Global Connected Ship Market By Application (Vessel Traffic Management, Fleet Health Monitoring, Fleet Operation, Other Applications), By Installation (Onboard, Onshore), By Platform (Ships, Ports), By Fit (Line fit, Retrofit, Hybrid fit), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2024

- Report ID: 25363

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

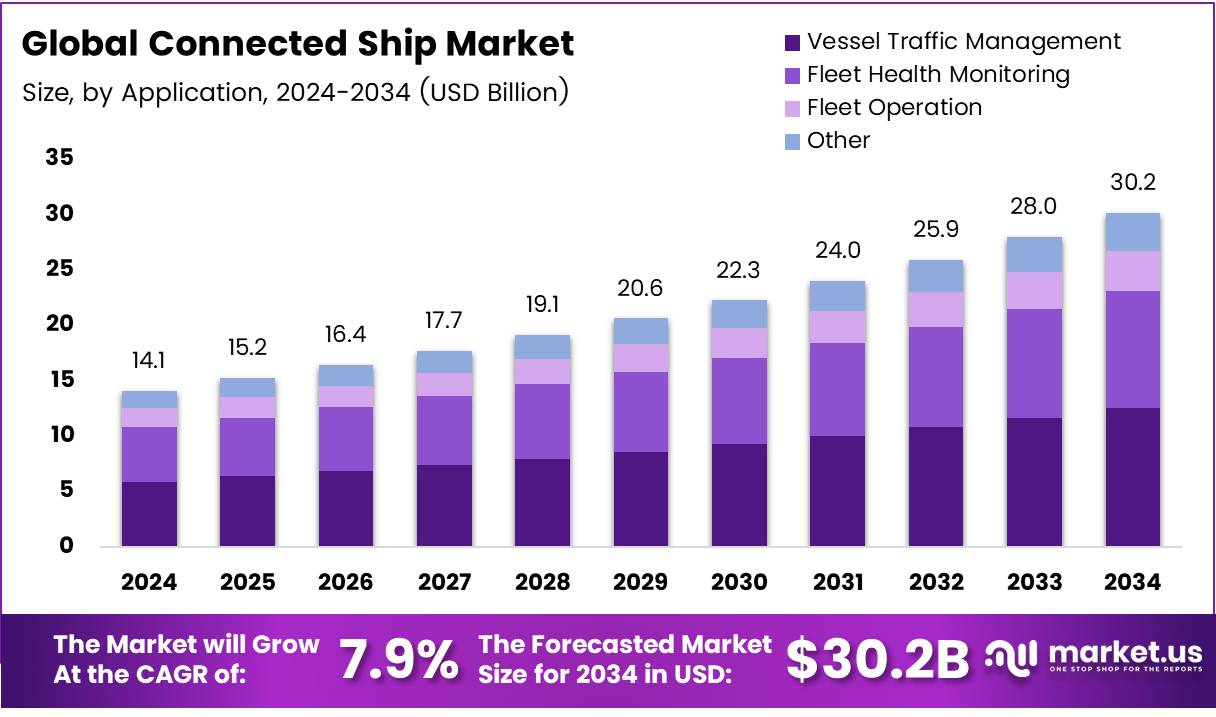

The Global Connected Ship Market size is expected to be worth around USD 28.14 Billion by 2033, From USD 13.15 Billion by 2023, growing at a CAGR of 7.90% during the forecast period from 2024 to 2033.

The Connected Ship Market refers to the integrated sector focused on enhancing maritime vessel operations through advanced digital technologies. This market encompasses solutions that facilitate real-time data exchange, operational efficiency, and improved navigation and communication systems onboard ships. By leveraging IoT, satellite communication, and data analytics, stakeholders aim to optimize fleet management, reduce operational costs, and enhance safety measures.

