Global Construction Additives Market By Type (Chemical, Fiber, and Mineral), By End-use (Residential, Infrastructure, and Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec 2023

- Report ID: 32115

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

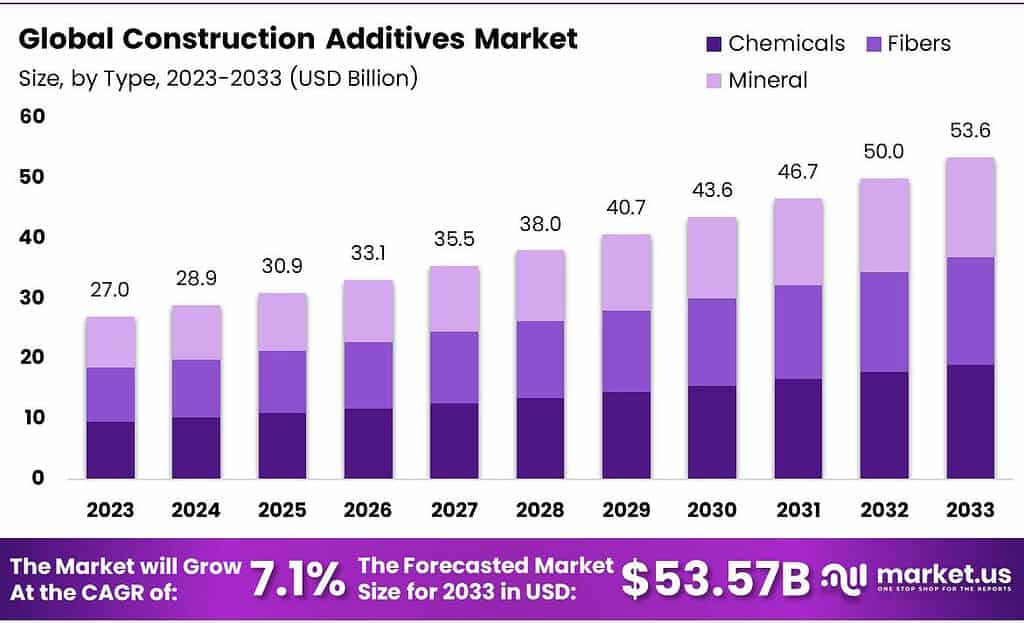

The Construction Additives Market size is expected to be worth around USD 53.6 billion by 2033, from USD 26.98 Bn in 2023, growing at a CAGR of 7.1% during the forecast period from 2023 to 2033.

Due to the recovery of the construction industry, the importance of construction additives is growing. With increasing residential and commercial construction projects and rapid urbanization in emerging countries such as China or India, the market is expanding. Market growth will be driven by architects and builders becoming more aware of the advantages of additives.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth and Size Projection: The Construction Additives Market is set to witness substantial growth, aiming to reach approximately USD 53.6 billion by 2033 from USD 26.98 billion in 2023, reflecting a CAGR of 7.1% during 2023-2033.

- Driving Forces: Increasing Demand for Improved Quality: Additives play a crucial role in enhancing construction material properties, meeting the rising need for durable and robust structures.

- Segment Insights: Chemicals Dominate: Chemical additives, like retarding, plasticizers, and water-reducing agents, lead the market due to increased usage in multi-story constructions.

- Opportunities and Challenges: Environmental Concerns Drive Demand: Eco-friendly additives and those improving building strength and longevity are in high demand.

