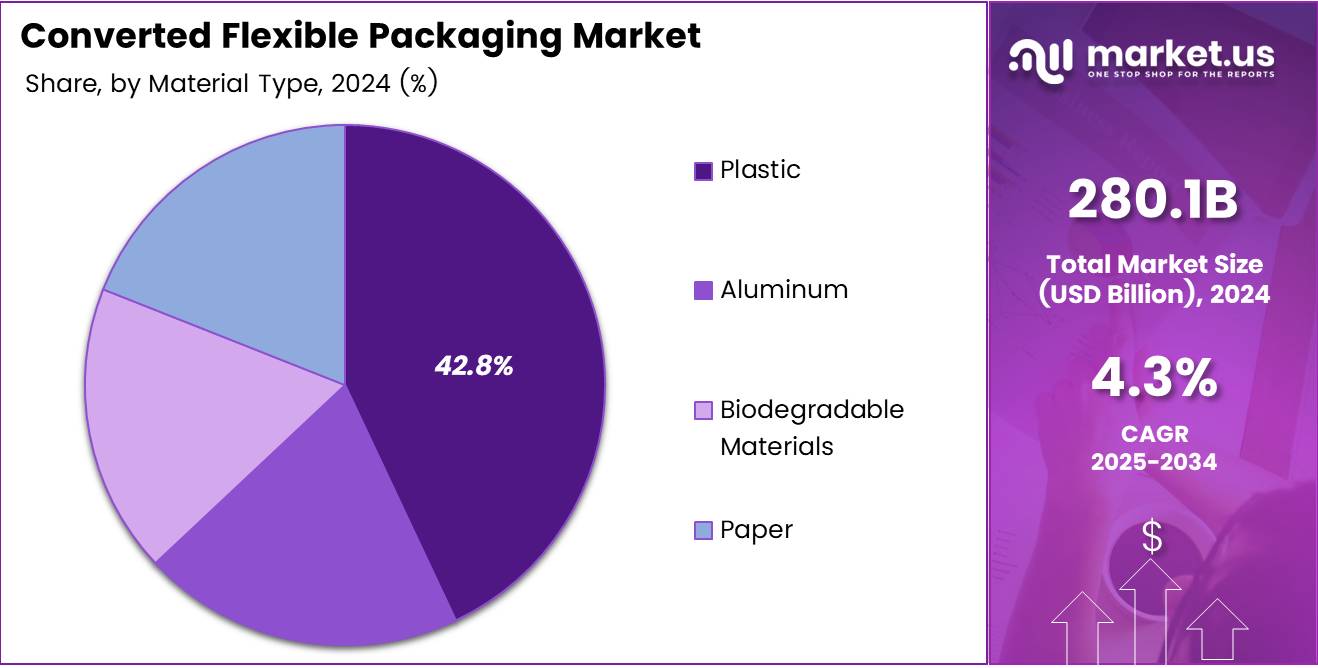

- In 2024, Plastic dominated the By Material Type Analysis segment, with a 42.8% market share.

- In 2024, Printed Packaging led the By Packaging Technology Analysis segment.

- In 2024, Food & Beverages remained the largest end-use sector in the Converted Flexible Packaging Market.

