Cone Beam Computed Tomography Market By Product (Instrument, Software and Services), By Application (Dental Imaging, Breast imaging, Orthopedic Imaging, ENT Imaging, Cardiovascular Imaging, Others), By End-User (Hospitals, Dental Clinics, Orthopedic Centers, Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 42779

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

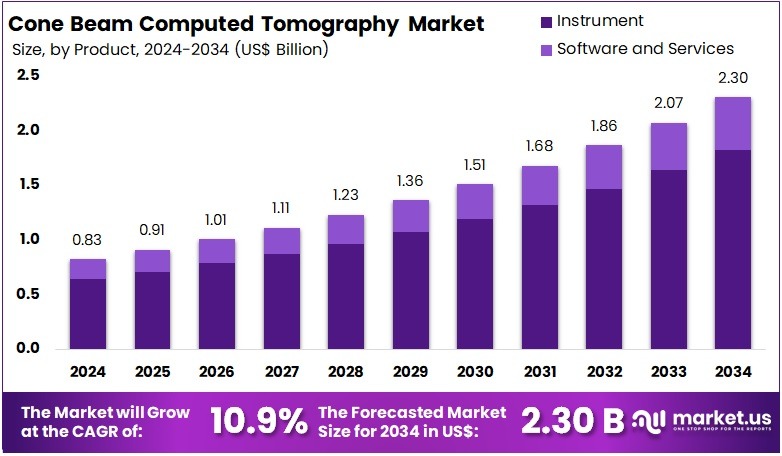

The Cone Beam Computed Tomography Market size is expected to be worth around US$ 2,302.15 million by 2034 from US$ 825.39 million in 2024, growing at a CAGR of 10.9% during the forecast period 2025 to 2034.

Cone Beam Computed Tomography Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 577.99 620.85 679.56 748.60 825.39 10.9% The CBCT has become a transformative imaging technology in modern diagnostic radiology, particularly in dental, orthopedic, and ENT applications. This advanced 3D imaging modality provides high-resolution images with lower radiation exposure compared to traditional CT scans, making it highly valuable for both clinicians and patients. CBCT systems are widely used in dental implant planning, maxillofacial surgery, and endodontic diagnosis due to their superior accuracy in visualizing hard tissues.

The rising demand for precise and non-invasive diagnostic tools has significantly boosted CBCT adoption across developed and emerging healthcare markets. According to the U.S. Food and Drug Administration (FDA), CBCT devices have seen a sharp increase in clinical usage due to their fast scan time, lower cost compared to conventional CTs, and ability to generate volumetric data in a single rotation.

Government initiatives to improve access to digital diagnostic imaging and the growing need for early detection of oral cancers and bone disorders have further fueled market growth. Additionally, technological advancements such as AI-enabled CBCT platforms and mobile CBCT units have enhanced operational efficiency and broadened point-of-care accessibility. In North America, particularly the United States, the increasing prevalence of dental disorders, coupled with the high adoption of digital imaging, has led to significant CBCT penetration.

Beyond traditional applications, CBCT is gaining traction in emerging clinical areas such as interventional pulmonology and oncology. In these fields, CBCT plays a crucial role in early-stage cancer detection and targeted treatment planning, improving outcomes through precise tumor localization and minimally invasive intervention guidance. This broadening scope of clinical use significantly contributes to the technology’s rising prominence.

Accessibility improvements are another important growth driver. The development of portable, affordable CBCT units allows healthcare providers in emerging economies and remote regions to leverage advanced imaging, overcoming barriers associated with cost and infrastructure. This democratization of CBCT technology supports more equitable healthcare delivery globally.

Furthermore, government initiatives focused on enhancing digital healthcare infrastructure and promoting advanced diagnostic tools are expected to stimulate CBCT market expansion. Policy support, funding, and regulatory frameworks aimed at modernizing healthcare systems create a conducive environment for adopting such innovative technologies.

Key Takeaways

- In 2024, the market for Cone Beam Computed Tomography generated a revenue of US$ 39 million, with a CAGR of 10.9%, and is expected to reach US$ 2,302.15 million by the year 2034.

- Based on product, the market is divided into Instrument and Software and Services. Among these, instrument segment dominated the market with the highest market share of 77.8% in 2024.

- Based on application, the market is segmented into Dental Imaging, Breast imaging, Orthopedic Imaging, ENT Imaging, Cardiovascular Imaging, and Others. Dental imaging segment led the market with 67.2% share in 2024.

