Global Container Depot Services Market Size, Share, Growth Analysis By Service Type (Storage, Handling/Movement, Maintenance & Repair, Transportation, Others), By Container Type (Dry/Standard, Reefer (Temperature-Sensitive), Tank (Liquid/Chemical), Others), By End-use (Shipping Lines/Container Owners, Freight Forwarders/3PLs, Importers/Exporters, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167802

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

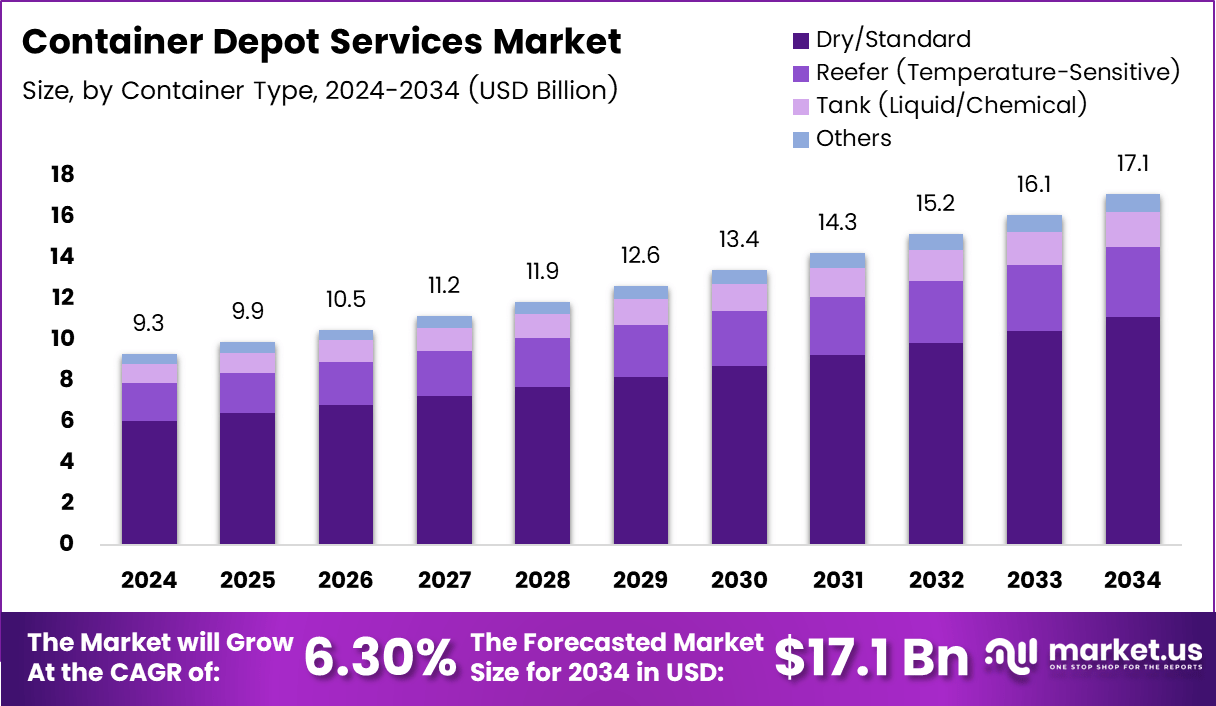

The Global Container Depot Services Market size is expected to be worth around USD 17.1 billion by 2034, from USD 9.3 billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Container Depot Services Market represents an essential logistics pillar supporting global container circulation, repair needs, and yard storage operations. The market continues evolving as shipping lines expand fleet capacities, ports modernise handling infrastructure, and inland logistics hubs integrate digital yard-management platforms. Depots increasingly focus on faster turnaround processes, predictive maintenance, and standardised inspection workflows.

Moreover, steady growth is expected as container trade rebounds across major import–export corridors, pushing operators to expand stacking capacity and upgrade handling equipment. Demand strengthens as supply chain volatility drives higher buffer-stock requirements, resulting in more storage utilisation across dry, reefer, and tank container segments. Operators also emphasise energy-efficient yard layouts and optimised container handling cycles.