As maritime trade continues to be a backbone of global commerce, the Connected Ship Market is pivotal for stakeholders, including product managers, seeking to innovate within the shipping industry, ensure regulatory compliance, and drive competitive advantage. This sector represents a confluence of technology and maritime expertise, promising a transformative impact on global shipping logistics and operations.

The Connected Ship Market, pivotal to the maritime industry’s evolution, is witnessing transformative growth, fueled by technological advancements and the digitalization of the maritime sector. This market’s expansion can be attributed to the burgeoning global fleet capacity, which reached an impressive milestone of 2.2 billion dead-weight tons as of January 2022.

Such growth reflects not only an increase in maritime traffic but also signifies the industry’s adaptability to economic demands and environmental regulations. Despite a contraction in the general cargo carriers segment, other segments have seen substantial tonnage increases, underscoring a diverse and expanding maritime landscape.

The centrality of Asia in shipbuilding and recycling activities further underscores the global maritime industry’s dynamics. China, the Republic of Korea, and Japan have emerged as behemoths, collectively accounting for a staggering 94% of global shipbuilding gross tonnage in 2021.

This dominance in shipbuilding, coupled with Bangladesh and Pakistan’s significant share in ship recycling—jointly comprising 72%, with India contributing an additional 18%—highlights the strategic importance of these regions in the maritime value chain.

In synthesizing these data points, the Connected Ship Market’s trajectory is marked by robust growth prospects. The integration of connectivity solutions aboard ships is not merely a trend but a fundamental shift towards smarter, more efficient maritime operations. This shift, powered by the digitalization of ships and the infusion of IoT (Internet of Things) technologies, offers unprecedented opportunities for operational optimization, enhanced safety, and environmental sustainability.

As the maritime industry continues to evolve, the Connected Ship Market stands at the forefront, poised for significant expansion and innovation, driven by digital advancements and a steadfast commitment to sustainability.

Key Takeaways

- Global Connected Ship Market size is expected to be worth around USD 28.14 Billion by 2033, From USD 13.15 Billion by 2023, growing at a CAGR of 7.90% during the forecast period from 2024 to 2033.

