Global Container Glass Market By Product (Bottles, Vials & Ampoules, Jars, and Other Products), By End-User (Chemical, Food & Beverage, Cosmetics & Personal Care, Pharmaceutical, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 39921

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

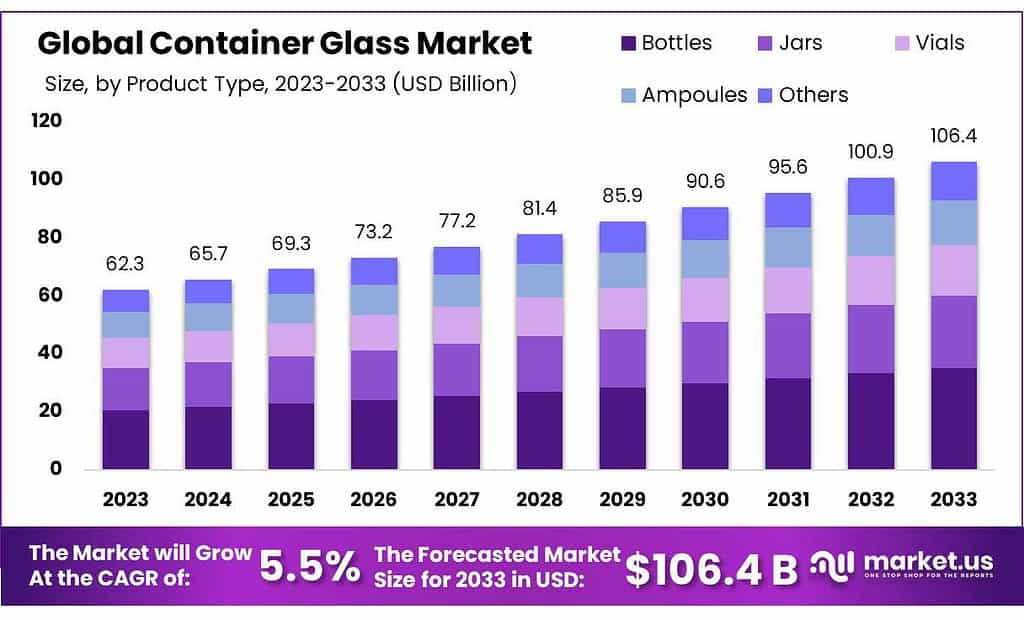

The Container Glass Market size is expected to be worth around USD 62.3 billion by 2033, from USD 35.3 Bn in 2023, growing at a CAGR of 5.5% during the forecast period from 2023 to 2033.

Market growth is expected to be driven primarily by increasing beverage consumption and the rising demand for ampoules, vials, and pharmaceutical products. The market growth is further being driven by the rising demand for premium packaging within the food processing sector.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth: The container glass market is set to hit approximately USD 62.3 billion by 2033, experiencing a notable CAGR of 5.5% from USD 35.3 billion in 2023. This growth is primarily fueled by increased beverage consumption and the surging demand for ampoules, vials, and pharmaceutical products.

- Product Insights: Bottles are the predominant product, claiming over 27% of the market share. Their versatility makes them highly adaptable across industries like beverages, pharmaceuticals, cosmetics, and various liquid-based goods. Glass bottles, due to their eco-friendliness and recyclability, maintain popularity among consumers.