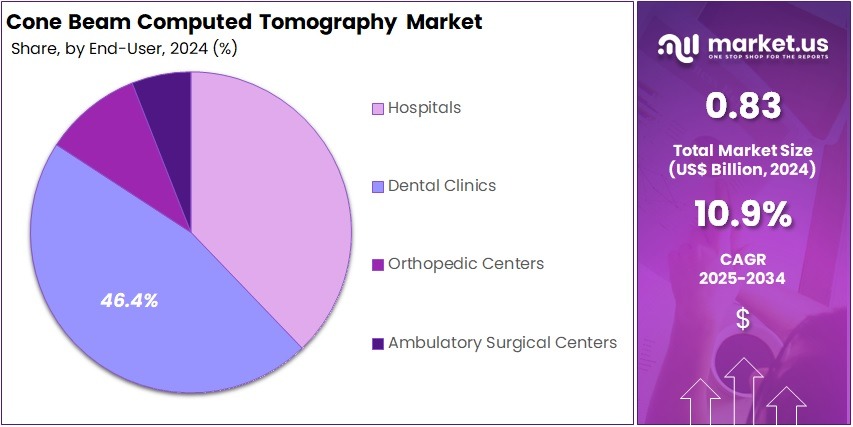

- Based on end-users, the market is segmented into Hospitals, Dental Clinics, Orthopedic Centers, and Ambulatory Surgical Centers. Dental Clinics segment held the maximum share of 46.4% in 2024.

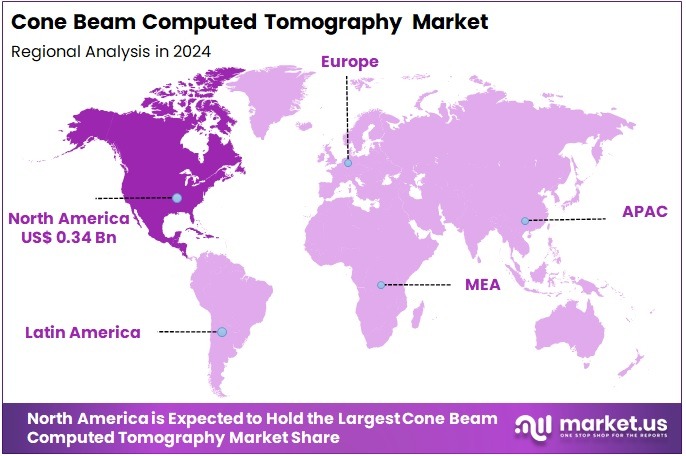

- North America was the highest revenue-generating region with a market share of 41.7% in 2024.

Product Analysis

The instrument segment held a significant share of 77.8% in the CBCT market due to its critical role in ensuring high-quality imaging and accurate diagnostics. Core components such as X-ray sources, flat panel detectors, and image processing units collectively enable the creation of detailed three-dimensional images essential for dental, orthopedic, ENT, and other medical applications. The precision and technological advancements of these instruments directly impact the clarity and reliability of CBCT scans, which in turn drives their clinical effectiveness and adoption.

Technological improvements have greatly enhanced CBCT instruments. For example, advances in X-ray source design optimize radiation dose, reducing patient exposure while maintaining superior image quality. Similarly, CMOS flat panel sensors have evolved to provide faster image acquisition, higher resolution, and improved contrast, expanding CBCT’s diagnostic capabilities.

For example, CS 9600 by Carestream Dental and the ProMax 3D by Planmeca. Carestream Dental’s CS 9600 features a sophisticated X-ray source combined with a large CMOS flat panel sensor, delivering high-resolution imaging for dental implants, orthodontics, and oral surgeries. It is supported by advanced software for precise 3D reconstruction and analysis.

Cone Beam Computed Tomography Market, Product Analysis, 2020-2024 (US$ Million)

Product 2020 2021 2022 2023 2024 Instrument 447.09 480.84 526.96 581.45 642.15 Software and Services 130.90 140.01 152.61 167.15 183.24 Application Analysis

The dental imaging segment dominated the CBCT market with 67.2% share in 2024 due to its critical role in transforming diagnostic and treatment procedures in dentistry. CBCT technology provides three-dimensional, high-resolution images of dental structures, bones, and soft tissues with lower radiation exposure compared to conventional CT scans. This precision imaging capability enables dental professionals to diagnose complex conditions, plan treatments more accurately, and execute surgical procedures with enhanced safety and effectiveness.