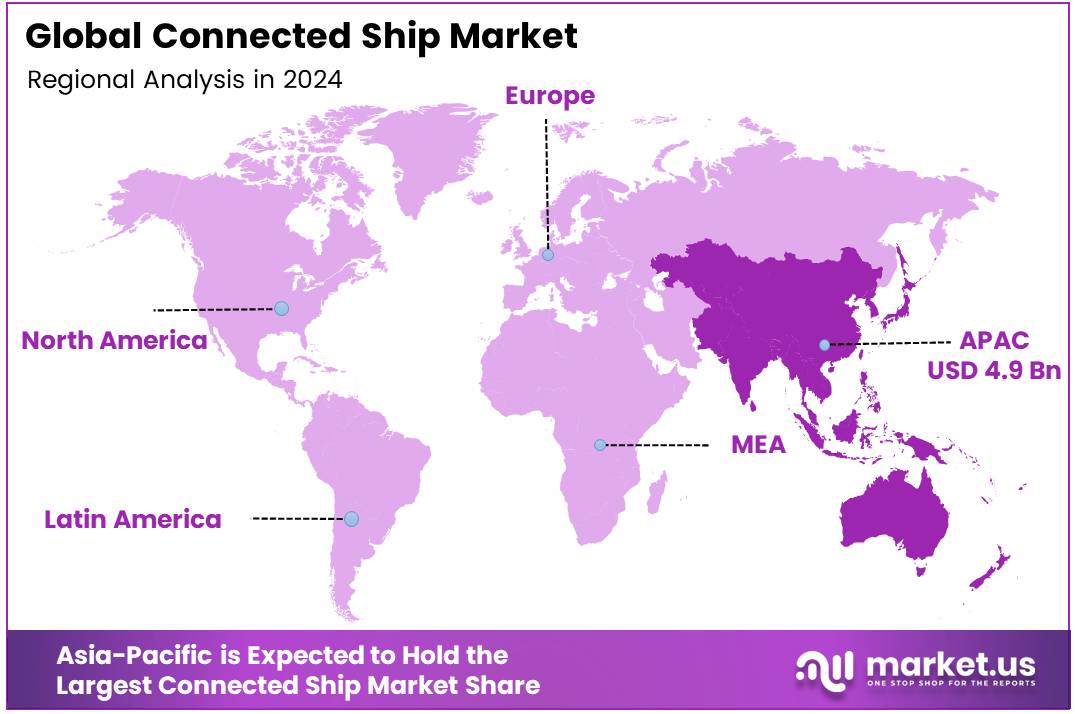

- Regional Dominance: Asia-Pacific leads the Connected Ship Market with a dominant market share of 35.4% valued 4.9 Billion.

- By Application: The Vessel Traffic Management application commands a significant market share of 52.4%, indicating its pivotal role in maritime operations.

- By Installation: With a 54.3% market share, onboard installations are preferred for their integral functionality in navigation systems.

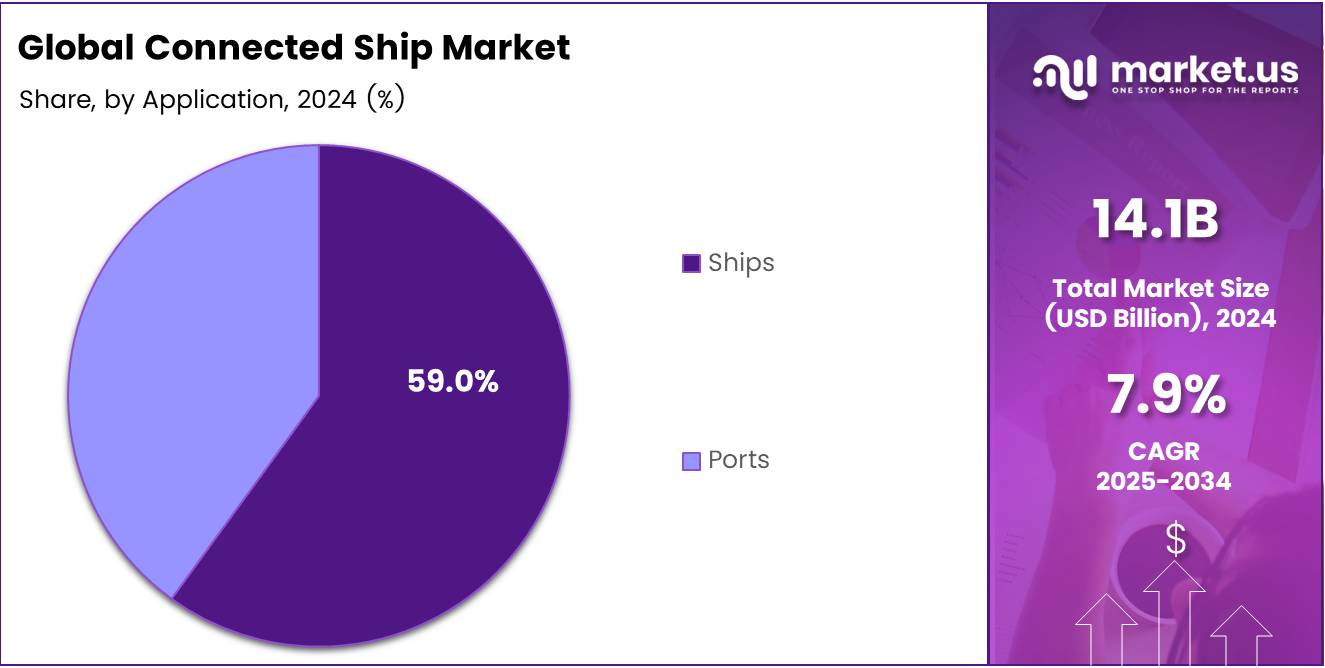

- By Platform: Ships, as a platform, hold a dominant position in the market with a 59% share, reflecting their critical importance in global maritime logistics.

