Global Contactless Payments Market By Component (Hardware, Solution, and Services), By Application (Retail, Transportation, Healthcare, Hospitality, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct. 2023

- Report ID: 60952

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

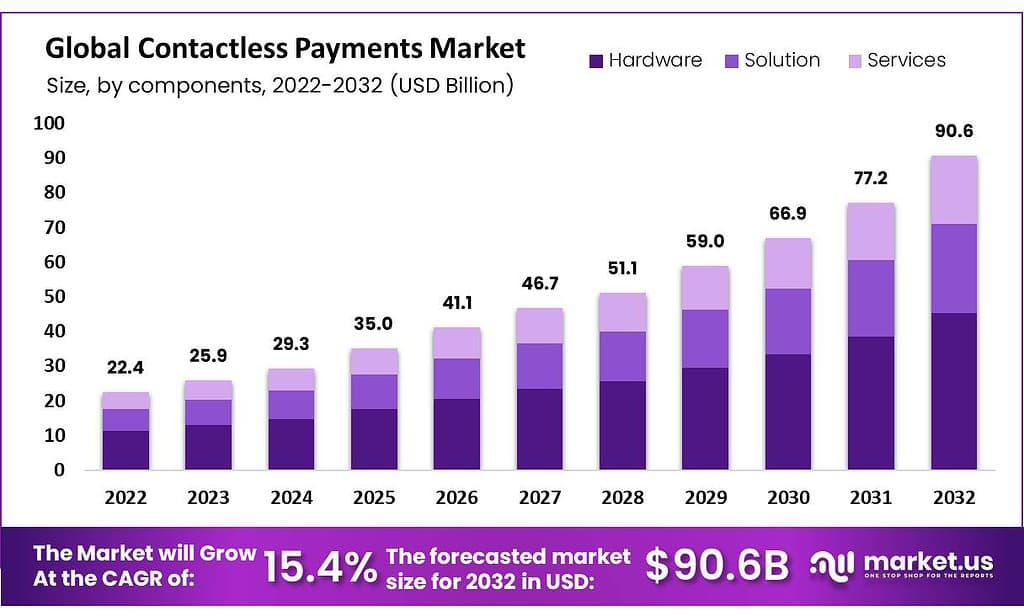

The global contactless payments market was valued at US$ 22.4 billion in 2022 and expected to grow US$ 90.6 billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 15.4%.

Contactless payments refer to payment methods that enable customers to complete transactions without physical touch. Instead, customers can utilize digital payment tools like mobile wallets or credit/debit cards with contactless capabilities for convenient purchases. Contactless payments can be enabled by various payment technologies, such as Near Field Communication (NFC) and Radio Frequency Identification (RFID). Such types of payments offer speedy transactions by simply entering a PIN number. They’re popular in BFSI, retail, IT & telecom, transportation, hospitality services, and government organizations alike. Furthermore, contactless payment provides direct payments from one bank account to another – ideal for larger purchases. With the increase in payment options, contactless payment is becoming ever more widespread.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Statistics: The global contactless payments market is expected to reach USD 90.6 billion by 2032, growing at a CAGR of 15.4% from 2023 to 2032.

- Demand: Demand for contactless payments is being driven by their convenience and security features, and an increasing awareness of this form of technology among consumers.

- Component Analysis: Hardware Segment is the most lucrative sector of the global contactless payments market.