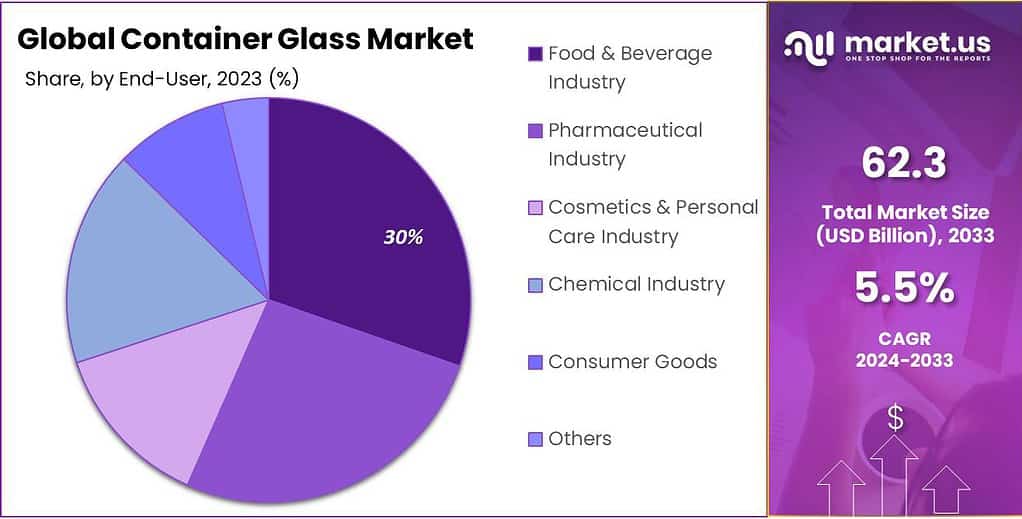

- End-User Analysis: The food and beverage industry stands out as the primary user of container glass, capturing over 28% market share. Glass packaging ensures freshness, flavor, and safety for products, reinforcing consumer trust due to its non-reactive nature, particularly crucial for preserving taste and quality.

- Market Drivers: The surge in sustainable packaging preferences, increased beverage consumption, and the trust placed in glass for preserving product quality act as major drivers. Glass, being highly recyclable and preserving taste, attracts industries seeking reliable packaging solutions.

- Market Restraints: Despite growth, glass faces competition from cheaper alternative materials like plastics and metals. Handling and transportation challenges due to fragility increase logistics costs. Additionally, the energy-intensive manufacturing process raises production expenses.

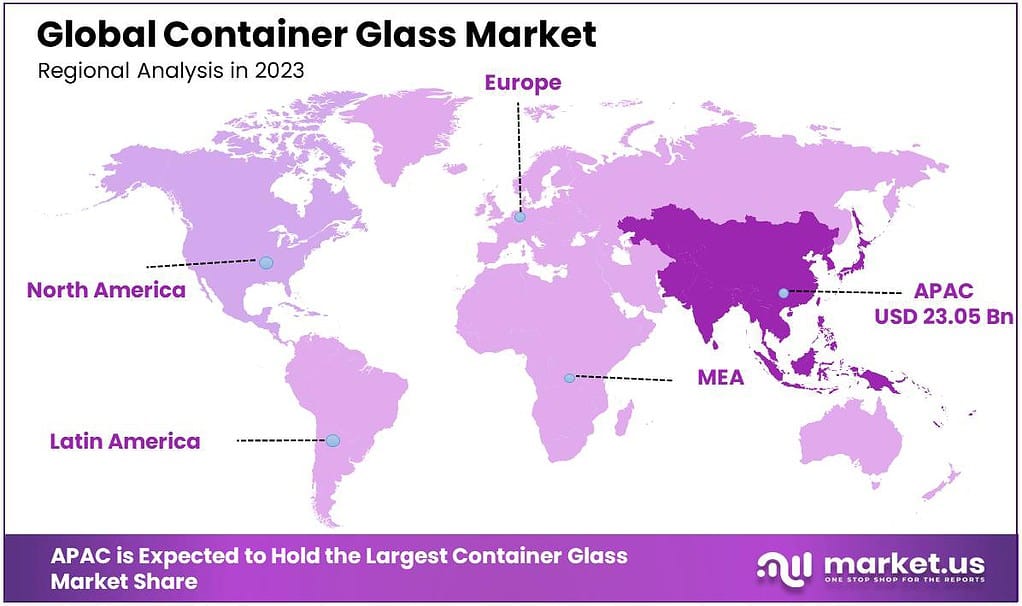

- Regional Growth: Asia-Pacific leads with a projected 7.3% annual growth, driven by increased online shopping. North America, Europe, South & Central America, and the Middle East & Africa each show varying growth rates attributed to distinct industry demands.

- Key Players: Ardagh Group, Gerresheimar AG, Borosil, and others are key players in the market. Strategies like mergers, acquisitions, and capacity expansions are used to strengthen market positions.

