Global Confectionery Packaging Market Packaging Type (Flexible Packaging, Rigid Packaging), By Material Type (Plastic, Paper and Paperboard, Glass, Metal), Confectionery Type (Chocolate Confectionery, Sugar Confectionery, Gums, Fruit and Nuts, Other Confectionery Types), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 40478

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

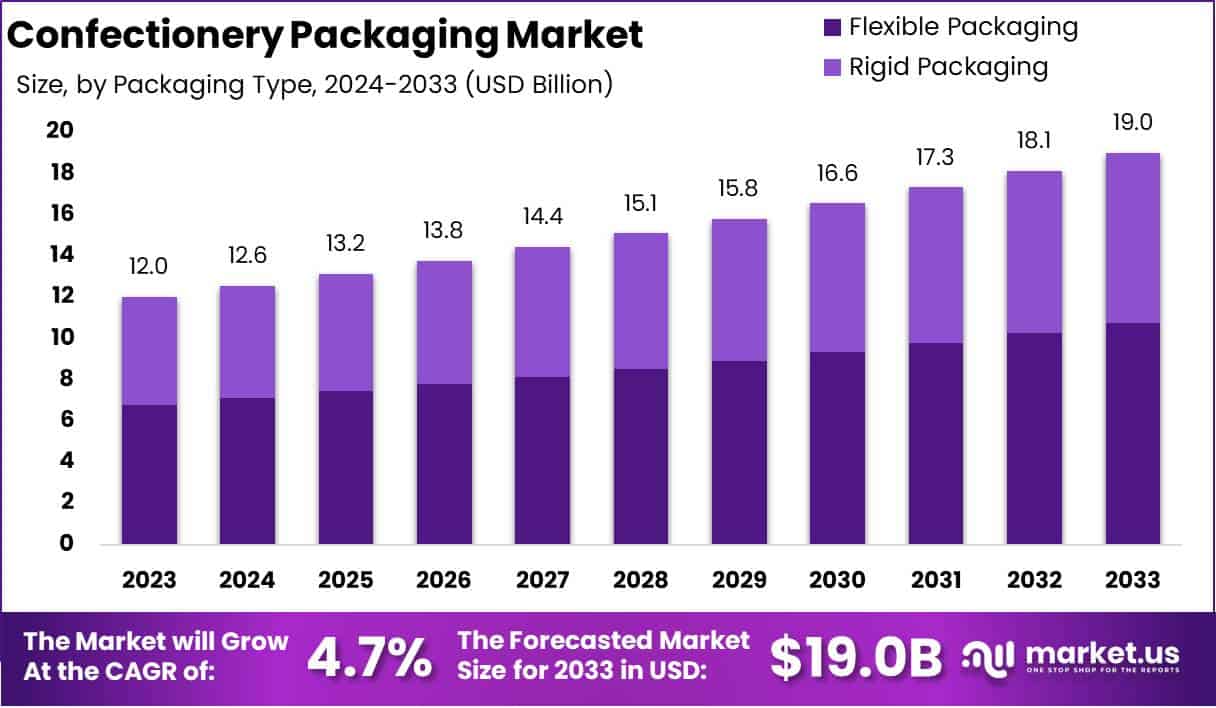

The Global Confectionery Packaging Market size is expected to be worth around USD 19.0 Billion by 2033, from USD 12.0 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

Confectionery packaging refers to the various materials and methods used to encase, protect, and present sweet food products such as chocolates, candies, gums, and other confectioneries. It serves multiple purposes, including preserving the freshness of the product, preventing contamination, enhancing visual appeal, and facilitating convenient handling and transportation.

The packaging often involves different types, such as flexible packaging (pouches, wrappers), rigid packaging (boxes, tins), and specialized options (e.g., foils, laminates) designed to maintain product integrity while also promoting brand differentiation.

The Confectionery Packaging Market encompasses the global production, distribution, and consumption of packaging materials specifically designed for confectionery products. This market involves manufacturers, suppliers, and distributors of packaging solutions tailored to the unique requirements of confectioneries, including moisture resistance, aroma retention, and visual attractiveness.