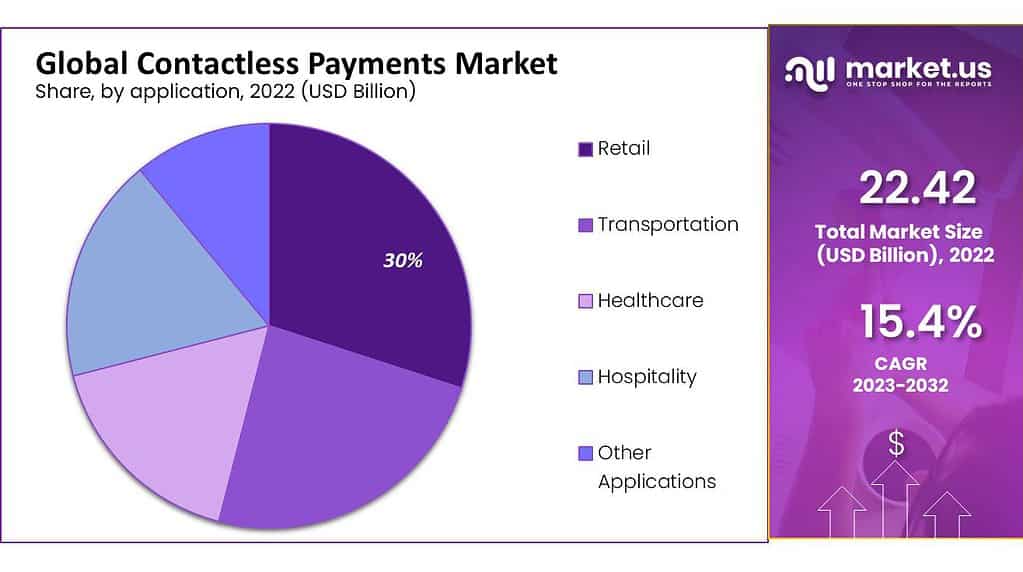

- Application Analysis: It is estimated that retail will remain the most profitable segment within the global contactless payments market with 56% market share by 2022.

- Driving Factors: Smartphone-Based Payments Are Fuelling the Market’s Growth

- Restraining Factors: High Cost for Implementing Software Solutions

- Opportunity: Growing Demand for digital payment options

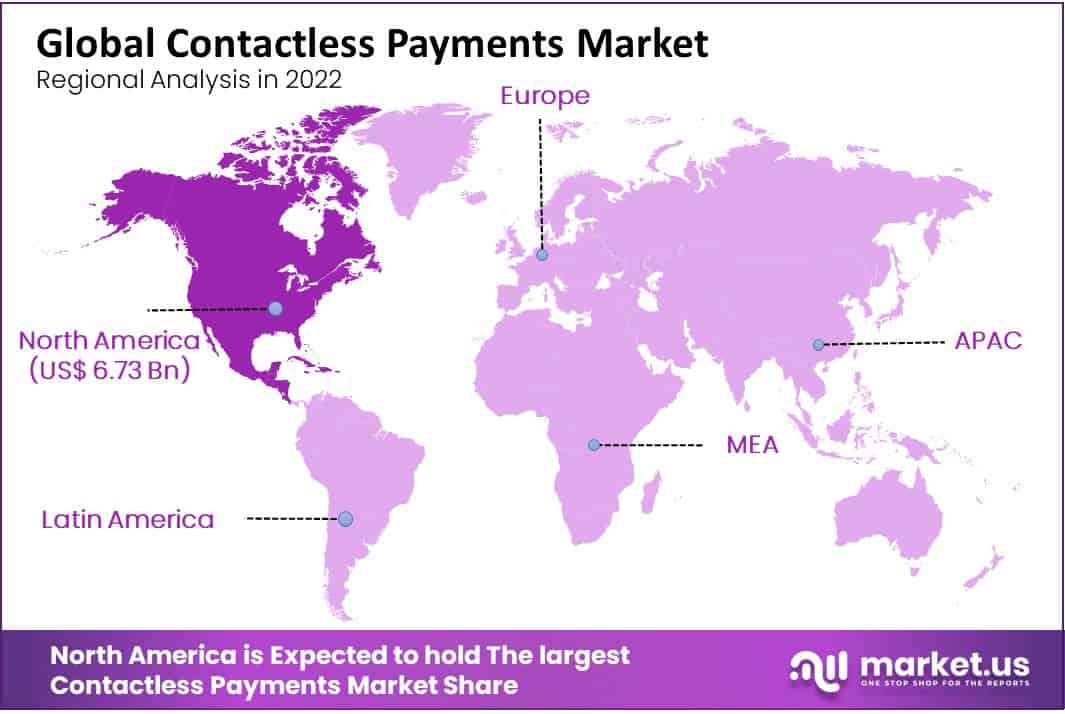

- Regional Analysis: According to estimates, North America is expected to lead the global contactless payments market with 30% market share during its forecast period.