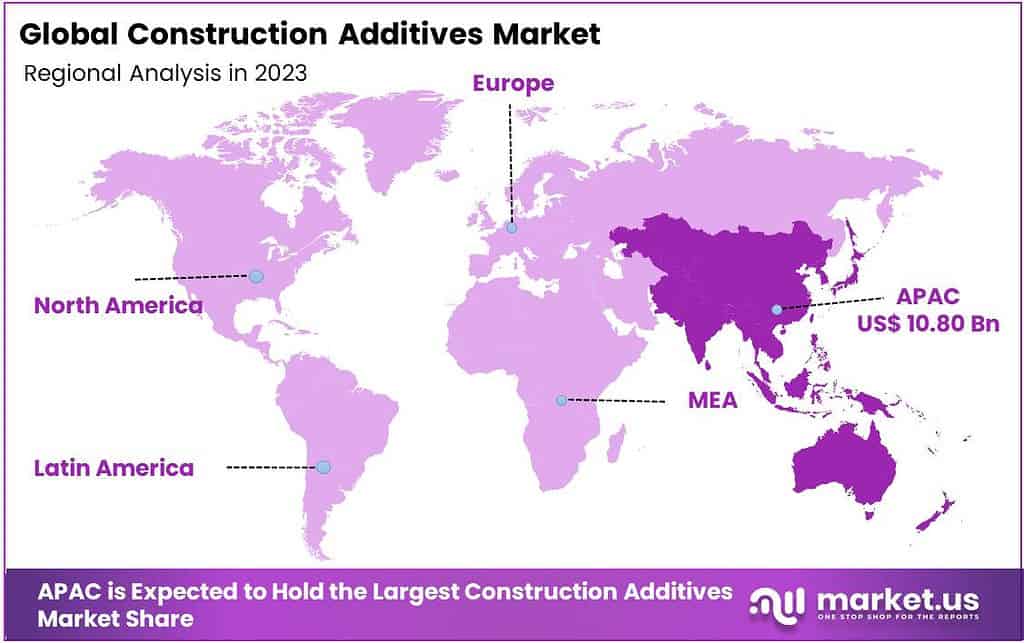

- Regional Dynamics: Asia-Pacific Dominance: APAC holds the largest revenue share, propelled by infrastructure initiatives in countries like China and India.

- Market Players: Oligopolistic Market: Key players like BASF SE, Sika AG, and Dow Chemicals have invested significantly in R&D for high-performance products, expanding their presence globally.

Type analysis

In 2023, Chemicals were at the top in the construction additives market, grabbing over 35.6% of the market share. These chemicals play a crucial role in enhancing various properties of construction materials.

Waterproofing Chemicals also played a significant role, securing a considerable market segment. They aid in preventing water penetration and safeguarding structures against damage.

Protective Coatings emerged as another essential segment, offering durability and resistance to corrosion, thereby extending the lifespan of constructions.

Concrete Mixtures constituted a notable share as well, contributing to the strength and workability of concrete used in diverse construction projects.

Fibers made their mark by reinforcing concrete and improving its toughness, minimizing cracking and enhancing structural integrity.

Minerals, though a smaller segment, provided specific functionalities like improving adhesion and strength in construction materials. They carved out a niche in the market with their specialized applications.

End-Use Analysis

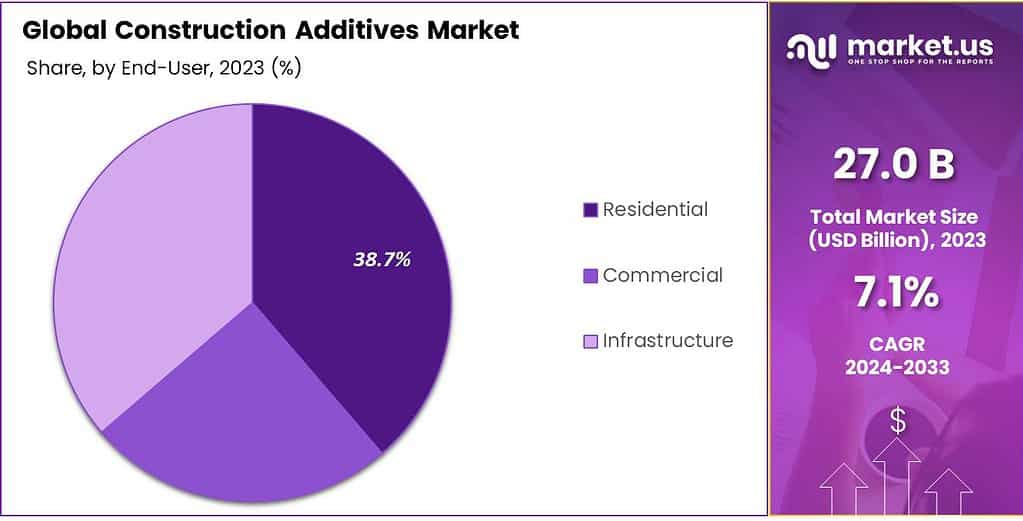

In 2023, the Residential sector led the construction additives market, grabbing over 38.7% of the share. This segment heavily relies on additives for various purposes, from enhancing aesthetics to improving structural integrity in home construction.