Furthermore, the market gains new opportunities as governments invest in port connectivity, multimodal logistics parks, and inland container depots to reduce coastal congestion. Policy support for digital documentation, smart gate systems, and paperless trade accelerates depot modernisation. These upgrades encourage higher adoption of yard-automation technologies, real-time tracking tools, and integrated depot-management systems used across container handling networks.

Additionally, regulatory frameworks promoting safe container handling, standardised repair guidelines, and environmental compliance reshape operator strategies. Governments increasingly encourage cleaner handling fleets, structured maintenance audits, and transparent storage practices. This regulatory momentum supports structured growth and reduces operational risks across container storage and repair environments.

As the market transforms, the interplay of rising throughput, infrastructure upgrades, and demand for efficient repositioning services fuels long-term expansion. Sustainable yard operations, remote diagnostics, and IoT-enabled container monitoring further enhance service efficiency. These shifts position depots as strategic enablers within broader port-centric and inland logistics ecosystems.

According to a survey dataset, 13 of the top 20 performing container ports in 2023 were located in East and Southeast Asia, reflecting the region’s strong operational maturity. Additionally, according to maritime mobility data, global container ship movement declined by 5.62% to 13.77% between March and June 2020, highlighting supply chain stress during early pandemic months.

Furthermore, according research, developed regions recorded a 23.1% drop in container ship calls in Q2 2020 versus the same period in 2019, demonstrating vulnerability in depot utilisation cycles. These disruptions eventually accelerated investments in resilient container depot services, digital yard management, and capacity expansion strategies to support future demand surges.

Key Takeaways

- The Global Container Depot Services Market is projected to reach USD 17.1 billion by 2034 from USD 9.3 billion in 2024, growing at a CAGR of 6.3%.

- Storage leads the By Service Type segment with a dominant share of 33.8% in 2024.

- Dry/Standard containers dominate the By Container Type segment with a market share of 64.9%.

