Global Content Services Platforms (CSP) Market Size, Share Analysis By Component (Solutions, Services), By Deployment Mode (On-Premises, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Business Function (Human Resources, Sales & Marketing, Accounting & Legal, Procurement & Supply Chain Management), By Vertical (BFSI, Consumer Goods & Retail, Energy & Utilities, Government & Public Sector, Healthcare & Life Sciences, IT & ITes, Manufacturing, Media & Entertainment, Telecommunications, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155427

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insights

- Analysts’ Viewpoint

- Role of AI in CSP Market

- U.S. CSP Market Size

- Component Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- Business Function Analysis

- Vertical Analysis

- Top Growth Factors

- Key Trends and Innovations

- Key Market Segments

- Emerging Trend Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

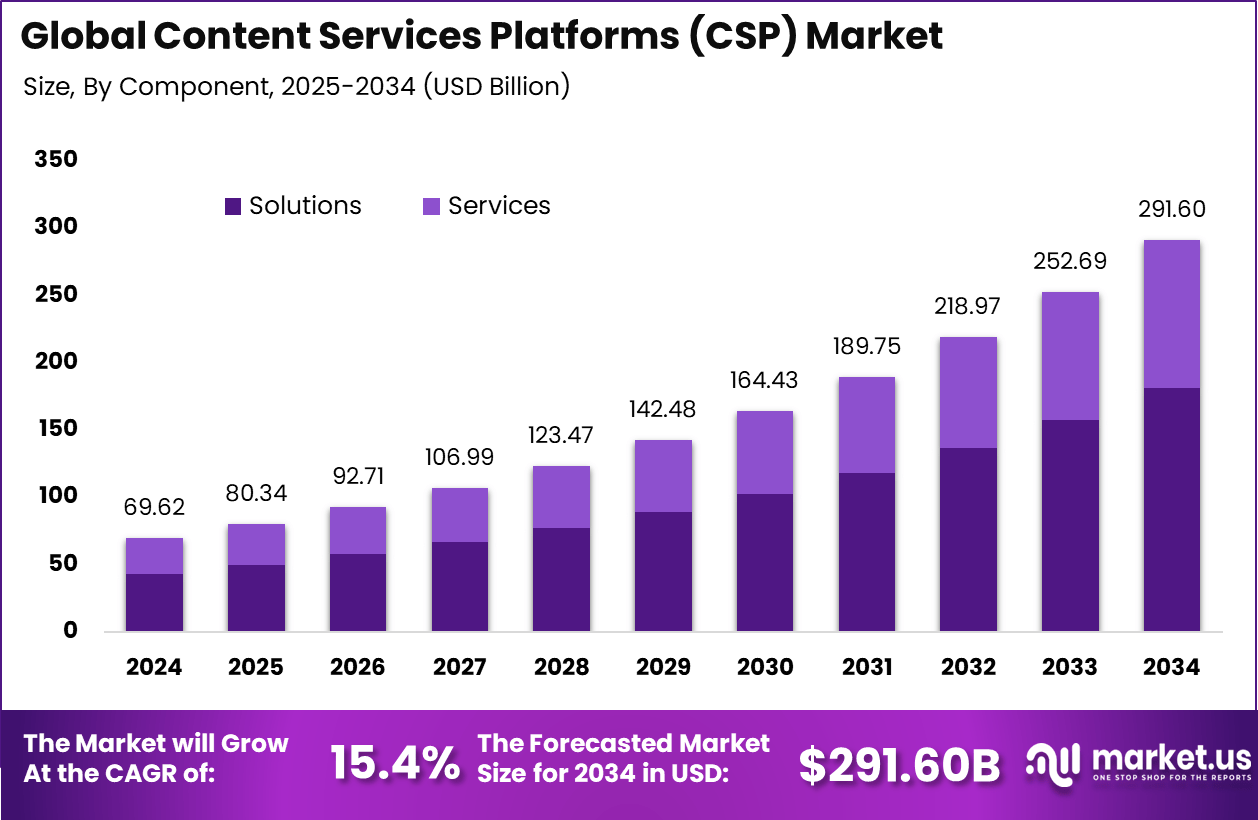

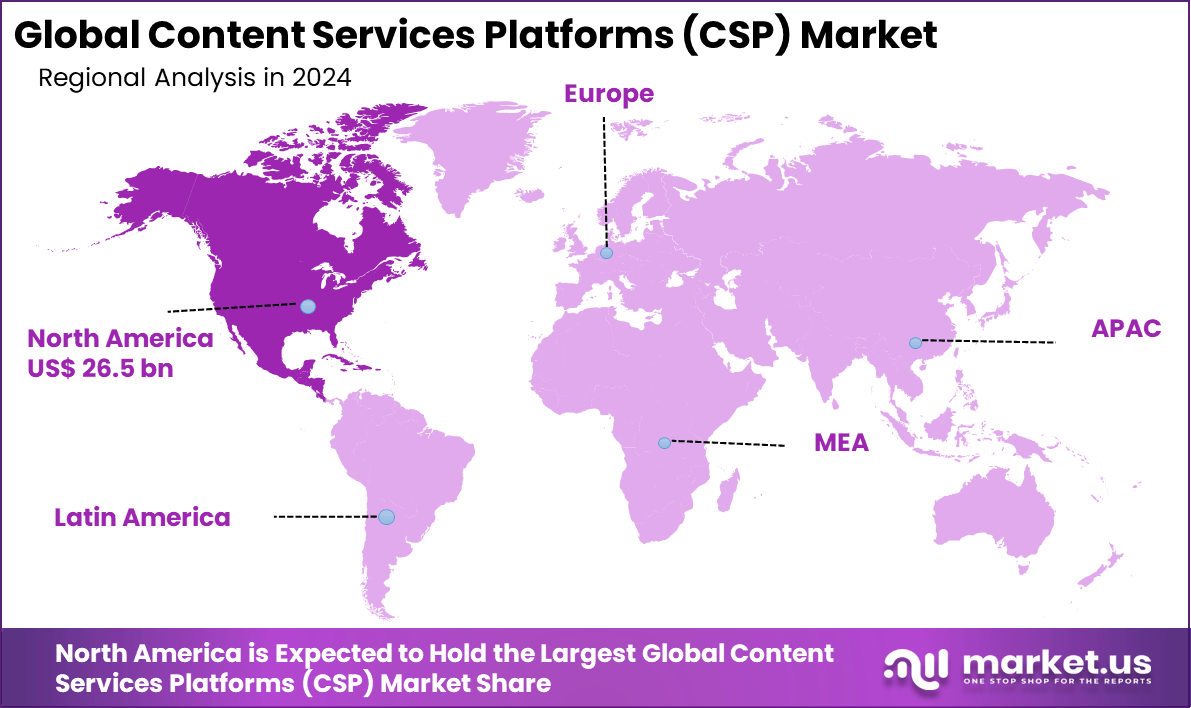

The Global Content Services Platforms (CSP) Market size is expected to be worth around USD 291.60 billion by 2034, from USD 69.62 billion in 2024, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.2% share, holding USD 26.5 billion in revenue.

The Content Services Platforms market is defined by a suite of integrated services and microservices, unified through common APIs and repositories, to manage and facilitate enterprise‑level content usage. These platforms represent an evolution from traditional enterprise content management systems by delivering scalability, connectivity, flexibility, low‑code configuration, and cloud‑native capabilities.

Key Insights

- In 2024, the Solutions segment dominated the Global Content Services Platforms (CSP) Market, accounting for 62.3% of the total share.

- The Cloud segment led the deployment model landscape with a 65.7% share, highlighting strong demand for scalable and accessible CSP solutions.

- Large Enterprises were the primary adopters, capturing 68.1% of the market in 2024 due to their extensive content management needs.