- By Fit: The preference for line fit solutions is evident with a 53.2% market share, underscoring their essential role in initial vessel outfitting.

Driving Factors

Evolution of the Maritime Industry Segment

The evolution of the maritime industry segment has been a cornerstone in propelling the growth of the Connected Ship Market. This progression is characterized by the integration of advanced technologies, such as IoT (Internet of Things), AI (Artificial Intelligence), and big data analytics, into maritime operations.

The application of these technologies enhances ship-to-ship and ship-to-shore communication, optimizing navigation, cargo handling, and operational efficiency. The market’s expansion can be attributed to the increasing demand for real-time data monitoring, predictive maintenance, and automated systems that reduce human error and increase safety and efficiency in maritime operations.

Moreover, the global maritime trade volume, which the United Nations Conference on Trade and Development (UNCTAD) reported to be on an upward trajectory, indirectly fuels the need for connected ship solutions. This need is further accentuated by the maritime industry’s shift towards digital ports and smart autonomous ships, aiming to improve the logistics chain’s transparency and efficiency.

Thus, the evolution of the maritime industry segment not only reflects the adoption of cutting-edge technologies but also underlines the sector’s drive towards enhanced operational efficiency, safety, and environmental sustainability, all of which significantly contribute to the growth of the Connected Ship Market.

Impact of Digitization and Innovation

The impact of digitization and innovation on the Connected Ship Market is profound and multifaceted. Digitization, encompassing the adoption of digital technologies to transform business models and processes, has revolutionized the maritime industry by enabling enhanced data collection, processing, and analysis capabilities. Innovations such as digital twins, blockchain for supply chain transparency, and cybersecurity measures have become integral to ensuring operational efficiency, security, and regulatory compliance in maritime operations.

Statistics reveal a growing inclination towards digital solutions in the maritime sector, with the market for digital maritime freight services expected to see significant growth. For instance, the adoption of cloud-based solutions and IoT devices onboard ships facilitates real-time tracking, monitoring, and management of maritime operations, leading to optimized fuel consumption, predictive maintenance, and improved decision-making processes.

Commitment to Cut Greenhouse Gas Emissions

The maritime industry’s commitment to cutting greenhouse gas emissions is a pivotal factor influencing the growth of the Connected Ship Market. In response to global environmental concerns and regulatory mandates, such as the International Maritime Organization’s (IMO) strategy to halve ship-generated greenhouse gas emissions by 2050, the industry is increasingly adopting connected ship technologies. These technologies play a critical role in monitoring fuel consumption, optimizing routes, and enhancing operational efficiencies, all of which contribute to reduced emissions.

Connected ship solutions enable the precise tracking and analysis of emissions data, facilitating compliance with environmental regulations and supporting the adoption of greener fuels and propulsion systems. For instance, IoT sensors and AI algorithms can predict the optimal speed and course of a vessel, significantly lowering fuel consumption and, consequently, emissions. Additionally, data analytics can identify patterns and areas for improvement in vessel operation, leading to more environmentally friendly practices.

Restraining Factors

Ethical Concerns Surrounding Data Privacy: A Critical Challenge for Market Expansion

The connected ship market, characterized by its reliance on data-driven technologies for enhanced maritime operations, faces significant restraint from ethical concerns surrounding data privacy. The apprehensions about the confidentiality and security of data collected aboard ships are not unfounded. As ships become more connected, they generate and exchange vast amounts of data, raising concerns over who has access to this information and how it is used.

The potential misuse of sensitive data related to ship movements, cargo details, and personal information of crew members poses a substantial risk. This scenario has prompted regulatory bodies and stakeholders within the industry to call for stringent data protection measures. The imposition of regulations such as the General Data Protection Regulation (GDPR) in the European Union exemplifies the legal response to such concerns, aiming to safeguard personal data and privacy.