Product Analysis

In the container glass market of 2023, bottles emerged as the predominant product type, securing an extensive market share exceeding 27%. This particular category of container glass found widespread usage across multiple industries owing to its versatility and adaptability.

Bottles provide the ideal packaging solution for an array of products, including beverages such as carbonated drinks, alcoholic beverages and juices, pharmaceuticals and cosmetics as well as various liquid-based goods. Their popularity stems not only from their convenient storage capabilities but also due to their eco-friendliness: glass bottles can easily be recycled while contributing towards sustainability initiatives.

The significant market share held by bottles reflects their fundamental role in various sectors, bolstered by their inherent characteristics. The flexibility in bottle design, encompassing various shapes, sizes, and closure options, ensures suitability for different products and industries.

This adaptability remains a key driver behind their dominance in the container glass market, allowing manufacturers to meet diverse packaging needs effectively. Additionally, the enduring popularity of bottles is underpinned by consumer preferences for glass packaging, which often signifies quality and purity, particularly in sectors like beverages and pharmaceuticals.

Bottles are really important in the glass container industry. Plastic straws have long been a part of life because they’re useful, look good and can easily be recycled – which appeals to people as being better for the environment.That’s why bottles are still a big part of this market and used in many different industries.

End User Analysis

In 2023, the Food & Beverage Industry emerged as the primary user in the container glass market, capturing a significant market share exceeding 28%. This industry heavily relies on glass containers to package an extensive range of food and beverage products, encompassing items like sauces, beverages, preserves, and more.

Glass packaging holds a pivotal role in this sector due to its unique capability to uphold the freshness, flavor, and safety of consumables. The trust in glass packaging stems from its non-reactive nature, which ensures that the taste and quality of the food and beverages remain unaffected. As a result, glass containers are highly favored by consumers, particularly for products where taste and quality preservation are paramount.

The substantial dominance of the Food & Beverage Industry in utilizing glass containers signifies the pivotal role of this packaging medium within the industry. Glass containers play a crucial part in preserving the integrity and taste of food and beverage items throughout their shelf life. Moreover, the inherent qualities of glass, including its transparency, ability to preserve taste, and recyclability, reinforce its position as a preferred packaging material in the food and beverage sector.

This dominance underscores the indispensable nature of glass containers in safeguarding and delivering food and beverage products, meeting both industry standards and consumer expectations.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

By Product

- Bottles

- Vials & Ampoules

- Jars

- Other Products

By End-user

- Chemical

- Food & Beverage

- Cosmetics & Personal Care

- Pharmaceutical

- Other End-Users

Drivers

The container glass market is experiencing rapid expansion due to various key drivers. Chief among these is an increase in consumer and industry interest for sustainable packaging solutions; glass containers’ highly recyclable nature has made them highly attractive as more people prioritize eco-friendly options such as these containers – fueling its surge in popularity across various sectors.

Increased beverage consumption – both alcoholic and non-alcoholic – plays an integral part in driving the container glass market forward. Glass packaging remains an ideal material to preserve taste and quality of drinks such as juices, sodas, and alcoholic beverages; its inert and non-reactive properties make it suitable for protecting these tastes while satisfying consumer preferences.

Food industry’s trust in glass containers remains strong due to their ability to preserve freshness, taste, and quality of products – particularly those where taste preservation is crucial – which further fuels demand for glass packaging solutions.

Collectively, these driving forces – the pursuit of sustainability, the increased consumption of beverages, and the reliability of glass in preserving product quality – are fueling the robust growth of the container glass market, positioning it as a key player in the packaging industry.

Restraints

The container glass market, despite its growth, encounters several challenges that impede its progress. One significant restraint is the rising competition from alternative packaging materials, such as plastics and metals. While glass is favored for its eco-friendly nature and recyclability, it faces tough competition from materials that are often cheaper to produce and transport. This competition poses a challenge for glass containers to maintain their market share and attract industries seeking cost-effective packaging solutions.