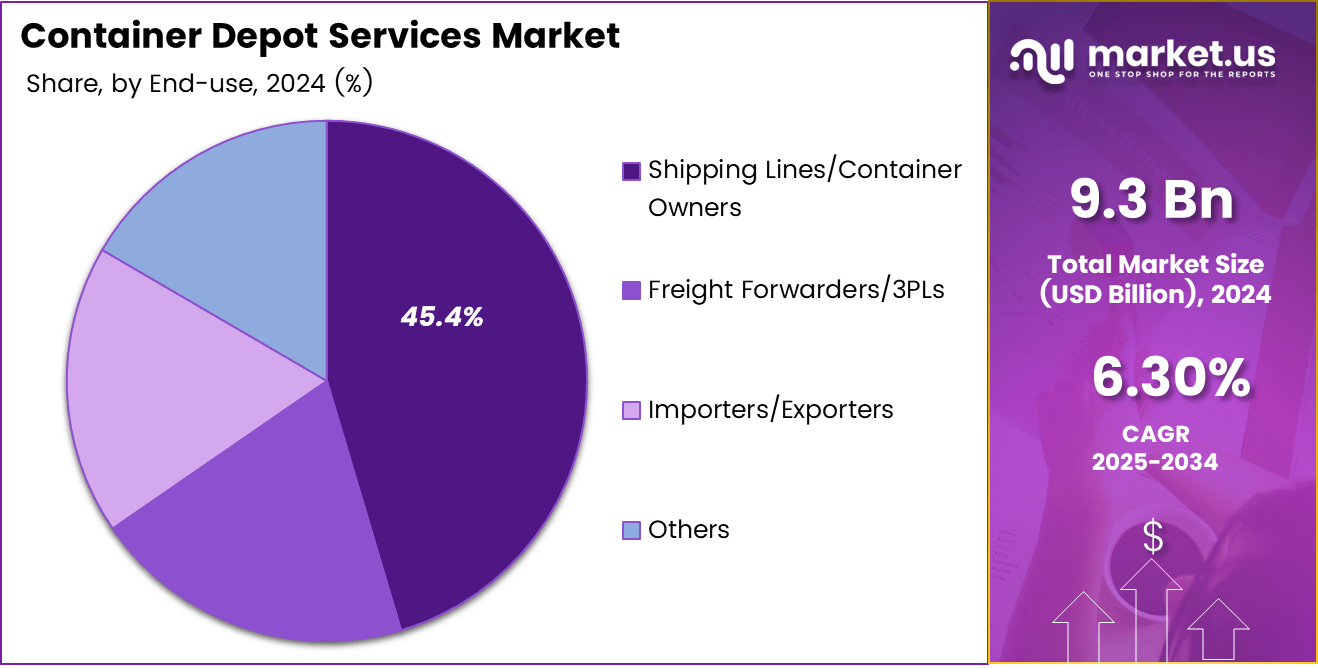

- Shipping Lines/Container Owners hold the highest share of 45.4% in the By End-use segment.

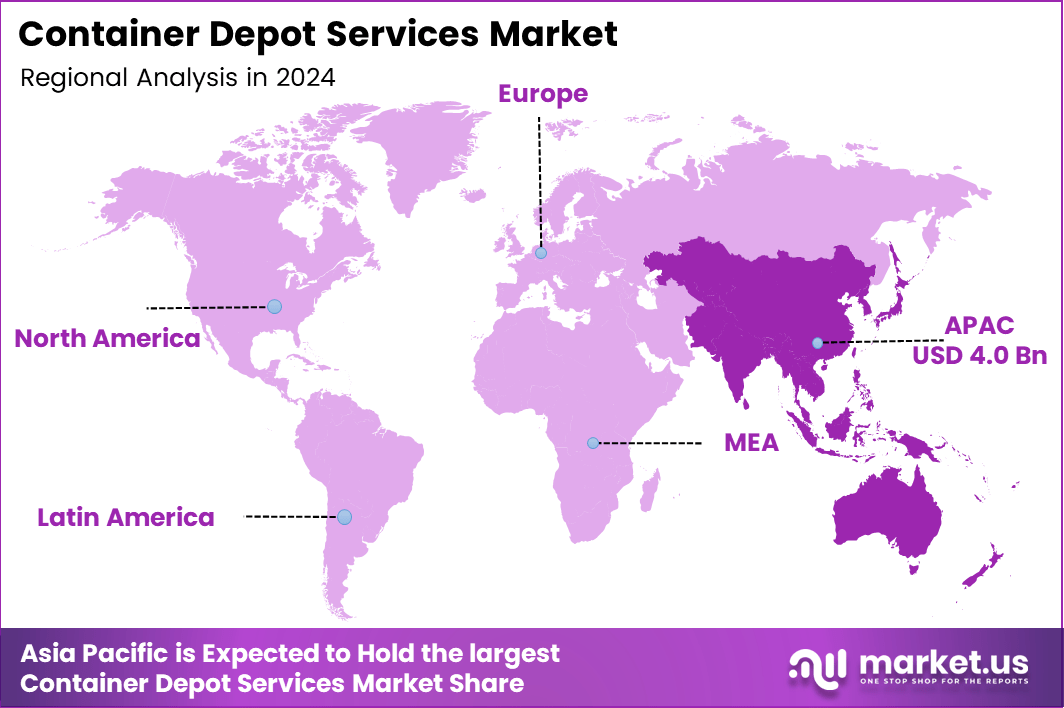

- Asia Pacific remains the leading region with a 43.9% market share valued at USD 4.0 billion in 2024.

By Service Type Analysis

Storage dominates with 33.8% due to its essential role in container flow continuity and yard optimisation.

In 2024, Storage held a dominant market position in the By Service Type Analysis segment of the Container Depot Services Market, with a 33.8% share. Storage remains essential because depots act as critical buffers between vessel schedules, inland distribution, and repositioning cycles, ensuring container availability and reducing congestion across major logistics corridors.

Handling/Movement supports steady growth as depots increasingly manage high container traffic requiring efficient lift operations, slot allocation, and yard mobility. This segment expands as operators adopt digital yard systems to track inbound and outbound container flows, accelerating turnaround times and supporting multi-modal linkages.