It is a segment of the broader food packaging industry and has been experiencing steady growth driven by evolving consumer preferences, product innovations, and increasing demand for sustainable packaging solutions. The market also caters to a diverse range of packaging types and formats, accommodating the needs of artisanal, mass-market, and premium confectionery brands.

Several factors contribute to the growth of the Confectionery Packaging Market. The rising consumption of confectionery products, particularly in emerging economies, drives demand for innovative and attractive packaging. The increasing emphasis on sustainability is prompting manufacturers to develop eco-friendly packaging solutions, further stimulating market growth.

Additionally, packaging innovations such as portion-controlled packs, resealable pouches, and temperature-resistant materials are boosting consumer interest and, in turn, driving the market forward. Digital printing technologies, which enhance customization and branding capabilities, also play a crucial role in the expansion of this market.

The demand for confectionery packaging is largely fueled by changing consumer preferences, which increasingly favor convenience, aesthetic appeal, and sustainable packaging options. The growing popularity of on-the-go snacking has led to higher demand for single-serving and portion-controlled packs, which are practical and portable.

Additionally, seasonal confectionery sales, promotional events, and product launches by confectionery brands have a significant impact on packaging demand, particularly for visually striking, limited-edition designs.

Furthermore, e-commerce channels, where packaging plays a critical role in ensuring product protection during transit, are contributing to increased demand for durable yet visually appealing packaging.

Opportunities within the Confectionery Packaging Market are abundant, particularly in the realm of sustainability and innovation. The increasing consumer shift toward environmentally friendly packaging creates growth avenues for companies that invest in recyclable, biodegradable, and compostable packaging solutions.

The advent of smart packaging technologies, such as QR codes on wrappers for augmented reality experiences or digital engagement, also presents new possibilities for enhancing consumer interaction and brand loyalty.

Additionally, the rapid growth of premium and organic confectionery segments offers opportunities for packaging providers to develop high-end, bespoke solutions that align with the branding of luxury confectionery products.

According to Mars India, the confectionery packaging market is witnessing robust growth, driven by evolving consumer preferences, sustainability trends, and innovations in packaging design. With the sector poised for expansion, recent M&A activities signal strong investment interest.

For instance, Mars, Incorporated’s acquisition of Kellanova for $35.9 billion highlights the strategic importance of expanding its presence in snacking and plant-based foods.

The transaction, at $83.50 per share, represents a 44% premium over Kellanova’s average trading price over the last 30 days and a 33% premium over its 52-week high, indicating confidence in long-term value. Such developments underscore a dynamic, growth-oriented packaging landscape.

According to Flexpack, the confectionery packaging market is witnessing a shift in consumer preferences, driven primarily by younger demographics aged 18-34, who place higher importance on attributes such as functionality, convenience, and sustainability. Over 60% of consumers prioritize packaging features like easy to store ability to reseal and easy to open, viewing them as very important or essential.

Notably, approximately 60% of respondents are willing to pay up to a 14% premium for these tangible benefits. A Harris Poll survey revealed that 81% of consumers notice new packaging designs, while 39% often purchase products due to such changes, indicating packaging’s role in driving sales.

According to the NCA, U.S. confectionery sales reached $48 billion in 2023, driven by inflation, with projections aiming for $61 billion by 2028. Over 98% of Americans purchased chocolate, candy, gum, or mints in 2023, indicating strong demand. Seasonal occasions contribute 64% of total sales.

Confectionery maintains high permissibility, as 86% of consumers support treating as part of a balanced lifestyle, and 80% believe in the link between physical health and emotional well-being. Moreover, 90% of consumers choose chocolate when seeking a personal treat, highlighting its strong market positioning.

Key Takeaways

- The Global Confectionery Packaging Market is projected to grow from USD 12.0 billion in 2023 to USD 19.0 billion by 2033, at a CAGR of 4.7% from 2024 to 2033.

- Flexible Packaging dominates with a 56.5% market share, driven by its cost-efficiency, lightweight properties, and sustainability focus.