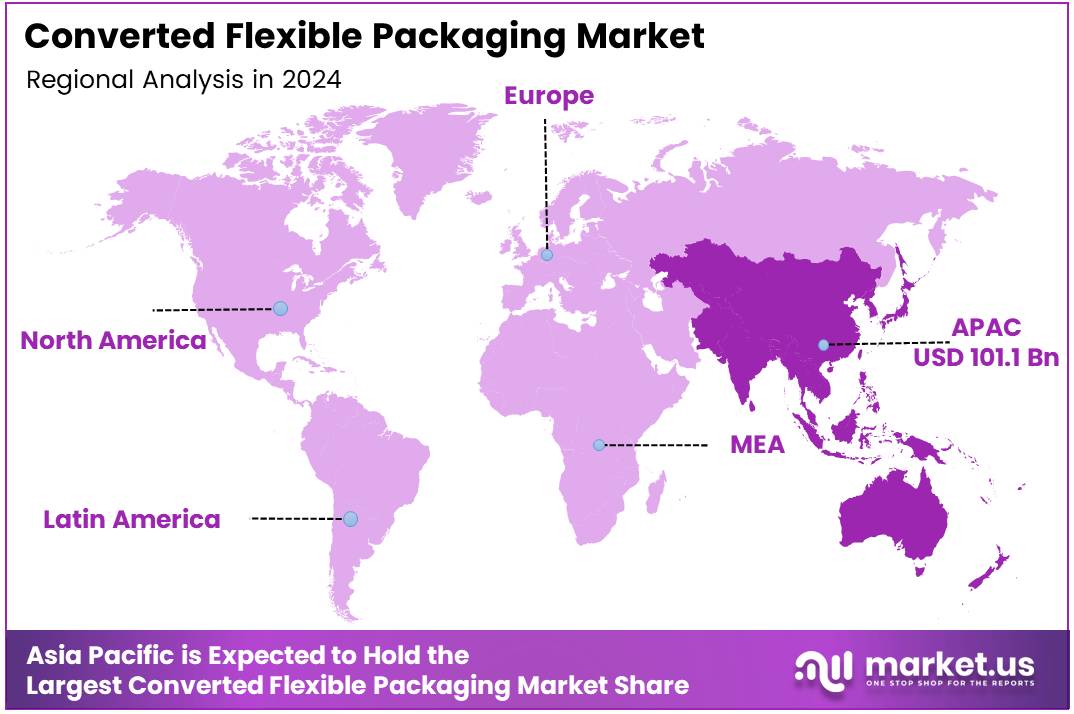

- Asia Pacific held a dominant market share of 36.1%, valued at USD 101.1 billion in 2024.

Product Type Analysis

Pouches held a dominant position due to their versatility and rising demand across sectors.

In 2024, Pouches held a dominant market position in By Product Type Analysis segment of Converted Flexible Packaging Market. Their lightweight nature, ease of storage, and suitability for both liquid and solid goods continue to fuel their preference among manufacturers. The shift toward single-serve and convenience packaging has further boosted demand.

Labels followed as a crucial component, aiding in product branding and compliance. With a growing emphasis on shelf appeal and regulatory requirements, labels remain integral in the overall packaging experience, though not leading the market.

Films offered excellent protection and shelf-life enhancement but occupied a comparatively smaller market share. Their barrier properties are beneficial, especially in food and pharmaceutical packaging.

Bags held a modest share, commonly used in retail and bulk packaging. Despite their wide usage, competition from more versatile pouches has limited their dominance.

Material Type Analysis

Plastic led the segment with 42.8% share due to its durability, cost-effectiveness, and widespread applications.

In 2024, Plastic held a dominant market position in By Material Type Analysis segment of Converted Flexible Packaging Market, with a 42.8% share. Its superior flexibility, sealing capabilities, and lightweight nature made it the material of choice across various industries. It continues to dominate despite sustainability concerns, thanks to innovations in recyclable and reusable plastic formats.

Aluminum held a secondary position, appreciated for its excellent barrier properties and high-end appeal. Often used in pharmaceuticals and food, its higher cost limits broader adoption.

Biodegradable Materials are gaining traction amid environmental awareness. Though still emerging, they represent a niche segment with future potential as regulations favor sustainable solutions.

Paper maintained a steady position, primarily in dry food and retail packaging. Its recyclability is a strong advantage, but limitations in barrier protection hinder broader application compared to plastic.

Packaging Technology Analysis

Printed Packaging stood out, driven by branding needs and visual appeal in consumer goods.

In 2024, Printed Packaging held a dominant market position in By Packaging Technology Analysis segment of Converted Flexible Packaging Market. The rise in consumer-focused branding and the need for eye-catching shelf presence have driven demand for printed formats. It enables product differentiation and information display, making it a preferred choice across industries.

Non-Printed Packaging served more functional purposes and held a modest share. Often used in industrial or secondary packaging, its limited role in consumer engagement affects its market position.

Smart Packaging is emerging, integrating digital features like QR codes or sensors. Although its share is currently low, it has strong growth potential as brands look to enhance traceability and interactivity.

End-Use Analysis

Food & Beverages dominated, driven by growing consumption of packaged foods and drinks.

In 2024, Food & Beverages held a dominant market position in By End-Use Analysis segment of Converted Flexible Packaging Market. The sector continues to drive the bulk of demand due to convenience, hygiene, and the rise in processed food consumption. Flexible packaging solutions like pouches and films support longer shelf life and ease of use.