- Top Key Players: Gemalto, Infineon, Ingenico, Wirecard, Verifone, Giesecke+Devrient, IDEMIA, On Track Innovations, Identiv, CPI Card Group, Bitel, Seomatic Systems, Valitor, PAX Global Technology, MYPINPAD, Mobeewave, Alcineo, Castles, SumUp, PayCore, Other Key Players

Driving Factors

The Growing Popularity of Smartphone-Based Payments Drives the Market Growth

Contactless payments provide a faster and more convenient way to make purchases, particularly small ones. Customers appreciate being able to tap their card or mobile device instead of having to carry cash or enter their PIN code manually. Contactless payments are more secure than other payment methods, as they utilize advanced encryption technology to protect sensitive financial data.

This provides consumers peace of mind and helps to reduce fraudulence and other security risks. Due to the growing popularity of smartphones for making payments, businesses are increasingly adopting contactless payment solutions in order to stay ahead in this trend. Furthermore, many credit card issuers have started issuing contactless cards in an effort to further accelerate the adoption of this technology.

Restraining Factors

High Cost for Implementing Software Solutions

One of the major obstacles in contactless payments is that it requires initial investment from businesses in infrastructure to support them. Payment terminals, software updates, and other hardware and software components can be costly and time-consuming to implement. Although contactless payments have become popular in recent years, there are still some hesitant consumers who have yet to embrace the technology. Some may feel insecure with contactless payments, while others might prefer traditional payment methods. Regulations and standards regarding contactless payments are still evolving, creating uncertainty for businesses and consumers.

As new regulations are implemented, it can be challenging for businesses to stay informed about them and ensure they adhere to the most up-to-date standards. Contactless payments rely on strong internet connectivity in order to function properly; in areas with slow internet connections, contactless payments may not be as dependable or effective, which could limit their usefulness in certain regions.

Opportunity

Rising Demand for Digitalized Payment Options

Over the forecast period, digitalized payment options are expected to fuel market growth. The payment industry is transitioning toward EMV (Europay, MasterCard, and Visa) chip cards for improved security and finer control when making offline purchases. The contactless payments market is expected to experience a strong growth due to this factor.

Contactless payment cards offer greater security compared to traditional payment methods, and also the payment industry is shifting toward contactless ways like Google Pay and Samsung Pay, etc. Payment industries are using contactless payment technologies in order to shield consumers from fraudulence and identity theft. IT provide a streamlined experience through the Omni channel (personalized user experience). Furthermore, increased security by strengthening authentication procedures of Cards (EMV), lucarative offers on payment and are anticipated to drive the growth of this market.

Trending Factors

Adoption of New Technologies such as Blockchain, AI, and IoT

Mobile payments are on the rise and will continue to expand. Consumers are increasingly using their smartphones to pay for goods and services, leading to an expansion in mobile payment options such as contactless payment. Wearable devices, such as smartwatches or fitness trackers, have become increasingly popular in recent years and now feature of contactless payments can be available on these wearables.

Due to this growth in acceptance among consumers, contactless payments appear to be on the rise. Contactless payments are being integrated into new technologies like blockchain, IoT, and artificial intelligence to enhance security and customer experience. As a secure payment option, governments and regulators are increasingly supporting contactless payments; this has led to the development of regulations and standards that will encourage their growth.

Component Analysis

The Hardware Segment is Dominant

Based on components, the market for contactless payments is segmented into hardware, solution, and services. Among these components, the hardware segment is the most lucrative in the global contactless payments market. The total revenue share of hardware-component contactless payments is 50% in 2022. This Segment is further classified as POS, Cards, and Others. Followed by solutions, the payment providers and technology firms offer complete end-to-end solutions such as payment terminal solutions, device management solutions, contactless mobile payment solutions, transaction & data management, and security and fraud management. The growing adoption of contactless payment methods in various sectors such as BSFI, retail, transportation, hospitality, and the government, is expected to drive segment growth.

Application Analysis

Retail Segment Dominates the global Contactless Payments Market

By application, the market is divided into retail, transportation, healthcare, hospitality, and other applications. The retail segment is estimated to be the most lucrative segment in the global contactless payments market, with a market share of 56% in 2022. Contactless payments have become increasingly commonplace in retail stores.

This trend has been fueled by the convenience and speed, enabling customers to complete purchases quickly and effortlessly. The hospitality sector, such as restaurants, bars, and hotels, has also adopted contactless payments. This has become crucial during the COVID-19 pandemic when customers seek ways to pay without physical touching. This factors can drive the growth for global contactless payments market.