One of the primary applications of CBCT in dental imaging is implantology. Accurate 3D visualization of the jawbone and surrounding anatomical structures allows dentists to assess bone density and volume, identify nerve pathways, and plan implant placement with minimal risk to patients. This reduces complications and improves the success rates of dental implants. Orthodontics also benefits from CBCT’s detailed imaging, facilitating the evaluation of tooth position, jaw alignment, and growth patterns, which supports effective treatment planning and monitoring.

New investments and strategic initiatives are significantly boosting the Dental Imaging segment within the CBCT market. In September 2024, Carestream Dental Application Parent Limited has secured over $525 million in new capital as part of a recapitalization to further its strategic innovation agenda. The investment was facilitated by a six-year first lien term loan from General Atlantic Credit’s Atlantic Park fund, with additional equity participation from Canyon Partners and other investors. This financial backing will support the company’s ongoing digital transformation in the oral healthcare sector.

The orthopedic imaging segment held a significant share in the CBCT market. The rising prevalence of orthopedic disorders driven by aging populations, sports injuries, and trauma cases is fueling demand for advanced imaging modalities like CBCT. According to the World Health Organization (WHO) and data from national health agencies, musculoskeletal conditions, including osteoarthritis, fractures, and spinal disorders, affect over 1.7 billion people worldwide in 2023. The incidence of fractures, especially among older adults due to osteoporosis, continues to increase, with over 3 million osteoporosis-related fractures occurring annually in the U.S.

Cone Beam Computed Tomography Market, Application Analysis, 2020-2024 (US$ Million)

Application 2020 2021 2022 2023 2024 Dental Imaging 384.92 414.22 454.42 501.82 554.66 Breast imaging 23.74 25.23 27.26 29.61 32.19 Orthopedic Imaging 68.67 74.35 82.20 91.53 102.02 ENT Imaging 55.17 58.95 64.10 70.12 76.76 Cardiovascular Imaging 15.78 16.65 17.82 19.17 20.63 Others 29.71 31.44 33.75 36.35 39.12 End-User Analysis

The hospital segment plays a critical role in the expansion and adoption of CBCT technology across the healthcare industry. This segment held a share of 37.8% in 2024. Hospitals, both general and specialized, are increasingly integrating CBCT systems into their diagnostic imaging departments due to the technology’s ability to provide high-resolution, three-dimensional images with lower radiation doses compared to conventional CT scans. This integration supports improved patient outcomes through enhanced diagnostic accuracy and more precise treatment planning.

The demand for CBCT in hospitals is driven by increasing patient awareness, rising incidences of chronic conditions requiring detailed imaging, and the shift towards minimally invasive surgical techniques that depend on precise anatomical visualization. Financially, the hospital segment tends to have higher purchasing power, enabling acquisition of advanced CBCT systems equipped with cutting-edge features such as AI-powered image enhancement and integrated software solutions for better image interpretation and data management.

Hospital care spending as a percentage of gross domestic product (GDP) is expected to rise from 5.5% in 2023 to 6.0% by 2032 globally. Historically, hospital spending grew significantly, increasing from 1.7% of GDP in 1960 to 5.4% in 2010. Between 2010 and 2019, this share remained relatively stable but surged in 2020 during the first year of the COVID-19 pandemic. After dipping below pre-pandemic levels in 2022, hospital spending rebounded to 5.5% in 2023, marking the fastest growth rate of 10.4% since 1990. Projections indicate a continued increase in hospital care expenditure as a share of GDP through 2032.

Cone Beam Computed Tomography Market, End-User Analysis, 2020-2024 (US$ Million)

End-User 2020 2021 2022 2023 2024 Hospitals 219.62 235.70 257.70 283.55 312.26 Dental Clinics 262.02 282.73 311.22 344.92 382.63 Orthopedic Centers 58.35 62.35 67.79 74.16 81.18 Ambulatory Surgical Centers 38.00 40.08 42.85 45.98 49.32 Key Market Segments

By Product

- Instrument

- Software and Services

By Application

- Dental Imaging

- Breast imaging

- Orthopedic Imaging

- ENT Imaging

- Cardiovascular Imaging

- Others

By End-User

- Hospitals

- Dental Clinics

- Orthopedic Centers

- Ambulatory Surgical Centers

Drivers

Advancements in Imaging Technology

Advancements in imaging technology have emerged as a major catalyst driving the growth of the CBCT market. CBCT systems have significantly evolved over the years, offering high-resolution 3D imaging with greater anatomical accuracy and lower radiation exposure compared to traditional CT scanners. These improvements have expanded CBCT’s clinical utility beyond dental applications to include fields like otolaryngology, orthopedics, and maxillofacial surgery.