Pharmaceuticals followed, relying on flexible packaging for moisture and contamination control. Blister packs, sachets, and tamper-evident designs are common, but the segment is smaller due to stringent regulatory needs.

Personal Care products also saw stable demand for aesthetic and protective packaging. Flexible formats enable creative branding, especially in travel-sized or single-use items.

Home Care packaging, while functional and cost-driven, had the smallest share. Still, innovations in refill packs and sustainable materials are expected to support future growth.

Key Market Segments

By Product Type

- Pouches

- Labels

- Films

- Bags

By Material Type

- Plastic

- Aluminum

- Biodegradable Materials

- Paper

By Packaging Technology

- Printed Packaging

- Non-Printed Packaging

- Smart Packaging

By End-Use

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Home Care

Drivers

Increasing Demand for Lightweight Packaging Solutions Drives Market Growth

The demand for lightweight packaging solutions is growing rapidly, as businesses and consumers seek to reduce the weight and cost of shipping. This is particularly important in industries like food and beverage, where reducing packaging weight can result in lower transportation costs and reduced carbon footprints. Lightweight packaging materials, such as flexible films and pouches, offer a more efficient and cost-effective solution for packaging goods, especially in e-commerce.

Sustainable packaging trends are also aligned with this demand, as consumers are increasingly aware of the environmental impact of their purchasing decisions. Lightweight packaging not only helps in reducing overall waste but also allows companies to optimize the use of resources, further driving its adoption across various industries.

Restraints

Volatility in Raw Material Prices Constraints Market Growth

One of the key challenges facing the converted flexible packaging market is the volatility in raw material prices. The prices of plastics, metals, and other key materials used in flexible packaging fluctuate based on various global factors, including oil prices and trade policies. This can lead to increased production costs, affecting the overall profitability of companies in the packaging industry.

Additionally, rising costs for sustainable raw materials, such as bio-based plastics, can create financial pressures for manufacturers. The fluctuating costs of raw materials can make it challenging for companies to maintain stable prices for their products, limiting their ability to plan and budget effectively.

Growth Factors

Adoption of Bio-based and Compostable Packaging Materials

The growing focus on sustainability presents significant opportunities for the converted flexible packaging market. The adoption of bio-based and compostable materials is increasing as companies look to reduce their environmental footprint. Consumers’ preference for environmentally friendly packaging is driving brands to invest in these alternative materials, creating a growing demand in the packaging sector.

The expansion of bio-based packaging solutions is supported by government initiatives and industry regulations aimed at reducing plastic waste. As companies work toward meeting sustainability goals, the demand for compostable and bio-based packaging will continue to rise, offering a considerable growth opportunity for market players.

Emerging Trends

Shift Towards Minimalist and Functional Designs

In recent years, there has been a noticeable trend towards minimalist and functional packaging designs in the converted flexible packaging market. Brands are focusing on creating packaging that is simple, efficient, and effective at delivering the product while using fewer resources. This trend is particularly prevalent in the food and beverage industry, where streamlined packaging not only appeals to consumers but also reduces material usage.

In addition to minimalist designs, there is an increasing use of high-barrier packaging to extend product shelf life and maintain quality. Moreover, the development of reusable and refillable packaging systems is becoming more popular, especially in the eco-conscious consumer segment. These trends align with the growing demand for sustainable and functional packaging solutions.

Regional Analysis

Asia Pacific Dominates the Converted Flexible Packaging Market with a Market Share of 36.1%, Valued at USD 101.1 Billion

Asia Pacific leads the global converted flexible packaging market, accounting for a market share of 36.1% and valued at USD 101.1 billion. This dominance is driven by robust growth in manufacturing, increasing urbanization, and expanding food & beverage and e-commerce sectors across countries such as China and India. The region benefits from cost-effective production and a strong supply chain infrastructure, making it a hub for packaging innovations and high-volume exports.

North America Converted Flexible Packaging Market Trends

North America holds a significant position in the converted flexible packaging market, supported by strong demand from food, pharmaceutical, and consumer goods industries. Sustainability trends and the adoption of recyclable materials are accelerating market developments across the U.S. and Canada. Advanced technological integration and a focus on convenience packaging further contribute to market expansion.