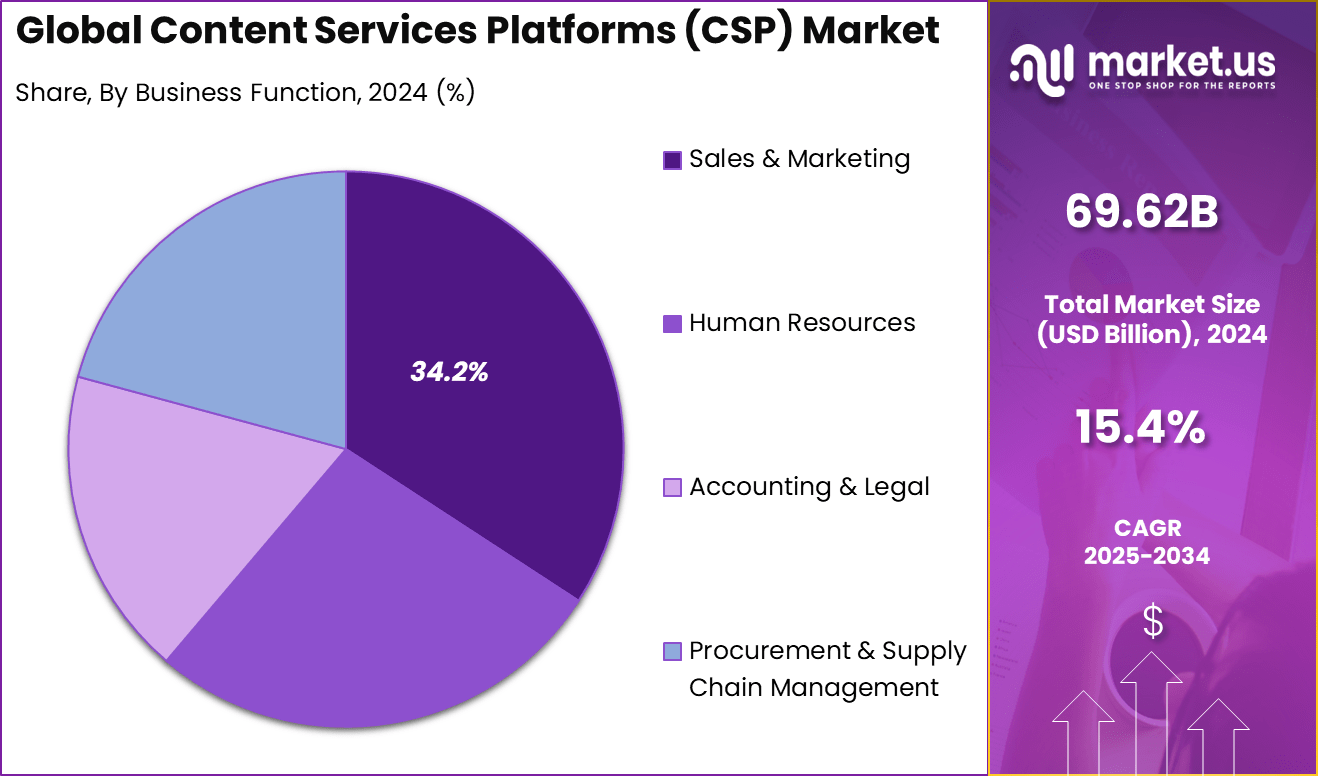

- By business function, the Sales & Marketing segment held a 24% share, driven by the need for centralized content workflows and customer engagement tools.

- The BFSI sector contributed 18.3% of the market share, reflecting high adoption for compliance, document management, and digital transformation initiatives.