One of the most transformative developments is the enhancement of image processing algorithms and reconstruction techniques. These have enabled practitioners to visualize intricate dental structures, bone density, and soft tissues with remarkable clarity. For instance, newer CBCT systems now integrate flat-panel detectors and faster scan times, reducing motion artifacts and improving diagnostic reliability.

Additionally, digital imaging software allows clinicians to manipulate images in multiple planes, facilitating precise diagnosis and surgical planning, especially in complex dental implant procedures. ClariCT.AI’s AI-driven noise reduction technology markedly improves CBCT image quality by minimizing noise and metal artifacts, which enhances diagnostic precision and treatment planning. Additional studies involving larger, multicenter populations are advised to confirm these results.

As these technological innovations continue to evolve, they are making CBCT systems more versatile, compact, and cost-effective, thereby increasing their accessibility across various healthcare settings. Ultimately, the ongoing advancements in imaging technology are not only enhancing clinical decision-making but also fueling sustained growth in the global CBCT market.

For instance, the Genoray Papaya 3D Plus marks a major advancement in dental digital imaging technology, reflecting Genoray’s dedication to transforming dental diagnostics. It integrates 3D CT, panoramic, and optional cephalometric imaging to meet diverse diagnostic needs. Versatile imaging capabilities support precise implant planning and various dental procedures.

Restraints

Severe Side Effects of Treatments

Concerns about cancer risk are acting as a significant restraint on the growth of the CBCT market. Although CBCT offers lower radiation doses compared to conventional CT scans, the cumulative exposure from frequent or unnecessary imaging can contribute to increased cancer risk, particularly in sensitive areas like the head and neck.

A key study from the United States highlights this issue: dentists’ use of CBCT and related imaging techniques is estimated to potentially cause around 967 new cases of head and neck cancers annually. This figure underscores the latent risk posed by repeated radiation exposure during dental diagnostics. Data from 2020-21 suggests that orthodontic treatments involving CBCT imaging may lead to approximately 135 new cancer cases.

The concern is even greater for children, who are more vulnerable to radiation effects. Projections indicate that a future rise in CBCT utilization could result in 361 additional cancers, predominantly in pediatric patients. These risks stem from the ionizing radiation emitted during CBCT scans, which, although low, can accumulate over multiple scans.

The radiation sensitivity of tissues in the head and neck region, combined with the increasing use of CBCT for orthodontic and dental implant procedures, raises valid safety concerns among patients and healthcare providers alike. This caution surrounding radiation exposure and its carcinogenic potential impacts the adoption rate of CBCT technology, especially in regions with stringent healthcare regulations. It also propels the development of alternative imaging modalities and drives manufacturers to innovate low-dose CBCT systems.

Despite its clinical advantages, the perceived and documented cancer risks serve as a considerable barrier, tempering the market’s growth momentum as stakeholders balance diagnostic benefits with patient safety.

Opportunities

Development of Portable CBCT Systems

The development of portable CBCT systems is emerging as a pivotal growth opportunity for the global CBCT market by addressing key limitations associated with traditional, bulky imaging devices. Portable CBCT units offer enhanced mobility and flexibility, enabling dental and medical professionals to perform high-quality, three-dimensional imaging directly at the point of care, including remote or underserved locations where access to advanced diagnostic equipment is limited.

This capability significantly broadens the reach of CBCT technology, facilitating timely and accurate diagnosis across a wider patient population. These compact systems are designed with user-friendly interfaces and faster scanning times, improving workflow efficiency and patient comfort. The 8200 3D CBCT System from ADROITT MEDISYS SOLUTIONS is an innovative imaging device designed to deliver high-quality 3D scans for dental and medical professionals.

Constructed from recyclable plastics, it offers an environmentally friendly choice for healthcare facilities. Its portable design allows easy transport between hospitals or clinics, although it is not foldable, it remains compact for convenient storage. Built as a durable, non-disposable unit, this CBCT system uses cone beam computed tomography technology to produce detailed images of teeth, jaws, and surrounding head and neck structures.

User-friendly and precise, the 8200 3D CBCT System is an essential tool for accurate diagnosis and treatment planning in clinical settings. Additionally, portable CBCT devices often incorporate low-dose radiation protocols, aligning with growing patient and regulatory demands for safer imaging solutions. Technological advancements such as wireless connectivity, integration with digital dental workflows, and compatibility with software for real-time image analysis further enhance their clinical utility.