Europe Converted Flexible Packaging Market Trends

Europe remains a key contributor to the global converted flexible packaging market, driven by stringent environmental regulations and a strong emphasis on circular economy practices. The region showcases increased investment in eco-friendly and biodegradable packaging formats. Demand is bolstered by sectors such as personal care, healthcare, and premium food packaging.

Middle East and Africa Converted Flexible Packaging Market Trends

The Middle East and Africa are witnessing steady growth in the converted flexible packaging sector, fueled by rising urbanization and a growing retail landscape. Emerging economies in the region are investing in infrastructure and modern retail formats, which in turn increases the demand for flexible packaging solutions. Consumer preference for convenience and packaged food products also supports market traction.

Latin America Converted Flexible Packaging Market Trends

Latin America shows promising growth potential in the converted flexible packaging market, backed by expanding food processing industries and increasing consumer awareness of packaged goods. Countries such as Brazil and Mexico are spearheading regional development, supported by economic recovery and shifts in consumption patterns. Flexible packaging’s cost-effectiveness and adaptability remain key growth drivers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Converted Flexible Packaging Company Insights

In 2024, Sealed Air continues to be a dominant player in the global converted flexible packaging market, leveraging its innovative packaging solutions for a variety of sectors including food and healthcare. The company is expected to focus on sustainability by investing in recyclable and eco-friendly materials.

Glenroy has earned a strong position in the flexible packaging market with its commitment to producing high-quality, sustainable packaging. The company is projected to grow by enhancing its product offerings, particularly in the food packaging segment, where it is known for its reliable and efficient solutions.

Smurfit Kappa stands out due to its extensive experience in corrugated packaging and its integration of flexible packaging solutions. The company is likely to maintain a strong market presence by focusing on product innovation, particularly with a growing demand for sustainable packaging options.

Avery Dennison holds a significant market share by offering a wide range of self-adhesive materials and packaging solutions. With a strong focus on enhancing its sustainability efforts and utilizing advanced technologies, Avery Dennison is expected to continue its growth trajectory by meeting the evolving packaging needs across industries.

Top Key Players in the Market

- Sealed Air

- Glenroy

- Smurfit Kappa

- Avery Dennison

- ProAmpac

- Amcor

- CCL Industries

- Constantia Flexibles

- Berry Global

- Hood Packaging

- Clondalkin Group

- Winpak

- Mondi

- Groupe Guillin

Recent Developments

In 2024, Sealed Air continues to be a dominant player in the global converted flexible packaging market, leveraging its innovative packaging solutions for a variety of sectors including food and healthcare. The company is expected to focus on sustainability by investing in recyclable and eco-friendly materials.

Glenroy has earned a strong position in the flexible packaging market with its commitment to producing high-quality, sustainable packaging. The company is projected to grow by enhancing its product offerings, particularly in the food packaging segment, where it is known for its reliable and efficient solutions.

Smurfit Kappa stands out due to its extensive experience in corrugated packaging and its integration of flexible packaging solutions. The company is likely to maintain a strong market presence by focusing on product innovation, particularly with a growing demand for sustainable packaging options.

Avery Dennison holds a significant market share by offering a wide range of self-adhesive materials and packaging solutions. With a strong focus on enhancing its sustainability efforts and utilizing advanced technologies, Avery Dennison is expected to continue its growth trajectory by meeting the evolving packaging needs across industries.

Report Scope

Report Features Description Market Value (2024) USD 280.1 Billion Forecast Revenue (2034) USD 426.1 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pouches, Labels, Films, Bags), By Material Type (Plastic, Aluminum, Biodegradable Materials, Paper), By Packaging Technology (Printed Packaging, Non-Printed Packaging, Smart Packaging), By End-Use (Food & Beverages, Pharmaceuticals, Personal Care, Home Care) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sealed Air, Glenroy, Smurfit Kappa, Avery Dennison, ProAmpac, Amcor, CCL Industries, Constantia Flexibles, Berry Global, Hood Packaging, Clondalkin Group, Winpak, Mondi, Groupe Guillin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Converted Flexible Packaging MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Converted Flexible Packaging MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sealed Air

- Glenroy

- Smurfit Kappa

- Avery Dennison

- ProAmpac

- Amcor

- CCL Industries

- Constantia Flexibles

- Berry Global

- Hood Packaging

- Clondalkin Group

- Winpak

- Mondi

- Groupe Guillin