Maintenance & Repair continues gaining relevance as container fleets age and require routine checks, welding, cleaning, and structural assessments. Depots offering integrated M&R services attract larger shipping clients who depend on consistent serviceability standards to maintain container safety and operational value.

Transportation contributes significantly by linking depots with ports, ICDs, dry ports, and customer locations. The segment grows with the rise of intermodal freight activity, supporting repositioning of empties and movement of laden units to optimise supply chain efficiency and reduce idle container time.

Others include add-on services such as inspection, fumigation support, documentation assistance, and ancillary yard services. These value-added operations help depots diversify revenue sources while meeting client-specific requirements across different cargo types and regional regulations.

By Container Type Analysis

Dry/Standard containers dominate with 64.9% owing to their universal deployment across global trade lanes.

In 2024, Dry/Standard containers held a dominant market position in the By Container Type Analysis segment of the Container Depot Services Market, with a 64.9% share. Their high usage across manufacturing, retail, automotive, and consumer-goods shipments ensures continuous depot demand for storage, handling, and repair.

Reefer (Temperature-Sensitive) containers witness steady service growth driven by rising cold-chain movements of pharmaceuticals, perishables, and processed foods. Depots increasingly invest in reefer monitoring, plug-in points, and specialised inspection areas to maintain temperature integrity and reduce cargo spoilage risks.

Tank (Liquid/Chemical) containers expand gradually as chemical, food-grade liquid, and hazardous cargo movements rise globally. These units need specialised cleaning, heating, and testing facilities, pushing depots to add compliant handling equipment and safety-certified operators to meet industry regulations and client expectations.

Others include specialised containers such as flat-racks, open-tops, and high-cubes used for oversized or irregular cargo. These units require careful yard coordination and selective repair services, making them a smaller but essential part of depot operations supporting niche cargo requirements.

By End-use Analysis

Shipping Lines/Container Owners dominate with 45.4% due to their large fleet volumes and continuous repositioning needs.

In 2024, Shipping Lines/Container Owners held a dominant market position in the By End-use Analysis segment of the Container Depot Services Market, with a 45.4% share. Their dependency on depots for storage, maintenance, inspection, and fleet balance keeps this segment the highest contributor.

Freight Forwarders/3PLs rely increasingly on depot networks to streamline container availability, reduce turnaround delays, and coordinate multi-modal movements. Their expanding role in global logistics strengthens service demand for handling, storage, and short-term leasing support.

Importers/Exporters generate consistent activity by using depots for pre-shipment staging, empty pick-up, cargo stuffing, and return operations. Growing manufacturing activity and cross-border trade reinforce this segment’s operational footprint across major distribution clusters.

Others include regional distributors, specialised cargo handlers, and smaller shippers who utilise depot services for flexible storage and container processing. Although smaller in scale, their diversified needs contribute to steady service engagement across various depot locations.

Key Market Segments

By Service Type

- Storage

- Handling/Movement

- Maintenance & Repair

- Transportation

- Others

By Container Type

- Dry/Standard

- Reefer (Temperature-Sensitive)

- Tank (Liquid/Chemical)

- Others

By End-use

- Shipping Lines/Container Owners

- Freight Forwarders/3PLs

- Importers/Exporters

- Others

Drivers

Expansion of Regional Transhipment Hubs Drives Market Growth

The Container Depot Services Market grows steadily as regional transhipment hubs expand and create stronger demand for high-capacity depot handling networks. This expansion improves routing flexibility, accelerates vessel scheduling, and increases the volume of containers requiring storage, lifting, and repositioning across busy maritime corridors.

The rising adoption of smart container tracking also strengthens market performance. Digital tools improve throughput visibility, enhance yard allocation, and reduce turnaround delays. As operators integrate IoT-based scanners and automated gate systems, depots experience smoother workflows that support greater operational accuracy and real-time movement oversight.

Growth in refrigerated cargo volumes further supports depot modernisation. Cold-chain expansion pushes depots to add temperature-controlled storage, reefer plug-in areas, and monitoring systems. These upgrades ensure product integrity for pharmaceuticals, perishables, and processed food shipments, increasing demand for specialised depot infrastructure.