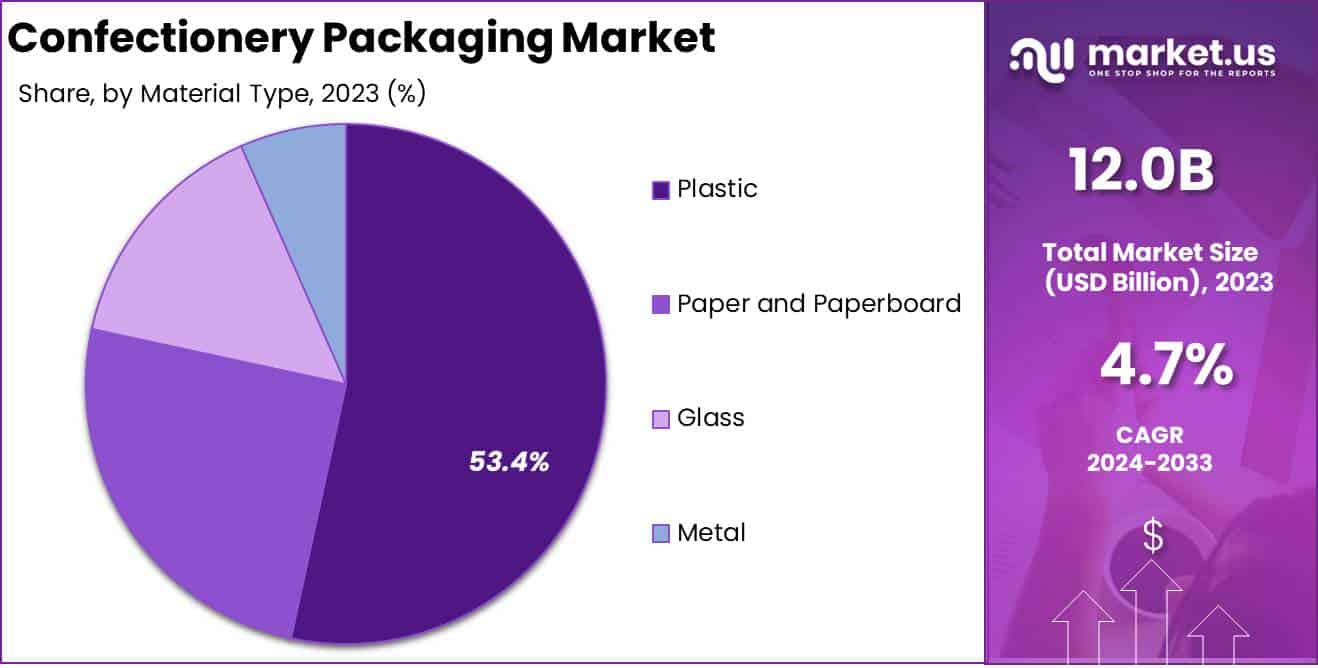

- Plastic leads with a 53.4% share, due to its versatility, low cost, and effective preservation capabilities.

- Chocolate Confectionery holds the largest share at 42.1%, fueled by its widespread appeal and demand for premium packaging solutions.

- North America captures the largest regional market share at 37.2%, supported by high confectionery consumption and strong demand for sustainable packaging solutions.

By Packaging Analysis

Flexible Packaging Dominates Confectionery Packaging Market with 56.5% Share

In 2023, Flexible Packaging held a dominant market position in the packaging type segment of the Confectionery Packaging Market, capturing more than a 56.5% share.

This segment’s growth is primarily driven by its lightweight nature, cost-efficiency, and ability to preserve product freshness and quality. The demand for flexible packaging is further bolstered by the increasing focus on sustainable and recyclable materials, making it a preferred choice among manufacturers and consumers alike.

Rigid Packaging accounted for a smaller share of the market compared to flexible packaging. However, it remains an important segment, particularly for premium confectionery products where durability, tamper resistance, and attractive design elements are valued.

Although its market share is comparatively lower, innovations in material usage and improved recyclability are expected to support steady growth in this segment over the forecast period.