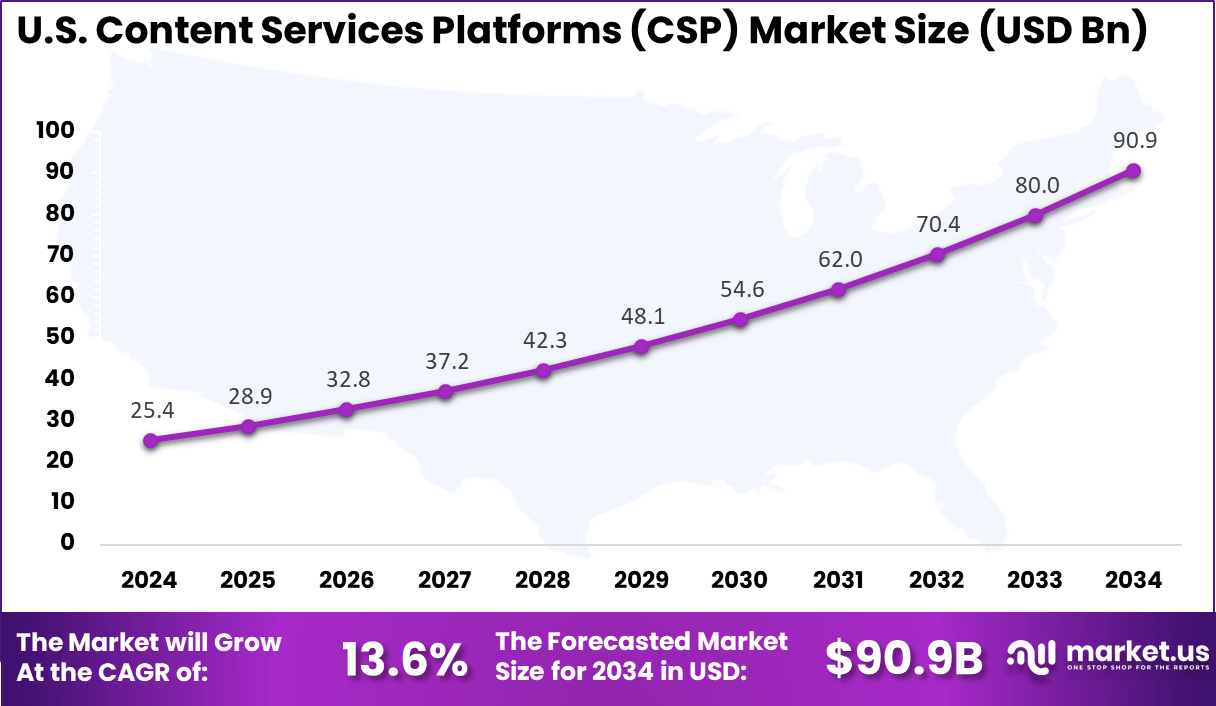

- The U.S. market was valued at USD 25.4 billion in 2024, with a strong CAGR of 13.6%.

- North America led globally, holding 38.2% of the total market share in 2024.

The growth of the CSP market can be attributed to several interrelated factors. Rapid increase in digital content across organizations requires centralized solutions that improve operational efficiency and governance. The convergence of social, mobile, analytics, and cloud technologies (known collectively as SMAC) continues to promote demand for CSPs.

For instance, in July 2025, M-Files and Microsoft expanded their collaboration to evolve document management. This strategic partnership enhances M-Files’ capabilities by integrating its document management system with Microsoft 365 and SharePoint. The integration provides AI-powered content organization, improved workflows, and more seamless collaboration across platforms.

Analysts’ Viewpoint

The market is witnessing growing adoption of technologies such as cloud computing, artificial intelligence, machine learning, robotic process automation, and API integrations. These technologies allow CSPs to deliver scalable, secure, and adaptive content services that meet diverse organizational needs. AI and analytics improve predictive curation, automate workflows, and deliver real-time insights, boosting adoption.

Investment opportunities within the CSP market arise from the rapid digitalization efforts across emerging and mature markets alike. Government initiatives supporting digital transformation, regulatory compliance mandates like GDPR, and enterprise demands for cloud-native and AI-powered solutions are catalyzing this growth.

Business benefits from implementing CSPs encompass enhanced efficiency, reduced operational costs, stronger compliance management, and improved collaboration across global teams. CSPs also enable organizations to adapt quickly to market changes by offering flexible and integrated content management environments.