Increased fleet renewal cycles among global shipping lines raise service requirements for repair, washing, and maintenance. As newer container fleets enter operations, depots must deliver high-quality inspection and refurbishment services. This trend expands maintenance workloads and increases reliance on professionally equipped depot facilities.

Restraints

Congestion at Gateway Ports Restricts Operational Efficiency

Congestion at major gateway ports limits yard availability and slows container turnaround, creating operational pressure for depot operators. When vessel arrivals cluster, depots face overflow challenges, reducing their ability to process incoming containers quickly and maintain balanced yard utilisation across different service categories.

High land-lease and operational costs further restrict the establishment of large-scale depot facilities near ports. Land scarcity in prime port clusters makes expansion difficult, forcing operators to shift to inland sites that require additional transport planning and may increase total logistical expenses for customers.

A shortage of skilled depot technicians adds another constraint. Repair, welding, inspection, and reefer servicing require experienced professionals. When skilled labour is limited, repair quality suffers, and cycle-time performance weakens, ultimately affecting container readiness and customer satisfaction levels.

These restraints collectively slow market expansion by increasing cost burdens, reducing yard fluidity, and placing higher operational risks on depot networks that already manage fluctuating container volumes.

Growth Factors

Development of Automated Stacking Systems Unlocks New Opportunities

The rise of automated container stacking and robotic handling systems creates significant opportunities for modern depots. Automation improves precision, reduces human-error risks, and enhances yard density, allowing operators to manage larger volumes within smaller footprints while supporting faster turnaround cycles.

Growing interest in green depots further broadens opportunity areas. Operators increasingly integrate solar power, EV yard tractors, low-emission lifting equipment, and energy-efficient lighting. These sustainability upgrades reduce operating costs, enhance compliance, and attract environmentally focused shipping customers.

The expansion of inland container depots (ICDs) strengthens hinterland connectivity. ICD development reduces port crowding, supports multimodal flows, and enables quicker distribution of empties and laden units. This shift improves supply chain stability and expands depot service coverage.

These emerging opportunities enable operators to enhance operational resilience, create new revenue streams, and meet evolving regulatory and environmental expectations in global logistics.

Emerging Trends

Increasing Uptake of IoT Sensors Drives Modern Depot Trends

The Container Depot Services Market experiences strong technological trends as depots adopt IoT-enabled condition-monitoring sensors across fleets. These sensors track container health, detect structural issues, and monitor temperature variations, supporting predictive maintenance and reducing operational disruptions.

A growing shift toward blockchain-based systems transforms container interchange documentation. Blockchain ensures tamper-proof audit trails, enhances documentation transparency, and reduces disputes between stakeholders. This transition improves trust, accelerates paperwork clearance, and reduces manual data-entry errors.

These trends reflect the logistics sector’s move toward high-automation, data-driven, and secure container depot ecosystems designed to support faster and more resilient global supply chains.

Regional Analysis

Asia Pacific Dominates the Container Depot Services Market with a Market Share of 43.9%, Valued at USD 4.0 Billion

Asia Pacific remains the leading region in the Container Depot Services Market due to its rapid port expansion, high transhipment intensity, and strong manufacturing-driven export flows. With a dominant 43.9% share valued at USD 4.0 billion, the region benefits from large-scale depot infrastructure integrated with major shipping corridors and inland logistics clusters.

North America Container Depot Services Market Trends

North America shows steady growth driven by the modernisation of inland depots, rising intermodal freight activity, and higher demand for yard automation systems. Strong trucking–rail connectivity supports repositioning efficiency, while the region’s emphasis on digital yard management continues to strengthen operational performance across container processing hubs.

Europe Container Depot Services Market Trends

Europe advances with stable container throughput supported by integrated port, Automotive networks and stringent depot safety and environmental compliance standards. The region focuses on efficient handling of reefer cargo and sustainable yard operations, driving investment in temperature-controlled facilities and low-emission equipment across major logistics nodes.