Impact of Macroeconomic / Geopolitical Factors

The CBCT market is significantly influenced by macroeconomic and geopolitical factors, which play a crucial role in shaping its growth trajectory, technological advancements, and regional demand patterns. Macroeconomic conditions, including economic growth rates, disposable income levels, and healthcare expenditure, directly impact the CBCT market. Geopolitical tensions and international trade policies also affect the CBCT market, particularly in terms of supply chain dynamics and the cost of manufacturing and distribution.

Rising healthcare expenditure worldwide, especially in emerging economies, drives demand for advanced diagnostic imaging technologies like CBCT. Increased investment in dental and ENT healthcare infrastructure boosts market growth. In 2025, health expenditure in Mainland China and India is expected to grow significantly, with projected increases of 9.2% and 8.6%, respectively, according to Healthcare Asia news.

Following US President Donald Trump’s April 2 tariff announcement in 2025, Siemens Healthineers, Philips Healthcare, and GE HealthCare experienced double-digit stock price declines. The 10% tariff on imported high-end CT or MRI systems priced between US$ 1 million and US$ 2 million could add US$ 100,000 to US$ 200,000 in costs for hospitals. With many hospitals already implementing cost-cutting measures, these increased prices may cause delays in large capital investments.

Latest Trends

Adoption of AI and Machine Learning

The adoption of artificial intelligence (AI) and machine learning (ML) technologies is significantly shaping the growth trajectory of the CBCT market. These advanced technologies are enhancing the capabilities of CBCT systems by improving image processing, analysis, and diagnostic accuracy, thus driving wider acceptance and utilization across various medical fields.

AI-powered algorithms enable automated image reconstruction and artifact reduction, which results in clearer and more precise 3D images. This improvement is critical for clinicians who rely on detailed imaging to make accurate diagnoses and treatment plans. Machine learning models also contribute to faster and more efficient image interpretation by identifying patterns and anomalies that might be subtle or easily overlooked by human observers. This capability reduces diagnostic errors and shortens the time required for image analysis, enabling quicker clinical decision-making.

Furthermore, AI integration facilitates personalized treatment approaches by combining CBCT imaging data with patient-specific information, thereby tailoring interventions to individual needs. Beyond image enhancement and interpretation, AI and ML are revolutionizing workflow automation within CBCT systems.

Automated patient positioning, exposure parameter optimization, and quality control checks help reduce human error and improve operational efficiency. These improvements not only enhance patient safety by minimizing radiation exposure but also increase throughput in busy clinical environments, making CBCT technology more accessible and practical.

Regional Analysis

North America is leading the Cone Beam Computed Tomography Market

North America has maintained a commanding position in the CBCT market with 41.7% in 2024, driven by several interconnected factors that collectively contribute to its significant market share. The region’s advanced healthcare infrastructure and high adoption rate of cutting-edge medical technologies form the foundation for robust CBCT utilization across various medical and dental specialties.

The United States and Canada, in particular, have been at the forefront of embracing innovative imaging modalities, supported by substantial investments in healthcare research, development, and clinical practice enhancement. With a growing aging population and a rising number of complex dental procedures such as implants, orthodontics, and oral surgeries, clinicians require imaging technologies that provide accurate 3D visualization to improve treatment outcomes.

CBCT systems offer detailed images with reduced radiation exposure compared to traditional CT scans, making them highly preferred in routine dental practice. This has led to extensive integration of CBCT in dental clinics, hospitals, and specialty centers throughout the region. According to the CDC’s 2024 Oral Health Surveillance Report, nearly 21% of adults aged 20–64 had one or more permanent teeth with untreated decay. The prevalence was notably higher among certain demographic groups, including non-Hispanic Black adults (30.3%) and those in high-poverty households (39.6%).

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The expanding clinical applications of CBCT outside of dental care contribute to its growing importance in the Asia Pacific market. For instance, CBCT is widely used in otolaryngology (ENT) for assessing sinus and nasal pathologies, helping clinicians plan minimally invasive surgeries. Orthopedic applications are also increasing, with CBCT systems employed for precise imaging of bone fractures, joint disorders, and preoperative planning.