High Deployment Cost of Marine Broadband Connectivity: A Barrier to Adoption

The deployment cost of marine broadband connectivity stands as a formidable barrier to the widespread adoption of connected ship technologies. The provision of high-speed, reliable internet connectivity across the vast expanse of the world’s oceans necessitates substantial investment in satellite communication infrastructure.

This includes the cost of onboard equipment, installation, and ongoing service charges, which can be prohibitively expensive for many shipping companies, particularly smaller operators. According to industry estimates, the initial setup for a comprehensive marine broadband system can run into hundreds of thousands of dollars, with operational costs adding further financial burdens.

By Application Analysis

Vessel Traffic Management holds a significant 52.4% share in its application market.

In 2023, the Connected Ship Market was significantly influenced by various application segments, among which Vessel Traffic Management emerged as the predominant sector. With a commanding market share exceeding 52.4%, this segment underscored its vital role in the broader context of maritime operations and safety. The application segments of the Connected Ship Market can be primarily categorized into Vessel Traffic Management, Fleet Health Monitoring, Fleet Operation, and Other Applications.

Vessel Traffic Management’s preeminence is attributed to its critical function in enhancing maritime traffic efficiency, safety, and the environmental sustainability of shipping operations. This segment’s substantial share reflects the growing emphasis on navigational safety and the strategic management of maritime traffic flows, driven by increasing global trade volumes and the heightened complexity of maritime operations.

Fleet Health Monitoring, another significant segment, focuses on the real-time monitoring of ship conditions, predictive maintenance, and the overall health of the fleet. This segment’s development is propelled by the need to optimize operational efficiency, reduce downtime, and ensure the longevity of maritime assets.

Fleet Operation, meanwhile, addresses the optimization of fleet performance, including fuel consumption, voyage planning, and cargo management. The adoption of digital solutions in this segment aims to achieve operational excellence and cost-effectiveness in the competitive shipping industry.

Other Applications encompass a range of emerging technologies and innovative practices, including cybersecurity, crew welfare, and regulatory compliance, highlighting the diverse and evolving nature of the Connected Ship Market.

By Installation Analysis

The Onboard installation category commands a majority with a 54.3% market share.

In 2023, Onboard held a dominant market position in the By Installation segment of the Connected Ship Market, capturing more than a 54.3% share. This significant market share underscores the increasing integration of advanced onboard technologies aimed at enhancing operational efficiencies, safety, and communication systems within maritime vessels. The Onshore segment, by contrast, accounted for a smaller portion of the market, yet it played a crucial role in supporting the overall infrastructure of the Connected Ship ecosystem through shore-based monitoring, maintenance, and operational management services.

The ascendancy of the Onboard segment can be attributed to several key factors. Firstly, the maritime industry’s ongoing digital transformation has spurred the adoption of IoT (Internet of Things) devices, advanced navigation systems, and real-time data analytics onboard ships. These technologies facilitate improved voyage planning, fuel management, and preventative maintenance, thereby optimizing operational costs and enhancing safety protocols.

Moreover, regulatory bodies and maritime organizations have increasingly mandated the implementation of connected technologies to comply with environmental and safety regulations. This regulatory push further accelerates the adoption of onboard-connected solutions.

On the other hand, the Onshore segment’s growth is driven by the need for remote monitoring, fleet management, and operational support from shore-based centers. The integration between Onshore and Onboard technologies is essential for realizing the full potential of the Connected Ship Market, ensuring seamless communication and data exchange between ship and shore.

By Platform Analysis

Ships emerge as the dominant platform, securing a 59% share of the market.

In 2023, Ships held a dominant market position in the “By Platform” segment of the Connected Ship Market, capturing more than a 59% share, with Ports also playing a significant role in this segment. The prominence of Ships within the market can be attributed to the increasing demand for enhanced maritime connectivity solutions, aimed at optimizing operational efficiency, ensuring safety, and enabling effective communication systems aboard vessels.