Role of AI in CSP Market

Role/Function Description Intelligent Content Automation AI and machine learning enable automated document classification, metadata tagging, and content categorization Workflow Automation & Optimization AI-driven process automation streamlines content approvals, routing, and lifecycle management Advanced Analytics & Insights AI mines content repositories for actionable intelligence, enabling predictive analytics and smart decision-making Enhanced Content Security AI supports automated threat detection, compliance monitoring, and data governance Personalized Content Delivery AI tailors content presentation based on user roles, preferences, and behavior for improved user experience Integration with Cloud & APIs AI-enabled CSPs leverage cloud scalability and integrate seamlessly with other enterprise systems U.S. CSP Market Size

The market for Content Services Platforms (CSP) within the U.S. is growing tremendously and is currently valued at USD 25.4 billion, the market has a projected CAGR of 13.6%. The market is experiencing significant growth driven by rapid digital transformation across industries. Companies are adopting cloud-based solutions to enhance scalability, security, and collaboration.

Sectors like healthcare, finance, and government are fueling this growth, as they require secure, compliant content management systems. Additionally, strict data privacy regulations are motivating organizations to seek efficient and secure CSPs, further accelerating the market’s expansion in the U.S.

For instance, in April 2025, Microsoft revamped its content management system using the Microsoft Power Platform, enhancing its Content Services Platform (CSP) capabilities. This upgrade strengthens Microsoft’s position in the U.S. market by providing a more flexible, scalable, and integrated solution for managing content, workflows, and collaboration across the organization.

In 2024, North America held a dominant market position in the Global Content Services Platforms (CSP) Market, capturing more than a 38.2% share, holding USD 26.5 billion in revenue. The market is growing due to the widespread adoption of digital transformation technologies across various industries.

The region’s preference for cloud-based CSP solutions provides scalability, flexibility, and support for remote work. Moreover, strict compliance and security standards in sectors like healthcare and finance drive the need for secure content management platforms. High investment in IT infrastructure and a focus on innovation further solidify North America’s leadership in the CSP market.

For instance, in February 2025, Reply announced the launch of Comwrap Reply to expand Adobe expertise in North America. This strategic move aims to enhance content management and digital experience capabilities, leveraging Adobe solutions within the region. By launching this initiative, Reply strengthens its position in the North American market, further reinforcing the dominance of U.S. and Canadian players in the CSP space.

Regional Insights

- Asia-Pacific: Fastest growing region, fueled by rapid enterprise digital transformation, cloud adoption, and regulatory developments in China, India, Japan, and Australia.

- Europe: Steady growth supported by strict data privacy regulations (e.g., GDPR), strong compliance requirements, and broad adoption across verticals like healthcare and manufacturing.

- Other Regions (Latin America, Middle East & Africa): Emerging markets with growing awareness and increasing deployment of CSPs, particularly in BFSI and government sectors.

Component Analysis

In 2024, the Solutions segment held a dominant market position, capturing a 62.3% share of the Global Content Services Platforms (CSP) Market. This dominance is due to the rising demand for CSP solutions that provide advanced content management, collaboration, and workflow automation.

The integration of AI-driven automation, workflow optimization, and compliance management enhances operational efficiency and meets industry-specific requirements. Additionally, the growing shift toward cloud-based and AI-powered platforms has significantly contributed to the expansion and adoption of this segment in the market.

For Instance, in January 2025, IBM announced its acquisition of Application Software Technology LLC, a move aimed at enhancing its capabilities in providing innovative software solutions. This acquisition will bolster IBM’s portfolio in the enterprise software space, strengthening its position in the competitive market of digital transformation technologies.

Deployment Mode Analysis

In 2024, the Cloud segment held a dominant market position, capturing a 65.7% share of the Global Content Services Platforms (CSP) Market. This dominance is driven by the flexibility, scalability, and cost-efficiency provided by cloud-based solutions. Cloud CSPs also enable the integration of advanced features like AI automation, secure content management, and compliance tools, which further enhance their appeal.

These platforms allow organizations to scale content management, improve collaboration, and access content remotely. The increasing demand for remote work and the need for secure, compliant solutions to meet regulatory standards have also contributed to the widespread adoption of cloud-based CSP platforms.