Note: Actual Numbers Might Vary In Final Report

Key Market Segments

Based on Component

- Hardware

- POS

- Cards

- Others

- Solution

- Payment Terminal Solution

- Device Management Solution

- Contactless Mobile Payment Solution

- Transaction & Data Management

- Security and Fraud Management

- Services

- Consulting

- Integration & Deployment

- Support & Maintenance

Based on Application

- Retail

- Transportation

- Healthcare

- Hospitality

- Other Applications

Regional Analysis

North America Dominates the Global Contactless Payments Market

North America is estimated to be the most lucrative market in the global contactless payments market, with the largest market share of 30% during the forecast period. The growing preference for digitization, the Internet of Things (IoT), and big data is expected to spur demand for advanced hardware and software solutions from contactless payment solution providers within the region.

The Asia-Pacific region has experienced a marked increase in contactless payment methods due to mobile payments and e-wallets; countries such as China, India, and Japan are key markets in this region. Europe has been a leader in contactless payment adoption, with countries like the UK, Poland and Germany boasting high penetration rates of contactless payment cards. This expansion has been spurred by favorable regulatory policies such as raising the contactless payment limit and encouraging mobile payments and e-wallets.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Vendors in the contactless payments market often rely on partnerships and collaborations to launch products, expand their reach, and offer various payment solutions to end users. Their speedy processing capabilities have contributed to the explosive growth of contactless payment. Visa Inc. recently unveiled India’s roadmap to strengthen payment security at a press conference held in December 2021. This program seeks protection for India’s rapidly evolving digital payments ecosystem against emerging threats and cyberattacks. Vendors also prioritize partnerships as part of their strategies.

Listed below are some of the most prominent contactless payments industry players.

- Gemalto

- Infineon

- Ingenico

- Wirecard

- Verifone

- Giesecke+Devrient

- IDEMIA

- On Track Innovations

- Identiv

- CPI Card Group

- Bitel

- Seomatic Systems

- Valitor

- PAX Global Technology

- MYPINPAD

- Mobeewave

- Alcineo

- Castles

- SumUp

- PayCore

- Other Key Players

Recent Developments

- June 2022 – Giesecke+Devrient, a leader in security technology, has announced the acquisition of Valid USA’s payment and identification solutions division. G+D plans to accelerate expansion into America – one of the world’s key payment and identification markets – by acquiring Valid USA. With increased scale at their disposal, clients will be able to address ongoing supply chain issues that impact all industries globally.

- In May 2022, Giesecke+Devrient unveiled a revolutionary banknote type: the “Green Banknote”. This innovative paper currency uses eco-friendly materials and efficient production processes to produce durable notes with advanced security features for an eco-friendly cash cycle.

Report Scope

Report Features Description Market Value (2022) US$ 22.4 Bn Forecast Revenue (2032) US$ 90.6 Bn CAGR (2023-2032) 15.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Solution, and Services), By Application (Retail, Transportation, Healthcare, Hospitality, and Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Gemalto, Infineon, Ingenico, Wirecard, Verifone, Giesecke+Devrient, IDEMIA, On Track Innovations, Identiv, CPI Card Group, Bitel, Seomatic Systems, Valitor, PAX Global Technology, MYPINPAD, Mobeewave, Alcineo, Castles, SumUp, PayCore, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the contactless payment market?In 2022, the global contactless payments market was valued at US$ 22.4 billion.

What is the contactless payment market growth?In 2022, the global contactless payments market was valued at US$ 22.4 billion and expected to grow US$ 90.6 billion in 2023.

What is the contactless payment market growth rate?Between 2023 and 2032, this market is estimated to register a CAGR of 15.4%.

Contactless Payments MarketPublished date: Oct. 2023add_shopping_cartBuy Now get_appDownload Sample

Contactless Payments MarketPublished date: Oct. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Gemalto

- Infineon

- Ingenico

- Wirecard

- Verifone

- Giesecke+Devrient

- IDEMIA

- On Track Innovations

- Identiv

- CPI Card Group

- Bitel

- Seomatic Systems

- Valitor

- PAX Global Technology

- MYPINPAD

- Mobeewave

- Alcineo

- Castles

- SumUp

- PayCore

- Other Key Players