By Material Analysis

Plastic Dominates Confectionery Packaging Market with 53.4% Share

In 2023, Plastic held a dominant market position in the material type segment of the Confectionery Packaging Market, capturing more than a 53.4% share. This segment’s prominence is attributed to plastic’s versatility, lightweight characteristics, and cost-effectiveness, making it ideal for various confectionery products. Its ability to offer extended shelf life, easy customization, and enhanced product visibility further drives its adoption in the sector.

Paper and Paperboard represented a growing segment within the confectionery packaging market. While its market share is lower than that of plastic, increasing consumer demand for sustainable and biodegradable packaging solutions is driving its growth.

The segment is particularly favored for eco-friendly brands and premium products aiming to appeal to environmentally conscious consumers.

Glass accounted for a smaller share of the confectionery packaging market in 2023 but remains a preferred choice for high-end confectionery products. Its appeal lies in its premium feel, recyclability, and ability to preserve product freshness without chemical leaching. Glass packaging is most commonly used for gourmet chocolates and confectionery gift sets.

Metal held a modest share of the market, primarily utilized for specific confectionery products like mints, candies, and collectible tins. The segment benefits from its durability, protection against moisture, and reusability, making it suitable for specialty and seasonal confectionery packaging.

By Confectionery Type Analysis

Chocolate Confectionery Dominates Confectionery Packaging Market with 42.1% Share

In 2023, Chocolate Confectionery held a dominant market position in the confectionery type segment of the Confectionery Packaging Market, capturing more than a 42.1% share. The popularity of chocolate across diverse consumer segments, combined with rising demand for premium and specialty chocolates, has fueled the need for effective packaging solutions in this segment.

Packaging innovations that enhance shelf appeal and protect product quality have also driven the growth of this segment.

Sugar Confectionery accounted for a significant share of the confectionery packaging market. This segment includes candies, toffees, and other sugar-based treats, which require durable, moisture-resistant, and cost-effective packaging. The demand for appealing packaging designs, particularly for children’s products, contributes to the steady growth of this segment.

Gums represented a consistent segment within the confectionery packaging market. The need for packaging that maintains product freshness, particularly for chewing gums, drives its demand. Additionally, portable and convenient packaging formats, such as pouches and blister packs, support this segment’s growth.

Fruit and Nuts, as a confectionery category, held a smaller market share but experienced growth driven by consumer preferences for healthier snack options. Packaging solutions for this segment focus on maintaining product integrity and offering resealability, which aligns with consumer demand for convenience and freshness.

Other Confectionery Types captured a modest share of the market. This segment encompasses a range of products, each with unique packaging requirements based on product characteristics, shelf life, and branding needs. While diverse, this segment’s overall market impact remains limited compared to mainstream confectionery types like chocolate and sugar-based products.

Key Market Segments

Packaging Type

- Flexible Packaging

- Rigid Packaging

Material Type

- Plastic

- Paper and Paperboard

- Glass

- Metal

Confectionery Type

- Chocolate Confectionery

- Sugar Confectionery

- Gums

- Fruit and Nuts

- Other Confectionery Types

Driver

Growing Consumer Demand for Sustainable Packaging Solutions

The increasing consumer preference for sustainable packaging is a significant driver for the confectionery packaging market in 2024. Consumers are becoming more aware of the environmental impact of packaging waste and are actively seeking products that align with their values.

This shift has pushed confectionery manufacturers to adopt eco-friendly materials such as recyclable, biodegradable, and compostable options in their packaging strategies.

The shift is particularly evident among younger consumers, with research indicating that over 70% of millennials and Gen Z actively seek sustainable packaging when purchasing snacks, including confectionery items.

As a result, packaging producers are intensifying their focus on creating innovative materials that maintain product safety and freshness while minimizing environmental impact.

This trend is driving investment in research and development to design new materials that not only meet regulatory requirements but also appeal to consumer preferences. For instance, advancements in plant-based polymers and recycled content materials are creating packaging solutions that maintain barrier properties for freshness while offering an eco-friendly appeal.

This consumer-driven shift toward sustainability is not only encouraging innovation but also expanding market penetration, particularly in regions with stringent environmental regulations like Europe and North America.

As consumer demand for sustainable packaging continues to rise, it is expected to contribute to steady growth in the confectionery packaging market, projected to expand at a CAGR of approximately 5-6% over the next few years.