This segment’s growth is further propelled by the integration of advanced technologies such as IoT (Internet of Things), satellite communications, and blockchain, which have significantly enhanced data exchange capabilities between ship and shore, thereby driving the demand for connected ship solutions.

On the other hand, Ports have also emerged as key contributors to the Connected Ship Market. The adoption of smart technologies and digitalization efforts in port operations have been instrumental in streamlining cargo handling, reducing turnaround times, and improving overall port efficiency. Investments in smart port initiatives across the globe reflect a strategic focus on enhancing port connectivity, which complements the broader objectives of the Connected Ship Market.

The synergy between Ships and Ports within the Connected Ship ecosystem is pivotal. It not only fosters a more integrated and efficient maritime logistics chain but also enhances maritime safety and environmental sustainability through better monitoring and management practices. As this segment continues to evolve, the interplay between technological advancements and regulatory frameworks will be critical in shaping the market’s trajectory, offering substantial opportunities for stakeholders within the maritime industry.

By Fit Analysis

Line Fit configurations lead, capturing a 53.2% share within the fit market.

In 2023, Line Fit held a dominant market position in the By Fit segment of the Connected Ship Market, capturing more than a 53.2% share. This was followed by Retrofit and Hybrid Fit, which accounted for the remaining market share.

Line Fit’s substantial share can be attributed to its widespread adoption in new vessels, where the integration of connected technologies is implemented during the construction phase. This approach not only ensures that ships are equipped with the latest connectivity solutions from the outset but also enhances operational efficiency and data analytics capabilities.

The Retrofit segment, though smaller in comparison to Line Fit, demonstrated significant growth potential. This growth is driven by the increasing need for older vessels to upgrade their systems to remain competitive and compliant with evolving regulations and standards. Retrofitting allows ship owners to integrate advanced connectivity solutions without the need for extensive new construction, providing a cost-effective method to enhance operational efficiency and safety.

Hybrid Fit, the smallest segment by market share, represents a blend of Line Fit and Retrofit approaches. This segment caters to vessels that are partially equipped with connectivity solutions during construction, with additional technologies installed post-build. The Hybrid Fit approach offers flexibility, allowing ship owners to gradually adopt new technologies and optimize investment in connected ship capabilities.

The Connected Ship Market is characterized by rapid technological advancements, regulatory changes, and evolving maritime operations. The dominance of the Line Fit segment underscores the maritime industry’s focus on building future-ready vessels, while the growth in Retrofit and Hybrid Fit segments highlights the ongoing need for technological upgrades across existing fleets.

Key Market Segments

By Application

- Vessel Traffic Management

- Fleet Health Monitoring

- Fleet Operation

- Other Applications

By Installation

- Onboard

- Onshore

By Platform

- Ships

- Ports

By Fit

- Line fit

- Retrofit

- Hybrid fit

Growth Opportunities

Increase in Seaborne Trade

The expansion of seaborne trade has been identified as a primary catalyst for growth in the global connected ship market. In 2023, the escalation of international trade activities, driven by globalization and the intensification of trade relations among countries, has necessitated advancements in maritime logistics and fleet management. This trend can be attributed to the increasing demand for efficient and real-time monitoring systems that enhance operational efficiency, safety, and environmental sustainability in maritime transportation.

The burgeoning volume of seaborne trade underscores the need for integrated solutions that can provide comprehensive insights into vessel operations, thereby driving the adoption of connected ship technologies. These developments are expected to contribute significantly to the market’s expansion, as stakeholders seek to leverage data-driven strategies for competitive advantage and compliance with regulatory standards.

Technological Developments in Vessel Monitoring Systems

Technological advancements in vessel monitoring systems represent a pivotal growth opportunity for the globally connected ship market. In the year 2023, the evolution of IoT (Internet of Things), big data analytics, and AI (Artificial Intelligence) technologies has transformed the maritime industry by enabling enhanced connectivity and automated data collection and analysis. These technological developments facilitate real-time tracking, predictive maintenance, and optimized route planning, which significantly improve operational efficiencies and reduce costs.