Middle East & Africa Container Depot Services Market Trends

The Middle East & Africa region grows with expanding maritime hubs, particularly in transhipment-focused economies, investing heavily in logistics infrastructure. Emerging inland depots strengthen regional trade links, while strategic port expansions support increased demand for container handling, storage, and repair services.

Latin America Container Depot Services Market Trends

Latin America experiences a gradual expansion fueled by rising agricultural exports, growing regional trade, and the development of inland depots supporting multimodal cargo flows. Infrastructure upgrades in key ports and dry ports drive demand for depot capacity, especially for storage and repair services supporting export-oriented industries.

U.S. Container Depot Services Market Trends

The U.S. market remains strong due to high import-driven container volumes, robust inland distribution networks, and increasing adoption of tech-enabled depot operations. Investments in automation, yard visibility tools, and congestion mitigation strategies continue to enhance national depot efficiency across major coastal and inland hubs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Container Depot Services Market Company Insights

The global Container Depot Services Market in 2024 is influenced by the operational scale, infrastructure capability, and digital modernisation efforts led by several major logistics players. DP World remains a central force in shaping depot efficiency through its extensive port-connected networks and integrated logistics solutions, which enhance storage, handling, and multimodal connectivity across major trade corridors. Its focus on automation and smart yard systems strengthens overall depot throughput.

A.P. Moller – Maersk plays a pivotal role as it advances end-to-end logistics strategies, driving demand for modern container depots aligned with its integrated supply chain model. The company’s emphasis on digital container management and sustainable equipment upgrades contributes to standardised yard practices and higher service reliability across global depots.

COSCO Shipping Corporation strengthens depot market momentum through its large fleet movements and high-volume port operations, particularly across the Asia-Pacific. Its reliance on efficient depot storage, movement, and repair functions supports greater container fleet readiness, while growing trade volumes continue to increase demand for structured depot networks connected to major shipping lanes.

PSA International continues to influence market performance through its advanced terminal ecosystems and strong transhipment positioning. Its investments in smart port technologies and yard automation create synergies that benefit depot operations, promoting faster turnaround cycles and improved equipment utilisation across container handling activities.

These leading companies collectively reinforce market stability by driving investments in digital visibility, sustainable yard operations, and globally aligned depot standards.

Top Key Players in the Market

- DP World

- A.P. Moller – Maersk

- COSCO Shipping Corporation

- PSA International

- Hutchison Port Holdings Trust

- ICTSI

- Gateway Distriparks Limited

- Adani Group

- DCI

- CONCOR

Recent Developments

- In Nov 2025, CMA CGM Group announced plans to acquire a 20% stake in EUROGATE Container Terminal Hamburg (CTH), strengthening its strategic presence in a major European port hub.The investment supports CMA CGM’s long term port infrastructure strategy and enhances access to critical container handling capacity in Northern Europe.

- In Dec 2024, MRI Software acquired iInterchange to expand its global intermodal and logistics software business.

This acquisition enhances MRI Software’s digital freight, container, and intermodal management capabilities across international transportation networks. - In Apr 2025, Triton International announced its agreement to acquire Global Container International, expanding its scale in the global container leasing market. The transaction strengthens Triton’s fleet size, customer base, and geographic reach, supporting long term growth in global trade and shipping demand.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Billion Forecast Revenue (2034) USD 17.1 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Storage, Handling/Movement, Maintenance & Repair, Transportation, Others),

By Container Type (Dry/Standard, Reefer (Temperature-Sensitive), Tank (Liquid/Chemical), Others),

By End-use (Shipping Lines/Container Owners, Freight Forwarders/3PLs, Importers/Exporters, Others)Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape DP World, A.P. Moller – Maersk, COSCO Shipping Corporation, PSA International, Hutchison Port Holdings Trust, ICTSI, Gateway Distriparks Limited, Adani Group, DCI, CONCOR Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Container Depot Services MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Container Depot Services MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DP World

- A.P. Moller - Maersk

- COSCO Shipping Corporation

- PSA International

- Hutchison Port Holdings Trust

- ICTSI

- Gateway Distriparks Limited

- Adani Group

- DCI

- CONCOR