Restraint

High Costs of Raw Materials and Manufacturing Processes

Despite positive growth prospects, the confectionery packaging market faces challenges, primarily the high cost of raw materials and manufacturing processes. Materials such as bioplastics, compostable films, and high-quality paper are generally more expensive than traditional packaging materials like polyethylene or polypropylene.

In addition, advanced manufacturing technologies needed to produce these materials require substantial investment, which can increase the cost of production. As a result, the overall cost burden can be prohibitive for many small to mid-sized manufacturers, limiting the adoption of sustainable packaging solutions in the short term.

The cost constraint is exacerbated by fluctuations in raw material prices, driven by factors such as global supply chain disruptions and geopolitical tensions. These fluctuations impact not only material availability but also production costs, which can discourage manufacturers from transitioning to sustainable packaging at a faster pace.

Smaller confectionery producers, particularly in emerging markets, find it challenging to absorb these costs while maintaining competitive pricing for their products. Consequently, this restraint may slow the growth of the confectionery packaging market, particularly in price-sensitive markets, where cost-effective packaging options often take precedence over sustainability. While government incentives and increasing economies of scale could help offset some of these costs in the long term, they remain a short-term barrier to growth in 2024.

Opportunity

Rise in E-commerce Channels Driving Demand for Durable Packaging

The rapid growth of e-commerce presents a substantial opportunity for the confectionery packaging market in 2024. As online shopping becomes increasingly popular for confectionery purchases, the need for durable, protective, and attractive packaging has intensified. E-commerce requires packaging that can withstand the rigors of handling, transportation, and storage, ensuring that confectionery products reach consumers in optimal condition.

This dynamic is encouraging packaging manufacturers to innovate in terms of material strength, moisture resistance, and tamper-evidence features. The global e-commerce market is projected to grow at a double-digit rate in 2024, creating a parallel surge in demand for packaging that meets online retail requirements.

Moreover, e-commerce also emphasizes the importance of aesthetically appealing packaging, as it often serves as the first tangible interaction between consumers and brands.

The increasing demand for visually appealing designs that can be shared on social media further boosts the need for unique packaging solutions. Packaging providers that offer customized, digitally printed designs that enhance brand visibility online stand to gain a competitive edge.

This shift is especially prominent in developed markets where consumer reliance on online confectionery shopping is higher. As e-commerce sales continue to rise globally, driven by convenience and digital marketing campaigns, the demand for efficient and eye-catching confectionery packaging is expected to expand, offering significant growth opportunities for market participants.

Trends

Growing Adoption of Smart Packaging Technologies

The adoption of smart packaging technologies is emerging as a key trend shaping the confectionery packaging market in 2024. Smart packaging integrates digital elements such as QR codes, Near Field Communication (NFC), and Augmented Reality (AR), providing consumers with interactive experiences.

These technologies are being utilized by confectionery brands to enhance engagement, enable traceability, and provide additional product information such as ingredients, nutritional content, or origin details. As consumers seek more information and interaction with their favorite brands, the integration of smart elements into packaging is becoming a differentiating factor in the market.

Smart packaging also serves functional purposes, such as monitoring the freshness and integrity of confectionery products. Sensors embedded in packaging can alert consumers if products have been exposed to unfavorable conditions like excess humidity or temperature changes.

This trend is particularly relevant for premium confectionery items, where product quality is a critical selling point. With digital engagement playing a larger role in consumer purchasing decisions, brands are increasingly adopting smart packaging solutions as a tool for marketing and consumer loyalty.

As a result, the confectionery packaging market is likely to see increased investments in digital technology integration in 2024, with this trend contributing to both brand differentiation and enhanced consumer experiences.

The growing penetration of IoT (Internet of Things) technologies in the packaging sector further supports this trend, driving the market towards more connected and interactive solutions.