Moreover, the incorporation of cybersecurity measures within these systems addresses the growing concerns over data privacy and security, fostering a safer and more reliable maritime ecosystem. As a result, the continuous innovation in vessel monitoring technologies is propelling the market forward, equipping maritime operators with tools to navigate the complexities of modern seafaring with greater agility and foresight.

Latest Trends

Digitization and Innovation Impact on the Global Connected Ship Market

The digitization and innovation within the global connected ship market have markedly accelerated, driven by advances in technologies such as IoT, AI, and big data analytics. This transformative phase is characterized by the integration of digital solutions that enhance operational efficiency, safety, and navigational capabilities. The proliferation of IoT devices on vessels enables real-time monitoring, predictive maintenance, and improved fleet management, leading to significant cost savings and operational optimizations.

Artificial Intelligence (AI) further complements these advancements by enabling autonomous navigation systems, which can significantly reduce human error and increase overall maritime safety. Moreover, big data analytics offer profound insights into voyage optimization, fuel consumption, and cargo management, facilitating informed decision-making processes. The impact of these innovations extends beyond operational improvements, fostering a more connected and data-driven maritime ecosystem.

Commitment to Cut Greenhouse Gas Emissions

The global connected ship market is increasingly aligning with the maritime industry’s commitment to reduce greenhouse gas (GHG) emissions. This commitment is reflected in the adoption of energy-efficient technologies and practices, underscored by international regulations and sustainability goals.

Connected ships play a pivotal role in this context, as they enable enhanced monitoring and management of fuel consumption, optimizing routes for energy efficiency, and facilitating the transition to alternative fuels.

Digital platforms and IoT solutions are instrumental in collecting and analyzing data related to emissions, supporting compliance with environmental standards, and guiding operational adjustments to minimize environmental impact.

The emphasis on sustainability is not only reshaping the technological landscape of the maritime sector but also contributing to a broader societal push toward ecological responsibility. The integration of connectivity and environmental stewardship is expected to drive innovation further, leading to the development of greener and more sustainable shipping practices.

Regional Analysis

Asia-Pacific dominates the connected ship market with a substantial 35.4% share, leading in technological adoption.

The connected ship market is experiencing a significant evolution across different global regions, characterized by regional disparities in adoption rates, technological advancements, and market penetration.

Asia-Pacific, commanding a dominating 35.4% share of the global market, leads in the adoption of connected ship technologies. This region’s growth is propelled by significant investments in maritime infrastructure, the digitalization of shipping operations, and the expanding merchant fleets of emerging economies. The emphasis on enhancing maritime connectivity and operational efficiency, particularly in countries like China, Japan, and South Korea, underscores the region’s pivotal role in the global market.

In North America, the market is driven by a strong focus on innovation and the adoption of advanced technologies for maritime safety and efficiency. The region’s advanced infrastructure and stringent maritime regulations foster a conducive environment for the growth of connected ship solutions.

Europe stands out for its robust maritime industry and emphasis on sustainable shipping practices, driving the demand for connected technologies that enable fuel efficiency and emissions reduction. The presence of leading maritime technology companies further contributes to the market’s dynamism.

Middle East & Africa region is witnessing gradual growth, attributed to increasing maritime trade activities and the modernization of port infrastructure. The focus on digital transformation and smart port initiatives are key factors driving the adoption of connected ship solutions in this region.

Latin America, though a smaller market, is seeing growth in connected ship technologies due to rising investments in maritime safety and operational efficiency, driven by its expanding shipping industry and efforts to integrate digital solutions into maritime operations.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the context of the global Connected Ship Market, the significance of key players such as Northrop Grumman Corporation, General Electric Co., Wartsila Corporation, Kongsberg Gruppen ASA, Marlink AS, Synectics Global, Atos SE, and Inmarsat plc, cannot be overstated. These entities have been pivotal in shaping the dynamics of the market, driven by their continuous innovations and strategic partnerships.