Infrastructure emerged as a significant player, securing a substantial market segment. Additives are pivotal in infrastructure projects, ensuring the durability and longevity of bridges, roads, and other public works.

Commercial projects constituted another vital segment, utilizing additives for diverse needs such as creating visually appealing structures and enhancing performance under heavy usage.

Each segment—Residential, Infrastructure, and Commercial—relies on construction additives to meet specific requirements, marking distinct but interconnected parts of the market landscape.

Actual Numbers Might Vary in the Final Report

Key Market Segments

By Type

- Chemicals

- Waterproofing Chemicals

- Protective Coating

- Concrete Mixture

- Fibers

- Mineral

By End-use

- Residential

- Infrastructure

- Commercial

Drivers

The Construction Additives market is witnessing significant growth due to several key drivers. Firstly, the rising demand for improved construction quality and durability in infrastructure projects acts as a major driver. Additives play a vital role in enhancing concrete strength, durability, and workability, meeting the increasing demand for robust and long-lasting structures.

Construction sector expansion globally and in emerging economies is further driving market demand. Urbanization and infrastructure development are creating a surge in construction activities which leads to a greater need for additives that improve various construction materials’ properties.

Sustainable construction practices are driving market expansion. Additives that promote sustainability by reducing the carbon footprint of construction materials, improving energy efficiency, and supporting eco-friendly materials have gained prominence and contributed to market expansion.

These drivers collectively underline the crucial role of construction additives in meeting the evolving demands of the construction industry for enhanced performance, sustainability, and efficiency in building materials and infrastructure projects.

Restraints

Construction Additives Market Development Restraints For this market to flourish, its development must overcome various hurdles. One such hindrance is government regulations and standards which impose restrictive compliance standards that add an extra step when developing or using additives in construction materials.

Price volatility in raw materials used to manufacture additives presents another significant challenge. Changes in raw material costs directly impact production costs and market stability.

One key impediment to market growth is end-users limited knowledge and understanding of the applications and benefits of construction additives, leading them to take less action to adopt these solutions, leading to slower market expansion.

These limitations impede the smooth development of the Construction Additives market by impacting production costs, compliance, and awareness among stakeholders in the construction industry.

Opportunities

The construction additives market has lots of chances for growth. One big reason is that people care more about helping the environment. They want additives that are good for the Earth, like using recycled stuff or making things that don’t hurt nature. People also want buildings to be stronger and last longer. So, they look for additives that make materials like concrete tougher and protect them from bad weather and damage.

Making construction faster and cheaper is also a big deal. Additives that speed up building or save money are really important. New technology, like tiny things that improve materials or gadgets that check if a building is okay, is also becoming popular. There are new places where construction is growing fast. And improving old buildings is getting attention too, especially if it helps the environment.

Following rules about keeping the environment safe is super important. Additives that meet these rules, like reducing pollution or using safer stuff, are in high demand. Lastly, additives that can be changed to fit different needs are liked by builders. To do well in this market, companies need to make new things, follow the rules, and focus on making stuff that helps the Earth and is easy to use.

Challenges

Construction additives manufacturers face several challenging hurdles that make its growth difficult. One big difficulty lies in adhering to government rules about how additives should be manufactured; sometimes these regulations change, forcing businesses to spend thousands to comply.

Another difficulty lies in creating new and advanced additives, as this requires significant investments of money, particularly if using cutting-edge technologies like nanomaterials or smart gadgets. Furthermore, not everyone understands how best to utilize such innovations so it may take more effort for everyone involved to utilize these things when building stuff.

Environmentally friendly additives can be difficult to make. Finding enough recyclable or eco-friendly materials makes producing large volumes of these additives challenging. Teaching builders and companies about the benefits of these new additives is also a challenge. Some folks prefer doing things the old way and might not want to change. Plus, if new additives cost more without showing clear benefits right away, some companies might not want to use them.

Getting the materials needed for these additives can also be tough. Sometimes, it’s hard to get the stuff needed to make these additives, which can cause problems in making and selling them. And since the construction industry has different needs in different places, making additives that work well everywhere is a challenge. To grow, this industry needs to figure out how to balance making new and eco-friendly additives while also following the rules and showing everyone how these new things are helpful in the long run.