For instance, In November 2024, OpenText introduced Cloud Editions (CE 24.4) with enhanced AI-driven features for its Content Services Platform. The update focuses on integrating AI to optimize knowledge work, streamline content management, and improve collaboration. By leveraging cloud-based infrastructure, CE 24.4 supports business agility, automates processes, and enables more informed decision-making.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 68.1% share of the Global Content Services Platforms (CSP) Market. This dominance is due to the larger scale and complexity of operations in big organizations, which require robust and scalable content management solutions.

Large enterprises often need advanced features like automation, enhanced security, and seamless integration with existing systems. Additionally, their higher budgets and the need for compliance and regulatory adherence drive the adoption of CSP solutions tailored to their needs.

For Instance, in August 2024, Hyland Software launched its Q3 product release, offering advancements for large enterprises. The update enhances content management, workflow automation, and security, with improved system integrations, AI-driven document processing, and stronger compliance features. These innovations help organizations streamline operations, boost efficiency, and meet regulatory standards while reducing costs.

Business Function Analysis

In 2024, the Sales & Marketing segment held a dominant market position, capturing a 34.2% share of the Global Content Services Platforms (CSP) Market. This dominance is due to the increasing need for efficient content management, personalized customer experiences, and streamlined workflows in sales and marketing operations.

CSPs enable businesses to manage large volumes of content, improve collaboration, and enhance customer engagement. The integration of AI and data analytics also helps in targeting customers more effectively, driving the adoption of CSPs in this sector.

For Instance, in February 2024, ByteDance partnered with Tecnotree to boost AI and 5G telecom monetization. This collaboration leverages AI-powered Content Services Platforms (CSP) to enhance sales, marketing, and customer engagement, driving digital transformation and increasing monetization opportunities in the telecom sector.

Vertical Analysis

In 2024, the BFSI segment held a dominant market position, capturing an 18.3% share of the Global Content Services Platforms (CSP) Market. This dominance is due to the need for secure, compliant, and efficient content management. CSPs assist in managing large volumes of sensitive data, streamlining workflows, and ensuring regulatory compliance.

The growing emphasis on data security, fraud prevention, and customer experience has accelerated CSP adoption. Additionally, the integration of AI-driven analytics, blockchain verification, e-signature solutions, and automation enhances the demand. With the sector’s stringent security and compliance needs, the shift toward digital transformation further boosts the preference for advanced CSP solutions.

For Instance, in April 2025, Microsoft’s AI initiatives for the Banking, Financial Services, and Insurance (BFSI) sector focused on ushering in a new era of digital transformation. The use of AI-powered Content Services Platforms (CSP) in this context would likely enhance the efficiency of document management, compliance, and automated workflows in the BFSI industry.

Top Growth Factors

- Accelerating digital transformation as enterprises prioritize digitization and replace paper-based workflows.

- Increasing adoption of remote and hybrid work driving demand for cloud-based, scalable, and accessible content services.

- Rising regulatory compliance requirements around content security, data privacy, and audit trails.

- Growing volumes of unstructured data and complexity in information management.

- Embedded AI and automation demand to improve operational efficiency and reduce manual workloads.

Key Trends and Innovations

- Adoption of cloud-native and hybrid platform models combining cloud scalability with on-premises control.

- AI-powered content intelligence enhancing classification, predictive analytics, and workflow automation.

- Integration of CSPs with collaboration tools like Microsoft 365, Google Workspace, and Slack.

- Focus on mobile and multi-device access ensuring secure content availability across devices.

- Emergence of industry-specific CSP solutions tailored for compliance and workflow needs in BFSI, healthcare, government, and manufacturing.

- Strong emphasis on security enhancements including compliance, encryption, and zero-trust models.

Key Market Segments

By Component

- Solutions

- Document & Record Management

- Workflow Management

- Data Capture

- Case Management

- Information Security & Governance

- Content Reporting & Analytics

- Others

- Services

- Training & COnsulting

- Support & Maintenance

- Deployment & Integration

By Deployment Mode

- On-Premises

- Cloud

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Business Function

- Human Resources

- Sales & Marketing

- Accounting & Legal

- Procurement & Supply Chain Management

By Vertical

- BFSI

- Consumer Goods & Retail

- Energy & Utilities

- Government & Public Sector

- Healthcare & Life Sciences

- IT & ITes

- Manufacturing

- Media & Entertainment

- Telecommunications

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

Intelligent Automation and AI Integration

One emerging trend in the Content Services Platforms (CSP) market is the increasing incorporation of intelligent automation and artificial intelligence technologies. CSPs are evolving beyond basic content management to include AI-driven functionalities such as automated content classification, intelligent search, and predictive analytics.