Northrop Grumman Corporation, with its robust portfolio in defense and maritime systems, has been a critical contributor to the advancement of connected ship technologies. Their focus on cybersecurity and integrated bridge systems has set a high standard for operational efficiency and safety in maritime operations.

General Electric Co., through its marine solutions, has played a vital role in the digital transformation of the maritime industry, offering advanced propulsion systems and digital services that enhance vessel connectivity and performance.

Wartsila Corporation has been at the forefront of introducing smart technologies for energy management and operational optimization in the maritime sector. Their proactive approach in adopting IoT and AI technologies signifies a strong potential for growth and innovation.

Kongsberg Gruppen ASA has distinguished itself with its integrated digital solutions for navigation, automation, and operational management, contributing significantly to the connected ship ecosystem.

Marlink AS and Inmarsat plc have been instrumental in providing satellite communications, ensuring seamless connectivity for vessels worldwide. These companies’ services are crucial for real-time data exchange, enhancing navigational safety and operational efficiency.

Synectics Global and Atos SE have emerged as key players in integrating digital solutions and cybersecurity, respectively, highlighting the importance of data protection and system integrity in the connected ship market.

Market Key Players

- Northrop Grumman Corporation

- General Electric Co.

- Wartsila Corporation

- Kongsberg Gruppen ASA

- Marlink AS

- Synectics Global

- Atos SE

- Inmarsat plc Source

Recent Development

- In February 2024, Flexport launched the Convoy Platform, connecting global shippers with small carriers for efficient logistics. Onyx Private transitions to a B2B model, offering platform-as-a-service for financial institutions. Griffin was approved as a bank in the UK.

- In January 2024, Singtel enhances maritime digital offerings by integrating Starlink’s satellites, enabling advanced technologies like AI and 5G for safety and efficiency. Paragon manages seamless connectivity for ships, ensuring uninterrupted operations.

- In January 2024, The USS Iowa cancels plans to relocate within the Port of Los Angeles due to increased costs. The focus shifts to waterfront development and connectivity.

Report Scope

Report Features Description Market Value (2023) USD 13.15 Billion Forecast Revenue (2033) USD 28.14 Billion CAGR (2024-2033) 7.90% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application(Vessel Traffic Management, Fleet Health Monitoring, Fleet Operation, Other Applications), By Installation(Onboard, Onshore), By Platform(Ships, Ports), By Fit(Line fit, Retrofit, Hybrid fit) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Northrop Grumman Corporation, General Electric Co., Wartsila Corporation, Kongsberg Gruppen ASA, Marlink AS, Synectics Global, Atos SE, Inmarsat plc Source Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Connected Ship Market in 2023?The Connected Ship Market size is USD 13.15 Billion in 2023.

What is the projected CAGR at which the Connected Ship Market is expected to grow at?The Connected Ship Market is expected to grow at a CAGR of 7.90% (2024-2033).

List the segments encompassed in this report on the Connected Ship Market?Market.US has segmented the Connected Ship Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Application(Vessel Traffic Management, Fleet Health Monitoring, Fleet Operation, Other Applications), By Installation(Onboard, Onshore), By Platform(Ships, Ports), By Fit(Line fit, Retrofit, Hybrid fit)

List the key industry players of the Connected Ship Market?Northrop Grumman Corporation, General Electric Co., Wartsila Corporation, Kongsberg Gruppen ASA, Marlink AS, Synectics Global, Atos SE, Inmarsat plc Source

Name the key areas of business for Connected Ship Market?The China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC are leading key areas of operation for Connected Ship Market.

-

-

- Northrop Grumman Corporation

- General Electric Co.

- Wartsila Corporation

- Kongsberg Gruppen ASA

- Marlink AS

- Synectics Global

- Atos SE

- Inmarsat plc Source