The technology’s utility in oncology is gradually being recognized as well, where it aids in tumor localization and radiation therapy planning, aligning with the region’s broader efforts in cancer management. According to the Global Burden of Disease Study, in 2022, the number of OA prevalence in China was about 152.85 million, and the number of incidences was about 11.65 million.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the CBCT market is marked by the presence of both established players and emerging companies focusing on technological advancements, product innovation, and strategic partnerships to gain market share. Leading manufacturers such as FUJIFILM Holdings Corporation, Hitachi, GE HealthCare, Koninklijke Philips N.V., and Dentsply Sirona dominate the market, leveraging their extensive experience in medical imaging and strong brand recognition to offer cutting-edge CBCT systems.

These companies continue to enhance their product portfolios through the integration of AI-driven imaging, improved image quality, and reduced radiation doses. Additionally, they have expanded their reach through strategic collaborations with dental and healthcare institutions, along with significant investments in R&D to develop user-friendly and cost-effective solutions.

Manufacturers are introducing advanced CBCT models with improved image quality, faster scanning times, and lower radiation doses, catering to the increasing demand for more precise, efficient, and patient-friendly diagnostic solutions. In February 2024, Carestream Dental launched an advanced 4-in-1 Cone Beam Computed Tomography (CBCT) system, the CS 8200 3D Access, which is fueling growth opportunities in the market. This system offers enhanced image quality and full-arch scanning capabilities, catering to dental professionals who require high-resolution imaging for accurate diagnosis and treatment planning.

Top Key Players in the Cone Beam Computed Tomography Market

- MORITA CORP.

- Genoray Co., Ltd.

- Carestream Health, Inc.

- Planmeca Oy

- Cefla

- CurveBeam AI

- Dentsply Sirona

- GE HealthCare

- Xoran Technologies, LLC

- Koninklijke Philips N.V.

- Hitachi, Ltd.

- FUJIFILM Holdings Corporation

- ASAHIROENTGEN IND. CO., LTD.

- PreXion Inc.

- Copenhagen Imaging ApS

Recent Developments

- In May 2025: GE HealthCare, announced the launch of CleaRecon DL, a technology powered by a deep-learning algorithm designed to enhance the quality of cone-beam computed tomography (CBCT) images. This AI-driven solution targets the removal of streak artifacts caused by the pulsatile blood flow in arteries and variations in contrast distribution during CBCT scans for liver, prostate, neuro, and endovascular aortic repair procedures. CleaRecon DL has recently received both US FDA 510(k) clearance and CE mark and will be available on the Allia platform.

- In March 2025: Planmeca launched the Viso G1, a powerful CBCT unit designed for modern dental clinics, featuring advanced sensor technology, an intuitive interface, and easy patient positioning. With a field of view up to 11 x 11 cm, it supports panoramic, 3D dental, TMJ, and optional cephalometric imaging. The Viso family also expands with Viso 2D Pro and Viso 2D Classic, delivering exceptional 2D imaging quality and usability worldwide.

- In December 2024: Morita Group established a new subsidiary, MORITA DENTAL INDIA PRIVATE LIMITED, through a joint investment by J. MORITA CORP. and its affiliates. Operation has begun on December 20, 2024. The move aims to strengthen Morita’s presence and expand sales channels in India and neighboring South Asian markets experiencing rapid economic growth.

Report Scope

Report Features Description Market Value (2024) US$ 825.39 million Forecast Revenue (2034) US$ 2,302.15 million CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Instrument, Software and Services), By Application (Dental Imaging, Breast imaging, Orthopedic Imaging, ENT Imaging, Cardiovascular Imaging, Others), By End-User (Hospitals, Dental Clinics, Orthopedic Centers, Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape J. MORITA CORP., Genoray Co., Ltd., Carestream Health, Inc., Planmeca Oy, Cefla, CurveBeam AI, Dentsply Sirona, GE HealthCare, Xoran Technologies, LLC, Koninklijke Philips N.V., Hitachi, Ltd., FUJIFILM Holdings Corporation, ASAHIROENTGEN IND. CO., LTD., PreXion Inc., Copenhagen Imaging ApS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cone Beam Computed Tomography MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Cone Beam Computed Tomography MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- MORITA CORP.

- Genoray Co., Ltd.

- Carestream Health, Inc.

- Planmeca Oy

- Cefla

- CurveBeam AI

- Dentsply Sirona

- GE HealthCare

- Xoran Technologies, LLC

- Koninklijke Philips N.V.

- Hitachi, Ltd.

- FUJIFILM Holdings Corporation

- ASAHIROENTGEN IND. CO., LTD.

- PreXion Inc.

- Copenhagen Imaging ApS