This integration enables organizations to streamline workflows, reduce manual effort, and extract actionable insights from large volumes of data. As digital transformation accelerates, businesses are seeking CSPs that not only store and manage content but also facilitate smarter decision-making and enhance operational efficiency through advanced automation.

The impact of this trend is profound across industries. For example, AI-powered content services can automatically tag documents for compliance purposes, flag anomalies, or even personalize content delivery based on user behavior patterns. Such capabilities improve accuracy and speed in content handling, empowering organizations to better meet regulatory requirements and customer expectations.

Driver Analysis

Rapid Cloud Adoption and Remote Work Enablement

A primary driver propelling the CSP market is the widespread adoption of cloud-based solutions and the shift toward remote and hybrid work models. Cloud platforms offer scalability, flexibility, and cost-efficiency that make deploying and managing content services more accessible for organizations of all sizes. The Cloud’s ability to facilitate seamless access to content from any location supports remote workforce collaboration, which has become critical in today’s dispersed work environments.

This driver underscores a fundamental shift in how businesses operate. Organizations are investing in CSPs to support agile workflows, secure information sharing, and uninterrupted business continuity despite geographically scattered teams. Cloud-enabled CSPs also integrate well with other digital enterprise tools, making them central elements of modern IT ecosystems. As cloud infrastructure continues to mature and expand, it will remain a vital catalyst for CSP market growth.

Restraint Analysis

Integration Complexity and Legacy System Challenges

One of the significant restraints facing the CSP market is the complexity involved in integrating these platforms with existing legacy systems. Many organizations rely on outdated content management solutions or fragmented IT infrastructures, making seamless migration and system interoperability difficult. The process of consolidating and migrating content requires extensive planning, coordination, and resources, often leading to increased costs and prolonged deployment times.

Moreover, organizational resistance to change, especially among employees accustomed to traditional workflows, can hamper CSP adoption. Resistance stemming from unfamiliarity with new platforms or training gaps reduces user engagement and the overall effectiveness of CSP implementations. These integration challenges and change management issues constrain the pace at which enterprises can realize the full benefits of modern content services.

For instance, in May 2025, the increasing importance of FedRAMP (Federal Risk and Authorization Management Program) standards in the private sector is highlighted, especially for Content Services Platforms (CSP). As data security concerns rise, businesses are increasingly required to comply with stringent security frameworks like FedRAMP to safeguard sensitive information.

Opportunity Analysis

AI-Powered Content Analytics and Compliance Management

A significant opportunity within the CSP market lies in the advanced capabilities for AI-powered content analytics and compliance management. Increasing regulatory mandates worldwide compel organizations to enhance content governance, security, and audit readiness. CSPs equipped with AI and machine learning can automate compliance processes, monitor content usage, and ensure data privacy rules are upheld, reducing legal risks and operational burdens.

Additionally, intelligent content analytics uncover patterns and trends within enterprise data, enabling more informed business decisions and improved customer engagement strategies. These advancements create value by transforming content from static data repositories into dynamic assets that drive competitive advantage. Vendors who innovate in this space can attract organizations prioritizing compliance and data-driven insights.

For instance, in May 2025, Microsoft introduced significant changes to its Cloud Solution Provider (CSP) program. These updates are designed to streamline partner engagement and enhance the integration of AI capabilities within Microsoft’s cloud ecosystem. The changes focus on improving partner incentives, expanding support for AI-driven solutions, and enhancing customer experience.