Glass containers present unique handling and transportation challenges that raise logistics costs and raise concerns over breakage during transit, raising logistic expenses as a result of their inherent fragility. Their fragile nature also increases vulnerability in supply chains, leading to additional expenses related to transportation and handling that ultimately affect overall costs for manufacturers and suppliers alike.

Additionally, the energy-intensive manufacturing process of glass containers, in comparison to some other packaging materials, contributes to higher production costs. This aspect includes the consumption of substantial energy during the melting and forming processes, adding to the overall expenses of producing glass containers.

Collectively, these restraints, including increased competition, logistical challenges related to fragility during transportation, and higher production costs due to the energy-intensive manufacturing process, present significant hurdles for the container glass market, impacting its growth trajectory.

Opportunities

The container glass market encounters several challenges that impact its growth trajectory. One prominent challenge is the intensifying competition from alternative packaging materials like plastics and metals. While glass has its unique eco-friendly appeal and recyclability, it faces stiff competition from materials that are often cheaper to produce and transport. This heightened competition poses a hurdle for glass containers to retain their market share and attract industries looking for more cost-effective packaging solutions.

Glass presents special handling and logistics challenges throughout its supply chain, from handling and transportation costs to potential breakages during transportation. As a result, handling and transportation expenses increase for manufacturers and suppliers, leading to higher overall expenses associated with handling and transportation expenses that impact overall costs for both parties involved.

As mentioned previously, glass container production requires high energy usage compared to other packaging materials. This energy-intensive production process, including melting and forming steps, adds additional expenses associated with making glass containers. As energy consumption contributes to rising production costs in a competitive market landscape, manufacturers face additional hurdles as a result.

In summary, these challenges, including tough competition from alternative materials, logistical issues due to fragility, and higher production costs owing to energy-intensive manufacturing processes, collectively pose significant hurdles for the container glass market, impacting its growth and sustainability.

Challenges

The container glass market encounters several challenges that impact its growth trajectory. One prominent challenge is the intensifying competition from alternative packaging materials like plastics and metals. While glass has its unique eco-friendly appeal and recyclability, it faces stiff competition from materials that are often cheaper to produce and transport. This heightened competition poses a hurdle for glass containers to retain their market share and attract industries looking for more cost-effective packaging solutions.

Glass presents special handling and logistics challenges throughout its supply chain, from handling and transportation costs to potential breakages during transportation. As a result, handling and transportation expenses increase for manufacturers and suppliers, leading to higher overall expenses associated with handling and transportation expenses that impact overall costs for both parties involved.

As mentioned previously, glass container production requires high energy usage compared to other packaging materials. This energy-intensive production process, including melting and forming steps, adds additional expenses associated with making glass containers. As energy consumption contributes to rising production costs in a competitive market landscape, manufacturers face additional hurdles as a result.

In summary, these challenges, including tough competition from alternative materials, logistical issues due to fragility, and higher production costs owing to energy-intensive manufacturing processes, collectively pose significant hurdles for the container glass market, impacting its growth and sustainability.

Regional Analysis

Asia-Pacific: This area is set to grow by 7.3% each year, mainly because more people are shopping online and need more glass packaging. North America: In North America, the glass packaging market will grow by 4.2% every year. This is because food and drink companies there want better glass bottles.

Europe: Europe’s glass packaging market will grow by 2.8% annually. It’s happening because more companies in healthcare and beauty want glass packages. South and Central America: In these areas, the glass packaging market will grow by 5.6% every year. That’s because more food and drink companies there need glass bottles

The U.S. has a high beer consumption which is a key factor in the growth of the container-glass market. China is the next largest consumer of beer in the world, with the U.S. being the second. Nearly 14.3% of all global beer consumption is made in the United States. Market growth can also be influenced by a large number of beverage and pharmaceutical companies based in the United States.Europe’s market is forecast to experience a 3.9% CAGR during the forecast period. The region’s large food and beverage industry is key to market growth. The European Union’s exports of food and beverages have increased by more than 82% in the past ten years.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

These companies are significant players within the glass and packaging industry, each contributing expertise and innovation to this sector. Ardagh Group specializes in packaging solutions, producing metal and glass containers for food and beverage industries globally. Gerresheimer AG is a leading provider of glass and plastic packaging for pharmaceuticals and healthcare products. Borosil operates in the glassware industry, focusing on laboratory glassware, consumer glassware, and scientific equipment.