Regional Analysis

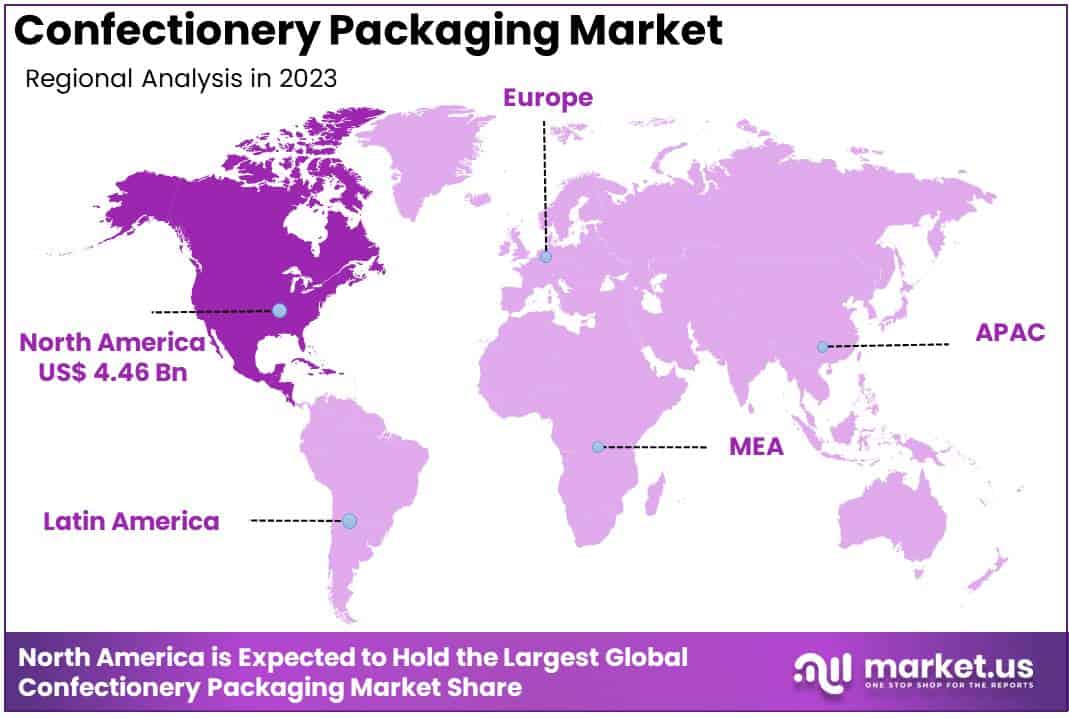

North America Leads Confectionery Packaging Market with Largest Share of 37.2%.

In 2023, North America emerged as the leading region in the Confectionery Packaging Market, capturing the largest market share of 37.2% and generating revenue of approximately USD 4.46 billion.

The strong market presence in this region is attributed to high confectionery consumption rates, driven by a well-established food and beverage sector and strong consumer demand for packaged sweets, chocolates, and snacks.

Advanced packaging technologies and growing consumer preference for convenient, sustainable, and visually appealing packaging further bolster market growth in the region.

Europe follows closely, supported by a mature confectionery industry and increasing consumer inclination toward premium and artisanal chocolate products, which require innovative packaging solutions.

The demand for sustainable and eco-friendly packaging materials, in line with stringent environmental regulations, is a significant driver in this market, particularly in countries like Germany, France, and the UK.

Asia Pacific is witnessing rapid growth in the confectionery packaging market, fueled by rising disposable incomes, urbanization, and growing consumer demand for diverse confectionery products, especially in countries like China, India, and Japan. The increasing adoption of flexible and cost-effective packaging formats also contributes to the region’s expanding market share.

Latin America holds a moderate share of the market, with a steady demand for confectionery packaging, primarily driven by rising chocolate and candy consumption. Brazil and Mexico are the major contributors to regional growth, benefiting from increasing urbanization and the expansion of retail networks.

The Middle East & Africa has a relatively smaller share in the global market, but it shows potential for growth due to increasing consumer demand for chocolates and sweets. The expanding retail sector, coupled with a rising youth population, supports the adoption of advanced confectionery packaging solutions in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, leading players in the Global Confectionery Packaging Market, including Amcor plc, Berry Global Inc., Mondi Group, Smurfit Kappa, and Sonoco Products Company, are set to drive significant advancements through strategic innovation and a focus on sustainability.