Geopolitical and Recession Impact Analysis

Geopolitical Impact on the Construction Additives Market:

When countries have disagreements or trade conflicts, they might impose taxes or restrictions on the materials used in construction additives. This can create difficulties in obtaining these materials, increase their costs, and disrupt their manufacturing and distribution.

Changes in rules governing the use or labeling of these materials can occur due to significant political shifts. This might require companies to modify their methods of producing construction additives and comply with new regulations, which can be challenging.

If regions where these additives are needed face conflicts or issues, it can hinder companies’ growth there. Moreover, disputes over sourcing materials for these additives can create challenges in production and environmental sustainability efforts.

Recession Impact on the Construction Additives Market:

When the economy isn’t doing well, people might spend less on things like construction additives, even though they’re important for building. They might choose cheaper options or reduce usage, which can lower the demand for these additives.

Because everyone’s watching their money, they’ll pay closer attention to how much these additives cost. Companies might need to rethink prices to keep up with the competition and keep selling.

When times are tough, it can mess up how these additives are made and sent out. If the companies making them or sending them to construction sites have money problems, it could slow down making and getting these additives. Also, when money’s tight, people might care more about the environment. They might prefer additives that are better for the planet and create less waste.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 40.1% in 2023. Over the forecast period, the market is expected to be driven by increasing infrastructure activities as a result of various government initiatives like One Belt One Road in China (OBOR), and the Bharatmala project in India. In India and China, there is expected to be a rapid increase in residential construction.

These regional markets are being driven by the reviving residential sector and the growing number of hospitals in the U.S., and other European countries. Because of their huge construction sector, Africa and the Middle East are two of the fastest-growing regions.

The market for construction products in MEA will benefit from the focus of Middle Eastern nations such as Qatar, Saudi Arabia, and the United Arab Emirates on turning the petroleum-centric economy into a tourism and business-focused economy. These countries are expected to build artificial islands and skyscrapers, which will drive the market between 2023 and 2032.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The market is oligopolistic, with both local and global players. BASF SE, Sika AG, and Dow Chemicals are some of the key players in the market. Market players have invested heavily in research and development for high-performance products to strengthen the construction and make it more durable. To tap into the expanding market potential, many companies have opened production facilities abroad, especially in Asian countries.

Маrkеt Кеу Рlауеrѕ

- ВАЅF SE

- Sika AG

- The Dow Chemical Co.

- Ashland Inc.

- Covestro AG

- Arkema SA

- RPM International

- Mapei

- Fritz Pak

- PAC Technologies

- Concrete Additives & Chemicals

- Berolan

- Others

Recent Developments

In September 2022, Sika recently purchased Sable Marco Inc. of Pont Rouge, Canada – an establishment producing cement goods and mortars – as an acquisition to explore potential new business opportunities in Eastern Canada.

In January 2022, Sika’s expanded production facility in Africa now produces both mortars and concrete admixtures, located in Tanzania and Ivory Coast. Furthermore, there is sufficient room set aside by this plant for future expansion plans.

Report Scope

Report Features Description Market Value (2023) USD 26.98 Bn Forecast Revenue (2033) USD 53.6 Bn CAGR (2023-2032) 7.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Chemicals, Waterproofing Chemicals, Protective Coating, Concrete Mixture, Fibers, Mineral), By End-use(Residential, Infrastructure, Commercial) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Ѕіkа AG, ВАЅF SE, W.R. Grасе & Со., DОW, Сhrуѕо S.A.S, RРМ Іntеrnаtіоnаl Inc., Fоѕrос Іntеrnаtіоnаl, Мареі Ѕ.Р.А., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are construction additives?Construction additives are substances added to construction materials like concrete, cement, and mortar to enhance their properties. They improve strength, durability, workability, and resistance to factors like water, heat, or chemicals.

Where are construction additives used?They are used in various construction projects such as buildings, roads, bridges, and tunnels. These additives help in improving the performance and quality of construction materials.

Where can construction additives be sourced?They are available through construction material suppliers, specialized additive manufacturers, and companies providing products for the construction industry.

Construction Additives MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Construction Additives MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- ВАЅF SE

- Sika AG

- The Dow Chemical Co.

- Ashland Inc.

- Covestro AG

- Arkema SA

- RPM International

- Mapei

- Fritz Pak

- PAC Technologies

- Concrete Additives & Chemicals

- Berolan

- Others