Schott AG is renowned for its specialty glass products, optical technologies, and glass ceramics used in various industries like healthcare, electronics, and home appliances. Stevanato Group is a key player in providing packaging solutions, especially in the field of pharmaceutical glass containers and drug delivery systems. Piramal Glass Private Limited manufactures glass packaging solutions for pharmaceuticals, cosmetics, and perfumery.

Corning Incorporated is known for its innovations in glass technologies, producing glass for applications in display technologies, telecommunications, and life sciences. Unitrade FZE operates in the glass packaging industry, supplying containers for food and beverages. Saverglass SAS specializes in manufacturing high-end glass bottles for the premium and luxury spirits market. O-I Glass, Inc. and Vitro are major producers of glass containers for beverages and food products.

Frigoglass SAIC focuses on manufacturing glass packaging for beverages and refrigeration equipment. Amcor plc is a global leader in packaging solutions, including glass containers, for various industries. SGD SA specializes in glass packaging for pharmaceuticals, perfumery, and food markets. Owens-Illinois is a prominent manufacturer of glass containers for beverages and food products. These companies collectively shape the glass and packaging industry, providing essential solutions for numerous sectors, including pharmaceuticals, beverages, cosmetics, and more.

Маrkеt Кеу Рlауеrѕ

- Ardagh Group

- Gerresheimar AG

- Borosil

- Schott AG

- Stevanato Group

- Piramal Glass Private Limited

- Corning Incorporated

- Unitrade FZE

- Saverglass SAS

- O-I Glass, Inc.

- Vitro

- Frigoglass SAIC

- Amcor plc

- SGD SA

- Owens-Illinois

- Other Key Players

Recent developments

March – 2023 – SCHOTT started producing amber pharmaceutical glass in India to satisfy rising demand. The company invested significantly over the past three years to increase its medical glass production in India to fulfill the rising demand in Asia. The company’s primary borosilicate glass tubing production plant is in Gujarat. This premium material is used to make pharmaceutical containers, including vials, ampoules, and syringes that are used to carry life-saving medications.

Report Scope

Report Features Description Market Value (2023) USD 35.3 Billion Forecast Revenue (2033) USD 62.2 Billion CAGR (2023-2032) 5.5% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Bottles, Vials & Ampoules, Jars, Other Products), By End-user(Chemical, Food & Beverage, Cosmetics & Personal Care, Pharmaceutical, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ardagh Group, Gerresheimar AG, Borosil, Schott AG, Stevanato Group, Piramal Glass Private Limited, Corning Incorporated, Unitrade FZE, Saverglass SAS, O-I Glass, Inc., Vitro, Frigoglass SAIC, Amcor plc, SGD SA, Owens-Illinois, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Container Glass?Container glass refers to glass packaging used in various industries to contain food, beverages, pharmaceuticals, and other products. It's known for its transparency, inertness, and recyclability.

What Trends Are Impacting the Container Glass Market?- Shift Towards Sustainable Packaging: Growing consumer preference for eco-friendly packaging materials.

- Customization and Design: Demand for unique and aesthetically pleasing packaging designs.

- Digitalization: Incorporation of technology for improved production efficiency and quality control.

What are the Major Applications of Container Glass?- Beverage Packaging: Including bottles for beer, wine, spirits, juices, and soft drinks.

- Food Packaging: Jars and bottles for sauces, pickles, spices, and other food products.

- Pharmaceutical Packaging: Medicine bottles and containers.

-

-

- Ardagh Group

- Gerresheimar AG

- Borosil

- Schott AG

- Stevanato Group

- Piramal Glass Private Limited

- Corning Incorporated

- Unitrade FZE

- Saverglass SAS

- O-I Glass, Inc.

- Vitro

- Frigoglass SAIC

- Amcor plc

- SGD SA

- Owens-Illinois

- Other Key Players