Amcor plc is expected to maintain its leadership by leveraging its extensive R&D capabilities to introduce high-performance, recyclable materials. Berry Global Inc. is likely to emphasize lightweight, flexible packaging solutions that cater to evolving consumer demands for both convenience and sustainability, capitalizing on its scale in manufacturing and distribution.

Meanwhile, Mondi Group and Smurfit Kappa will probably focus on expanding their range of sustainable paper-based packaging solutions, aligning with regulatory trends and consumer preferences for eco-friendly options. Both companies have invested heavily in recycled and compostable materials, positioning them well to cater to the growing segment of organic and premium confectionery brands.

Sonoco Products Company is also likely to emphasize its expertise in rigid paper containers and innovative designs, aiming to strengthen its position in both the retail and e-commerce sectors.

Other prominent players such as WestRock Company and Huhtamaki are projected to pursue advancements in design flexibility and barrier properties, catering to both mass-market and premium segments.

Constantia Flexibles and C-P Flexible Packaging are likely to focus on customization capabilities and the use of smart packaging technologies, offering tailored solutions that enhance consumer engagement.

PPC Flex Company Inc. and other emerging players will aim to tap into niche markets, emphasizing agility, speed-to-market, and cost-efficiency in their offerings. Collectively, these companies are poised to drive competitive differentiation, innovation, and growth in the confectionery packaging sector in 2024.

Top Key Players in the Market

- Amcor plc

- Berry Global Inc.

- Mondi Group

- Smurfit Kappa

- Sonoco Products Company

- WestRock Company

- Huhtamaki

- Constantia Flexibles

- C-P Flexible Packaging

- PPC Flex Company Inc.

- Other Key Players

Recent Developments

- On August 14, 2024 – Mars, Incorporated, a global giant in pet care and food products, announced a deal to acquire Kellanova (NYSE: K), a major name in snacking and plant-based foods. The acquisition will be an all-cash transaction valued at $35.9 billion, or $83.50 per share. This offer represents a substantial 44% premium over Kellanova’s average trading price over the past 30 days and a 33% premium above its 52-week high as of early August 2024. The deal is structured around a valuation of 16.4 times Kellanova’s adjusted earnings for the last twelve months, as of June 29, 2024.

- In 2024, International Paper, a leading packaging and paper products company, confirmed an all-stock acquisition of DS Smith, valued at approximately $7.2 billion. DS Smith’s board has expressed support for the agreement, encouraging shareholders to vote in favor of this deal, which marks a key development in the competitive landscape for the London-based company.

- In 2023, Barry Callebaut, a top-tier chocolate producer, published its 2024 trends report, indicating that consumers are actively seeking new flavor experiences despite rising prices. The global chocolate market is forecasted to exceed $128 billion by the end of 2024, with an estimated annual volume growth of 2% over the next five years.

- By mid-2024, global M&A activity revealed contrasting trends: deal values rose by 5% compared to the same period in 2023, yet transaction volumes fell by 25%, continuing the decline that began in 2022. The first half of 2024 saw roughly 23,000 deals, totaling $1.3 trillion in value—a noticeable decrease from the peak of nearly 34,000 deals, valued at $2.7 trillion, in the latter half of 2021.

Report Scope

Report Features Description Market Value (2023) USD 12.0 Billion Forecast Revenue (2033) USD 19.0 Billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Packaging Type (Flexible Packaging, Rigid Packaging), By Material Type (Plastic, Paper and Paperboard, Glass, Metal), Confectionery Type (Chocolate Confectionery, Sugar Confectionery, Gums, Fruit and Nuts, Other Confectionery Types) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor plc, Berry Global Inc., Mondi Group, Smurfit Kappa, Sonoco Products Company, WestRock Company, Huhtamaki, Constantia Flexibles, C-P Flexible Packaging, PPC Flex Company Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Confectionery Packaging MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Confectionery Packaging MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Berry Global Inc.

- Mondi Group

- Smurfit Kappa

- Sonoco Products Company

- WestRock Company

- Huhtamaki

- Constantia Flexibles

- C-P Flexible Packaging

- PPC Flex Company Inc.

- Other Key Players