Challenge Analysis

Data Security Risks and Vendor Lock-In

A critical challenge for CSPs is addressing data security concerns while managing vendor dependency risks. Storing sensitive corporate content on third-party platforms raises the stakes for potential data breaches, unauthorized access, or compliance violations. Organizations demand stringent security frameworks, encryption, and regulatory alignment to trust CSP providers fully.

At the same time, reliance on specific CSP vendors introduces vendor lock-in risks. Proprietary technologies, custom integrations, and data portability limitations can make switching providers difficult and costly. This challenge requires CSP suppliers to offer more flexible, interoperable solutions and establish transparent, trust-building practices to maintain customer confidence and long-term relationships.

Key Players Analysis

IBM Corporation, Microsoft Corporation, OpenText Corporation, and Oracle Corporation shape the enterprise core of Content Services Platforms. IBM focuses on automation, AI enrichment, and strict governance. Microsoft unifies content inside Microsoft 365 and Azure. Integration with Teams and Copilot strengthens adoption. OpenText delivers broad repositories, lifecycle controls, and cloud choices. Oracle aligns content with business processes in its applications.

Box Inc. drives cloud native adoption with simple sharing, workflow, and integrations. Adobe Systems Inc. extends CSP value through document creation, eSignature, and analytics. Hyland Software Inc. serves complex use cases and industry workflows. Alfresco Software Inc., now under Hyland, adds open core flexibility. Laserfiche Inc. targets process automation for mid sized agencies.

M Files Inc. differentiates with a metadata driven repository that improves findability. Newgen Software Technologies Limited competes through low code process design and case management. Abasoft AG remains a regional specialist with archiving and compliance strengths. Hewlett Packard Enterprise assets linked to Micro Focus are now under OpenText control, shaping consolidation. Other Key Players expand reach through ISV plugins and managed services.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Box Inc.

- Oracle Corporation

- Hyland Software Inc.

- Laserfiche Inc.

- Hewlett Packard Enterprise (Micro Focus)

- Adobe Systems Inc.

- M-Files Inc.

- Newgen Software Technologies Limited

- abasoft AG

- Everteam SAS

- DocuWare Corporation

- Alfresco Software Inc.

- Other Key Players

Recent Developments

- In February 2025, JioStar will introduce JioHotstar, combining JioCinema and Disney+ Hotstar into a single platform. The service aims to attract 500 million users and provide over 300,000 hours of content. It will feature original productions and international titles from Disney, NBCUniversal’s Peacock, Warner Bros., Discovery, HBO, and Paramount, with a strong emphasis on cricket programming.

- In August 2024, VisualVault leveraged Artificial Intelligence (AI) to help its clients build unprecedented knowledge through its Content Services Platform (CSP). By integrating AI capabilities, VisualVault enables organizations to automate content categorization, enhance document workflows, and gain deeper insights from data.

- In August 2023, OpenText received the prestigious “Built for NetSuite” accreditation from Oracle. This recognition highlights OpenText’s ability to deliver integrated content services solutions that work seamlessly with NetSuite’s cloud-based ERP system.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment Mode (On-Premises, Cloud), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Business Function (Human Resources, Sales & Marketing, Accounting & Legal, Procurement & Supply Chain Management), By Vertical (BFSI, Consumer Goods & Retail, Energy & Utilities, Government & Public Sector, Healthcare & Life Sciences, IT & ITes, Manufacturing, Media & Entertainment, Telecommunications, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, OpenText Corporation, Box Inc., Oracle Corporation, Hyland Software Inc., Laserfiche Inc., Hewlett Packard Enterprise (Micro Focus), Adobe Systems Inc., M-Files Inc., Newgen Software Technologies Limited, abasoft AG, Everteam SAS, DocuWare Corporation, Alfresco Software Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Content Services Platforms MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Content Services Platforms MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- OpenText Corporation

- Box Inc.

- Oracle Corporation

- Hyland Software Inc.

- Laserfiche Inc.

- Hewlett Packard Enterprise (Micro Focus)

- Adobe Systems Inc.

- M-Files Inc.

- Newgen Software Technologies Limited

- abasoft AG

- Everteam SAS

- DocuWare Corporation

- Alfresco Software Inc.

- Other Key Players